Ethereum Price Prediction February 2026 – Buy or Sell?

It’s hardly surprising that many people are interested in an Ethereum Price Prediction for 2026. Ethereum is the second-largest cryptocurrency in the world by market capitalization after Bitcoin.

As we venture into 2026, the anticipation surrounding Ethereum’s price trajectory is palpable among investors and enthusiasts alike. Ethereum, standing as the second-largest cryptocurrency by market capitalization only next to Bitcoin, has not only carved a niche in the digital asset space but has also revolutionized it with its innovative blockchain technology. The platform’s open-source architecture, renowned for enabling smart contract functionalities, scalability, and the creation of decentralized applications (dApps), continues to drive its prominence and utility in the crypto ecosystem.

The recent milestone in Ethereum’s journey – the much-discussed transition known as the Ethereum Merge – marked a significant shift from the proof-of-work (PoW) consensus mechanism to a more energy-efficient proof-of-stake (PoS) model. This pivotal change has sparked a flurry of predictions and speculations among experts regarding Ethereum’s price movement in 2022, with many anticipating notable growth in its valuation.

This comprehensive guide delves into an in-depth analysis of Ethereum’s price trends for 2026, seeking to unravel the critical question on every investor’s mind: “Will Ethereum experience an upward trajectory in its value?” Our objective is to provide investors with insightful data and expert opinions, aiding them in evaluating Ethereum’s potential as a viable investment in the current financial landscape.

Ethereum Price Prediction – Overview

As 2023 unfolded, Ether (ETH), the native cryptocurrency of the Ethereum network, exhibited a notable recovery from the significant downturn it experienced in 2022. According to data from CoinGecko, Ether’s price rallied to nearly $2,400 recently, a substantial rebound from previous lows. Despite this impressive recovery, the current valuation remains considerably below its all-time high of over $4,800, which was recorded in November 2021.

This resurgence in Ether’s value has sparked optimism among some analysts, who foresee the potential for continued upward momentum into the next year. These experts suggest that the recent positive trend could pave the way for ETH to ascend to new heights in the coming months, potentially surpassing its previous peak. This outlook is grounded in various factors, including the evolving dynamics of the cryptocurrency market and Ethereum’s ongoing developments, particularly in the wake of its transition to a proof-of-stake (PoS) consensus mechanism. Such advancements are viewed as pivotal in bolstering Ethereum’s appeal and, consequently, the value of Ether in the broader digital asset landscape.

In the coming months, the Ethereum network is poised for significant developments with the anticipated Deneb and Cancun upgrades. These enhancements are expected to mark a substantial evolution in the network’s capabilities.

The Cancun-Deneb upgrade, particularly with its introduction of proto-danksharding, is aimed at significantly augmenting the scaling efficiency of Ethereum Layer 2 solutions. This advancement is crucial as it’s expected to substantially boost the network’s overall capacity while simultaneously reducing gas fees for users. The reduction in transaction costs and improved scalability will enhance the user experience and potentially attract more activity on the Ethereum network.

Additionally, a key focus of the upgrade is to improve Ethereum’s interoperability with other blockchain networks. By facilitating safer and more fluid cross-chain data transfers, Ethereum is poised to become a more integral part of the broader blockchain ecosystem. This interoperability is essential for the seamless integration of various blockchain platforms and for fostering a more interconnected and efficient blockchain landscape.

These upcoming upgrades represent a pivotal step in Ethereum’s ongoing evolution, reinforcing its position as a leading blockchain platform in terms of innovation, scalability, and user-centric development.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Ethereum (ETH) At A Glance

Before delving fully into our ETH price prediction or analyzing the potential future price, it’s essential to understand the coin’s history and why experts believe it could be massively rewarding for investors.

What is Ethereum?

Ethereum, often synonymous with its native cryptocurrency Ether (ETH), represents more than just an alternative to Bitcoin in the digital currency space. While Ether indeed stands as a notable crypto asset, Ethereum’s scope extends far beyond its token.

Conceived in 2014 by Vitalik Buterin as a groundbreaking alternative to Bitcoin, Ethereum emerged as a decentralized blockchain network, distinguished by its security, scalability, and efficiency. Buterin, along with co-founder Joe Lubin, officially launched Ethereum as an open-source platform in 2015. Today, it operates as a peer-to-peer network that excels in executing complex agreements, known as smart contracts. These smart contracts enable users to engage in digital currency transactions through a process called staking. In staking, users lock up their Ethereum coins to support the network’s operations and, in return, earn periodic rewards.

A significant transition occurred in Ethereum’s history before September 2022. Until then, Ethereum functioned on a proof-of-work (PoW) consensus mechanism, wherein miners were responsible for processing and validating transactions (blocks) on the network. In return for their efforts, miners received ETH tokens as rewards for each verified transaction. This mechanism, however, has since evolved.

As of the latest information available, Ethereum has transitioned to a proof-of-stake (PoS) consensus model. This shift marks a fundamental change in how the network processes transactions and secures its blockchain, emphasizing efficiency and sustainability.

Beyond Ether, Ethereum serves as a versatile platform where developers can create decentralized applications (dApps). These dApps, envisioned as next-generation alternatives to conventional Web2 applications, operate on Web3 models. They offer users increased control and autonomy through decentralization. The Ethereum blockchain hosts thousands of such dApps, each leveraging the network’s robust infrastructure for a variety of applications.

One of the critical functionalities of the Ethereum network is its ability to process transactions, for which it levies fees known as “gas.” These transaction fees, integral to maintaining the network’s operations, can only be paid using ETH tokens.

In summary, Ethereum stands as a multifaceted ecosystem, facilitating not only financial transactions through its cryptocurrency, ETH, but also providing a foundation for innovative applications and developments in the blockchain and digital currency domains.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

The Ethereum Merge

Ethereum’s evolution, particularly its transition from Ethereum 1.0 to Ethereum 2.0, marks a pivotal shift in the landscape of blockchain technology and cryptocurrency.

Ethereum 1.0

Initially modeled after Bitcoin, Ethereum 1.0 operated on a proof-of-work (PoW) consensus mechanism. In this system, miners connected to the network via nodes to process transactions. Mining, the method of generating new ETH tokens, involved solving complex mathematical problems. Miners who successfully solved these problems and verified transaction blocks were rewarded with ETH. However, this model was not without its shortcomings. Criticisms of Ethereum 1.0 focused on its substantial energy consumption and limited efficiency, with the network only capable of processing 10-20 transactions per second.

Ethereum 2.0: The Birth of a New Ethereum

Addressing these issues, Ethereum underwent a significant upgrade on September 15, 2022, known as the Ethereum Merge. This transition moved the blockchain from PoW to a proof-of-stake (PoS) consensus mechanism. Post-Merge, the role of miners was eliminated, replaced by validators who stake their ETH to participate in the block validation process. Smart contracts now facilitate transactions, enhancing the efficiency and security of the network.

This shift to PoS has dramatically reduced Ethereum’s energy usage, with reductions exceeding 99%. The upgrade is part of a broader development strategy aiming to enable Ethereum to process up to 100,000 transactions per second, significantly enhancing its scalability.

Post-Merge, Ethereum has seen a net supply reduction of nearly 300,000 ETH, indicating a decrease in annualized supply by 0.249%. Had Ethereum continued with PoW, its supply would have increased by more than 3.8 million, highlighting the impact of the PoS mechanism.

Looking ahead, Ethereum’s next significant upgrade, known as Shanghai, is set for March 2023. This update will focus on allowing validators to withdraw their staked ETH and accrued rewards, which have been locked up since the Beacon Chain went live in December 2020.

Another crucial development on the horizon is “proto-danksharding,” expected in fall 2023. This process aims to enhance network scalability by splitting it into several chains or “shards,” thus reducing transaction fees and speeding up transaction times.

As Ethereum continues to evolve, these developments are eagerly anticipated by both developers and investors, marking a new era of efficiency, scalability, and sustainability in the blockchain space

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

ETH Tokenomics

Understanding Ethereum’s tokenomics, especially in the context of Ethereum 2.0, is key to making informed predictions about its price and overall market behavior.

Ethereum 1.0

Originally, Ethereum operated on a proof-of-work (PoW) model, similar to Bitcoin. This model involved miners who validated transactions on the network and were rewarded with new ETH tokens. However, this mechanism faced criticism due to its significant energy consumption and limited transaction processing capacity.

Ethereum 2.0

With the transition to Ethereum 2.0, which began with the Ethereum Merge on September 15, 2022, the network shifted to a proof-of-stake (PoS) consensus mechanism. This change eliminated the role of miners, replacing them with validators. Validators are required to stake a minimum of 32 ETH in the network’s liquidity pool to participate in transaction validation and network security. Staking involves locking up ETH tokens, and validators are rewarded proportionally based on the amount staked and the duration of staking.

Unlike the PoW model, where new ETH tokens were constantly minted, the introduction rate of new tokens in Ethereum 2.0 is significantly lower, ranging between 0.5% and 1.0%. Malicious actors within the network risk having their staked assets burned. Validators also receive priority fees from transactions, adding to their earnings. The priority fee depends on the network’s condition and usage at the time of the transaction.

Staking Ethereum, especially through centralized exchanges and staking pools, offers various annual percentage yields (APY), typically ranging from 3% to 7%. The exact APY can vary based on several factors, including the total amount of ETH staked, network demand, and prevailing market conditions. Validators are also subject to market risks, slashing penalties for inappropriate behavior, and network risks related to the evolving technology. It’s important to note that staking rewards are generally taxable income in many jurisdictions.

As Ethereum continues to evolve, its tokenomics are expected to become more intricate, with the network aiming to enhance scalability, reduce gas fees, and improve interoperability with other blockchains.

Ethereum transaction fees

Ethereum’s transaction fee structure is poised for significant changes, particularly with the upcoming implementation of the Sharding and Danksharding upgrades. These upgrades are designed to enhance Ethereum’s scalability and efficiency, potentially revolutionizing the way transaction fees are calculated and applied.

Sharding

Sharding is a technique that divides the Ethereum blockchain into smaller segments known as ‘shards.’ Each shard is capable of processing transactions independently, which allows for parallel transaction processing. This approach not only increases the throughput of the network but also reduces network congestion and, consequently, lowers transaction fees. Sharding is a crucial step toward scaling the Ethereum network to handle a more significant number of transactions while maintaining efficiency and accessibility.

Danksharding

Danksharding is an advanced sharding architecture that employs large data chunks, referred to as ‘blobs,’ to scale the Ethereum blockchain. This design is particularly beneficial for Layer 2 rollup-centric protocols, as it allows them to utilize the additional space provided by these blobs to alleviate network congestion. The result is a reduction in transaction costs and an increase in processing speed, with the potential to reach around 100,000 transactions per second.

Proto-Danksharding

Proto-Danksharding, a key component of the Ethereum Cancun upgrade, is an intermediary step towards full Danksharding. It introduces a new type of transaction capable of accepting ‘blobs’ of data, thus preparing the network for the eventual implementation of full Danksharding. By temporarily storing these blobs on the Ethereum consensus layer, Proto-Danksharding aims to significantly decrease the cost of data transfer from rollups to the Ethereum base layer, effectively reducing transaction fees for end users.

EIP-4844

EIP-4844, or Proto-Danksharding, aims to address Ethereum’s scalability issues by increasing transaction volume on the network. This is achieved through a temporary solution to increase the block size by up to 2 MB, thereby reducing gas fees and making transactions more efficient. The update introduces blob-carrying transactions, which are large in size but less expensive compared to current calldata.

The update is anticipated to go live in the second half of 2023, with expectations of significantly reduced gas fees and increased transaction throughput. This will bring the network closer to managing the capacity of a global transaction network.

Conclusion

The Ethereum Cancun upgrade, which includes EIP-4844, represents a significant development in Ethereum’s evolution. By introducing Proto-Danksharding, the upgrade is set to substantially reduce gas fees and increase transaction throughput, paving the way for the future implementation of full Danksharding. This transition will likely make Ethereum more competitive in the cryptocurrency space, marking a notable advancement towards a fully scalable and accessible network

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

The Team Behind Ethereum

To make an informed Ethereum price prediction, it’s essential to consider the team behind its inception and development. Vitalik Buterin, a Russian-Canadian programmer and writer, originally conceptualized Ethereum in 2014. Buterin didn’t work in isolation; he collaborated with seven co-founders, each bringing unique skills and roles to the Ethereum project.

These co-founders included Mihai Alisie, who had previously worked with Buterin on Bitcoin Magazine. Anthony Di Lorio and Amir Chetrit, initially intrigued by Bitcoin, also joined the endeavor. The team was further strengthened by the contributions of Charles Hoskinson, Gavin Wood, Jeffrey Wilcke, and Joseph Lubin.

While the original team was marked by diverse talents and ambitious visions, as recounted by Mihai Alisie, the team’s composition has evolved over time. Today, only Buterin remains actively involved in Ethereum’s ongoing development. Other co-founders have embarked on different paths within the broader blockchain and cryptocurrency landscape.

Charles Hoskinson and Gavin Wood, for instance, have each founded their own blockchain platforms. Hoskinson developed Cardano through his company IOHK, while Wood focused on creating Polkadot. These platforms have emerged as competitors in the blockchain space.

On a different trajectory, Anthony Di Lorio, Amir Chetrit, and Jeffrey Wilcke have shifted their focus to ventures outside the crypto industry. Joseph Lubin, another original member, founded ConsenSys, which supports developers in building decentralized applications (dApps). Mihai Alisie also remains active in the blockchain space, leading the Akasha Project, an initiative focused on developing a decentralized social media platform.

This historical perspective on Ethereum’s founding team provides insights into the diverse expertise and visions that shaped Ethereum, which continue to influence its development and position in the cryptocurrency market.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Ethereum Use Cases

Understanding Ethereum’s vast array of use cases is crucial for making informed predictions about its future price and overall value proposition. Ethereum, often compared to Bitcoin, distinguishes itself by supporting a global network of decentralized applications (dApps) which offer a range of innovative solutions across various industries.

- Decentralized Autonomous Organizations (DAOs): DAOs are one of the earliest innovations on Ethereum. These are organizations that operate without central authorities, governed by rules encoded in software. The decisions within DAOs are made through community voting, offering a new model of organizational governance.

- Store of value: Ether (ETH), the native cryptocurrency of the Ethereum blockchain, has emerged as a prominent store of value within the digital asset space. Its increasing adoption and the underlying robustness of the Ethereum network enhance its appeal as a long-term investment option, comparable in some respects to digital gold.

- Initial Coin Offerings (ICOs): Ethereum has played a pivotal role in the evolution of startup fundraising through ICOs. This process allows startups to raise capital by issuing new tokens, representing a paradigm shift in how innovative projects secure funding.

- Enterprise Ethereum: Tailored for private corporations and businesses, Enterprise Ethereum offers permissioned network solutions. This allows enterprises to maintain control over network architecture and users. Prominent organizations, including J.P. Morgan, Microsoft, and Mastercard, have explored private Ethereum networks for various applications.

- Non-Fungible Tokens (NFTs): Ethereum’s blockchain underpins the burgeoning NFT market. NFTs have gained mainstream attention, being used in digital art, gaming, and verification of luxury goods’ provenance.

- Stablecoins: These are cryptocurrencies whose value is pegged to other assets, like fiat currencies or commodities. Ethereum supports various stablecoins, providing a stable store of value and a hedge against cryptocurrency market volatility.

- Decentralized Finance (DeFi): DeFi on Ethereum includes peer-to-peer lending and borrowing platforms, decentralized exchanges (DEXs), and interest-earning mechanisms on crypto holdings. Popular DeFi platforms built on Ethereum include Compound, MakerDAO, and Aave.

- Ethereum Ecosystem Projects and Tokens: Ethereum supports a myriad of other projects and tokens, such as MakerDAO for cryptocurrency lending and borrowing, 1INCH for optimized cryptocurrency exchange rates, and The Sandbox for monetizing gaming experiences. Decentraland, Chainlink, Uniswap, and Aave are other significant projects that utilize Ethereum’s capabilities.

- Gaming industry: The gaming industry is experiencing a significant transformation with the integration of blockchain technology, particularly on the Ethereum network. In 2023, several notable blockchain games are gaining popularity, showcasing diverse and innovative use cases of Ethereum’s capabilities. These games, leveraging Ethereum’s infrastructure, include:

- My Neighbor Alice (ALICE): A blockchain game focusing on community building and player interaction within a virtual world.

- Decentraland (MANA): An innovative platform combining virtual reality with blockchain, allowing users to create and monetize online experiences and structures.

- The Sandbox (SAND): An ecosystem of games offering crypto earning opportunities, where players can use SAND tokens to engage in various gaming activities.

- ApeCoin (APE): Powering the Otherside Metaverse, ApeCoin enables players to explore and interact in a dynamic virtual environment.

- Star Atlas (ATLAS): A space exploration-themed game that merges play-to-earn mechanics with a vast and immersive cosmic setting.

These games exemplify the growing trend of utilizing Ethereum for gaming applications, with their focus on NFTs, decentralized finance models, and in-game economies, showcasing Ethereum’s versatility and potential for widespread adoption in the gaming sector.

- Other Emerging Use Cases: Ethereum’s blockchain technology is being applied in numerous other sectors, including healthcare, entertainment, and real estate. It’s used for managing royalties in the music industry, simplifying cross-border payments in the remittance industry, and ensuring product provenance in supply chain management.

As Ethereum continues to evolve and its scalability improves, particularly with the upcoming implementation of proto-danksharding and full danksharding, we can expect these use cases to expand even further. This scalability enhancement is likely to attract more users and developers, thereby potentially increasing Ethereum’s value and utility in the blockchain ecosystem.

[/su_note]Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Ethereum Price History

Ethereum’s price history is marked by significant fluctuations and milestones. Initially launched in 2015, ETH was valued at around $2.77. It experienced rapid growth, surpassing $100 in 2017 and briefly reaching over $1,000 in early 2018 during a crypto bubble. However, it faced a prolonged period of lower prices, hovering around $300 during the so-called crypto winter.

2021 saw a resurgence in ETH’s value, with its price nearing $4,000 in May, influenced by the rise of NFTs and a robust market. Ethereum’s all-time high was recorded at $4,891.70 in November 2021. In 2022, the crypto market faced challenges, and ETH’s price was affected, dropping close to $1,000 at times.

As of December 20, 2023, Ethereum’s price is approximately $2,176.84, reflecting an 86.53% increase from the previous year and showcasing its resilience and potential for growth in the dynamic cryptocurrency market

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

How Has Ethereum Performed So Far in 2026?

Ethereum has seen significant developments and changes in 2023. One of the key advancements has been the implementation of Proof of Stake (PoS) in 2020, which set the stage for further upgrades and improvements in the Ethereum network. This shift to PoS made staked ETH an illiquid asset initially, but services like Lido offered liquid staking, providing a “deposit receipt” called stETH, which holds nearly equal value to the actual ETH being staked. The upcoming Shanghai update in the Ethereum network is expected to allow for the withdrawal of staked ETH, which could lead to more stability in the price of stETH and encourage more ETH holders to stake, thereby enhancing the network’s security.

In terms of performance and scaling, Ethereum continues to compete with various layer-2 scaling solutions. Companies are racing to offer these solutions to increase transaction speeds on the Ethereum network. Major networks like Polygon, Loopring, Arbitrum, and Optimism, along with new concepts like zero-knowledge proofs and parallel chains, are in the forefront of these developments. Ethereum is projected to handle hundreds of thousands of transactions per second once network sharding technologies are implemented. This scalability will be further enhanced by the anticipated phases after the Merge, namely Surge, Verge, Purge, and Splurge, each focusing on different aspects like speed, reducing validator memory space, and adding extra features.

Undergoing Shapella

Additionally, in 2023, Ethereum underwent the Shapella hard fork, considered a significant change with the implementation of EIP-4895, allowing for validator withdrawals of staked ETH from the Beacon Chain.

Another significant development on the horizon for Ethereum is the Dencun upgrade, which aims to enhance rollup-centric scaling via data sharding, also known as Danksharding. The key update in this upgrade is EIP-4844, also known as Proto-Danksharding. This update introduces blob-carrying transactions, which are expected to lower data availability costs for Layer-2 rollups and increase the transaction throughput of Ethereum.

Growing adoption

Furthermore, Ethereum’s performance in the broader crypto market has been notable. Despite facing challenges due to the macroeconomic environment, the overall adoption of cryptocurrencies, including Ethereum, has remained strong. As of November 2023, the number of crypto owners reached 575 million, and depending on market conditions, this number is expected to grow significantly in 2024.

In summary, Ethereum’s journey in 2023 has been marked by significant technical advancements, upgrades like the Shapella hard fork, and a strong presence in the broader crypto market. The developments around Ethereum’s scalability, particularly through the anticipated Dencun upgrade and the implementation of various phases post-Merge, showcase a strong future trajectory for the network.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

What Is The Current Price of Ethereum?

In 2023, Ethereum experienced a period of recovery, with its value surpassing $2,000 in April for the first time since the previous year. However, market fluctuations in early June led to a decrease, with Ethereum’s value dropping to $1,624.14 on June 15. The market saw a rebound, and following a legal decision regarding Ripple’s XRP not being considered a security on exchanges, Ethereum’s value climbed to a peak of $2,026.20 on July 14.

Later in the year, on December 9, Ethereum reached its highest value since May 2022, at $2,401.76. By December 20, 2023, its value was approximately $2,232. At this point, the total supply of Ethereum in circulation was around 120.2 million, giving it a market capitalization of $261.8 billion and maintaining its position as the second-largest cryptocurrency, following Bitcoin.

Ethereum Price Prediction 2026

Recently, Ethereum has shown a positive trend in its price, but it encountered a resistance level on December 9. This resistance might signal the conclusion of its current uptrend, and there’s a possibility that its value could decline, potentially reaching as low as $1,400.

However, this anticipated drop might represent a price correction rather than a sustained downturn. If this is the case, Ethereum could potentially reach new highs in 2024 as the market adjusts and stabilizes.

In the realm of technological advancements within the Ethereum ecosystem, 2023 has been a pivotal year for the development of scaling solutions, particularly zero-knowledge Ethereum Virtual Machines (zk-EVMs). These zk-EVMs, which are mostly still under development, are expected to significantly enhance the performance of decentralized applications (dApps) by increasing their speed and transaction throughput. Additionally, the introduction of new ZK rollups is anticipated to reduce gas fees, further optimizing the Ethereum network’s efficiency and user experience.

Here’s a restructured table summarizing the Ethereum price predictions as of December 20, 2023. It’s important to note that cryptocurrency predictions can be quite speculative and are often subject to rapid changes. These forecasts, especially long-term ones, are typically generated by algorithms, and thus, they might be updated frequently.

| Year | Prediction #1 | Prediction #2 | Prediction #3 |

|---|---|---|---|

| 2023 | $4,664 | $3,296.55 | $5,275.52 |

| 2025 | $3,872 | $18,114 | $7,039.14 |

| 2030 | $18,549 | $45,285 | $22,274 |

In addition to these predictions, CoinCodex provided a short-term forecast for Ethereum in 2023, suggesting a possible increase to $2,282.37 by December 22, and then to $2,335.03 by January 12, 2024. Their analysis at that time was neutral, with 15 indicators showing bullish signals and 14 indicating bearish trends. Remember, these predictions are based on current trends and models, and the actual market performance may vary significantly.

Ethereum Fundamental Analysis

Ethereum is currently trading at $2,232.34 per token, up 3.7% in the last 24 hours, with a total market cap of $264,517,983,236.

As of December 19, 2023, Ethereum (ETH) has been experiencing a positive trend in the market. The cryptocurrency was last trading at around $2,238.23, marking a 3.18% increase from the previous day. This rise in value comes despite some setbacks, including the delay by the U.S. Securities and Exchange Commission (SEC) in decisions regarding Ethereum Exchange Traded Fund (ETF) applications. The broader crypto market, including Ethereum, has been rallying, influenced by macroeconomic factors and speculations about future interest rate cuts, which have positively impacted U.S. equity prices and the cryptocurrency market.

Ethereum Technical Analysis

In terms of technical analysis, Ethereum is currently at a critical juncture, testing a major breakout zone. Analysts are observing key support and resistance levels, with the cryptocurrency retesting its breakout zone from an ascending triangle, indicating a potential setup for a significant upward movement. The price range between $2,150 and $1,900 is considered an ideal area for accumulation before Ethereum possibly targets a higher price of around $3,500.

However, it’s important to remember that the cryptocurrency market is highly volatile and influenced by a range of factors. These include market sentiment, macroeconomic trends, regulatory developments, and technological advancements. As such, while the current trends seem positive, market participants should exercise caution and stay informed about potential catalysts that could impact Ethereum’s price movements.

In summary, Ethereum’s current market performance shows a positive trend, with analysts anticipating potential growth. However, the volatile nature of the cryptocurrency market means that these predictions are subject to change based on various influencing factors

Upcoming Events That Could Affect The Price of ETH

Several upcoming events and developments could significantly impact the price of Ethereum (ETH) in the near future:

- Proto-Danksharding (EIP-4844) Upgrade: Slated for implementation in the first half of 2024, this upgrade is a crucial step towards enhancing Ethereum’s scalability. It introduces a new transaction type with a blob of data, which should reduce costs and improve transaction throughput, especially benefiting Layer 2 networks like Arbitrum and Optimism. This upgrade is part of Ethereum’s broader vision to increase network efficiency and lower transaction fees, which could positively influence its market value.

- Market Analyst Predictions: Analysts, including Michael van de Poppe, are predicting a surge in Ethereum and other altcoins in early 2024. This forecast is based on market patterns and shifts in capital within the cryptocurrency ecosystem. The prediction includes potential capital movement from Bitcoin to Ethereum, historically indicating an upswing in altcoins. Such trends, if realized, could lead to a substantial increase in Ethereum’s value.

- General Crypto Market Trends: The overall sentiment in the cryptocurrency market, including the performance of other major cryptocurrencies like Bitcoin, can also impact Ethereum’s price. For example, positive movements in the broader market, such as Bitcoin nearing $43,000 and the gains observed in altcoins on platforms like Solana and Avalanche, can create a favorable environment for Ethereum’s growth.

These factors, combined with the ever-evolving landscape of the cryptocurrency market, suggest that Ethereum’s price could experience significant changes in the coming year. As always, it’s important to approach these predictions with caution, considering the inherent volatility and unpredictability of the crypto market.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Why Might Some Investors Consider Investing in Ethereum Right Now?

Investors might consider investing in Ethereum right now for several reasons. Ethereum is currently priced at around $2,214.40, with predictions suggesting it could increase to $2,268.43 by December 21, 2023. The market sentiment for Ethereum is neutral to bullish, with the Fear & Greed Index showing a score of 73 (Greed).

Over the last 30 days, Ethereum has experienced a majority of positive (green) days and moderate price volatility. These factors, combined with Ethereum’s established position in the crypto market and its ongoing technical developments, make it an attractive option for investors looking for both stability and growth potential in the cryptocurrency space

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Why Might Some Investors Avoid Ethereum Right Now?

Some investors might be cautious about investing in Ethereum right now for several reasons:

- Volatility: Ethereum, like other cryptocurrencies, is known for its price volatility. Its value can fluctuate significantly in a short period, which might be risky for investors seeking steady returns. This volatility is a common characteristic of the cryptocurrency market and is influenced by various factors, including market sentiment and global economic conditions.

- Risk of Loss: Investing in Ethereum comes with the risk of losing the investment, especially for those who are new to cryptocurrency or have a significant portion of their portfolio in Ethereum. The cryptocurrency market is speculative, and there’s always a chance that the value of an investment could decrease substantially.

- Market Fluctuations: Ethereum’s market dominance and the overall cryptocurrency market’s fluctuations can impact its value. Investors might be wary of these market dynamics, which can be influenced by a range of factors, including regulatory changes, technological developments, and broader economic trends.

- Uncertainty in the Crypto Market: The broader cryptocurrency market, including Ethereum, has experienced significant changes and developments. This environment of uncertainty might lead some investors to be cautious about investing in Ethereum at this time. Factors such as regulatory developments, changes in investor sentiment, and competition from other cryptocurrencies can all contribute to this uncertainty.

These reasons reflect the cautious approach some investors might take towards Ethereum, considering the inherent risks and uncertainties associated with cryptocurrency investments. It’s important for investors to conduct thorough research and consider their risk tolerance before making investment decisions in the volatile crypto market.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

How To Invest in Ethereum (ETH)

Crypto enthusiasts can take advantage of Ethereum’s current low price and invest in the coin for its long-term value. To invest in ETH right now, it may be best for investors to purchase the coin and hodl it for long-term gains. The best place to buy Ethereum is on eToro. The cryptocurrency exchange is reputable, fast, and secure, with low trading fees. Follow the step-by-step guide below to buy ETH on eToro and to get an Ethereum wallet.

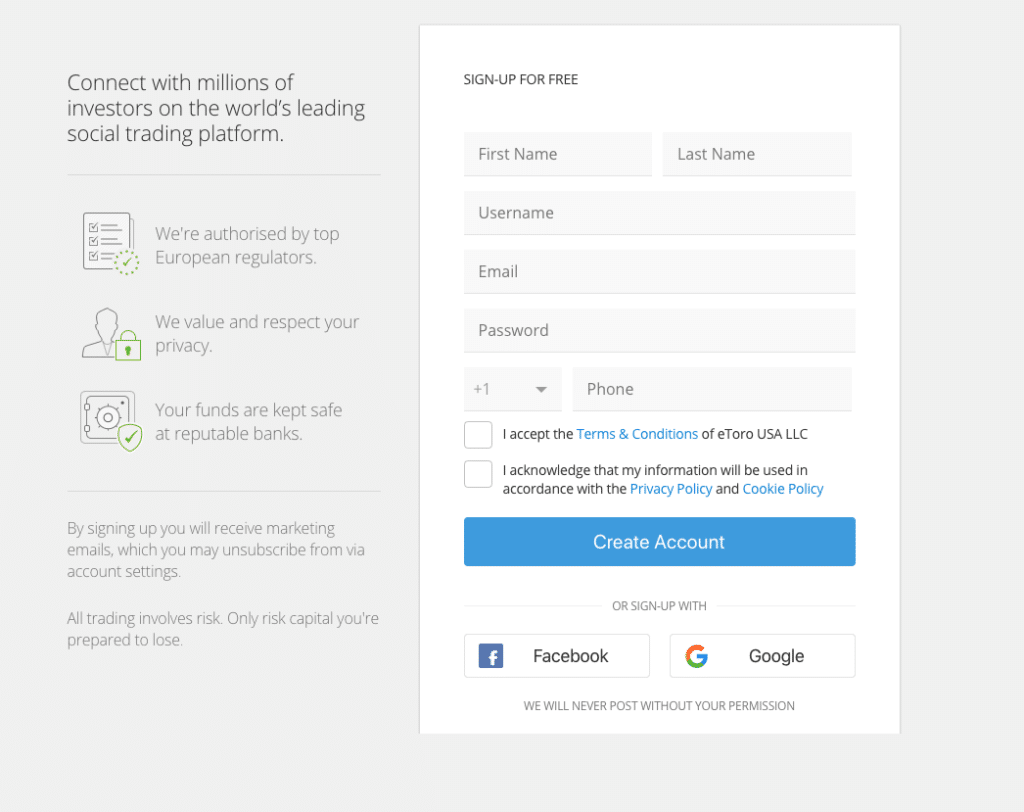

Create an eToro account

To buy Ethereum on eToro, the first step is to sign up and create an account. Navigate the eToro website homepage and click on “Start Investing” to create an account. Enter the required information in the dialogue box on the next screen. These include a unique username, a valid email address, and a password. Check the consent boxes below and click on “Create Account” to complete the process.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Verify ID

eToro requires all users to verify their accounts as part of its know-your-customer (KYC) process. After signing up, log into the account to start the verification process. You must enter personal information about your identity, trading history, and the purpose of trading during the verification. You must also provide proof of identity, proof of residence and verify your phone number.

After submitting all the required documents and information, eToro will process them and provide feedback. This usually takes a few days.

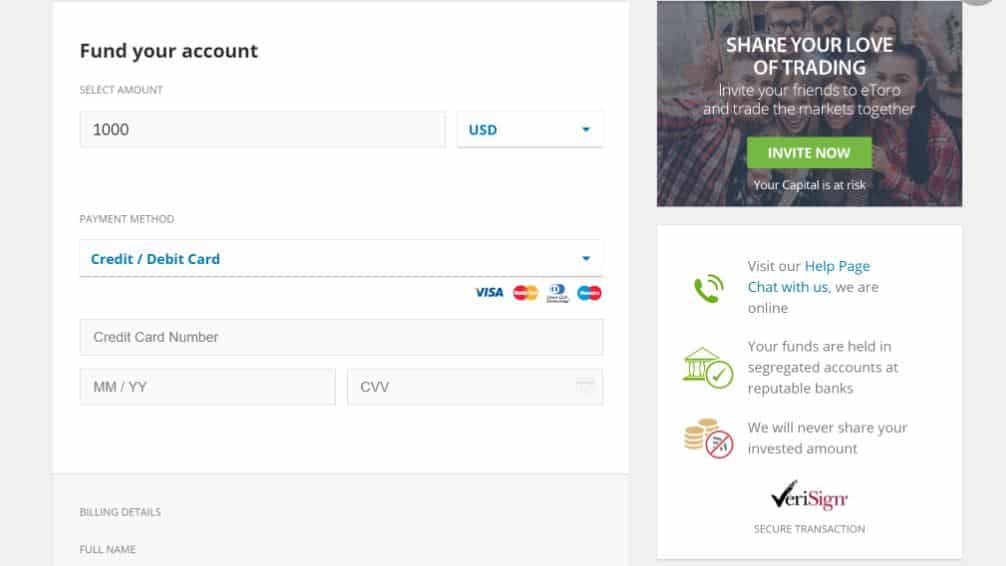

Deposit funds

Once your eToro account has been verified, the next thing to do is deposit funds into your eToro wallet. The exchange provides a wide range of payment options, including debit/credit cards, bank wire transfers, and e-wallets like PayPal, Skrill, Neteller, etc.

The minimum deposit for first-time customers on eToro is $10 in the United Kingdom. However, if you’re looking to invest more in Ethereum, you can increase your first deposit.

Search for ETH

After funding your account, the next step is to buy ETH. To do this, search for ETH or Ethereum via the search bar on the home screen and click on “Trade”.

Place an order

Enter the amount of ETH you want to purchase, verify the order details, and complete the order. The total ETH purchased will reflect in your eToro wallet within a few minutes.

Transfer crypto to a cold wallet

After buying Ethereum on eToro, the next thing to do is store the asset. While eToro provides asset custodial services through its wallet, we recommend that you transfer your crypto to a cold wallet for more security. You can invest in a hardware wallet that gives you unlimited access to your funds and is less vulnerable to hacks.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

Ethereum Price Prediction 2026 – Conclusion

There have been different analyses and predictions about Ethereum’s future price. Many experts believe the coin has the potential to become more valuable over the coming weeks, while others say it will be massive in the coming years. Though the growth is inarguable, the Ethereum price prediction 2026 is speculative and doesn’t represent investment advice.

However, with the Ethereum Merge completed and other upgrades yet to come, it’ll be exciting to see what lies ahead in the future of Ethereum.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.