LQDFX Review 2025 – Pros & Cons Revealed

LQDFX is a popular online forex broker that provides access to forex trading, commodities, and indices with tight spreads as low as 0.1 pips. If you are interested in opening an LQDFX account we recommend you read this in-depth broker review beforehand.

In this LQDFX review 2025, we cover all the key metrics from supported markets, fees and commissions, payments, mobile trading apps, user experience, regulations, and much more.

What is LQDFX?

Launched in 2015, LQDFX has become one of the top brokers in the forex sector after winning two distinctive awards in January 2017: as the best ECN broker, and as the Most Reliable Broker.

LQDFX traders can choose from five different account types with varying leverage, maximum trade sizes, typical spreads and more. Three out of the five brokerage accounts offer commission-free forex trading and access to more than 70 currency pairs.

LQDFX supports the top-rated and trusted MetaTrader 4 trading platform which blends an extensive selection of trading features and tools with a user-friendly interface, making it ideal for all types of traders.

LQDFX uses the STP execution model. Simply put, this means that when an LQDFX user places a trade, there are no dealing desk manipulations, requotes, or conflict of interests. All trades are managed by the LQDFX aggregator which elicits the optimal price for each trade, provided by several top-tier liquidity banks.

LQDFX Pros & Cons

Before we move any further into this in-depth LQDFX review, let’s take a brief look at the top pros and cons that we deemed worthy of your attention.

- Client funds are held in segregated accounts in major tier-one banks such as Deutsche Bank and HSBC

- Access to a demo account with $100,000 worth of virtual paper funds to use in a simulated trading environment

- Five different account types on offer from a Micro account to a VIP account.

- The minimum deposit for the Micro account is just $20

- LQDFX provides access to the popular MT4 trading platform on both desktop and mobile devices

- Flexible leverage up to 1:500 for Micro accounts

- LQDFX forex trading covers 71 different pairs

- Available financial assets include forex, indices, commodities and metals

- Typical spread as low as 0.1 pips

- Wide range of supported deposit methods including bank transfers, credit cards, Skrill, Neteller, Bitcoin and other altcoins, VLoad and more

- Variety of educational resources such as courses, calculators, and chart analysis.

What we don’t like

- LQDFX does not support cryptocurrency trading

- Not regulated by top-tier financial authorities such as the FCA, or SEC

- $500 minimum deposit for ECN account

Your capital is at risk.

What Can You Invest in and Trade on LQDFX?

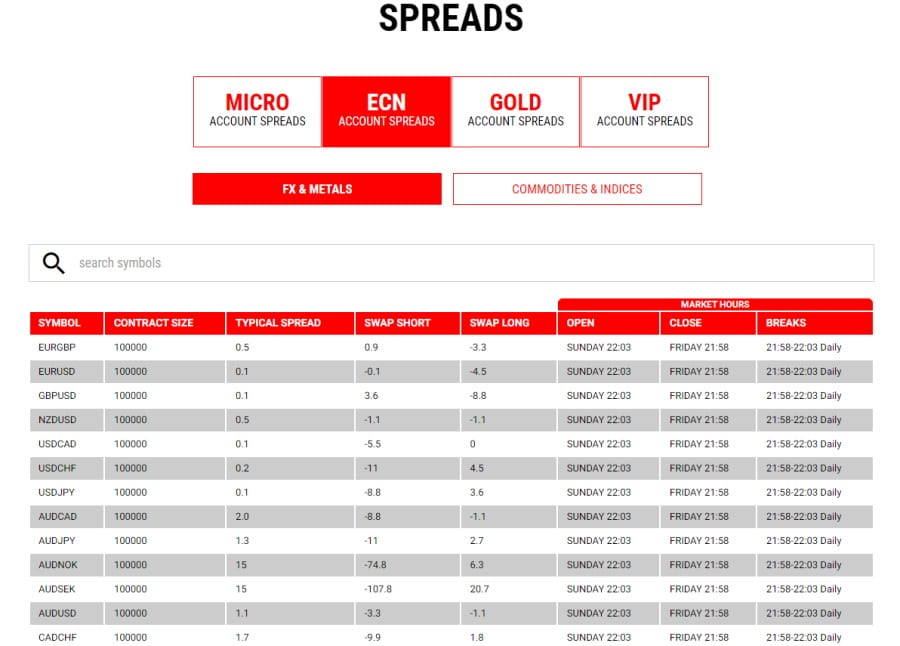

As we have already mentioned, you can trade 71 forex pairs, indices, commodities and metals with LQDFX. When it comes to the spreads and commission fees, these vary depending on the account type and market conditions. For example, if you were to trade the EUR/USD forex pair with an ECN account the typical spread is just 0.1 pips. On the other hand, if you were to trade the same currency pair with a Micro account the typical spread is 1.2 pips.

In terms of commission for forex trading this only applies to ECN and VIP account holders, but more on this later on.

Forex trading

Forex trading on LQDFX provides access to 71 different currency pairs including majors, minors and exotics. Furthermore, Micro account holders also have the flexibility to trade with maximum leverage of 1:500.

Trading with leverage has several benefits including the ability to gain greater market exposure and larger positions than would be possible with trading the underlying security. Leverage also gives you more flexibility and buying power as you only need to provide a portion of the trade value.

However, just as any potential profits are maximized, this also applies to potential losses. With that said, some of the most popular currency pairs supported by LQDFX include:

- EUR/GBP

- EUR/USD

- GBP/USD

- USD/CHF

- USD/ZAR

- USD/HKD

You can also buy and sell precious metals such as gold, silver, platinum and palladium against fiat currencies; these include XPT/USD, XPD/USD, XAU/USD, XAG/EUR.

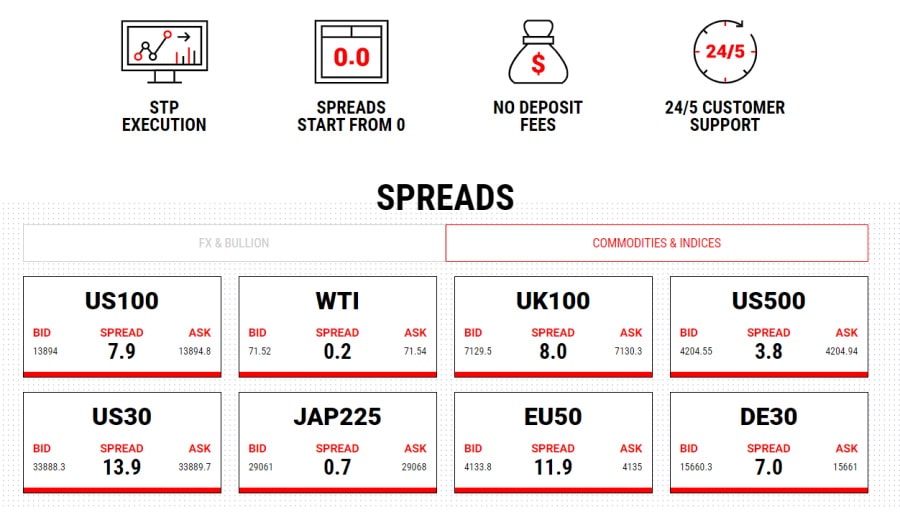

Commodities and Indices Trading

LQDFX users can trade energy and agricultural commodities with Micro account spreads ranging between 0.17 and 26.5 pips. When it comes to indices you can trade the HK50, JP225, STOXX50, UK100, US500, and many more with Micro account typical spreads ranging between 6 and 212 pips.

LQDFX Fees & Commissions

The fees and commissions charged by LQDFX are relatively low, however, during our research we found that the spreads and commissions vary depending on the account type you choose. So, let’s take a look at the different fees and commissions charged by LQDFX depending on the 5 available trading accounts.

| Fees | Micro account | ECN account | Gold account | Islamic account | VIP account |

| Maximum leverage | 1:500 | 1:300 | 1:300 | 1:300 | 1:100 |

| Minimum trade size | 0.01 | 0.01 | 0.01 | 0.01 | 0.1 |

| Typical spread | 1 pip | 0.1 pips | 0.7 pips | 0.7 pips | 0.1 pips |

| Forex commission | None | $3.50 per 100,000 | None | None | $2.50 per 100,000 |

| Minimum deposit | $20 | $500 | $500 | $20 | $25,000 |

Forex trading with either a Micro, Gold or Islamic account is commission-free as the fees are built into the competitive spreads. On the flip side, if you are a keen forex trader and want to open an ECN or VIP account then you will need to keep in mind that there are respective commission fees that will impact your overall trading costs.

When it comes to non-trading fees, LQDFX does not mention anything about an inactivity fee, so this is left in the dark. As for deposit and withdrawal fees they are as follows:

| Deposit fee | $0 except for bank transfers as LQDFX covers the deposit fees for deposits above $500 |

| Withdrawal fee | None for e-wallets, cryptocurrencies, and VLoad |

| Minimum deposit amount | $250 for bank transfers, and $20 for credit cards and other methods |

| Minimum withdrawal amount | $100 for bank transfers, $20 for credit cards, and amount varies for e-wallets, cryptos and other methods. |

LQDFX User Experience

The LQDFX website is user-friendly and supports a well-designed interface and structure. During our research we found that it is well-suited for both new and advanced investors as you can navigate through the different pages with ease.

The process of opening either a live account or demo account is simple and fully digital. After entering your details and uploading documents, account verification typically takes between 20 minutes and 24 hours.

Furthermore, LQDFX offers its users the popular MetaTrader 4 trading platform which was created by MetaQuotes in 2005. Aside from being aligned with forex trading, the MT4 platform can be used to buy and sell a whole variety of markets such as indices, CFDs, spread betting, and commodities.

Part of MetaTrader 4’s widespread popularity is its customizability that allows all types of traders to tailor the trading platform to suit their investing preferences and needs. Additionally, the MT4 platform can be used to set up automated trading, using robo-advisory services and sophisticated trading algorithms that execute trades based on predefined trading parameters.

The MT4 charts offer a wide range of features and settings so that users can tweak things to meet their personal needs.

There are heaps of educational materials to sift through including courses, chart analysis, an economic calendar featuring all the latest macroeconomic events that can impact the financial markets, as well as Pivot, Deal Size, and Fibonacci calculators.

Overall, LQDFX provides a user-friendly interface and simple website with access to the top-rated trading platform MetaTrader 4 on desktop devices and via a mobile trading app.

LQDFX Features, Charting, and Analysis

One of the stand out features of the fifth-generation MT4 platform is its analytical aspect. Real-time price charts offer greater flexibility and functionality.

MetaTrader 4 charts offer a variety of settings for users to customize and modify them to suit their preferences. The MT4 trading terminal supports three categories of charts: a sequence of bars, broken line charts, Japanese Candlestick charts. You can set individual colors to any item within the charts to make the most ideal workspace for long-term trading and analysis.

The trading terminal offers more than 35 technical indicators including Bollinger Bands, Moving Average, Parabolic SAR, Ichimoku Kinko Hyo, Alligator, Bulls Power, Bears Power, and many more. There are also analytical tools such as Fibonacci and Gann tools.

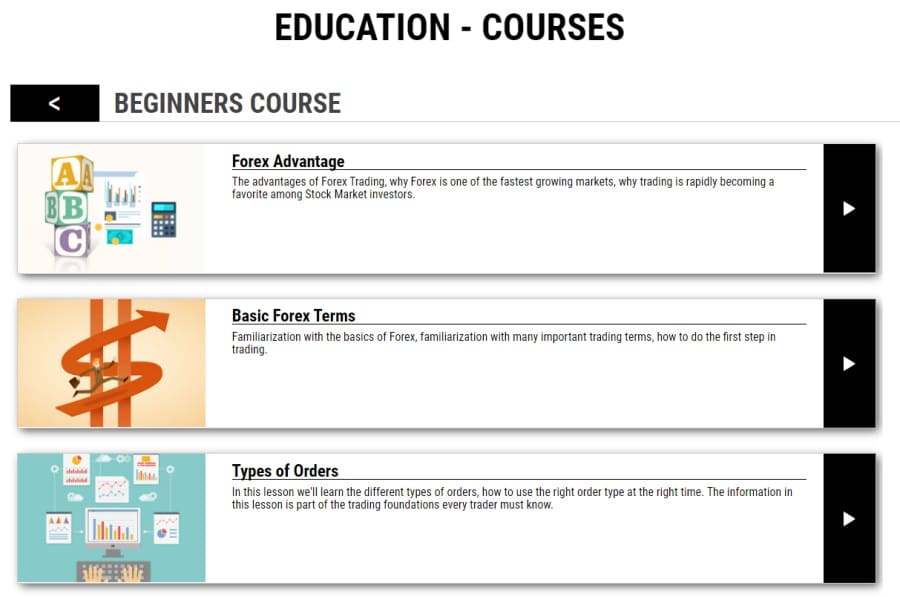

Educational courses

Another useful feature is that of the courses that can be found under the Education dropdown menu at the top of the homepage. The available courses are designed for both advanced and beginner traders and as such include:

- A beginner’s course that outlines the most important information all traders need to know before investing in tradable assets and securities. These include forex trading advantages, basic terms, basic trading strategies and a glossary of concepts.

- Trading tools courses that go through all elements of online trading and are aimed at seasoned investors.

- Trading strategies are ideal for traders looking for innovative strategies and ways to maximize potential returns. Each strategy covers subjects such as How to identify, time frames, recommended pairs, technical indicators, when to enter and exit a trade, and examples.

- Courses regarding ECN (Electronic Communications Network) accounts and why they are effective tools for investors.

- MetaTrader desktop platform and MetaTrader mobile app tutorials cover everything you need to know about the industry-leading trading platform.

- A comprehensive forex eBook with topics such as Traders’ psychology and behavior, essential concepts and terms, as well as tips for effective forex trading.

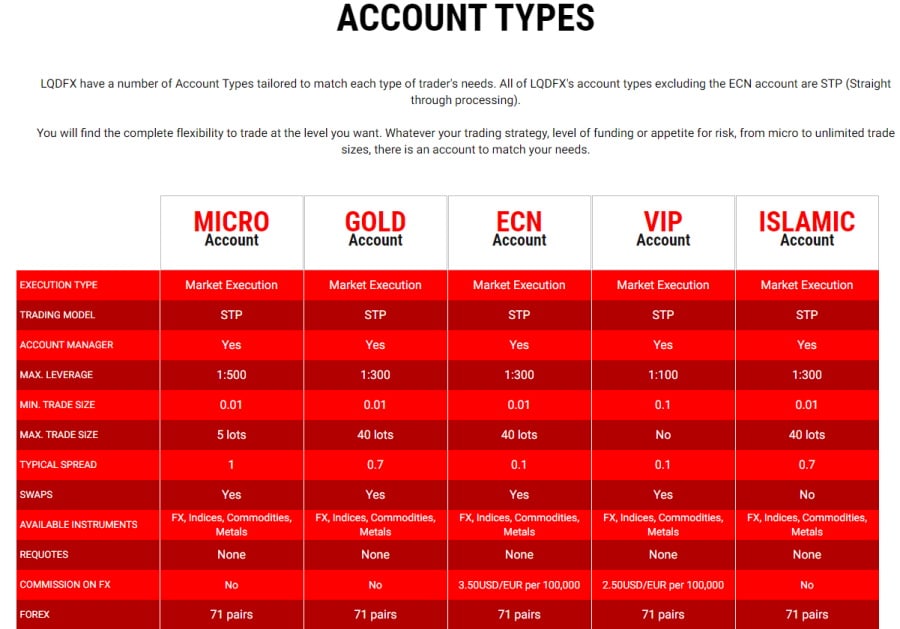

LQDFX Account Types

LQDFX has five different account types designed to meet each type of investor’s preferences and needs. All account types, except for the ECN account, are STP (Straight Through Processing). Simply put, STP is a forex brokerage structure that sends traders’ orders straight to the market thus bypassing a dealing desk.

Depending on the level of flexibility you are looking for, LQDFX is likely to have an account to suit you. The five trading accounts available with LQDFX are as follows:

- Micro account

- Gold account

- ECN account

- VIP account

- Islamic account

All accounts provide access to metals, commodities, indices, and forex markets. The maximum leverage, maximum and minimum trade sizes, typical spread, forex commissions, and minimum deposits vary depending on the account you choose. Orders executed through all 5 account types are market orders which are orders executed at the current market price.

For a comprehensive breakdown of all the spreads, fees and features of each account type please refer to the LQDFX table below.

LQDFX MT4 Mobile App Review

As well as using the MetaTrader 4 platform on your desktop, you can also manage your MT4 trading account via your iOS Apple or Android mobile device by downloading the MetaTrader 4 mobile app from the Google Play Store or the App Store. It is important to note that all iOS mobile devices need to be running on at least iOS 9.0 for the trading software to function properly. Both Android and Apple apps have an average rating of 4.5 out of 5 stars by the hundreds of thousands of satisfied MT4 users.

Both the desktop and mobile versions of the MT4 trading software are simple and user-friendly. While it will require some work and dedication to take advantage of the platform’s tools and features, using the platform is relatively straightforward.

LQDFX Payments

LQDFX supports a wide range of payment options including bank transfers, Visa and Mastercard credit cards, and other methods such as Skrill, Neteller, FasaPay, Bitcoin, other altcoins, and VLoad.

After extensive research we found that deposits and withdrawals made through Skrill and Neteller are the fastest and cheapest with the minimum deposit being $20, instant deposit times which means that your funds will be in your account immediately, minimum withdrawals are just $5, with a withdrawal time of 1 working day, as well as no deposit fees.

| Payment method | Min. & Max. deposit amount | Deposit Time | Deposit fee | Min. & Max. Withdrawal amount | Withdrawal time | Withdrawal fee |

| Bank Transfer | $250 – $500,000 per day | 2-7 business days | $0 fee for deposits greater than $500 | $100 – $500,000 per day | 2-10 business days | Depends on corresponding banks |

| Credit cards (Visa/Mastercard) | $20 – $2,000 per transaction, $15,000 max per card | Up to 30 minutes | None | $20 – $10,000 | 2 business days | $10 |

| Skrill | $20 Min deposit, no max limit | Instant | None | $5 and no max withdrawal limit | 1 business day | None |

| Neteller | $20 Min deposit, no max limit | Instant | None | $5 and no max withdrawal limit | 1 business day | None |

| Bitcoin & other cryptos | $30 – no max deposit limit | Instant | None | $50 – $50,000 | 1 business day | None |

| VLoad | $20 – no max deposit limit | Instant | None | $10 – depends on VLoad Tier allowance | 1 business day | None |

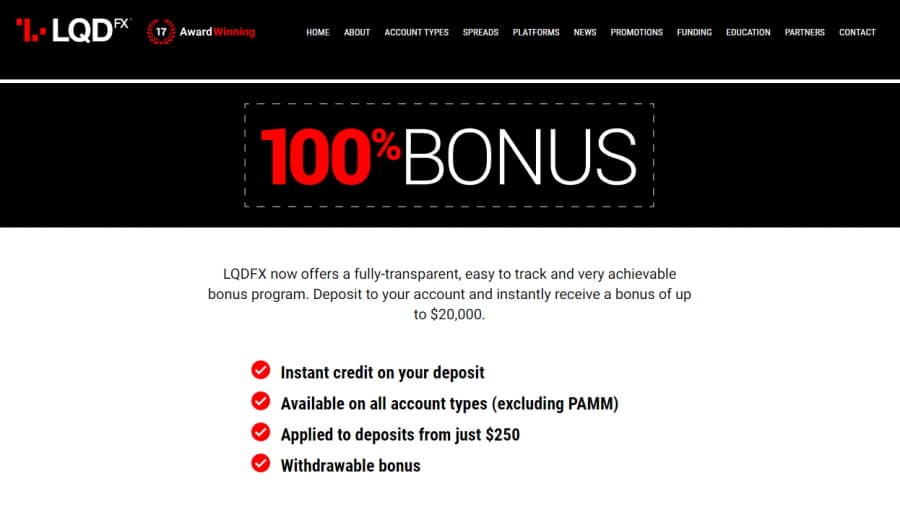

LQDFX Bonus

The LQDFX 100% Bonus Program is a bonus that is added to your trading account and is credited when the volume requirements have been met. The 100% deposit bonus applies to deposits greater than $250, is available with all 5 account types and is instantly credited to your trading account when you deposit a minimum of $250 and a maximum of £20,000.

LQDFX Contact and Customer Service

You can contact LQDFX customer support via email at [email protected], telephone, or via Live Chat which is located on the right-hand side of the screen. Additionally, you can also request a callback via the Contact page of the website. The customer service team is available 24/5.

Is LQDFX Safe?

LQDFX is not regulated or registered with any top-tier financial authority. The LQDFX financial services are provided by LQD Limited which is headquartered in the Marshall Islands. Despite being an unregulated brokerage firm, it has published multiple legal documents and is relatively transparent about its pricing structure and business model.

However, top-tier financial authorities ensure that brokers do not saturate their sites with misleading and fake information, as well as offering client fund protection schemes.

According to LQDFX, it takes the security of its clients’ funds very seriously and as a result, keeps company funds and clients’ funds separate so that if the broker were to liquidate, the client funds are segregated, off the balance sheet and therefore cannot be used to pay back creditors.

LQDFX also collaborates with its payment service providers and thus has partnered with more than 200 global banks including HSBC and Barclays.

All in all, we recommend doing extra research and taking careful consideration when deciding whether to open an account with LQDFX.

How to Start Trading with LQDFX

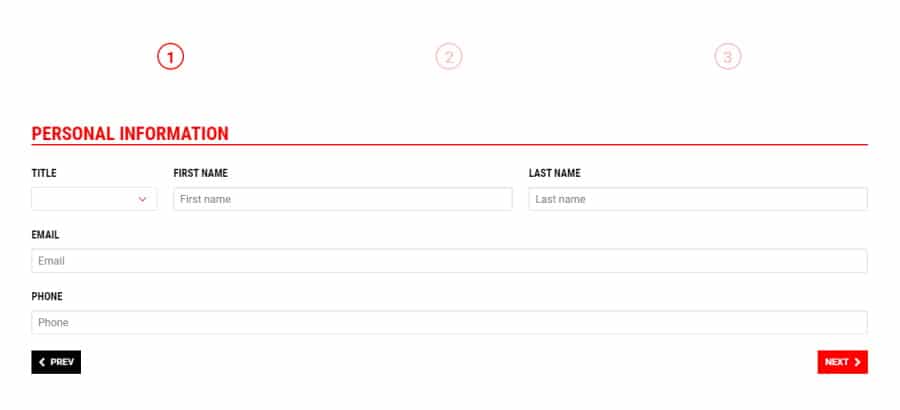

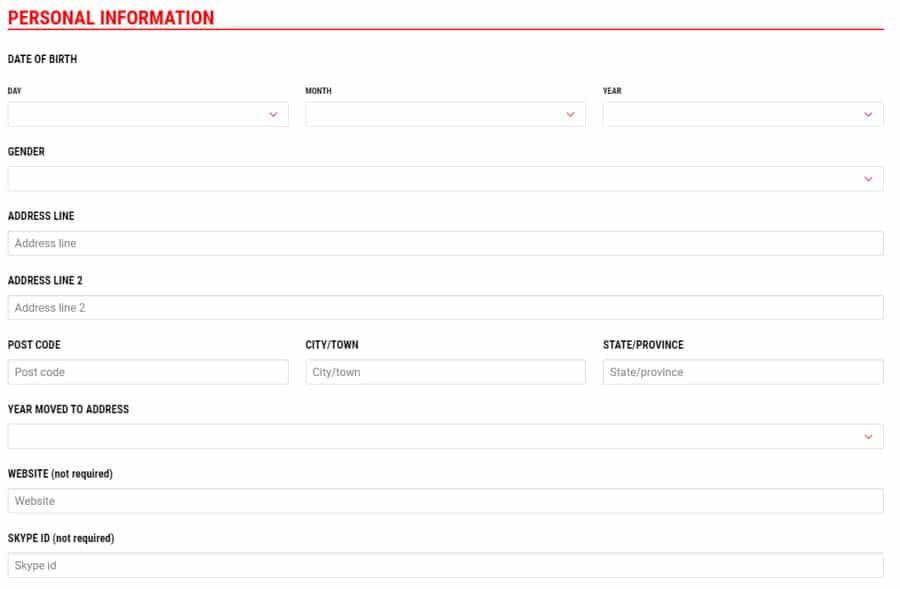

Step 1: Open an account

Go to the LQDFX website and click on the Open Live account button. Next, you will be required to provide your personal information including your name, email address, and phone number. Then you will need to provide further information regarding your financial status, employment, trading experience, as well as choosing your account base currency (either Euros or USD), as well as the platform and account type of your preference.

Step 2: Complete the Verification Process and Deposit Funds into your Trading account

Once your LQDFX account has been verified successfully you will receive several confirmation emails with your account login credentials. Once you have logged into your trading account you can choose from any of the available payment options to deposit funds.

Step 3: Start trading via the LQDFX MetaTrader 4 trading platform

To get the ball rolling, simply download either the desktop version of the MT4 trading software, or download the mobile trading app to start buying and selling tradable assets such as forex pairs, commodities, and indices.

LQDFX vs eToro

In summary, if you are looking for a broker to trade forex, commodities and indices with low spreads via the top-rated MetaTrader 4 trading platform then LQDFX may be a good choice. Although it does keep its clients’ funds in segregated accounts, and partners with tier-one EU banking institutions, LQDFX is an unregulated broker, and for many beginner traders this is a red flag when it comes to safety and regulation.

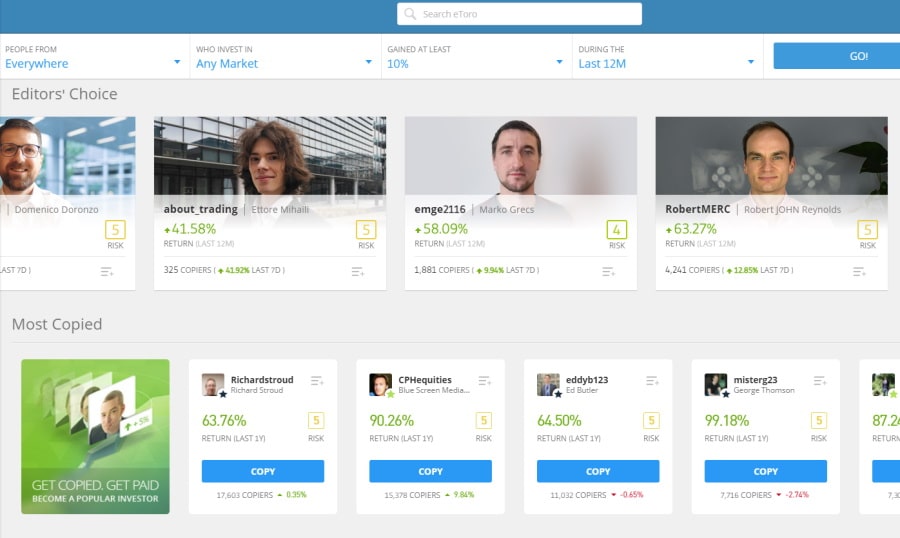

Consequently, we would recommend eToro as the best free trading platform in 2025 as it is fully regulated by multiple top-tier financial authorities including the FCA, CySEC, ASIC, and the US Securities and Exchange Commission.

Established in 2007, eToro is now home to more than 20 million traders and is one of the top-rated and trusted social trading platforms out there. eToro clients have access to forex, CFDs, commodities, indices, and crypto trading.

Furthermore, this copy trading platform offers commission-free ETF and stock trading. eToro provides access to 17 international stock markets which is great for your portfolio diversification. Additionally, eToro supports fractional share trading which means that you can invest in shares of stocks with as little as $50 for a portion of a share whose price per unit is greater than your investment amount.

67% of retail investor accounts lose money when trading CFDs with this provider.

eToro also provides added functions using CFD trading. With CFDs, you have the option to open SELL positions and use leverage.

There are two distinctive copy trading tools available with eToro:

- CopyTrader is very much a social trading tool that allows you to copy the portfolio of other investors, who also use the eToro platform. This is especially ideal for beginner traders who want a more passive approach to online trading. The minimum investment is $200, and you can copy up to 100 individual investors at one time.

- CopyPortfolio is essentially a CFD portfolio that allows you to invest in a theme such as cryptocurrencies or stocks, or a portfolio of eToro investors.

When it comes to trading fees and commissions, it doesn’t matter what asset class you are trading because at eToro you don’t pay a penny in commissions. Instead, the trading fees are included in the spread.

Additionally, if you are looking to invest in shares of stock listed on the London Stock Exchange then you will be happy to know that eToro waives the 0.5% stamp duty tax, thus helping to minimize your trading costs even more.

LQDFX Review: The Verdict

This in-depth LQDFX review has covered all the key metrics from fees and commissions to charts and user experience. All things considered, we recommend eToro as the best social trading platform in 2025 as it not only offers commission-free trading on heaps of financial instruments but it also provides access to innovative copy trading features.

If you’re new to online trading then eToro is perfectly matched to your trading needs. So, to start trading stocks on a commission-free basis, or to practice your trading strategies with a $100,000 paper trading account, just follow the link below and open an eToro account today!

eToro – Best Copy Trading Platform for Commission-free Stock and ETF Trading

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.