Best Solar Energy Stocks to Watch in February 2026

Solar energy has gained popularity due to an increased concern about climate change, government stimulus packages, and subsidies for renewable energy sources. As a result, solar energy has grown at an average annual rate of 42% in the past decade since it is clean, emissions-free, and renewable.

This article reviews some of the popular solar energy stocks to watch in 2026 and how to obtain them through a regulated stockbroker.

10 Best Solar Energy Stocks to Invest in 2026

The 10 companies outlined below represent some of the popular solar stocks to invest in.

- Enphase Energy, Inc

- Sunrun Inc

- First Solar, Inc

- Sunnova Energy International Inc

- SolarEdge Technologies Inc

- Daqo New Energy Corp

- Plug Power

- Hannon Armstrong Sustainable Infrastructure Capital

- JinkoSolar Holding Co

- Brookfield Asset Management

You should carefully research the markets and historical data before investing.

A Closer Look At The Best Solar Energy Stocks To Watch

Today’s world has a real concern for solar energy. Although it has been noted that the transition from fossil fuels to renewable energy has led to an increase in the market, this does not mean that you should consider all companies that operate in this sector for your portfolio.

For this reason, we have reviewed some of the popular solar energy stocks in the sector down below.

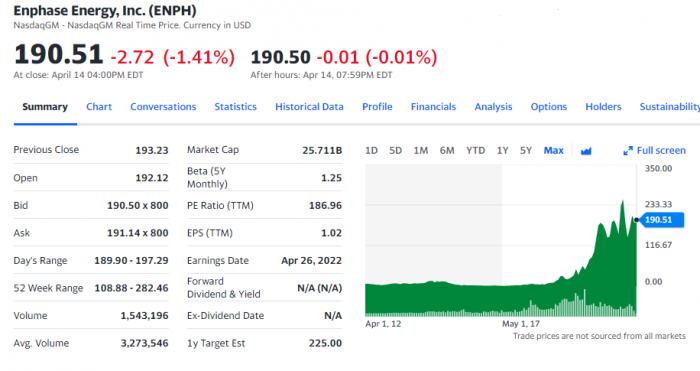

1. Enphase Energy, Inc

Enphase Energy, Inc. (ENPH) is a clean energy technology company based in California that provides solar solutions and home energy storage.

The company is gaining popularity due to the expected expansion of residential and commercial solar demand, increasing battery attach rates over time, and decentralizing energy production.

Moreover, Enphase Energy, Inc. announced its third-quarter earnings on October 26. The EPS came in at $0.60, beating estimates by $0.11. Revenue was $351.52 million, up 96.93% year-over-year, beating estimates by $7.60 million.

Bruce Emery’s Greenvale Capital is one of the largest shareholders of Enphase Energy, Inc. (ENPH) as of Q3. It owns an $85.4 million stake in the company. In the third quarter, 52 hedge funds were long Enphase Energy, Inc. (ENPH), up from 44 funds the previous quarter.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

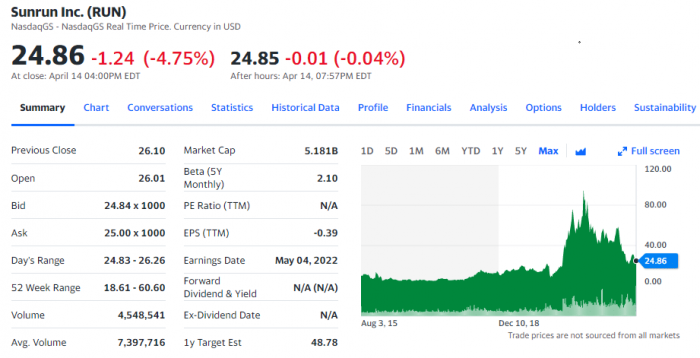

2. Sunrun Inc

The solar energy stock Sunrun Inc. (RUN), a California-based provider of residential solar panels and home batteries, was one of the most popular solar energy stocks among hedge funds in the third quarter. Based on Insider Monkey’s Q3 hedge fund database, 37 funds were bullish on Sunrun Inc. (RUN). The stake value totalled $1.67 billion.

The largest shareholder in Sunrun Inc. (RUN) from the third quarter is Philippe Laffont’s Coatue Management, with 9.5 million shares worth $418.3 million.

Sunrun Inc. (RUN) reported its third-quarter results on November 4, posting a $0.11 EPS, beating estimates by $0.09. Revenue jumped by 109.17% from the prior-year quarter, reaching $438.77 million, outperforming expectations by $25.03 million.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

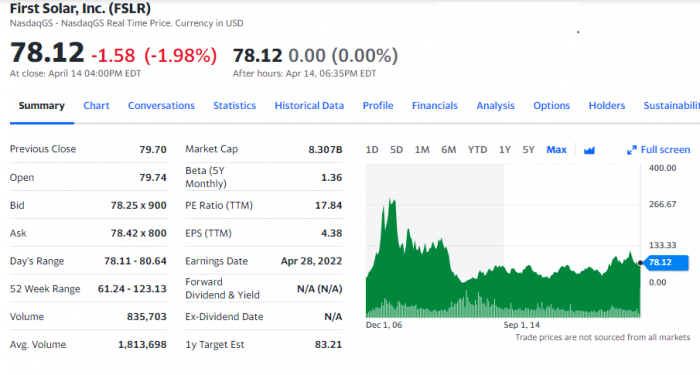

3. First Solar, Inc.

Gordon Johnson, an analyst at GLJ Research, raised First Solar’s price target to $152.87 on November 23 from $104.41 and kept his Buy rating. According to the analyst, US solar manufacturers like First Solar, Inc. (FSLR) may get impacted by the Biden Administration’s $1.9 trillion Build Back Better legislation. The company will receive approximately 50% taxpayer subsidies to produce 6 gigawatts of solar capacity each year.

First Solar, Inc. (FSLR), based in Arizona, provides solar panels, utility-scale PV power plants, and support services such as construction, maintenance, and panel recycling.

In the third quarter, Michael Cowley’s Sandbar Asset Management increased its stake in First Solar, Inc. (FSLR) by 7%, holding 365,470 shares worth $34.8 million. In addition, 31 hedge funds reported owning stakes in First Solar, Inc. (FSLR) in Insider Monkey’s Q3 database, valued at $266.5 million.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

4. Sunnova Energy International Inc

A company that provides solar solutions to residential customers, Sunnova Energy International Inc. (NOVA) announced its third-quarter earnings on October 27. The company lost $0.23 per share, missing expectations by $0.06. However, revenue jumped by 37.32% year-over-year to $68.9 million, exceeding expectations by $1.41 million.

Despite “solid” Q3 results, Riley analyst Christopher Souther raised Sunnova Energy International Inc. (NOVA) to $54 from $52 and maintained a Buy rating on the stock on October 29. According to the analyst, Sunnova Energy International Inc. (NOVA)’s “demonstrated execution and bolstered balance sheet position it well to meet or exceed its 2022+ goals.”

Sunnova Energy International Inc. (NOVA) was long by 27 hedge funds at the end of September, compared with 25 hedge funds a quarter earlier. Electron Capital Partners, owned by Jos Shaver, is the leading shareholder in Sunnova Energy International Inc. (NOVA) starting in Q3 2021, with a shareholding of $48.55 million.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

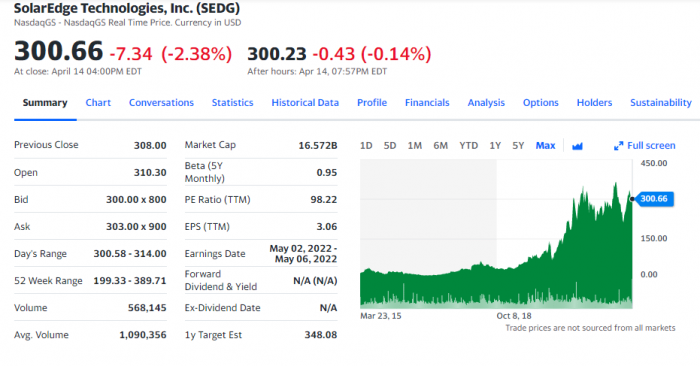

5. SolarEdge Technologies Inc.

The SolarEdge Technology Company manufactures inverters and power optimizers that use the sun’s energy to generate electricity. As a result, solar panels have become more efficient at converting DC power from the sun into AC electricity. As a result, the cost of a system that uses SolarEdge’s power optimizers is lower than that of one built by, for example, Enphase Energy (ENPH), and the efficiency loss is minimized.

Since SolarEdge manufactures low-cost power optimizers, it has gained market share from rivals as solar project developers focus on price. The company has also invested in developing new energy storage and energy management products and smart modules to help increase its average revenue per installation.

With a cash-rich balance sheet, SolarEdge complements its leading market position. Because of that, it has the financial flexibility to expand its manufacturing capabilities and strengthen its technological edge over competitors.

Additionally, SolarEdge has been able to expand into other smart energy markets. In addition to storage, electric vehicle (EV) charging, batteries, uninterruptible power supply (UPS) systems, EV powertrains, and grid services solutions.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

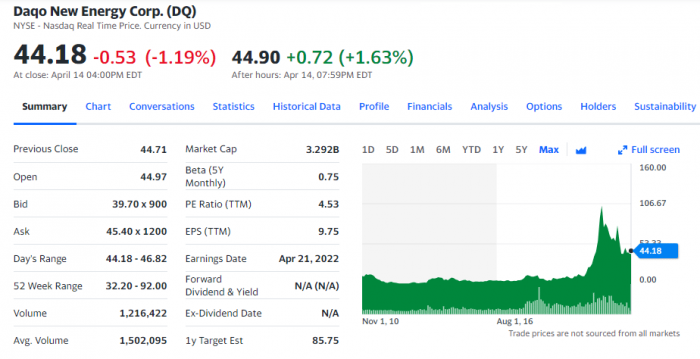

6. Daqo New Energy Corp.

Daqo New Energy Corp. (DQ) is a Chinese company that develops and distributes monocrystalline silicon and high-purity polysilicon for solar photovoltaics.

On November 1, Roth Capital analyst Philip Shen raised the price target on Daqo New Energy Corp. (DQ) to $79 from $52 and kept a Neutral rating on the shares after the company’s Q3 earnings beat and reiterated 2021 production guidance.

Daqo New Energy Corp. (DQ) reported solid third-quarter results on October 28. The company reported EPS of $3.84, beating estimates by $1.19. In addition, revenue increased 366.65% to $585.78 million, exceeding estimates by $37.55 million.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

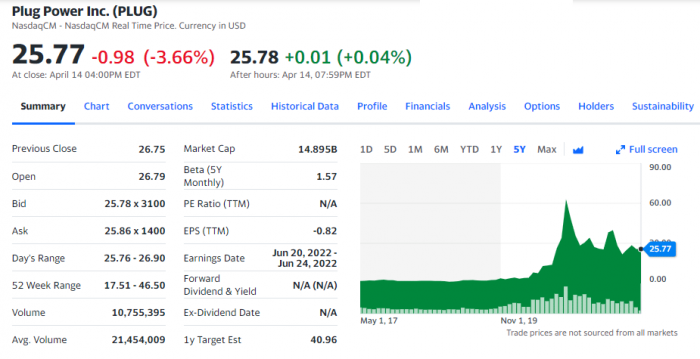

7. Plug Power

Plug Power focuses primarily on the development of hydrogen fuel cell systems. Ideally, they would serve to replace conventional batteries in electric-powered equipment. Two notable announcements were made by the company just last month. First, plug Power plans to grow massively on the financial front in 2022. According to Plug Power CEO Andrew Marsh, the company targets $900 million this year.

The company aims to become the world’s largest producer of green hydrogen through this move. In addition, plug Power continues to expand its footprint across global markets, having accumulated almost 370,000 square feet of manufacturing space.

In addition, the company works with some of the most well-known names in the retail industry. Amazon (NASDAQ: AMZN), Walmart (NYSE: WMT), and Home Depot (NYSE: HD) are included. Plug Power is also working with the state of New York to become a hydrogen hub. It would be included in the federal infrastructure bill signed into law in 2021.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

8. Hannon Armstrong Sustainable Infrastructure Capital

Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI) is a Maryland-based company that invests in solar energy projects and sustainable infrastructure projects that support energy efficiency improvements such as heating, ventilation, air conditioning systems, lighting, and energy controls, roofs, and building shells.

The B Riley analyst Christopher Souther raised his price target on Hannon Armstrong Sustainable Infrastructure Capital, Inc. (NYSE: HASI) to $83 from $82 and kept a Buy rating on the shares. By the end of 2021, the analyst predicts that the company’s balance sheet may grow by more than 20%, and by 2022, net investment income will rise by more than 20%.

On November 4, Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI) reported Q3 earnings of $0.41, as expected by analysts.

Impax Asset Management, owned by Ian Simm, has been the largest shareholder of Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI) since the third quarter, owning 2.18 million shares worth $116.66 million. In addition, compared to the previous quarter, 15 hedge funds were bullish on the stock in Q3.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

9. JinkoSolar Holding Co

JinkoSolar Holding Co., Ltd. (JKS) is the world’s largest manufacturer of solar panels. This Chinese company serves residential, industrial, and commercial utility sectors in China, the United States, Japan, United Kingdom, Germany, Brazil, the United Arab Emirates, Italy, Spain, and France, among other regions. JinkoSolar Holding Co., Ltd. is also a manufacturer of solar cells, solar wafers, and solar modules.

On November 30, JinkoSolar Holding Co., Ltd. announced its Q3 results. In the latest quarter, EPS exceeded expectations by $0.03 to come in at $0.05. In the third quarter, revenue came in at $1.33 billion, missing estimates by $62.37 million.

On December 2, CICC analyst Tao Zeng upgraded JinkoSolar Holding Co., Ltd. to Outperform from Market Perform with a $66.10 price target.

It was announced on December 2 that JinkoSolar Holding Co., Ltd. would reinforce its partnership with Aldo Solar for 2022, a leading distributor of solar energy solutions in Brazil. As a result, JinkoSolar Holding Co., Ltd. signed the largest distribution agreement outside China, where modules with 2 gigawatts of installed power will be distributed.

In the third quarter, Marshall Wallace LLP held a $12.99 million stake in JinkoSolar Holding Co., Ltd. As a whole, 10 hedge funds were long JinkoSolar Holding Co., Ltd. in Q3, up from 7 funds in Q2.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

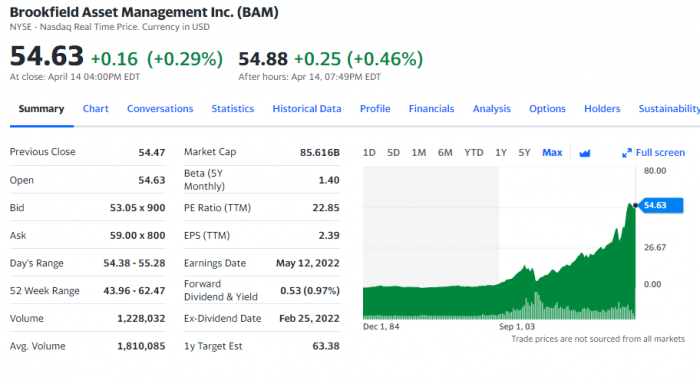

10. Brookfield Asset Management

The Brookfield Asset Management company is an alternative asset manager and REIT/Real Estate Investment Manager specializing in real estate, renewable energy, infrastructure, venture capital, and private equity. The company manages public and private investment products and services for institutional and retail clients. In addition to investing its own money, it also invests capital from other investors, often in large, premier assets across various geographies and asset classes.

As a rule, the firm considers equity investments ranging between $2 million and $500 million. The investment period of the project is four years, and it has a 10-year term with two one-year extensions. The firm prefers to take a minority share and a majority share with offices in North America, South America, Europe, the Middle East, and Asia.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Factors Affecting Solar Energy Stocks

With the analysis of ten solar energy stocks, users may also be interested in knowing more about the sector. In the sections below, we talk about some factors that influence solar energy stocks.

Performance vs. Broader Markets

Energy plays a key role in the global economy as it provides fuel and power to the engines that drive international trade and travel. Consequently, during times of economic slowdowns, such as during the pandemic of COVID-19, it can significantly affect energy demand and prices. That can significantly affect energy stocks prices. In contrast, when the economy hits the pedal, as it did in 2021, demand soars, and prices usually rise.

Operating Costs And Break-Even Price

The companies involved in the exploration and production of solar energy are subject to enormous operating costs. Thus, this will play a major role in determining the profitability of the solar energy stock.

A concern about buying solar stocks is how many solar panels cost and how they affect the stock’s performance. By 2020, the global cost of solar power will be below $0.06 per KWH, down from more than $0.38 just a decade ago. Although it is higher than some fossil fuels in certain locations, the prices are often comparable when tax breaks and incentives are considered.

Currently, the most efficient solar panels have an efficiency rating of up to 23%, but the majority have a rating between 15% and 20%.

Solar Energy Stock Platform – Reviewed

For investors looking to enter in this sector, you may want to do so with a suitable broker that can cater to your investing needs. In the section below, we review one popular broker that allows you to invest in solar energy stocks.

eToro

Markets are supported in the US, UK, Hong Kong, Germany, and others. eToro allows you to invest in and sell solar energy stocks at 0% commission, whether you are purchasing the US or foreign companies.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

The company supports fractional shares and requires only a $10 minimum deposit to begin investing in solar energy stocks. You can also deposit funds for free if you’re based in the US. In addition, several convenient payment methods are available, including debit or credit cards, Paypal, Neteller, ACH, and online banking.

Additionally, if you invest in solar stocks that pay dividends – you will receive your share of the dividends direct to your eToro account. Dividends can be reinvested in the oil industry or withdrawn. Additionally, hundreds of commission-free ETFs are available through eToro if you want to diversify your portfolio.

Professionally managed portfolios are also available. Smart portfolios allow you to gain passive exposure to various industries – such as solar energy. Finally, eToro is known for its popular cryptocurrency exchange – which allows you to purchase Bitcoins and dozens of other leading digital currencies.

| Stock Broker | Minimum Deposit | Fractional Shares? | Pricing System | Cost of Buying Stocks | Fees & Charges |

| eToro | $10 | Yes – $10 minimum | 0% commission on ALL real stocks, spreads for CFDs | Market spread is not included when purchasing real stocks | No Deposit fees, $5 withdrawal fee, $10 inactivity fee, no account management fees. |

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Conclusion

In this guide, we have reviewed some of the best solar energy stocks to watch in 2026. Investors may want to analyse and research each of the stocks in order to make a decision on their investments.

Should you choose to invest in this sector, you may want to use a popular broker that can cater to your investing needs.