How To Buy Bitcoin ETF Token (BTCETF) for February 2026

The community of investors and traders has long been waiting for the Bitcoin ETF, something that has been discussed more and more. Recently, the first premises appeared through an announcement by BlackRock. The investment company is negotiating with major market makers to legalize Bitcoin ETs.

This is where Bitcoin ETF crypto enters the market – a new project that aims to gather a community of enthusiasts who want to take advantage of the bull run that Bitcoin ETFs could bring to the crypto market. The whole project’s tokenomy is based on its native cryptocurrency – BTCETF. Our experts have invested over 25 hours studying this project. On this page, you will find everything you need to know about the new ETF token, as well as a step-by-step guide on how to become an early investor in this new token.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

-

-

How To Buy Bitcoin ETF (BTCETF) in 2026

Before delving deeper into the actual project, our experts decided to test how easy and fast you can buy Bitcoin ETF in 2026. The buying process has been manually simulated, and below we present a step-by-step guide to buying a Bitcoin ETF in less than 5 minutes.

Step 1: Fund your crypto wallet with ETH

BTCETF is listed on the UniSwap exchange which means that it can be purchased with ERC20 compatible tokens including ETH and USDT. We recommend trading the ETF/WETH pair.

To do this, you will need to fund a compatible crypto wallet with ETH. MetaMask is a good option because it works well with Uniswap.

You can either by ETH directly through MetaMask via Coinbase Pay. Or, you can send ETH to your wallet from a third-party exchange such as eToro.

Step 2: Connect your wallet to Uniswap

Once you have added funds to your wallet, connect it to the UniSwap exchange by clicking ‘connect wallet’ and choosing the suitable option.

You may need to verify the connection with the wallet provider by entering your passcode.

Step 3: Swap ETH for BTCETF

Once your wallet is connected to the exchange, you will be able to swap ETH for BTCETF in the swapping interface. Simply enter the amount of ETH that you would like to swap for Bitcoin ETF and confirm the transaction.

Note; you will need to pay network fees which means that you will not be able to swap your entire ETH balance for BTCETF. It may take a few minutes for the transaction to complete. You can check the status of the transaction in Etherscan.

Step 4: Stake your tokens

After buying Bitcoin ETF, you can start staking your tokens for passive rewards. To do this, head to the official Bitcoin ETF website, connect your wallet and start staking. Once you tokens are staked, you will start receiving daily rewards.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

What is Bitcoin ETF?

Now that you know how to buy a Bitcoin ETF, let’s take a look at the project itself. Our experts recommend investing only in the projects that you have analyzed in depth; therefore, we invite you to spend another 5-7 minutes reading this article to the end and learning all the important details about the Bitcoin ETF.

The Bitcoin ETF Token (BTCETF) is a new cryptocurrency that is related to the launch of Bitcoin ETFs requested by pension funds, hedge funds, and large asset management companies. In addition to offering BTCETF token owners huge staking benefits (currently more than 5,400 percent, which will decrease later), the project can also expect strong growth due to planned burns.

The BTCETF project aims to capitalize on the returns that are expected upon the approval of a Bitcoin ETF asset. The token is an anticipatory measure for the Bitcoin ETF rush, which means that the success of the new coin will largely correlate to the approval of a new crypto ETF. According to the data presented by Statista, the world market of ETFs is valued at over 9.6 trillion dollars.

BTCETF tokenomics

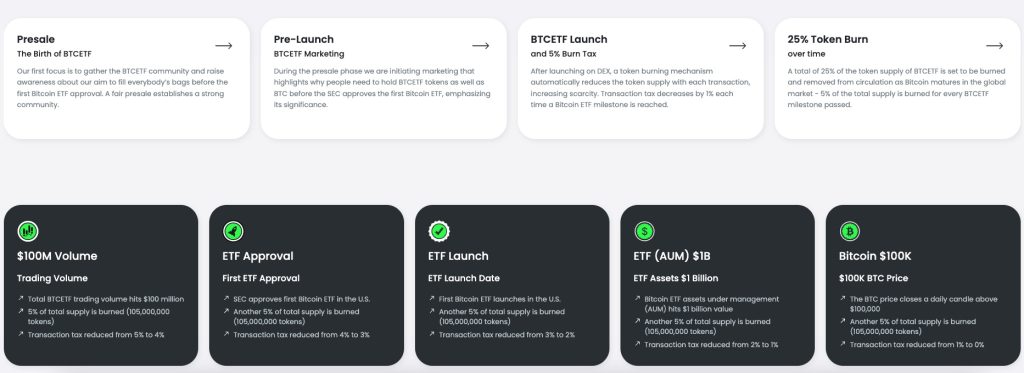

Tokenomics is one of the main aspects that our experts draw attention to when analyzing new cryptocurrency projects. The Bitcoin ETF, in this sense, has positioned itself as a project with a sustainable tokenomy. First, the token is deflationary, as its total supply is limited to 1.2 billion tokens.

The deflationary character is also accentuated by the token burning, as foreseen by the development team. According to the Whitepaper, a total burning of 25% of the total token issue is planned. Tokens are burned at each transaction in the amount of 5% of the transaction value.

BTCETF tokens can be staked by early investors for passive rewards. 25% of the token supply will be held for staking rewards that will incentivize investors to hold their tokens long-term. Staking will ensure network security and stability.

Is Bitcoin ETF token legit?

Most investors ask themselves this question about any new project launched on the crypto market. It is for this reason that our experts analyzed in depth the Bitcoin ETF and important aspects related to the honesty of the project.

- Contract code: the project has an official contract code (on Ethereum): 0x3c87AAff27f1085B67cd742302939a50E2F2d406

- Audit: The project has gone through an official and in-depth audit by Coinsult

- Transparent fees: The audit demonstrated that fees cannot exceed 5% of the transaction amount

- Security: The project has passed all the cyber attack simulations performed during the audit

- Solid Tokenomics: The team behind the project has taken care to ensure all activities vital to the development of the token, including marketing.

Considering the above, you realize that this is a legitimate token that you can invest in without fear of it being a scam.

The Bitcoin ETF roadmap

The advantage and special feature of Bitcoin ETF is that the project roadmap is related to the actual evolution of Bitcoin and the approval of Bitcoin ETFs. Right now, the first phase of the roadmap – the BTC ETF presale – has recently come to an end. After this, the marketing campaign is planned, and with the launch of the BTC ETF on the DEX, the token-burning mechanism will also be launched (to maintain the deflationary character of the Bitcoin ETF).

The next major step in the Bitcoin ETF roadmap will begin once the SEC approves the first Bitcoin ETF. In this context, experts forecast an increase in the price of BTC and, respectively, a potential increase in the value of the BTC ETF.

What is the likelihood that Bitcoin ETFs will be approved?

Currently, several sources and experts are talking about the fact that the legitimization of Bitcoin ETFs is inevitable and is only a matter of time. Our experts have analyzed several reliable sources that talk about it, we present to you the important details below:

- Grayscale is very Close to entering dialogue with SEC on legalizing Bitcoin ETFs – Bloomberg

- SEC already reviewing 8-10 filings on approval of Bitcoin ETFs – Reuters

- BlackRock is in the process of negotiating with the main market makers regarding the collective request for the approval of the Bitcoin ETF by the SEC – Medium.

BTCETF locked liquidity

Bitcoin Tokenomy also provides 10% of the total issue reserved for token liquidity. This is an important aspect that ensures a high degree of liquidity for the Bitcoin ETF. So BTCETF is a token, which you will soon be able to resell later (and if the roadmap develops as predicted, you may be able to resell BTCETF at an increased price).

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

Is BTCETF a Good Investment ?

Based on our expert’s opinion, the project has the potential to be the next cryptocurrency to explode. After analyzing the Bitcoin ETF token, our experts concluded that it may have potential for future growth, with investors expecting unrealized gains when crypto ETFs are launched.

However, the token’s sales tax and additional 5% fee may cause demand to outstrip supply, leading to a significant increase in the price. In the long term, supply will decline due to sales tax and burning at each stage, with demand increasing with news about Bitcoin ETF development.

But potential investors should also keep in mind that BTCETF also involves some risks and uncertainties. For example, the uncertainty and unpredictability of the SEC’s decision on Bitcoin ETFs could affect the token’s price and demand.

Also, the lack of transparency and regulation of the project, according to our experts, could expose the token holders to fraud, hacking, or scams. Based on all of the above, it cannot be certain whether the Bitcoin ETF token is a good investment, so investors should be cautious and do their own research before buying the token.

Pros and cons of buying bitcoin ETF in February 2026

Pros:

- Roadmap related to the actual evolution of Bitcoin and the approval of Bitcoin ETFs

- Reduced Token Price (1 BTCETF – $0.005)

- Well thought out Tokenomy

- Token verified by an in-depth audit

- Staking ensured by 25% of the total issue

Cons:

- The fate of the token depends on the SEC’s approval of the Bitcoin ETFs

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

How much potential does the Bitcoin ETF Token have?

The Bitcoin ETF Token is the first cryptocurrency of its kind. So far, no such product as the Bitcoin ETF has been launched in the US market, and no token has had any tangents or direct link, according to data analyzed by our experts, between tokens and regulatory events such as the approval of the Bitcoin ETF by the SEC.

This makes it difficult to accurately predict the potential price of the Bitcoin ETF token. However, our experts are optimistic about BTCETF and estimate that it could see a gain of 10x or more over the initial pre-sale price by the time it reaches the 5th and final burn stage.

The combination of sales fees and stake rewards ensures that few BTCETF tokens will reach the market, keeping prices high. And the burn phases will build anticipation and provide potential upside shocks to the token price.

If our prediction of a 10x increase is correct, the Bitcoin ETF token could eventually reach a market cap of over $50 million and a price of over $5 per token.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

Bitcoin ETF token covered on crypto media portals

As a possible approval of the Bitcoin ETF Spot by the SEC gets closer, BTCETF is being widely discussed on crypto media platforms and by influencers. A popular and well-known crypto influencer on Youtube, going by the nickname Coin Bureau, with over 2.360.000 subscribers, discussed in his video the potential impact of a spot Bitcoin ETF on the market dynamics and BTC’s price.

The video, where he highlights the market dynamics shift by analyzing the correlation of BTC with other assets and the potential impact of ETF approval on its price, gained over 200K views in just 2 days.

On the other hand, the Bitcoin ETF token is described as ”highly appealing” by another crypto analyst on YouTube. Mattew Perry, who owns a YouTube channel with over 204K subscribers, discusses the concept of the Bitcoin ETF token and its potential popularity.

Perry highlights the benefits of buying and staking the token, as well as the milestones and burning mechanism associated with it. The influencer claims that ”the approval of ETFs is expected to bring billions or trillions of dollars into the crypto market”.

Conclusion

Bitcoin ETF is a new token launched in response to the hype about the SEC approval of Bitcoin EFTs. The developers of the project and the creators of the token have given it a well-thought-out tokenomy, which includes all the imploring aspects: liquidity, staking, and marketing.

Our experts have deeply analyzed the legitimacy of the token and convinced themselves that it is not a scam. Another aspect that our experts drew attention to is the low price level – only $0.005 per token at the time of writing. The current price level is temporary and is planned to increase soon.

BTCETF will follow the success of Bitcoin ETFs which means that it could see impressive returns in 2026. You can invest in the token by connecting your crypto wallet to Uniswap and swapping ETH or USDT for BTCETF.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk.

FAQ

What is a Bitcoin ETF?

Bitcoin ETF is a new token developed on the Ethereum blockchain, launched in the circumstances in which there is more and more talk about the approval by the SEC of Bitcoin ETF. With well-thought-out tokenomics, the token has a real chance to grow shortly.

How do Bitcoin ETFs work?

Bitcoin ETF roadmap is tied to actual Bitcoin price evolution as well as SEC legitimization of the first Bitcoin ETF.

What are the pros and cons of crypto ETFs?

The community of crypto investors and traders appreciate crypto ETFs because of the great advantage they offer – the ability to trade cryptocurrencies without owning them. The main downside here is the price inaccuracy, as well as the general risks, associated with trading ETFs.

Where can I buy Bitcoin ETF?

Bitcoin ETF is currently available to buy on the Uniswap DEX. The team plans to list the token on further exchanges throughout the roadmap.

Why was the Bitcoin ETF token created?

Bitcoin ETF was created in response to the topic circulating about the approval of the Bitcoin ETF by the SEC. The development team decided to create a token, which will gather around it a community of crypto ETF and Bitcoin ETF enthusiasts.

References:

-

- https://medium.com/@OKGResearch/the-key-to-open-the-floodgate-of-blackrocks-bitcoin-etf-market-maker-718e62399fb3

- https://www.reuters.com/business/finance/sec-has-8-10-filings-possible-bitcoin-etf-products-gensler-2023-10-26/#:~:text=To%20date%2C%20the%20SEC%20has,to%20the%20five%2Dmember%20commission.

- https://www.bloomberg.com/news/articles/2023-10-14/grayscale-s-bitcoin-etf-push-what-s-next-after-sec-doesn-t-appeal-court-ruling#xj4y7vzkg

- https://www.statista.com/topics/2365/exchange-traded-funds/#topicOverview

- https://www.investing.com/news/cryptocurrency-news/bitcoin-etf-tokens-presale-attracts-35k-in-one-day-promising-deflationary-measures-93CH-3225225

Antonio Bors Finance and Crypto Writer

View all posts by Antonio BorsAntonio is a cryptocurrency and finance writer with 3 years of experience in the finance niche. Before working as a write, Antonio studied at the Universitatea „Dunărea de Jos” din Galați where he received a Masters Degree in Organizational Communication.

Antonio is passionate about investments, blockchain and content marketing. As well as writing for Trading Platforms, Antonio has written content for Dad Accountant and the Jivvy Group. His studies and professional background in Finance and Marketing help him make reliable predictions and share them with the community of enthusiasts who share similar interests to his. Antonio actively invests in several fields, including crypto and stocks, which allows him to share his own investment experience as well.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up