Best Forex Demo Account 2026 – Top Brokers Compared

If you’re looking to trade forex online for the very first time – you might want to start off with a demo account. This will allow you to trade in live forex market conditions without needing to risk any capital. Then, when you feel comfortable with how currency trading works, you might then consider upgrading to a real money account.

In this guide, we review the best forex demo accounts right now.

Top Forex Demo Accounts 2026

If you’re strapped for time and looking to start trading via a top-rated demo account right now – check out the list of the best providers below. By scrolling down, you can read a full review of each demo account in more detail.

- eToro – Overall Best Forex Demo Account for 2026

- Libertex – Forex Demo Account with Tight Spreads

- AvaTrade – Best Forex Demo Account or Mobile Trading

- Forex.com – Best Forex Demo Account for Professional Traders

- FXCM – Best Forex Demo Account for Spread Betting

Best Forex Demo Accounts Reviewed

Before you consider which forex demo account to use, it is important to remember that your chosen provider is also a brokerage site. In other words, you will need to open an account with a forex trading platform before you can use its demo facility.

As such, you need to look at factors other than just the demo account – such as tradable forex pairs, spreads, commissions, customer support, and more. After all, there is every chance that eventually – you’ll look to start trading currencies with real money.

To point you in the right direction, below we discuss a selection of the best forex demo accounts.

1. eToro – Over Best Forex Demo Account

eToro is now one of the most popular online trading platforms. With more than 17 million global clients, the broker is often the go-to provider for newbies.

Not only is this because the trading platform is really easy to use, but eToro is home to a wealth of educational and training materials.

Plus, you’ll have access to a fully-fledged forex demo account facility as soon as you register. This mirrors the real eToro trading platform like-for-like, in terms of supported markets, real time pricing, and liquidity. The key difference is, of course, that you will be trading with paper money.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

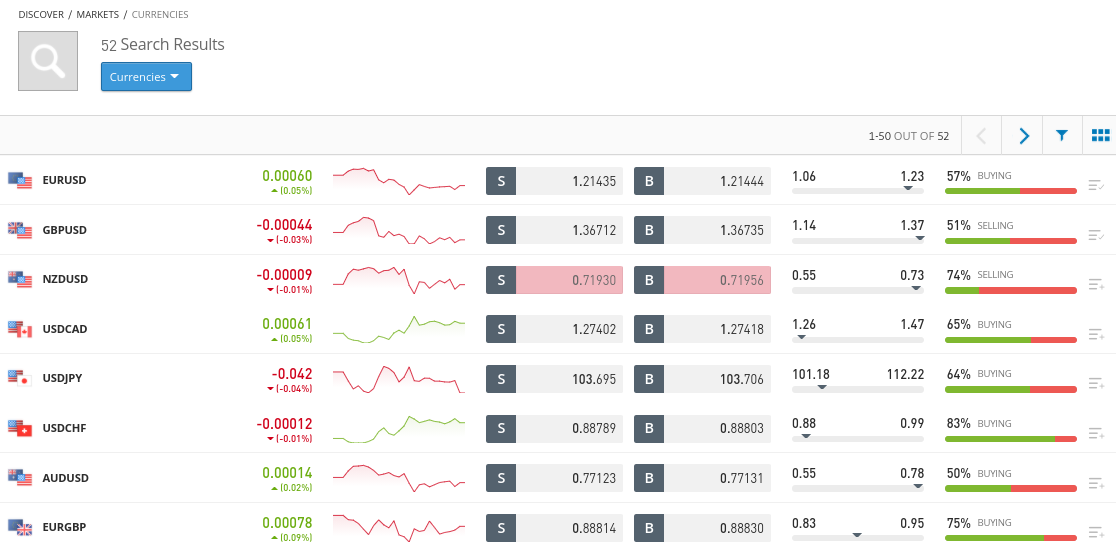

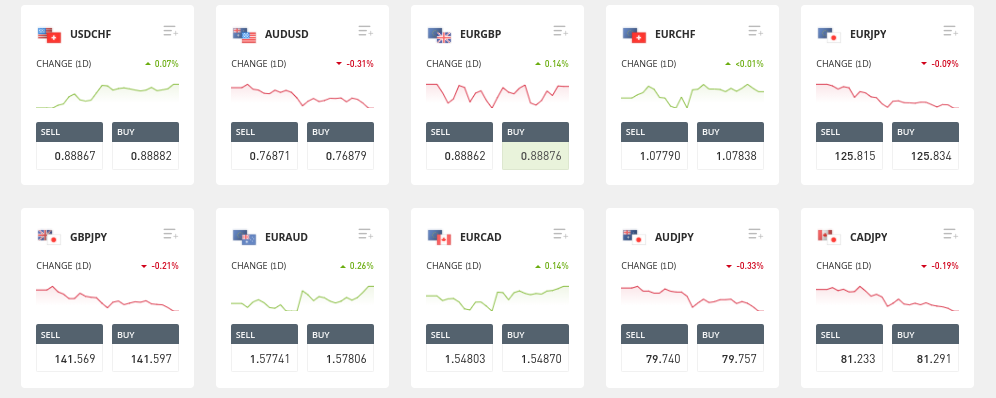

In fact, the forex demo account comes pre-loaded with a $100,000 demo fund balance – suitable for demo trading. In terms of supported markets, eToro gives you access to over 55 forex pairs. This covers majors, minors, and plenty of exotics, too. In addition to forex, eToro also supports stocks, ETFs, cryptocurrencies, indices, and commodities.

All supported assets – including forex, can be traded commission-free at eToro. This means that once you eventually start trading with real money, you’ll be doing so in a super cost-effective way. The eToro demo account can be accessed online or via the provider’s mobile app.

Past performance is not an indication of future results

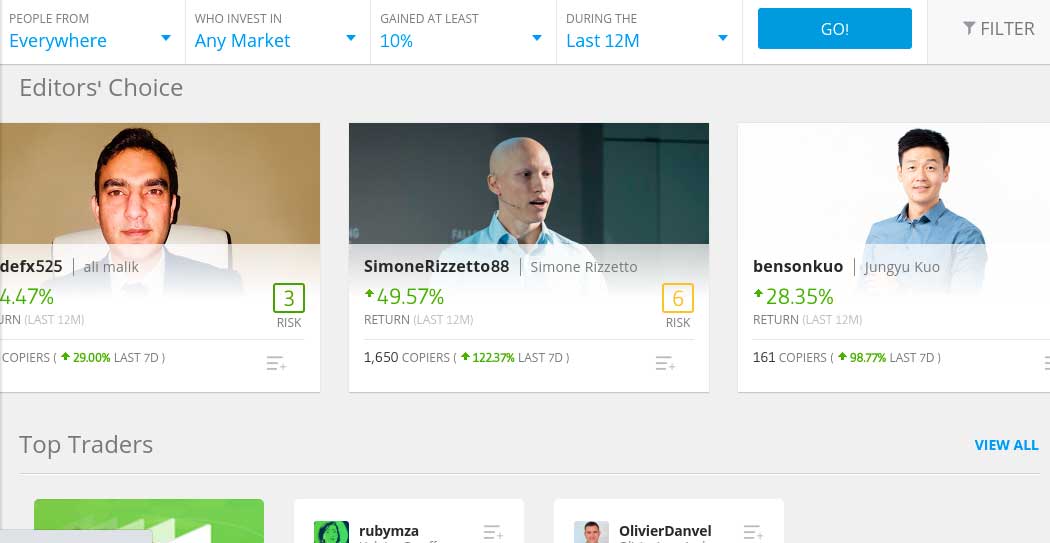

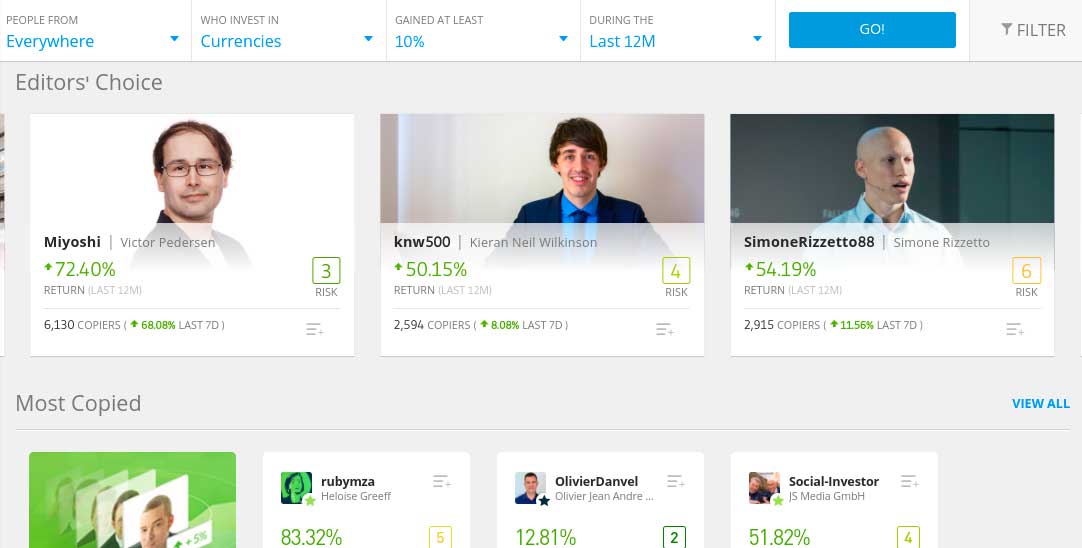

There is no time limit on this, so you can switch between the demo and real account any time you wish. An additional feature that some of you might be interested in is the eToro Copy Trading tool. As a social trading platform, eToro allows you to copy an experienced forex trader like-for-like – at an amount proportionate to what you invest.

Once you start trading forex with your own capital, the minimum deposit is just $200. The platform supports debit/credit cards, e-wallets, and bank transfers. eToro is heavily regulated, including an FCA license. Your funds are also protected by the FSCS.

eToro fees

| Fee | Amount |

| CFD trading fee | 0.09% per trade in ETF CFDs and stocks CFDs; from 0.75% per trade in crypto CFDs |

| Forex trading fee | Spread, 2.1 pips for GBP/USD |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros:

- Super user-friendly online broker and trading platform

- Trade thousands of assets with tight spreads

- 100% commission-free

- You can also trade stocks, indices, ETFs, cryptocurrencies, and more

- Deposit funds with a debit/credit card, e-wallet, or bank account

- Social trading and copy trading

- Regulated by the FCA, ASIC, and CySEC

Cons:

- Not suitable for advanced traders that like to perform technical analysis

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

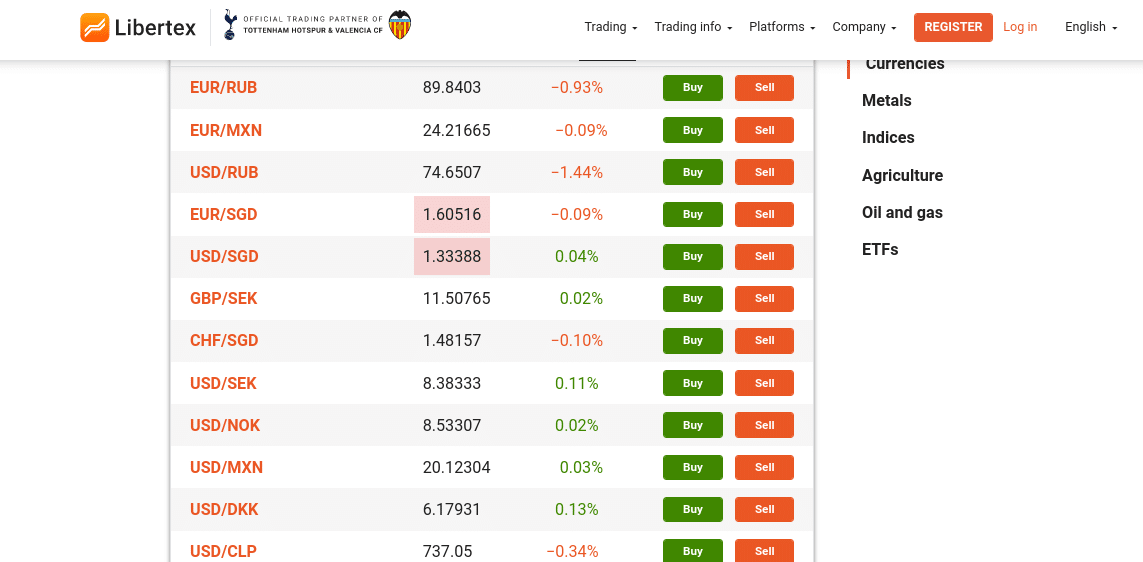

2. Libertex – Forex Demo Account with Tight Spreads

Libertex is one of the most established forex and CFD trading platforms in the online space. Launched over 23 years ago, the platform is now home to almost 3 million traders.

Perhaps the most attractive aspect of choosing this provider is that Libertex is a tight spread broker. This means that there is no gap between the buy and sell price of your chosen forex pair.

Plus, many of the markets offered by Libertex can be traded commission-free. In terms of its forex demo account facility, new traders could use a €50,000 paper trading balance to perform demo trading for free, which acts as a practice account. This is more than enough for you to get to grips with trading currency pairs in a risk-averse manner.

You actually have two options at Libertex when it comes to the demo account. If you’re a complete newbie, then you can trade via the Libertex website. This is a platform built by Libertex itself and it is particularly popular with inexperienced traders. Alternatively, you can also use your demo funds via MT4.

This third-party platform is often used by seasoned traders, as it comes packed with advanced chart reading tools and technical indicators. Either way, there is no time limit on how long you can use the demo account at Libertex. When you eventually decide to start trading with your own capital, the minimum deposit here is just £100.

You can choose from an assortment of payment methods at this MT4 broker, such as a debit/credit card, bank transfer, or an e-wallet. After your initial deposit, the minimum goes down to just £10 per transaction. Finally, Libertex is also available via an Android/iOS mobile app – should you wish to trade on the move.

Libertex fees

| Fee | Amount |

| CFD trading fee | Free |

| Forex trading fee | Commission. 0.008% for GBP/USD. |

| Crypto trading fee | Commission. 1.23% for Bitcoin. |

| Inactivity fee | $5 a month after 180 days |

| Withdrawal fee | Free |

Pros:

- Tight spread CFD trading

- Very competitive commissions – starting from 0% upwards

- Good educational resources

- Long established broker

- Compatible with MT4

- Great choice of markets

Cons:

- Only offers CFDs

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

3. AvaTrade – Best Forex Demo Account for Mobile Trading

If so, it’s well worth checking out AvaTrade. This popular forex and CFD trading platform has been active in this space for over 12 years and it is regulated in 6 jurisdictions.

You will have access to an abundance of forex trading pairs on this platform – all of which can be traded commission-free. Spreads on major currency pairs are often industry-leading, especially with the likes of EUR/USD and AUD/USD.

Once you download the mobile app – which the provider calls AvaTradeGo, you will first need to open an account. Then, you can start trading with demo funds directly from the palm of your hands. You can also access your demo account online. AvaTrade offers its own native platform, as well as support for MT4/5.

If you decide to upgrade to a real money account, AvaTrade requires a minimum deposit of just £100. You can facilitate this via debit/credit card and the transaction will be processed instantly. Finally, on top of commission-free trading, there is no ongoing platform fee and you won’t be charged on deposits/withdrawals.

AvaTrade is a MetaTrader 5 broker and is compatible with MT4 and Zulutrade.

AvaTrade fees

| Fee | Amount |

| CFD trading fee | Variable spread |

| Forex trading fee | Spread. 0.9 pips for EUR/USD |

| Crypto trading fee | Commission. 0.25% (over-market) for Bitcoin/USD |

| Inactivity fee | $50 per quarter after three months of inactivity |

| Withdrawal fee | Free |

Pros:

- Supports MT4/5

- Commission-free platform

- Wide range of tradable instruments

- Educational materials

- Islamic trading account

- ASIC regulated

Cons:

- Does not offer traditional stock ownership – CFDs only

72% of retail CFD accounts lose money with this provider.

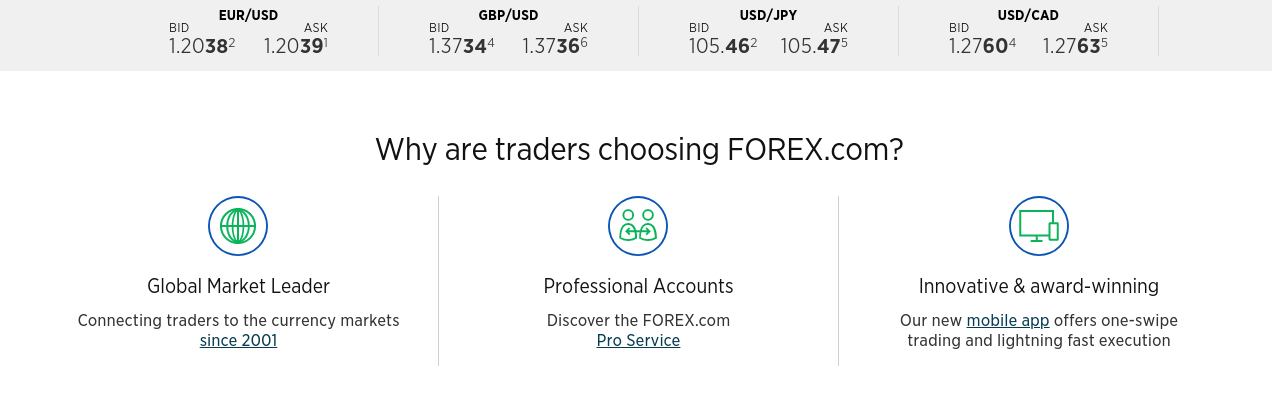

4. Forex.com – Best Forex Demo Account for Professional Traders

So far in this guide, we stressed that forex demo accounts are ideal for newbies that wish to learn the ropes of currency trading before risking any capital. However, we should make it clear that demo accounts are also suitable for experienced traders that wish to test or perfect a new strategy.

If this sounds like you, then Forex.com is well worth considering. As the name implies, this popular online platform is a specialist forex broker. It gives you access to more than 80 currency pairs – many of which come from the emerging markets.

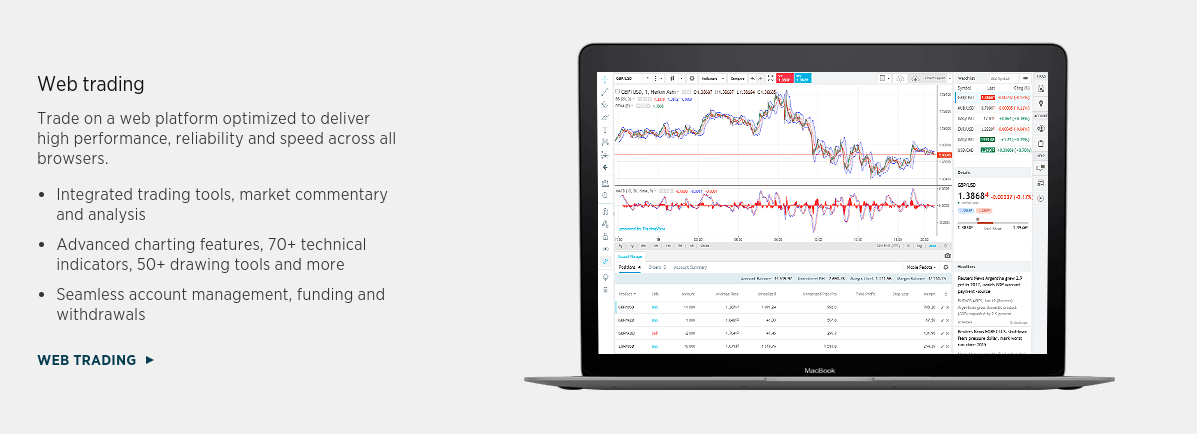

You will never struggle for liquidity on this platform and the number of trading tools on offer is highly extensive. In terms of the demo account itself, most traders will opt for MT4. All you need to do is quickly open an account with Forex.com and then enter your login credentials into the MT4 platform – which you can access online or via desktop software.

Once you do, you’ll then have access to £10,000 in demo account funds. In particular, Forex.com is an advocate of the best trading robots and EAs, so this is a good platform to try out a new automated system. In fact, it even offers dedicated forex VPNs, which are highly conducive for running advanced trading bots around the clock.

If and when you decide to upgrade to a real money account, Forex.com offers some very competitive trading fees. There are several account plans to choose from, one of which allows you to trade commission-free. If you’re a seasoned pro trading larger volumes, an alternative account type offers spreads from just 0.2 pips on major pairs.

This will attract a small commission of $5 per $100,000 traded. There is also an STP Pro account, which gets the spread down to an industry-leading 0.1 pips. If you decide to trade with real capital, the minimum deposit is £100 on debit/credit cards and Paypal, and nothing when opting for a bank transfer.

Forex.com fees

| Fee | Amount |

| CFD trading fee | Variable spread |

| Forex trading fee | Spread. 0.2 pips for EUR/USD |

| Crypto trading fee | N/A |

| Inactivity fee | $15 a month after 365 days |

| Withdrawal fee | Free |

Pros:

- Specialist forex trading app

- Access to dozens of currency pairs

- Particularly strong when it comes to exotic currencies

- No minimum deposit when opting for a bank wire

- Also offers CFDs

- Heavily regulated – including US licenses

- Top-notch forex and economic new

Cons:

- KYC process is a bit long-winded

There is no guarantee you will make money with this provider.

How to Choose the Best Forex Demo Account for You

We have presented a selection of the best forex demo accounts right now. While some are suitable for newbies attempting to learn how to trade currencies for the first time, others are more conducive to advanced trading strategies.

Crucially, no two forex demo accounts are the same, so it’s worth doing a bit of research before you get started. With this in mind, below we explain what you need to look out for in your search for the best forex demo account.

Amount of Demo Funds

The best forex demo accounts that we reviewed come pre-loaded with a set amount of paper funds. For example, while eToro offers $100,000 in demo money, Forex.com offers £10,000.

You’ll want to ensure that the amount being offered is sufficient enough for you to learn the ropes of forex trading. After all, if you’re a newbie, there is every chance that you will encounter more losing trade than wining ones – especially at the start of your trading journey.

On the other hand, some of the best forex demo accounts allow you to top-up your paper trading balance.

Time Limits

You also need to explore whether or not the demo account comes with a time limit. We came across plenty of providers that only give you 30-days of usage.

This might not be enough time for you to learn how the forex trading market works if you are just starting out. This is why the best forex demo accounts come with no time limit at all. In particular, this is really useful if and when you come up with a new trading strategy later down the line.

In the case of eToro, there is no limit on how long you can use the demo account. On the contrary, you can switch between demo and real money mode at the click of a button.

Demo Account Functionality

This metric is perhaps the most important. In a nutshell, the best forex demo accounts will mirror live trading conditions like-for-like. In other words, you will be trading in live conditions, but in a 100% risk-free manner.

This is crucial, as the whole point of using a demo account is to learn and build effective trading strategies that eventually – you can use in the real forex scene.

Deposit Required

As noted above, most forex trading platforms require you to open an account before you can gain access to its demo account facility. This is fair, as the provider is allowing you to trade in live market conditions risk-free.

However, we came across several platforms that also ask you to make a deposit before you can use the demo account. These providers should be avoided, as the best forex demo account will never stipulate a requirement to deposit funds.

Currency Pairs

Once again, forex demo accounts are offered by regulated trading sites. While some sites offer dozens of currency pairs, others are somewhat thin on the ground.

As such, it’s important to check what forex trading pairs the platform offers, before going through the motions of using the demo account facility.

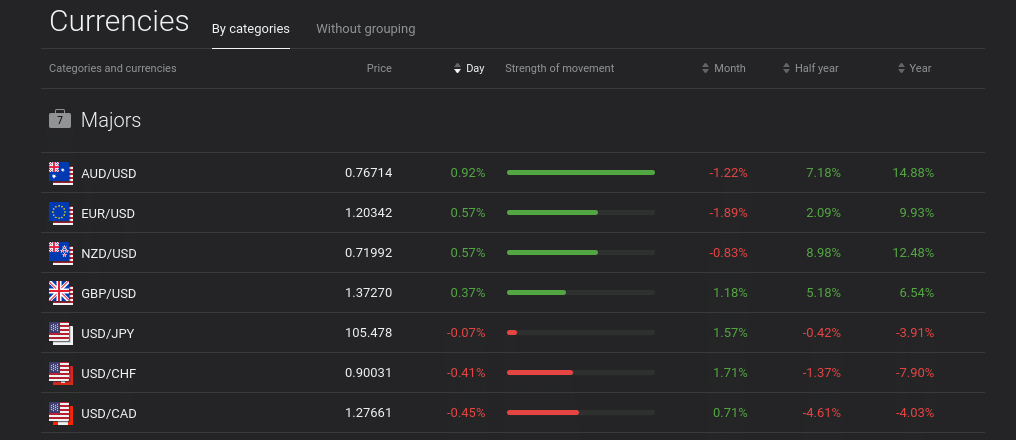

The most commonly traded markets are major pairs – which include the likes of EUR/USD, GBP/USD, and AUD/USD. But, if you’re looking to trade an exotic currency like the Thai baht, make sure this is supported.

Trading Tools & Analysis

Put simply, you should only consider a forex demo account if it comes packed with trading tools. If it doesn’t, then you won’t be able to perform analysis in-house and thus – make rational, sensible trading decisions. You may also want to explore the best forex signals providers, these work on your chosen broker account and aim to provide tips and insights in to future market trends.

When reviewing the best forex demo accounts, we came across the following tools:

Copy and Automated Trading

If you want to trade forex with real money but don’t know where to start – it’s worth considering an automated trading tool. There are several variations available in the market. For example, eToro offers a Copy Trading feature, which allows you to mirror the trades of an experienced forex pro.

Past performance is not an indication of future results

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Some forex brokers offer support for MT4/5, which allows you to install a third-party robot. This will trade around the clock on your behalf. You should, however, run the robot in demo mode for at least a few weeks to see how it performs in live market conditions.

Technical Indicators

In order to find trends when trading forex, you need access to technical indicators. There are more than 100+ such indicators in the market – all of which will analyze a particular metric.

For example, the RSI (Relative Strength Index) looks to assess whether a forex pair is potentially over or undervalued.

With this in mind, you’ll want to choose a forex demo account that comes packed with technical indicators, chart drawing tools, and other important analysis features. On the other hand, as long as the platform offers support for MT4/5, this will come with all of the technical research tools you’ll need.

How to Start Forex Trading

So now that we have discussed what you need to do to find the best forex demo account for your needs, it’s now time to get started!

There is no time like the present in this respect, as the best providers require no deposit to use the demo facility. Instead, you simply need to open an account.

To show you how easy this is with top-rated FCA broker eToro, we are now going to walk you through the process step-by-step.

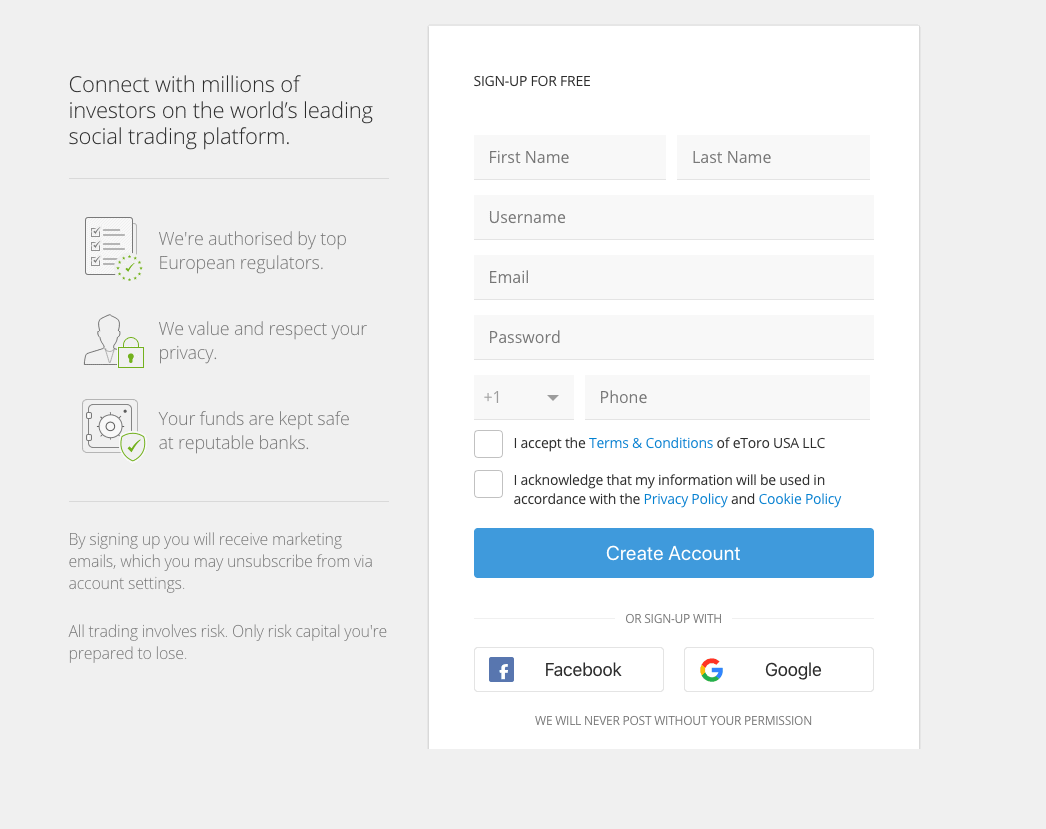

Step 1: Open a Trading Account

As noted above, the first is to open an account. Simple head over to the eToro website, click on ‘Join Now’, and follow the on-screen instructions.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

The platform will collect some personal information from you – as well as your contact details. You will also need to choose a username and password and verify your mobile number.

Step 2: Change to Demo Mode

Once you have opened an account, eToro will ask you to make a deposit. You can skip this step and instead switch ‘demo mode’ on. In doing so, you will have $100,000 in paper funds at your disposal.

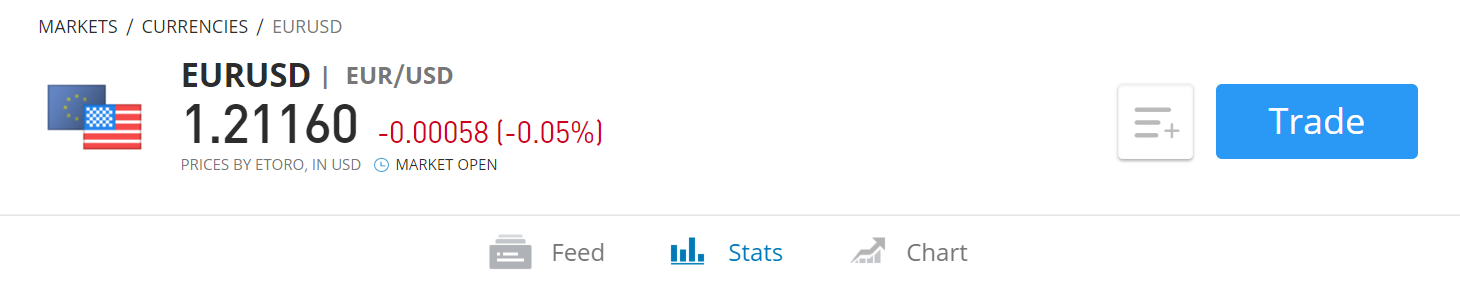

Step 3: Search for a Forex Market

Now you can search for a forex market that takes your interest. If you know which pair you wish to trade, search for it. In the example below, we are looking to trade EUR/USD.

Alternatively, click on the ‘Trade Markets’ button to view what forex pairs the platform supports. When you find a pair you like, click on the ‘Trade’ button.

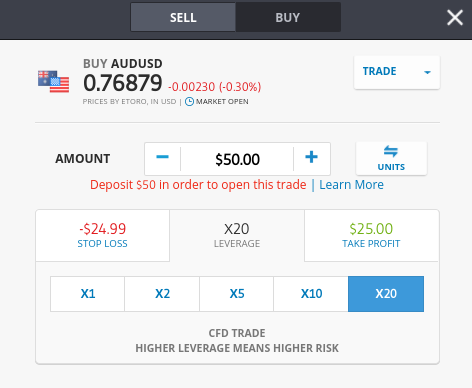

Step 4: Place a Demo Forex Trade

You will now see an order box on-screen. Put simply, eToro needs to know what trade you wish to place. As such, you first need to choose from a ‘buy’ or ‘sell’ order – depending on which way you think the price of the forex pair will go.

Then, you need to select your stake. Don’t worry, this is paper money, so you can stake as much or little as you like without needing to worry about monetary loss!

Finally, to complete your position, click on the ‘Open Trade’ button.

Once you close the position, you will be able to view the profit or loss on the trade.

Step 5: Upgrade to a Real Money Account

Perhaps a few days, weeks, or even months later – you might decide that you have the required skills to start trading forex with real money. If and when this is the case, doing this via eToro will result in a 100% commission-free experience.

All you need to do is:

- Meet a minimum deposit of $200 – or about £145.

- To do this instantly, choose from a debit/credit card or an e-wallet like Paypal

- Change your eToro account from demo mode into real money mode

Then, it’s just a case of repeating the steps you took when trading via the demo account facility.

Best Forex Demo Account – Conclusion

In summary, there are hundreds of online brokers that offer forex demo accounts However, it’s important to remember that at some point – you will likely want to start trading currencies with real money. As such, you should choose a forex demo account that meets your long-term trading goals.

As per our findings, we found that eToro offers the best forex demo account. By going through a quick 5-minute registration process, you’ll have access to 55+ forex pairs via a $100,000 paper trading balance. Once you eventually make the transition to a live account, you’ll benefit from a 100% commission experience.

eToro – Best Forex Demo Account

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.