Best Day Trading App – Top Apps for Beginners Revealed

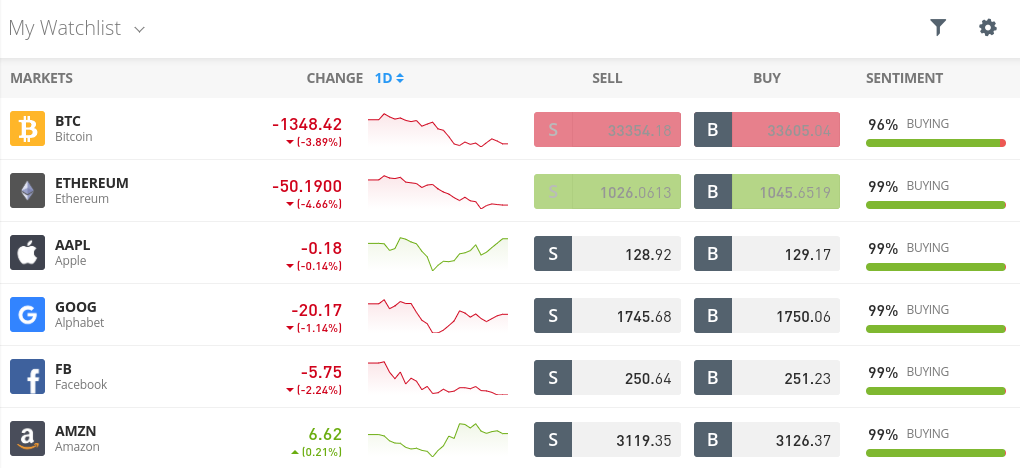

Looking to day trade the likes of stocks, forex, or commodities on your phone? If so, you’re going to need a top-rated day trading app that offers heaps of markets, low fees and commissions, and a great user experience.

In this guide, we review the 10 best day trading apps available in the market right now.

Best Day Trading App 2026 List

We have listed the best day trading app providers for 2026 below. You can scroll down to read our review of each trading app further down!

- eToro – Overall Best Day Trading App 2026

- Libertex – Best Day Trading App for Tight Spreads

- AvaTrade – Best Day Trading App for MT4/5

- Robinhood – Best Day Trading App for US Stock Traders

- TD Ameritrade – Best App for Day Trading Financial Derivatives

- CedarFX – Best Day Trading App for High Leverage (500x)

- FXCM – Best Day Trading App for Automated Systems

- Forex.com – Best App for Day Trading Forex

- Interactive Brokers – Best Day Trading App for Diversification

How to Choose the Best Day Trading App for You

In the sections above we have reviewed the best day trading apps for 2026. We have covered a wide range of providers to ensure that all trading requirements are met. With that said, it’s important that you do some research of your own before opening an account with a day trading app provider – as no two platforms are the same.

The most important considerations that you need to make when searching for the best day trading app are as follows:

Regulation

Day trading apps that allow you to buy and sell assets with real money must be regulated by a reputable body. For example, AvaTrade is regulated in six different jurisdictions – including Japan and Canada.

You then have eToro – which is authorized and regulated by the FCA, ASIC, and CySEC. Opting for a day trading app that is regulated by a reputable financial authority will ensure that you are able to trade in a safe and secure ecosystem. Not only in terms of transparency and fairness – but when it comes to investor protections.

For example, your money will need to be kept in a bank account that is separate from that of the app’s working capital – and regular audits are a minimum requirement.

Assets

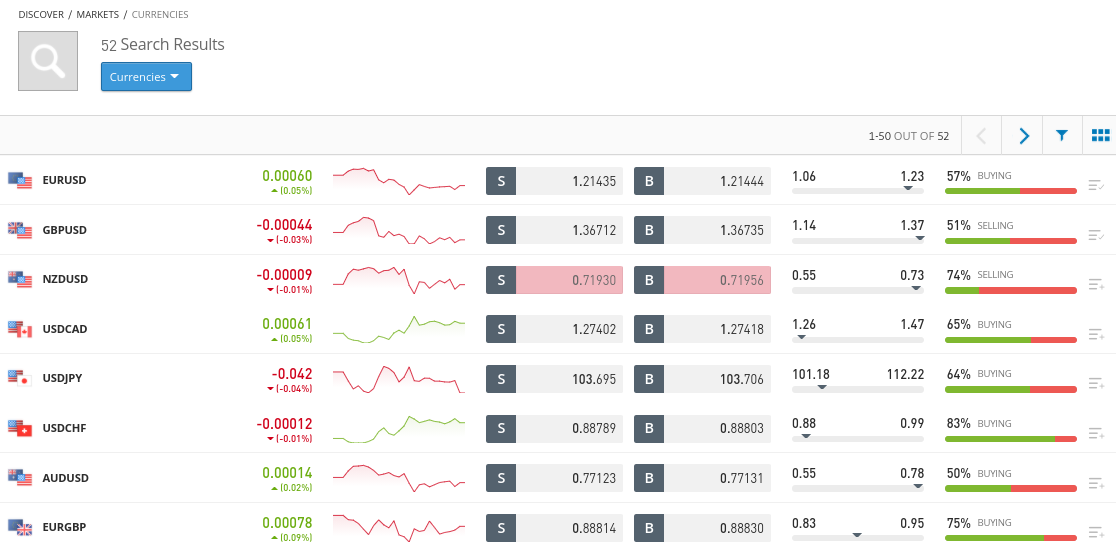

As we covered in our reviews of the best day trading apps for 2026 – you can choose tens of thousands of financial markets. You do, however, need to ensure that your chosen marketplace is supported by the broker.

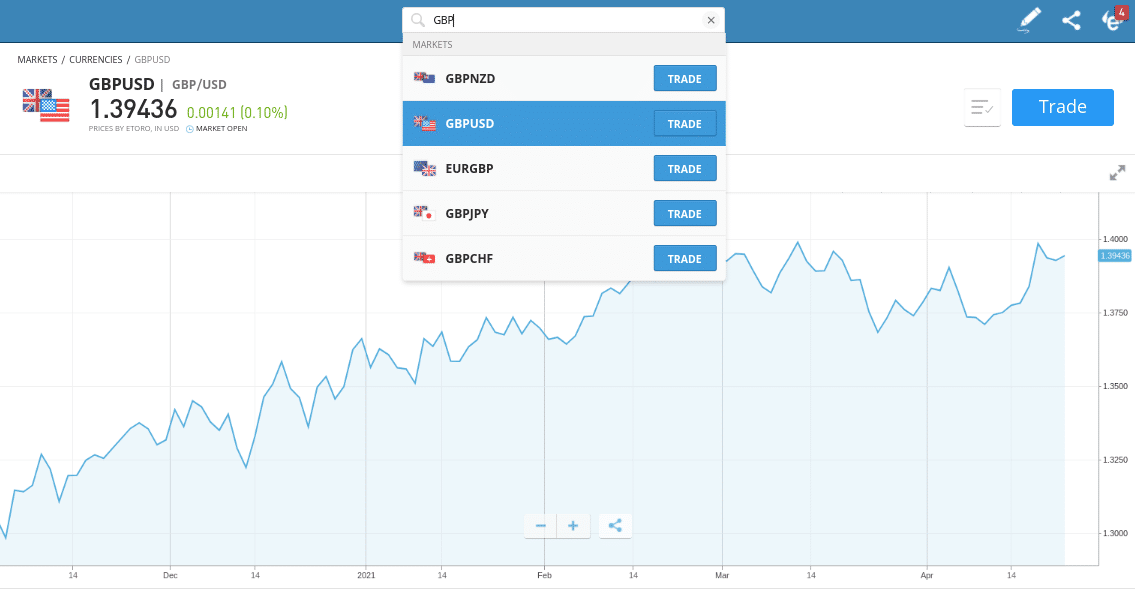

For example, the app might offer markets on forex – but does it support the specific currency pairs that you wish to trade? Similarly, all of the best day trading app providers discussed today offer stocks. But, you need to take a closer look to ensure your preferred exchange is offered.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

This is one of the many reasons that eToro is the best day trading app in the market – as the broker offers everything from indices, forex, and stocks, to crypto day trading, ETFs, and commodities.

Trading Tools & Features

Once you are sure that the provider is regulated and offers the financial instrument you wish to access – you then need to explore what trading tools are available.

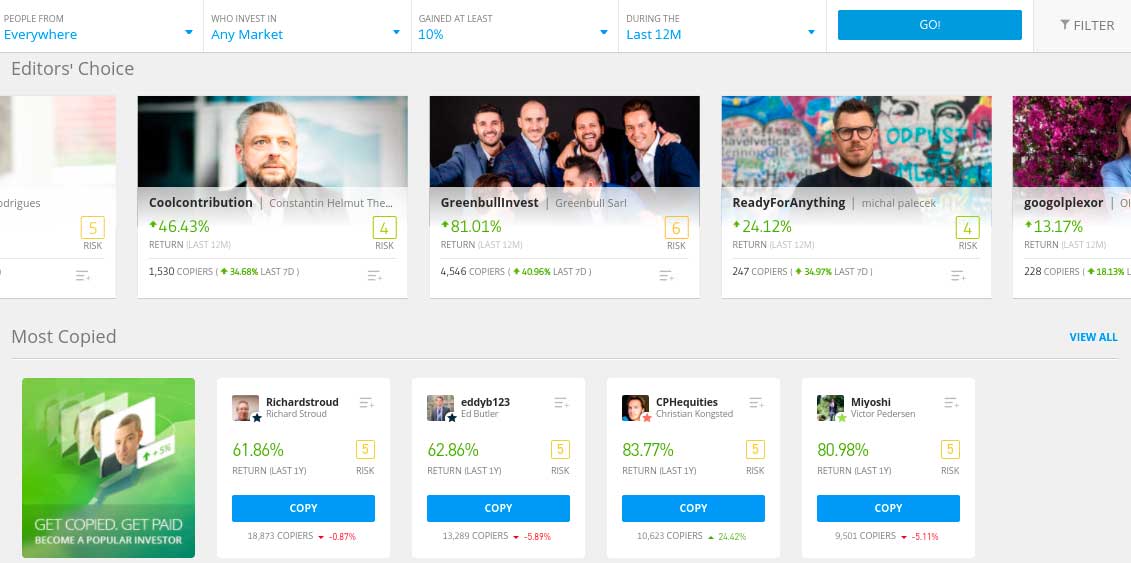

- For example, if you are looking to trade in a passive manner, then you might want to consider eToro.

- This trading app comes alongside a Copy Trading tool that allows you to mirror the trades on an experienced investor – like-for-like.

- In other words, if the trade you decide to copy allocates 7% of their portfolio into Facebook stocks – you will do the same.

We also like the social trading feature at eToro. This works like any other social media platform insofar that you can publicly communicate with other users of the app. For example, you can post your thoughts on a potential trade idea, reply to other threads, and even ‘Like’ comments.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Another key trading tool that we came across is support for third-party robots. AvaTrade and FXCM are a good shout here – as the apps are compatible with MT4 and forex EAs. This means that once the robot is set up, you can monitor its progress via the respective trading app.

Education, Research & Analysis

If you are a newbie trader then it’s best to use an app that offers educational materials. For example, the eToro app allows you to learn and trade at the same time – through informative guides, explainers, videos, and more.

In fact, eToro even gives you access to free webinars – which are usually hosted by one of its experienced in-house traders. When it comes to research, the best day trading app providers will offer financial news on key market developments. For example, if the US Federal Reserve announces that it is hiking interest rates – you’ll want to know about this in real-time.

And of course, if you are an experienced technical day trader, you’ll need unfettered access to financial indicators like the RSI or MACD. These indicators and charting tools should be optimized so that you can easily access them on the mobile phone.

User Experience

The best day trading app providers for 2026 offer a seamless and error-free user experience. Crucially, trading applications are designed for your specific operating system – whether that’s iOS and Android. You should find that loading times are fast – especially when it comes to viewing market data and pricing feeds in real-time.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

And of course – execution speeds on new orders should be lighting fast. Any delays or bugs could result in your missing a trading opportunity or not being able to exit a position when you want to. The process of browsing and searching for markets should also be simple. In terms of all-round user experience, we found that eToro, AvaTrade, and Libertex stand out from the crowd.

Payment Methods

Some of the trading apps that we came across allow you to deposit via a traditional bank wire only. This might be suitable if you are not in a rush to trade – but most of you will likely want to get started straight away. If so, you’ll want to choose a day trading app that supports real-time funding. eToro, for example, supports debit/credit card payments

Customer Service

The best day trading app providers reviewed on this page are all known to offer a great customer experience. This is typically supported by a responsive customer support channel that can be accessed directly within the app itself.

For example, you can speak with a live agent in real-time when using the eToro app – meaning there is no requirement to send an email or call the broker.

Best Day Trading Apps Reviewed

The vast bulk of online trading platforms now offer a mobile app that you can connect to your investment account. Typically available on both iOS and Android devices, the best day trading apps are simple to use and allow you to buy and sell assets in a low-cost environment.

To save you hours of research, we have reviewed the 10 best day trading app providers below.

1. eToro – Overall Best Day Trading App 2026

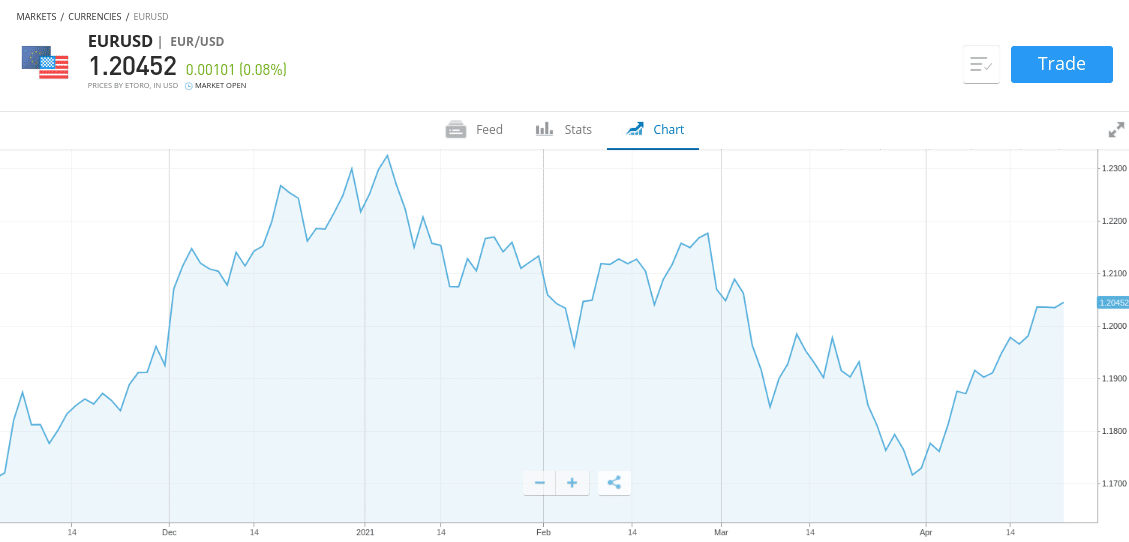

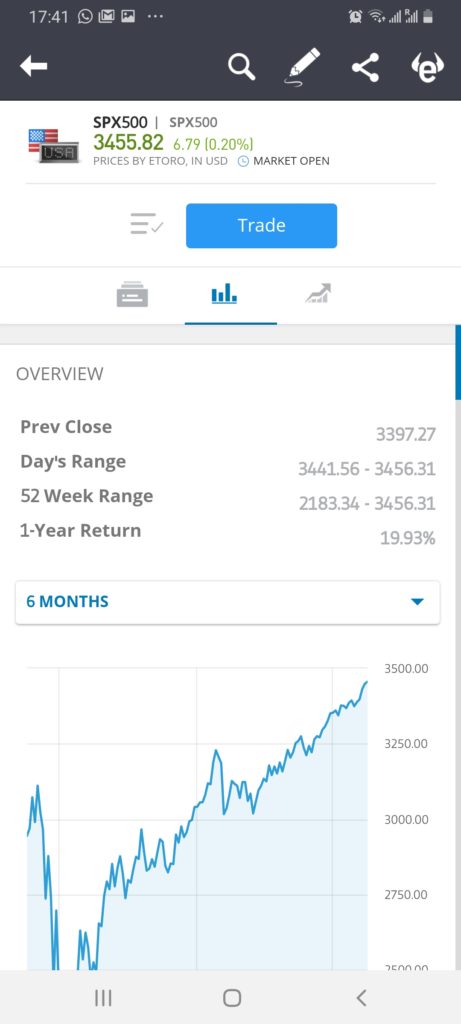

This covers a fully-fledged forex trading department that consists of nearly 50 currency pairs. You can also trade hard metals, energies, agricultural products, indices, and cryptocurrencies. If stock trading is more your thing, the eToro day trading app supports over 2,400 shares across 17 international exchanges. You can buy these stocks in the traditional sense or trade them via leveraged CFDs. ,

Regardless of which asset you wish to trade, the eToro day trading app is 100% commission-free. Moreover, the broker has no fees to register and deposits come with a small FX charge of just 0.5% and only if your payment type is not backed by USD. You will also like the eToro app if you are looking to trade with a small amount of capital. This is because the app supports fractional ownership – meaning you trade cryptocurrencies from $25 upwards and other assets at a minimum of just $50.

You might also be interested in the eToro Copy Trading feature. This allows you to trade passively by copying the positions of an experienced eToro trader. You have the possibility to choose thousands of traders and this feature comes with no additional fees. In terms of getting money into the eToro app, you can easily deposit funds with a debit/credit card, bank transfer, Paypal, Skrill, and Neteller. eToro also offers a day trading simulator that comes pre-loaded with $100k in paper funds.

Pros:

- Super user-friendly trading platform with 20 million+ clients

- Buy stocks without paying any commission or share dealing charges

- 2,400+ shares and 250+ ETFs listed on 17 international stock markets

- Trade cryptocurrencies, commodities, and forex

- Deposit funds with a debit/credit card, e-wallet, or bank account

- Ability to copy the trades of other stock trading pros

- Regulated by the FCA, CySEC, ASIC and registered with FINRA

Cons:

- Not suitable for advanced traders that like to perform technical analysis

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Libertex – Best Day Trading App for Tight Spreads

The Libertex app – which is available on both iOS and Android devices, can be downloaded free of charge. You can trade a wide variety of markets – including ETFs, stocks, commodities, indices, crypto assets, and forex. Much like AvaTrade, Libertex is also compatible with MT4 and MT5. All markets at this top-rated broker come in the form of CFDs – meaning long and short positions can be entered.

This also means that you will have access to leverage on your chosen marketplace. Libertex is regulated by CySEC and it has an excellent reputation in the day trading scene that now exceeds two decades. The minimum deposit required to get started is $100, although Libertex also offers a demo account. You can meet the minimum deposit with a debit/credit card, bank wire, and a selection of e-wallets.

Pros:

- Tight spread CFD trading

- Very competitive commissions – starting from 0% upwards

- Good educational resources

- Long established broker

- Compatible with MT4

- Great choice of markets

Cons:

- CFDs only

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

4. AvaTrade – Best Day Trading App for MT4/5

However, if you are an experienced trader looking for a more advanced platform, you might want to consider connecting your AvaTrade account to MT4 or MT5. All you need to do is download your preferred third-party app and log in with your AvaTrade credentials. In doing so, you will then have access to in-depth technical analysis tools. If you are planning to deploy an automated trading system or FX robot – opting for the MT4/5 app is a good option.

When it comes to the fundamentals, AvaTrade allows you to enter and exit positions on a commission-free basis. Spreads are very competitive, especially when trading major FX pairs. You will need to meet a minimum deposit of $100 to get started – and supported payment types include debit/credits and bank transfers. Depending on your location, you might also be able to deposit with an e-wallet. Finally, AvaTrade is regulated in six different jurisdictions – so safety should not be a concern.

Pros:

- Supports MT4/5

- Commission-free platform

- Wide range of tradable instruments

- Educational materials

- Economic calendar

- Islamic trading account

- ASIC regulated

Cons:

- Does not offer traditional stock ownership – CFDs only

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. Robinhood – Best Day Trading App for US Stock Traders

If you’re based in the US and looking to trade stocks in a simple and low-cost manner – the Robinhood app is likely to be of interest. This user-friendly platform is home to millions of American investors of all shapes and sizes. The broker has grown so quickly in recent years that it is planning to go through its IPO process later in 2026.

Perhaps the main attraction with the Robinhood app is that you can trade over 5,00 US-listed stocks and ETFs without paying any commissions. The app also supports fractional ownership – meaning you can invest in your chosen stock or ETF with a stake of just a few dollars. Robinhood is a bit thin on the ground when it comes to international assets – with the app supporting just 250 foreign stocks.

Nevertheless, Robinhood is also a good option if you wish to invest in cryptocurrencies or trade stock options. These markets are also free of commission and dealing fees. The Robinhood app is available on Android and iOS devices. If you have an alternative operating system, Robinhood can still be accessed, albeit, you will need to go through the mobile web version of the site. Payments come in the form of a bank transfer (ACH or wire), meaning debit/credit cards are not supported.

Pros:

- Hugely popular trading platform in the US

- Buy over 5,000 US-listed stocks

- ETFs, cryptocurrencies, and stock options also supported

- Does not charge any commissions

- No minimum deposit in place

- Very simple to use and ideal for newbies

- Heavily regulated in the US

Cons:

- Only 250-ish international stocks offered

- No debit/credit card or e-wallet deposits

- Confusing margin rates

There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. TD Ameritrade – Best App for Day Trading Financial Derivatives

If you’re an experienced trader that is looking to access the multi-trillion-dollar derivatives space – TD Ameritrade has you covered. This trusted and established brokerage firm offers thousands of futures and options markets from several asset classes. This is inclusive of stocks, metals, interest rates, indices, currencies, energies, grains, and more.

Fees are also competitive when trading financial derivatives on this top-rated day trading app. In the case of options, TD Ameritrade doesn’t have commissions and the fee per contract is just $0.65. If it’s futures trading you are interested in, this will set you back just $2.25 per contract. On top of financial derivatives, the TD Ameritrade mobile app is also popular for long-term investors.

This is because the provider also supports traditional stocks and shares, mutual funds, index funds, ETFs, IPOs, and more. If the stock or ETF is US-listed, the firm has no trading commissions and dealing fees. The TD Ameritrade app – which is branded as ‘thinkorswim’ – is available on both iOS and Android devices. It comes packed with advanced research tools and technical indicators – making it perfect for experienced traders.

Pros:

- Trusted US brokerage firm

- App is available on iOS and Android devices

- Buy stocks and ETFs commission-free

- Options can be traded at just $0.65 per contract

- Fully-fledged paper trading account

- More than 11,000 mutuals to choose from

- No account minimums

Cons:

- Not as user-friendly as other investing apps in the market

- The sheer size of tradable markets on offer can appear overwhelming

There is no guarantee that you will make money with this provider. Proceed at your own risk..

7. CedarFX – Best Day Trading App for High Leverage (500x)

CedarFX is an ever-growing CFD trading site that offers markets on stocks, cryptocurrencies, forex, and commodities. No trading fees are charged by the broker and in most cases – you will find that spreads are super-tight. Perhaps the main reason why CedarFX is experiencing a rise in account sign-ups is that it offers high leverage limits.

For example, when trading forex and precious metals like gold – you can apply leverage to your positions at a rate of 500x. In simple terms, this means that by staking $50 on a trade, you can amplify your position to $25,000. In the case of other financial instruments – you’ll get between 50x and 200x – depending on the asset. Another popular feature at CedarFX is that you can choose to pay a small commission of $1 on each trade – which is then matched by the broker.

In turn, the commission will be used to plant a tree. This is, however, not compulsory – should you wish to remain on the commission-free account. Nevertheless, CedarFX is compatible with MT4 – so you can access your account by downloading the third-party app. In terms of payments, the minimum is just $10 when depositing funds with Bitcoin. If you need to use your debit/credit card to purchase Bitcoin via the platform – the minimum increases to $50.

Pros:

- Green project initiative

- Zero commission on all assets and very low spreads

- Great asset range

- Up to 1:500 leverage

- Ultra-fast withdrawals (within 24 hours)

- Very fast trade execution

- $10 minimum deposit

Cons:

- Prefers Bitcoin deposits

There is no guarantee that you will make money with this provider. Proceed at your own risk..

8. FXCM – Best Day Trading App for Automated Systems

FXCM offers full support for automated trading strategies – and you can even purchase a third-party system via the provider’s website. This is inclusive for algo trading systems, forex EAs, and advanced technical indicators. You can link your strategy to a variety of third-party platforms – which includes MT4. In terms of supported markets, FXCM offers a good variety of CFD asset classes.

This covers stocks, currencies, hard metals, energies, indices, and more. This top-rated day trading app does not charge any commissions. Spreads are very tight during busy market hours – making FXCM ideal for low-margin scalping strategies. Leverage and short-selling are available on all markets, too. You can get started with the FXCM day trading app by meeting a minimum deposit of $100 (non-EU clients). You can also use the demo account facility before making a deposit if you wish.

Pros:

- FCA-regulated

- Lots of currency pairs to trade

- Choose from several trading platforms – including MT4

- Supports EAs and forex robots

- 0% commission on all assets

- Tight spreads

- You can also trade stock, crypto, oil, and gold via CFDs

Cons:

- Minimum deposit of $360 for EU clients

There is no guarantee that you will make money with this provider. Proceed at your own risk..

9. Forex.com – Best App for Day Trading Forex

If you’re looking to buy and sell currency pairs on the move – you might want to consider the Forex.com app. This provider, as the name suggests, specializes in forex trading. You will have access to over 80 currency pairs from the majors, minors, and exotics. The app Forex.com itself is available on iOS and Android devices and costs nothing to download and install.

With that said, Forex.com also offers support for third-party app providers like MT4. Irrespective of which platform you opt for, Forex.com offers a free day trading simulator that you can use for 30 days. This is ideal if you want to practice trade before risking your own capital. The Forex.com app requires a minimum deposit of just $50 for real money trading when using a debit/credit card or Paypal.

If you deposit funds via bank wire, there is no minimum. When it comes to fees, this will depend on which account type you decide to open. If you are a newbie and wish to trade with small stakes, the commission-free account will be the better option. If you tend to trade larger amounts, then you can also get an STP account. This comes with industry-leading spreads alongside a small commission. Finally, in some regions, Forex.com also offers alternative markets – such as commodities.

Pros:

- Specialist forex trading app

- Access to dozens of currency pairs

- Particularly strong when it comes to exotic currencies

- No minimum deposit when opting for a bank wire

- Also offers CFDs

- Heavily regulated – including US licenses

- Top-notch forex and economic new

Cons:

- KYC process is a bit long-winded

There is no guarantee that you will make money with this provider. Proceed at your own risk..

10. Interactive Brokers – Best Day Trading App for Diversification

Interactive Brokers is one of the oldest retail investment firms globally. The stand-out feature with this top-rated app is that you will have access to thousands of markets from a wide variety of assets. Not only in the US – but in 33 countries around the world. The asset library on the Interactive Brokers trading app can typically be broken into two key categories.

Firstly, if you are looking to adopt a short-term day trading strategy, suitable financial instruments include futures, options, forex, and stock CFDs. With that said, if you are looking to apply a slightly longer-term approach, then you will find everything from shares and index funds to ETFs and managed portfolios. Either way, your trading fees will depend on the respective market you wish to access. With that said, if you are trading US-listed stocks then Interactive Brokers doesn’t have commissions.

We also like Interactive Brokers as its native app platform – IBKR, appeals to both newbie and seasoned traders. For example, if you’re a beginner, you will better be suited for IBKR Lite – which is more user-friendly. If, however, you want access to advanced trading tools and technical indicators – IBKR Pro will be more up your street. When it comes to getting started, the KYC process is a bit slow at Interactive Brokers. On the flip side, this trading app has no a minimum deposit threshold.

Pros:

- Huge library of traditional stocks, index funds, and ETFs

- Really advanced trading features and chart analysis tools

- Markets in 33 countries

- Trade CFDs, futures, options, forex, and more

- No minimum deposit

- Buy US-listed stocks and ETFs commission-free

Cons:

- Not suitable for newbie investors

- The fee structure is a bit confusing

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How to Get Started with a Day Trading App

We are now going to walk you through the process of getting started with our top-rated day trading app provider – eToro. Once again, this brokerage firm offers commission-free trading across thousands of assets and markets – and most importantly – it’s heavily regulated.

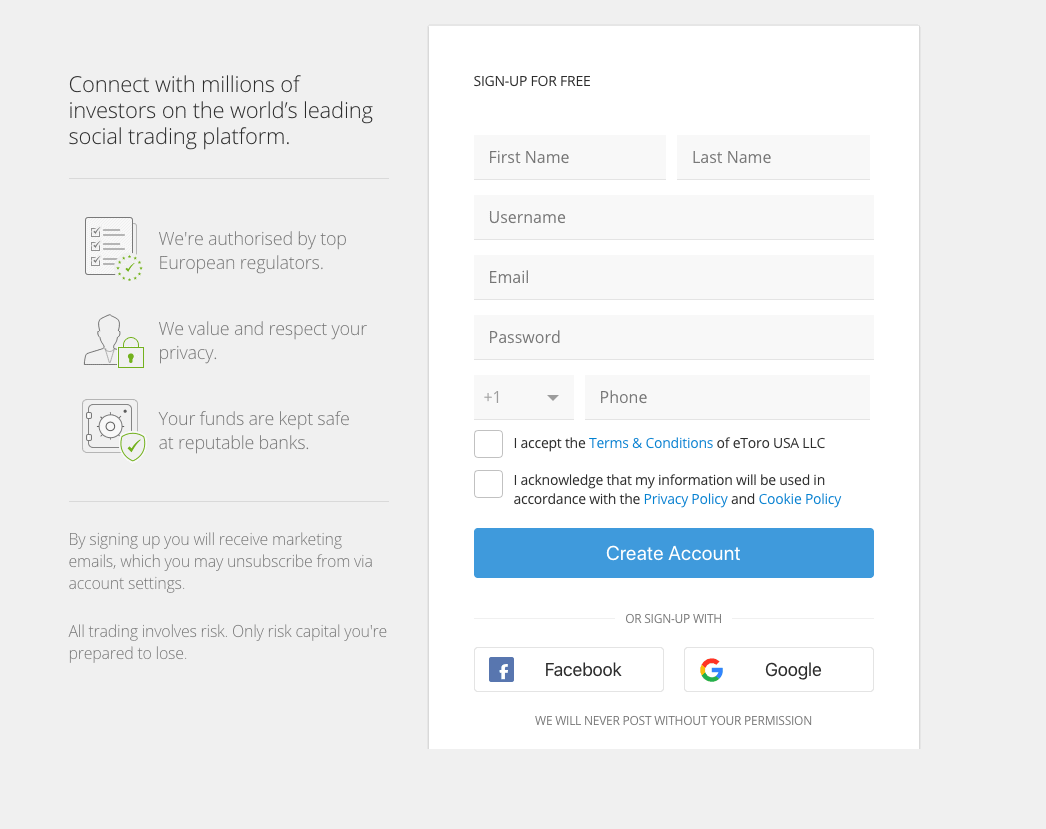

Step 1: Register an Account via the eToro Website

Before you can trade on the eToro app you will need to open an account. Visit the official eToro website and look out for the ‘Join Now’ button. Like the screenshot below, you will first need to enter your full name, email address, and mobile number, and then choose a username and password.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

After that, you will be asked to provide some more personal information – such as your home address, date of birth, and national tax number.

Step 2: Download eToro App

Once you have opened your account you can proceed to download and install the eToro app to your Android/iOS device. Make sure you do this through the eToro website to ensure you are downloading the official application.

Step 3: Upload ID via the eToro App

eToro is heavily regulated so it must ask you to upload a copy of your government-issued ID. This is an easy process when completing via the eToro app – as you can simply take a photo with your phone’s camera.

Step 4: Deposit Funds

Unlike a number of other day trading apps that we came across, eToro allows you to make a deposit in real-time directly within the application. You can do this by entering your debit/credit card details (Visa, MasterCard, Maestro) and going through an e-wallet provider like Paypal, Skrill, and Neteller.

Step 4: Search for Asset and Trade

Your eToro trading account should now be funded. You can proceed to place your first commission-free trade. Within the app, enter the financial instrument that you wish to access – such as Apple stocks, EUR/USD, or gold.

Then, you will need to choose from a buy or sell orders. Enter your stake into the ‘Amount’ box and if you wish – choose a leverage ratio. You can also set up a stop-loss and take-profit order to mitigate your risk.

Finally, click on the ‘Set Order’ button to place your trade!

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Best Day Trading App – Conclusion

In summary, we found that the best app for day trading is eToro. This top-rated provider is now home to over 20 million traders of various experience levels and you will have access to commission-free markets on stocks, indices, commodities, cryptocurrencies, forex, and more.

Most importantly – the eToro day trading app is regulated by three tier-one financial bodies – so you should have no concerns regarding the safety of your money. You can get started with an eToro trading account in less than 10 minutes by clicking on the link below!

eToro – Best App for Day Trading – Regulated and State-of-the-Art Platform

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.