How and Where to Buy Solana (SOL) in February 2026

Solana’s native token, SOL, saw an impressive surge in 2023, increasing by 400% from its initial value of $7.63, approaching the $40 mark, with the majority of this surge happening since September 11. This substantial price movement has drawn the focus of the investment community, prompting conversations about the durability of this growth and the possibilities for future gains or adjustments.

If you’re looking to investing in SOL in 2026, this article will provide a comprehensive guide about how and where to buy Solana coin. Here, we review the top platforms that Solana is currently listed on and explain how to use our recommended broker to buy SOL in simple steps.

-

-

The Best Platforms To Buy Solana in 2026

- eToro: Our recommended centralized exchange to buy Solana. eToro supports 25 cryptocurrencies, including Solana. It is one of the only regulated crypto exchanges available to US traders, which provides a layer of protection making it suitable for amateurs. eToro also offers crypto Smart Portfolios which are developed by experts and make it easy for beginners to build a diverse crypto portfolio of their own.

- Coinbase: Coinbase is a good SOL platform to consider if you are interested in staking. Coinbase offers a variety of features as well as its own native crypto wallet which can be used to store your tokens safely. Coinbase is available as a mobile app which allows users to trade on the go.

- Binance: Binance is one of the largest crypto exchanges in the world. The platform supports a wide range of assets and offers low trading fees. Users can lower the fees even further by holding BNB tokens – the native currency of the exchange. Binance is built on blockchain technology which makes it transparent and secure.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

What is Solana?

Solana is a blockchain platform that was founded in 2020 by Anatoly Yakovenko. He is a well-known figure in fintech because he had earlier worked as an engineer at renowned companies such as Qualcomm and Dropbox, among others.

Solana can be defined as a blockchain platform for creating decentralized applications (DApps) and running smart contracts on top of it. Current projects that use the Solana blockchain include the Chainlink project and the Solanart NFT platform. In addition, the Solana blockchain is also used by crypto exchanges such as Raydium, which runs on the Solana blockchain for its transactions.

When you consider this, Solana shares many similarities with the Ethereum blockchain. Solana and Ethereum can engage in competition across multiple dimensions, with a notable focus on scalability and performance. Solana’s design permits fast and cost-effective transaction processing. In contrast, Ethereum’s forte lies in its well-established ecosystem, encompassing DeFi, NFTs, and DApps.

Solana stands out as one of the swiftest blockchain networks available, having undergone rigorous benchmark testing, achieving an impressive 29,171 transactions per second (tps). Solana’s network exhibits a remarkable block processing time of merely 2.34 seconds. In contrast, Ethereum currently maintains a throughput of approximately 15 transactions per second (tps).

Furthermore, the Solana blockchain also allows for transactions to be performed for a minimum fee of $0.001, thereby allowing for cost-effective transactions. This makes it an attractive choice for projects that want to minimize costs.

Why Buy Solana in 2026?

Throughout the year, a phase of consolidation within a horizontal range was observed, occasionally accompanied by attempts to establish an upward trend characterized by higher highs and higher lows. Notably, the $30 resistance level posed a significant obstacle on July 14, resulting in a retreat to $17.

Interestingly, this price level exhibited resilience, leading to a rebound and the formation of a second higher low by September 11. This was followed by even more robust upward momentum, ultimately leading to a breakout from the horizontal range, resulting in a more pronounced upward trajectory.

As it escaped the consolidation phase, it reached the upper boundaries of the range that persisted from mid-June to early November 2022, just before a final downward move. Additionally, the RSI indicator reading, surpassing 80%, indicates potential signs of the price being overextended.

Does it still make sense to invest in Solana? We believe it is a good alternative to investing in Ethereum based on the research we conducted to write this guide. A growing number of market analysts are backing up this statement by pointing out that there is a huge potential resting on Solana’s shoulders. Even some people go the extra mile by waiting for it to become the next Bitcoin.

Solana vs Ether

Solana’s biggest competitor is Ethereum – the second largest crypto and most widely used blockchain network. Even though Ethereum still current sits in the top spot, some people believe that Solana could take it’s place due to the network’ fast transaction speeds and low fees.

Solana’s Speed:

Solana is renowned for its exceptional transaction processing speed. It utilizes a unique combination of Proof of History (PoH) and Proof of Stake (PoS) consensus mechanisms to achieve high throughput. The Proof of History mechanism sequences transactions, providing a historical record that enables validators to unanimously agree on the order of events. This significantly reduces the time needed for consensus, resulting in an impressive transaction rate of up to 65,000 transactions per second (TPS). Solana’s rapid speed positions it ideally for real-time transaction applications like decentralized exchanges, gaming platforms, and high-frequency trading.

Ethereum’s Speed:

Ethereum originally employed a Proof of Work (PoW) consensus method. While Ethereum boasts a large and active user base, transaction speed has been a concern, leading to network congestion during peak demand periods. Ethereum’s solution to this issue lies in the Ethereum 2.0 upgrade, which introduces a Proof of Stake (PoS) consensus mechanism, enhancing scalability and transaction speed. However, the full implementation of Ethereum 2.0 is an ongoing process, and its scalability benefits are yet to be fully realized. Achieving the target version capable of processing over 100,000 transactions per second and delivering enhanced scalability demands significant effort and multiple updates.

Solana’s Consensus Mechanism:

Solana adopts a hybrid consensus approach that combines Proof of History (PoH) with Proof of Stake (PoS). As mentioned earlier, Proof of History furnishes a verifiable and efficient event history, facilitating quick consensus among validators. This methodology allows Solana to process numerous transactions concurrently, resulting in high throughput and minimal latency. To maintain decentralization, Solana’s consensus mechanism necessitates a relatively large number of validators.

Ethereum’s Consensus Mechanism:

Ethereum operates on the Proof of Stake (PoS) consensus mechanism. In this approach, validators hold and lock a specific amount of cryptocurrency to secure the network and validate transactions. Validators are chosen to create new blocks based on their stake in the network. Ethereum’s transition to PoS, particularly with Ethereum 2.0, is designed to tackle scalability issues and reduce energy consumption compared to the previous Proof of Work (PoW) mechanism. The shift to PoS is anticipated to enhance transaction throughput, boost network efficiency, and align with environmental sustainability goals.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

How much does it cost to buy Solana in 2026?

**last updated, 19th of December 2023

With a remarkable price surge of over 20% in August 2023, Solana (SOL) has significantly outperformed Ether, which registered a modest increase of just over 10% during the same period.

Thanks to its robust price growth in recent days, the total value locked (TVL) on Solana has risen to $397.32 million, marking its highest TVL level since 2022.

Following a substantial drop from approximately $1 billion to below $300 million in November 2022, Solana’s TVL encountered challenges throughout most of 2023. Nevertheless, the combined value of assets locked on the network has been steadily increasing, surpassing the $330 million mark on October 1.

Solana has recently reached the end of a bull run and currently sits at a price range between $60 and $80. The price appears to be consolidating which means that investors should keep an eye on the price chart before making any decisions.

How To Buy Solana (SOL) in 2026

Solana is listed on a number of reputable crypto exchanges. For the purpose of this guide, we will use eToro as an example. However, the process of buying SOL from a centralized platform is fairly similar no matter what platform you choose to use.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

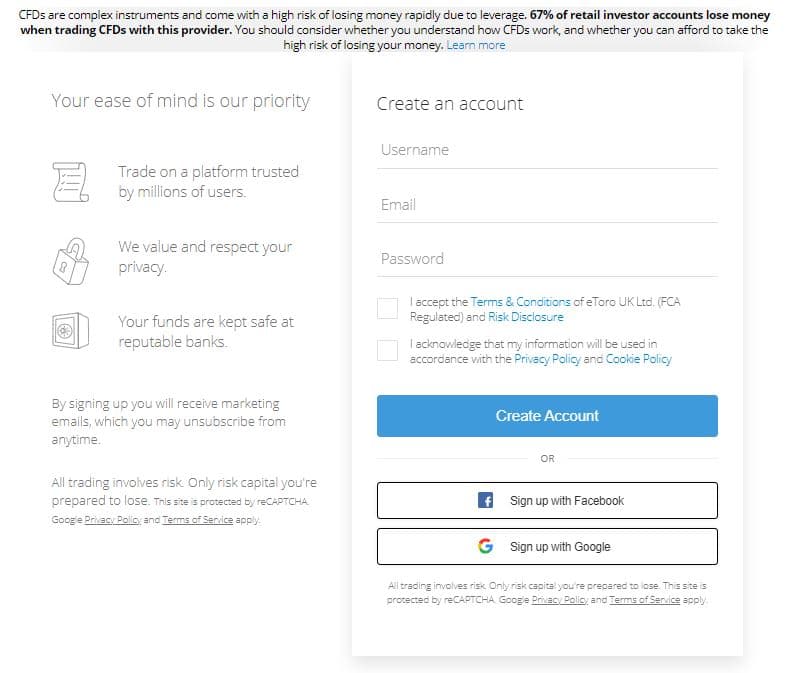

1. Register for an account

Head to the official eToro website and click ‘create an account’. Here, you will be redirected to a registration portal.

You can choose to sign up with your Facebook or Google account or manually enter your email address to create an account.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

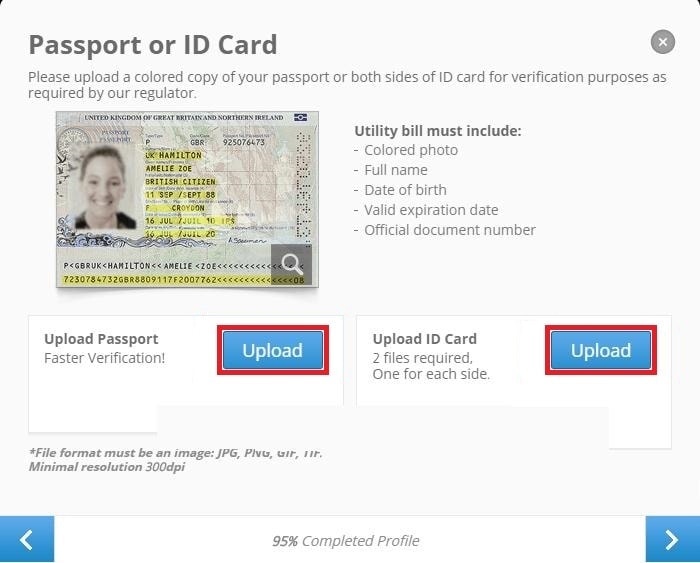

2. Upload your ID

Next, you will need to verify your identity by uploading two forms of ID. One should show evidence of your name and citizenship and the other should show proof of address. Accepted documents include passports, birth certificates, driving license’s and bank statements.

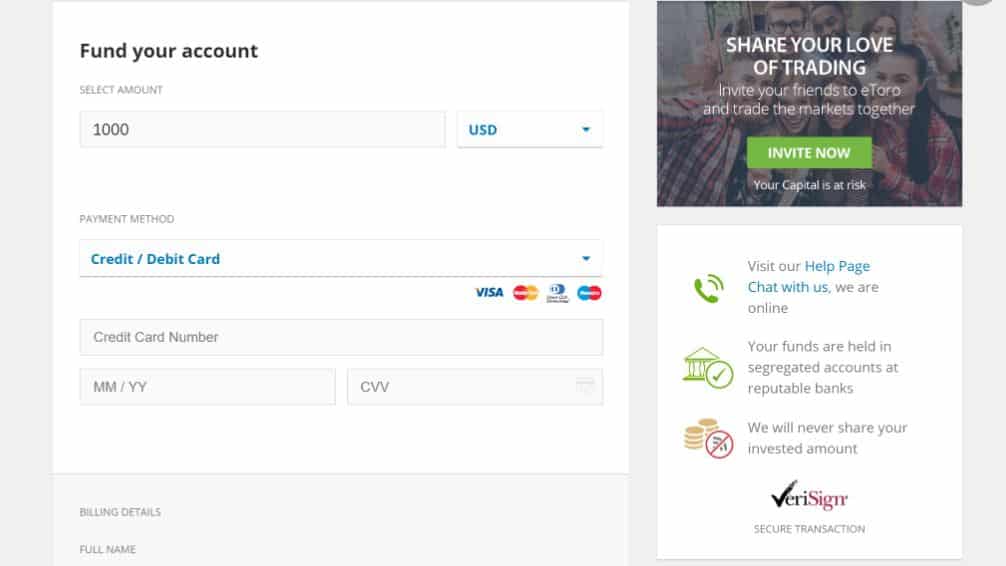

3. Deposit funds

In order to buy Solana, you will need to deposit funds into your eToro account. The minimum deposit is $50 and accepted payment methods include bank transfer, debit card and wire transfer.

The platform does not charge any fees for deposits or withdrawals. However, some banking providers may charge you a fee for sending funds to eToro. It is a good idea to check this before proceeding.

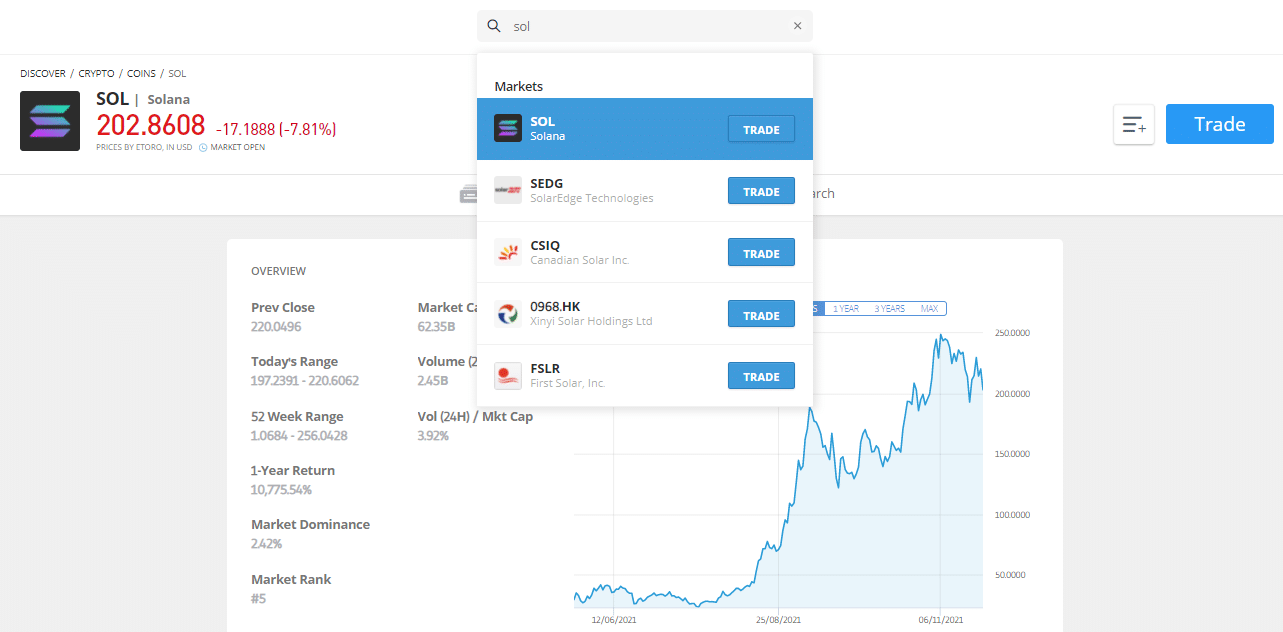

4. Buy Solana

Once you have deposited funds into your account, you will be able to buy SOL.

To do this, go to ‘explore’ and select cryptocurrencies. Then search for ‘Solana’ in the search bar. You should see the Solana symbol appear.

Click on the crypto to view the price chart, news feed and investor insight. You can also use this feature to conduct some analysis before making a trade.

After analyzing the Solana price chart, click ‘trade’ to begin executing your order.

On eToro, it is possible to place buy or sell orders. Investors can also set stoploss limits and choose to enter the trade at a specific price point rather than immediately.

5. Move SOL to the eToro Money Wallet

When you buy Solana on eToro, it will automatically be stored in your trading account. For long term investors, it is a good idea to move your tokens to the eToro Money crypto wallet. This is a crypto wallet that allows you to send your tokens to external DeFi applications.

To send your Solana to eToro Money, go to your trading account. Select transfer, then select ‘eToro Money Wallet’.

You will need to download the eToro Money app before proceeding with this process.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

How to buy Solana with PayPal?

It is possible to buy cryptos, including Solana, with PayPal in 2026. This is a convenient alternative for people who do not want to provide their bank details to online exchanges.

Platforms that accept PayPal as payment for US traders include eToro and Coinbase. To buy crypto with PayPal on these platforms, simply select PayPal as an option when prompted to choose a payment method. You will need to confirm any transactions through your PayPal app.

It is important to understand that PayPal is not accepted as a payment method on eToro in all countries.

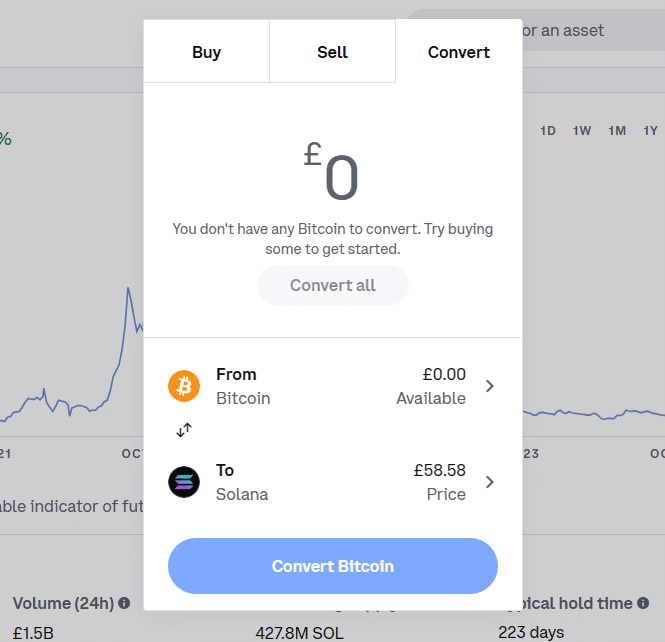

How to buy Solana with Bitcoin?

Bitcoin holders will be able to utilize this currency to purchase Solana as well if they already own it. You can simply connect your Coinbase account to your Bitcoin wallet so you can add your bitcoins to your balance. Then, simply convert BTC for SOL.

If you do not have a Bitcoin wallet, you’ll have to get one. By doing so, you’ll be able to use it as a payment method in the future. Generally, it is recommended to purchase Solana with a separate Solana wallet as not all Bitcoin wallets are able to be used with Solana.

Solana Price Forecast

The bear market for SOL commenced on November 6, 2021, following an all-time high of $260, leading to a considerable 97% decline, bottoming out at $7.63 by December 31, 2021.

Starting in January, Solana’s price embarked on an upward trajectory, following a five-wave pattern within an ascending channel. This pattern signifies the initiation of a bullish cycle, with the most recent surge from September 11 to the present serving as its fifth wave. Under a bullish analysis, the peak reached on July 14 at $31 and the subsequent low on September 11 at $18 constitute the initial two sub-waves of the higher-degree wave 3. This suggests that while there may be temporary pauses in the upward trend, a substantial downward movement is not expected at this stage.

The current Solana price chart shows an ascending trading channel which has led to a $47 movement. As well as this, the Solana community has continued to grow throughout 2023, despite that bearish trend that tanked the price in 2021.

A big contributor to the fall of SOL in 2021 was the collapse of the FTX bank. This was due to the involvement of Sam Bankman Fried. Since the collapse, Solana has been slowly reconsolidating its losses and now appears to be recovering 2 years on from the event.

It’s essential to note that there are currently no discernible signs of encountering resistance, and the price continues its parabolic ascent. Therefore, in the short term, our ability to pinpoint these targets with greater accuracy depends on monitoring where the ongoing upward movement culminates.

How To Sell Solana

You may want to sell your SOL tokens after making profit from your investment or to avoid being caught out by a bearish trend. Luckily, the process of doing this is fairly simple. If you chose to store your tokens in your trading account, simply log into the trading platform and close the order.

If you transferred your SOL tokens to a crypto wallet, you can sell them by sending them to a compatible decentralized exchange and swapping them for fiat currency.

It is also possible to sell Solana by swapping it for other tokens such as USDT, Ethereum or USDC. You can do this through exchanges such as Binance and Coinbase.

What Are The Risks of Buying Solana in 2026?

Like all cryptocurrencies, investing in Solana coin comes with risks. It is important to be aware of the risks involved with investing before making any final decisions. Here is an overview of some of the risks involved with buying Solana in 2026.

Solana has experienced major volatility

It goes without saying that Solana has had a turbulent few years. The crypto has fallen by 97% and then regained its value in a 3-month long bull run in the space of just 2 years. This major price movement shows that the token is prone to volatility.

Although volatility isn’t always bad, it does increase the risks of investing. High volatility means that the price of the token could suddenly change at any time. These movements are often hard to predict and could spot early.

Market competition

The value of the Solana token relies on the success of the native blockchain network. However, the network has a plethora of competitors including big players such as Ethereum, Ripple and Polygon.

Although Solana has managed to keep its spot as a leading network, many of it’s competitors are working to improve their systems and potentially come out on top. Furthermore, the network’s main competitor Ethereum currently hosts significantly more applications.

Inflationary tokenomics

One of the major disadvantages of buying Solana is that the token has an inflationary design. This means that the number of coins in circulation can increase over time which will reduce scarcity.

The inflation rate of Solana will decline annually until it reaches 1.5%. The supply of SOL will continue to climb, pushing the value of the asset downwards.

Top Tips For Buying Solana Safely

Even though investing in Solana comes with risks, there are a few steps that you can take to minimize the risks that are involved.

1. Diversify

One of the best ways to minimize the risks of investing in a volatile cryptocurrency is to diversify. This involves spreading your investments over a basket of currencies rather than investing in just one token.

A diverse portfolio includes tokens that have varying utilities, tokenomic structures and roadmaps. For example, Bitcoin uses a different consensus mechanism and has a different tokenomic structure to Solana which could make it a good coin to diversify with.

Diversification reduces risk because if one token falls in price, there is a chance that the others might gain value. A popular strategy used by long term investors is to invest small amounts into lots of different tokens, this is also known as dollar cost averaging.

2. Never invest with more than you can afford to lose

When you read a particularly positive price prediction, it can be tempting to invest with a large amount of capital. However, price predictions can be wrong and there is no guarantee that you will make any money.

Therefore, you should only ever invest with money that you can afford to lose. This is money that will not be missed if it were to disappear in a bear market. Know your limits before you invest and stick to them.

3. Keep up to date with market news

Solana’s fall in 2021 was due to the collapse of FTX. This shows that the token is vulnerable to large market events. Therefore, it is a good idea to stay on top of market news so that you can spot potential catalysts.

Many of the best Solana trading platforms have built in news feeds that show the most important events. Using these platforms is a good way to identify essential news and events that could potentially effect your portfolio.

Conclusion

In 2026, Solana is expected to become one of the most popular cryptocurrencies in terms of market cap. Despite its relative newness, the Solana platform is making strong progress as it gains in power, and dApp developers are confident that they will be able to develop high-quality dApps on this platform.

In this guide, we have taken a look at how to buy Solana on our recommended trading platforms. We have also discussed the potential risks of investing and different steps that you can take to minimize these risks.

By following our detailed guide and implementing risk management, it is possible to buy Solana safely in 2026.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

FAQ

What is Solana?

Solana is a platform for creating decentralized applications (DApps) and creating smart contracts that run on top of a blockchain. Several current projects use the Solana blockchain, such as the Chainlink cryptocurrency project and the Solanart NFT project. Furthermore, the Solana blockchain is also used by crypto exchanges such as Raydium, a cryptocurrency exchange that operates on the Solana blockchain for digital transactions.

Who created Solana?

It was founded by Anatoly Yakovenko in 2020. In addition to his current role as CEO of the company, he has contributed to the development of operating systems at Qualcomm, distributed systems at Mesosphere, and compression at Dropbox during his career. Furthermore, he holds two patents for high-performance operating system protocols, and he was also in charge of a team developing the technology that made Project Tango (VR / AR) possible on Qualcomm’s phones.

Do I need a crypto wallet to buy Solana?

You do not need a crypto wallet to buy Solana however, it is recommended that you own one. This is because it is safer to store cryptos in external wallets than it is to keep them on exchanges.

Can I buy Solana in the US?

Yes, as long as you choose a US-compatible exchange such as eToro or Coinbase.

References:

- https://www.forbes.com/advisor/investing/cryptocurrency/what-is-solana/

- https://solana.com/

- https://coinmarketcap.com/currencies/solana/

- https://finbold.com/crypto-community-with-92-historical-accuracy-sets-solana-price-for-july-31/

- https://www.coinspeaker.com/xrp-solana-tackle-market-hedgeup-become-100-token/

Omar Ortiz Freelance Writer

View all posts by Omar OrtizOmar is a seasoned writer with a strong background in media. He has written for several high authority websites including Stockapps.com and Buyshares.co.uk, as well as TradingPlatforms.com.

Thanks to his strong investment knowledge, Omar is able to write in-depth stock trading and cryptocurrency articles that help readers to make informed decisions. He invests in the financial markets himself and is interested in sharing his expertise with others.

Before starting his career as a freelance writer, Omar studied at the Universidad de Bogotá Jorge Tadeo Lozano in Columbia.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Solana is a blockchain platform that was founded in 2020 by Anatoly Yakovenko. He is a well-known figure in fintech because he had earlier worked as an engineer at renowned companies such as Qualcomm and Dropbox, among others.

Solana is a blockchain platform that was founded in 2020 by Anatoly Yakovenko. He is a well-known figure in fintech because he had earlier worked as an engineer at renowned companies such as Qualcomm and Dropbox, among others.