How To Invest in Crypto in the UK in 2025 – Beginner’s Guide

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

During November 2021, cryptocurrency market value increased to the much-anticipated figure of $3 trillion, demonstrating how powerful decentralized currencies can be. By 2025, it will have held at $2 trillion or higher.

Do you think it makes sense in 2025 to invest in cryptocurrencies? Throughout this guide, we answer some of the most common questions about Web3, how to invest in crypto in the UK, build a crypto investment portfolio, and what the future may hold for the top financial asset of the past decade.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

-

-

Why Invest in Cryptocurrencies?

Here are some reasons to invest in cryptocurrencies as soon as possible if you are curious about digital currencies but are unsure about doing so:

Decentralization of cryptocurrencies gives you control over your assets

In the trading of cryptocurrencies, no third parties are involved in your transaction, making it a decentralized form of trading. The cryptocurrencies you store are yours, and you have complete crypto ownership. Furthermore, crypto prices are not determined by exchanges or brokers.

Cryptos are transparent and secure

Due to their transparency and security, cryptocurrencies have skyrocketed in popularity. Blockchain technologies increase security and transparency in crypto transactions, allowing investors to put their money into a huge investment with confidence. Additionally, the fact that cryptocurrencies are open-source and publicly verifiable makes them popular with traders.

Crypto investments could give you big returns

It is well known that cryptocurrencies offer lucrative returns to the general public. Individuals can make informed investments that can yield short-term and long-term returns with expert advice, price history analysis, and other important factors. Crypto

Crypto trading provides you with the necessary independence and flexibility

Trades can be done at any time to suit every trader’s schedule. All investors and traders have access to the crypto market at all times during the day, giving them the freedom to make trading decisions at any time after thorough research and analysis.

How To Invest in Crypto in the UK 2025

In the following section, we will delve into the 5 basic steps of investing in cryptocurrency in the UK. Before you make any investments, take time to learn about the crypto market and build a robust risk management strategy.

Step 1: Choose a Crypto Trading Platform or Exchange

Step 1 of crypto investing is to choose a broker or crypto exchange that meets your investment needs. There are several different platforms available to UK investors which can make it difficult to decide on one.

The platform that you decide to use should offer the tools and features that are required to carry out your trading strategy. Therefore, the best platform will depend on whether you plan on adopting a long-term or short-term approach. Long-term crypto investors should look for exchanges that offer low commissions, zero inactivity fees, and staking features. On the other hand, active, short-term traders may prefer a platform that offers advanced charting tools, low spreads, and social trading features.

A List of UK Crypto Exchanges

- Crypto.com – Best UK crypto trading platform to buy cryptocurrency with GBP. Invest in over 250 coins with bank transfer, debit card, Apple Pay or Google Pay. Crypto.com is available on desktop and mobile and offers crypto debit cards that can be used to access your tokens at any time.

- OKX– A good option for experienced traders who are looking to implement advanced trading strategies. OKX offers Peer-to-peer trading, and spot trading and is compatible with the TradingView charting platform.

- Margex – Beginner-friendly crypto trading platform that offers an excellent range of educational resources. It is also possible to use the platform to trade with up to 100x leverage, which is suitable for experienced traders who want to increase the side of their position.

- HTX– HTX, formerly Huobi, is most suitable for experienced crypto investors. As well as traditional crypto trading, the platform supports cryptocurrency derivatives trading. HTX also offers crypto loans, OTC loans, dual investment, and copy trading.

- Binance – The best crypto trading platform for investors who want to access the wider web3 space. Binance supports cryptocurrencies and NFTs as well as crypto staking for long-term investors. Binance is supported by it’s own utility token, BNB, and built on the Binance Smart Chain blockchain network.

- Coinbase – The largest crypto exchange in the United States that is also available in the UK. It ensures the security and safety of users’ information on its platform and provides a healthy trading experience to all of its users. Coinbase is the best option for beginners because it has a simple interface, is available on mobile and provides a good range of educational resources.

- Kraken – Kraken provides some of the industry’s best safety and security features, and it allows traders to trade futures based on cryptocurrency, which most other platforms don’t offer.

- Coinjar – Best wallet app to invest in crypto for long-term investors. Coinjar allows users to purchase and sell Bitcoin as well as other cryptocurrencies from £10 and provides a seamless mobile app for managing your portfolio.

- Evonax – Evonax offers some of the lowest crypto trading fees in the UK. The company was founded in 2016 and offers zero-fee cryptocurrency trading as well as no transaction fees.

UK exchange fees compared

Platform Crypto trading fee Inactivity fee Withdrawal fee Crypto.com 0.04% maker and taker fees Free According to the currency withdrawn. 0.0004 for ETH OKX 0.10% per trade Depends on account verification level Free Margex Maker Fee of 0.019% and a Taker Fee of 0.060 Determined individually for each account Approved Crypto Network Fees Binance Commission, starting from 0.1% Free 0.80 EUR (SEPA bank transfer) Huobi Commission, starting from 0.2% Free 0.2% Coinbase Commission, starting from 0.50% Free 1.49% to a bank account Kraken For sellers, commissions start at 1% per trade. Free for buyers Free According to the currency withdrawn. 0.0005 for BTC Coinjar Currently 0.2181% Free Depending on amount Evonax Vary between 1-3% Free Free How to choose an exchange

To choose a suitable crypto exchange, it is helpful to understand what to look for. Here is an overview of the key features of a good exchange that you should consider when making your decision.

✔️ Security

This is an essential criteria when choosing a trading platform. As the crypto space is rife with fraud and scams, we have chosen options that are verified and offer maximum security for data and portfolio assets.

✔️ A user-friendly trading environment

Whatever your level of experience, a platform that is efficient and easy to use is always the perfect choice. In our list you’ll find platforms for beginners who are just taking their first steps into the world of trading, as well as those with more experience.

✔️ Fees and commissions

Depending on the options available and the volume or criteria used, some platforms charge different fees for these operations. In general, when choosing platforms, we look for them to offer minimum fees and commissions for each action and processing.

✔️ Trading Bitcoin and other popular cryptocurrencies

We have selected platforms that allow Bitcoin trading in the UK, as well as other major digital assets that may be of interest to investors. For example, Huobi supports over 355 types of cryptocurrency, making it the largest crypto exchange in the world today.

Step 2: Create a Trading Account and Crypto Wallet

Once you have chosen a platform to buy cryptocurrency, you will need to create an account and a crypto wallet. Some platforms, such as Coinbase and Crypto.com, come with native wallets that can be used seamlessly with the exchange. For other platforms, you may have to create an external cryptocurrency wallet with a provider such as MetaMask or Trust Wallet.

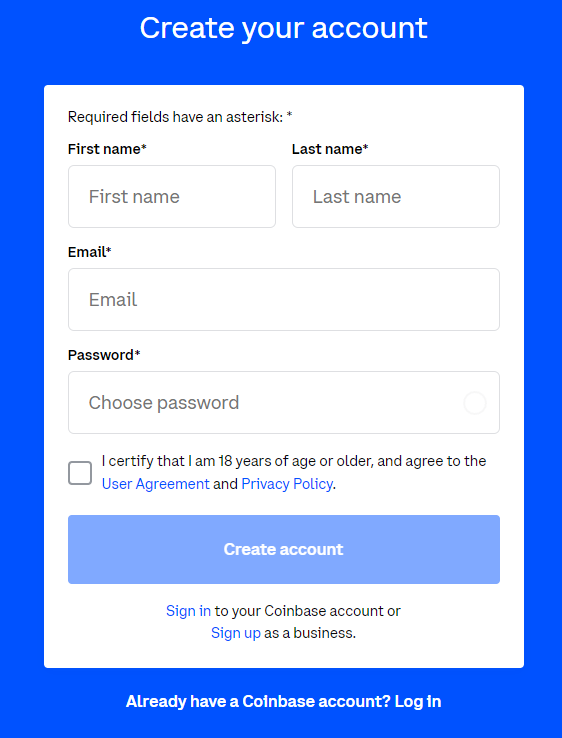

Creating an account with a centralized exchange

Centralized cryptocurrency exchanges require UK traders to provide personal information including an email address and phone number. You can sign up to one of these platforms by following the steps below:

- Fill out your personal details: Most platforms will ask for your name, email address, phone number, and residential address. Make sure that you have access to the email that you use so that you can verify your account.

- Account verification: Some crypto trading platforms will ask you to verify your ID by either uploading two forms of ID to the system or verifying via email.

- Tax information and payment details: Upon registering, you will be aksed to provide payment details and tax information. This is used to make sure that you are paying taxes correctly according to UK guidelines.

Signing up for a decentralised exchange

Decentralized exchanges are built on blockchain technology and do not require KYC information. The processes of signing up to a DEX is simple:

- Create an account: You can sign up for a decentralized exchange with just a username and password. You will not need to provide any proof of ID.

- Connect your crypto wallet: Most decentralized exchanges will ask you to connect your crypto wallet in order to start trading. This can be done by clicking ‘connect wallet’ and following the prompts that appear on your screen.

- Connect payment method: Some DEXes will allow you to buy crypto directly with your debit card. To do this, you will need to connect your payment method to your account.

How to create a crypto wallet

To invest in crypto in the UK, you will need to own a DeFi wallet. Some exchanges come with a wallet however, in other cases, you may need to follow these steps to create your own:

- Download browser extension or app: Most crypto wallets can be accessed through a browser extension or mobile app. Download the application of your choice to get started.

- Create a wallet: Digital wallets can be created without any personal information. Instead, you will be asked to create a password that will be used to access the wallet when connecting it to D’Apps.

- Store your recovery phrase: Hot wallets are securred with a secret recovery phrase which should be kept secret and stored somewhere safe. Recovery phrases, or ‘seed phrases’ are a randomized string of words that are unique. Anyone who has access to the recovery phrase will be able to access your wallet so you must keep it safe.

Step 3: Conduct Crypto Market Research and Analysis

The next step involves researching the crypto market to find potential investment opportunities. The best crypto trading platforms should provide research tools and live market data that you can use to analyze tokens and spot promising opportunities.

To research cryptocurrencies effectively, it’s crucial to understand the fundamentals of cryptocurrencies. Take the time to learn about blockchain, as this forms the backbone of most cryptocurrencies. Understanding how it works and its potential applications will provide you with a solid foundation for analyzing different coins and tokens.

Additionally, staying up to date with the latest news and developments in the crypto space is essential. Subscribe to reputable crypto-related websites, blogs, and forums to gain insights into emerging trends, regulations, and technological advancements. This information will help you make informed decisions based on market sentiment and expert opinions.

Lastly, use analysis tools to conduct more in-depth research into tokens that you are interested in. Most exchanges offer in-house charting tools but you can also use websites like CoinMarketCap and CoinGecko. Combining data from these sources with your own research will enable you to make more educated investment decisions.

What Are The Best Digital Assets to Invest in Right Now?

To help you start your research, here is a look at some of the best cryptos to watch in July 2025.

ETH (Ethereum)

Ethereum (ETH) is the second largest crypto by market cap after Bitcoin. It is a leading altcoin that uses a consensus proof-of-stake method to verify transactions.

With the open-source, decentralized blockchain network, decentralized applications (dApps) and smart contracts can be created and utilized without the interference of any third party.

Ethereum is the best alternative to Bitcoin due to all these features. In addition, a decentralized collection of financial products has been created for Ethereum that can be accessed by anyone around the world.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

ADA (Cardano)

Cardano (ADA) is a cryptocurrency that runs on the Cardano blockchain platform that utilizes proof-of-stake. The market capitalization of this cryptocurrency puts it in the top 10 cryptos by market cap. In addition, its use of fewer energy resources for validating transactions makes it a popular alternative to Bitcoin.

Cardano has a competitive advantage over other Blockchain technologies because of its proof-of-stake mechanism. Interoperability, scalability, and sustainable development are the goals of this cryptocurrency.

In September, the blockchain network launched its highly-anticipated Alonzo upgrade which means that the network can now be used to support NFTs. This will improve the functionality of Cardano, making it attractive to a wider range of projects.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

XRP (Ripple)

XRP is the native cryptocurrency of the Ripple blockchain network. The XRP Ledger uses this currency for remittances and international currency exchange. On the Ripple network, XRP is generally used as a bridge between transactions using different currencies. XRP is currently the 6th largest cryptocurrency by market cap.

One of the main reasons for Ripple’s popularity is the speed at which transactions can be processed on the network. For example, compared with Bitcoin (7 transactions per second) and Ethereum (15 transactions per second), Ripple can process 1,500 transactions per second.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

DOGE (Dogecoin)

Dogecoin was the coin of the year in 2021. The Shiba Inu on its logo references the popular doge meme. However, at the beginning of 2021, investors didn’t pay much attention to Dogecoin. The price charts of this meme coin increased in value after Elon Musk tweeted about it.

As soon as the cryptocurrency was listed on popular trading platforms like Coinbase, traders gained confidence in it. According to its market capitalization, this cryptocurrency currently ranks 11th. The supply of Dogecoins is uncapped, which means there is no upper limit on how many coins can be mined.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

Shiba Inu (SHIB)

In August 2020, Shiba Inu was launched to compete with Dogecoin in the crypto market. With a total supply of 1 quadrillion coins, it was founded on the Ethereum blockchain. As a result, the digital finance market has quickly gained significant traction with this cryptocurrency.

Since it was launched to compete with Musk’s favorite coin, it has attracted the attention of investors. Furthermore, after its listing on Coinbase, the largest US-based crypto exchange, its value increased by 40 percent, bringing it to the forefront of the crypto world. With an average daily trading volume $ 211.12M USD, the price of this cryptocurrency fluctuates between $0.00000667 and $0.00000701.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

Polkadot (DOT)

The Polkadot network uses the DOT token as its native token. Data and assets can be transferred across blockchains using Polkadot. Multi-blockchain technology is integrated across its network, providing high security and scalability. This platform uses DOT to secure its network and connect new chains.

Polkadot uses a proof-of-stake consensus mechanism to secure its network and validate its transactions, unlike Bitcoin and Ethereum. As a result of staking and participating in the network, users can also earn rewards in DOT.

Its market capitalization currently ranks 13th, according to CoinMarketCap. Polkadot has allocated 1 billion DOT tokens so far. Their initial coin offering was held in October 2017. The tokens were launched at $0.29 each.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

Tips To Build a Diversified Portfolio

The best way to reduce risk when investing in cryptocurrencies is to build a diverse portfolio. This involves investing small amounts into a basket of currencies rather than investing all of your capital into one token.

Here are some top tips for building a diverse crypto portfolio in 2025.

How many cryptos do you need to invest in?

You could be at risk if you have an insufficient number of cryptocurrencies in your wallet. On the other hand, your wallet will reap benefits in the long run if you have both volatile and stable coins. In addition, many investors open accounts on multiple crypto exchanges and brokers to gain access to different altcoins.

How long would you need to hold your investment?

Volatility and unpredictability are characteristic of the cryptocurrency market. Therefore, investing over a certain period is not possible because the duration of each investment depends on factors like the nature of crypto, market factors, and news regarding the market.

However, it is only after thorough research and analysis that you can decide the duration of the crypto investment.

How much would you need to invest?

You shouldn’t invest all your net worth into cryptocurrencies, especially volatile and unpredictable altcoins. However, keeping some capital aside to buy the dips is not a bad idea, even if you’re bullish on crypto as a long-term investment.

Depending on your disposable income, you may adjust that figure accordingly. In addition, do not invest too much money in cryptocurrency as this would bring unnecessary risk to you.

You can open multiple cryptocurrency exchange accounts to split up your money, keeping some of your money in Bitcoin, which has never experienced a 90% price correction or higher, as many altcoins have.

Step 4: Invest in cryptocurrency

After conducting research and analysis, you can buy crypto through the crypto exchange of your choice. The process of buying crypto is similar to buying traditional stocks and shares.

You will need to fund your trading account with fiat currency or deposit other crypto tokens that can be swapped for the asset that you wish to buy.

How to invest in cryptocurrency with fiat

If you choose to use a centralized exchange, you will be able to buy crypto with fiat currency. This involves connecting a debit card or bank account to your trading account and then using your capital to execute the order.

When you buy crypto with fiat, you may run into transaction fees. These fees can be imposed by both the exchange and your banking provider.

To trade crypto with fiat:

- Connect a payment method to your account.

- Fund your account with fiat. It is a good idea to start with the minimum deposit.

- Search for the token that you wish to buy.

- Enter the amount of crypto that you would like to buy in the order box.

- Check the details of the order and confirm the transaction.

How to trade crypto through a DEX

If you choose to use a decentralized exchange to buy cryptocurrency, you will need to use other coins to buy tokens. This means that you will need to fund your crypto wallet with digital currency before you can proceed with investing in cryptos.

The tokens that you will need to use depend on the blockchain network that your chosen crypto investment is built on. For example, tokens built on the Ethereum network can be bought with ETH or USDT.

To start trading crypto on a DEX:

- Connect your wallet to the DEX so that you access your crypto funds.

- Search for the token that you would like to buy.

- Fill out the order form. This involves selecting which tokens you would like to swap and the amount of crypto that you would like to buy.

- Check the order details and confirm the transaction.

- The new tokens will be sent to your wallet address.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

How To Store Your Crypto Investments Safely

In general, cryptocurrency is like computer code. However, unlike traditional fiat currencies, crypto holdings can’t be stored physically. Therefore, we need crypto wallets to store or trade cryptocurrencies by interfacing with blockchains. Crypto wallets are hardware or software products that allow for the storage or trading of cryptocurrencies.

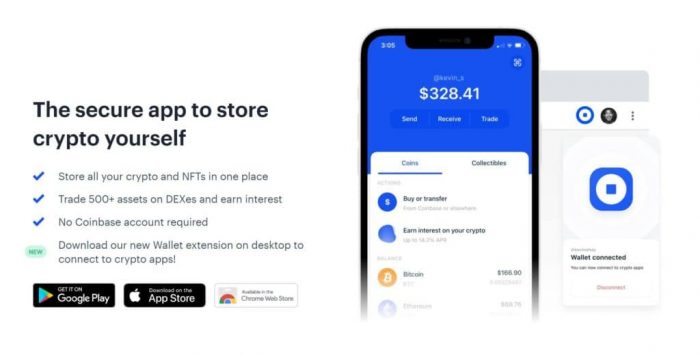

Coinbase Wallet

As well as a separate crypto wallet, Coinbase is a reputable crypto exchange. This wallet has the advantage of not requiring users to have an account with Coinbase to use it. It does, however, facilitate quick transfers to Coinbase.

The wallet allows you to store more than 500 cryptocurrencies and many different non-fiat currencies. Moreover, this wallet ensures high security for your information and funds, thanks to biometric authentication and optional cloud backup.

Binance Exchange Wallet

You can earn rewards and store cryptocurrencies using the Binance crypto wallet by staking your coins. About 10 million people worldwide use this wallet, which is available as a mobile app. You can buy, trade, or exchange hundreds of cryptocurrencies through the wallet’s easy-to-use interface.

Security and Risks of Cryptocurrency Investing

Volatility is the most significant risk associated with cryptocurrencies. Its price could change dramatically if there are unanticipated changes in the market. In addition, it should be remembered that cryptocurrencies can lose their value in hundreds, if not thousands, of dollars at a time.

When trading on cryptocurrencies, technical glitches, hacking, errors, and other human errors can also occur. In addition, considering that the market is unregulated, scams and corruption are possible. For example, a hacking incident in 2011 resulted in more than $450 million worth of cryptocurrency being stolen from Mt Gox. However, the money was eventually repaid to those who lost their money.

Hard forks and discontinuity are also risks associated with crypto trading. On price charts, hard forks are marked by significant price variations. In addition, beginners are more vulnerable to frauds or scams in crypto trading, making it more important to avoid pump and dump groups, obvious Ponzi schemes, and leverage trading.

Considering all these risks, dealing with a reputable crypto exchange and using a high-security wallet is imperative. The Coinbase platform provides all these essentials by offering a wallet with a secured private key and a free recovery service.

How To Sell Crypto in the UK

Investing in crypto is especially risky, as the price can always crash back to where you entered, so you should de-risk once you have made a big profit. The conversion of any cryptocurrency into cash, Bitcoin, or stablecoins like Tether (USDT) is instant.

Cryptocurrencies can be sold using Coinbase in a few simple steps. After logging into your account, you must first enter the withdrawal channel. Lastly, make sure your account has the minimum withdrawal amount ($1) and that you have closed all active positions (open trades).

As soon as your available balance is reflected on the bottom left corner of the menu, you can begin withdrawing funds by clicking on withdraw funds. If you withdraw money, keep in mind the £1 withdrawal fee. Your investment money can be withdrawn after you’ve selected your withdrawal amount and channel.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

UK Crypto Taxes and Regulation

As cryptocurrencies become more popular, many countries have made laws concerning their taxation. In addition, cryptocurrencies are taxed in the UK, where they are treated as property and therefore are taxed.

To determine if cryptocurrency transactions are taxable or not, Her Majesty’s Revenue and Customs (HMRC) has issued guidelines. A similar tax rate is applied to these digital assets to ordinary income. Any losses incurred while holding crypto-assets can be deducted from the taxable income generated by those cryptocurrencies and carried forward to the following year.

Tokens are subject to capital gains tax in the following scenarios: they are sold, they are received from employment or mining, they are exchanged from one cryptocurrency to another, they are used to buy goods and services, they are given to another individual except when given as a gift to a spouse or civil partner.

Conclusion

The finance industry’s future will be shaped by cryptocurrency for years to come. Over the past few years, the crypto market has grown exponentially. As a result, regulators cannot ignore this trillion-dollar industry. For this reason, governments recognize these digital currencies informally or formally.

As an example, Goldman Sachs, once skeptical about the future of crypto, has now stated in publications that allocating a certain percentage of your portfolio to blockchain-based assets makes sense. That is because cryptocurrencies will transform the way we buy and sell goods and services within a few years.

Investing in crypto is a good way to diversify your portfolio with digital assets and take advantage of future growth. In this guide, we have provided a comprehensive overview of how to invest in crypto in the UK. Before making any investment decisions, take time to conduct thorough research and analysis.

Cryptoassets are highly volatile. Please make sure that you can afford to lose your investment.

FAQs

How much to invest in crypto?

How much you invest depends entirely on your preferences, disposable income, and other factors. Nevertheless, do not invest too much money in cryptos as that would be a risk to you.How many people are investing in cryptocurrency?

It is estimated that over 100 million people have begun investing in these digital assets, even though there is no exact data regarding how many people are investing in cryptocurrency. According to some sources, around 10% of the world's population is reportedly investing in cryptocurrencies.How to learn to invest in cryptocurrency?

Invest in cryptos with the Coinbase trading platform. The platform gives you information like how to start investing in cryptos, what your portfolio should look like, your trading strategies, price analysis, expert comments, market-related news, and so much more.How to invest in Bitcoin ETF?

To invest in a Bitcoin ETF, you will need to sign up to a stock broker that supports that asset, deposit funds and execute a buy trade.Are banks investing in cryptocurrency?

Standard Chartered Bank of London, BNY Mellon, Citibank, etc., are just some of the big banks that have started investing in cryptocurrencies.What is the best cryptocurrency to invest in?

References:

“https://www.trulioo.com/blog/kyc”

“https://www.kaspersky.com/resource-center/definitions/what-is-cryptocurrency”

“https://www.wired.com/2014/03/bitcoin-exchange/”

“https://changelly.com/blog/ethereum-eth-price-predictions/”

“https://coinpriceforecast.com/cardano-forecast-2020-2025-2030#:~:text=1%20Cardano%20%3D%20%240.2797,2029%20and%20%240.7%20in%202032.”

“https://coinmarketcap.com/currencies/polkadot-new/”Jhonattan Jimenez Finance and Crypto Writer

View all posts by Jhonattan JimenezBefore starting his career as a freelance writer, Jhonattan studied at the Universidad La Gran Columbia from which he graduated in 2019. Jhonattan describes himself as a crypto enthusiast and regularly writes price prediction articles for new projects. During his time as a writer, Jhonattan has gained great knowledge about the crypto space and has mastered technical analysis skills that he uses when writing token price predictions. As well as writing for Trading Platforms, Jhonattan has written for Stocksapps.com and Buyshares.co.uk.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up