How To Spread Bet The FTSE 100 in the UK 2026

Irrespective of whether you want to go long or short on the FTSE 100 – spread betting is one way to speculate on the UK’s primary stock market index. In the UK, traders are not required to pay any tax on spread-betting profits, stamp duty is waivered, and you can trade with leverage of up to 20x.

In this guide, we review the ins and outs of how FTSE 100 Spread Betting in the UK works and which FCA brokerage sites offer this trading strategy.

[stocks_table id=”65″]How To Spread Bet the FTSE 100 in the UK

Prospective traders could get started with a FTSE 100 spread betting UK position with these steps:

- Open an account with a UK spread betting platform that is authorized and licensed by the Financial Conduct Authority.

- Make a deposit into your newly created spread betting provider. Pepperstone, for example, requires a minimum deposit of £200 and you can choose from a Visa or MasterCard debit/credit card or an e-wallet.

- Head over to the ‘Indices’ section and click on the FTSE 100 market.

- Choose from a buy order if you think the price of the FTSE 100 will rise. If you think the FTSE 100 will drop in value – place a sell order.

- Enter the amount you wish to stake on each point movement (e.g. £10 per point) and confirm the order.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Spread betting is only available for clients in the UK.

Spread Betting the FTSE 100 Explained

By spread betting on the FTSE 100 – you are looking to potentially profit from the rise and fall of the index. For example, if you think the value of the FTSE 100 will rise, you would place a ‘long’ spread betting position. If you think that the opposite will happen – you would instead place a ‘short’ position at your chosen spread betting broker.

And of course – if you speculate correctly, you will make a profit. If not, you will lose money. When trading the future value of FTSE 100 – you do not take ownership of any assets. This is the same as a conventional CFD trading site – insofar that the spread betting market will simply track the real-time price of the FTSE 100 like-for-like.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

As we cover in more detail in the section below – there are several characteristics that make FTSE 100 spread betting a popular marketplace for traders – such as:

- You can profit from rising and falling markets – as spread betting platforms allow you to go long or short

- You can spread betting the FTSE 100 with leverage of 20x

- Some spread betting sites – like Pepperstone, allow you to trade commission-free

Additionally, FTSE 100 spread betting UK markets can be traded free of stamp duty and capital gains tax. This is in stark contrast to traditional stock trading or forex trading platforms.

How Does FTSE 100 Spread Betting Work?

There are several key aspects that you need to have a firm grasp of before you attempt to spread bet on the FTSE 100. In entering this marketplace with your eyes wide open – you will have a much better chance of making potential profits and protecting your bankroll from losses in the financial markets.

As such, in this part of our guide on FTSE 100 Spread Betting – we are going to explain the fundamentals in much more detail.

Point Movements and Stakes

First and foremost, the FTSE 100 is priced in points, while traditional shares are valued in pennies.

For example:

- Say, at the time of writing, the FTSE 100 is being quoted at 6,859.87 points.

- If the index increased by 10% – this would see the FTSE 100 priced at 7,545.87 points

- In the world of spread betting, this would represent a price movement 686 points

Now, your profit or loss on this trade would depend on two key metrics:

- The amount you stake per point movement

- Whether or not you correctly predicted the price movement of the FTSE 100

If, for example, you went ‘long’ on the FTSE 100 and staked 50p per point – this trade would have made you a profit of £343. This is because the index moved by 686 points in your favor. However, if you placed the same stake on a ‘short’ order, you would have lost £343.

Fortunately, many spread betting platforms allow you to set up a guaranteed stop-loss order – subsequently allowing you to limit your losses. For example, if you had set your stop-loss at 40 points – the most you could have lost from the above trade would have been £20 (40 points x 50p per point).

Entering and Exiting the Market

As we have mentioned a couple of times – you need to choose from a long (buy order) or short (sell order) position when trading the market.

- If you enter the trade with a long position, this means that you think the index will rise in value and the sell price will be higher.

- If you enter the trade with a short position, this means that you think the index will fall in value.

When it comes to exiting your trade (i.e. closing your position) – you need to:

- If you entered with a long order, close with a short order

- If you entered with a short order, close with a long order

As per the above, the process of entering and exiting an FTSE 100 position is very similar to forex and CFD trading.

Leverage

Both the CFD and spread betting markets are backed by financial derivatives. In Layman’s Terms, this means that you can speculate on the future price of an asset – like the FTSE 100, without actually taking ownership. As a result of this, you can spread bet the FTSE 100 with leverage.

The FCA allows retail investors in the UK to trade the FTSE 100 with leverage of up to 20x. This means that by staking £1 per point – your position is amplified to £20 per point.

To put it another way:

- Let’s say that you enter a long position on the FTSE 100 at £2 per point

- You apply leverage of 20x on this trade

- The FTSE 100 increases by 30 points

- You would have made a profit of £60 had you not applied leverage to your position

- But, as you applied leverage of 20x – your profit is amplified from £60 to £1,200

You need to have a full understanding of the risks associated with leveraged trading. This is because you can lose your entire stake – should your position go against you by a certain amount.

For example, if you traded with leverage of 20x – this translates to a margin requirement of 5% (20/100). As such, if your trade went in the wrong direction by 5% – your position would be closed by the broker and you would lose your margin.

Market Duration

Irrespective of which spread betting instrument you wish to trade – all markets have an expiry date. This is purposeful – as it allows spread betting to retain its status as ‘gambling’ – meaning no tax is liable on capital gains.

Many spread betting brokers offer at least two trade durations on the FTSE 100 – a daily market and a quarterly market. If you still have an open position on the FTSE 100 and it expires – this simply means that your trade will be closed automatically.

For example, if you are 40 points in profit and the expiry date is triggered – you will still make 40 points. If you wish to remain in the market, you simply need to open a new position.

FTSE 100 Trading vs Spread Betting: What is the Difference?

The only way to trade the FTSE 100 is via a financial derivative. This is because the FTSE 100 is made up of 100 individual shares – all with various weightings. For example, Diageo has a weighting of 3.83% while Natwest Group is much lower at 0.50%. This is because the former has a market capitalisation of £74 billion while the latter is at £22 billion.

With this in mind, when trading the FTSE 100 you can do so via a CFD instrument or a spread betting market. Both operate virtually like-for-like, albeit, spread betting is the better option as your profits are tax-free.

Why Might Some Traders Do FTSE Spread Betting in the UK?

We have briefly discussed why FTSE 100 spread betting is popular with UK traders and financial speculators. In the following section, we elaborate on these points.

FTSE 100 Spread Betting Tax

One advantageous outcome of trading via a spread betting FTSE 100 broker, is that there is no taxation to take into account. This isn’t the case when you buy shares in the traditional way – as if you sell them for more than you initially paid the profits are liable for capital gains tax.

Plus, if you receive any dividends from your shares – this is also taxable. Furthermore, when you initially make the share purchase – you will be charged a stamp duty tax if the company is listed on the London Stock Exchange (LSE).

On the other hand, when trading the FTSE 100 via a spread betting instrument – you won’t pay any capital gains tax on your profits. As we briefly noted earlier, this is because financial spread betting falls within the remit of gambling.

5% Margin Requirement

During normal economic conditions, the FTSE 100 is a relatively stable asset class. This is because it is backed by some of the largest companies in the UK market. Think along the lines of AstraZeneca, GlaxoSmithKline, HSBC, British American Tobacco, and Unilever.

Although this is suitable for risk-averse investors – this does limit your opportunity to make viable gains when trading with small amounts. For example, if you have a £100 in your trading account and make 2% – this amounts to gains of just £2. Fortunately, this is where the benefit of spread betting margin comes into play.

On the FTSE 100, the margin requirement is just 5% – meaning that you can boost your stake by 20x. As such, small gains of £2 could transition into a profit of £40.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Potential to Make Gains When the Markets are Falling

Speculating on a spread betting FTSE 100 market is one possible way to profit from a stressed UK economy. There have been plenty of examples of this happening over the past five years – with the Brexit referendum standing at the forefront of this.

After all, when there is uncertainty surrounding the UK economy, this will directly impact the value of the FTSE 100. This is because investors will exit their UK stock or ETF positions and thus – the FTSE 100 will decline.

Rather than sitting on the fence when this happens – you might want to consider short-selling the FTSE 100 via a spread betting broker. The more the index falls by, the more profit you will make.

Low Cost

An additional benefit from trading at a FTSE 100 spread betting UK site is that fees, commissions, and spreads are typically very low. For example, if using Pepperstone – you can spread bet the FTSE 100 with low fees. Additionally, Pepperstone charges an industry-leading spread on the FTSE 100 of just 2 points.

FTSE 100 Spread Betting Strategies 2026

If you are planning to trade the FTSE 100 – you need to have a strategy in place. This should be the case no matter what financial market you are speculating on.

Below we list a few FTSE 100 spread betting strategies that you might want to consider:

- Technical Analysis: If you are looking to day trade or swing trade the FTSE 100 – you need to learn the art of ‘technical analysis. In its basic form, this means learning how to analyze and interpret historical and current pricing charts. Technical analysis is aided by indicators that focus on metrics like support and resistance levels, volatility, and trading volume.

- Hedging: If you are heavily invested in the UK economy – perhaps through stocks, ETFs, or even domestic REITs, you should always be prepared for a potential market slump. If there is a possibility of this happening in the very near future – you might want to consider hedging the FTSE 100. This means that you will enter a short position at your chosen spread betting broker. If the UK economy does take a turn for the worse – you will lose money from your original investments but make a profit from your FTSE 100 short-selling position.

- Buy the Dip: Like all indices – the FTSE 100 will go through temporary dips. This might be because of a bit of bad news surrounding the UK economy – like worse-than-expected GDP results. However, as these dips are more often than not temporary – this allows you to enter a long position at a discount. If and when the FTSE 100 recovers, you will make a profit.

If you haven’t yet mastered a FTSE 100 trading strategy – consider opening a free demo account with Pepperstone. This will allow you to practice your strategy in a 100% risk-free manner.

FTSE 100 Spread Betting Brokers for 2026

If you’re ready to start placing orders on the future value of the FTSE 100 – you’ll first need to open an account with an FCA-regulated spread betting broker. There are a handful of options to choose from, albeit, below we review FTSE 100 platforms currently in the market.

1. AvaTrade – Spreading betting CFD broker with low fees

AvaTrade, a leading spread betting broker in the UK, provides traders with leveraged spread betting across an extensive selection of markets. This includes forex currency pairs, metals, energies, agricultural commodities, major indices, global bonds, and a diverse range of equities and ETFs. With such a wide array of financial products, you can easily find instruments that align with your preferences. It’s important to note, however, that AvaTrade is not regulated by the Financial Conduct Authority (FCA).

AvaTrade caters to novice investors aiming to develop a foundational understanding of spread betting. With a diverse product suite, reasonable spreads, and multiple user interfaces to choose from, it is an ideal platform for new and undercapitalized traders looking to expand their skills. AvaTrade’s trading fees and spreads are competitive, aligning with industry standards. For instance, the average spread for trading the S&P 500 index CFD is 0.5, while the average spread for the Europe 50 index CFD is one pip. Additionally, the cost of trading the EURUSD pair stands at 0.9 pips, which falls within the industry’s average range.

The platform offers traders access to their proprietary trading platforms, which includes the web-based and mobile app called Webtrader. This platform serves as the company’s primary trading interface, while AvaOptions is specifically designed for forex CFD traders. WebTrader provides essential real-time information about client activity, including balances, transaction history, and profit/loss breakdowns. However, it is important to note that WebTrader lacks a built-in tool for analyzing trading activity. Additionally, AvaTrade does not offer a trading journal or tax accounting tools within the platform.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

2. Trade Nation – Top spread betting broker with access to advanced charting tools

Trade Nation has gained significant popularity among UK traders due to its extensive range of features and user-friendly interface. As a financial spread betting and CFD provider, Trade Nation places emphasis on offering low spreads and rapid trade execution speeds. It is regulated in multiple jurisdictions, including the UK (FCA). In addition to these offerings, Trade Nation also provides special features that enhance traders’ overall trading experience. These include advanced charting tools, copy trading functionality, and real-time market data, all of which contribute to helping traders optimize their trading journey.

The trading platform provides a well-designed and user-friendly trading app tailored for beginner traders. One notable advantage is that there is no minimum deposit requirement, and traders can enjoy free withdrawals. The platform offers a reasonable selection of products, striking a balance without overwhelming users. If you value the concept of ‘fair trading’, which emphasizes transparency regarding brokerage fees, Trade Nation is an ideal choice. The proprietary spread betting platform offered by Trade Nation ensures that traders can effectively manage their expenses, even in volatile market conditions, thanks to low and fixed spreads.

Trade Nation understands the importance of catering to the diverse needs of its clients, which is why they offer a variety of trading platforms. These platforms include web, mobile, and desktop options, ensuring that traders can enjoy a seamless and efficient trading experience regardless of their preferred device or location. The web trading platform provided by Trade Nation is easily accessible through any modern web browser, eliminating the need for additional downloads or installations. For those who prefer to manage their investments while on the move, Trade Nation also offers a mobile trading app that is compatible with both iOS and Android devices.

77% of retail investor accounts lose money when trading CFDs with this provider.

3. Admiral Markets – Reputable spread betting platform for the FTSE 100

Admiral Markets is a globally recognized spread betting platform that has achieved financial stability and regulatory licenses, including one from the UK. The trading platform provided by Admiral Markets stands out with its unique set of volatility protection tools, enabling users to effectively manage risks associated with agency execution, such as market gaps and slippage. These tools are not only advantageous for experienced traders but also beneficial for beginners looking to safeguard their investments.

Admiral Markets aims to deliver functional software, high-quality offerings, transparent pricing, and fast execution, aligning with its commitment to providing an exceptional trading experience. Admiral Markets incorporates its fees into the spread of the tradable instrument, although the precise details may vary depending on the chosen platform and account type. The brokerage offers four distinct account types, each with its own fees and trading options. However, all account types maintain similar pricing in terms of the all-in cost of trading, ensuring transparency and allowing clients to select the account type that best suits their individual trading needs.

The broker prioritizes high trading frequency and low latency by employing a system that aggregates liquidity from multiple banks and venues into a single liquidity pool. These efforts have not gone unnoticed, as the broker has received recognition from various industry awards and garnered numerous positive client reviews for its algorithmic trading services. This further solidifies Admiral Markets as a spread betting platform for traders seeking a reliable and efficient trading environment.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

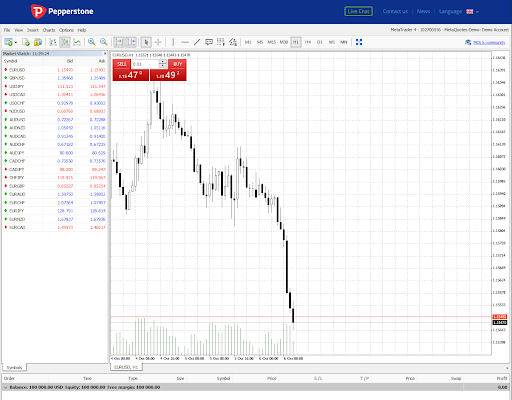

4. Pepperstone – FTSE 100 spread betting platform with access to MT4 and MT5

Regarding the former, you can link your Pepperstone spread betting account with MT4 or MT5. As you likely know, these third-party platforms are used by experienced traders as they are packed with advanced chart reading tools and technical indicators. This will ensure that you are able to perform short-term analysis on the FTSE 100. When it comes to accounts, the Razor Account will often get you spreads of 0 pips – or slightly over depending on market conditions.

Either way, this account ensures that you are not trading through a middleman – meaning you are speculating against other market participants. The Razor Account comes alongside a small commission of $3.50 – which is very competitive. As well as the FTSE 100, Pepperstone also supports shares spread betting, as well as markets on hard metals, energies, forex, and other indices like the Dow Jones, DAX, and NASDAQ 100. At Pepperstone, you can deposit funds via Paypal, debit/credit card, or bank wire.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

How to Spread Bet the FTSE 100 Online

In the following guide, we will take a closer look at how to spread bet the FTSE 100 in the UK using an online trading platform.

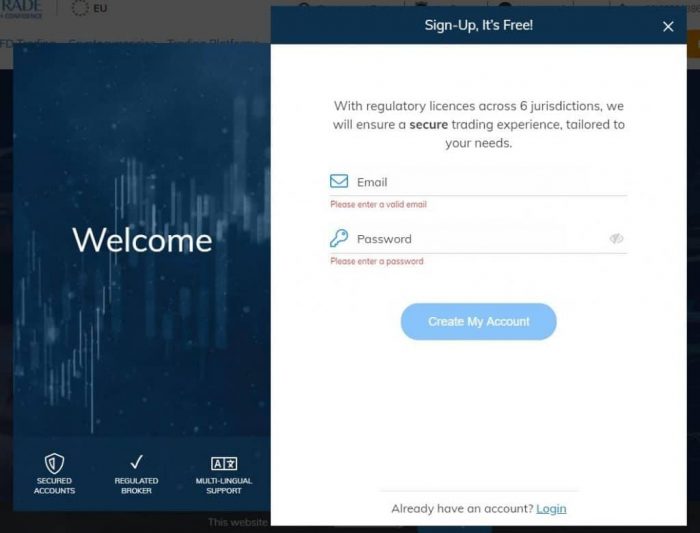

Step 1: Open a Spread Betting Account

Join a regulated spread betting platform. After entering your email address and a strong password, you’ll need to provide some personal information.

Once you confirm your account by clicking the link sent to your email address, you will be asked to upload a copy of your passport or driver’s license. This is to ensure a regulated broker complies with the FCA.

Step 2: Deposit Funds

You can now make an instant deposit with your debit/credit card or a supported e-wallet. The minimum deposit is just £20.

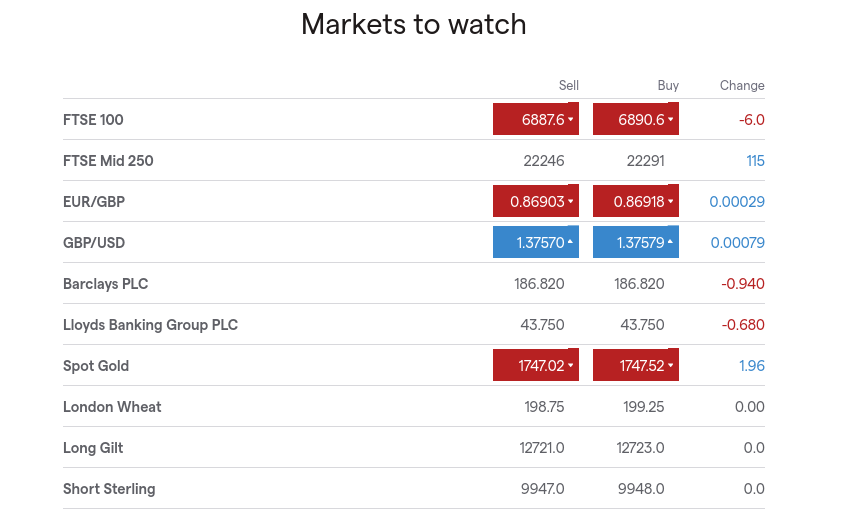

Step 3: Search for FTSE 100

Enter ‘FTSE 100’ into the search box at the top of the page. Like the image below, look out for the ‘UK 100’ and click it.

Step 4: Enter Long or Short Position

Set up your FTSE 100 spread betting position by clicking on the ‘buy’ or ‘sell’ button. As we covered earlier, a buy order is applicable if you want to go long and a sell order if you wish to short-sell the FTSE 100.

Step 5: Enter Stake and Confirm Order

You now need to enter your stake. This refers to the amount you wish to risk for each FTSE 100 point movement – such as £1 per point.

Confirm the order to execute your first FTSE 100 spread betting trade.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

The Verdict?

Spread betting is used by some UK traders to speculate on the future price of assets, such as the FTSE 100. In the UK, spread betting is tax-free and it is possible to trade with leverage. Traders should use a regulated platform that provides a good selection of tools and features to conduct research and analysis before making any trading decisions.

In this guide, we have outlined what spread betting is, how it works and which UK brokers are suitable for spread betting in 2026.