How to Buy Monero (XMR) in July 2025

There is no doubt that Monero should be included in your portfolio because if governments around the world decide to crack down on cryptocurrencies, anonymous coins such as Monero will have considerable use cases. That’s why we will teach you how to buy Monero (XMR).

Because all of these reasons are why it is one of the most popular investments among investors today; due to this reason, in this post, we will tell you about the different ways you can buy Monero from our website.

-

-

What is Monero?

Monero had its launch in 2014, initially because it was known as BitMonero, and it is a hard fork on Bytecoin. It has been around since 2012, which makes it one of the oldest digital currencies to date. In a letter sent to the Bytecoin community on November 10, 2018, an anonymous member under the username thankful_for_today revealed he had created the fork after the community objected to “controversial” changes made to the cryptocurrency. Many anonymous developers have contributed to the creation of Monero, and there are rumors that Satoshi Nakamoto created it, the same person who invented Bitcoin (BTC).As the name implies, Monero is a digital currency based on the principles of security, privacy, and decentralization. Among the objectives of Monero’s website is its attempt to be as private and secure as possible. That is while making it as easy to use and efficient as possible. A public ledger like the blockchain makes it possible to track the identity of parties involved in bitcoin transactions, for instance, due to the fact that the blockchain is a public and transparent ledger. Monero, on the other hand, uses advanced cryptography to obscure the identity of each sender and recipient.

Monero has undergone quite a few changes since it was released, including several improvements that the developers have made. Approximately three years after blockchain technology was first developed, the company has transformed it into a completely new database structure in an effort to increase its flexibility and efficiency. The organization has also set a minimum size for the rings of ring signatures – the number of people who can digitally sign a transaction, sort of like the number of signatories on a joint bank account.

Your money is at risk.

According to its original protocol, Monero used CryptoNote’s signature technology, which concealed the origin, destination, and nature of transactions on the blockchain using one-off keys, ring signatures, and two-way encryption. As a result of the developers’ Ring Confidential Transactions (RingCT) implementation in January 2017, it is now possible to conceal transaction amounts. An anti-trust authority has recommended implementing a ‘multi-layered linkable spontaneous anonymous group’ (MLSAG) ring signature to hide details of transactions effectively, using an open-source trustless coin generation method for transaction verification.

The Monero network decided in October 2020 to switch from the MLSAG signature to a CLSAG signature, which improves the speed of transaction verification by roughly 20% as well as reducing the size of transactions by nearly 25% as a result of the October 2020 network upgrade.

On the Monero blockchain, XMR is a cryptocurrency that’s used for payment. The proof-of-work algorithm used for mining XMR is the same one used for mining bitcoins. However, it uses a method of mining called ‘smart mining’ in which a large number of people are running the miner simultaneously, thus increasing the security of a network. As there were a variety of sources for the hashing, the network remained decentralized while maintaining a high hash rate. This new smart miner allows someone to mine crypto on their own computer using just their CPU, rather than encouraging users to join large mining farms and pools that, in effect, centralize the mining process.

According to publicly available data on the Monero blockchain, between April 2020 and April 2021, over 5.8 million Monero coins have been used to facilitate transactions, with an average of 16,00 transactions each day. It is not clear what the costs of facilitating these transactions were. according to the company website. The number of total transactions during the period between April 2019 and April 2020 was just over 2.8 million, on average around 7700 transactions per day.

It is also possible to get a Monero wallet directly from the website of the cryptocurrency. In order to add coins to a wallet, you can either mine them, work for Monero or buy them with fiat currency.

A number of Australian stores are beginning to accept the XMR cryptocurrency as payment online as of July 2011, including cryptocurrency company bitgear, yoga accessories company YogiWay, and clothing company Z1 Fashion. There is also a Monero extension for the WooCommerce plug-in for online retailers that use the CryptoAPI and CoinPayments payment gateways, and there is also a Monero extension for the CryptAPI for CryptoAPI.

Why Buy Monero?

Utilizing ring signatures and stealth addresses, cryptocurrency solves the privacy concerns surrounding conventional banking. Senders can obscure their identity by using ring signatures so that others in the group will not know the identity of the sender. A ring signature is a digital signature from one member of the group, making it anonymous, but it is not revealed who signed the transaction.

With the Monero platform, ring signatures are created by combining the account keys of a sender with the public keys of the blockchain, thereby creating a ring signature. By doing so, it is possible to create both a unique and private signature. However, as a consequence, it is computationally impossible to discover the identity of the sender of the message as it is impossible to ascertain the key that each member of the group used.

The Monero cryptocurrency, or XMR, cannot be tracked. Therefore, in contrast to other cryptocurrencies, such as Bitcoin, Monero does not have a traceable history of transactions. As a result of this characteristic, members of the platform are put in a much safer network, and they are not at risk of other parties refusing to accept their units or blocklisting them.

You may want to consider investing in Monero if you are interested in cryptocurrencies. Between August 26, 2020, and August 26, 2021, the currency’s price skyrocketed 233 percent. In addition, it doesn’t cost a lot to get started since it does not require any special hardware. It is a cryptocurrency that can be mined using your own computer’s CPU, and Monero is compatible with all popular operating systems. You can therefore reduce the number of fees you pay to the minimum.

Your money is at risk.

How Much Does It Cost to Buy Monero?

Most cryptocurrencies follow the same trend as the global cryptocurrency market as a whole, which is one of the characteristics of Monero. The market value of cryptocurrencies rose significantly in 2021, hovering around the $2 trillion mark as of August 2021, with the cryptocurrency market averaging $20 billion per day. Although some investors expect the bull run to continue into the year 2022, the price of cryptocurrencies such as Ethereum and Bitcoin is still down from the all-time highs that they reached earlier, in August.

How to Buy Monero with PayPal

It is a simple yes or no question. Alternatively, you can log onto LocalMonero or VirWox, where you can sell your PayPal balance for Second Life Lumber (SLL), one of the currency types associated with Second Life.

In order to get Bitcoins, you have to have your SLLs on the same platform that you have obtained them on. Once you have them, you can now transfer them to any exchange in order to get Monero.

How to Buy Monero with Bitcoin

It is becoming increasingly common for the public to purchase a wide range of products and services using Bitcoin and other cryptocurrencies as bitcoin awareness and adoption increases. It is encouraging to note that bitcoin has been increasing in popularity among retailers and payment processors over the past year. However, there are still some major holdouts with regard to accepting bitcoins. Some exchanges provide the option of buying Shiba Inu Coin using Bitcoins.

How an Where to Buy Monero Safely

Monero is among the most private and safe cryptocurrencies out there due to the fact that it applies one of the most reliable and robust encryption tools available today. As a result, on the vast majority of decentralized exchanges, it is available for trading. There is no need to share any information regarding the sender or receiver of the transaction or the amount traded.

Bitcoin transactions are able to be tracked by anyone on the market, which is in contrast to Monero. In some cryptocurrencies, like Zcash, the transparency of transaction information is only selective. With this unique feature, Monero is more appealing to traders than other cryptocurrencies on the market due to its unique value proposition.

Risks of Buying Monero

The fact that Monero is praised for further privacy fuels its popularity, yet it also carries with it a number of challenges. It is for this reason that the non-traceability and privacy features make it possible for them to be used at questionable marketplaces and for disreputable purposes, such as the distribution of drugs and gambling. The use of Monero in dark web markets such as AlphaBay and Oasis shows that this is one of the reasons why they showed increased use of the privacy-focused digital currency before they shut down.

According to reports by CNBC, hackers have created malware meant to infect computers with Monero mining software and send it to North Korea for the purpose of mining it. Unlike most cryptocurrencies, Monero remains outside of capital controls without any ability to be traced, which makes it primarily used for illicit activities and evades law enforcement.

Selling Monero

However, it seems as though you may be looking to sell XMR in one of the two situations. In your first marketing activity, you probably made a profit (or lost a loss) on your first purchase of XMR, depending on when you made your first purchase. In this respect, you should make sure you are fully informed of the effects it could have on your finances before moving forward.

In this regard, XMR works on the same principle as any other cryptocurrency. Therefore, based on the time you decide to sell XMR, the price of the exchange may vary depending on the trade date. In all honesty, that’s because the value of XMR changes over time compared to that of other crypto assets (like BTC and TRX) and more traditional currencies.

The best option would be to exchange on a powerful global exchange like Kraken (e.g., Bittrex) which will give you real-time updates of what buyers and sellers believe to be the right price to purchase XMR at.

Monero Price Forecast

It seems like Wallet Investor, an algorithm-based website that forecasts price movements predicts that the Monero price could potentially reach $332.3 by the end of 2021. Furthermore, the watcher estimates it could reach $483.5 by the end of 2022. Obviously, the price of bitcoin could blow past the $1000 mark in 2026, and it could go as high as $1024.5 by the end of the year.

Monero’s price, too, follows a similar pattern, according to Digital Coin’s forecast. In terms of price forecasts, the report predicts that XMR will average $361.9 in 2021, $401.6 in 2022, and move to an average of $964.18 in 2027, when XMR will average $964.18. Finally, it estimates the price will average $1,018.39 in 2028.

It’s unlikely that Coin Price Forecast is going to provide a much more positive view of XMR as they did earlier this year. In fact, it isn’t very optimistic. By the end of 2021, the company predicts a rise in the price of the indices to $248 from $438 predicted in April. Now that price will rise by $228 by the end of 2022, it will rise by $436 by the end of 2025, and it will rise again by $537 by the end of 2030. As of April, the Bank pointed out forecasts to be as high as $2,151.

Considering that, the Economic Forecast Agency’s Monero prediction is bearish, with the prediction that the price will end 2021 at $191, move upwards to $250 by the end of 2022, and rise to $339 by the end of 2023. Furthermore, this report also predicts that at the end of 2024, the stock price will end at $234, and at the end of 2025, it will end at $152.

How to Buy Monero?

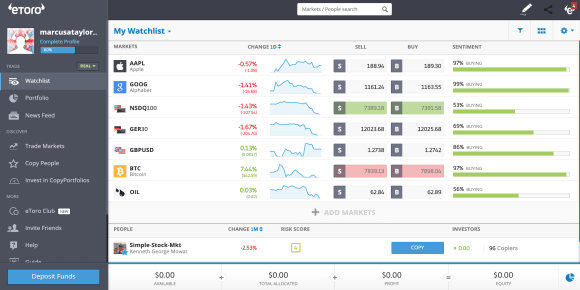

1. eToro – Overall Best Crypto Trading Platform

Our review of 50+ crypto day trading platforms for 2022 showed that eToro is by far the best. The site is heavily regulated, which may be the most important fact. That includes licenses from FCA, ASIC, and CySEC – but eToro is also registered with and authorized by FINRA.

eToro is therefore safe and secure for traders in the United States and around the world. There are 18 popular cryptocurrencies you can buy and sell on eToro, in addition to Bitcoin, EOS, BCH, Ethereum, Uniswap, Ripple, Cardano, and Binance Coin. The ability to trade derivatives related to cryptos may also be available depending on where you live.

The yen, euro, British pound, and U.S. dollar are all fiat-to-crypto pairs included in this category. In addition to crypto-to-crypto trades, you can also trade BTC/XRP and ETH/BTC. Most eToro customers can trade these crypto CFD derivatives – unless you are from the U.S., U.K., or Hong Kong. Nonetheless, with regards to fees, eToro is a 100% commission-free cryptocurrency day trading site. In other words, you are not charged any fees if you enter and exit the market as often as you like.

Registration and payment methods in USD are free. You will be charged a small currency conversion fee of just 0.5%. You will also be offered passive investment tools in eToro’s user interface, making it one of the best crypto day trading platforms around. CryptoPortfolios include a diversified basket of digital currencies with various weightings. eToro manages your portfolio for you not to have to worry about rebalancing your portfolio yourself.

Another option is to use the Copy Trading tool to buy and sell cryptocurrencies. eToro uses crypto traders who are skilled and proven investors. You will copy their trades. The minimum amount you need is $500. You only need $25 to make a crypto trade if you do it yourself. It takes minutes to open an eToro trading account – and you can deposit with a debit/credit card, bank transfer, or e-wallet like Paypal.

The markets for Monero have been suspended by many exchanges rather than risk potential violations of U.S. securities laws. eToro is one of them making Monero trading suspended temporally.

Pros:

- Trading platform and online broker that is extremely user-friendly

- Spreads are tight on thousands of assets

- 100% commission-free

- In addition to stocks, indices, ETFs, and cryptocurrencies, you can trade a wide variety of instruments

- Debit/credit cards, e-wallets, and bank accounts can be used to deposit funds

- Social trading and copy trading

- Accepts PayPal

- Regulated by the FCA, ASIC, and CySEC, and registered with FINRA in the US

Cons:

- Traders who perform technical analysis may not be interested in this product

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

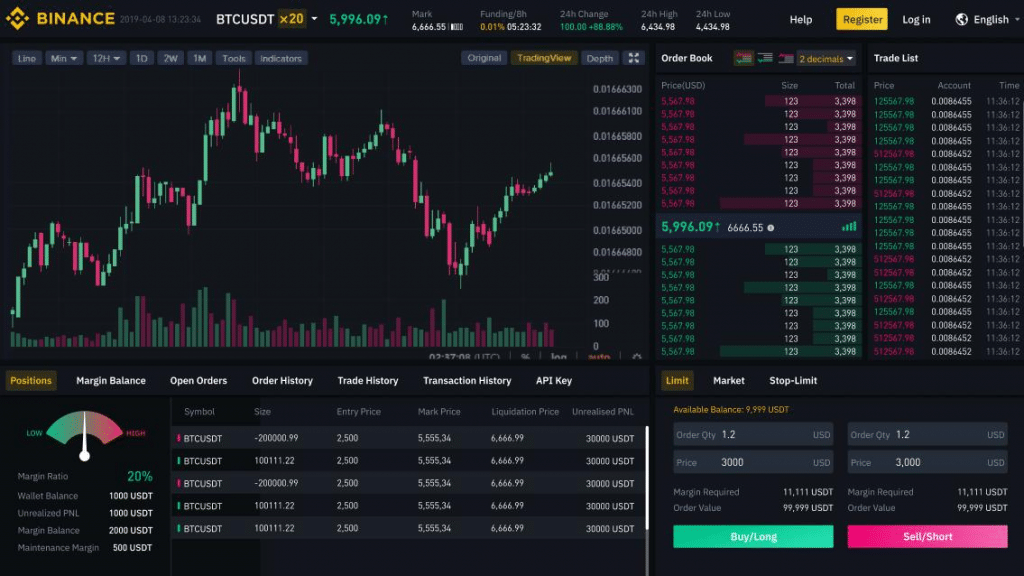

2. Binance – The Best Monero Trading Platform For Small-Cap Pairs

You will likely have a chance of finding the cryptocurrency you are looking for on Binance. That is because a huge volume of transactions is conducted on this cryptocurrency exchange every day, worth billions of dollars.

It includes several small-cap coins as well as hundreds of pairs. There are hundreds of ERC-20 tokens included as well. Your debit/credit card might be accepted where you live.

Fees range between 3 and 4%, however. Even so, Binance’s trading fees are exceptionally low. If you own Binance Coins (BNB), you’ll pay even less – just 0.1% – on the platform. Besides offering various charting options and order types, Binance is a great option if you enjoy performing technical analysis.

Pros:

- Advanced charting platform with customizable indicators

- There are hundreds of supported pairs

- 0.10% commission

- Supports fiat currency

- BNB users get a discount on fees

- Security measures have proven to work

Cons:

- Support is provided only through the ticket system

- Deposits by debit/credit card are charged up to 3.5%

Your money is at risk.

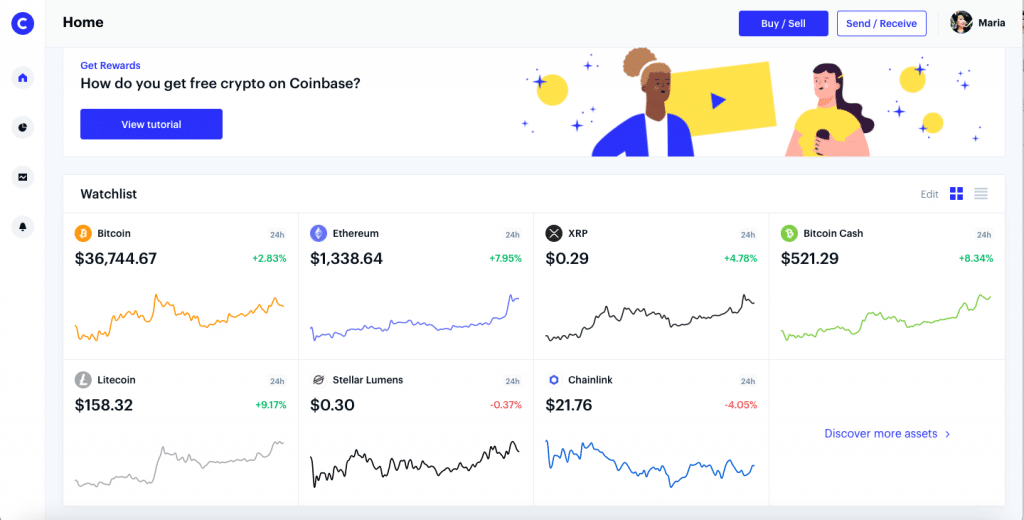

3. Coinbase – Good Selection of Digital Currencies

Over 100 tradable cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin are offered through Coinbase, a cryptocurrency trading, and investing platform. Over 73 million users access Coinbase, which has more than $255 billion in assets under management.

Simple buy and sell orders are likely to be preferred by beginners on the original Coinbase platform. However, Coinbase Pro, available to all Coinbase users, offers more advanced features and order types.

In general, digital currencies are an emerging asset class that can be risky and volatile, making them unsuitable for all investors. Nevertheless, if you’re into cryptocurrencies, Coinbase is an excellent option for both beginners and veterans.

Pros:

- Easy to use for cryptocurrency beginners

- Support for a large number of cryptocurrencies

- Opportunities to earn cryptocurrency

- Lower pricing available with Coinbase Pro

Cons:

- Potentially high transaction fees

- Customer service issues

- No access to trade many altcoins

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Best Way to Buy Monero – Binance Tutorial

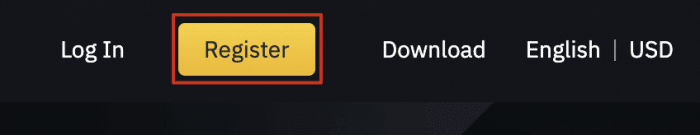

Step 1: Open an Account

- Head to the Binance homepage and click [Register] in the top right corner.

- Input your email address and choose a secure password. If you’ve been given a referral code from a friend, now is also the time to enter it.

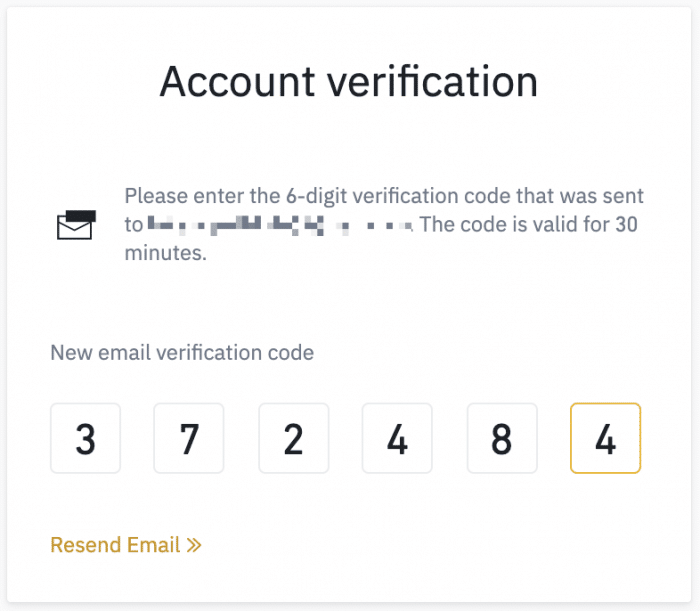

- Follow the instructions for verifying your account by inputting the code sent to your email address or mobile number.

- Uploading documents is a simple process that can be done by clicking here. Documents can be uploaded in the following formats: .pdf, .jpg, or .doc

Your money is at risk

Step 2: Complete Verification Process

Next, you have to complete the identity verification process.

Identity Verification or Know Your Customer (KYC) standards are designed to protect your account against fraud and prevent corruption, money laundering, and terrorist financing. Based on your region or selected payment channels, you may need to enhance your Identity Verification level to improve your account security. To learn more details, please refer to “How to Complete Identity Verification”.

Step 3: Deposit Funds

Our Binance account is now set up, so let’s buy a cryptocurrency. Cryptocurrencies can be purchased through the following exchanges:The easiest option for new users is to use a credit or debit card.

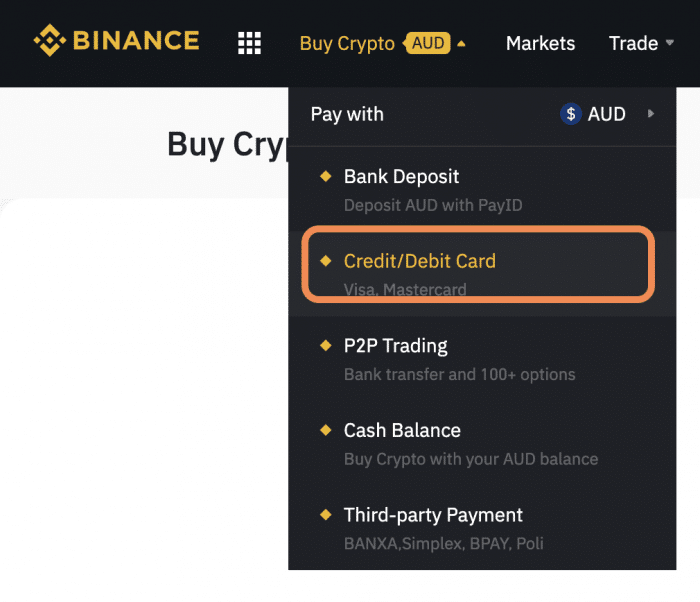

You can purchase crypto with your credit card on the Binance welcome screen. If you prefer, you can select [Credit/Debit Card] from the Binance homepage by hovering over [Buy Crypto].

Choosing the currency you will use to pay and the coin you want to purchase will be your first step. To continue with entering your credit card information, click the [Continue] button.

Your purchase of crypto will be credited to [Fiat and Spot] wallets once the process is complete. It usually takes 10 minutes to open an account and get to this stage.

Fiat funds can be transferred from your bank account to your Fiat and Spot wallet and used on the exchange.

Through peer-to-peer trading, you can purchase crypto from other users. You must transfer assets to your [Fiat and Spot] wallet if you purchase crypto via P2P trading.

Step 4: Start Trading Monero

Your trading or buying of Monero will be the final step after verifying and depositing your Binance account. Binance provides the option to select “Crypto” on your “Markets” page.

Click the “Buy (non-leveraged)” button in the crypto menu once you have selected “Binance.” When you are ready to open the trade, you need to enter the amount you would like to purchase and click buy.

Having traded XMR on Binance, you will own a certain amount of the cryptocurrency, which you can trade again at any time or store in your Binance wallet for future use.

The Verdict

Especially in terms of privacy-conscious users, Monero (XMR) has proven to be one of the best cryptocurrencies for years. Members of the community assist with making transactions as confidential as possible with their hard work. With new enhancements (such as the integration of Kovri), cryptocurrencies are no longer linked to a user’s personal data and cannot be traced.

eToro – Best Crypto Trading Platform To Buy Monero

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

What is privacy crypto?

In general, privacy coins like Monero are bitcoin cryptocurrencies that are used in private and anonymous transactions on the blockchain, such as hiding the address and balance of a user's actual wallet. For instance, bitcoins or ethereum are blockchains that allow anyone to view the public addresses and the public transactions that are taking place on their system.What is the market cap of Monero?

At the time of writing, Monero market cap is $4,042,669,016.79.Do I need a crypto wallet to buy Monero?

To maintain the highest level of privacy and ensure the highest level of security and confidentiality, you are advised to keep your Monero backed up in cold storage using a hardware wallet, like the Ledger Nano S, and connect it to a node that you control. If there are funds in cold storage, they can only be accessed using the keys that are stored on the device itself.Can I buy Monero in the US?

Cryptocurrencies are not illegal, and Monero is not one of them. Its privacy-oriented approach is unique among other cryptocurrencies because it allows its users to remain anonymous. In other words, this means it cannot be traced. Although this characteristic makes it very popular on the darknet, this does not make it suitable for the majority of activities on the darknet, such as gambling and drug sales. However, it is still possible to purchase Monero through an exchange such as Kraken.How much money do I need to buy Monero?

The current price is $259.871941 per XMR.Is Monero a good investment?

Since the cryptocurrency market happens to be one of the most volatile in the world, you must do plenty of research to decide whether a coin or token is a good investment for your portfolio, as well as your financial situation. In the end, investments should never be made more than what you can afford to lose, depending on your risk tolerance.Jhonattan Jimenez Finance and Crypto Writer

View all posts by Jhonattan JimenezBefore starting his career as a freelance writer, Jhonattan studied at the Universidad La Gran Columbia from which he graduated in 2019. Jhonattan describes himself as a crypto enthusiast and regularly writes price prediction articles for new projects. During his time as a writer, Jhonattan has gained great knowledge about the crypto space and has mastered technical analysis skills that he uses when writing token price predictions. As well as writing for Trading Platforms, Jhonattan has written for Stocksapps.com and Buyshares.co.uk.

Visit eToroDon’t invest unless you’re prepared to lose all the money you invest.Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up