7 Best High Leverage Forex Brokers in June2025

For newcomers, forex trading starts as an exhilarating venture, but as they gain experience, many traders seek more challenging and risky opportunities. This shift often leads to greater rewards, reigniting their passion for trading.

Leveraged trading emerges as an ideal choice for such traders.

However, the key to maximizing potential rewards is choosing the right broker. To assist in this decision, we’ve compiled a list of the top 10 brokers that provide high leverage in a secure setting, meeting most, if not all, essential criteria.

-

-

Best Forex Brokers with High Leverage2025

- Plus500: Plus500 offers a maximum leverage of 1:30 in Australia and the UK, with different limits for various asset types. For professional accounts, leverage can reach up to 1:300.

- Avatrade: In 2025, Avatrade offers leverage up to 1:400

- FXTM: For FX, FXTM offers leverage from 1:3 to 1:1000 (fixed), and for metals, it’s 1:500 (fixed). Additionally, FXTM offers up to 1:2000 leverage (floating).

- Libertex: As of 2023, Libertex offers up to 1:30 leverage for retail clients.

- VantageFX: VantageFX provides leverage options ranging from 100:1 to 500:1 for currency pairs, with a default of 500:1 for currency products.

- FinmaxFX: In 2025, FinmaxFX offers a maximum leverage ratio of 1:200.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

High Leverage Forex Trading Explained

Before diving into high leverage forex trading on various platforms, it’s crucial to prioritize acquiring knowledge about this aspect of trading.

High leverage in forex trading essentially means borrowing funds from a broker to invest a larger sum than what the trader initially plans to use. This approach allows traders to utilize a smaller portion of their own capital while leveraging a significant amount provided by the broker.

However, this benefit comes with a cost. Brokers typically charge an interest rate, known as a swap fee or overnight fee, on the borrowed amount. This fee is the price traders pay for the advantage of trading with high leverage.

What is Considered a Good Leverage Ratio in Forex Trading?

The suitability of a leverage ratio in trading hinges on several factors. Higher leverage escalates the amount of money at risk, increasing both stress and risk due to a narrower margin for error and a heightened likelihood of losses. While some risk-tolerant traders may find this thrilling, it’s not a universal sentiment.

Traders must choose a leverage ratio that aligns with their comfort level, trading strategy, and the specific market conditions they plan to engage in.

For instance, the inherently high risk of trading cryptocurrencies often leads brokers to offer lower leverage for this market. In contrast, the forex market, typically less volatile, might accommodate higher leverage ratios. This careful consideration of various factors is essential in selecting an appropriate leverage level.

Why is leverage trading beneficial?

Leverage trading offers the advantage of utilizing larger sums of capital without the need for the trader to supply all the funds personally. This enables traders to potentially achieve greater profits while limiting the risk to their own capital.

Leverage can be an effective tool in trading when used wisely. However, it’s important to remember that with higher leverage comes increased risk; the greater the leverage used, the less margin there is for error in trading decisions.

Tip For Trading With High Leverage

- Implement Trailing-Stop Orders: Utilize trailing-stop orders to protect profits and limit losses dynamically as market prices fluctuate.

- Employ Broker-Specific Risk Management Tools: Take advantage of any additional risk management features offered by your broker.

- Understand Pip Value: Before entering a trade, make sure you comprehend the value of a pip in your trading pair to assess potential risk and reward.

- Adopt a Risk-Reward Ratio: Use a predefined risk-reward ratio to maintain a balanced approach in your trading decisions.

- Limit High Leverage to Short-Term Trades: High leverage is best suited for short-term trading due to its increased risk, whereas lower leverage is more appropriate for long-term investments.

- Regularly Review and Adjust Leverage Levels: Continuously assess your leverage level based on current market conditions and your risk tolerance.

- Educate Yourself Continuously: Stay informed about market trends, economic indicators, and news that could affect your trading positions.

- Practice on a Demo Account: Before engaging in live trading with high leverage, practice your strategies on a demo account.

- Maintain a Strict Trading Plan: Develop and adhere to a detailed trading plan that includes entry, exit, and money management strategies.

- Avoid Emotional Trading: Keep emotions in check and avoid impulsive decisions, especially when trading with high leverage.

Best High Leverage Forex Brokers in the US Reviewed

After extensive research, we have come up with a list of the top 10 best high-leverage forex brokers for your convenience, where you will, hopefully, find at least one that fits your needs. Without further ado, here are the ones we can recommend.

1. Plus500 — Regulated CFD broker with high leverage and low spread

Plus500 stands out as a CFD forex broker that offers both high leverage and low spreads, making it a strong contender for traders seeking a balance between risk and reward.

It provides leverage of up to x30 for retail accounts and a substantial x300 for professional accounts, catering to different levels of trading experience and risk tolerance. Additionally, Plus500 is overseen by top-tier regulators, ensuring a high standard of safety and fairness in its trading practices.

With access to over 70 forex currency pairs and a variety of other markets like shares, commodities, options, indices, ETFs, and cryptocurrencies, Plus500 offers a diverse trading portfolio.

The platform also features CFD options trading, albeit with a lower leverage of x5, catering to traders who prefer a more cautious approach. Its user-friendly interface makes it an excellent gateway for new traders embarking on leveraged trading, while still providing the tools and options needed by more experienced traders.

Plus500’s blend of regulatory compliance, high leverage options, and a broad range of tradable assets positions it as a versatile and reliable choice in the forex trading market.

Pros:

- Very user-friendly

- Offers FX options

- Regulated by top-tier regulators

- Retail accounts have access to x30 leverage, while professional ones get as much as x300

- Great mobile app

- A variety of available assets

Cons:

- Not the most advanced platform

- High overnight fees

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. AvaTrade — Top US forex broker with high leverage for expert traders

AvaTrade stands out as a top-tier U.S. forex broker, particularly suited for expert traders seeking high leverage options. Its appeal lies in a comprehensive suite of advanced trading tools and a diverse range of platforms, catering to the sophisticated needs of professional traders.

Additionally, AvaTrade’s global operational footprint makes it a versatile choice for traders in various regions.

The leverage AvaTrade offers varies by region, reflecting its adaptability to different regulatory environments. For forex trading, it provides a high leverage ratio of up to x400, while for commodities, the leverage can go up to x200.

ETFs and stock traders have access to leverage of x20 and x10, respectively. This range of leverage options allows traders to tailor their strategies according to their risk tolerance and market dynamics.

Unique to AvaTrade is its offering of forex options trading, a feature that is relatively uncommon among brokers. While the leverage for standard forex trading is at x400, it’s noteworthy that forex options trading is offered at a leverage of x100.

This distinction further enhances AvaTrade’s position as a versatile broker, providing expert traders with various avenues to explore different trading strategies and leverage their expertise in the forex market.

Pros:

- High Leverage Ratios for Forex

- Diverse Leverage Options Across Instruments

- Global Reach with Region-Specific Leverage

- Availability of Forex Options Trading

Cons:

- Increased Risk of Loss

- Complexity for Beginners

- Limited Leverage on Non-Forex Products

- Potential for Overleveraging

There is no guarantee that you will make money with this provider. Proceed at your own risk..

3. Libertex — Grants professional traders a leverage ratio of 600:1

Libertex, a broker with a solid reputation built over nearly a quarter of a century, secures a commendable position in the market, particularly among high-leverage forex brokers. This enduring presence reflects its reliability and expertise in catering to the needs of traders.

For retail clients, Libertex provides a respectable x30 leverage for forex pairs, a provision that aligns with the stringent regulations set by the Cyprus Securities and Exchange Commission (CySEC). This level of leverage is considered quite accommodating for retail traders, offering a balance between opportunity and risk.

However, where Libertex truly stands out is in its offering for professional traders, granting an impressive x600 leverage for professional accounts.

This high leverage ratio is a testament to Libertex’s commitment to serving the needs of seasoned traders who possess a deep understanding of market nuances and have a higher tolerance for risk. This high leverage allows these traders to significantly amplify their trading positions, providing the potential for substantial returns.

Being regulated by CySEC adds a layer of credibility and ensures that Libertex operates within the framework of strict regulatory guidelines, instilling trust among its clients.

Pros:

- High Leverage for Professional Traders

- Regulatory Compliance

- Tailored Leverage Options

Cons:

- Risk of Significant Losses for Professionals

- Limited Leverage for Retail Clients

- Complexity and Suitability

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

4. Vantage FX — Top forex broker with high leverage trading options

Vantage FX is widely recognized as a top forex broker, particularly noted for its high leverage trading options.

This level of leverage places it among the higher echelons of forex brokers in terms of the trading power it offers to its clients.

The appeal of Vantage FX extends beyond just its leverage options. Being a regulated broker, it ensures a high standard of compliance and security, instilling confidence in traders that their investments are in safe hands.

This regulatory framework provides a stable and trustworthy environment for traders to operate in, which is crucial when engaging in high leverage trading.

Moreover, Vantage FX’s leverage options are flexible, allowing traders to choose their preferred level of leverage up to the maximum of 500:1.

This flexibility is beneficial for both experienced traders who seek to maximize their trading potential and for those who are more risk-averse and prefer to trade with lower leverage.

By offering a range of leverage options, Vantage FX caters to a diverse clientele with varying trading strategies and risk tolerances.

Additionally, Vantage FX’s reputation for excellent customer support and the provision of educational resources makes it an attractive option for traders.

Pros:

- High Leverage Options

- Regulatory Compliance

- Flexibility in Leverage Selection

- Strong Customer Support and Resources

Cons:

- Increased Risk of Substantial Losses

- Potential Overleveraging

- Not Ideal for Inexperienced Traders

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. FinmaxFX — Offers x200 leverage for retail traders

FinmaxFX, positioned as a notable choice among high leverage forex brokers, offers a comprehensive trading experience with several advantages. As of 2023, FinmaxFX provides up to 200:1 leverage on all accounts.

This leverage ratio applies to a vast array of over 400 tradeable instruments available on its award-winning MetaTrader 5 (MT5) platform.

FinmaxFX is regulated by the Financial Market Regulation Center (IFMRRC) and the Vanuatu Financial Services Commission (VFSC). While these regulatory bodies may not be as globally recognized as the FCA or CySEC, they still provide a layer of reliability and oversight.

This regulatory framework ensures that FinmaxFX operates with a degree of transparency and safety, important considerations for traders engaging in high-leverage trading. Moreover, the broker has maintained a reputable operation since its inception in 2015, adding to its credibility as a safe and reliable trading platform.

The broker’s platform is designed to be accessible to both beginners and advanced traders, offering a range of tools and resources to support their trading activities.

This includes deposit bonuses, live webinars, guidance from analysts, and daily market reviews, enhancing the overall trading experience. These features, coupled with the broker’s leverage options, make FinmaxFX an attractive option for traders seeking a balanced mix of high leverage and diverse trading instruments in a regulated environment.

Pros:

- High leverage of x200 for FX trading

- Supports MT5

- It offers plenty of tools, features, and an extensive education center

- Supports automated trading

Cons:

- It has inactivity and withdrawal fees which are somewhat high

- Not licensed by the top regulators

There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. FXTM — The highest leverage broker with 1000:1 for all traders

FXTM, also known as ForexTime, distinguishes itself as a broker offering exceptionally high leverage, reaching up to 1000:1. This level of leverage is among the highest available in the industry, making FXTM a standout choice for traders who are looking for maximum trading power.

Such high leverage allows traders to significantly amplify their trading positions, offering the potential for substantial profits even with a relatively small initial investment.

This high leverage ratio is accessible to all FXTM traders, irrespective of their experience level, providing a uniform opportunity to leverage their trades extensively.

While this can be an attractive feature for those seeking to maximize their market exposure, it also requires a thorough understanding of leverage risks and market dynamics. FXTM’s offering caters to traders who are confident in their trading strategies and are comfortable with the high-risk, high-reward nature of such leverage levels.

Pros:

- Up to x1000 leverage

- Zero spreads for some assets, tight spreads for others

- Low minimum deposit

- Low overnight fees

Cons:

- Lower selection of instruments compared to others

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How To Get Started With A High Leverage Forex Broker

Once you feel confident about your understanding of trading with leverage, you should start by opening an account with a broker you like the most. For our guide, we will use AvaTrade but note that the procedure is simple and rather similar on other platforms, as well.

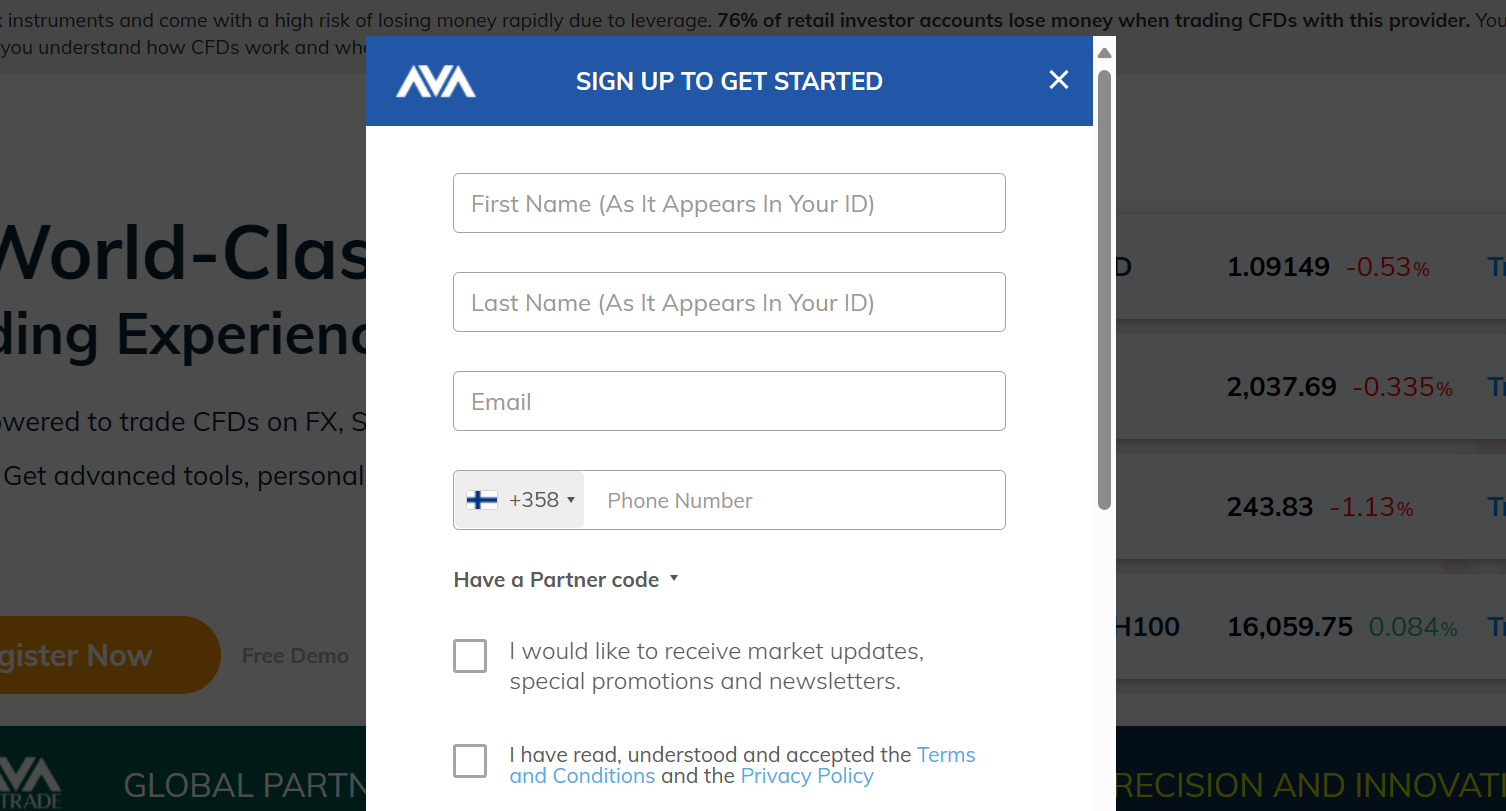

Step 1: Open a Trading Account and Verify Your Identity

Start by opening an account on AvaTrade by filling out the simple registration form.

After filling out your details, you will also have to provide two forms of ID that can be used to verify your account.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Accepted forms of ID include a passport, drivers’ license, birth certificate, recent utility bill or bank statement. One form of ID must confirm your address and the other must confirm your age.

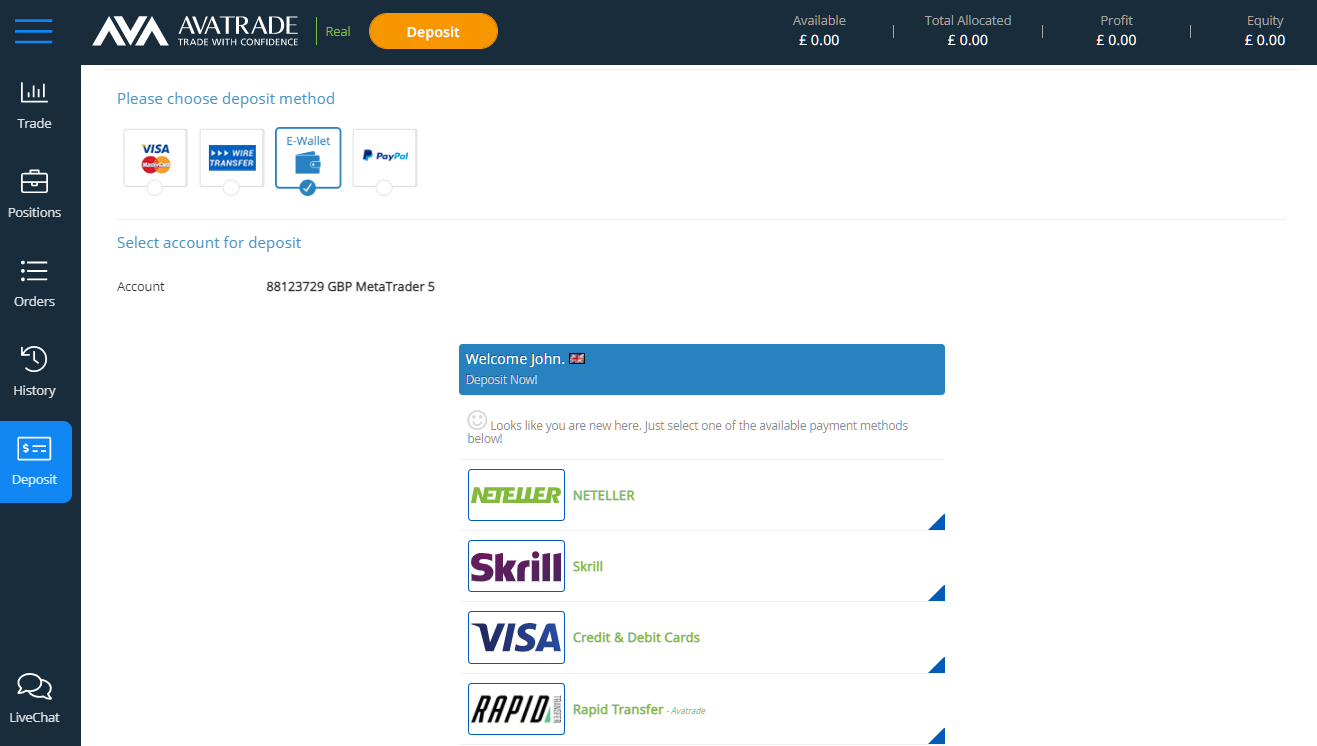

Step 2: Deposit Funds

Once your account is created and verified, it will be time to deposit some funds into it. This is also a very simple process, and all you need to do is click on the Deposit button on the bottom left side of your screen and enter the desired amount and payment method (popular ones such as debit or credit cards are available too).

Step 3: Practice Your Leverage Trading on a Demo Account

Before you start using your money in various trades, however, it would be good to first get familiar with AvaTrade and the way its platform works. The best way to do this would be to use its Demo account for trading. This is a practice account that grants you fake money that you can use in a simulation of the market.

That way, you can see how your trades may end up going in a simulated situation, which reflects the market situation and shows you exactly what would have happened to your funds.

Step 4: Start Trading with Leverage

Finally, once you feel like you are ready, you can start trading with leverage on the live market. It is recommended that you start carefully, and trade with low leverage at first until you gather more trading experience and feel more comfortable with raising the stakes.

Conclusion

Trading with leverage can be extremely beneficial and profitable when it comes to forex, but also very risky, so it is recommended that you do it with as much care as possible. Be patient, take your time, and test things out in the Demo account before trying them out in live markets.

As for which broker to choose, we have provided a list of top brokers that traders around the world are using, and have very positive experiences with.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

Which broker gives highest leverage forex?

FXTM provides the highest forex leverage of up to 1:2000. This means that users can borrow 2000x their available funds.

Which forex broker has 500 leverage?

Libertex, Vantage FX and FXTM are all brokers that offer 500x leverage on forex instruments. However, it is important to understand that leverage limits change regularly and this list may vary.

Which broker has a 1 2000 leverage?

FXTM is a broker that offers 1:2000 leverage on forex. This is the only broker that offers 2000x leverage that we cam across during our review.

What leverage is good for $100 forex?

According to professional traders, the ideal leverage for a $100 investment is 1:100. This allows you to trade up to 100x more than your total funds which gives traders access to $100,000.

References:

Ali Raza Crypto Writer

View all posts by Ali RazaAli is an experienced writer covering the cryptocurrency markets and the blockchain industry. He has 8 years of experience writing about cryptocurrencies, technology, and trading. His work can be found in various high-profiled investment sites including CCN, Capital.com, BeInCrypto, Bitcoinist, and NewsBTC.

Ali studied Master in Commerce with Finance at The Islamia University of Bahawalpur from which he graduated in 2012. Since then, he has used his skills and finance knowledge to create insightful content that helps readers to better understand the cryptocurrency space. Ali regularly analyzes the markets to stay ahead of trends and spot potential changes. He is able to distill these trends into clear and actionable insights.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up