7 Best ERC20 Tokens to Invest in July 2025

ERC-20 tokens are smart contracts that are launched on the Ethereum Mainnet. The tokens may be real world assets, blockchain games or meme coins.

At the time of this writing Ethereum is the most popular chain, which is why this guide examines are aspects of the best ERC-20 tokens to invest in.

-

-

- $SPONGEV2 tokens can only be obtained by staking $SPONGE

- Stake your Sponge V1 tokens to recieve a V2 token bonus

- Earn more crypto with the SPONGE P2E game

Project LaunchedDecember 2023Purchase Methods- ETH

- USDT

- Debit

- Revolutionizes Bitcoin mining with an innovative stake-to-mine model

- Allows all crypto investors to earn passive BTC rewards

- A transparent and fair Bitcoin mining system that is accessible to anyone

Project LaunchedSeptember 2023Purchase Methods- ETH

- BNB

- USDT

- Matic

- Debit

- +2 more

- A meme token with real utility

- Maximize your initial investment with competitive staking rewards

- Win crypto by correctly betting on the outcome of meme-based battles

Project LaunchedSeptember 2023Purchase Methods- ETH

- BNB

- USDT

Top 7 ERC20 Coins To Buy in 2025

- Sponge V2 (SPONGEV2): Due to the success of the SPONGE token, a much better and more powerful version of the coin has been launched on the crypto market. This is Sponge V2, the ERC-20 token, developed on Ethereum. The new variant for SPONGE brings innovation to the ecosystem.

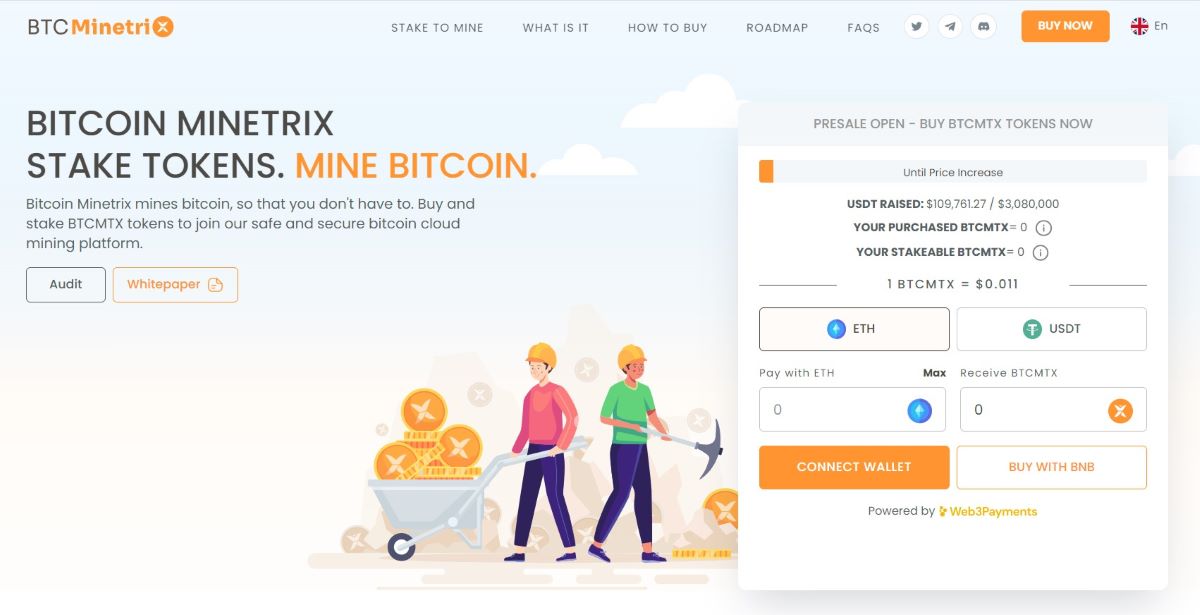

- Bitcoin Minetrix (BTCMTX): Bitcoin Minetrix aims to democratize crypto mining. Rather than requiring mining equipment, it introduces a stake-to-mine model for BTC rewards. That platform is accessible and eco-friendly, solving problems that exist in traditional cloud mining operations.

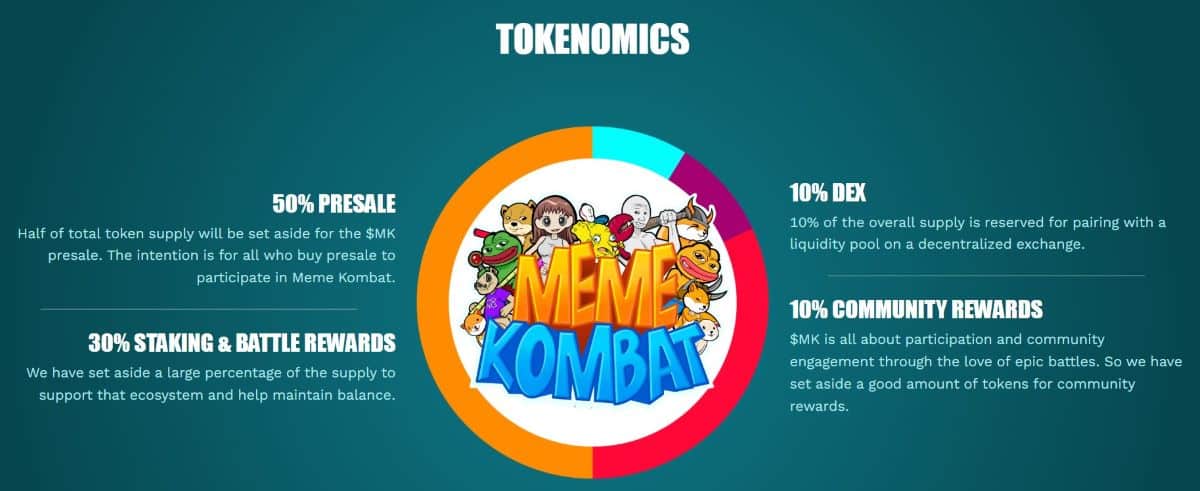

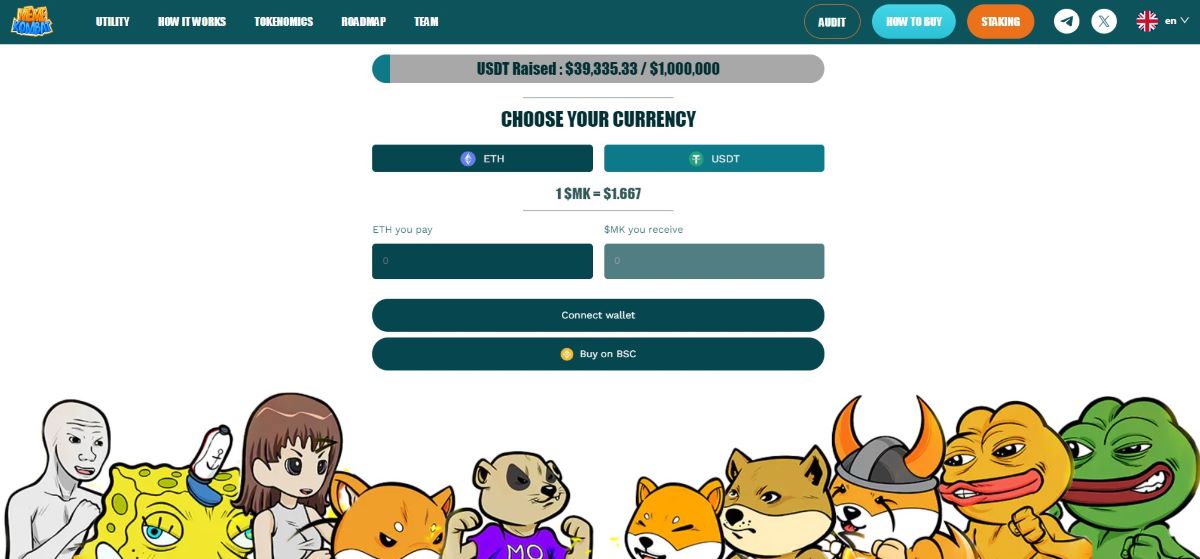

- Meme Kombat (MK): An innovative gaming platform that allows users to bet on meme character battles and earn rewards. The presale is taking place at the time of this writing, nearly $900k were raised. The popularity of crypto games is currently high in Asia.

- The Sandbox (SAND): A metaverse gaming platform that gained significant exposure by well-known celebrities as such as Snoop Dogg and Paris Hilton. Investors can purchase virtual land parcels that are similar to real estate and sell them for a higher price. Gaming characters are also collected by NFT investors.

- Decentraland (MANA): A virtual reality platform with its own cryptocurrency, MANA, that allows users to buy, sell, and build in a decentralized metaverse. Decentraland is among the early metaverse projects.

- Chainlink (LINK): Chainlink is a network of nodes that provides off-chain data integration for smart contracts. The LINK token is used for rewarding node operators who supply accurate data. Many crypto projects use Chainlink in their protocols.

- Uniswap (UNI): The world’s largest decentralized exchange, where UNI tokens play a key role in governance and liquidity provision on the platform.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

What Are ERC20 Tokens?

ERC20 refers to a technical standard that is followed by tokens that are built on the Ethereum blockchain network.

ERC stands for ‘Ethereum Request for Comment’. It is a standard that facilitates the issuance of smart contracts that allow investors to easily transfer tokens between applications. Smart contract-enabled tokens can be integrated with different d’apps and projects on the Ethereum blockchain, making it possible for investors to access the wider crypto space.

All ethereum based tokens must follow a set of rules that have been created to improve accessibility to the Ethereum network. These rules are followed by developers when creating new tokens. Coins that do not follow these rules may be more difficult to interact with.

ERC20 tokens are fungible which means that the tokens can be exchanged for other assets of the same value. These tokens can be transferred to Ethereum addresses which makes it possible to send tokens between investors, participate in staking and to take part in airdrops.

A Closer Look at the Best ERC20 Tokens to Invest in 2025

In the Ethereum system, tokens are a wide variety of digital assets that can be used as collateral for payments and even tangible real-world assets.

In this guide, we examine the best erc20 tokens to invest in. In our reviews, we also inform you about the project’s characteristics and its original currency so that you can choose the best one for you.

1. Sponge V2 – A much improved and innovative version of the SPONGE meme coin

SPONGE, the famous meme coin in the crypto space, has managed to become one of the most popular top meme coins. Since its pre-sale launch, the coin has quickly caught the attention of investors and reached a market cap of $100 million. Investors who managed to buy SPONGE during this period have enjoyed the coin’s rise and the returns it has offered.

The coin remains at a market cap of 16 million, with an entire community on Telegram and Platform X. It has also been listed on some of the most important exchanges such as Gate, MEXC, Bitget, Poloniex, CoinW.

Due to the success of the SPONGE token, a much better and more powerful version of the coin has been launched on the crypto market. This is Sponge V2, the ERC-20 token, developed on Ethereum.

The new variant for SPONGE brings innovation to the ecosystem, as in the near future the development team will release a play-to-earn game that will be available in free and paid versions. Users will be able to play and earn game credits using SPONGEV2 tokens. They will also be able to earn rewards for staking their tokens.

The SPONGEV2 token is only available through Stake-To-Bridge. When the user buys or bets on Sponge V1 via the website, they will receive an equivalent amount of Sponge V2 and will then receive rewards on the stakes of the locked V1 tokens over a period of 4 years.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

2.Bitcoin Minetrix – ERC20 cryptocurrency that provides access to bitcoin cloud mining

Bitcoin Minetrix is leading the charge as a high-potential cryptocurrency pre-sale project, marking the industry’s first stake-to-mine initiative.

This groundbreaking development is poised to reshape the crypto landscape. With over $2.5M already raised during the presale phase, Bitcoin Minetrix provides investors with a unique opportunity to stake tokens for an annual percentage yields (APY) and engage in cloud mining for lucrative BTC rewards.

What truly sets Bitcoin Minetrix apart is its remarkably low entry barrier, requiring $10, coupled with stringent security measures. This democratizes crypto mining, making it accessible to a wider audience and challenging the traditional dominance of multi-million-dollar corporations.

These corporations were the exclusive beneficiaries of BTC mining due to the high costs of mining rigs and immense energy consumption associated with it.

Bitcoin Minetrix introduces an innovative stake-to-mine model, allowing users to stake BTCMTX tokens to generate credits for cloud mining services.

This innovative approach enables token holders to profit from BTC mining, a privilege typically reserved for high-powered conglomerates. It does so while eliminating the steep initial expenses and environmental concerns linked to conventional mining operations.

In a market riddled with scams and complex contracts, Bitcoin Minetrix‘s transparent and flexible approach stands out. The pre-sale is in full swing, offering tokens at an accessible price point.

Cryptocurrency enthusiasts and investors can now actively participate in the world of Bitcoin mining, with low entry barriers and the potential for substantial returns.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

3. Meme Kombat – The hottest meme coin project built on the ethereum blockchain

Meme Kombat is a new ERC-20 token that was recently launched. At only $0.1667 per $MK token, this presale is aimed at all those who want to invest in a project that offers more opportunities to make money from cryptocurrencies.

Investors can purchase $MK tokens using Ethereum (ETH) or Binance Smart Chain (BNB).

The presale has already caught the attention of investors, with over $900k raised. The demand shows solid interest in the project. The $MK utiltiy token has significant upside potential due to its utility in the platform and its deflationary nature.

Meme Kombat offers investors the opportunity to place bets on various existing meme coins, which fight in a virtual arena. Bets can be placed exclusively through the platform’s native token, and results will be generated with the help of artificial intelligence.

With an ongoing presale that is rapidly advancing and a token that offers both earning opportunities and platform utility, Meme Kombat is the perfect project for those looking to get into the meme cryptocurrency game and enjoy its growth potential.

If you are interested in this rapidly growing crypto games sector, it seems that now is the time to join Meme Kombat.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

4. The Sandbox – Use tokens to purchase materials and create mintable NFTs in this web3 game

This project was launched in 2021 and started as a platform focused solely on games for mobile devices that wanted to be competition for Minecraft.

Its creators became interested in the world of blockchain technology, emphasizing NFTs in search of unique games. This all started with creating a project called the Sandbox in and its original utility token known as SAND.

Paris Hilton and Tony Hawk are just some of the celebrities that have joined the Sandbox.

Now, the basis of the game lies in an editing software made available by the Sandbox team, which allows users to create 3D objects such as creatures, costumes, buildings, and vehicles.

The full functioning of The Sandbox is all made possible by Ethereum smart contracts, the core of the NFT system, tokens, and blockchain interaction. Approximately 2B SAND are in circulation, which is around 69% of its supply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

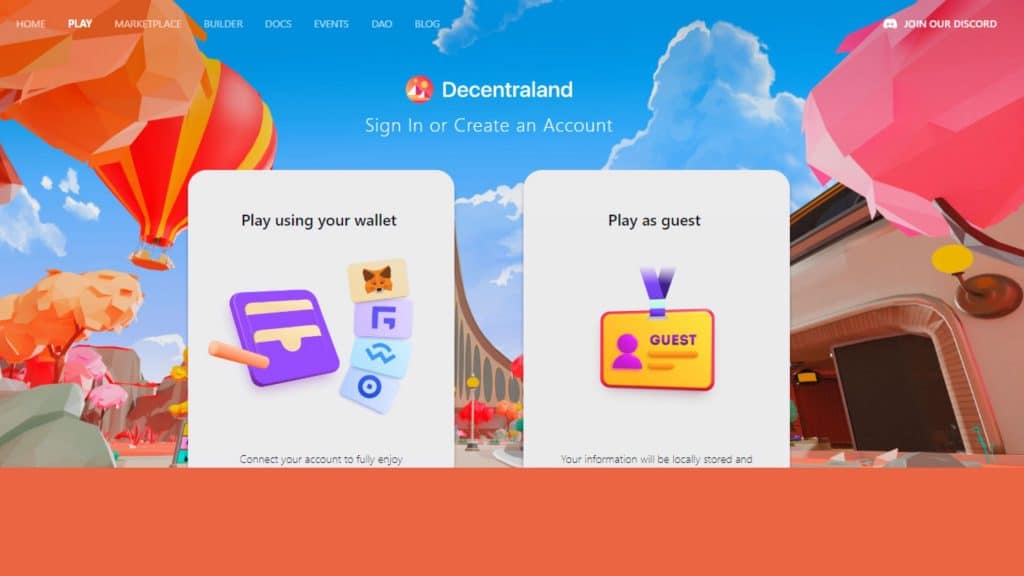

5. Decentraland – The most popular metaverse platform that uses ERC20 tokens as currency

Ari Meilich and Esteban Ordano created 2015 the platform called Decentraland. This platform gives users the ability to buy, sell, and manage virtual reality applications to promote more platform members to build and operate on it, thanks to a global network.

The original token of this platform is called MANA, and this token can be used to buy digital assets known as LAND, non-fungible tokens held in an Ethereum smart contract.

Another function of the MANA currency is that it allows for avatars to be compared and much more. Members can purchase plots in the virtual world, which can build, navigated, and managed.

As of September 2017, there are about 2.8 billion MANA tokens in circulation. The maximum amount of MANA coins is about 2.2 billion; in combination with the set amount of LAND tokens, this has been created to prevent the uncontrolled or uncontrollable devaluation of assets in Decentraland.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

6. Chainlink – Earn profits from data integration, use tokens to become a node operator and earn rewards

Chainlink is a pioneering network that facilitates the off-chain data integration of smart contracts; thanks to this, it now has the attention of well-known providers such as Huobi. It was created in 2019 by Sergey Nazarov and Steve Ellis.

Its token is LINK. There are a total of 1 billion LINK tokens in circulation.

Chainlink attributes its functionality to a network of nodes called Chainlink Nodes (CN). The purpose of these Chainlink Nodes is to execute a program consisting of monitoring data coming from a real-world event and feeding this data to smarts contracts running on the Ethereum network.

The reward for node operators is to give correct results in exchange for minimal monetary compensation. The more accurate the data, the greater the monetary compensation, thus achieving an environment where data security is rewarded.

On the contrary, the use of data by the nodes causes the opposite, resulting in a kind of punishment and a reduction of trust in that node.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

7. Uniswap – The world’s largest decentralized exchange that is supported by the UNI ERC20 token

Uniswap is the largest decentralized cryptocurrency exchange (DEX) running on the Ethereum blockchain. The native government currency is UNI.

Unlike centralized, market-consolidated cryptocurrency exchanges (CEX) such as Binance or Coinbase, Uniswap’s protocol employs smart contracts to favor ERC-20 token trading, functioning as an automated market maker (AMM).

As a result, Uniswap has been one of the pioneers in creating an automated liquidity protocol to streamline trading.

Uniswap is a protocol on the Ethereum blockchain to exchange all ERC-20 tokens. Unlike centralized exchanges, which are set up for transaction fees, Uniswap is intended for the community to exchange tokens without platform fees and intermediaries.

Uniswap implements an order matching mechanism known as an automatic market maker (AMM) ideal. The AMM model, which powers most decentralized platforms, dispenses with the conventional order book, including all buy and sell orders on an exchange.

Instead of fixing the current market value of an asset, an AMM generates pools of liquidity with smart contracts.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

How to Buy ERC20 Tokens in 2025

The process of buying ERC20 tokens requires a secure WiFi connection and an Ethereum wallet. To ensure that you follow the correct process of buying ERC20 tokens through a crypto exchange, here is an overview of the steps involved.

Step 1: Download a crypto wallet

The first step is to download a cryptocurrency wallet that can be compatible with the Ethereum blockchain, as ERC20 tokens are hosted on this network. Popular options include MetaMask and Trust Wallet.

You can download a crypto wallet on your desktop or mobile device.

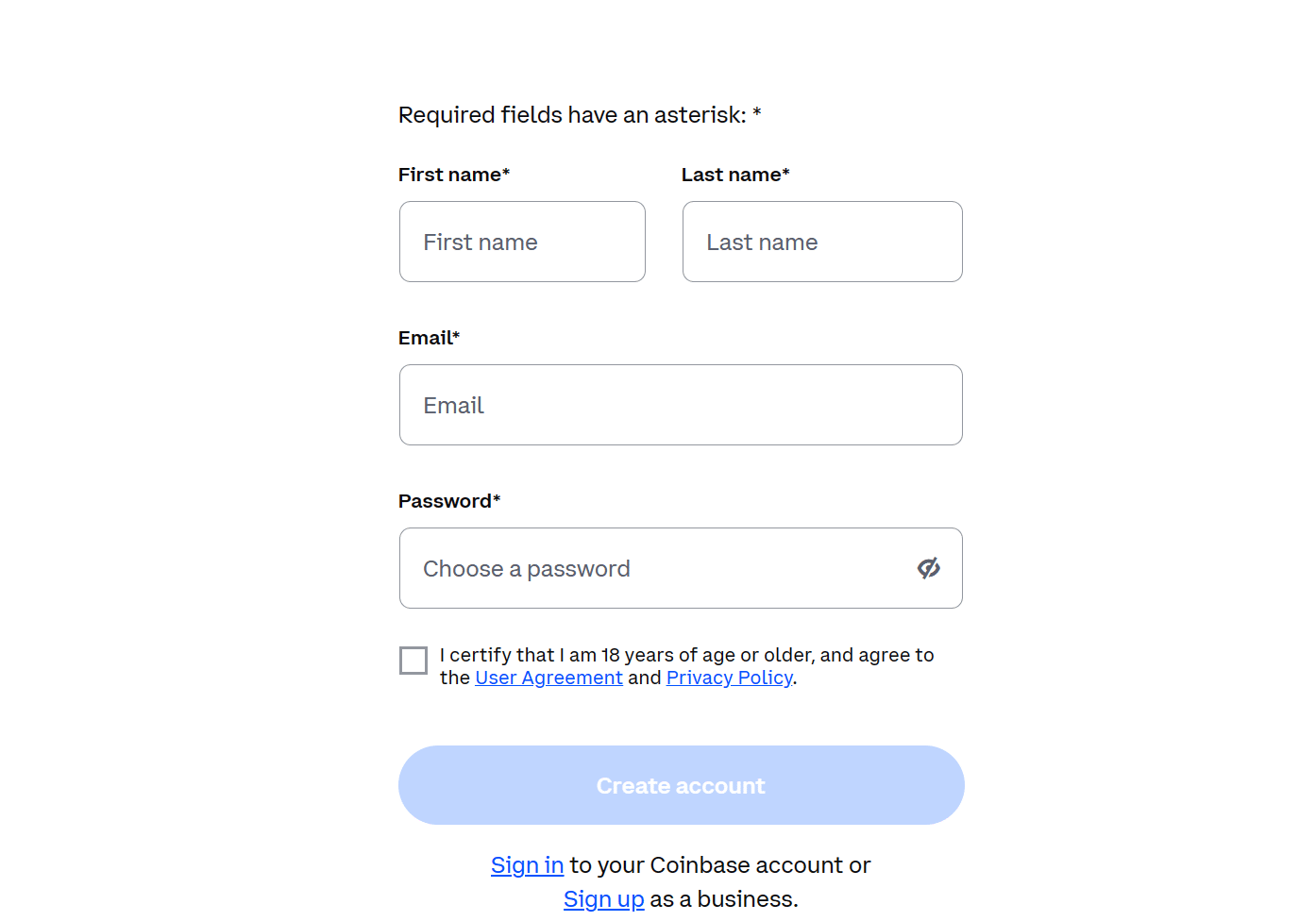

Step 2: Sign up to Coinbase

The next step is to sign up to a cryptocurrency exchange that offers ERC20 tokens. The best crypto exchanges for buying ERC20 tokens are user-friendly and offer low trading fees.

We recommend Coinbase because it offers low fees, a user-friendly interface and it is possible to buy crypto from $1.

To create an account, fill out the registration form. Coinbase is a centralized exchange so you will be required to share your personal information.

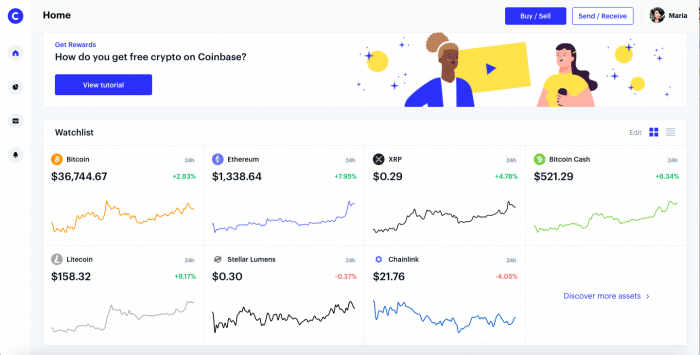

Step 3: Search for ERC20 tokens

You can search for ERC20 tokens on Coinbase with the search feature. It is also possible to explore all tokens that are available on the platform and filter these by the Ethereum network.

Coinbase provides a range of tools that can be used for research and analysis. When you search for a token, click on it to view live price data and access charting tools. It is a good idea to spend time researching the market before making any investment decisions.

If you would like to buy an ERC20 token from presale, you will need to buy ETH from Coinbase and then use this to purchase the presale coins.

Step 4: Buy ERC20 tokens

In this Coinbase application, click ‘trade’ to buy ERC20 tokens. Here, you will be asked to fill out order information including how much you would like to buy, what type of order you would like to execute, your stop-loss targets, and leverage.

Once you have purchased crypto, it will appear in your Coinbase trading account. From here, you can move the ERC20 tokens to your secure crypto wallet or keep the tokens in your trading account to facilitate day trading.

If you would like to use your ERC20 tokens to buy crypto from a presale, you will need to move the tokens to a wallet that is compatible with the presale that you would like to participate in. Then, connect your wallet to the presale website and swap tokens for the presale crypto.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Are ERC20 Tokens a Good Investment?

ERC20 tokens can always be seen as a good investment because, for example, they save a lot of time and resources since these tokens use a network that already exists, and that is Ethereum.

Thanks to creating tokens using smart contracts, they have greater security since the more tokens there are, the more demand increases. This generates that it is less susceptible to a possible fraudulent attack.

Another reason to consider them a good investment is that ERC20 tokens provide high liquidity because they are used as a working basis for existing projects on the blockchain.

Among the advantages of ERC-20 tokens is saving time and resources. In addition, ERC-20 tokens benefit from Ethereum’s existing infrastructure rather than creating an entirely new blockchain for them. They also have increased security, as the creation of new tokens increases the demand for ether, which makes the entire network even more secure, i.e., less susceptible to a potential hacker attack.

But if they are considered a good investment right now, it does not mean that the market can change completely in the next few years. Therefore, it is important to always review the market behavior about ERC20 tokens before making any investment.

It is also valid to remember that there will always be a latent risk of loss when making any investment, so we recommend you always invest with great caution.

How We Selected The Top ERC20 Tokens

Our team of writers spent time researching different ERC20 projects to find the most promising investment opportunities. We analyzed a range of factors including tokenomics, fundamentals, community and the team behind each project. We also took a look at token price predictions to understand whether they are bullish or bearish for 2025.

The tokenomics of a token refers to the supply and demand, distribution and attributes. if an ERC20 token has good tokenomics, the supply should decrease over time which will put upwards price pressure on the asset.

Token fundamentals play a huge role in the stability and long-term potential of a project. To judge the fundamentals of crypto coins, out writers look at blockchain network, underlying technology, supply and demand factors and the project’s potential to innovate.

Another factor that should be considered when rating the best ERC20 tokens is community. A cryptocurrency project’s community refers to investors who actively support the project online through social media and other platforms. Strong communities can play a big role in driving traffic to a new project, which is essential for growth.

We also researched the team behind each of the ERC20 tokens that we have mentioned in our list. It is a good sign if the team behind a crypto project are transparent and known. In the case of our list, all ERC20 tokens are developed by a team of industry experts.

Security is also an essential part of our research. Many tokens have been exploited. The tokens on our list have been audited by crypto security firms, which minimizes the odds of potential flaws in the conrract.

What is The Best ERC20 Token to Invest in 2025?

After researching several promising ERC20 tokens, we found Green Bitcoin to be the best ERC20 token to buy in 2025. Green Bitcoin recently launched its presale which means that it is possible to buy tokens for a discount before the price goes up. The value of tokens will increase gradually at each stage of the presale, rewarding the earliest investors generously.

Furthermore, Bitcoin derivatives are positioned to do very well in 2025 due to the upcoming Bitcoin halving. During the event, the circulating supply of Bitcoin will half which will increase scarcity and push the price of BTC upwards. Green Bitcoin provides investors with a sustainable alternative to Bitcoin that could attract the interest of eco-conscious investors.

Furthermore, Green Bitcoin could be very rewarding to investors because it offers a gamified staking model that allows holders to earn passive income by predicting the price of Bitcoin.

In conclusion, ERC20 tokens continue to be attractive amongst crypto investors and come with promising potential for 2025. In this guide, we have taken a look at the best ERC20 cryptos to buy and how to buy them from the Coinbase crypto exchange. Make sure to do your own research before making any investment decisions.

Your money is at risk.

FAQs

What tokens are ERC20?

ERC20 tokens are digital assets developed, launched, and employed but only developed on the Ethereum blockchain. These tokens are typically backed by a smart contract that tracks their transactions.

How many ERC20 tokens are there?

There are about 518,530 token contracts in the current market.

Where can I buy ERC20 tokens?

At eToro is where it is possible to access the best tokens with a $10 deposit and on a safe and secure exchange platform

How much are ERC20 tokens worth?

The value of each token depends on a set of factors such as the total availability of tokens and other external factors such as the market supply of the token or the expectation of its price in the future.

Why are ERC20 tokens so popular?

The popularity of these tokens is determined by the fact that this blockchain is reliable and allows the creation of various types of tokens and contracts. Precisely for this reason, most of the tokens released in the press are ERC-20 tokens.

How can I identify the best ERC-20 tokens?

In order to identify the best ERC-20 tokens, you must analyze the utility of the cryptocurrency. After that, you need to analyze the team behind the project in order to understand if the ERC20 token has the potential to develop.

References

- https://ethereum.org/en/developers/docs/standards/tokens/erc-20/

- https://mooning.com/blogs/crypto/3-reasons-to-use-an-erc-20-token-for-your-investments/

- https://aitechtrend.com/investing-in-the-future-exploring-the-best-ethereum-erc20-tokens-for-2023/

- https://bitpay.com/blog/erc-20-tokens-what-they-are-and-how-they-are-used/

Carlos Sereno Freelance Writer

View all posts by Carlos SerenoCarlos is an experienced content writer who specializes in cryptocurrency and forex content. After spending time as an active trader himself, he has a good understanding of TradingPlatforms and best practices and uses this to create informative content for TradingPlatforms.

Carlos has also written for Rather Labs Inc., Daily Forex Ltd., and Tradeview Markets. He has a plethora of experience in both forex and cryptocurrency and is able to explain complex terms in a user-friendly way.

As well as writing content, Carlos is a skilled researcher who regularly investigates new crypto projects to understand their potential. He uses these skills within his content writing work to provide an analytical overview and helpful insight to readers.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up

ERC20 refers to a technical standard that is followed by tokens that are built on the Ethereum blockchain network.

ERC20 refers to a technical standard that is followed by tokens that are built on the Ethereum blockchain network.