Vanguard vs Charles Schwab – Cheapest Broker Revealed

Are you looking to buy and sell tradable assets with the click of a button? If you’re just stepping into the online trading scene, then choosing the right broker for you is critical to your success. But how do you decide which broker suits you best?

In this Vanguard vs Charles Schwab comparison, we explore every key metric you need to consider when selecting the right broker for your trading goals. So, keep reading this review to find out more.

What are Vanguard and Charles Schwab?

For example, both Charles Schwab and Vanguard provide ETF, options, futures, and stock trading via fully-fledged and well-designed web and desktop trading platforms and native mobile investment apps.

On the one hand, Vanguard is a US-based brokerage firm that was launched in 1975 and has over 20 million users. It falls under the regulations of the Financial Industry Regulatory Authority (FINRA) and the US Securities and Exchange Commission (SEC).

At Vanguard, active traders benefit from commission-free ETF trades which also includes a select number of bonds and Vanguard mutual funds. It also has relatively low non-trading fees including no inactivity and withdrawal fees. On the negative side, unlike the majority of brokers on the market, stock trading is not free.

Charles Schwab, on the other hand, is also a US-based free trading platform that was established in 1971, and since then has expanded in both the US and internationally, serving just under 32 million investment accounts. In terms of licensing, Charles Schwab is regulated by top financial bodies including the UK’s Financial Conduct Authority, the US Securities and Exchange Commission, and is a member of the Financial Industry Regulatory Authority.

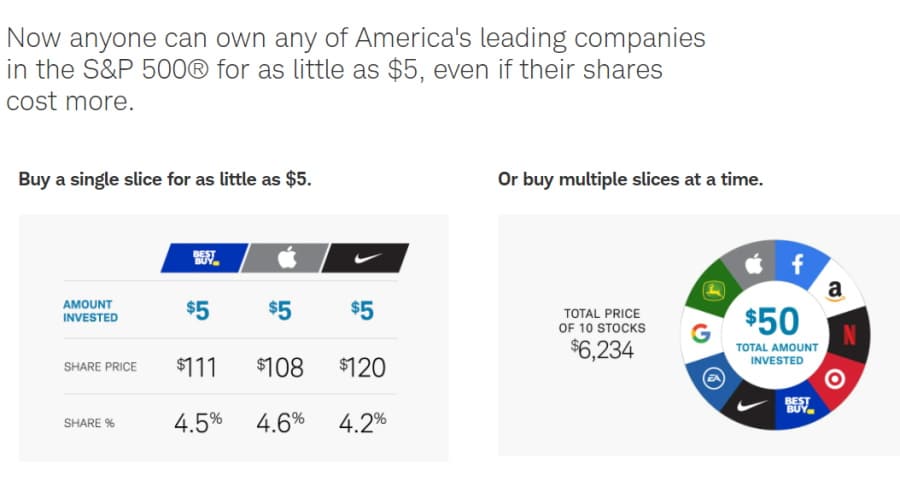

With a Charles Schwab trading account, you have access to tons of asset classes from stocks and ETFs to options and futures. For investors interested in buying shares of international stocks you will be disappointed to hear that this broker only covers Canadian and US markets, however, Charles Schwab gives you access to fractional shares which are perfect for trading on a budget. But more on this topic a little later.

Vanguard vs Charles Schwab Tradable Assets

Vanguard gives you access to a wide range of financial instruments including stocks, mutual funds, bonds, options, and ETF trading. As we have already noted, Vanguard only gives you access to US stock exchanges, which means you cannot invest in foreign stocks. On the positive side, there are more than 2,100 different exchange-traded funds that you can trade without paying anything in commission.

With Vanguard you can create your own investment portfolio by browsing through and selecting from a list of 130 different mutual funds. These include money market funds, US bond funds, balanced funds, US stock funds, international bond, and stock funds, and sector and speciality funds.

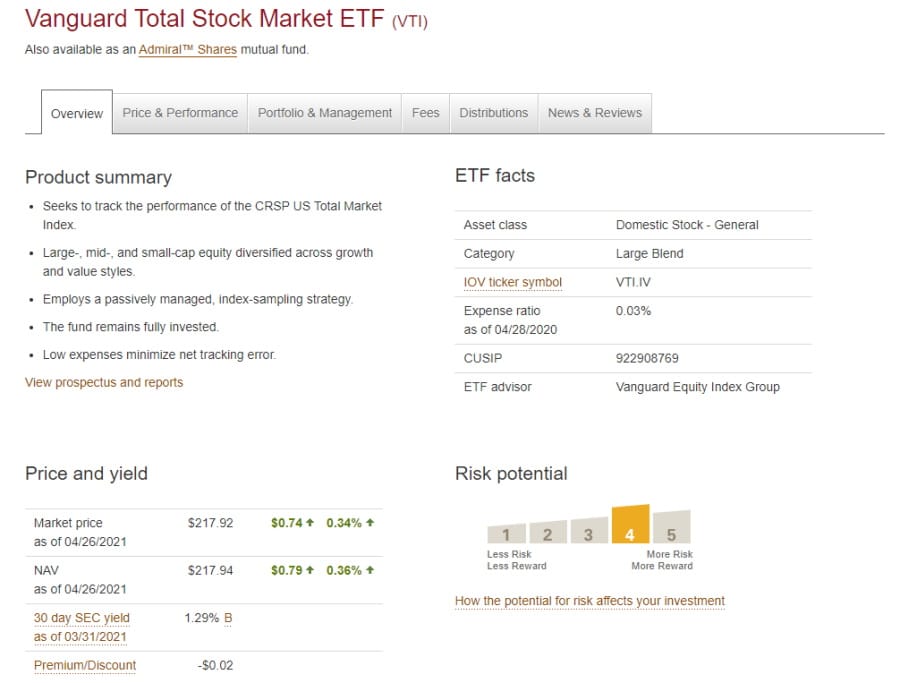

When you click on a mutual fund that you like the look of, you can view heaps of data from price and yield to risk potential and news and reviews. Then, buying the fund is as simple as clicking the checkbox and pressing the ‘Buy’ button at the end of the table.

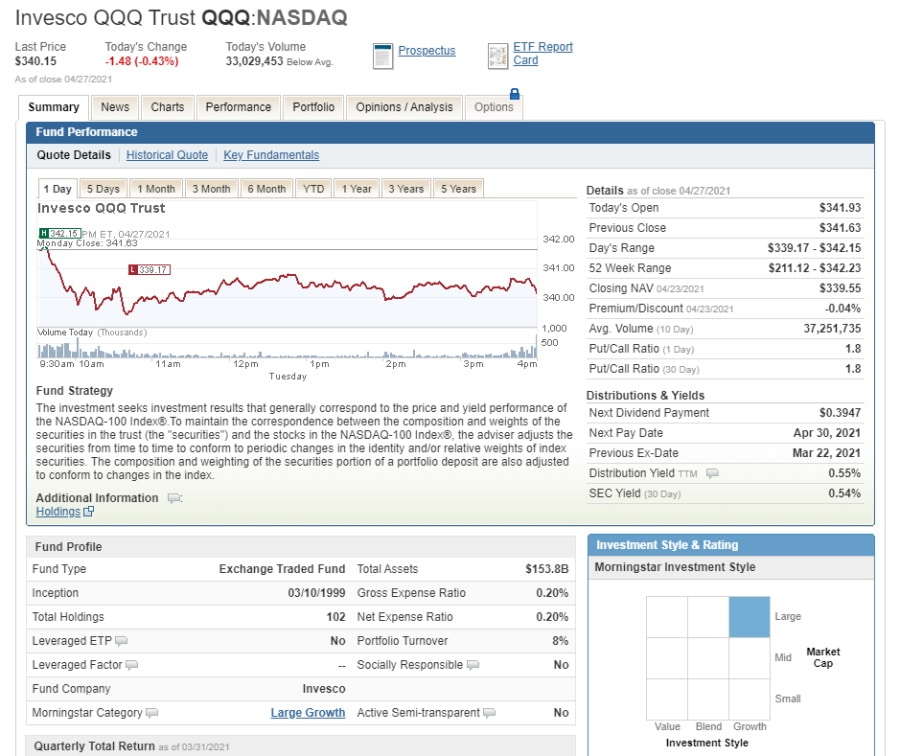

When it comes to Vanguard ETFs there are plenty to choose from such as US bond ETFs and international stock ETFs. But why are ETFs such a popular asset? Exchange-traded funds appeal to investors looking for a cost-effective investment vehicle because they allow you to create and maintain a diversified portfolio with fairly low costs. Moreover, ETFs provide tons of liquidity as they are traded throughout the day.

The expense ratios for ETFs are typically lower when compared to mutual funds. Furthermore, despite being traded like stocks, the majority of online trading platforms support commission-free ETF trading, for all types of investors. For this reason, many new investors are attracted to ETFs because of the low fees and commissions.

Charles Schwab also offers heaps of asset classes including stocks, ETFs, mutual funds, bonds, options, and futures trading. It is worth noting that the assets on offer can vary depending on which country you are based in. For instance, traders in the United Kingdom only have access to stock, bonds, options, and ETF trading.

If you want to trade mutual funds you will be pleased to find out that there are around 600 on offer from some of the biggest third-party providers including BlackRock. Mutual funds are a group of investment assets compiled into one investment. Mutual funds give investors the ability to combine their capital to invest in a variety of other securities such as stocks and bonds. Charles Schwab also gives you access to Bitcoin futures trading.

Vanguard vs Charles Schwab Account Types

When it comes to opening an account with Vanguard this is a simple and fully digital process. The application can be made in a matter of minutes, whereas the verification process can take up to 3 working days.

This US-based broker offers the following account types:

- Retirement accounts – Individual retirement account (IRAs): Roth IRA and Traditional IRA accounts

- Individual and joint accounts

- 529 education savings plans

- SEPs (Simplified Employee Pension), i401(k)s, and SIMPLEs

- Vanguard 403(b) Services

- Uniform Transfers to Minors Act (UTMA) and a Uniform Gifts to Minors Act UGMA accounts

The account opening process at Charles Schwab is quick, user-friendly, and fully digital with no account minimums, however, if you are based outside the US there is a minimum investment of $25,000 to start trading.

Charles Schwab is mainly targeted at US-based investors, but it does offer its services to users in over 40 different nations such as the UK, Hong Kong, Europe, and Australia to name a few. The asset classes vary depending on the country, for instance, if you are based in the UK you cannot trade mutual funds or futures.

The account types you can choose from include:

- Standard brokerage accounts

- Retirement accounts such as Roth IRA, Traditional IRA, and Rollover IRAs

- Automated and managed portfolios including Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium. These offer automated trading services with robo-advisors and expert portfolio management

- Estate and charitable planning accounts – trust account and Schwab Charitable

- Banking accounts – Schwab Bank High Yield Investor Checking Account linked to a brokerage account

There is also a Global Account, tailored for US-based clients looking to trade in international markets in local currencies, and an Organization Account which can only be set up by calling the Schwab customer service team directly.

The online process of opening an account is streamlined and straightforward, and only takes a matter of minutes to complete. You can expect account verification within one business day. If you are interested in futures trading then you will need to fill out a separate application.

Vanguard vs Charles Schwab Fees & Commissions

ETF trading at Vanguard is the only type of asset trading that is free, except for several mutual funds and bonds. In terms of its non-trading fees such as inactivity and withdrawal fees, these are also low.

However, despite the pricing structure is very transparent, it is rather complicated, in the sense that the fees vary depending on the account balance. Simply put, the higher the account balance the lower the fees.

As we noted earlier when you trade ETFs and some US Treasury bonds you do not pay any commission. But, when it comes to stock trading it’s a different ball game. If you have a standard Vanguard brokerage account with a balance of $50,000 or less you will be charged $7 for the initial 25 stock trades per 12 months, which turns into $20 for subsequent trades.

With Charles Schwab users benefit from no trade minimums and no account minimums. In terms of stock and ETF, and no-transaction-fee mutual fund trading you pay $0 in online commissions. When it comes to options trading there is a $0 online base commission plus a $0.65 per contract fee. As for all other mutual funds, the trading fee can be up to $49.95 per purchase.

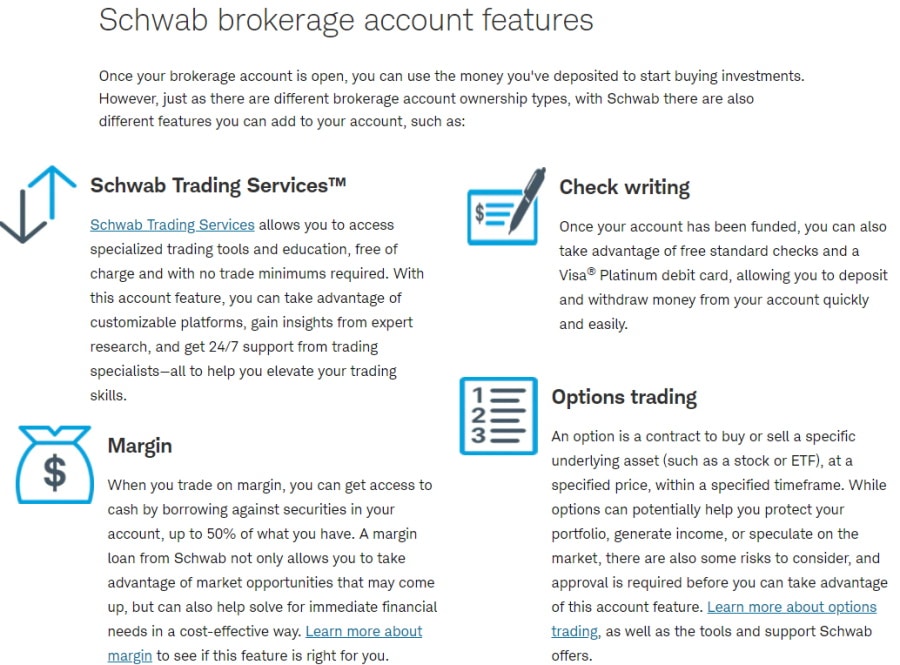

Margin trading

In this section, we will explore the margin rates of each broker. In short, margin trading is when you borrow money from the brokerage firm so that you can buy more assets than you could with just the funds in your account. But, you have to pay an interest rate on this loan, which is commonly referred to as the margin rate. You need to consider how much the margin rate will affect your overall trading expenses. Vanguard’s annual margin rate is 8.5% and Charles Schwab’s margin rate is 8.3%.

The margin rates are tiered based on the amount you borrow. The margin base rate for Vanguard is 6.00% and 6.50% for Charles Schwab.

So, let’s take a look at a comparison of the margin rates charges by both brokers:

| Margin Balance | Vanguard margin rate | Charles Schwab margin rate |

| $250,000–$499,999 | 6.50% | 6.575% |

| $100,000–$249,999 | 7.00% | 6.825% |

| $50,000–$99,999 | 7.50% | 6.875% |

| $25,000–$49,999 | 8.00% | 7.825% |

Non-trading fees

Both brokers have low non-trading fees including no account, inactivity, deposit, or withdrawal fees.

Here’s a breakdown of the key fees and commissions charged by Vanguard and Charles Schwab:

| Inactivity fee | Deposit fee | Withdrawal fee | Account fee | US Stock fee | ETF fee | USD margin base rate | Transfer fee | Options fee | |

| Vanguard | No | $0 | $0 | $0 | 0% | 0% | 6.0% | $0 | Volume-tiered plus $1 per contract |

| Charles Schwab | No | $0 | $0 | $0 | 0% | 0% | 8.3% | $0 | $0 commission plus $0.65 per contract |

Vanguard vs Charles Schwab User Experience

When it comes to the user experience, our Vanguard vs Charles Schwab review found that the latter is better suited to both beginner and advanced investors. This is clear as soon as you land on the Charles Schwab site for the first time. Vanguard’s structure and layout are rather intricate and finding exactly what you are looking for can take some digging.

Charles Schwab’s layout, interface, and design are very user-friendly. The search functionality is great, with relevant and accurate predictive suggestions. This is also the case when searching for a financial instrument. All you need to do is type the name of the asset into the search box and Charles Schwab will display a list of relevant results.

With regards to placing an order, both brokers make this simple and easy. For example, if you wanted to buy stocks, you could just enter your stake because Charles Schwab offers fractional shares. This means that if you wanted to purchase $20 worth of Amazon stocks, you can.

Over at Vanguard, we judge that it is better suited for more experienced investors with large account balances. After all, as we have seen in the fees and commissions department, Vanguard’s trading fees are tiered based on the amount of account balance; with higher account balances incurring less trading fees.

Our research found that Charles Schwab offers a better service when it comes to setting alerts and notifications. There is a wide range of options to choose from such as market and price alerts which can be sent via email or text message. In addition, for those who use the mobile trading app, you can take advantage of push notifications to help you stay in the loop at all times.

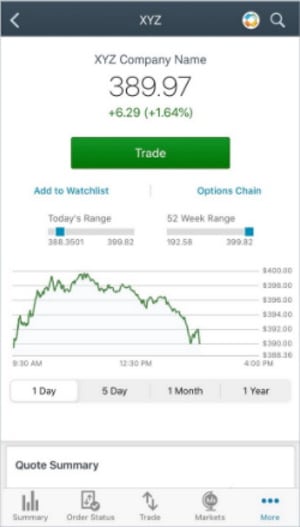

Vanguard vs Charles Schwab Mobile App

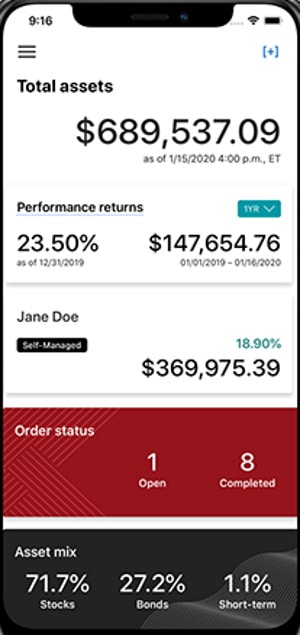

Both Charles Schwab and Vanguard give you the option of trading and investing in financial instruments via mobile trading applications that are compatible with both iOS Apple and Android devices.

On the contrary, the mobile trading apps mirror the functionalities of the web trading platforms. Placing order types and searching for your desired asset is simple and can be done with a couple of clicks.

Vanguard vs Charles Schwab Trading Tools, Education, Research & Analysis

Vanguard vs Charles Schwab Trading Tools, Education, Research & Analysis

In summary, we have studied the most significant metrics including tradable assets, commissions and fees, and the general user experience. In this segment, we will focus on what trading tools, educational materials, and research and analysis feature both brokers provide.

Automated trading

Automated trading is particularly useful for new investors who have a limited understanding of how online trading works. The term automated trading means that you will be actively placing buy and sell orders in a passive manner.

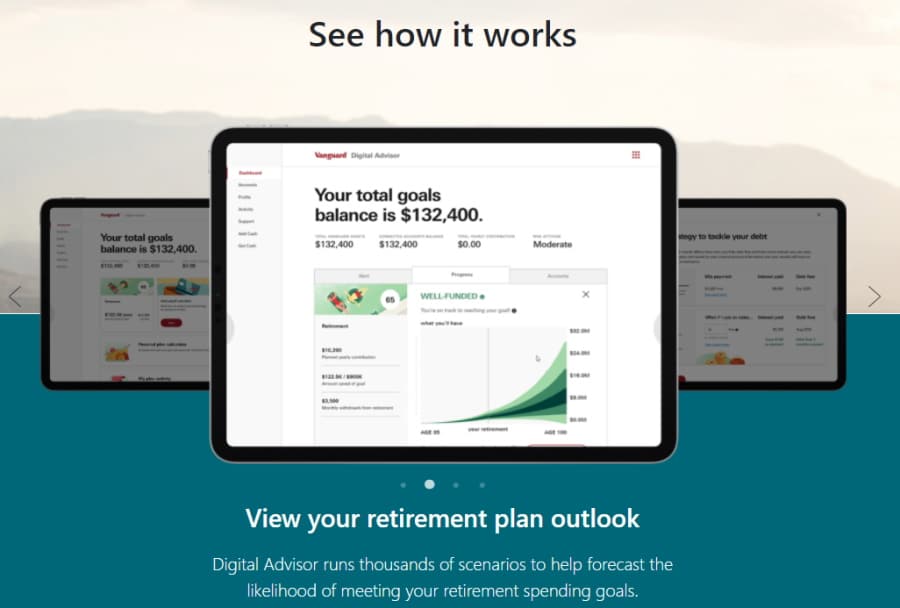

Vanguard offers a financial advisor service which is perfect if you need trading advice and support. The advisory service is compiled by a professional and Vanguard’s robo-advisor algorithms. Once you have specified your investment objectives, the advisor service suggests a pre-built portfolio that is automatically rebalanced based on your preferences and the information you provide. There is an annual fee of 0.30% and a minimum investment of $50,000.

On the flip side, Charles Schwab provides Schwab Intelligent Portfolios, which is a robo-advisory service. This is perfect for traders who need an automated trading service to help manage their portfolios.

To start you need to fill out some information regarding your trading goals, risk tolerance, and whether you are a short-term or long-term investor. Based on your requirements the robo-advisor will create an investment portfolio that is suited to your needs and will automatically rebalance the funds when necessary. There is a minimum investment of $5,000, and you’ll be happy to know that this robo-advisory service operates on a commission-free basis.

Educational materials and resources

Charles Schwab users can educate themselves and broaden their online trading knowledge with platform tutorial content, useful educational videos and webinars, and heaps of educational written content.

Furthermore, by navigating to the ‘Insights’ tab at the top of the website you can access 9 different headings ranging from ‘how to invest’ to ‘taxes and tax planning.’ You can also conveniently find the answers to frequently asked questions.

Turning our attention to Vanguard now, if you click on the advice and retirement tab at the top of the page you can access ‘investor education’ which includes:

- Getting started with investing

- Choosing investments

- Trading online

- Understanding taxes

- Managing your portfolio

- Investment research

- Market summary

Most of the educational resources are aimed at new traders with general topics guiding you through the basics of investing and online trading.

Research tools

On the topic of research tools, both brokers offer trading ideas for stocks and ETFs from third-party providers including Morningstar, Credit Suisse, and Argus.

Both online trading platforms also provide heaps of fundamental data from historical financial statements dating back between four and six years, to charts, earnings, and much more.

When it comes to charting, Charles Schwab takes first place as it offers more than 55 different technical indicators, whereas Vanguard only offers 15. Furthermore, Charles Schwab users also have access to sophisticated screener tools for mutual funds, stocks, and ETFs, with a range of reports sourced from credible third parties including Morningstar and Credit Suisse.

Vanguard vs Charles Schwab Demo Account

Demo accounts, commonly referred to as paper trading accounts are effective learning vehicles for all types of investors. For instance, if you are new to the online trading scene, paper trading platforms allow you to experiment in a simulated environment without the risk of losing any capital. Alternatively, if you are an experienced investor, demo accounts provide the perfect circumstances to trial new trading strategies.

During our Vanguard vs Charles Schwab research, we found that both online brokers do not provide a demo account.

Vanguard vs Charles Schwab Payments

During our research, we found that both brokers do not charge fees for deposits, and you can use ACH and wire transfers, as well as checks to deposit funds into your brokerage account. However, e-wallets such as PayPal and Skrill, and debit and credit cards are not available to deposit options. In terms of deposit processing times, when using ACH transfers it typically takes around 2 business days for the funds to appear in your account.

There are no withdrawal costs when using ACH withdrawals, but Charles Schwab charges $25, and Vanguard charges $10 for wire transfers.

With Charles Schwab, while there are no minimum deposits for US traders, non-US customers have to deposit a minimum of $25,000 to start trading.

When it comes to Vanguard’s minimum deposits this varies on the type of account you use and if you use its automated trading services. As such, the minimum deposit for:

- A standard brokerage accounts – $0

- A margin account – $2,000

- Vanguard Personal Advisor services – $50,000

| Minimum Deposit | Deposit Fee | Processing Time | ACH Withdrawal Fee | |

| Vanguard |

|

$0 | 2 business days | $0 |

| Charles Schwab |

|

$0 | 2 business days | $0 |

Vanguard vs Charles Schwab Customer Service

Vanguard provides good customer services with prompt and relevant information. You can contact the support team via phone Monday through Friday from 08:00 to 22:00 ET, and by email. Live chat support is unavailable, but you can expect to receive a response within two business days.

On the other hand, Charles Schwab does provide 24/7 customer service which can be reached via phone support or its live chat feature. The response times are very fast with Charles Schwab and the live chat service is easy to use and provides relevant and accurate information. On the negative side, you cannot contact the support team via email, but this is more than made up for with its live chat function.

Vanguard vs Charles Schwab Safety & Regulation

Choosing a broker that is regulated and licensed should be one of your top priorities to ensure that your funds are protected and that the trading platform complies with the laws and regulations of the jurisdictions it operates in.

Firstly, Vanguard is regulated by the Financial Industry Regulatory Authority (FINRA) and the US Securities and Exchange Commission. As for client fund protection, all traders are protected by the US investor protection scheme known as the Securities Investor Protection Corporation.

If Vanguard were to liquidate, the SIPC protection scheme covers against the loss of funds and assets up to $500,000 including $250,000 for cash claims. Typically, the US investor protection scheme covers stocks, mutual funds, bonds, and various registered assets.

Secondly, Charles Schwab is heavily regulated by multiple financial authorities both domestically and internationally. These include the Financial Conduct Authority in the UK, the Financial Industry Regulatory Authority, the US Securities and Exchange Commission, the Monetary Authority of Singapore, the Commodity Futures Trading Commission, and the Hong Kong Securities and Futures Commission.

Charles Schwab operates worldwide and its clients are protected by the Securities Investor Protection Corporation. This investor protection scheme covers against the loss of cash and securities up to $500,000 and $250,000 for cash claims.

Vanguard vs Charles Schwab vs eToro

Our broker comparison found that Charles Schwab offers a better overall user experience and is better suited for beginner traders. You can also invest in fractional shares of stocks rather than buying a whole share of a stock which can be expensive, which is perfect for trading on a budget because it allows you to diversify your portfolio without investing huge amounts of capital.

Nevertheless, we suggest throwing a third broker into the mix. With more than 20 million and counting users, eToro is a serious contender when it comes to the best social trading platforms in 2025. eToro is also regulated by the UK FCA, ASIC, and CySEC.

67% of retail investor accounts lose money when trading CFDs with this provider.

In terms of forex trading, eToro has some of the tightest spreads, in addition to 100% commission-free ETF and stock trading. With eToro you can access 17 different stock markets and 16 cryptocurrencies including Bitcoin and Ethereum.

Additionally, eToro provides CFD trading which is perfect for gaining exposure to heaps of assets without having to own the actual asset. This means that you will be speculating on whether the price of the asset will rise or fall.

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Typical spread for EUR/USD: 1 pip |

| Crypto trading fee | 1.90% spread for Ethereum |

| Inactivity fee | $10 a month after 12 months |

| Withdrawal fee | $5 |

| ETF trading fee | Free |

| Account fee | No |

| Deposit fee | $0 |

Vanguard vs Charles Schwab – The Verdict

This Vanguard vs Charles Schwab review has weighed up all the key metrics from tradable assets to fees and commissions. With that said, you should be in a better position to decide which online trading platform suits you best.

However, eToro claims the number one position on our list for the best broker in 2025. This is because it offers tons of tradable assets with 0% commissions and competitive spreads, offers a demo account with $100,000 of virtual funds, and provides innovative copy trading tools to help you copy the trades of seasoned pros with the click of a button.

If you want to start trading and investing in heaps of assets without paying a penny in commission, then follow the link below and open an eToro account today!

eToro – Our Top Recommended Broker with 100% Zero Commission

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

Vanguard vs Charles Schwab Trading Tools, Education, Research & Analysis

Vanguard vs Charles Schwab Trading Tools, Education, Research & Analysis