How To Invest In Reits- Beginner’s Guide 2026

That said, REITs function like mutual funds or exchange-traded funds such as ETFs, allowing smaller investors to enter the real estate market without paying fees.

Although REITs specialize in the real estate market sector, it is possible to find them in different sectors with diversified portfolios.

It should also be noted that REITs must invest in real assets to obtain the highest possible income, usually paid in dividends, which can be higher than equities or fixed income.

-

-

What Are The Benefits of Investing In Reits?

REITs offer dividends along with the possibility of long-term capital appreciation. Generally, REITs have a higher long-term return than equities and a higher return than fixed income with lower risks.

Thanks to the high income generated with REITs, they can prove to be an investment that can be leveraged by users looking to save and those looking to have income on an ongoing basis. Below we will go into detail with some positive aspects to consider when investing in REITs.

Access to specialist sectors

REITs offer the opportunity to invest in specialized sectors, such as the retail sector. While certain sectors are considered to be more profitable, it is worth researching each sector and finding an area that provides you with the best returns based on your strategy.

Liquidity

The lack of liquidity in the real estate market is a major disadvantage of investing directly in physical properties. There are some cases where selling and buying properties can take years. On the other hand, it is easy to buy and sell REITs since they are publicly traded and highly liquid.

Exposure to the real estate market

Diversifying your portfolio with real estate can be an effective way to reduce risk. Investing in real estate investment trusts provides investors with this diversification, as they do not require physical property ownership or management.

Inflation protection

Real estate has historically provided an effective hedge against inflation in times of inflationary pressure, not just for REITs but for the real estate market.

Rental income from their property portfolio is REITs’ primary source of income. Inflation and rent payments tend to be positively correlated; in other words, when inflation increases, rent payments increase. Therefore, REIT dividend payments are maintained during inflationary periods, and growth continues.

Portfolio diversification

Diversifying your portfolio with real estate can be an effective way to reduce risk. Investing in real estate investment trusts provides investors with this diversification, as they do not require physical property ownership or management.

Best REIT Stocks in 2026

There are over 200 REIT stocks in the United States. Below are the best REIT stocks to consider in February 2026.

VICI Properties Inc.

VICI portfolio consists of entertainment and casino properties such as Caesars Palace Las Vegas and MGM Grand. The real estate investment trust was established in 2016, revenue reached $1.46B in 2022.

According to TipRanks, VICI pays a dividend of $0.415 per share. The annual dividend yield stands at 5.06%.

In October 2023, VICI Proprties Inc. completed the acquisition of 38 bowling centers from Bowlero Corp. It is worth noting that the real estate investment trust is not solely focusing on US Markets.

In September 2023, VICI completed the purchase of Century Casino St. Albert and Century Mile Racetrack and Casino in Canada.

The 12-month net profit margin of VICI is currently 68.7%.Park Hotels & Resorts Inc.

As the name suggests, Park Hotels & Resorts Inc. (PK) focuses on resorts on hotels. The investment fund holds assets across the United States such as New York, Chicago, Boston, and many other states.

The dividend yield is 22.9%, ex-dividend date 28 December 2023.

In January 2024, the real estate investment fund is expected to finalize its $230M (approx,) expansion and renovation of The Waldorf Astoria Orlando and Signia by Hilton Orlando Bonnet Creek hotels.How To Invest In Real Estate Investment Trusts

The most important thing is to have an active account with a broker, as you can access all types of investments, including those of companies and stocks. You can access all types of investments, including stocks and REITS companies.

The second way is to use ETFs, and this option is for users who want to diversify their portfolios. ETFs always replicate the indexes listed in this class of products. Both forms of investment are explained below.

Buy directly from the company

You can invest in REITs by buying shares of the company. With this, you can fully control the asset, meaning that you own the shares. It is always best to buy shares directly from a company through a broker regulated by a financial authority.

Invest via ETFs

Buying shares of several companies in a single package is similar to buying shares of several companies simultaneously. That is why ETFs have a clear advantage over stocks: diversification.

In addition, a fund is a way of reducing our risk exposure, and if one of the companies included in the fund goes bankrupt, you do not risk losing your investment.

5 Best Places To Invest In REITs

If you want to invest in a REIT in today’s market, you should first find a broker that is reputable and provides great customer service. Moreover, this is necessary because your chosen REIT will be represented by an EFT, which, at the same time, you must acquire on the regulated trading platform.

Therefore, when looking for a broker, you should ensure that they offer your preferred REIT ETF and look at their commissions, current fees, and supported payment methods.

With that in mind, here are five of the best-known U.S. brokers that allow you to invest or trade REITs in the United States:

1. eToro

Our first choice is eToro, a platform regulated by the FCA. Being a regulated broker, your investments in REITs will be completely safe..

The broker has more than 150 ETFs available. Furthermore, the minimum investment for many new users is only $50 per fund, allowing you to invest in the U.S. and international REITs. In addition, eToro offers commission-free trading.

So if you want to buy or sell any REITs, you already know that commissions are something you don’t have to be concerned about, plus eToro doesn’t charge any account maintenance fees.

So when it starts distributing the profits from REITs, you will see it in your account. Profits are generally paid out over three months. In addition, eToro offers over 1,700 stocks from 17 foreign and U.S. markets to add to your investment portfolio. So again, you will not be charged any commission for using this service.

Once registered and your account is activated, you will need to add your preferred payment method. Available options include debit and credit cards and e-wallets.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

2. Interactive Brokers

If you are an experienced user, then Interactive Brokers is your best platform for investing in REITs and Index funds. With the platform, you can trade the best way in the market with the tools available. In addition, the platform is completely designed for advanced traders.

Using real trading contracts, you can trade indices, stocks, EFTs, commodities, and currencies with Interactive Brokers. It is possible to access markets worldwide at Interactive Brokers, not only in the United States. In addition, there is no minimum deposit needed to join.

Likewise, a section is considered one of the best for new traders if you are new to the market. Several categories are available through the Interactive Brokers Campus, which offers an organized program.

The Traders Academy offers three levels of trading training, which is a great place to start. One of the industry’s best video libraries is offering interactive webinars with industry experts. Additionally, the user can access educational materials through the Student Trading Lab.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

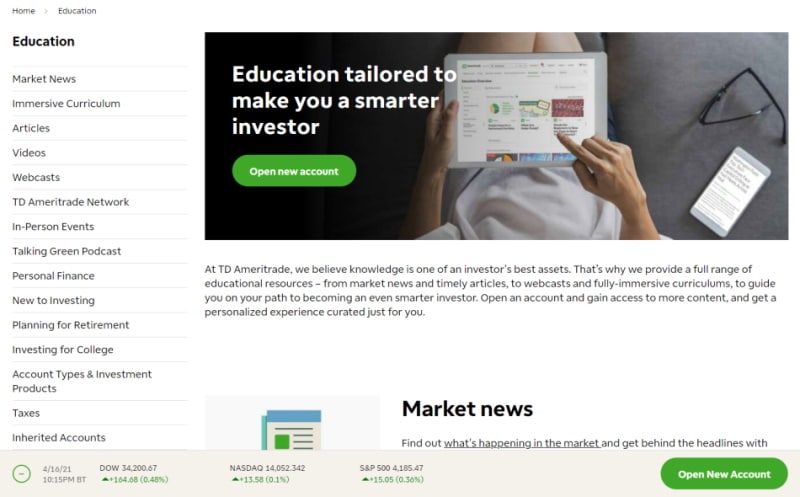

3. TD Ameritrade

Founded in 1975, TD Ameritrade has a long history in the U.S. market. Approximately 11 million users are active on the platform. In the United States, it is among the top five platforms. In the market, you can find more than 100 currency pairs.

If you want to invest in REITs, this platform does not charge commissions like eToro. However, you must pay a $25 fee to make any assisted trades. In addition, the U.S. regulator FINRA monitors the platform.

There are versions of the app for both Android and iOS. Market movements can be tracked in the app. The platform requires a minimum deposit depending on the type of account. As well as stocks, mutual funds, and ETFs, TD Ameritrade offers various other products. In addition, we said again that several ETFs and mutual funds are available for free trading.

Traders with extensive market knowledge are more likely to benefit from the strategies and tools available on this platform.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. Trade Station

Stock traders looking for US markets will find Trade Station appealing. With the platform, you can buy and sell commission-free stocks across the Nasdaq and NYSE.

There are no international stock markets available on the platform. Stocks from the UK, Europe, Asia, and other notable regions cannot be purchased. Cryptos, stocks, and REITs can all be traded on this platform.

TradeStation does not support fractional shares. As a result, stocks like Tesla, Google, and Amazon will be extremely limited to causal traders.

A full share of TradeStation will not be appropriate unless you have enough money to invest. For fractional shares, you could consider eToro, which allows you to invest as little as $50 per stock.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. Fidelity

Around 3.5 million trades are made daily at Fidelity, home to more than 36 million investors. As a global company, Fidelity employs over 47,000 people across nine countries, including the US, Canada, Europe, and Australia.

Commission-free stock and ETF trading are available through Fidelity. As well as providing advanced research tools, including Active Trader Pro, technical analysis, charting, trading ideas, and technical indicators, the software provides a wide range of advanced analysis tools as well. Whether you are interested in standard trading accounts or Roth IRAs, Fidelity offers a wide range of account types.

An intuitive, well-designed, interactive, and user-friendly interface makes the web trading platform user-friendly. Additionally, opening an account is fully digital, so trading becomes more efficient.

The Fidelity platform offers a range of tradable assets, including US stocks, commission-free ETFs, fixed income, bonds, CDs, and options. In addition, the robot investing and wealth management services Fidelity offers allow you to adopt passive trading strategies.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Conclusion

To conclude our guide, we will say that REITs can prove to be a great investment, available to any investor. Moreover, REITs can offer an interesting investment possibility as they can generate great returns in the market.

Furthermore, REITs offer access to a wide range of lucrative international markets. A reputable FCA-regulated broker will be needed to ensure that you can invest effectively.

We have reviewed the benefits that can be obtained when investing in REITs. Finally, we have reviewed the five best platforms for buying REITs in the market. It is important to remember that our preferred platform is eToro, perfect for beginners, and most importantly, it is commission-free.

FAQs

What are REITs in simple terms?

REIT is an acronym referring to Real Estate Investment Trust. Investments in real estate are made by REITs directly through buying real estate and purchasing mortgages. They are formed as partnerships, corporations, trusts, or associations. As with ordinary stocks, REIT shares are traded on a stock exchange.Where do you buy REITs?

You can buy Reits on the various platforms reviewed in this article. Our recommendation is eToro, an easy-to-use platform that offers many advantages to novice users.Should I invest in REITs?

It is well known that REITs can produce competitive total returns because they produce steady dividend income and long-term capital growth. They can also help reduce overall portfolio risk and increase returns due to their.What is Reit investing?

It is currently invested in real estate, parks, shopping centers and much more.Matti Williamson

View all posts by Matti WilliamsonMatti Williamson is a capital markets and crypto analyst with +15yr experience. He was among Saxo Bank's analysts, providing in-depth market coverage and assisting traders in live webinar sessions. Matti's knowledge is spread across multiple markets. He masters the top financial assets including forex, stocks, indices and commodities. In the crypto sector, he is well-versed with the current blockchain technology and has been researching cryptocurrencies since the collapse of MTGox in 2014, the biggest bitcoin exchange at the time. His previous articles can be found at Finance Magnates. From traditional finance to DeFi, expect Matti to cover and simplify the latest trends, research and analysis.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Stock traders looking for US markets will find

Stock traders looking for US markets will find