Best Forex Trading App – Top Apps for Beginners Revealed

If you’re planning to buy and sell currencies on the move – you’ll need a top forex trading app on your side. Your chosen app should offer plenty of tradable markets, have low fees and tight spreads, and allow you easy deposit and withdraw funds at the click of a button.

In this guide, we review the Best Forex Trading Apps for 2025.

Best Forex Trading App 2025 List

Below you will find a list of the best forex trading app providers in the market right now. Scroll down to read our review of each forex trading app!

- eToro – Overall Best Forex Trading App 2025

- Libertex – Popular Forex Trading App That Offers Tight Spreads

- AvaTrade – Multiple Forex Trading Apps and Competitive Fees

- Oanda – Forex Trading App with Many Years on the Market

- Forex.com – Forex Trading App With More Than 80+ Currency Pairs

- TD Ameritrade – Top-Rated Forex App With Seasoned Traders

- CedarFX – Best Forex Trading App for Leverage (1:500)

- FXCM – Best Forex Trading App for Algo Trading

- Interactive Brokers – Best Forex Trading App for Professionals

- FXTM – Best Forex Trading App for Education

Best Forex Trading Apps Reviewed

Virtually all online forex trading platforms offer a mobile app that is compatible with iOS and Android devices. In choosing the best forex trading app for your needs – you’ll need to explore some key metrics surrounding supported pairs, commissions, spreads, payment methods, and regulation.

We have done the hard work for you by reviewing the best forex trading app providers for 2025.

1. eToro – Overall Best Forex Trading App 2025

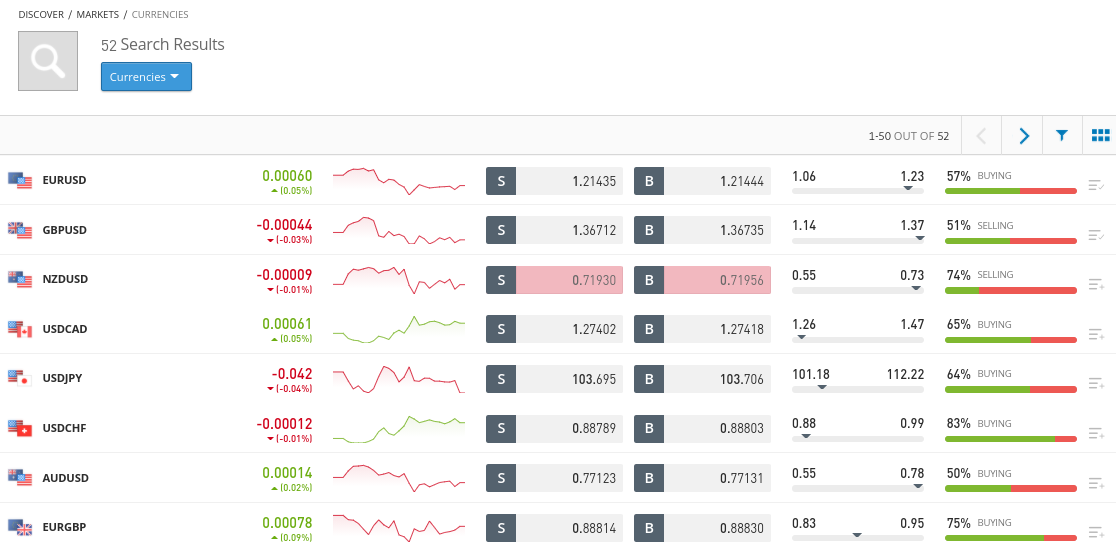

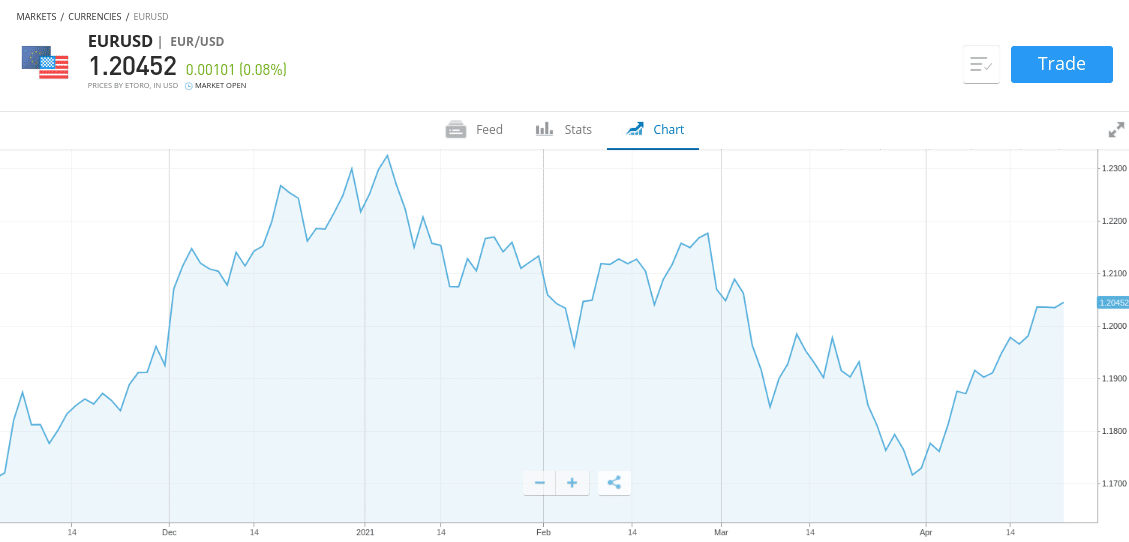

The current section of the app allows you to trade dozens of pairs from the major, minor, and exotic categories. You will not pay any commissions to trade on the eToro app and spreads are very competitive. Leverage is available too – with eToro offering retail investor clients 1:30 on major pairs and 1:20 on minors and exotics. The app itself is very simple to use and offers a great all-round trading experience.

When it comes to payments, eToro allows you to deposit funds instantly with a debit/credit card (Visa, MasterCard, Maestro) and e-wallets such as Payal and Neteller. Local and international bank wires are also supported but might take slightly longer to arrive. If you are looking for an automated trading app – eToro has you covered. This is because the app comes with a popular Copy Trading tool that allows you to trade forex autonomously.

You will have thousands of seasoned forex traders to choose from and eToro will provide you with an abundance of data points. For example, you can view how much money the trader has made on the eToro platform and how much risk they typically take. In terms of safety, eToro is heavily regulated. This is inclusive of licenses with the FCA (UK), CySEC (Cyprus), and ASIC (Australia). Taking all of the above into account – eToro is by far the best forex trading app in the market.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

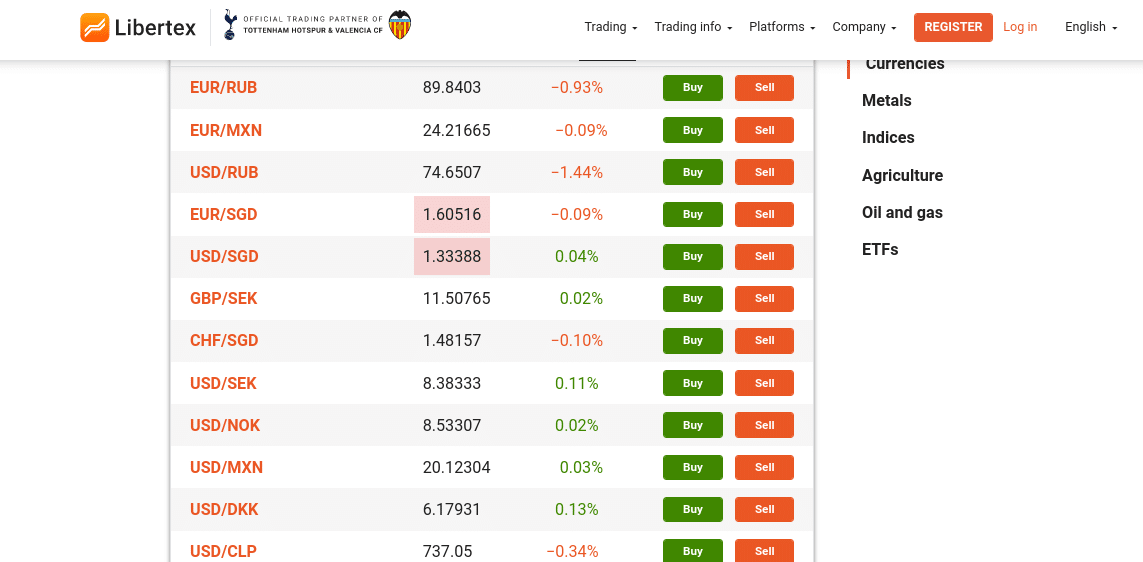

2. Libertex – Popular Forex Trading App That Offers ZERO Spreads

For example, The likes of EUR/JPY, USD/CHF, and USD/CLP will cost you just 0.006% per slide. In terms of supported markets, Libertex offers a huge range of currency pairs. This is inclusive of exotic currencies such as the Chilean peso, Mexican peso, Turkish lira, and Chinese yuan. Being able to trade these exotic pairs without spreads is one of the many reasons why Libertex is so popular.

Outside of its forex trading suite, Libertex also offers markets on stocks, ETFs, indices, energies, precious metals, and more. You can get started with an account on the Libertex app in minutes and the minimum deposit is just $100. The app supports several payment methods – which is inclusive of debit/credit cards, e-wallets, and a bank wire. This top-rated provider has been offering forex trading services for more than 20 years and it is regulated by CySEC.

Pros:

- Tight spread CFD trading

- Very competitive commissions – starting from 0% upwards

- Good educational resources

- Long established broker

- Compatible with MT4

- Great choice of markets

Cons:

- CFDs only

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

3. AvaTrade – Multiple Forex Trading Apps and Competitive Fees

This offers a great user experience and will give you access to all of the same markets and functionality features as found on the main AvaTrade website. Alternatively, if you are an experienced trader, you might consider linking the MT4 or MT5 app to your AvaTrade account. In doing so, you will have access to a lot more in the way of chart analysis tools, order types, and the ability to deploy a forex robot.

Irrespective of whether you go for AvaTradeGO or a third-party app, AvaTrade gives you access to dozens of forex pairs. You can trade with leverage and all fees are built into the spread – meaning AvaTrade is commission-free. When it comes to safety, AvaTrade is regulated in six jurisdictions. This includes licenses with the IIROC (Canada), FSA (UK), and Central Bank of Ireland.

Pros:

- Supports MT4/5

- Commission-free platform

- Wide range of tradable instruments

- Educational materials

- Economic calendar

- Islamic trading account

- ASIC regulated

Cons:

- Does not offer traditional stock ownership – CFDs only

71% of retail CFD accounts lose money with this provider.

4. Oanda – Forex Trading App with Many Years on the Market

Founded in 1996, Oanda is an online forex broker. With its continued growth, it has become one of the most respected forex brokers in the world. The company has offices in New York, London, Toronto, Singapore, and Sydney. Besides currency pairs, Oanda offers other financial instruments such as commodities, metals, and indices. Besides currency conversion and historical exchange rates, they offer various other services.

Its user-friendly trading platform is one of the key features of Oanda. Due to its web-based nature, traders can access the platform from any device with an Internet connection. As a result, traders of all levels will find it easy to use, with an intuitive interface that is simple to use. Additionally, traders can customize the platform’s layout, indicators, and charts.

Furthermore, Oanda offers a number of educational tools and resources to help traders improve their skills and make better trading decisions. They provide a variety of educational materials, such as videos, e-books, and webinars. The company also provides traders with a comprehensive FAQ section and a support team available 24/7 to answer any questions or resolve any issues.

Trading fees at Oanda are competitive; they charge a variable spread, subject to change based on market conditions. In addition, traders can practice and test their strategies using a free demo account before investing real money. For new traders, a demo account can be a great way to get a sense of the market before they start trading with real money. In addition to virtual money, the demo account simulates real-market conditions.

Therefore, Oanda is one of the most reputable and reliable brokers suitable for novice and experienced traders. In addition, Oanda is an excellent choice for traders looking to trade forex due to its user-friendly platform, wide range of financial instruments, and educational resources.

Pros:

- Spreads from 1.4 pips on 68 forex pairs

- With commissions starting at 0.25%, you can trade 9 cryptocurrencies

- New traders can get a welcome bonus of up to $5,000

- Provides TradingView, MetaTrader 4, and Oanda apps

- Demo trading account for free

Cons:

- Trading in stocks, ETFs, and indexes are not available

- Negative balance protection is not available

71% of retail CFD accounts lose money with this provider.

5. Forex.com – Forex Trading App With More Than 80+ Currency Pairs

As the name implies, Forex.com is an online trading platform that specializes in currencies. The platform also offers a popular forex trading app that is compatible with both Android and iOS devices. At Forex.com, you will have access to over 80+ currency pairs, which is huge. This covers all major and minor pairs, plus a great selection of exotics.

The mobile app comes packed with charting features and technical indicators – so Forex.com is particularly useful if you want to perform research while on the move. There is also a demo account facility on the app – which allows you to trade risk-free. When it comes to trading fees, this will depend on the account type that you open.

For example, there is a commission-free account that is suited to newbies and an STP Pro account that gets you zero spreads. In terms of payments, there is no minimum deposit if opting for a bank transfer. However, if you wish to deposit funds via debit/credit card or Paypal – the minimum is $100. We should also note that the Forex.com app allows you to trade other financial instruments – which includes gold, silver, shares, indices, and more.

Pros:

- Specialist forex trading app

- Access to dozens of currency pairs

- Particularly strong when it comes to exotic currencies

- No minimum deposit when opting for a bank wire

- Also offers CFDs

- Heavily regulated – including US licenses

- Top-notch forex and economic new

Cons:

- KYC process is a bit long-winded

There is no guarantee you will make money with this provider.

6. TD Ameritrade – Top-Rated Forex App With Seasoned Traders

TD Ameritrade is super popular in the traditional investment arena – as the brokerage firm offers thousands of stocks, index funds, mutual funds, ETFs, bonds, and more. However, TD Ameritrade is also known for offering one of the best forex trading apps in the market.

In what it calls ‘thinkorswim’, the mobile app comes packed with advanced charting tools. This includes customizable chart layouts, hundreds of technical indicators, and real-time data feeds. The thinkorswim app also allows you to set custom alerts and you will have access to daily market updates.

In terms of supported markets, TD Ameritrade offers more than 70 currency pairs – all of which can be traded with leverage. This top-rated forex trading app is commission-free, so it’s only the spread that you need to take into account. Finally, TD Ameritrade requires you to fund your account with a bank transfer, albeit, there is no minimum account balance.

Pros:

- Trusted US brokerage firm

- App is available on iOS and Android devices

- Buy stocks and ETFs commission-free

- Options can be traded at just $0.65 per contract

- Fully-fledged paper trading account

- More than 11,000 mutuals to choose from

- No account minimums

Cons:

- Not as user-friendly as other investing apps in the market

- The sheer size of tradable markets on offer can appear overwhelming

Your capital is at risk.

7. CedarFX – Best Forex Trading App for Leverage (1:500)

CedarFX

Leverage of 1:500 is also offered on precious metals, while indices, stocks, and cryptocurrencies come with slightly less. Either way, all markets – including forex, can be traded on the CedarFX app on a commission-free basis. When looking at the provider’s spreads, we found this to be very competitive. For example, USD/JPY and EUR/USD can be traded at just 0.8 pips.

We also like the fact that CedarFX offers live chat 24 hours per day, 7 days per week. In terms of payments, CedarFX allows you to deposit and withdraw funds with Bitcoin. If you don’t have any BTC to hand – you can purchase some via CedarFX’s partnered payment provider with your debit/credit card.

Pros:

- Green project initiative

- Zero commission on all assets and very low spreads

- Great asset range

- Up to 1:500 leverage

- Ultra-fast withdrawals (within 24 hours)

- Very fast trade execution

- $10 minimum deposit

Cons:

- Prefers Bitcoin deposits

Your capital is at risk.

8. FXCM – Best Forex Trading App for Algo Trading

You can trade at FXCM without paying any commissions, so all fees are built into the spread. We like FXCM in particular for its support for algo trading and forex EAs. In fact, the platform has its own third-party store where you can buy automated strategies, expert advisors, indicators, trading scripts, and more.

You can set these up via MT4 and then download the app to your phone. Once you connect the MT4 app to FXCM, you can then monitor your algo trading strategies in real-time directly on your mobile device. In terms of safety, FXCM is licensed by the FCA and has been active in this industry for more than two decades. The minimum deposit here is just $50 (non-EU clients).

Pros:

- FCA-regulated

- Lots of currency pairs to trade

- Choose from several trading platforms – including MT4

- Supports EAs and forex robots

- 0% commission on all assets

- Tight spreads

- You can also trade stock, crypto, oil, and gold via CFDs

Cons:

- Minimum deposit of $360 for EU clients

Your capital is at risk when trading forex with this provider

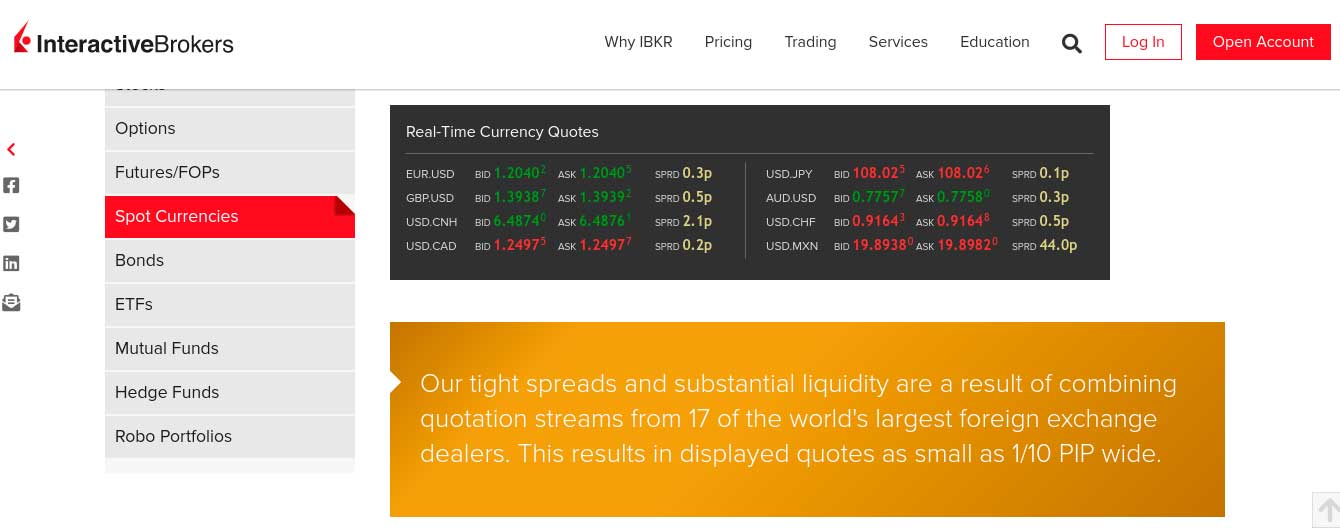

9. Interactive Brokers – Best Forex Trading App for Professionals

Interactive Brokers is a household name in the online investment and trading scene. This brokerage site gives you access to tens of thousands of markets – covering everything from stocks and index funds to commodities and futures.

Additionally, Interactive Brokers also offers a spot currency facility that is popular with professional traders. Available online or via the mobile app – you will be able to trade 23 currencies. This comes via an ECN-like pricing structure, as you will get the spreads available in the market.

When trading major FX pairs, this will often come free of any spreads at all. You will pay a very small commission to trade forex on the Interactive Brokers app – which averages 0.08 to 0.20 basis points, multiplied by your trade size. This top-rated forex trading app comes with real-time streaming quotes, technical indicators, and super-fast execution speeds.

Pros:

- Huge library of traditional stocks, index funds, and ETFs

- Really advanced trading features and chart analysis tools

- Markets in 33 countries

- Trade CFDs, futures, options, forex, and more

- No minimum deposit

- Buy US-listed stocks and ETFs commission-free

Cons:

- Not suitable for newbie investors

- Fee structure is a bit confusing

Your capital is at risk when trading forex with this provider

10. FXTM – Best Forex Trading App for Education

This is inclusive of in-depth guides and educational videos, as well as regular webinars and seminars. FXTM also offers a free demo account facility – which you can access online or via the provider’s mobile app. You can trade currencies on FXCM by meeting a very small deposit of just $10.

There are no commissions charged by the forex trading app provider – so it’s only the spread that you need to factor in. The spreads you pay will depend on your account type – albeit, this starts from just 1.3 pips on the Standard Account. FXTM also supports a wide range of CFD markets – including stocks, metals, and indices.

Pros:

- Provides heaps of educational resources

- Great for market insights and market research

- Several account types supported

- Extensive forex department

- No commissions when trading currencies

- Great reputation and heavily regulated

Cons:

- Does not support US traders

74% of retail investor accounts lose money when trading CFDs with this provider.

How to Choose the Best Forex Trading App for You

Still not sure what the best forex trading app is for your personal requirements?

If so, it’s a good idea to perform a little bit more research before proceeding to open an account with a provider. To point you in the right direction, below we explain the steps needed to choose the best forex broker app for you.

Regulation

The forex trading industry is heavily regulated in most countries around the world. This is to ensure that retail investor clients are protected from shady broker practices. All of the best forex trading apps discussed on this page are regulated by at least one reputable financial body.

For example, eToro is regulated by ASIC, CySEC, and the FCA, while AvaTrade is licensed in six different jurisdictions. This ensures that your capital is protected at all times and that you are trading in transparent and fair conditions.

FX Pairs

All of the best forex trading app providers that we have reviewed today offer a huge suite of forex pairs. This typically includes all major and minor currency pairs, alongside a selection of exotics.

The latter might include the likes of the Mexican peso, South African rand, and Turkish lira. Irrespective of which pairs you prefer to speculate on – make sure that your chosen currency trading app supports it.

Fees

Even the best forex trading app providers are in the business of making money – so you need to understand what fees you will be required to pay. At eToro, for example, you can trade forex without paying any commission. Libertex, on the other hand, charges a very small commission that starts from just 0.006% per slide, albeit, you won’t pay any spreads.

As such, commissions and/or spreads are the main way that the best forex trading apps make money. Other fees to look out for are related to deposits/withdrawals and overnight financing.

Trading Tools & Features

Some trading apps offer the bare-bone basics – meaning that you will be able to trade forex but do little else. At the other end of the spectrum, providers like eToro, AvaTrade, and Libertex offer heaps of useful trading tools and features.

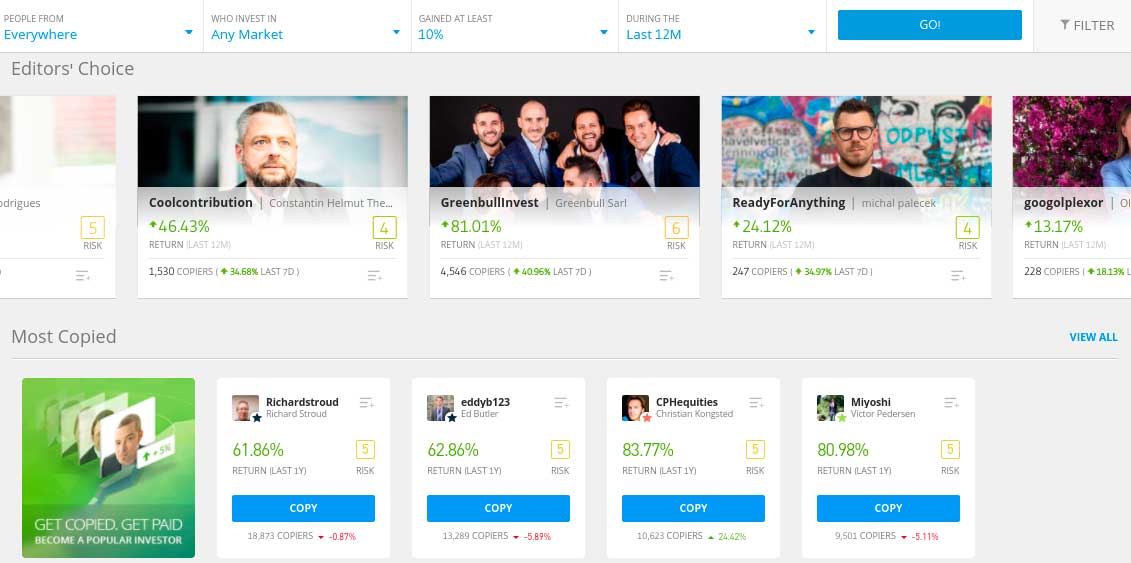

For example, at eToro, you can trade forex via its Copy Trading tool. All you need to do is decide which forex trader you wish to copy and how much you want to invest (minimum $500).

Past performance is not an indication of future results

Then, any positions that the trader enters will be reflected in your own eToro account at a proportionate amount. For instance, let’s say that you invested $2,000 into a trader. If the trader allocates 4% of their capital to a EUR/USD long position – your trade size would amount to $80.

Education, Research & Analysis

As you likely know, the best forex traders in this industry rely on technical analysis to make consistent gains. With this in mind, the best forex trading apps will give you access to core analysis tools like technical indicators and real-time pricing quotes.

Of course, performing technical analysis on your phone will be difficult. But, we found that the best forex trading app providers have optimized their application to ensure you can perform analysis on a smaller screen without being hindered.

User Experience

Leading on from the previous point, we should again stress the importance of choosing an app that offers a great user experience.

This is because you will be trading currencies with your own capital – so you want to ensure that you can do this in a seamless manner. We found that eToro is by far the best forex trading app when it comes to the end-to-end user experience, as its iOS and Android applications have been fully optimized.

For example, it’s really easy to find your preferred forex pair, and placing orders via your phone is straightforward. You can even review live pricing charts on the app – as well as instantly deposit funds with a debit/credit card or e-wallet.

Payment Methods

If you want to deposit funds with a specific type of payment method, then make sure your chosen forex app accepts it. As we just mentioned – eToro supports a plethora of debit and credit cards, e-wallets, and bank transfers.

This is also the case with the likes of AvaTrade. On the other hand, age-old forex brokers like TD Ameritrade only support traditional bank transfers – meaning deposits can take a few days to arrive in your trading account.

Customer Service

The best forex trading app providers offer top-notch customer support. For example, eToro offers a live chat feature on a 24/5 basis. CedarFX goes one step further by offering customer support 24/7. Very few currency trading apps offer telephone support, so if live chat isn’t offered you will likely need to send an email to get assistance.

How to Get Started with a Forex Trading App

We are now going to show you how to get started with a live FX account with our top-rated forex trading app – eToro.

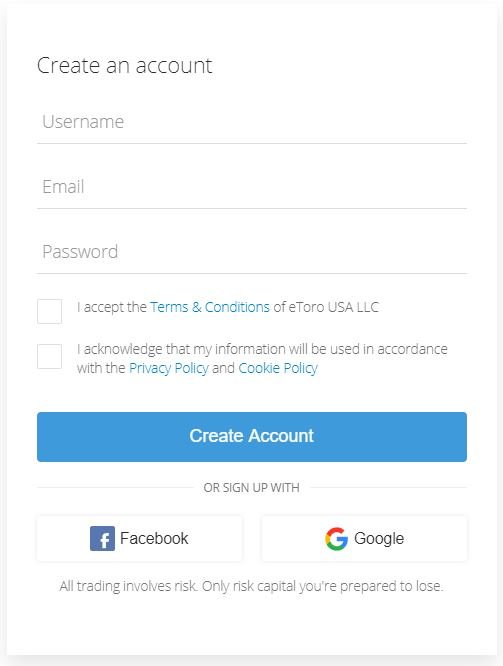

Step 1: Visit the eToro Website and Open a Forex Account

To get the ball rolling, visit the eToro homepage and open an account. Here, you will need to provide your personal information – such as your name, home address, and contact details.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro will also ask you to provide a copy of your government-issued ID – as per KYC rules.

Step 2: Download the eToro Forex Trading App

You can now proceed to download the eToro app. Once the download is complete, open the app and log in with the username and password that you created in the previous step.

Step 3: Deposit Funds

You can now make a deposit directly within the eToro app. Instant payment methods include debit/credit cards and e-wallets. Bank transfers are also supported but typically take a couple of days to arrive. With that said, eToro offers instant bank transfers in certain countries – so be sure to check this yourself.

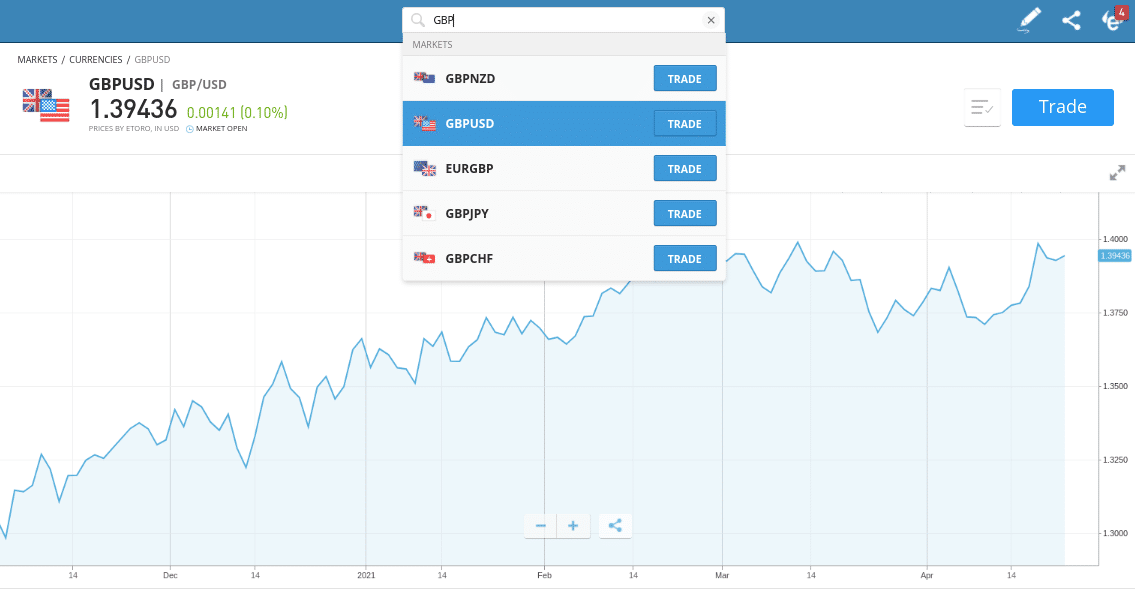

Step 4: Trade Forex

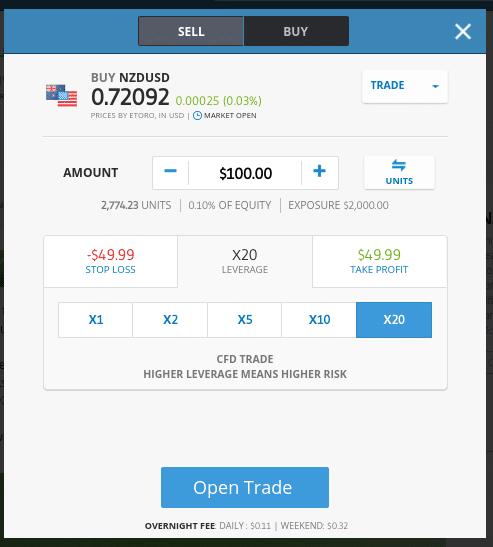

Now you can search for the forex market that you wish to trade. Once you click on the ‘Trade’ button next to the respective pair, an order box will appear.

You then need to enter your particulars – such as whether you want to go long (buy) or short (sell), the amount you wish to stake, whether you want to apply leverage, and your entry, stop-loss, and take-profit order prices.

Confirm your forex trading position by clicking on the ‘Set Order’ button.

Top Forex Trading Apps 2025 – Conclusion

Choosing the best forex trading app for your needs is a crucial step that you need to take if you wish to profit from the currency market. There are many options on the table – but we concluded that eToro is the best forex trading app for 2025.

You’ll have access to almost 50 FX pairs on a tight spread and commission-free basis – alongside leverage. The app itself is super easy to use and getting started takes minutes.

eToro – Best Forex Trading App

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.