Best Futures Trading Platforms of February 2026

By buying and selling futures online – you are entering a trading space that is largely dominated by institutional investors. This is because futures require a much larger minimum capital outlay in comparison to traditional financial instruments.

Plus. many futures contracts are settled in the underlying asset – such as oil or wheat.

Nevertheless, if you’re a retail client who wishes to trade futures, – below are the top brokers for futures trading in 2026. We also explain how futures trading works and how you can get started with your first investment today!

-

-

4 Best Futures Brokers in 2026

- Plus500: Plus500 is a reputable online broker that offers CFDs, however, U.S.-based investors have access to the futures markets with competitive commissions.

- Interactive Brokers: IBKR is suited to experienced traders who want to use advanced charting tools and indicators. The platform offers access to a range of futures markets across 35 global exchanges covering stocks, oil, and more. Users can also trade the E-Mini S&P 500 futures at just $0.85 per contract.

- TradeStation: TradeStation provides access to over 350 instruments that can be traded as futures. The broker also supports margin trading and provides a good range of analysis tools. The platform is catered to experienced traders but can also be used by beginners.

- TD Ameritrade: TD Ameritrade offers access to over 70 financial markets and facilitates futures trading with low spreads and commissions. TD Ameritrade is an established US trading platform with a long history.

What is Futures Trading?

As the name suggests, by trading futures you are speculating on the future price of an asset. This might be a market on stocks, oil, natural gas, interest rates, or even Bitcoin.

Either way, the objective is to predict whether the price of the financial instrument will be higher or lower when the contracts expire – which is typically three months.

This means that you can trade the asset in question in a much more flexible way, as you have the option of going long or short. The best broker for futures also allows you to apply some leverage, depending on your available account balance and margin requirements.

What Assets Can I Trade as Futures?

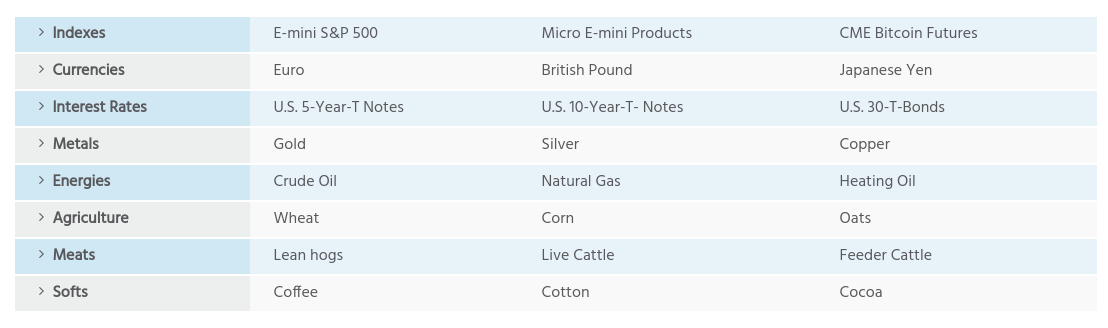

As we covered in our mini-reviews of the best futures brokers for 2026 – there are many markets that you can trade.

This includes:

- Stocks: Some futures platforms allow you to trade individual stocks. This is useful if you want to place more sophisticated trades – such as going short or applying leverage. Usually, one stock futures contract contains 100 individual equities.

- Indices: Indices are arguably one of the most popular futures markets as volatility levels are much lower than other asset classes. This includes markets on the Dow Jones, S&P 500, and NASDAQ 100.

- Commodities: Precious metals and agricultural products without needing to take direct ownership. You do, however, need to ensure that you are not holding the futures contracts when they expire.

- Currencies: One of the best ways to speculate on the future value of a currency is via futures. This allows you to avoid the overnight financing fees associated with forex trading platforms.

- Interest Rates: Some of the best futures brokers that we came across also support markets on interest rates.

As you can see, there are futures trading markets available on a wide variety of asset classes. You do, however, need to check what the minimum trade size is and how many instruments are contained within each contract.

And even more importantly – you need to check what your liability is in the event you are still holding the contracts once they expire.

Why Trade Futures?

There are many reasons why you might consider trading a complex financial instrument like futures. In many cases, this is because you will have access to a broader set of markets, the ability to go long or short and be able to trade on margin.

Let’s explore these key benefits in more detail:

Asset Diversify

As we have noted throughout this guide, futures are available on many financial markets. Gold, crude oil, natural gas, and wheat would otherwise be difficult to speculate on without the availability of a futures contract.

After all, you would be required to personally purchase, store, and transport gold bullion bars or barrels of oil. But, by making use of a futures broker, all you need to do is speculate whether you think the price of the asset will rise or fall.

Long or Short

When you use a traditional stock trading platform – you can only purchase shares in the hope that they rise in value. This is also the case with other asset classes. However, in future contracts, you will always have the option to speculate whether the price will rise or fall.

The latter means that you are speculating on the price of the asset falling. For example, you might be looking at gold and think that it is overvalued. If so, all you need to do is short-sell a futures contract.

Trade on Margin

We mentioned earlier that futures contracts will contain a large number of individual financial instruments. For example, in the case of oil futures, a single contract will contain 1,000 barrels.

This means that ordinarily, you are required to outlay tens of thousands of dollars to access the market.

Fortunately, the best futures trading brokers offer buying or selling contracts on margin. For those unaware, this means that you are only required to put a small amount of money upfront to enter the market. The amount of margin you have available will depend on several factors – such as whether you are a professional or retail client, the asset class, and where you are located.

But, in many instances, you might be able to get up to 1:100 – sometimes more. For example, if the minimum trade size required is $100,000 – at 1:100 this would require an outlay of just $1,000.

Futures Trading Hours

The futures trading scene operates much like the traditional stock exchange. That is to say, most trading is conducted during standard market hours – Monday to Friday. With that said – and much like conventional stocks, it is also possible to trade futures outside of standard market hours. Each futures exchange will, however, have its own rules surrounding tradable hours.

For example, in the US, futures can be traded from 5 pm (Central Time) on Sunday through to 4 pm on Friday in most brokers. On the other hand, futures markets in the UK take a more traditional approach – choosing to close their doors over the weekend.

Futures Trading Strategies

It is important to have a strategy in place when trading futures. After all, futures are complex financial derivatives that offer a much higher risk/reward potential than conventional assets.

If you are completely new to the futures trading scene – consider some of the strategies discussed below.

Hedging

Hedging is a crucial tool when you are invested in the financial markets. For those unaware, hedging simply refers to the process of ‘covering your bets’ in the event the markets turn against you.

In other words, instead of cashing out your position in fear of a market reversal, you can keep your investments open through a hedging strategy. And, there is no better way of achieving this goal than through a futures contract.

Here’s an example of how this futures trading strategy works:

- You have $10,000 invested in gold

- Although your gold investment has performed well to date – there is speculation that US interest rates are due to rise

- If this is the case, then history suggests that this will have a negative impact on the value of gold

- To cover this potential outcome, you decide to short-sell $10,000 worth of gold futures contracts

At this point, you now have two contrasting positions. That is to say, you are ‘long’ on gold through your initial investment and ‘short’ via your futures contracts.

Let’s see how the hedging strategy might pan out.

- Let’s say that the US Federal Reserve does hike interest rates. In turn, the value of gold declines by 10%. This means that your initial gold investment drops by 10%, but your futures contract increases by 10%. The net result is break-even.

- Now let’s suppose that the US Federal Reserve doesn’t hike interest rates. In turn, gold increases by 5%, and your futures contract drops by 5%. Once again, the net result is break-even.

As you can see from the above, by hedging your position through a futures contract, you can cover your exposure to a sudden market downturn.

Market Correction Strategy

If you are looking for a way to capitalize on market corrections, futures are an excellent financial instrument to achieve this goal. For those unaware, a market correction or ‘pullback’ is when an asset temporarily goes through a downward price movement.

This could be for several reasons, such as:

- Speculation on a change in central bank interest rates

- Political tensions and/or war

- Market uncertainties – for example Brexit or the coronavirus

- Worse-than-expected earnings reports

- Or simply because investors have to cash out a profitable position to lock in gains

Irrespective of the reason, the market correction is a temporary pullback, meaning that the upward trend is expected to resume in the coming days or weeks.

If this is the case, then you can go long on a futures contract at a much more favorable price. This is because futures prices are determined by market forces – meaning that when the asset goes down in value, so does the price of the contract.

Best Futures Trading Platforms Reviewed

When searching for a futures trading platform, there are many considerations to bear in mind.

For example, the broker needs to support your chosen futures market – whether that’s stocks, commodities, or even cryptocurrencies. Commissions and trading tools must also be explored.

To help clear the mist, below you will find the best futures brokers.

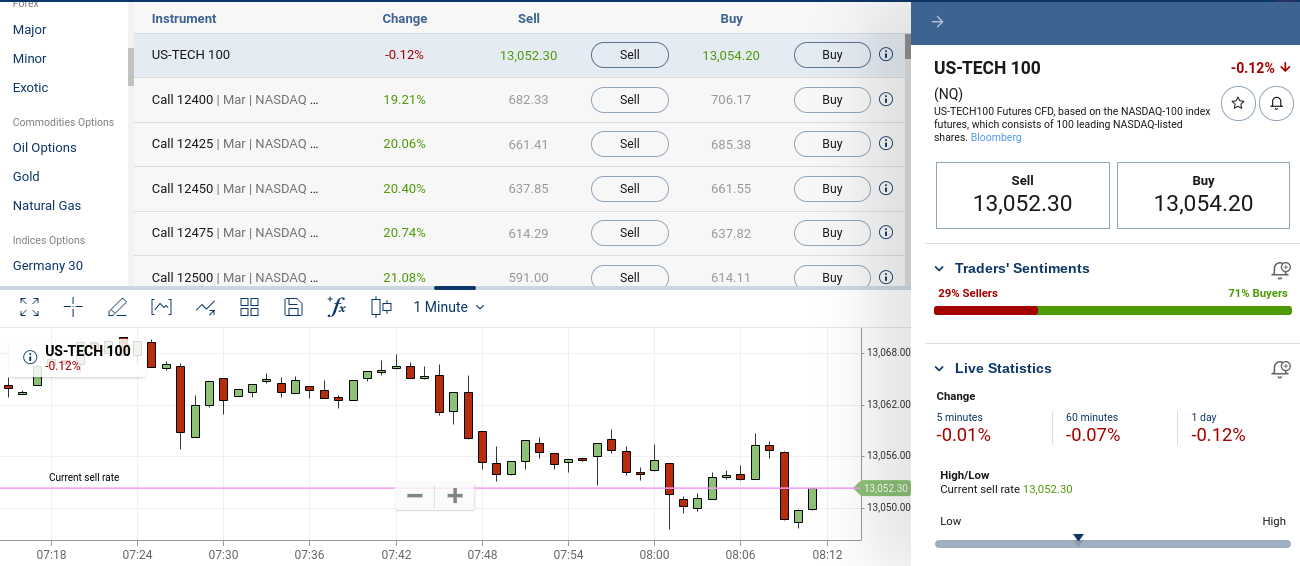

1. Plus500 – Best Online Broker for Futures Trading for Low Fees and Leverage

If you are looking for a futures broker to access the global futures trading scene – Plus500 is a good option. The platform specializes exclusively in CFDs -making it perfect for those of you seeking a low-cost entrance to this marketplace.

This is because Plus500 does not charge any trading commissions. Instead, it’s only the spread that you need to factor into your futures trading costs. In terms of supported markets, Plus500 is very strong in two key areas – indices and commodities.

In addition to the CFD platform, Plus500 offers a futures platform where instruments like crypto, agriculture, metals, forex, interest rates, energy, and equity index can be traded.

In the case of commodities – Plus500 offers a huge library of hard metals, energies, and agricultural products. There are popular Equity Indices like E-mini S&P MidCap 400 or Micro E-mini S&P 500 to your portfolio, or trade crypto futures and metals such as gold, silver, and more. You can also trade interest rates like Micro 10-Year Yield as well.

Plus500 doesn’t support third-party platforms like MT4 – so you can trade CFD futures directly in your web browser. The platform also offers a top-rated mobile app, allowing you to easily trade and manage your positions without the need to be next to your computer.

The minimum deposit at this heavily regulated broker is just $100 and you can choose from a debit/credit card, Paypal, or bank transfer.

Pros:

- A member of the Futures Industry Association (FIA) in the United States.

- Access to Micro Bitcoin and Ethereum

- Futures trading educational resources for beginners

- Start trading with as little as $100

Cons:

- Futures trading is restricted to US traders

Trading with leverage comes with a high risk and may not be suitable for everyone.

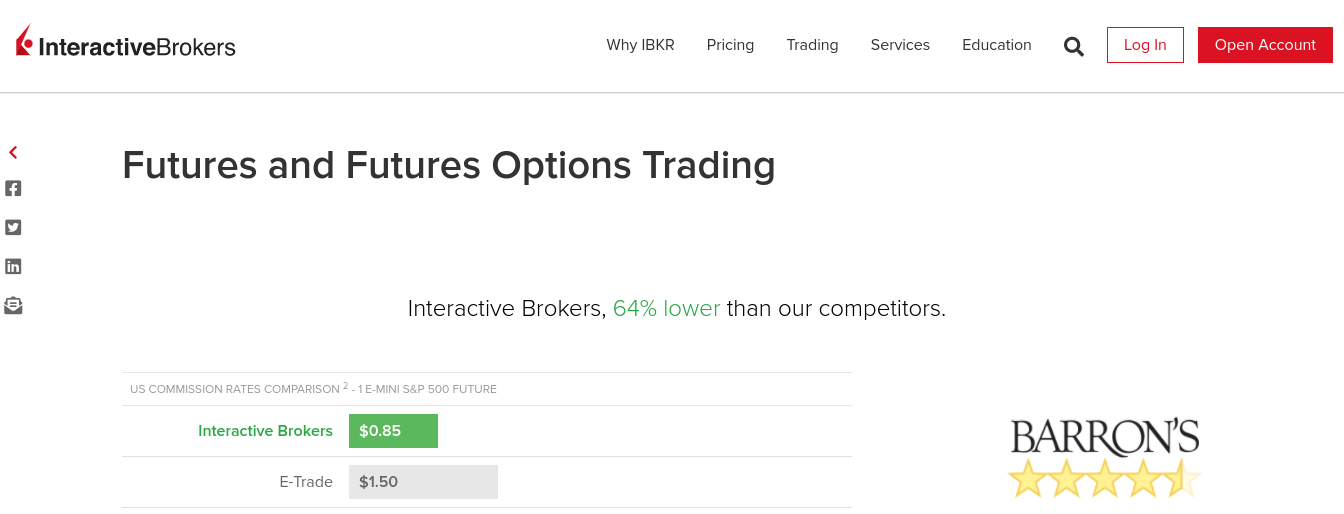

2. Interactive Brokers – Best Futures Platform for Asset Diversity

Interactive Brokers is an established online trading platform that not only supports US clients – but residents of many other countries. This futures trading platform is without a doubt the best option on the table if you are a seasoned pro.

First and foremost, Interactive Brokers gives you access to a huge library of futures markets across 35 different global exchanges. In the US, This includes 8 different exchanges – such as the CBOE, CME, ICE Futures, New York Mercantile Exchange, and OneChicago.

Outside of the US, Interactive Brokers also allows you to buy and sell futures from the UK, Europe, Canada, Mexico, Asia, and Australia. Best of all, you can trade virtually every futures market imaginable. This includes futures linked to stocks, oil, natural gas, agricultural products (e.g. wheat and corn), and more.

Interactive Brokers does have somewhat of a complex pricing structure. This is because the fees you pay will not only depend on the exchange you are looking to access but also the account type you are on. Nevertheless, if you are looking to trade futures on the E-Mini S&P 500, this will cost you $0.85 per contract.

Pros:

- Access to futures, futures options, and single-stock futures

- Trade futures across multiple regions including US, UK, Canada, and Mexico

- No minimum deposit

Cons:

- May not be suitable for new investors

- Complex fee structure

There is no guarantee that you will make money with this provider. Proceed at your own risk..

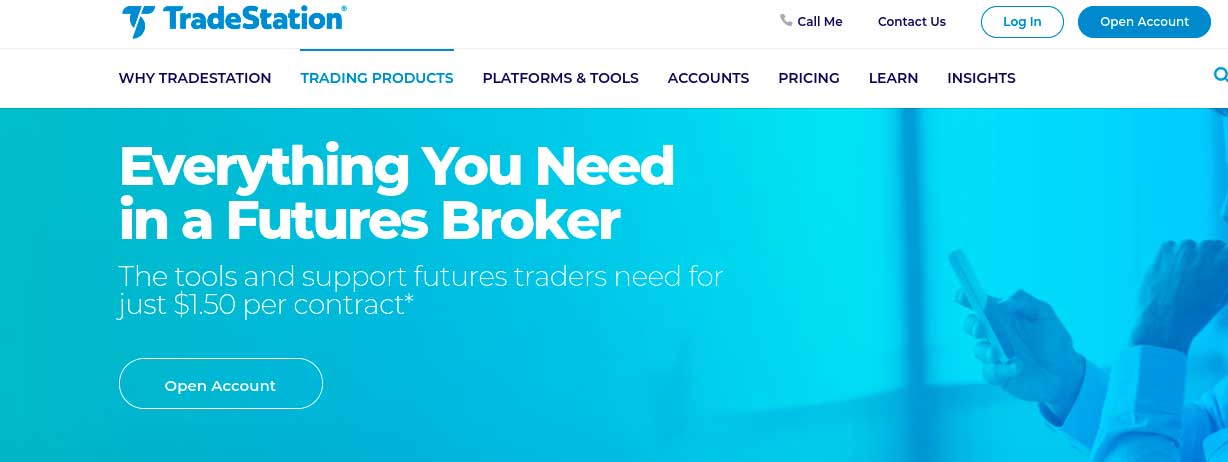

3. TradeStation – Best Futures Trading Broker for US Retail Clients

If you’re a retail client based in the United States – then the best futures trading platform for you could be TradeStation. This popular online broker offers everything from stocks, bonds, ETFs, and mutual funds to cryptocurrencies, options, and futures.

Regarding its futures trading marketplace – this covers over 350 different instruments. This includes index futures such as the E-mini S&P 500 and currencies like the British pound and Japanese yen.

Futures markets on interest rates are also supported – with popular instruments including both 5-year and 10-year US Treasury Notes. And of course, this covers everything from gold, silver, platinum, crude oil, sugar, cotton, wheat, etc.

What we like about TradeStation is that it is suitable for those of you with a small amount of capital. This fact also makes the platform be considered in the survey for the best trading platform for e-mini futures – the minimum margin amount required is just $175. In addition to this, TradeStation also offers some very competitive trading fees. This starts at just $1.50 per futures contract.

Pros:

- $0 commission on stocks

- Options charged at just $0.50 per contract

- Thousands of stocks including access to the OTC markets

- User-friendly futures trading app

- Excellent reputation

- Suitable for new and seasoned traders

Cons:

- International assets are not as extensive as other platforms in the space

There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. TD Ameritrade – Top Futures Broker for Advanced Traders

If you’re an experienced futures trader who knows your way around an advanced platform – then TD Ameritrade is well worth considering. This age-old brokerage firm gives you access to over 70 futures trading markets – which cover a wide variety of assets.

There are futures markets on many stock markets and commodities – covering the likes of the Dow Jones, S&P 600, NASDAQ 100, Russell 2000, and Nikkei 225.

Other futures markets on TD Ameritrade include interest rates and currencies. As a seasoned trader, you will likely find the thinkorswim platform super-useful. Native to TD Ameritrade, this platform comes packed with advanced trading tools, technical indicators, and order types.

The thinkorswim platform is also accessible via a mobile app – which is available on both Android and iOS devices. TD Ameritrade charges $2.25 per futures contract.

This is slightly more expensive than the futures fees charged by Interactive Brokers and TradeStation, you can also see this when compared to Fidelity in our Fidelity vs TD Ameritrade review.

But, TD Ameritrade does allow you to buy US-listed stocks and ETFs on a commission-free basis – should you wish to access these instruments. Finally, if you’re also interested in trading options, TD Ameritrade offers heaps of markets. Prices are competitive at just $0.65 per options contract.

Pros:

- Trusted US brokerage firm

- The app is available on iOS and Android devices

- Buy stocks and ETFs commission-free

- Options can be traded at just $0.65 per contract

- Fully-fledged paper trading account

- More than 11,000 mutuals to choose from

- No account minimums

Cons:

- Higher futures trading fees

- The sheer size of tradable markets on offer can appear overwhelming

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Conclusion

In summary, choosing the right commodity trading platforms for your needs is crucial. Not only does the provider need to support your preferred instruments - such as CFDs or futures, but also the specific market, like gold, silver, or natural gas.

And of course, the commodity broker needs to be regulated by the appropriate bodies and offer low fees and commissions.

In our view, Plus500 is the best futures trading platform to consider in 2026. You will have access to over 2800 CFD instruments and low commissions. The regulated broker also offers advanced charting tools and an easy-to-use mobile app.

Trading with leverage comes with a high risk and may not be suitable for everyone.

FAQs

How does futures trading work?

The main concept with futures trading is that you need to speculate on whether you think the asset will be worth more or less when contracts expire. For example, if you are trading 3-month oil futures that are currently priced at $65, you need to decide whether you think the price of the asset will be more or less than $65 per barrel in 3 months' time. If you speculate correctly - you make money.How is futures trading different to options trading?

There are many similarities between futures and options. For example, both markets come with an expiry date that typically sits at the 3-month area, and they both allow you to apply leverage and short-sell. However, the key difference is that options give you the 'right' to buy or sell the asset on expiry, and not the 'obligation' like you get with futures. Additionally, options only require an upfront deposit to access the market - which is known as the 'premium'. In the case of futures, you need to put the full amount upfront, unless you trade with leverage.When will bitcoin futures start trading?

The Bitcoin futures scene has been active since late 2017. However, this is mainly geared towards institutional investors. The good news is that retail clients can trade Bitcoin futures via CFDs.What is the best futures trading platform?

If you are a complete newbie and wish to trade futures, commission-free broker eToro is a great option. However, eToro doesn't offer futures to US citizens, so if you're an American, the likes of Interactive Brokers and TradeStation are worth considering.How much money can you make trading futures?

There is no one size fits all answer to this question. After all, the amount of money that you can make from futures trading depends on how much you stake and how successful your predictions are.How much money do you need to trade futures?

Although this will vary from asset to asset, futures contracts are often worth tens of thousands of dollars. For example, there are 1,000 barrels in a single oil futures contract. So, at $65 per barrel, that's $65,000 per contract. Stocks, on the other hand, usually have 100 shares per futures contract. This can still be sizable, as many US stocks are worth hundreds of dollars each.What assets can you trade futures on?

The most commonly traded futures markets include commodities and indices. However, you can also trade futures on stocks, interest rates, Bitcoin, currencies, and more.References:

Matti Williamson

View all posts by Matti WilliamsonMatti Williamson is a capital markets and crypto analyst with +15yr experience. He was among Saxo Bank's analysts, providing in-depth market coverage and assisting traders in live webinar sessions. Matti's knowledge is spread across multiple markets. He masters the top financial assets including forex, stocks, indices and commodities. In the crypto sector, he is well-versed with the current blockchain technology and has been researching cryptocurrencies since the collapse of MTGox in 2014, the biggest bitcoin exchange at the time. His previous articles can be found at Finance Magnates. From traditional finance to DeFi, expect Matti to cover and simplify the latest trends, research and analysis.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up