Best Forex Trading Strategies 2026 – Beginner’s Guide

If you’re thinking about buying and selling currencies online – you’ll need to have a few forex trading strategies under your belt. Not only will this ensure that you protect your bankroll – but you’ll have a much better chance of making consistent, risk-averse profits.

In this guide, we discuss the best forex trading strategies for beginners.

-

-

Rating5Mobile App10/10RegulationFCA CYSEC ASICBillMin.Deposit$50Leverage max50Forex pairs49Fees & spreadsEUR/GBP1.5 pipsEUR/USD1 pipEUR/JPY2 pipsEUR/CHF5 pipsGBP/USD2 pipsGBP/JPY3 pipsGBP/CHF4 pipsUSD/JPY1 pipUSD/CHF1.5 pipsCHF/JPY6 pipsEUR/RUB2USD/RUB1000Additional FeeContinuous FeeVariableConversion Fee50 pipspipsTrading platformsDemoWebtraderCopytradingMt4STP/DMACtraderMT5AvasocialAva OptionsLeverageFCACYSECASICCFTCNFABAFINCMASCBDFSACBFSAIBVIFSCFSCAFSAFFAJADGMFRSAActiveForexIndicesActionsCryptocurrenciesRaw MaterialsETFSAdditional characteristicsIslamic AccountEducation & WebinarsCharts & ToolsScalpingSpread BettingAutomated TradingFree Forex SignalsPayment methodsBank TransferCredit CardGiropayNetellerPaypalSepa TransferSkrillSofort

Best Forex Trading Strategies 2026 List

The best forex trading strategies ensure that you find the perfect balance between risk management and upside potential. The strategies that we are going to discuss in this guide can be used by forex traders and scalpers of all shapes and sizes – especially those with little to no experience of the currency scene.

- Master the Basics and Trade With eToro

- Practice on a Day Trading Simulator With Libertex

- Create a Bankroll Management Plan

- Become a Swing Trader

- Consider Automated Forex Trading

- Take a Forex Trading Course to Learn Technical Analysis

- Make Sure You’re Using a Low-Cost Platform

Your capital is at risk.

67% of retail investor accounts lose money when trading CFDs with this provider.

Forex Trading Strategy 1: Master the Basics

The best forex trading strategy for those that are just starting out in the world of currency speculation, is to ensure you have a firm grasp of the basics. If you don’t, you are certain to walk away from your forex endeavors at a financial loss.

Although there is much to learn about online forex trading – we would argue that there are three core pillars to understand fully. This includes pairs, pips, and orders.

Forex Pairs

Forex markets are traded in pairs – which will contain two competing currencies. The specific currencies within each pair will determine the market category – which includes majors, minors, and exotics.

- The best forex trading strategies you come across should tell you to focus on major pairs.

- These are pairs that contain the US dollar and another strong currency – such as the Japanese yen or Euro.

- Crucially, these pairs are the most traded in the forex scene, and thus – they possess the most liquidity, tightest spreads, and lowest levels of volatility.

Alternatively, you also have minor pairs – which contain two strong currencies but never the US dollars. Examples include EUR/GBP and NZD/AUD.

The final pair category – which is best avoided as a beginner, is exotics. These pairs will contain a currency from a non-major economic region – such as South Africa, Peru, Kenya, and Turkey. Naturally, the spreads and volatility levels on exotic pairs can be huge – so stick with majors.

Forex Pips

Understanding how percentage in points work – or PIPs, is also a crucial strategy. In a nutshell, when the exchange rate of a currency pairs suffer fluctuations (the market moves up and down) – this is calculated in pips. Other than pairs containing the Japanese yen, most user-friendly forex trading platforms will display five digitals after the decimal.

- For example, if you’re trading GBP/USD – the exchange rate might look like this: 1.38609

- If the above pair increase to 1.38619 – that’s would be a price action trading movement of 10 pips

The number of pips that the pair moves by will ultimately determine how much you make or lose. As such, it’s really important that know how forex pips work before risking any money.

Forex Orders

When buying and selling currencies via a day trading platform – you’ll need to let your broker know what position you wish to take.

For example:

- If you think that that USD/CAD will rise – you need to place a buy order

- If you think that USD/CAD will fall – you need to place a sell order

In addition to a buy/sell position – you can also place risk-management orders. This ensures that you have a clear entry and exit strategy on your forex trade.

For example:

- Let’s say that USD/CAD is priced at 1.22824

- You want to enter the market when the pair breaks 1.22900

- As such, you can specify this exact price via a limit order

- Once the trade is live – you might want to cap your potential losses by 1%. You can do this via a stop-loss order – meaning the broker will close your position if it goes down by 1%

- You can also set up a take-profit order to lock in your gains. For example, you might enter this at 4% – meaning the broker will close the position if it increases in value by 4%.

Ultimately, ensuring that you understand the ins and outs of limit, stop-loss, and take-profit orders is one of the best forex trading strategies that you can learn as a beginner.

Forex Trading Strategy 2: Practice on a Day Trading Simulator

Once you have done your homework on forex pairs, pips, and order types – it’s then time to start trading. However, we would strongly suggest that you start off with a day trading simulator. These are essentially demo accounts offered by online brokers and they allow you to trade in live currency market conditions without risking any money.

We would suggest considering eToro for this – as the regulated broker offers the following:

- Free day trading simulator without you needing to make a deposit

- Demo trading account mirrors actual market conditions

- 49 forex pairs supported

- Tight spreads and 0% commission

- The simulator is pre-loaded with $100,000 in paper trading funds

- You can use the demo facility for as long as you wish

Ultimately, eToro allows you to practice the best forex trading strategies in a 100% risk-free ecosystem – and it takes just minutes to get the demo account set up!

Forex Trading Strategy 3: Create a Bankroll Management Plan

Once you have spent a reasonable amount of time practicing on a forex demo account and you feel ready to start trading with real money – make sure you create a bankroll management plan.

In its most basic form, this will ensure that you never risk more than a certain amount on each trade. This should be stipulated in percentage terms and multiplied by your current brokerage account balance.

For example:

- Let’s say that you want to create a bankroll management plan that limits your forex trades to 1% of your balance

- You start off with a balance of $2,000

- This means that your first trade cannot exceed $20

- A few days later, your balance stands at $2,300 – so your maximum stake is now $23

- In 6 months time – you have built your balance to $5,000 – so that’s a maximum stake of $50

It is important to note that a bankroll management plan not only increases your stake. On the contrary, if you are going through an extended losing period of time – your maximum stake size will go down.

Your capital is at risk.

67% of retail investor accounts lose money when trading CFDs with this provider.

For example, if you started with $2,000 but your balance now stands at $1,500 – your maximum stake has been reduced to $15 from $20. Crucially, this ensures that you never burn your account balance in its entirety – which is why bankroll management is one of the best forex trading strategies for beginners.

Forex Trading Strategy 4: Become a Swing Trader

You might be under the impression that most currency speculators are day traders – meaning that they open and close positions within a few hours or even minutes. However, some of the most successful currency traders actually prefer to take a swing trading strategy.

The overarching reason for this is that you are not pressured into closing a position before the end of the day. On the contrary, forex swing trading offers much more flexibility – so you can keep positions open for hours, days, or even weeks.

This is much more conducive for beginners – as you can take your time researching the markets and thus – you can avoid having to make quick and instant decisions. In terms of forex swing trading strategies, a good starting point is to focus exclusively on financial news.

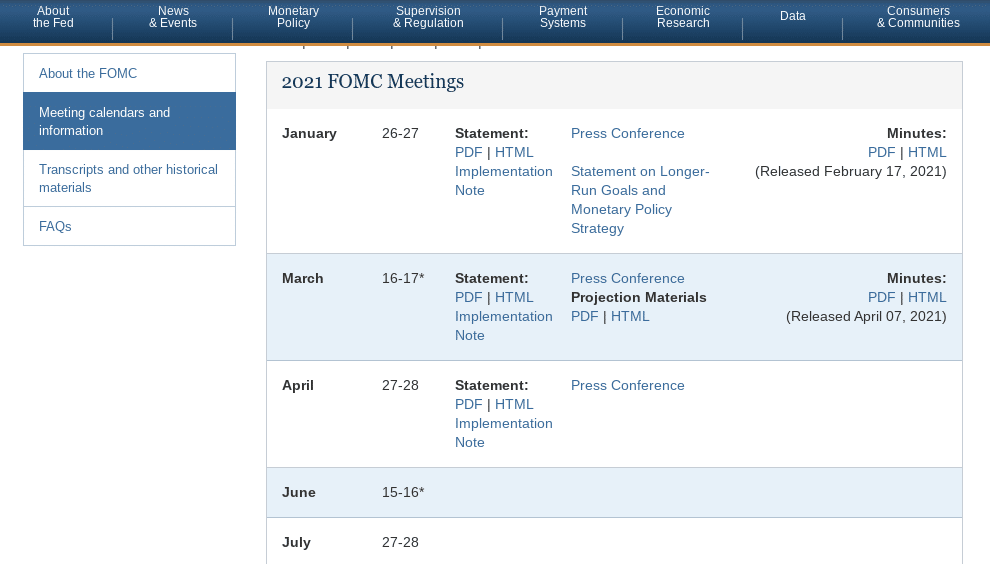

This means that you don’t need to understand how to read and analyze pricing charts or charts patterns. Instead, you will be entering and exiting trades based on real-world events. To do this, you’ll need to look out for crucial developments like interest rate changes, economic data (e.g. GDP levels), geopolitical events, and more.

Your capital is at risk.

67% of retail investor accounts lose money when trading CFDs with this provider.

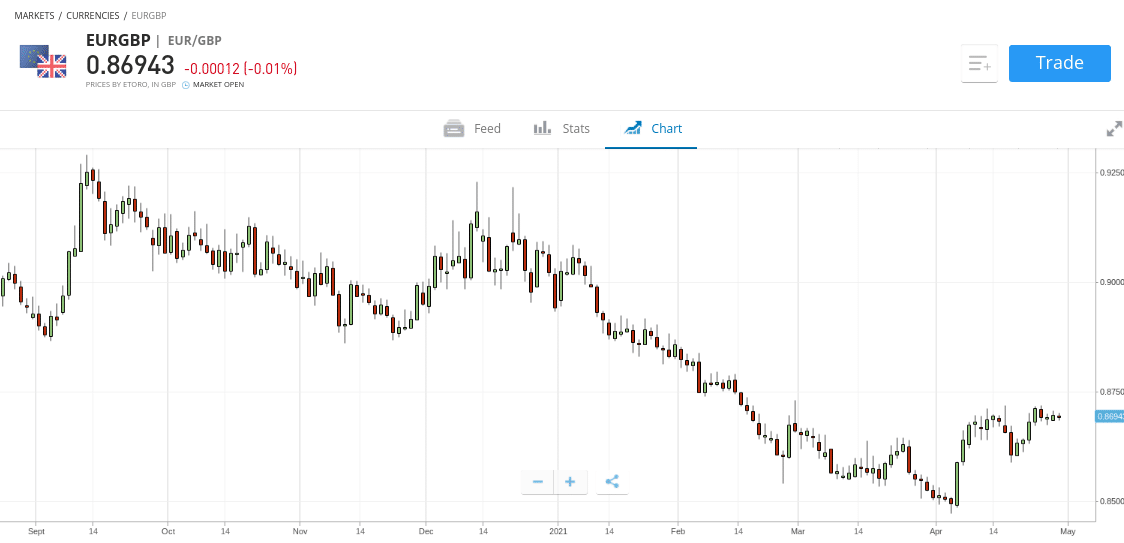

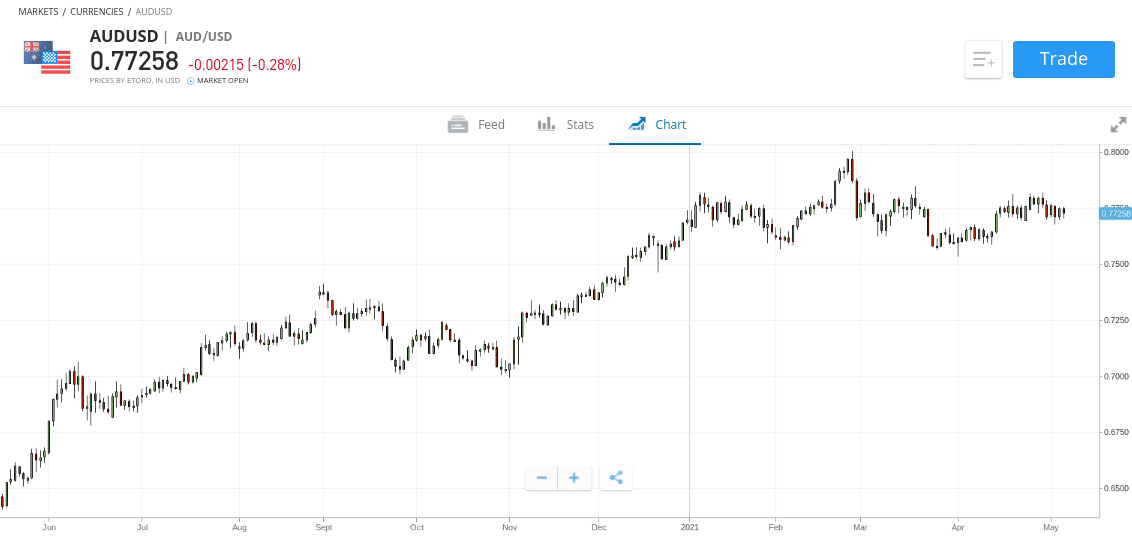

Another idea that you might consider in your search for the best forex swing trading strategies is to identity a prolonged trending. For example, in the image above – you can see that NZD/USD has been on an extended upward trajectory for many, many months.

A swing trader would look to capitalize on this by keeping a buy order open on NZD/USD for as long as the trend remains in play.

Forex Trading Strategy 5: Consider Automated Forex Trading

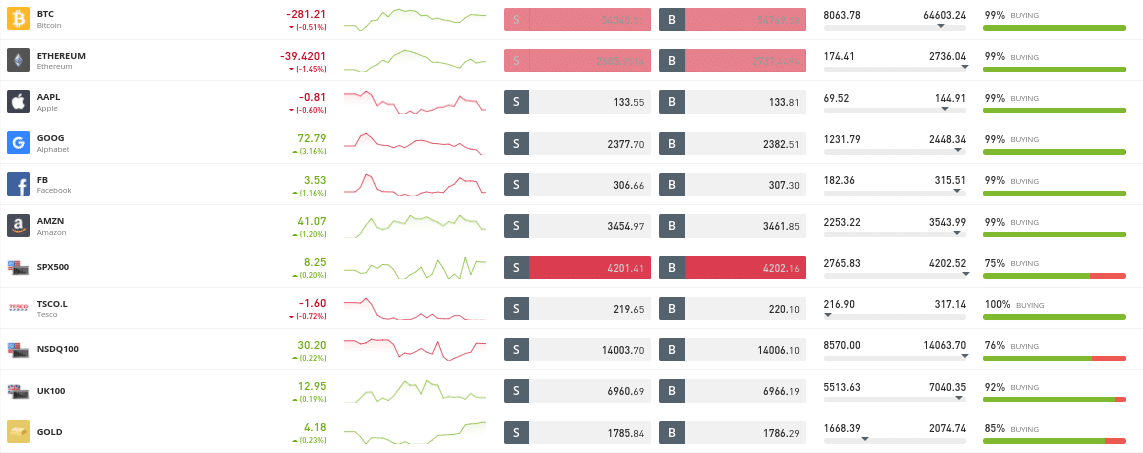

The best forex trading strategy for those without any knowledge of technical or fundamental analysis is to consider an automated system. By this, we mean trading in a fully autonomous manner – relying on a piece of pre-programmed software of a Copy Trading platform.

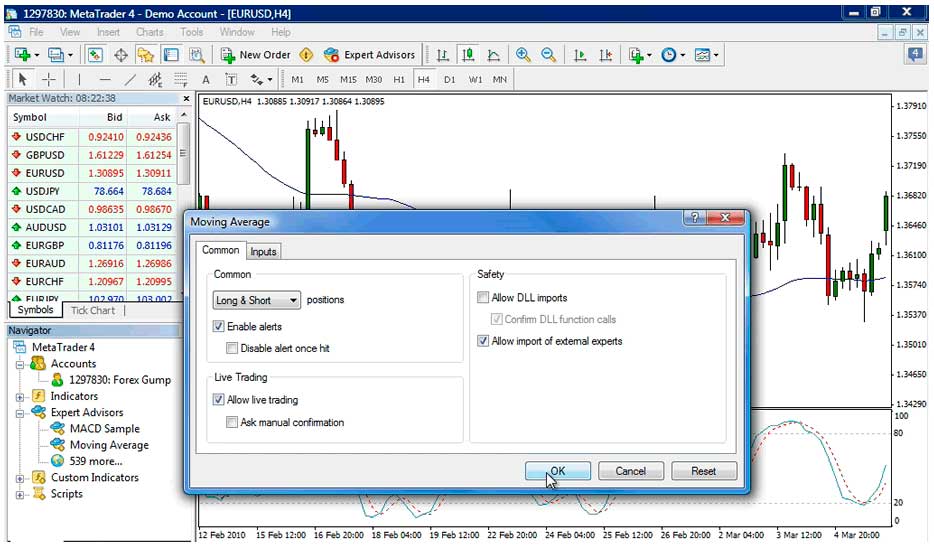

Regarding the software option, this will come in the form of a forex EA (expert advisor) – which is essentially a trading robot. You will purchase the robot from a third party, and then install it into MT4. Once activated, the robot or forex EA will start trading on your behalf.

However, this form of automated trading is fraught with risk, as you never know what you are getting with a robot. For example, the robot provider might claim that the underlying software is able to outperform the market consistently. But, in reality, it could end up blowing through your account balance on the first day.

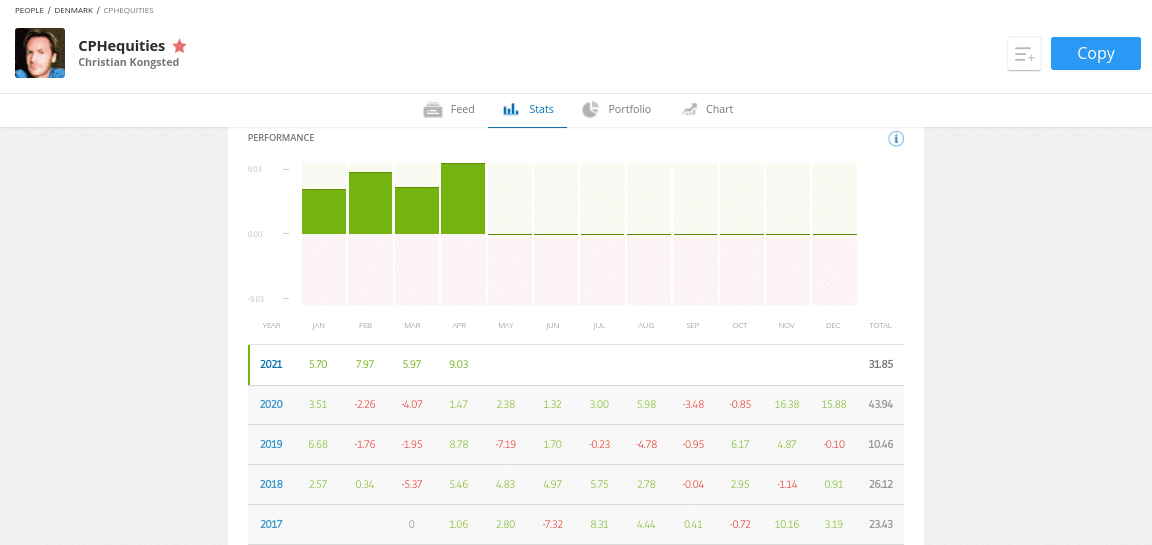

Instead, Copy Trading via a regulated online broker is a much better option. For example, at eToro, you can copy a seasoned trader like-for-like and know that the data in front of you is 100% valid. In other words, you can view stats surrounding the trader’s historical performance, preferred forex pairs, average trade duration, and risk level.

Ultimately, once you select a top-rated Copy Trading pro – you can sit back and invest in a passive nature. This means that you won’t need to spend countless hours researching the forex markets yourself.

Forex Trading Strategy 6: Take a Forex Trading Course to Learn Technical Analysis

At some point in your currency trading career, you will need to understand the art of technical analysis. After all, the best forex trading strategy employed by seasoned investors is to read and interpret pricing charts. The only way to do this is to learn about the many different technical indicators in the market.

These indicators will look to analyze the historical pricing data of a forex pair and will look for a specific trend. For example, the technical indicator will look to evaluate whether a forex pair is overbought or oversold, or perhaps whether a particular support or resistance level is about to broken.

Your capital is at risk.

67% of retail investor accounts lose money when trading CFDs with this provider.

Either way, there are dozens of technical indicators that are popular with seasoned forex traders – so consider taking a course so you can incorporate this into your short-term trading strategy. Once you know your way around a pricing chart, you’ll be able to deploy some of the best forex day trading strategies utilized in the currency scene.

In other words, you’ll be able to actively enter and exit positions throughout the day – as opposed to taking a more passive approach via swing trading. Don’t forget – you can always revert back to your eToro demo account when practicing a new day trading strategy – meaning you won’t be risking any capital.

Note: Some of the best indicators to start with include the moving average, support and resistance levels, trend trading lines, and downtrend and uptrend price movements.

Forex Trading Strategy 7: Make Sure You’re Using a Low-Cost Platform

Often overlooked by newbies, one of the best forex trading strategies is to ensure your chosen broker offers super-low fees. After all, if your broker charges high commissions or wide spreads – many of the best forex day trading strategies discussed today will not be possible. Instead, you’ll find that your risk-averse profit margins get eaten away at by expensive trading fees.

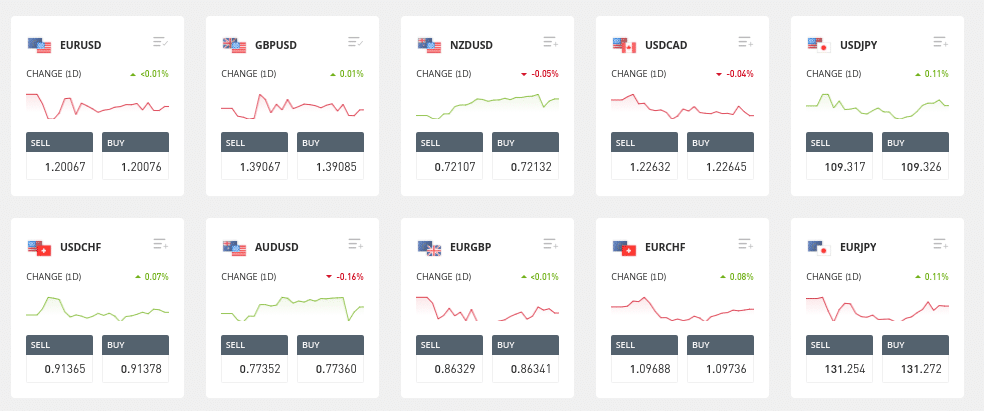

The two main fees that you need to look out for when choosing a forex broker is the spread and commission.

Spreads

The spread is simply the difference between the buy and sell price of a forex pair. We explained how pips worked earlier – so should be able to calculate the spread with ease.

For example:

- Let’s suppose that you are trading EUR/USD

- Your broker is quoting a buy price of 1.19996

- The sell price is being quoted at 1.19994

- The difference between these two prices is 2 pips

- As such, the spread on EUR/USD in this example is 2 pips

The number of pips that the spread is quoting will tell you how much you need to make in a position to cover your costs. In this example, this means that your position needs to grow by 2 pips just to break even. If it increases by 3 pips, your net profit is 1 pip when factoring in the spread.

Commission

In addition to tight spreads your chosen forex broker should also offer low commissions. In fact, the best forex brokers in the online space will charge you no commissions at all. This includes the likes of eToro and AvaTrade, which we discuss in more detail shortly.

In other cases, your chosen broker might charge commission in percentage terms. For example, if you are being quoted 0.2% and you stake $2,000 – you will pay a commission of $4 to enter the market. When you close the trade, you will again pay a commission of 0.2%.

Best Forex Trading Platforms 2026 Revealed!

The section above explained that one of the best forex trading strategies for beginners is to choose a low spread and zero commission broker. However, when choosing a broker, you need to look at a variety of other factors.

For example, is the broker regulated, does it offer transparent trading conditions, and what currency pairs are supported. Additionally, don’t forget to look at accepted payment methods and minimum account balances.

To ensure you are able to deploy the best forex trading strategies in the most effective way possible – below you will find a small selection of brokers that are worth considering.

1. eToro – Overall Best Forex Trading Platform 2022

If you’re looking to start deploying the best forex trading strategies discussed today – eToro is a great shout. This regulated forex broker offers dozens of major, minor, and exotic pairs – all of which come with tight spreads. You won’t pay any commissions at eToro – making it perfect for both day and forex swing trading strategies alike.

Before you start trading with real money, you might consider the demo account offered by eToro. As noted earlier, you can access this as soon as you register, there is no requirement to make a deposit, and your demo account comes with $100k in paper funds. When you get around to trading forex with real capital, you can fund your account with a debit/credit card, e-wallet, or bank wire.

eToro also offers the Copy Trading tool that we discussed earlier. This means that you can trade forex passively – as your chosen currency trader will buy and sell on your behalf. This tool comes fee-free, albeit, the minimum is $500 per copy trader. eToro is really simple to use, too – making it perfect for newbies. In terms of safety, eToro is regulated by the FCA, ASIC, and CySEC.

Pros:

- Super user-friendly trading platform with 20 million+ clients

- Buy stocks without paying any commission or share dealing charges

- 2,400+ shares and 250+ ETFs listed on 17 international stock markets

- Trade cryptocurrencies, commodities, and forex

- Deposit funds with a debit/credit card, e-wallet, or bank account

- Ability to copy the trades of other stock trading pros

- Regulated by the FCA, CySEC, ASIC and registered with FINRA

Cons:

- Not suitable for advanced traders that like to perform a trading style based on technical analysis

Your capital is at risk.

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Libertex – Forex Trading Platform with ZERO Spreads

Next up is Libertex – a hugely popular forex and CFD trading platform that allows you to enter and exit the market without paying any spreads. Instead, you will pay a super-small commission per slide.

This pricing structure operates like a conventional ECN broker account – which is especially ideal for forex day traders. Much like eToro, Libertex offers a great selection of major, minor, and exotic currencies.

The platform allows you to trade via its website or through third-party providers MT4 and MT5. There is also a mobile app – should you wish to trade forex on the move. Libertex is regulated by CySEC and had a 20+ year track record in the online forex trading scene.

Pros:

[/su_list]- Tight spread CFD trading

- Very competitive commissions

- Good educational resources

- Long established broker

- Trade stocks and indices like the Dow Jones

- Compatible with MT4

- Great choice of financial markets

Cons:

- As a disclaimer, please take into consider that CFDs are only available

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

3. AvaTrade – Best Forex Trading Platform for Technical Analysis

We discussed earlier how technical analysis is one of the best forex trading strategies to learn as a beginner. If you’re ready to take the plunge – AvaTrade is a good option. This platform is fully compatible with MT4 and MT5 – which are both packed with technical indicators and candlestick time frames.

AvaTrade offers a free demo account that you can connect to the aforementioned third-party platforms – meaning you can practice technical analysis risk-free. This top-rated forex broker also offers plenty of educational resources that can help you learn how to read pricing charts effectively.

When it comes to fees, AvaTrade allows you to enter and exit forex positions without paying any commission. Plus, when trading major pairs, you’ll get some of the best spreads on offer. AvaTrade is regulated in six regions and allows you to deposit funds with a debit card or bank wire.

Pros:

- Zero commissions and tight spreads

- Supports MT4/MT5

- A great trading platform for automated trading

- Regulated in several jurisdictions

- No deposit or withdrawal fees

- Low deposit requirement of just £100

Cons:

- No traditional investments

- Charges inactivity fee

79% of retail investors lose money trading CFDs at this site

How to Start Forex Trading with Strategy

If you’re ready to deploy one or more of the best forex trading strategies discussed today – we are now going to walk you through the process with commission-free broker eToro.

Step 1: Open an Account and Upload ID

Visit the eToro website and click on the ‘Join Now’ button. You will need to provide some personal information – such as your full name, nationality, and contact details.

Your capital is at risk.

67% of retail investor accounts lose money when trading CFDs with this provider.

Although you don’t need to upload any ID to use the demo account facility – it’s best to quickly do this now. After all, there will come a time when you decide to start trading with real money. All you need to do is upload a copy of your government-issued ID and a proof of address.

Step 2: Use Demo Account

We mentioned earlier that one of the best forex trading strategies for beginners is to start off with a demo account. All you need to do at eToro is switch your account from ‘real’ to ‘virtual’. In doing so, you’ll have $100k in paper funds to use at your disposal!

Step 3: Deposit Funds

When you are ready to trade in live market conditions – you’ll need to make a deposit. You can choose from a debit/credit card, bank wire, or an e-wallet like Paypal.

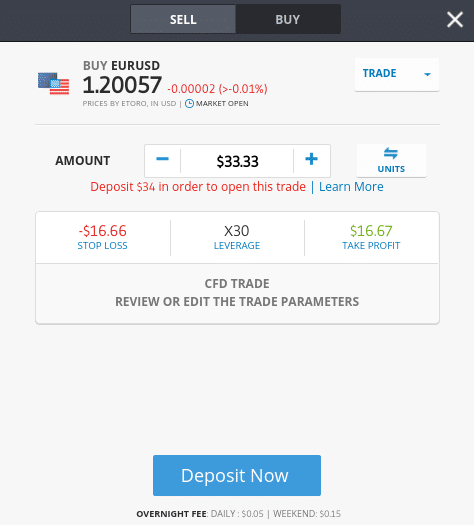

Step 4: Place Real Forex Trade

Now that your account is funded you can search for the forex pair you wish to trade. Then, you’ll need to set up a real order so that eToro knows what position you wish to take.

Once you have filled in your order details – confirm the position by clicking on ‘Set Order’.

Conclusion

This guide has covered some of the best forex trading strategies for beginners. Each and every strategy can be deployed through a good online broker. In fact, when opting for eToro, you can try the best forex day trading strategies discussed today in a risk-free manner. This is because all eToro users get a free demo account simply for signing up.

Plus, you’ll find dozens of forex pairs on the platform – all of which can be traded commission-free. The final icing on the cake is the eToro Copy Trading feature – which allows you to copy an experienced currency trader in a fully passive nature!

eToro – Try the Best Forex Trading Strategies

Your capital is at risk.

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

How to choose a forex trading strategy?

In order to choose the best forex strategy for you - spend some time thinking about your financial goals. For example, if you can only commit a certain amount of time to forex - swing trading is the way forward. But, if you are prepared to trade forex on a full-time basis - day trading will likely suffice. Once you become a pro - you might then consider forex scalping and break out strategies.What is a forex trading strategy?

A forex trading strategy will ensure that you trade currencies in a risk-averse way. It will ensure you protect your capital in the long run and deploy sensible entry and exit positions. Ultimately, all successful traders have a strategy in place - so make sure you find one that works for you!How to backtest forex trading strategy?

The most effective way to backtest a forex trading strategy is to use a demo account. eToro, for example, offers a free demo account with $100k in paper trading funds. This will mirror actual market conditions and thus - you can backtest your forex trading strategy.What is the best strategy in forex?

One of the best forex trading strategies is to stick with a risk-reward ratio. For example, many traders will opt for a ratio of 1:3 - meaning they risk 1% of their capital to make 3% in profit.How to create a forex strategy?

The best way to create a forex strategy that works for you is via trial and error. You can do this without risking any money on a top-rated demo account that mirrors live market conditions.What is the best forex trading strategy for beginners?

We would argue that the best forex trading strategy for beginners is one that combines research with a day trading simulator. In other words, you should learn the theory of forex trading, while practicing this via a risk-free demo account.What is a good forex trading strategy?

One of the best forex strategy ideas to consider is to only trade major pairs like EUR/USD and JPY/USD. This will ensure that you avoid high levels of liquidty.Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

eToro: Best Trading Platform - Trade Stocks & ETFs

61% of retail CFD accounts lose money. Your capital is at risk.

Visit eToroeToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.61% of retail CFD accounts lose money. Your capital is at risk.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up