Best Brokers for FTSE 100 UK – Cheapest Brokers Revealed

If you want to trade or invest in the most popular UK index from the comfort of your home – you will need to find a top-rated trading platform to do just that. In this review, we reveal the best and cheapest brokers for the FTSE 100 in 2026.

By the end, you will know how to trade or invest in the FTSE 100. We also examine some key FTSE 100 trading principles and guide you through the process of starting right away.

Best Brokers for FTSE 100 in 2026

In this section, we reveal which top FTSE 100 brokers secured a place on our list. You can keep reading to find a full analysis of each broker to help you decide which ones match your investment objectives.

- eToro – Overall Best FTSE 100 Trading Platform

- Libertex – Low-Cost Index Trading Platform with Tight Spreads

- AvaTrade – Fully Regulated Broker with Low CFD fees

- Fidelity International – Best Provider of ETFs and Stocks Traded on the LSE

- Interactive Brokers – One of the Best Indices Trading Platforms for Seasoned Traders

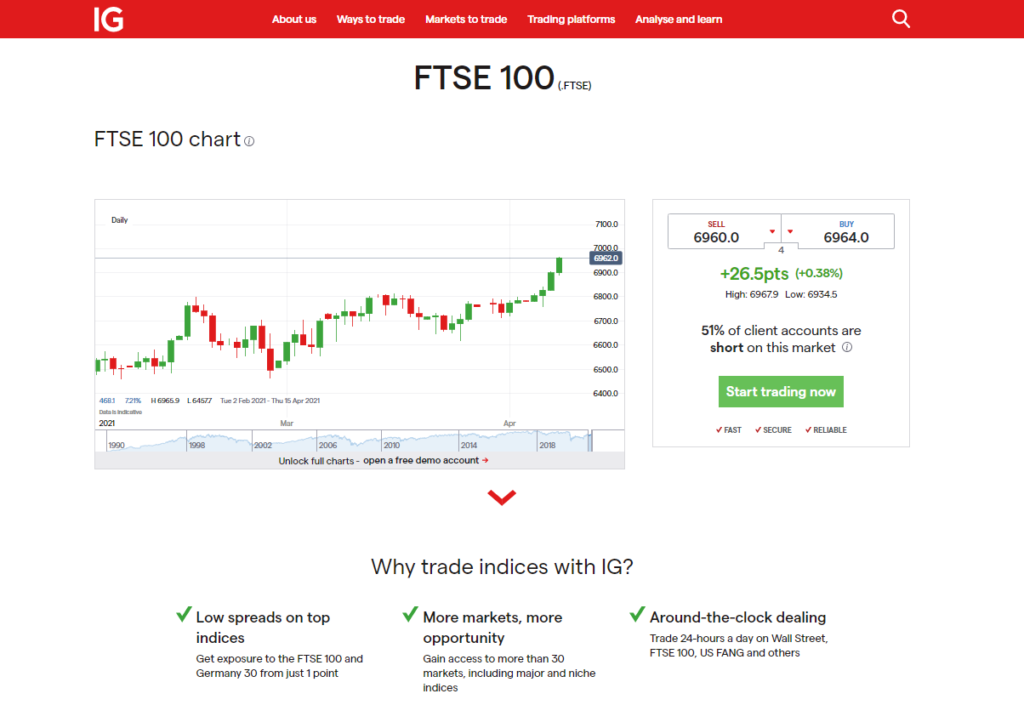

- IG – Top-rated CFD Broker

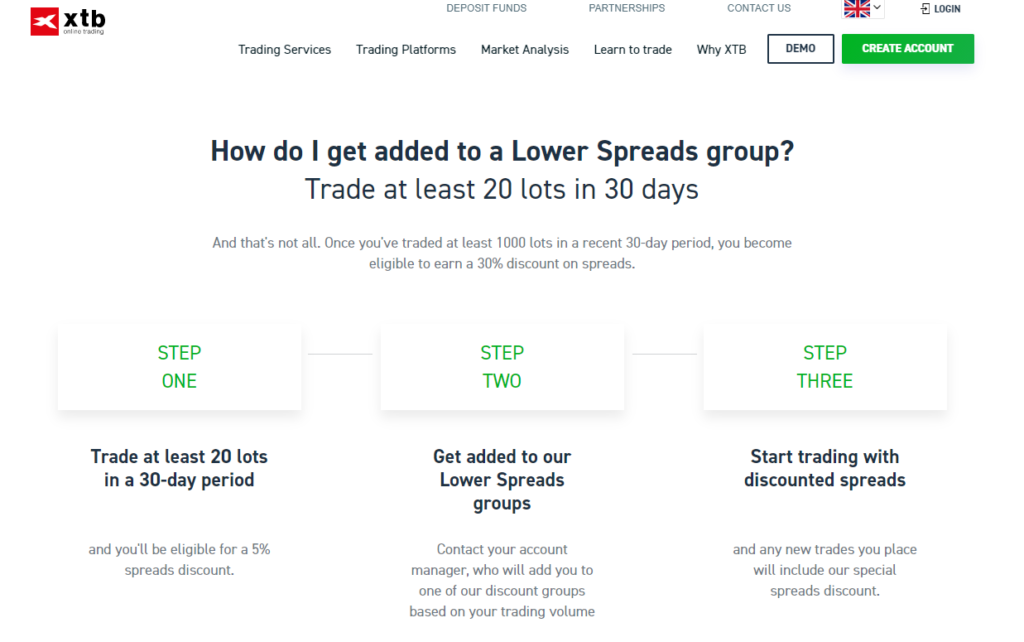

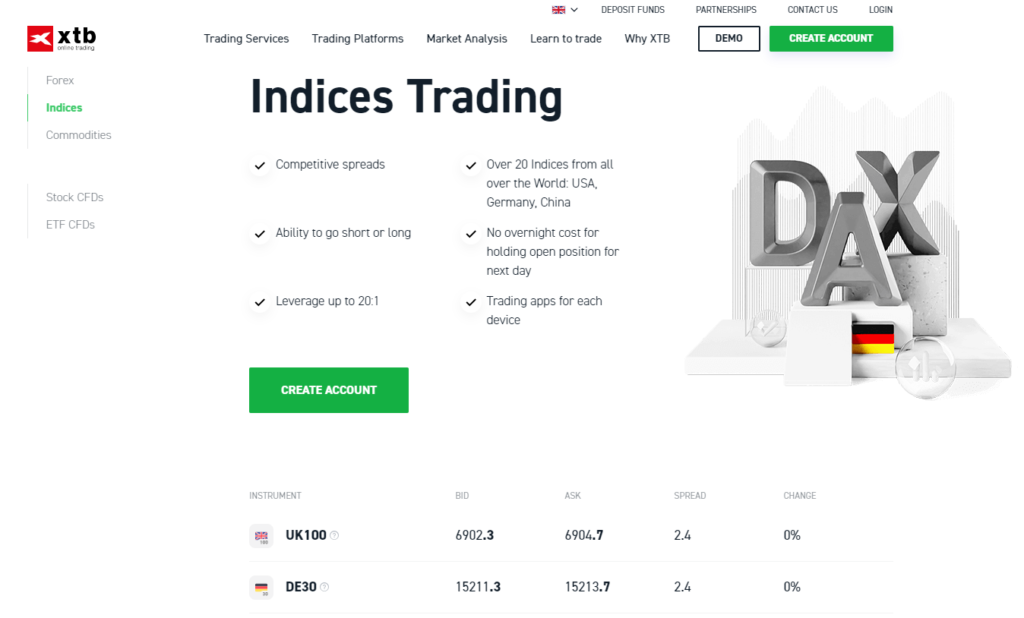

- XTB – Best CFD and Forex Broker with Low Trading Fees

- CMC Markets – CFD and Forex Broker with Competitive Fees

What is the FTSE 100?

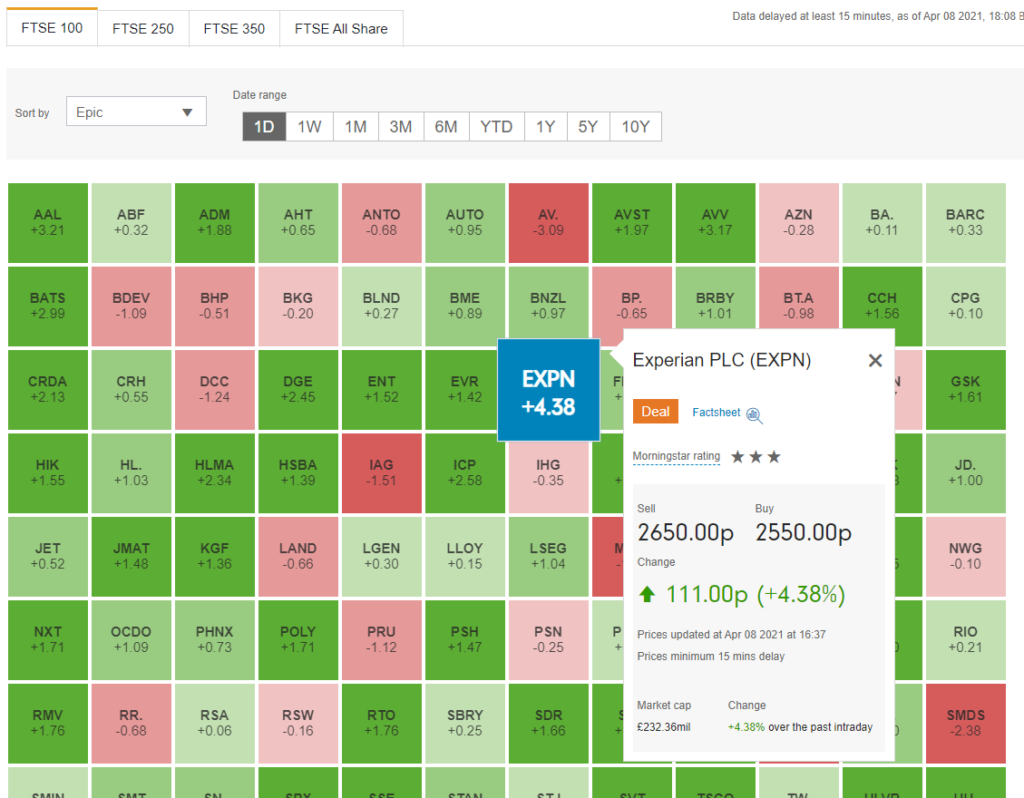

Most investors and traders regard the FTSE 100 as the most relevant and key indicator of the United Kingdom’s economy and stock market’s overall status. Shares from the largest 100 companies that are listed on the London Stock Exchange make up the FTSE 100 index. The FTSE 100’s value depends on the price of these 100 different stocks.

Ways to Trade and Invest in FTSE 100

Finding the right broker for your specific needs means understanding the different trading hours of the index, the minimum deposit required, whether you will trade the FTSE 100 by using spread bets or CFDs to forecast potential price fluctuations, or whether you will invest in the FTSE 100 by purchasing shares in ETFs that monitor the index price.

Trading spread bets and/or CFDs is the only way to get direct access to the FTSE 100 index’s price movements. When trading spread bets and CFDs you get direct exposure to the index without actually owning any of the underlying shares. The best part about trading CFDs is that you have the ability to counteract any losses against any profits.

On the flip side, to invest in the FTSE 100 you can purchase shares in exchange-traded funds that closely track either the FTSE 100 price or the price of specific shares that make up the index. Investors make profits by selling the share later on. Unlike trading, when you invest in FTSE 100 ETFs you do actually own the shares.

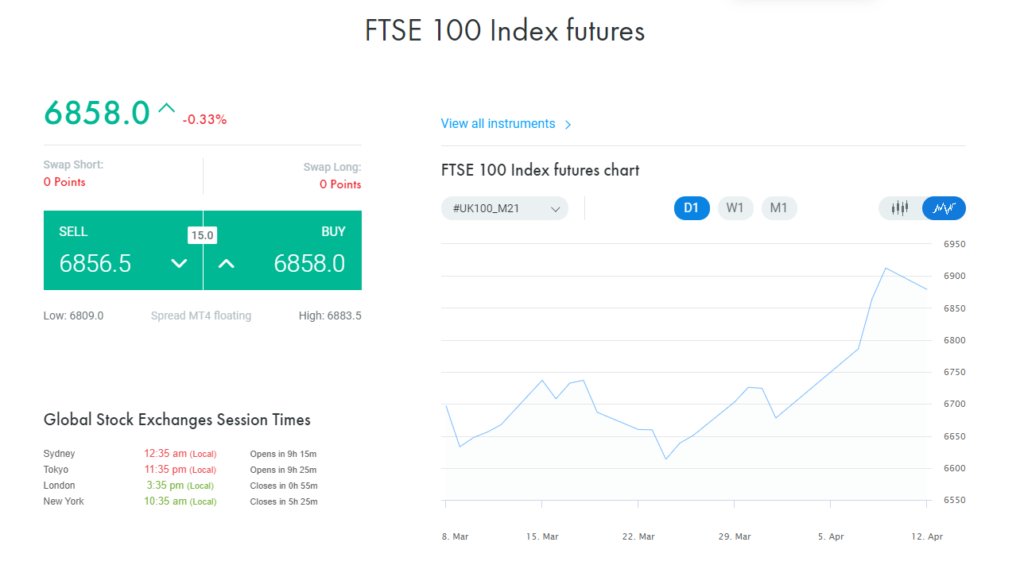

When it comes to trading the price movements of the FTSE 100, there are two types of trading known as the futures index and the cash index.

- The FTSE 100 futures index covers the futures contract price that is traded on the LIFFE futures exchange.

- The FTSE 100 cash index covers the actual index price and is typically quoted from your provider.

FTSE 100 Tracker Funds

Investing in FTSE 100 tracker funds is something that long-term traders commonly use. Simply put, a FTSE 100 tracker fund is a fund that tracks a FTSE 100 index and is typically useful for investment trusts.

If you are searching for long-term exposure to the FTSE 100 index then investing in tracker funds may be the best option available.

For instance, the HSBC ETFS PLC FTSE 100 UCITS ETF tracks the index’s performance. The tracker fund is listed on the stock exchange giving investors the opportunity to purchase shares within it and therefore gain direct exposure to the price movements of the FTSE 100. Choosing a UK-based broker is key when investing in FTSE 100 tracker funds. With that said, eToro is our recommended top broker for trading the FTSE 100 index.

FTSE 100 ETFs & Stocks

A great way to gain exposure to the FTSE 100 index is to invest in ETFs. But, for some traders having a more focused investment of the actual stocks that make up the FTSE 100 is preferable.

For instance, some of the biggest companies that are listed on the London Stock Exchange are mainly banks and energy firms. For this reason, some investors prefer to choose exactly which stocks they will invest their money in rather than investing in a collective index.

Why Trade the FTSE 100?

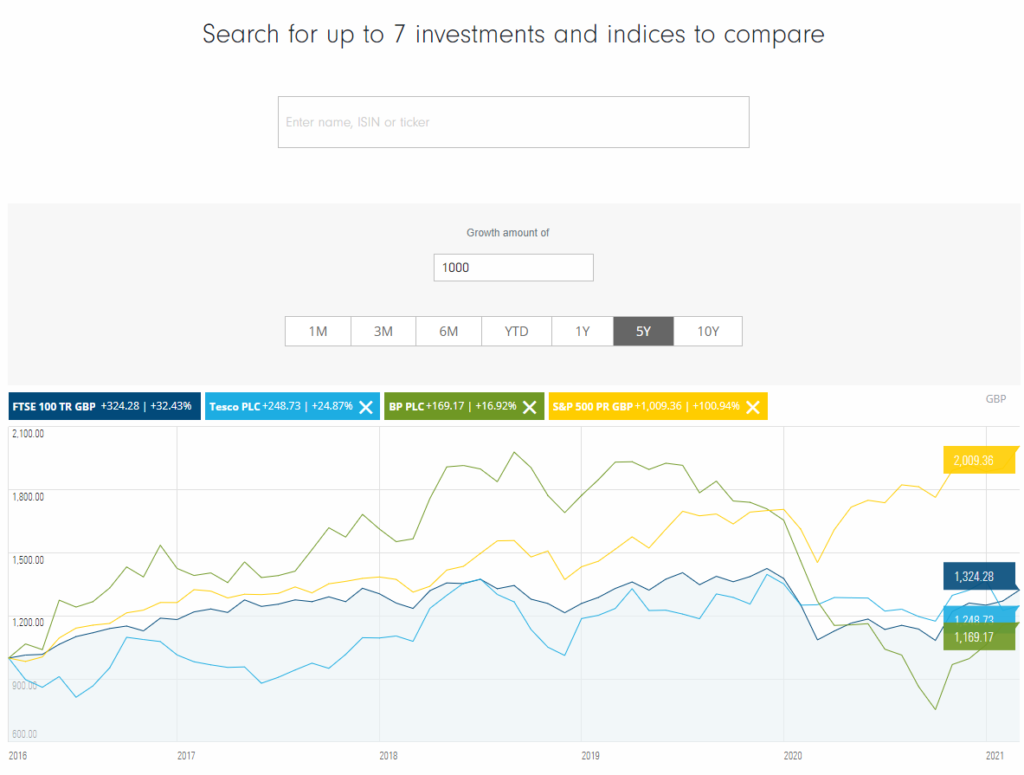

Repercussions from the US-China trade war, Brexit, and the Covid-19 pandemic have dealt a massive blow to the global economy. As a result, the FTSE 100 index has struggled under the sluggish business and investor sentiment.

Nevertheless, financial experts and investors are adopting bullish sentiments regarding the long-term trajectory of the FTSE 100 index. This can be narrowed down to a range of causes such as the end to the Brexit dilemma. The uncertainty that loomed over the country in terms of the future relationship between Britain and the EU has cleared. This means that businesses can now deal with the changes that have taken place. This is great news for the UK economy as businesses and investors can now plan and invest for the future.

On the other hand, the successful distribution of the Covid-19 vaccine means that consumer and business sentiment can eventually resume normality.

Best FTSE 100 Brokers Reviewed

When searching Google for FTSE 100 brokers you will come across thousands of potential options. As a result, pinpointing the best brokers for the FTSE 100 can be immensely time-consuming and confusing. After all, you will need to consider things such as whether you will gain exposure to the FTSE 100 by investing in ETFs and specific shares, or trading on the index’s worth. Whether you are a long-term or short-term trader, how you will conduct risk management, and whether you will open CFD trading, spread betting, or share dealing accounts.

In this guide, we review the best FTSE 100 brokers in 2026. We also go through the most effective steps and tips to start investing and trading in the FTSE 100 with one of our recommended and top-rated FTSE 100 Brokers.

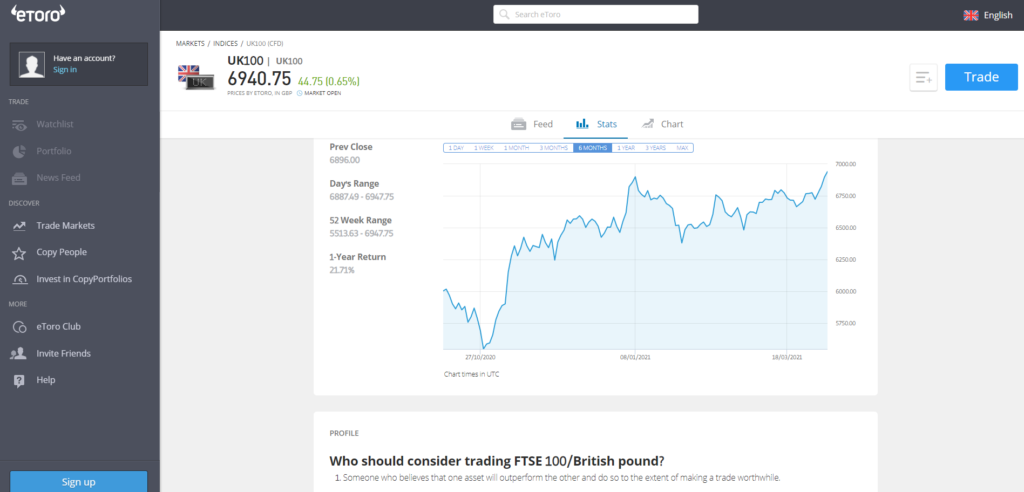

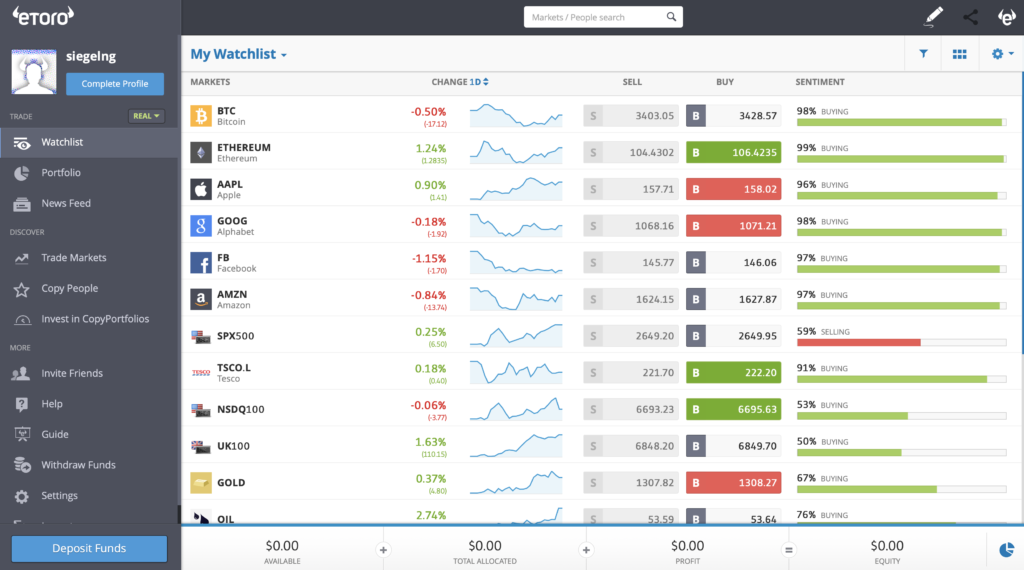

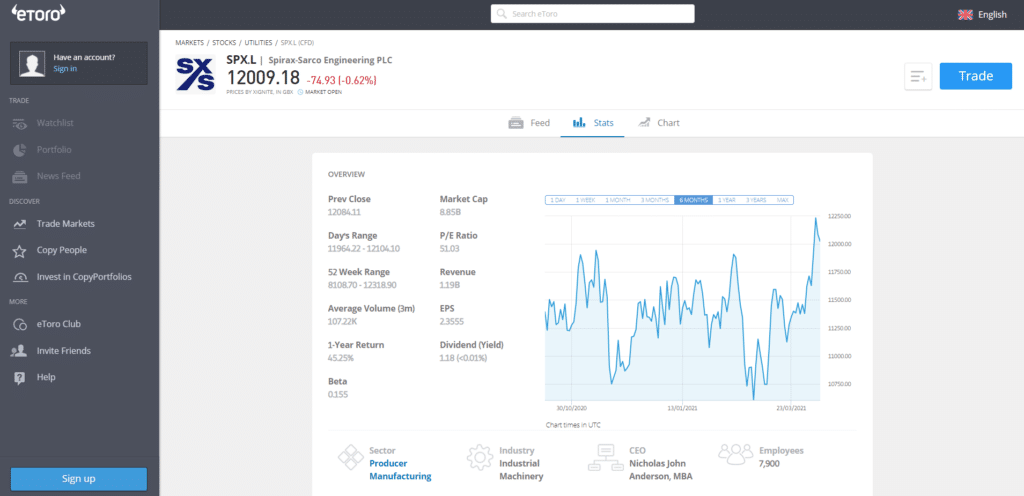

1. eToro – Overall Best FTSE 100 Trading Platform

After fully researching hundreds of online trading platforms, we found that eToro stands out as the best trading platform to pick in 2026. First of all, the social trading platform is designed with beginner traders at its core. This is mainly due to the broker’s user-friendly design as well as its popular copy trading features.

To further this point, there is just a $200 minimum deposit and you can start buying and selling from just $25. When it comes to tradable assets, eToro offers heaps of asset classes. This includes more than 2,000 stocks across dozens of international markets. This means you can trade shares of stocks across multiple exchanges.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

If you’re into ETF and Bitcoin trading then you’ll be happy to hear that eToro clients have access to hundreds of ETFs and 16 cryptocurrencies. eToro’s usual spread for buying Bitcoin is 0.75%. If you’re searching for a FTSE 100 trading platform, eToro provides everything from stock and ETF trades to CFD trades. Additionally, eToro offers forex trading. Moreover, all financial markets supported by eToro can be traded with 0% commission. Also, there aren’t any ongoing fees which is why eToro is a perfect trading platform for discount trading.

As we have already mentioned, eToro is one of the best and cheapest trading platforms for beginner traders on the market. The broker’s passive investing tools are easy to use and offer extra support for those who need help managing their investment objectives.

eToro claims the top spot on our list as it is the best match for beginner FTSE 100 traders. The web and mobile trading platforms are very easy to use, opening an account are seamless, and it even supports social trading. eToro’s innovative Copy Trading feature allows you to copy the trades of advanced FTSE 100 traders.

Depending on your own trading strategy and risk tolerance, gaining access to the FTSE 100 index can be achieved in two ways.

- You can trade the FTSE 100 via spread betting and CFDs (Contracts for Difference).

- Alternatively, you can invest in the FTSE 100 by purchasing ETFs or shares of the company stock that is listed on the London Stock Exchange (LSE).

eToro is primarily a forex and CFD discount broker. Having said this, eToro offers 13 different Stock index CFDs, around 2,000 stock CFDs, just under 150 ETF CFDs, and much more.

Another point worth mentioning is that with eToro you can modify the amount of leverage of the tradable products. This is great when it comes to reducing potential trade risks. Trading with leverage can magnify profits but it can also act in the opposite direction and maximize losses. For instance, rather than trading an asset with 10:1 leverage, you can trade with a 5: 1 leverage.

As for the fundamentals, eToro is regulated by leading financial authorities including the UK’s FCA (Financial Conduct Authority), ASIC (Australian Securities and Investment Commission), and CySEC (Cyprus Securities and Exchange Commission).

When it comes to UK client fund protection, if the broker were to go bust then the FSCS covers account funds up to £85,000.

Pros:

- A social trading platform designed for beginners

- Trade or invest in the FTSE 100 without paying any commission

- 2,000 Stock CFDs and 145 ETF CFDs listed on 17 international markets

- Trade cryptocurrencies, commodity CFDs, and forex

- Deposit funds easily and instantly with a debit/credit card, e-wallet, or bank account

- CopyTrader promotes social trading

- FCA, CySEC, ASIC regulated

- The effortless process involved when opening an account

- Free ETF and Stock trading

- Demo account gives you access to $100,000 paper funds

Cons:

- Lack of fundamental data and analysis

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

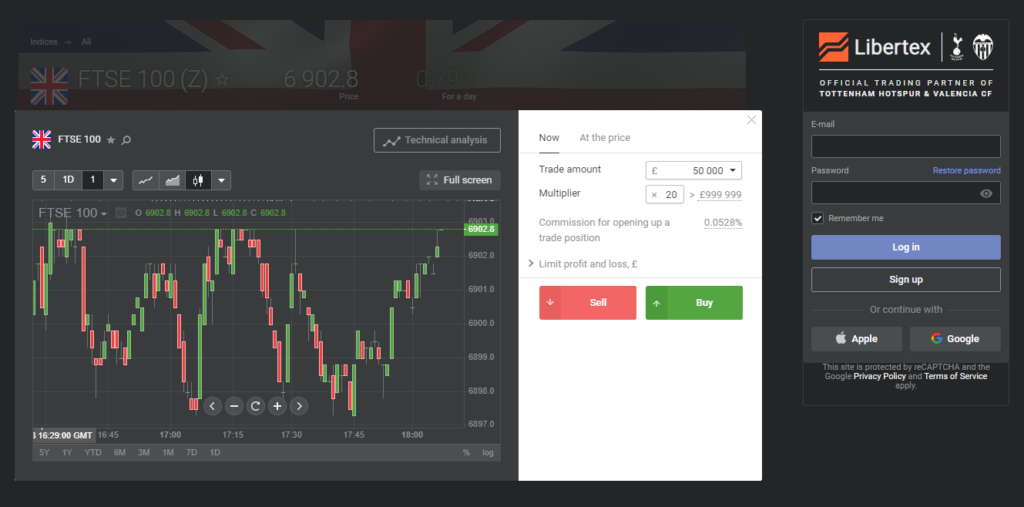

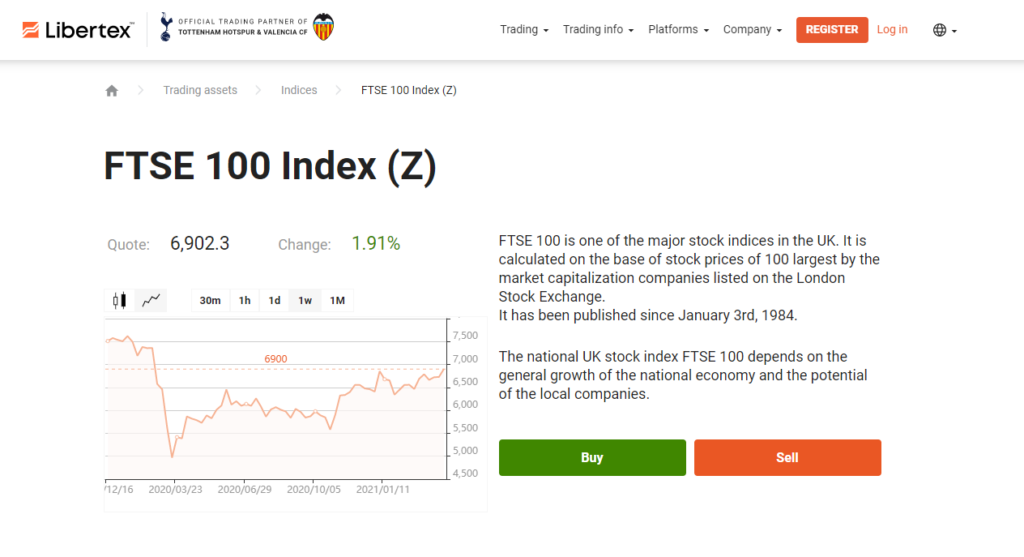

2. Libertex - Low-Cost Index Trading Platform with Tight Spreads

Home to nearly 3 million clients across the globe, Libertex was launched in 1997. Specializing in CFDs, Libertex is one the best index trading brokers in the investment sector.

Libertex is regulated by CySEC and provides a variety of CFD asset classes – such as stocks, indices, ETFs, cryptos, and commodities. Trading without paying any spreads is one of the many added benefits that come with Libertex.

What shares can Libertex clients purchase?

Firstly, it is crucial to note here that you will not be ‘purchasing’ shares. In fact, you will be trading stock CFDs. Simply put, trading stock CFDs means that you will try and forecast whether the stock price will rise or fall.

More importantly, with Libertex when you trade stock CFDs these are not backed by the actual stock, which means that you do not have legal rights to own the shares. However, trading stock CFDs in this manner means that you have access to low trading fees, leverage and have the option to either go short or long on the trade.

If you’re looking to gain exposure to the indices trading scene, you’ll be happy to find out that Libertex covers loads of markets. Top indices markets include the Dow Jones 30, the Nikkei 225, and the all-important FTSE 100.

What about spreads?

Libertex’s popularity can be justified by its tight spread offering. If you don’t know or need a refresher, the spread is essentially the difference between the ask and bid prices of a financial instrument.

Pros:

- Trade CFDs with tight spreads

- Low commissions on major markets like forex and stocks

- MT4 supported

- No deposit fees

- User-friendly mobile app for trading on the go

- Demo account with 50,000 euros paper funds perfect for beginners

Cons:

- No fundamental research

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

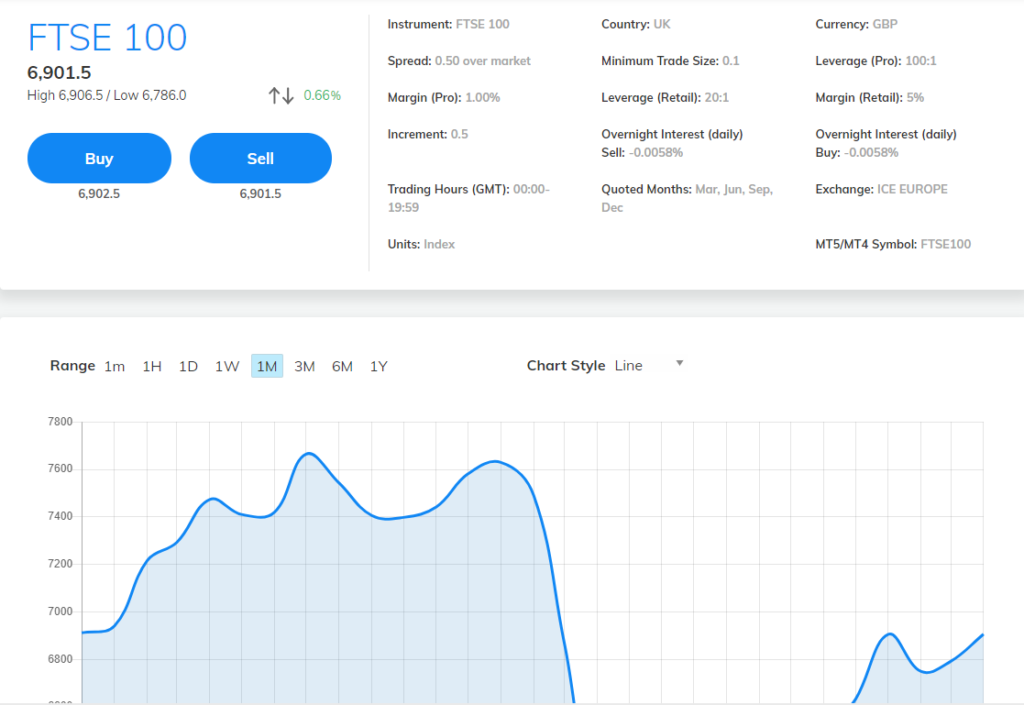

4. AvaTrade - Fully Regulated Broker with Low CFD fees

AvaTrade is a global forex and CFD brokerage that has been operating since 2006. In terms of the fundamentals, AvaTrade is regulated by a host of top-tier financial authorities such as ASIC, the FSA, and the Central Bank of Ireland just to name a few.

In terms of tradable instruments, AvaTrade offers 19 different stock index CFDs, 620 Stock CFDs, and 41 ETF CFDs. Contract for difference trading can be a complex topic for beginner traders but AvaTrade offers AvaSocial which is a social trading mobile application. This is a great feature for new investors as it allows you to interact with other investors and copy their trades with the click of a button.

In terms of fees, let’s say that you wanted to trade the FTSE 100 CFD. During peak trading hours and with the fees being built into the spread, the average spread is 0.5 points for this broker.

As if this industry-leading spread structure wasn’t enough, AvaTrade also gives its clients the ability to trade CFDs with 0% commission. This broker provides heaps of other financial assets from forex to commodities trading. So, for most investment goals chances are that you can achieve them with AvaTrade.

Pros:

- More than 200 spread betting markets

- Fees are built into the spread, so 0.5 points is the average spread for FTSE 100 CFD

- Low CFD fees

- Zero withdrawal fees

Cons:

- $50 inactivity fee

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. Fidelity International - Best Provider of ETFs and Stocks Traded on the LSE

Fidelity International is an FCA-regulated UK-based trading platform that offers low trading and non-trading fees. In terms of its market and product portfolio, it is rather limited when compared to other brokers in its division. However, seeing as this review is focused on the best FTSE 100 brokers, Fidelity International makes it on our list. 280 ETFs and a range of stocks that are on the London Stock Exchange are accessible with average trading fees.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

If you don’t trade with a standard savings plan you will incur a £10 flat fee. There is also a £30 fee for share dealing orders made through the phone. Fidelity charges a £0 deposit fee and you can fund your account easily with a debit card or cheque. On the flip side e-wallets like Paypal are not available with this broker.

This ETF trading platform also offers a mobile trading platform that is user-friendly and well-developed. While you can place order types and invest in ETFs at the swipe of a finger you cannot set price alerts or notifications.

Pros:

- Free withdrawals and zero deposit charge

- Low trading and non-trading fees

- Advanced research tools

- Provides ETFs and stocks listed on the London Stock Exchange

Cons:

- A desktop trading platform is not provided

- Mobile trading app does not support price alerts or push notifications

There is no guarantee that you will make money with this provider. Proceed at your own risk..

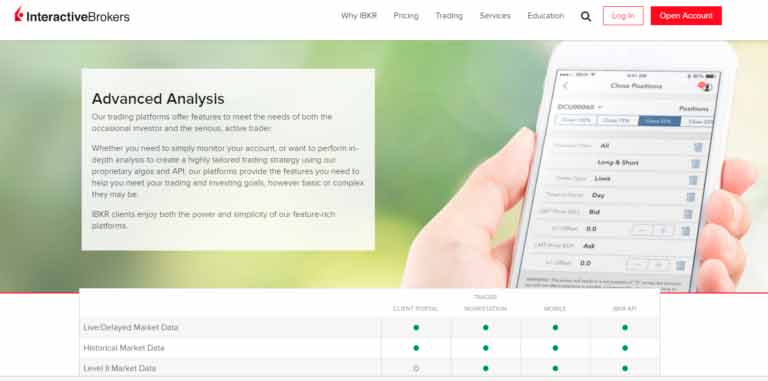

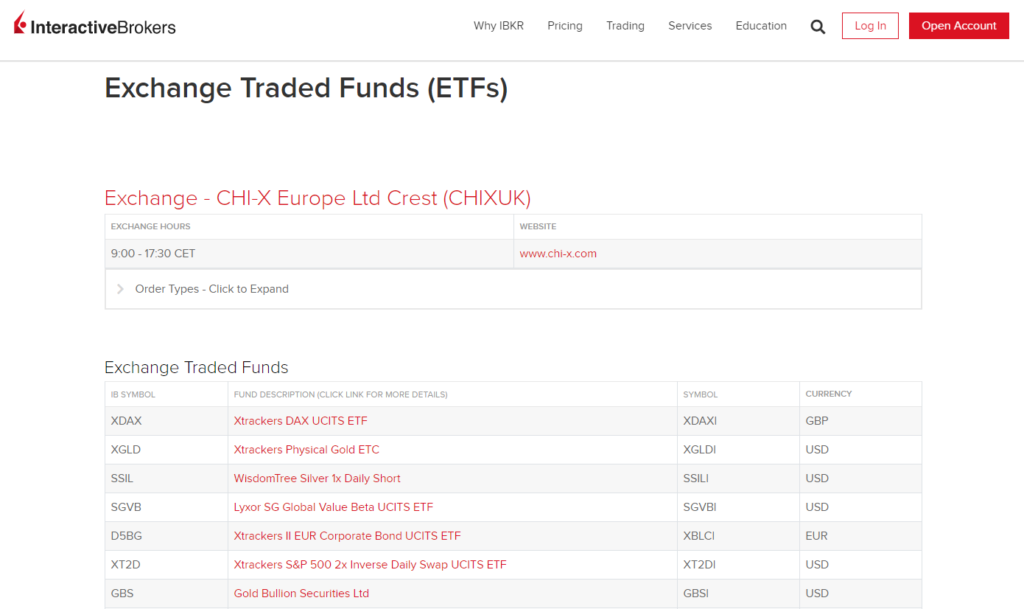

6. Interactive Brokers - One of the Best Indices Trading Platforms for Seasoned Traders

Interactive Brokers Ltd, perhaps one of the best index brokers, is regulated and authorised by the UK’s FCA and provides access to everything from stocks and ETFs to investment funds and bonds on a low-commission basis.

Interactive Brokers gives you access to bond and equity indices on heaps of exchanges spanning more than 12 nations. This includes leveraged and short ETFs trades as well as index option and index futures trading. Furthermore, the trading platform is available across Europe, the United States, and Britain.

All in all, during our best FTSE 100 brokers review for 2026, we found that Interactive Brokers is better suited to experienced investors and active traders because the desktop trading platform is rather complicated for beginner traders to understand.

Pros:

- Trade indices by investing in ETFs, options, and futures.

- If you’re the type of trader who holds positions for the long term you can earn interest by lending to short sellers

- 24/6 access to market analysis spanning more than 100 markets

Cons:

- Developed with experienced traders and investors in mind, as beginners can find the desktop platform overwhelming

There is no guarantee that you will make money with this provider. Proceed at your own risk..

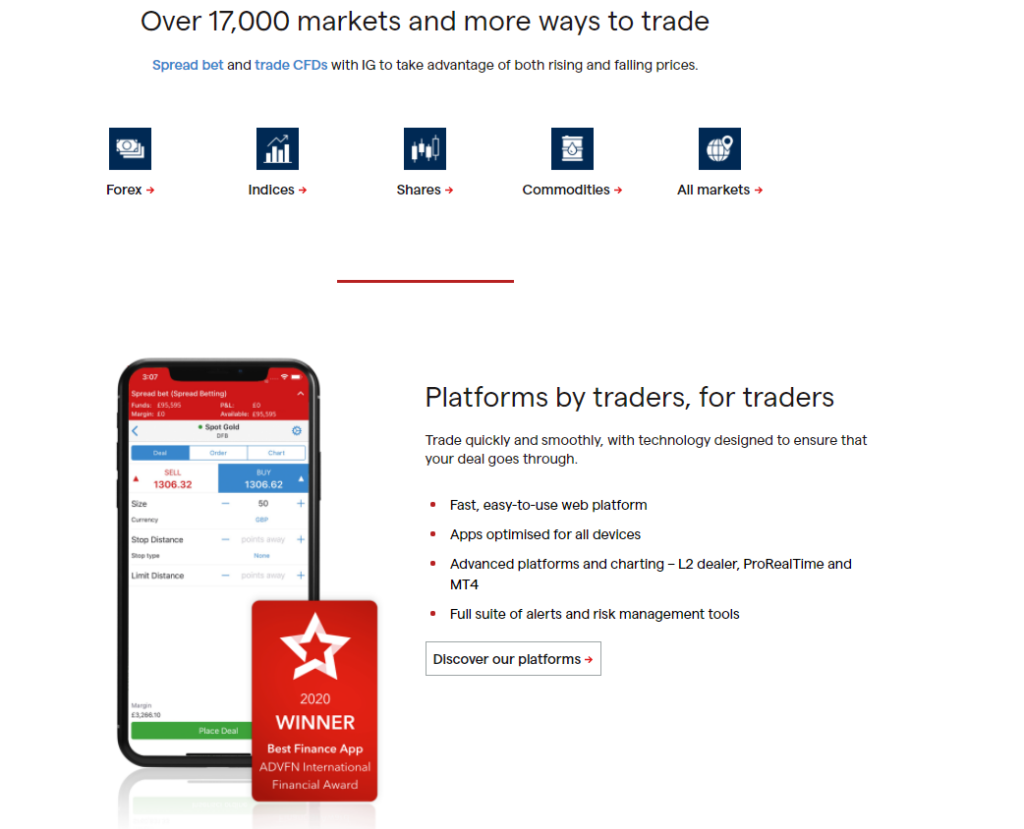

7. IG - Top-rated CFD Broker

IG is a top-rated CFD trading platform that was established in 1974 and is regulated by several financial authorities including BaFin and the UK’s FCA. Reinforcing its regulation is the fact that it is listed on the London Stock Exchange under the ticker symbol IGG.

In addition to other tradable assets such as forex, cryptocurrencies, and ETFs this CFD trading platform gives its clients access to stocks with the click of a button. This covers international markets such as the UK, Australia, the United States, and a bunch of other European exchanges.

When it comes to trading commissions this will vary depending on your location. This means that certain countries have access to UK stock CFD trading on a zero-commission basis, whereas other countries have to pay a low average trading commission of around 0.10%.

When it comes to IG’s trading platform itself you have two options either the in-house developed platform or MetaTrader 4. Both platforms are very user-friendly and have heaps of technical indicators and fundamental analysis.

Pros:

- Low trading fees with an average spread of 0.8 pips

- 0% commission on UK and US stock CFDs

- MetaTrader 4 supported platform

- FCA and BaFin regulated

- Low non-trading fees with £0 deposit, withdrawal, and account fees

- Detailed technical analysis

Cons:

- Account verification processing time can take 3 working days

There is no guarantee that you will make money with this provider. Proceed at your own risk..

8. XTB - Best CFD and Forex Broker with Low Trading Fees

Established in 2002 XTB is a global CFD and forex provider and falls under the FCA’s regulation. XTB offers low-cost forex trading with its CFD trading fees slightly above average. XTB’s account types determine the trading fees that you are likely to incur while investing. For example, a standard account holder only has to pay the spreads, whereas Pro account users pay commission fees in addition to the spreads.

When it comes to non-trading fees XTB comes up fairly average with zero accounts, deposit, and withdrawal fees. You also don’t have to worry about conversion fees with this broker because it offers 5 different account base currencies as EUR, USD, and GBP.

XTB offers indices from the most popular stock exchanges. A feature that attracts investors is the ability to easily diversify your trading portfolio. Index positions can be rolled over when contracts expire, which means that the open position can be held for a longer period of time.

Pros:

- Traders benefit from tight spreads

- Clients can go short or long on the FTSE 100 and other popular indices with low spreads

- No requotes with XTB trades

- Trade CFDs on more than 1,500 markets, such as shares, indices, ETFs, and more

Cons:

- Inactivity fee of $10 charged after 12 months

75% of retail investor accounts lose money when trading CFDs with this provider.

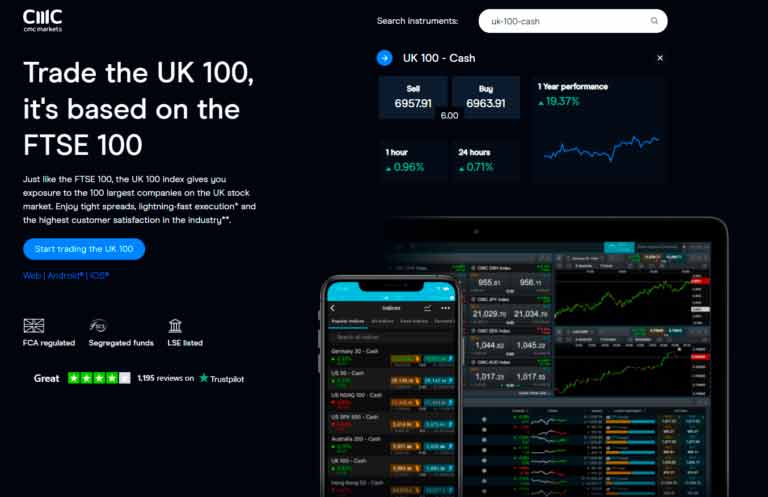

9. CMC Markets - CFD and Forex Broker with Competitive Fees

Last but not least CMC Markets is a globally recognized forex and CFD stock broker which was launched in 1989. In terms of fundamentals, this CFD provider is regulated by the UK’s top-level financial authority: the Financial Conduct Authority. Additionally, CMC Markets is listed on the London Stock Exchange under the ticker symbol CMCX.

In terms of trading and non-trading fees, CMC Markets offers low stock index CFD fees, and deposits and withdrawals come without any fees. For example, the fees are low when trading the FTSE 100 CFD because the fees are built into the spread. On the flip side, this CFD broker does not charge fees for deposits, withdrawals, or its accounts. But it does include a monthly inactivity fee of £10 after one year.

CFD account users can pick from ten different base currencies including EUR, GBP, and USD. If you’re a trader looking for a spread betting account then the only available currencies are GBP and EUR. CMC Markets offers a variety of instant payment options from e-wallets like Paypal to credit and debit cards. This CFD broker offers well-designed and user-friendly web, desktop, and mobile trading platforms. When it comes to chart and dashboard customization CMC Markets offers great options to modify your trading experience to suit your needs.

Pros:

- Several options to choose from including its in-house developed Next Generation trading platform and MetaTrader 4 which is better suited for advanced traders

- Highly customizable charts and top-rated search functions with real-time price alerts

- Trade with low stock index CFD fees

- Zero deposit, withdrawal, and account fees

- No minimum deposits

Cons:

- After 12 months of inactivity a £10 fee is charged every month

There is no guarantee that you will make money with this provider. Proceed at your own risk..

FTSE 100 Brokers Fees Comparison

In this section of our Best Brokers for trading the FTSE 100, you will find a comprehensive comparison of all key metrics in terms of trading and non-trading fees. This includes things like deposit fees, CFD trading fees, and more.

| Deposit fee | Withdrawal fee | Account fee | Inactivity fee | ETF fee | Stock fee | Index CFD Min Spread | |

| eToro | No | $5 | No | $10 per month after 1 year | 0% | 0% | 1.5 |

| Libertex | No | 0% with e-wallet | No | $5 per month after 180 days | 0% | 0.1%-0.2%. | 2.5 |

| AvaTrade | No | No | No | $50 every 3 months after 3 months | 0% | n/a | 1.0 |

| Fidelity | No | No | No | No | £10 per deal | £10 per deal | Fees built into spread |

| Interactive Brokers | No | No | No | Varies depending on account type | 0% | 0% | 1 |

| IG | No | No | No | $12 per month after 2 years | 0.75% | 0.75% | 1 |

| XTB | No | No | No | $12 per month after 1 year | 0.12% volume-based fee (10 euro min fee) | 0.12% volume-based fee (10 euro min fee) | 0.9 |

| CMC Markets | No | No | No | £10 monthly after 1 year | n/a | n/a | 1 |

How to Get Started with a FTSE 100 Broker

At this point in our Best Brokers for FTSE 100 review, we will guide you through the steps to start investing or trading the FTSE 100 index with eToro. This social trading platform offers heaps of tradable assets on a zero-commission basis and provides great trading features like Copy Trading. eToro is perfect for beginner traders which is why we recommend it as the best FTSE 100 broker in 2026.

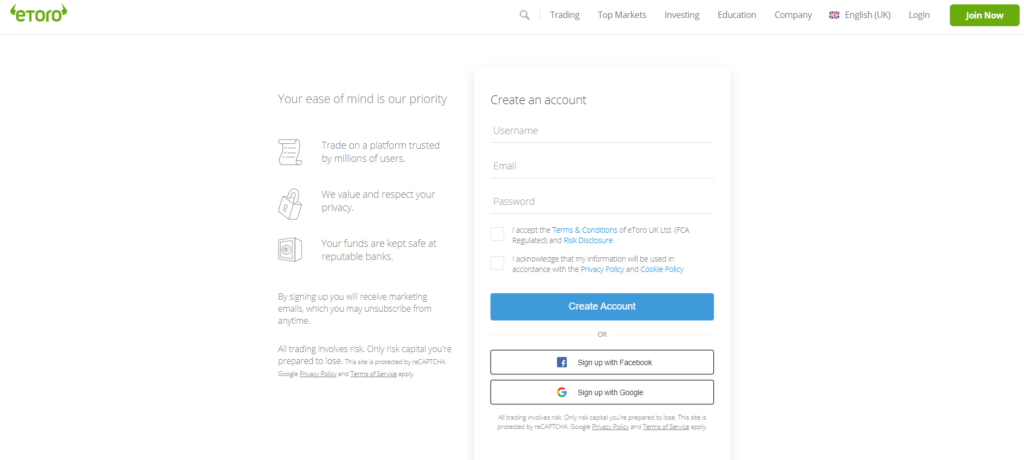

First step: Opening an eToro account

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

eToro’s account opening process is user-friendly and very easy. Simply provide your personal credentials such as username, email address, and password. Once you have accepted the terms and conditions and the risk disclosure you are on your way to online trading with the click of a button.

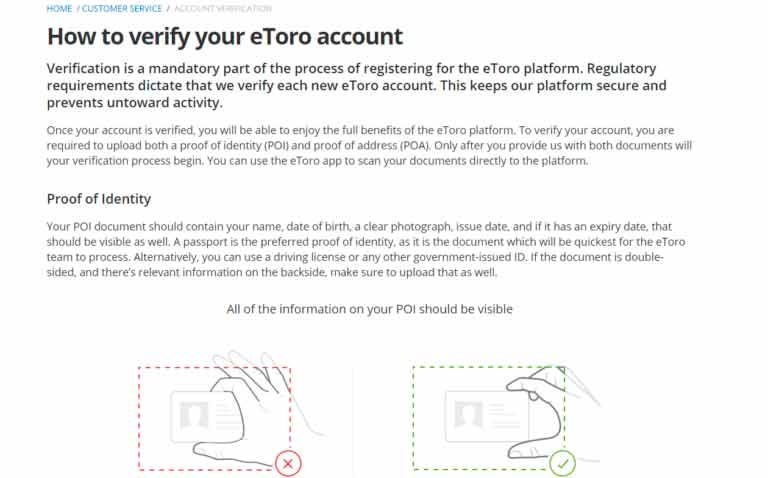

Second step: Proof of Identity

eToro is regulated by top-tier financial authorities including the FCA, CySEC, and ASIC. Part of this regulation involves verifying its user's address and identity.

This process is easy and fully digital, simply upload a passport or ID card to prove your identity. Then for proof of address, you can upload a bank statement or utility bill which is dated within the last 6 months.

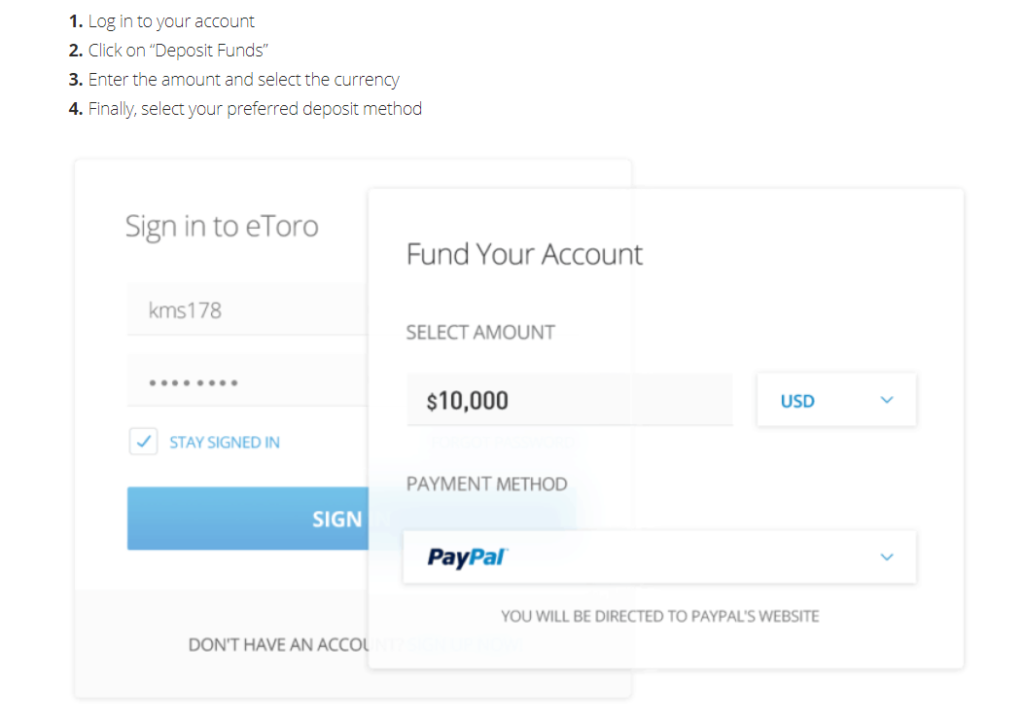

Third step: fund your eToro account

Depositing funds into your new trading account is as simple as opening the account in the first place. Simply press the Deposit button at the bottom right-hand side of the screen. One of its best selling points is that this discount broker offers 0% commission for deposits.

There are a variety of payment options available with eToro such as via e-wallets (PayPal and Skrill), debit and credit cards, and bank wire transfers.

Fourth step: Pick your FTSE 100 asset and start trading

eToro offers heaps of financial instruments from CFDs to stocks and ETFs all on a commission-free basis.

You can trade FTSE 100 CFDs or invest in FTSE 100 tracker funds and ETFs at a very low cost. Additionally, as we have already mentioned you could also take advantage of individual stocks that are part of the FTSE 100 index.

After you have picked the type of asset class you are going to invest in or trade, just click the button that says the trade.

The trading ticket gives you the option to specify the investment amount, how much leverage, and place order types such as stop-loss orders. In terms of overnight fees, these are typically presented on the ticket itself. The final step is to press the Open Trade CTA and you’re done.

eToro - Trade the FTSE 100 Index with 0% Commission on Stocks Trading

During this FTSE 100 brokers guide, we have examined a list of exceptional and top-tier regulated trading platforms, and have reviewed the FTSE 100 index with ways you can start trading today.

Many experienced traders are bullish on the immediate and future trajectory of the FTSE 100 index as the UK begins its ascent from both the Covid-19 pandemic and its divorce from the European Union. After all, research suggests that the FTSE 100 is amongst the most undervalued indices in the world today.

To make the most of this unique trading opportunity you will need to use the best platform and assets. From our comparisons and analysis, eToro surpasses all expectations as the best 0% commission social trading platform in 2026.

Designed with beginner traders in mind, online trading has never been simpler!

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

FAQs

What is the FTSE 100 index?

What is eToro?

What are CFDs?

How does eToro Copy Trader work?

What are tracker funds?