NinjaTrader Review 2026 – Fees and Features Revealed

NinjaTrader is a trading software company that is based in the US and offers a top-rated online trading platform with sophisticated research tools. NinjaTrader users benefit from being able to connect their brokerage accounts to NinjaTrader platforms.

In this NinjaTrader Review 2026, we cover all the key metrics from fees and commissions to mobile trading and safety so that you can choose the right broker for your trading needs. With so many options available making the right decision can be difficult, but we have everything you need to know in this comprehensive broker review.

-

-

What is NinjaTrader?

Launched in 2003, NinjaTrader is a software business based in the United States that offers a top-rated trading platform with a wide range of research tools.

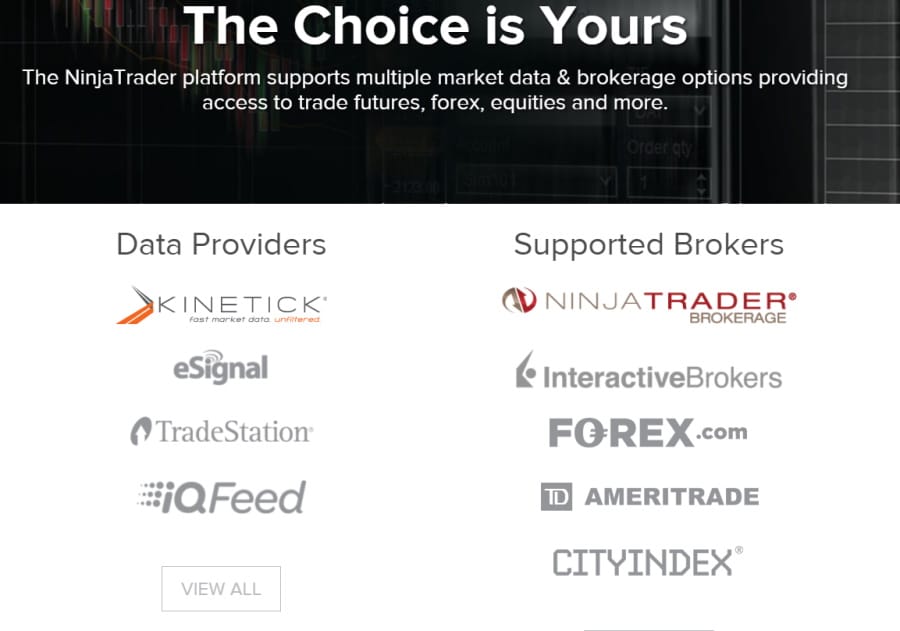

Other than delivering software, NinjaTrader is registered as a National Futures Association firm and an introducing broker. But, what is an introducing broker? Simply put, this means that your assets and funds are held with another broker such as Interactive Brokers or TD Ameritrade, while the fees, trading platform, customer and brokerage services are handled by NinjaTrader.

Additionally, if you have a Forex.com, City Index, Oanda, or FXCM brokerage account you can connect it to the NinjaTrader platform. The main benefit of connecting other brokerage accounts with the NinjaTrader platform is that you can buy and sell other popular financial instruments such as stocks on the NinjaTrader trading platform.

NinjaTrader Pros & Cons

Before we jump into a full review of NinjaTrader let’s cover the top pros and cons that we found during our in-depth research.

What we like

- Low day trading margins for Micro Futures trading of just $50

- Commissions as low as $0.09 per contract

- Practice simulated futures trading via a demo account

- 24-hour customer support

- Over 1,000 apps to customize your trading platform to suit your needs

- Micro futures give you the chance to trade top trending equity index contracts at a portion of the cost.

- Unfettered access to simulated futures trading

- Top-rated analysis and charting tools

- More than 100 different technical indicators and technical analysis tools

- Heaps of third-party trading apps

What we don’t like

- $25 minimum account activity fee after one month of inactivity

- Withdrawal fee for domestic wire transfer is $30, and for international wire transfers is $40

- NinjaTrader does not support a mobile trading app

- The desktop platform is only compatible with Windows operating system

- $400 minimum deposit

- No access to cryptocurrency trading

There is no guarantee that you will make money with this provider. Proceed at your own risk..

What Can You Invest in and Trade on NinjaTrader?

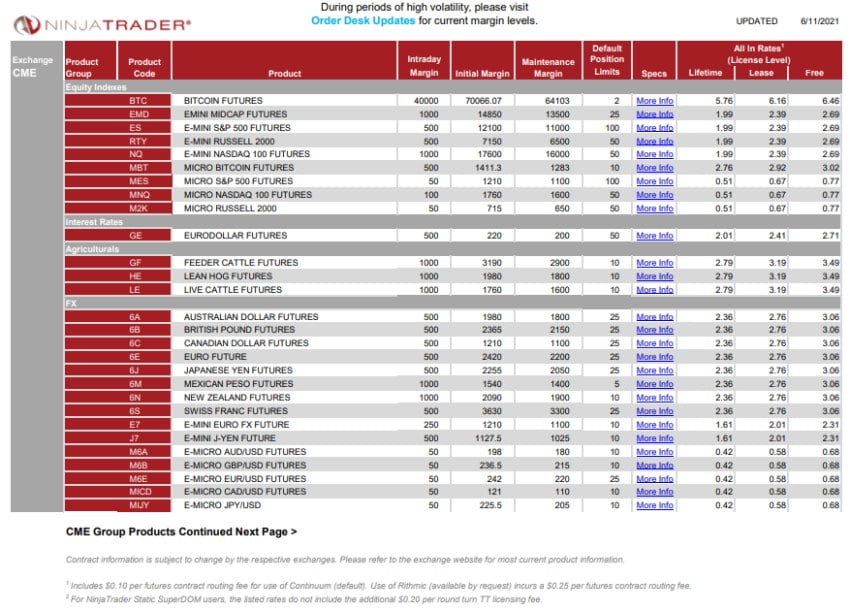

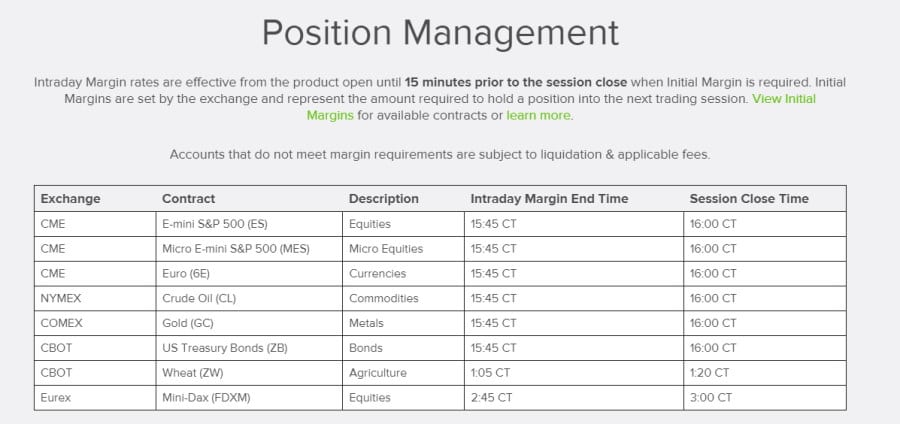

NinjaTrader offers traders competitive $50 intraday margins for Micro contracts and just $500 for trending futures markets such as the E-mini S&P 500 and the Mini-Dax.

NinjaTrade only supports futures and options on futures trading. This means that to trade other popular financial assets such as stocks and forex trading, you will need to connect your brokerage account to NinjaTrader.

The futures exchanges covered by NinjaTrader are as follows:

Index Futures:

• E-mini S&P 500 Index Futures

• E-mini Nasdaq-100 Index Futures

• E-mini Russell 2000 Index Futures

• E-mini Dow Jones Industrial Average Index FuturesEnergy Futures:

Crude Oil Futures

Crude oil futures are highly liquid contracts that allow traders to speculate directly on the price of crude oil. It serves as the cornerstone of the energy complex attracting traders of all sizes.Natural Gas Futures

Natural gas futures are a widely traded energy market that allows traders to speculate on the price of natural gas. Similar to crude oil futures, natural gas futures have significant liquidity throughout trading sessions.Gasoline Futures

Gasoline futures are an important energy market that can be influenced by economic conditions, making it an efficient way to trade price fluctuations in gasoline.Heating Oil Futures

Heating oil futures are a popular traded energy market that can experience seasonal price volatility as demand for heating oil can increase in colder months.Crypto futures:

- Nano Bitcoin Futures

- Micro Bitcoin futures

But what are the benefits of futures trading? Futures are derivative contracts that gain value from other assets including stocks, indices, and commodities, just to name a few. Futures are popular amongst the trading community because they are effective in managing risk and hedging against potential losses.

Trading futures contracts involves using margin which is a portion of the sum amount (usually 10% of the futures contract price). Trading futures allows traders to gain greater exposure to stocks and other assets without having to own the underlying asset. Therefore, potential profits can multiply if the market moves in the direction of the position they have taken. However, this also applies to potential losses.

For instance, if a trader decides to invest $2,000 into Microsoft (MSFT) stock priced at $200, they can either purchase 10 stocks or a futures contract of 100 Microsoft stocks. Let’s say that there is also a 10% margin for 100 MSFT stocks. If the price of Microsoft stock rose by $10 the trader who invested $2,000 in a futures contract holding 100 MSFT stocks would make a profit of $1,000, compared to a $100 profit when investing in the actual stock itself.

Future contracts gather a large trading volume daily which leads to high levels of liquidity. With a continuous flow of buyers and sellers in the futures markets, market orders can be executed swiftly.

NinjaTrader also gives its users access to a handful of options markets including CME, NYMEX, CBOT, and COMEX for options on futures trades. Options on futures contracts offer the right, as opposed to the obligation, to either purchase or sell an underlying futures contract at a predetermined price at or before a set expiration date.

You can gain exposure to the commodities, indices, and forex markets by investing in heaps of futures, E-Mini, and E-Micro futures contracts such as E-Mini NASDAQ 100 Futures, EUR/USD Futures, E-Micro EUR/USD Futures, and E-Mini Crude Oil Futures, just to mention a few.

NinjaTrader Fees & Commissions

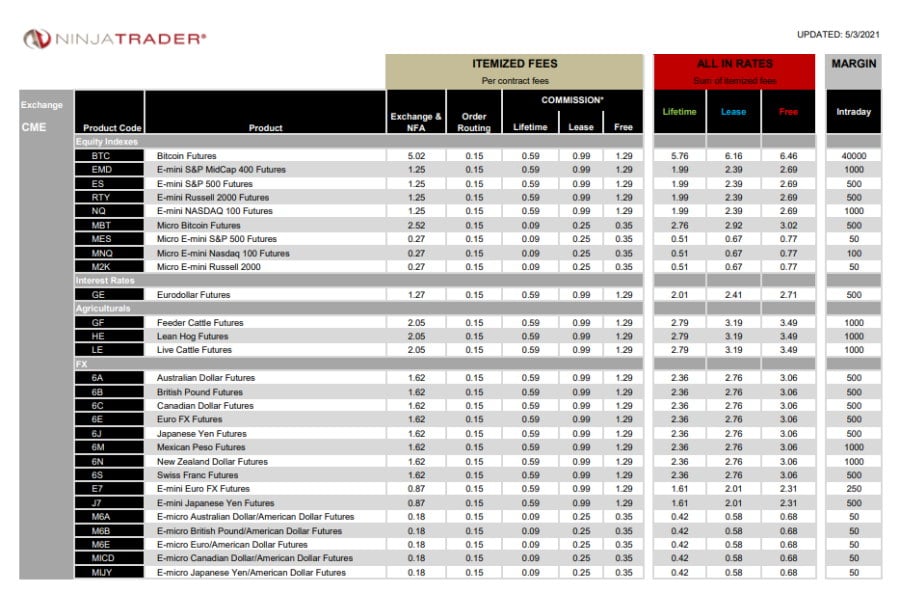

Generally speaking, the fees and commissions charged by NinjaTrader are relatively low which makes it a great match for active day traders.

Let’s take a look at a couple of examples to help you understand just how low NinjaTrader’s commissions actually are.

Asset Commission for Free License Commission for Lease License Commission for Own License Order Routing Fee Exchange & NFA Fee Micro E-mini S&P 500 Futures $0.35 per contract $0.25 per contract $0.09 per contract $0.15 $0.27 E-micro Euro/American Dollar Futures $0.35 per contract $0.25 per contract $0.09 per contract $0.15 $0.18 Micro Bitcoin Futures $0.35 per contract $0.25 per contract $0.09 per contract $0.15 $2.52 In addition to the commission charged by NinjaTrader you will incur separate fees such as exchange & NFA, and order routing fees. By default, the order routing fee is $0.10 per contract via the Continuum connection. There is also the option to pick the Rithmic connection which has an order routing fee per contract of $0.25.

Now, let’s take a look at the non-trading fees charged by NinjaTrader:

Non-trading fee NinjaTrader Deposit fee None Withdrawal fee Domestic Wire transfer: $30 International Wire transfer: $40

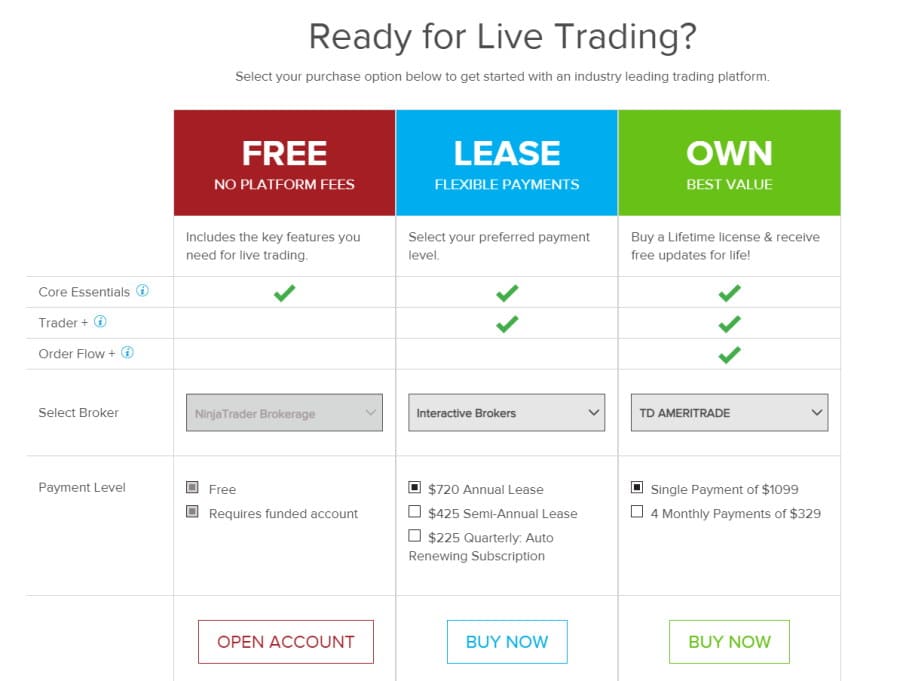

Minimum Account Activity Fee Existing accounts that login to their trading account but do not place a trade during the month will be charged a $25 inactivity fee Level II Market data subscription $39 per month including all 4 exchanges or $15 per month per exchange Margin Call $50 Account fee $0 for Free license, $720 Annual Lease for Lease license, Single payment of $1,099 for Lifetime license NinjaTrader User Experience

The most striking thing about NinjaTrader is that it only offers a desktop trading platform that is only compatible with Windows operating systems. Furthermore, the only way of using a web trading platform alongside the NinjaTrader desktop platform is to connect an existing third-party brokerage account such as Interactive Brokers or TD Ameritrade.

With customizable charts and other advanced tools and features, the NinjaTrader desktop platform is perfect for active traders. As far as the user experience for beginner traders is concerned this may be rather daunting and difficult for someone with little experience in online trading.

The desktop platform facilitates full customizability as well as the option to incorporate thousands of different app add-ons. It is worth bearing in mind that the platform’s functionality varies depending on the type of license. For example, with the Lease License you can access all core functions including charting, market analysis, paper trading, as well as automated trading, automatic stop-loss orders and much more.

In terms of search functionality this is great too as it is simple and user-friendly. Simply open the Tools menu and click on Instruments Lists. To add new assets to the instruments list simply type the name in the search bar or browse through the relevant asset categories.

You can also set up alerts and notifications on the desktop platform such as new intraday high alerts and price alerts.

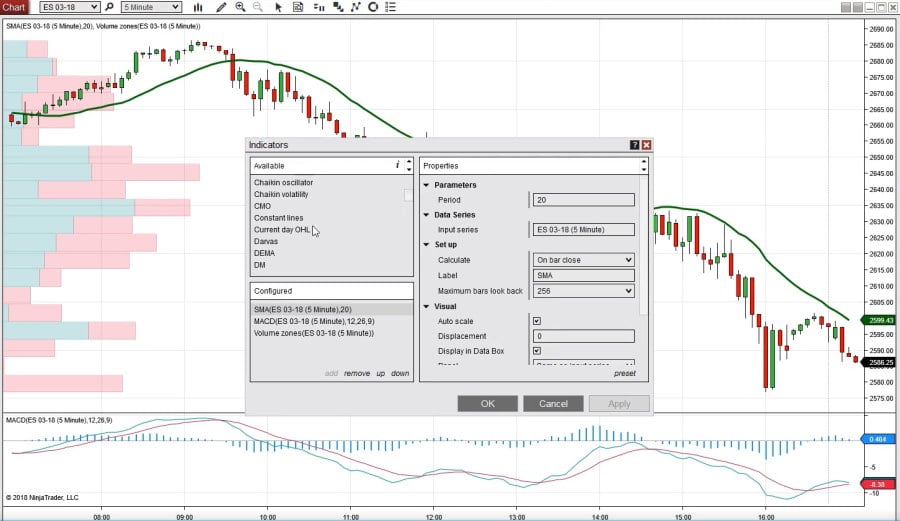

NinjaTrader Features, Charting, and Analysis

NinjaTrader’s Help Guide and webinars are great tools for beginner and advanced traders looking to familiarize themselves with the desktop trading platform. The Help Guide is well designed and you can find exactly what you are looking for via web or PDF downloadable content.

When it comes to research tools and charting features NinjaTrader has a wide range of research and charting tools. The charts are user-friendly and offer tons of technical indicators such as Bollinger Bands and Fibonacci Extensions. Furthermore, NinjaTrader clients have access to automated trading tools such as Bloodhound that offers visual feedback on your trading charts conveying trading signals.

NinjaTrader Account Types

NinjaTrader offers three different licenses Free, Lease, and Lifetime and all have varying commissions, prices, and functions.

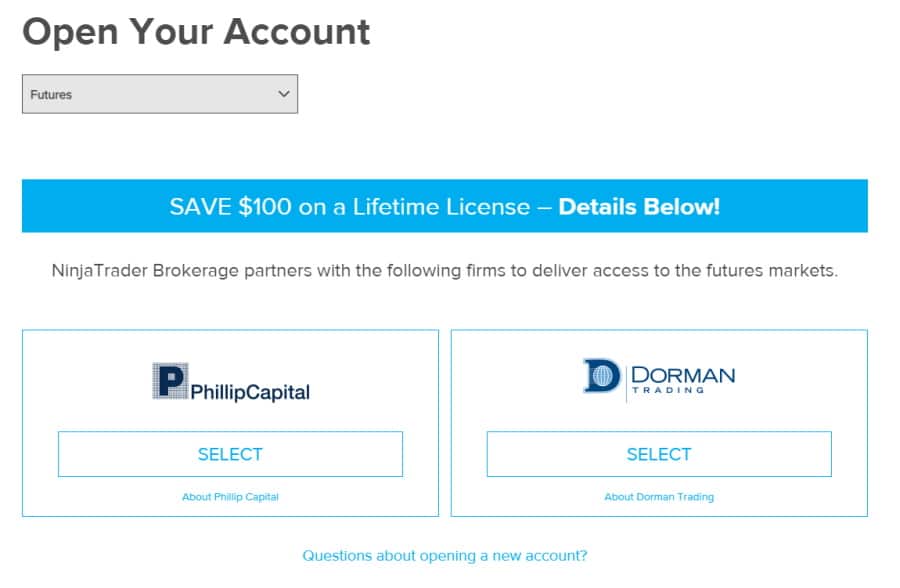

If you choose the Free license your funds will be held by either Dorman Trading or Phillip Capital. Alternatively, you can connect an existing brokerage account with any of the following brokers: Interactive Brokers, TD Ameritrade, Oanda, FXCM, Forex.com, and City Index. In this instance, your funds will be held by the third-party broker and NinjaTrader will be used for its desktop trading platform.

The main benefit of connecting your existing brokerage account with the NinjaTrader account is that you can access other financial instruments such as spot forex trading and CFDs as well as being able to use web trading and mobile trading platforms alongside the NinjaTrader trading platform.

If you choose the Free license and NinjaTrader brokerage through Dorman Trading or Phillip Capital you can select any of the following account types:

- Individual account

- LLC/Trust account

- Joint account

- Retirement account

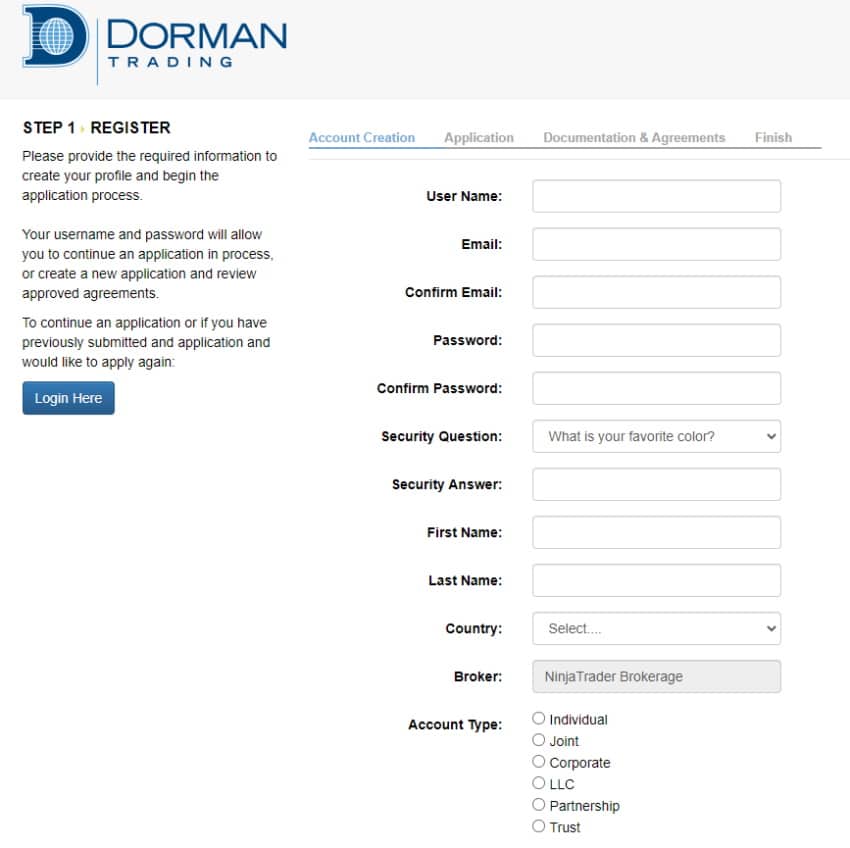

In terms of the account opening process, this follows standard protocols including KYC policies and providing proof of ID and address, as well as other personal information and contact details. After you have accepted the terms and conditions the verification process can take up to 5 working days.

NinjaTrader Payments

NinjaTrader supports 3 account base currencies including the US Dollar, GBP, and Euros which helps to reduce your overall trading costs because if you fund your trading account with the same currency as your bank account, or you buy and sell financial instruments in the same currency as your account base currency, you can avoid having to pay conversion fees.

While there are no deposit fees or fees for incoming checks or wires, the only available payment options are via bank wire transfer and checks. Furthermore, the withdrawal fee for a domestic wire transfer is $30, while the fee for international wire transfers is $40.

NinjaTrader is lagging behind when it comes to payment methods, as the majority of brokers support payments via credit cards, debit cards, and e-wallets. It typically takes between one and two business days for deposits and withdrawals at NinjaTrader to be processed.

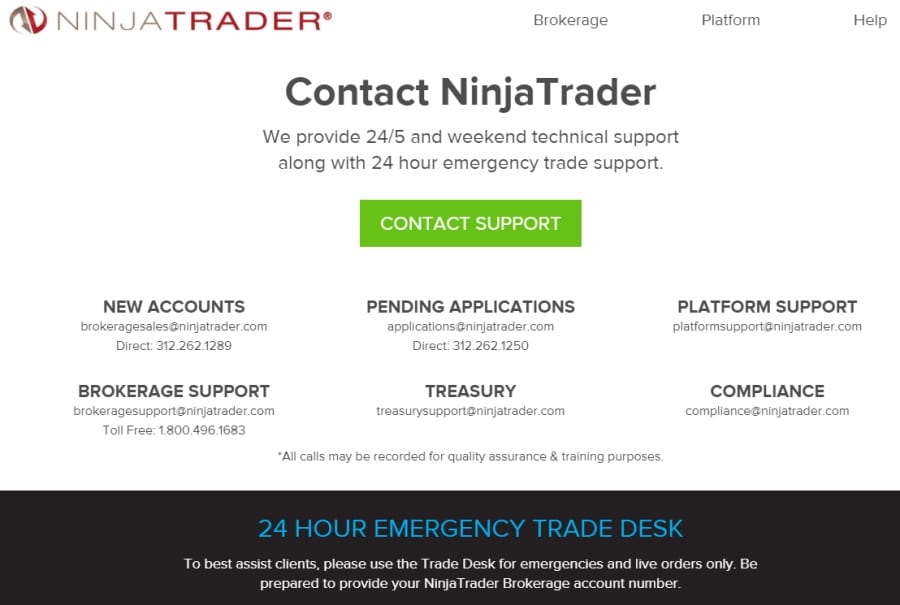

NinjaTrader Contact and Customer Service

When it comes to customer services, you can contact the NinjaTrader customer support via telephone, Live Chat, email, and a support forum. Furthermore, you can also submit questions or request and receive a fast response from the support team in a matter of minutes.

All you have to do is enter your name, email address and phone number, and enter your question or issue and hit Submit Request. There is also a useful and convenient FAQ page that has a wide range of answers to general questions regarding the NinjaTrader software and trading platform.

Is NinjaTrader Safe?

When you choose a license and open an account with NinjaTrader your assets and capital are held by third-party brokers such as Phillip Capital, Dorman Trading, TD Ameritrade, and Interactive Brokers. These third-party brokers are regulated by major financial authorities including the US Commodity Futures Trading Commission, the UK’s Financial Conduct Authority, and the US Securities and Exchange Commission.

NinjaTrader, on the other hand, is not listed on a major exchange and therefore does not publish its financials. Nevertheless, NinjaTrader is registered with the National Futures Association, and as a result is permitted to provide introducing broker services for other brokers.

In terms of client fund protection, our research found that NinjaTrader would be a better match for more experienced and advanced traders as futures trading does not qualify for investor protection schemes as well as the fact that there is no negative balance protection. Simply put, if your account balance goes below zero, you will be responsible for paying the losses.

How to Start Trading with NinjaTrader

The minimum deposit for opening an account with NinjaTrader is $400. Additionally, there are three different licenses to choose from with varying account fees and commissions.

Step 1: Account opening

To open an account with NinjaTrader through a third-party broker simply head over to the NinjaTrader website and select the financial instrument you want to trade. For futures trading you can open a brokerage account with Dorman Trading or Phillip Capital.

Step 2: Provide your personal details

In compliance with strict KYC policies and regulations you will be required to provide certain personal information including name, date of birth, email address and phone number, as well as answers to several financial questions.

Step 3: Verify your account

Next you will be required to verify your identity and address by uploading copies of your passport, drivers license and utility bills and bank statements dated within the last 6 months.

Step 4: How to buy and sell assets

To get the ball rolling, login to your NinjaTrader account and head over to the control centre. Click on the menu heading called New and select Basic Entry. From there you will need to choose the account you wish to execute the trade from and the ATM strategy. Then you can specify the instrument (which could be EUR/USD for instance). Then depending on whether you want to buy or sell the market click on the appropriate command on the trading window.

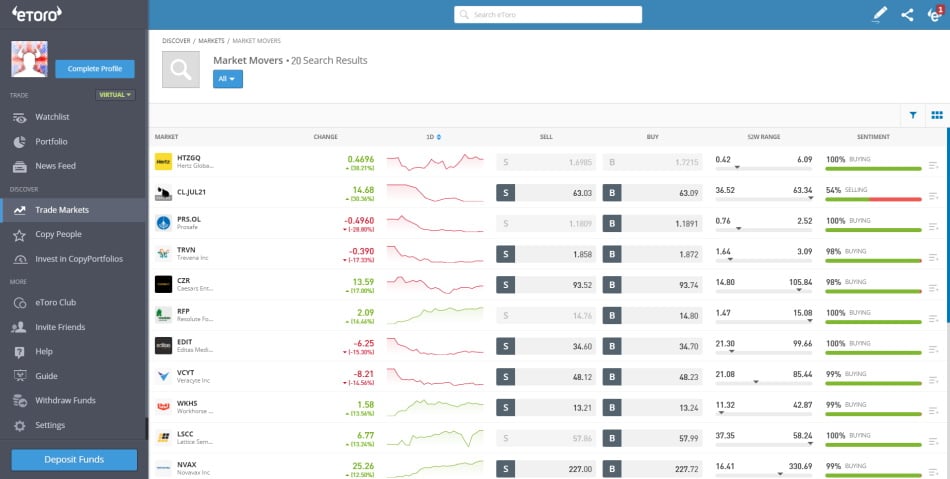

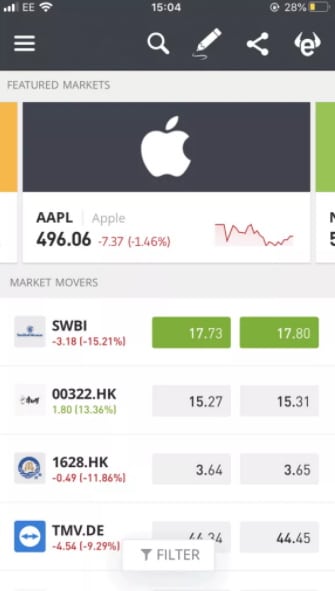

NinjaTrader vs eToro

At this point in our NinjaTrader review we have covered all the key metrics from fees and payments to safety and user experience. In summary we would suggest that NinjaTrader is a better match for more advanced investors mainly because of the sophisticated charting features, as well as the fact that the buying and selling process can be rather cumbersome.

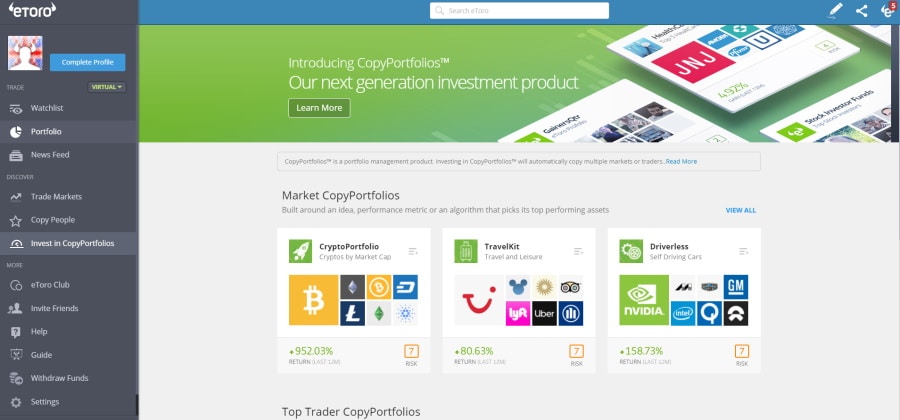

Nevertheless, after reviewing heaps of online brokers we found that eToro is the best free trading platform in 2026.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

eToro was established in 2007 and has rapidly grown to serve more than 20 million traders worldwide. This discount broker is regulated by top financial authorities including the FCA, ASIC, and CySEC.

Let’s take a closer look at why eToro secures the number one spot on our top recommended brokers for 2026.

- Copy Trading features: eToro is a social trading platform that offers the copy trading tools CopyTrader and CopyPortfolios. Simply put, with copy trading tools you can copy the trades of other eToro experienced traders.

- Safety and regulation: eToro is regulated by the US SEC, UK’s FCA, CySEC, and ASIC. Each of these financial authorities offers client fund protection schemes such as the SIPC which covers up to $500,000 of client funds as well as $250,000 for cash claims, should the broker go out of business.

- Low trading and non-trading fees: eToro offers commission-free ETF and stock trading. In terms of non-trading fees there are no deposit or account fees, and there is a $10 inactivity fee after 12 months, however just logging into your trading account is classed as activity.

- Payment methods: There are tons of deposit options available with eToro including bank transfers, debit cards, credit cards, e-Wallets such as PayPal, Skrill, Neteller, China UnionPay, and Sofort Banking.

- eToro trading platform: While there is no desktop trading platform, eToro provides access to a web trading and mobile trading platform.

- Paper trading account: Opening a demo account with eToro is fully digital and easy. With access to $100,000 worth of paper funds, you can practice your trading strategies in a risk-free environment without putting your real funds at risk.

- Access to cryptocurrency trading: eToro traders have access to cryptocurrencies including Ethereum and Bitcoin trading. The typical spread for buying Bitcoin on eToro is 0.75%.

- No Stamp Duty on LSE stocks: If you are interested in trading shares that are listed on the London Stock Exchange, you will be pleased to know that eToro waives the stamp duty fee, therefore, saving you 0.5% on your overall trading costs.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

Our Verdict on NinjaTrader

In conclusion, during our research we found eToro to be a better overall option for beginner traders. The interface is user-friendly and all trading is encompassed in either the demo or live trading accounts.

Furthermore, if you want to adopt passive trading methods such as copy trading or want to trade stocks without having to pay a penny in commissions then simply follow the link below and open an eToro account today!

There is no guarantee that you will make money with this provider. Proceed at your own risk..

FAQs

What is NinjaTrader?

NinjaTrader was first launched in 2003 and is registered with the National Futures Association, and as a result is permitted to provide introducing broker services for other brokers. There are three separate licenses you can choose from with NinjaTrader including Free, Lease, and Lifestyle. The NinjaTrader platform is perfect for active and experienced traders who are looking to use advanced charting tools and features. NinjaTrader only supports futures and options on futures trading. To trade other popular assets such as stocks or forex, you will need to connect an existing brokerage account to NinjaTrader.How do you use NinjaTrader?

Using the NinjaTrading platform is fairly straightforward and user-friendly. Additionally, there are heaps of platform tutorial videos and educational content to help you familiarize yourself with how things work. Furthermore, you can open a demo account and practice in a simulated trading environment.When will NinjaTrader 8 be released?

Version 8.0.24.2 of NinjaTrader 8 was released on March 10th, 2021.How do you import indicators into NinjaTrader?

To import indicators into the NinjaTrader platform simply download the indicator in a compressed .zip file. Then from the control center window select File then Utilities and Import NinjaScript. Next select the downloaded indicator file. NinjaTrader will then confirm that the import has been successfully installed.How do you update NinjaTrader?

To update NinjaTrader, simply follow these instructions: Firstly, copy your license key that can be found by navigating to Help and then clicking on License Key and exit NinjaTrader. Then go to http://ninjatrader.com/PlatformDirect and paste the license key before tapping on the Submit button. Then choose NinjaTrader 8 and press Download. It is important to make sure that the NinjaTrader platform is closed before letting the installer run.Michael Graw Freelance Writer

View all posts by Michael GrawMichael Graw is a freelance journalist who covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech such as TechRadar and Top10.com. Michael has also written for StockApps, Buyshares and LearnBonds.

Before starting his career as a freelance writer, Michael studied at Cornell University where he obtained a BA in Microbiology. He then went on to recieve a Ph.D in Philosophy from Oregon State University. With 6 years of finance writing under his belt, Michael is an expert in his niche and has built up significant industry knowledge during his time as a writer. Michael writes informative content with the goal of supporting readers to make better financial judgements.

eToro: Best Crypto Trading Platform with Low Fees

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY

Visit eToroDon’t invest unless you’re prepared to lose all the money you invest.Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up