Best Leveraged Trading Platforms in the UK for June 2025

Leveraged trading is a trading strategy that allows traders to take a large position in the market using a small amount of capital. This makes it possible to maximize profits, however, it also increases the risks involved with trading. Not all trading platforms offer leveraged trading in the UK, so finding a suitable platform to use can be tedious. In this article, we reveal 7 leverage trading platforms to consider as a UK trader.

We will discuss the key features of each platform to assist traders in selecting a suitable broker according to individual needs. We will also take a look at leverage trading strategies that are accepted on UK trading platforms in 2025.

6 UK Platforms for Leverage Trading June 2025

The following are leverage trading platforms for UK traders.

- XTB: XTB broker has been serving Europe’s traders for over 15 years, offering more than 5400 trading instruments. It provides a wide range of financial assets including shares, commodities, indices, forex and ETFs to diversify investments. The platform offers leverage trading across instruments, with retail classified clients in the UK restricted to 1:30.

- AvaTrade: AvaTrade is a regulated online trading platform with a low minimum deposit of $100. It offers accessibility and a user-friendly interface, along with a rich learning centre that includes tutorials, webinars, and a demo account. Users are able to trade with leverage at a maximum of 1:30, however, can take larger positions with margin trading. AvaTrade offers various trading platforms including MetaTrader 4 & 5.

- Admiral Markets: Admiral Markets is a global brokerage offering over 8000+ assets, including CFDs on stocks, ETFs, forex, indices, commodities, and treasury bonds. Leverage varies by instrument, with a maximum of 1:30 for major currency pairs.

- Pepperstone: Pepperstone is known for fast and free account opening, low fees, and no deposit, withdrawal, or inactivity fees. It primarily focuses on CFDs and forex trading, with 90+ currency pairs and more than 1200 CFDS across stocks, indices, ETFs and commodities.

- Trade Nation: A regulated platform, Trade Nation offers leverage up to 200x on various financial instruments, including CFDs, spread betting, and forex if using a professional account. For retail clients the maximum leverage is 1:30. Trade Nation offers access to over 2000+ financial assets and offers low fixed spreads starting from 0.6 pips.

What is Leverage Trading?

Leverage trading is a strategy that allows traders to amplify their positions in the market. It works by requiring users to invest only a fraction of the total amount, while the broker covers the rest. In essence, leverage trading is conducted by borrowing funds to boost the size of the investment. This approach can be especially beneficial for traders who have limited capital but want to take on larger positions in trading.

By using leverage, traders can increase the result of potential gains, however, the risk of higher losses is also magnified. While it can offer the chance for significant profits, it also comes with increased risk, so it’s crucial to use leverage cautiously and be aware of the potential consequences of amplified market exposure.

What is a Margin in Leverage Trading?

An initial margin is essentially a mandatory upfront cash deposit, expressed as a percentage, that traders must set aside as collateral when deciding to buy a security with borrowed funds. This concept lies at the heart of leveraged margin trading. In simple terms, it’s the money required to put down with the online broker to minimize the risk they face by extending credit to the user for the given trade.

For example, if a broker sets the initial margin at 50%, traders will need to deposit 50% of the security that they wish to trade as leverage. If a trader wants to trade with £10,000, they will need at least £5000 in their trading account.

The margin is used as a safety net to ensure that investors can cover losses if trades do not go as planned.

How Does Leverage Trading Work?

Leveraged trading is a type of investing that allows traders to control more assets than they would be able to with their own money. This is achieved by borrowing money to increase the size of their investment. The process is carried out with financial derivatives known as “leverage products”.

Let’s say a trader wants to buy $10,000 worth of a stock. In traditional trading, the trader would need to have the full $10,000 to make the purchase. However, with leveraged trading, the trader can use a leverage product to control a larger position in the stock with less capital.

For example, if the trader decides to use a 10:1 leverage product, they would only need to put in $1,000 to control the same $10,000 worth of stock. This means that for every dollar the trader puts in, they can control $10 worth of the stock.

If the stock goes up by 10%, the trader would make a profit of $1,000 with traditional trading ($10,000 x 10%). However, with leveraged trading, the trader would make a profit of $10,000 ($100,000 x 10%) – a ten-fold increase from traditional trading.

On the other hand, the potential losses are also amplified by leverage. If the stock were to go down by 10%, the trader would lose $1,000 with traditional trading, but with leveraged trading, they would lose $10,000 – again, ten times the potential loss.

For this reason, leveraged trading is more suitable for experienced traders who understand the risks and are willing to accept potential losses. It is crucial to have a good understanding of the risks involved and to have a robust risk management strategy in place before engaging in leverage trading.

What Assets Can You Use for Leverage Trading?

It is possible to trade a number of markets with leverage in the UK. Below is an overview of the assets that can be traded.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

✔️ Cryptocurrencies

The crypto market is one of the most volatile which makes it an attractive market for leverage trading in the UK. Trading cryptocurrencies involves buying and selling digital assets that are built and stored on blockchain technology. You can trade cryptos through both traditional trading platforms and dedicated crypto exchanges. MEXC is an example of a crypto leverage trading platform that specializes in digital assets.

✔️ Stocks

Stocks are one of the most traded securities, and leveraged stock trading is no different. Purchasing a share in a company can be quite risky because any single company can go out of business given enough time. This is why leverage is capped at 5:1, due to the volatility of equities.

✔️ ETFs

Exchange-Traded Funds (ETFs) are a security that aims to track an index, commodity, or sector. There are ETFs that take a leveraged position to capture the average market returns of the S&P 500, for example, and amplify this through leverage. Strategies for trading leveraged ETFs are common, but there are also inverse ETFs, which can leverage the opposite performance of an underlying index. So, a 5x S&P 500 inverse ETF would turn a 5% downturn into a 25% positive return.

✔️ Forex

Forex is a common leverage trading asset. This is partly because many forex trading strategies operate on small margins with frequent trades. This can be difficult for those with a small pool of capital, which leveraged margin trading can help overcome. Furthermore, forex is often used as a hedging tool, and the ability to leverage this hedge can make it more effective. Because of the low volatility within currencies, usually, the maximum leverage of 30:1 can be exercised.

✔️ Commodities

Commodities include assets such as gold, silver, oil, and so on. Commodities often have a strong inverse relationship with other asset classes, such as forex, because they’re used as hedges against each other. For example, leveraged gold trading often rises in value when the dollar falls. Thus, it may be a strategy to leverage a commodity if you can foresee political or economic events.

✔️Indices

Whilst individual stocks can outperform the entire index, many consider the risk to not be worthwhile. This is similar to ETFs, but there is less liquidity on indices and they can only be sold at the end of the trading day. It is therefore common for buy-and-hold strategies that use indices to capture the long-term average market returns. Generally, this will incur high overnight costs for leverage investors, who should take such fees into consideration when choosing a platform.

Our Research Process to Evaluate Leverage Trading Platforms in the UK

In order to provide readers with a comprehensive view on popular leveraged trading apps, out team of experts look at various factors of each broker. Our team conducts in-depth research into the features of each platform, types of financial instruments offered, fees & charges and the overall user-friendliness of the trading interface.

It is also crucial to mention that all the brokers selected are regulated across a number of judications, including the UK Financial Conduct Authority. This provides traders with overall security when choosing a suitable brokerage platform for leveraged trading. These brokers all must follow regulatory framework with oversight from the UK’s primary regulatory body, which ensures a safe and fair trading environment for investors.

Best UK Leverage Trading Platforms Reviewed

Choosing the right trading platform is incredibly important for a trader. It can determine how fast trades are made, what trades are possible, the analysis and execution of a strategy, and what fees are incurred. Below is a breakdown of UK leverage trading platforms for retail investors in Britain.

1. XTB – Broker with Over 5400 Financial Assets and Offers Leverage Trading

XTB provides more than 5400 trading instruments overall. This makes it a viable option for traders seeking to diversify their portfolio and increase their market exposure across different asset classes. Additionally, XTB offers reasonable spreads with no deposit or withdrawal fees. For individuals who keep positions after the market closes, the platform does impose overnight fees.

Members of XTB can access a range of educational tools if they are new to trading in the financial markets. There are also numerous tutorials and several eBooks providing informative insights on trading different asset classes, trading strategies, investor guides, and fundamental & technical analysis. Additionally, users have access to in-depth market analysis to assist with trading decisions on XTB.

XTB also provides a demo account, which presents a method to test out the platform without risking any money. XTB primarily uses the XStation 5 trading interface, with the XStation Mobile app available to download on iOS and Android.

75% of retail investor accounts lose money when trading CFDs with this provider.

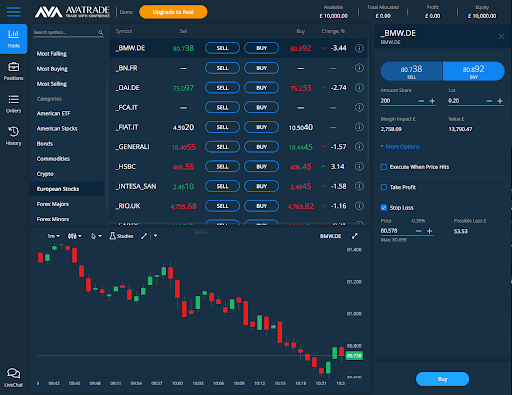

2. AvaTrade – One of the best crypto leverage trading platforms compatible with MetaTrader 4&5

The platform has a rich learning center, with many tutorials, general education, webinars, and a demo account. Furthermore, AvaTrade is also a Bitcoin leverage trading platform. The broker allows traders to go long or short on BTC and several other crypto assets.

However, AvaTrade does have relatively high FX spreads and high inactivity fees. There is a decent range of financial instruments to trade with leverage through the platform. AvaTrade is mostly a forex trading platform, but it has over 600 stock CFDs, 59 ETF CFDs, cryptocurrencies (such as Bitcoin), and a handful of commodity CFDs. The maximum leverage offered on AvaTrade is 400:1, though this is dependent on the trader’s jurisdiction.

For UK traders, a maximum of 1:5 leverage is permitted for stocks, 1:20 for commodities, while with forex it is possible to use a maximum leverage of 1:30.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

3. Admiral Markets – Global Brokerage that Offers up to 1:30 Leverage

Admiral Markets is a trading and investment ecosystem that was founded in 2001. The platform is a global brokerage with 16 offices worldwide and offers multilingual customer support. Admirals provides a wide range of features and advanced trading tools, all while giving investors exposure to over 8000 assets. The various CFD financial instruments include over 3000 stocks, 370+ ETFs, 80 different currency pairs for forex trading, 43 indices, popular commodities and treasury bonds for US and European countries.

Admiral Markets enables users to leverage trade across the various instruments that they offer to clients. while the maximum leverage is 1:30, this is only for major currency pairs EUR/USD, GBP/USD, USD/JPY, USD/CHF and USD/CAD. Traders can also use the 1:30 leverage for major cross rates that include Canadian Dollar, Japanese Yen and Swiss Franc pairings. All other currency pairs have a maximum leverage of 1:20, as does Gold pairings and all major index futures contracts such as FTSE 100 and S&P 500.

Users are permitted a 1:10 leverage for all other index and commodity CFD pairs. A leverage of 1:5 is offered for all CFDs on stocks, ETFs and Bonds, while for cryptocurrency pairs the leverage is set at 1:2.

Admiral Markets provide a wide variety to choose from when it comes to trading interfaces. The brokerage supports web based trading and has app connectivity for mobile phones. Trading interfaces include the popular MetaTrader 4 and MetaTrader 5, with free access to use the Supreme Edition of both. Uniquely, customers also have free access to use StereoTrader trading panel which has a diverse range of tools such as multiple asset trading windows, intelligent automation for entries and exits, advanced order types and risk management features.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

4. Pepperstone – Trade with Leverage up to 30:1 and No Withdrawal Fees

Pepperstone is a brokerage founded in 2010 that is regulated in two tier-1 jurisdictions. Whilst the platform is often associated with algorithmic traders, with its integration of MetaTrader and cTrader, it’s also a viable platform for traders who use leverage.

The maximum leverage at Pepperstone is 500:1, though British retail traders under FCA regulations can only use a maximum of 30:1. Pepperstone is a very accessible platform with fast and free account opening, low fees (no deposit, withdrawal, or inactivity fees), and 9 base currencies.

Forex and other trading fees are low, but holding overnight positions imposes a high cost. The downsides of the platform centre mostly around their limited markets and products, with only CFDs and forex being tradable. There are 61 currency pairs (including forex pairs as EUR/USD, GBP/USD, etc.), and almost 300 stock, index, and commodity CFDs.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

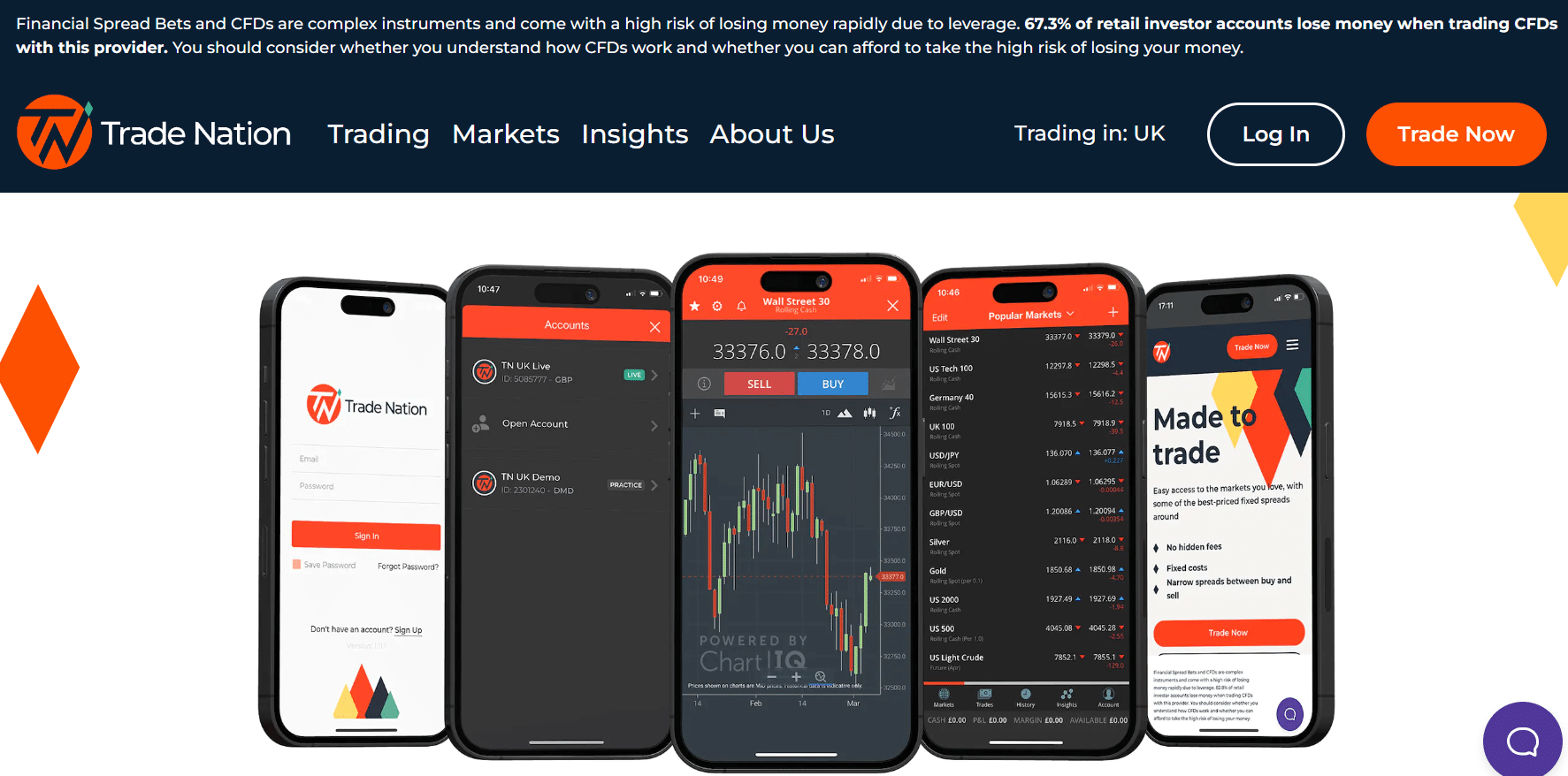

5. Trade Nation – Regulated Leverage Trading Platform with No Minimum Deposit Requirement

Trade Nation is a regulated online leverage trading platform that offers leverage up to 200x on a variety of financial instruments. For retail clients in the UK only a maximum of 1:30 leverage is permitted. The platform can be used for CFD trading, spread betting, forex trading and more. Traders can access over 2000 financial instruments from around the globe.

Trade Nation also offers low fixed spreads which make it a cheaper option for traders. Spreads start from 0.6 pips on some instruments. There is no minimum deposit requirement to start trading and new users can practice using Trade Nation for free with the demo account.

Trade Nation has its own TN Trader platform that can be used to conduct technical analysis. However, users can also opt to use Meta Trader 4 if preferred. Both trading interface charting capabilities provide a good range of indicators and analysis tools that can be used to make informed decisions.

Trade Nation is available to use on desktop and is also downloadable on mobile devices, allowing users to manage trading portfolios on the go.

77% of retail investor accounts lose money when trading CFDs

with this provider.

Leveraged Trading Platforms Compared

For retail investors in the EU and UK, the maximum leverage is always going to be 30:1 as per regulation. Here is a breakdown of the leverages among different asset classes.

| Platform | Max. Leverage: Stocks | Max. Leverage: ETFs | Max. Leverage: Forex | Max. Leverage: Commodities | Max. Leverage: Indices |

| AvaTrade | 5:1 | 5:1 | 30:1 | 10:1 | 20:1 |

| Pepperstone | 5:1 | 5:1 | 30:1 | 10:1 | 20:1 |

Leverage Trading Strategies

Leveraged Swing Trading

Swing traders look to capitalise on the price swings over a day or so, in which they use technical analysis to detect such patterns. Charting capabilities on the broker platform become very important for swing traders, in order to spot support and resistance lines, for example. Swing trading is one of the most popular trading strategies for leverage traders as it aims to execute high risk trades over short time frames when volatilities can be exploited.

Leveraged Scalping

Scalping is similar to arbitrage, in which the time between buying and selling is in minutes or hours. Therefore, it is less about predicting an asset’s rise in value, but more about price discrepancies and buying before the market has finished reacting. Scalpers aim to take a small amount of profit per trade, and instead trade with high frequency, making it intuitive to use leverage.

Leveraged Day Trading

Day trading is very similar to swing trading, but trades occur within the same day. This increases the frequency of trades and means more opportunities can be capitalised on (as there is less time spent holding a position). However, day trading is more susceptible to market noise and being prematurely stopped out, which is an issue that is magnified when leveraging.

Benefits of Leverage Trading

Leverage can help free up capital, given that traders are only committing a fraction of the asset’s value. This is positive news for retail investors and beginners, who often have limited capital but spot many trading opportunities. It’s even more of a benefit for those who use a trading strategy that takes small profits on large trading positions, as the profits are amplified, yet the risk is limited due to the short-term nature of the trade.

Risks of Leverage Trading

Of course, when profits are amplified, so is the risk. Although, there are many ways to limit losses through risk management, there is no denying that the relationship of risk/reward doesn’t change simply because you’re in a leveraged position. In fact, the relationship is slightly changed when using leverage because of the extra fees incurred, which must be factored in when devising and practising a strategy. Furthermore, it can be psychologically more difficult to use leverage as a trader, where they may become more prone to panic selling due to the higher risk involved.

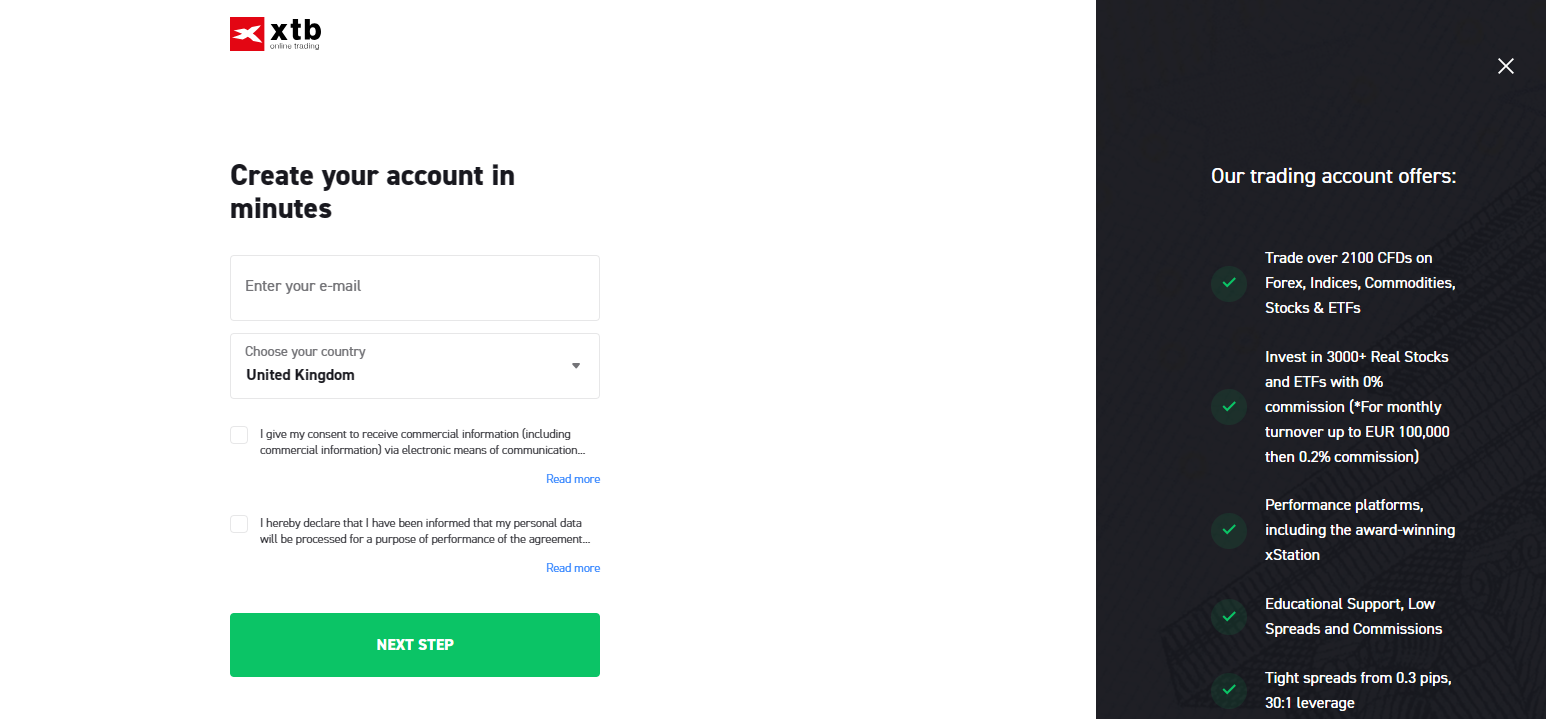

How to Start Leverage Trading on XTB?

XTB is a widely used broker for UK traders, and provides a safe and secure trading environment due to it being a fully regulated platform by the Financial Conduct Authority. The platform provides a slick and easy-to-use trading interface and users can easily sign up to the platform to start leverage trading following the steps below.

1. Register with XTB to Open an Account

In order to start trading on XTB users will need to register with the platform to open an account. Simply fill in the registration form which requires user data such as full name, email and mobile number, while setting a username and password.

2. Complete Identity Verification Process

Trading platforms that are regulated in the UK must adhere to Know Your Customer (KYC) requirements. All users must verify their identity on XTB in order to start trading financial instruments on the platform. Users must either upload a coloured copy of their passport, or alternatively a coloured copy of their ID card. If using an ID card then an additional utility bill copy will also need to be provided.

3. Deposit Funds into XTB Account

Once the verification process is approved, users can go ahead and deposit funds into their XTB account. There is no minimum deposit for XTB and the platform accepts several payment methods including credit/debit card, PayPal, Skrill and Neteller. Users can also top up their balance via bank transfer, however, if opting for this method the minimum deposit is $500.

4. Start Leverage Trading

Once the funding process is complete users should be able to see their liquid capital in the account balance section. Users can then access the trading interface, select which assets to trade and set the desired leverage amount according to individual risk appetite. Bear in mind according to UK regulatory framework the maximum leverage permitted is 1:30, and that is only for major currency pairs. Other assets have maximum leverages of between 2x – 20x depending on which asset class is being traded.

Conclusion

Leverage trading comes with its risk, but it equally comes with its high reward potential. The high leverage forex brokers reviewed above are all ways to start trading with leverage trading, and they are regulated, and reliable platforms. To conclude our review, XTB stood out as the top ranked leverage trading platform for UK traders.

A key feature of XTB is the user-friendly trading interface which makes it a broker that gives investors a smooth and reliable trading experience. The platform is easy to navigate, spreads and any fees are easily viewed, and placing trades can be executed without complication. The platform also provides a unique social trading feature, whereby users can see other traders strategies and positions for better decision making and can even directly copy the trades.

All-in-all, being one of the most popular trading platforms amongst UK investors, XTB enables traders of all experiences to easily transact in the financial markets. It provides optimum trading conditions with quick executions, fast settlements and features that are easy to utilise. The platform does not have any deposit or withdrawal fees, and it proves to have some of the tightest spread and lowest fees making it a go-to platform for leverage trading.

75% of retail investor accounts lose money when trading CFDs with this provider.