High Leverage Forex Brokers in the UK 2026 – Platform Reviews

To trade forex on leverage, you need to do is to find a broker who ticks off all the boxes and lets you trade on a variety of forex pairs with high leverage. In this guide, we have reviewed high leverage forex brokers that UK traders are accepted at.

It is important to spend time researching the different options that are available. This is because each broker offers different features and fees. Read each mini review to discover more about UK high leverage forex brokers.

-

- 1. XTB - High Leverage trading platform promoted by Connor McGregor

- 3. Trade Nation - User-friendly high-leverage trading app in UK

- 4. Admiral Markets - A high-leverage platform with low trading fees that are difficult to match

- 5. Plus500 - A multi-asset trading platform that is listed on the London Stock Exchange.

- 6. Pepperstone - High Leverage 2023 Awarded best MetaTrade 4 broker

-

- 1. XTB - High Leverage trading platform promoted by Connor McGregor

- 3. Trade Nation - User-friendly high-leverage trading app in UK

- 4. Admiral Markets - A high-leverage platform with low trading fees that are difficult to match

- 5. Plus500 - A multi-asset trading platform that is listed on the London Stock Exchange.

- 6. Pepperstone - High Leverage 2023 Awarded best MetaTrade 4 broker

[stocks_table id=”95″]7 High Leverage Forex Brokers in the UK

There are several brokers that provide the option to trade FX currency pairs using high leverage. However, each of these brokers is suitable for a different type of trader. Here is a list of UK high leverage forex brokers, followed by a review of each of them:

- XTB: XTB is a popular high-leverage platform with a 1:500 leverage, allowing investors to access up to $50,000 in trading capital with a $100 commitment. It offers a variety of payment options, including debit and credit cards, bank transfers, and Paysafe. XTB is known for its user-friendly interface, security, and easy usability, and has received three awards, including “Best CFD and Forex Broker” by Investcuffs in 2021 and “Best Forex Broker” by Rankia in 2022.

- Avatrade: AvaTrade is favored by expert traders for its compatibility with MT4/MT5, high leverage up to 400x for forex pairs, and forex options at 100x leverage. It operates globally, providing various asset classes, but fees may apply based on the asset. AvaTrade suits traders seeking advanced tools.

- Trade Nation: Trade Nation is a UK-based forex trading platform with low-cost fixed spreads, offering a user-friendly interface and mobile application for effective trading. It accepts regular forex trading, forex spread betting, and CFD trading, offering a diverse choice of currency pairings and technical analysis tools. Trade Nation supports over 1000 financial instruments and has no minimum deposit requirement.

- Admiral Markets: Admiral Markets is a respected forex broker with low trading fees, offering standard accounts with spreads as low as 0.5 pips and ECN trading accounts with spreads as low as 0 pips and commissions as low as $1.8 per lot. With over 40 currency pairs, it offers a diverse range of trading strategies and allows users to leverage trade across various instruments.

- Plus500: Plus500 is a FTSE 250 trading platform based in the UK, established in 2008 and sponsoring the Chicago Bulls NBA team. It specializes in CFDs for stocks, indices, options, forex, commodities, and commodities. With over 300 million opened positions and $800 billion in trade volume since its launch, Plus500 offers three account types for forex trading: Invest, CFD, and Futures.

- Pepperstone: Pepperstone, founded in 2010, is a popular MetaTrader brokerage platform with over 1200 instruments, including forex, commodities, shares, and ETFs. It offers over 60 currency pairs with spreads starting at 0.6 pips and is regulated by financial authorities. Pepperstone offers a Razor Account with zero pip spreads on 14 forex pairs and lower spreads on all other instruments.

How We Reviewed High Leverage Forex Brokers

When selecting the platforms for this article, we were guided by several criteria that helped us identify some of the best forex trading platform options. Firstly, the basic criterion was to find some options that allow you to trade from the UK. Some of the platforms operate in over 100 countries worldwide, which is an advantage. We considered for a variety of features that could be useful to users, such as different trading products and tools, high levels of security and ease of use.

We also looked for platforms that offered access to multiple currency pairs from around the world. These include some of the most widely traded forex pairs. Traders can choose between MT4 and TN Trader, both of which offer technical analysis tools and risk management features. Another important consideration is commissions. Many of the chosen platforms have low fees, no commissions and no minimum deposit requirements.

What is High Leverage Forex Trading?

High leverage forex trading refers to the practice of using borrowed funds to increase the size of a position in forex trading. In essence, it allows traders to control larger positions in the market with a relatively smaller amount of capital. This leverage is offered by brokers and typically ranges from 1:5 to 1:1000, although different brokers may offer varying levels of leverage.

The main benefit of high leverage trading is that traders can amplify potential profits. Traders can enter positions that are significantly larger than their account balance, giving them the opportunity to make substantial gains. However, it is important to note that leverage works both ways, as it also amplifies the risk of losses. With higher leverage, even a small adverse movement in the market can result in significant losses, potentially exceeding the initial investment.

While high leverage trading can be attractive to experienced traders, it is crucial for traders to exercise caution and have a clear understanding of the potential risks involved. It is recommended to have a solid risk management strategy in place and to only use leverage that aligns with personal risk tolerance and trading skills. In addition, it is essential to choose a reputable broker that provides transparent information about leverage and offers robust risk management tools.

What is Considered an Appropriate Leverage Ratio in Forex Trading?

The amount of leverage that is useful to you depends entirely on your risk appetite, as increased leverage comes with its own set of risks. Higher leverage means that you will have a higher profit if the trade goes in your favour. However, the trade-off is that there is a higher amount of money at risk, the margin of error is lower, and the chances of you losing a lot of money are quite high if the trade goes against you. Therefore, higher leverage is only suitable for those who have a higher risk appetite.

Therefore, the amount of leverage that is right for you depends on how you wish to trade. If you are a risk-averse trader, then it may be more suitable to trade with lower amounts of leverage, which will limit your risk and downside and leave more room for error. On the other hand, if you’re a risk-happy trader, then platforms that offer high leverage may be appealing, as you believe that the higher risk is justified by the high reward potential on the trades.

What Is Margin and How Does it Relate to Leverage in Forex Trading?

Margin is a crucial concept in forex trading, and it plays a significant role in determining the level of leverage a trader can utilize. In simplest terms, margin is the amount of money required by a trader to open a position in the forex market. It acts as a form of collateral or a security deposit, allowing traders to access larger positions with a smaller upfront investment.

Leverage, on the other hand, refers to the ability to control a larger position using a smaller amount of capital. It is expressed as a ratio, such as 1:50 or 1:100, which means a trader can control 50 or 100 times the amount they have in their account. Leverage amplifies both profits and losses, as gains or losses are calculated based on the total value of the position, not just the initial investment.

The relationship between margin and leverage is intertwined. The higher the leverage, the lower the margin requirement will be, allowing traders to control larger positions with less capital.

Understanding margin and leverage is essential for anyone venturing into forex trading. It is crucial to learn how to calculate margin requirements and to use leverage responsibly. By employing risk management strategies, traders can effectively utilize leverage to their advantage while minimizing the potential for significant losses.

Pros and Cons of High Leverage Forex Trading

Pros:

- Traders can use leverage to amplify potential profits without needing to deposit more funds.

- High-leverage forex trading allows investors to take advantage of small price movements that would otherwise result in only marginal returns.

Cons:

- Trading with leverage amplifies losses.

- Most high-leverage trading strategies use short-term positions that resemble day trading. Day trading is known for being highly volatile and requires constant monitoring and adjustment. This type of trading is not suitable for traders who cannot watch the market around the clock.

A Closer Look At High Leverage Forex Brokers in the UK

After extensive research on all the high leverage forex trading platforms available to traders and investors in the UK, we have reviewed high leverage forex brokers that are available in the United Kingdom. Each of these platforms has been discussed below in detail.

1. XTB - High Leverage trading platform promoted by Connor McGregor

XTB, which has been among the most popular high-leverage platforms so far, as one of its ambassadors is Connor McGregor, has managed to integrate some of the most important aspects any trader considers before using a trading platform. It offers an excellent combination of values, high-quality products, security, and easy usability. According to Finance Magnates, net profit for Q1 in 2023 was reported at an impressive €64.4 million, which means an impressive 19.9% year-on-year growth.

XTB appears to recognize and value the necessity for leverage while trading forex, since the broker provides a massive 1:500 leverage. This means that investors can gain access to up to $50,000 in trading capital with a simple $100 commitment. It's easy to see why XTB is popular among forex traders. It's one of the most leveraged brokers available, making it ideal for capitalizing on small price changes.

Newbies who do not want to risk large sums will appreciate the fact that XTB does not have a minimum deposit requirement, has about 48 currency pairs available for trading 24/7, and has several payment options available, including debit and credit cards, bank transfers, and Paysafe. Bank transfers and card deposits are free, but Paysafe deposits are subject to a 2% fee. Withdrawals are free, starting at $100.

XTB, an experienced platform, considers user needs and opinions before making changes, positioning itself as a top option in the industry. It has received three awards, including "Best CFD and Forex Broker" by Investcuffs in 2021 and "Best Forex Broker" by Rankia in 2022.

75% of retail investor accounts lose money when trading CFDs with this provider.

2. Avatrade - High leverage trading platform compatible with MT4

AvaTrade is a suitable platform for expert traders, and this is the case for a variety of reasons. For starters, it is compatible with several trading platforms, including but not limited to MT4 and MT5, which allow automated trading, signals, and bots.

At the same time, they also have high leverage and operate in several regions across the world. While their exact leverage differs, they have a maximum leverage of 400x for forex pairs, alongside 200x for commodities, 10x for stocks, and 20x for ETFs.

AvaTrade is also one of the very few high leverage forex brokers that offer forex options, which makes it a unique option for expert traders. However, the leverage on forex options is only 100x, much lower than the standard forex leverage of 400x.

Avatrade fees:

Fee Amount CFD trading fee Variable spread Forex trading fee Spread. 0.9 pips for EUR/USD Crypto trading fee Commission. 0.25% (over-market) for Bitcoin/USD Inactivity fee $50 per quarter after three months of inactivity Withdrawal fee Free There is no guarantee that you will make any profits with this provider. Your money is at risk.

3. Trade Nation - User-friendly high-leverage trading app in UK

Trade Nation is the next platform in our ranking of forex trading platforms in the UK. Trade Nation is regulated by the Financial Conduct Authority (FCA) and defines itself by offering low-cost fixed spreads, making it one of the most cost-effective forex trading platforms in 2023.

The platform has an easy-to-use interface, and its mobile application ensures effective trading in any situation. Traders can also use the PC trading interface for in-depth market analysis. Trade Nation accepts both regular forex trading, forex spread betting, and CFD trading. This adaptable method is suitable for a wide range of traders and trading tactics.

Trade Nation gives you access to a diverse choice of significant currency pairings from across the world, including some of the most widely traded forex pairs. Traders can choose between MT4 and TN Trader, which both provide technical analysis tools and risk management features.

In addition to FX, Trade Nation supports over 1000 financial instruments from various markets. The website allows users to trade stock CFDs, indices, commodities, and other major markets.

Trade Nation has no minimum deposit requirement, and customers can experience trading with a free demo account before depositing any funds. If you have any questions, the customer support service is available 24 hours a day, seven days a week.

77% of retail investor accounts lose money when trading CFDs with this provider.

4. Admiral Markets - A high-leverage platform with low trading fees that are difficult to match

One of the most respected forex brokers with low trading fees is Admiral Markets, which is ASIC-regulated. Standard accounts at this brokerage have spreads as low as 0.5 pips. ECN trading accounts have spreads as low as 0 pips and commissions as low as $1.8 per lot. Traders will struggle to find low spread forex brokers that can compete with these fees.

The foreign exchange market, also known as forex, is one of the world's most liquid and traded financial markets. Admiral Markets offers over 40 currency pairs for trading, including major, minor, and exotic pairs. Admiral Markets offers major currency pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as a number of minor and exotic pairs. This provides investors with the ability to pursue a diverse range of trading strategies.

Admiral Markets allows users to leverage trade across various instruments, with a maximum leverage of 1:30 for major currency pairs and cross rates. Other currency pairs have a maximum leverage of 1:20, while CFDs on stocks, ETFs, bonds, and cryptocurrency pairs have a leverage of 1:10.

Admiral Markets provides MetaTrader 4 and 5 access, as well as a custom forex trading app for iOS and Android devices. Traders also receive daily market analysis, an economic calendar, and a global market news feed. Admiral Markets also provides 24/7 customer service via phone, WhatsApp, and email.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

5. Plus500 - A multi-asset trading platform that is listed on the London Stock Exchange.

Plus500 is an internationally recognized trading platform and a FTSE 250 company listed on the London Stock Exchange. The Plus500 group was established in 2008, and as of 2011, it has been based in the UK. Additionally, Plus500 is the primary sponsor of the well-known Chicago Bulls NBA team and a major global sponsor of numerous sports teams from the Italian, Polish, and Swiss football leagues.

This broker specializes in providing CFDs for stocks, indices, options, forex, commodities, and commodities. The platform has enabled more than 300 million opened positions and $800 billion or more in trade volume since its launch.

Plus500 offers three account types for forex trading, including Invest (for stocks), CFD (leverage trading), and Futures (U.S. future markets). For UK customers, the CFD option is available, providing access to most instrument types.

The platform offers low costs, no commissions, tight spreads, and educational resources on forex. It also provides risk management tools and a +Insights feature for monitoring and tracking other traders' activity. Users can access all features through their browser-based device or app.

The maximum permitted leverage, which is 1:30 for the more than 60 forex pairs the platforms support, varies depending on the type of asset. Leverage is allowed up to 1:20 for commodities and indices and up to 1:5 for exchange-traded funds (ETFs).

There is no guarantee that you will make any profits with this provider. Your money is at risk.

6. Pepperstone - High Leverage 2023 Awarded best MetaTrade 4 broker

Pepperstone was founded in 2010 by seasoned traders and has since grown to become one of the world's most popular MetaTrader brokerage platforms. The company is regulated by a number of financial authorities around the world and only keeps user funds in tier 1 segregated banks.

Clients have access to over 1200 instruments, including forex, commodities indices, commodities, shares, and ETFs, through the award-winning broker. Investors can trade CFD instruments or participate in tax-free spread betting for their UK clients.

Pepperstone is a competent forex brokerage that offers over 60 currency pairs with spreads starting at 0.6 pips. It is a strong contender for new forex traders because it provides straightforward pricing, a wealth of educational resources, and a selection of trading platforms.

The maximum leverage at Pepperstone is 500:1, though British retail traders are only permitted to use a maximum of 30:1 under FCA regulations. Pepperstone is an easy-to-use platform with quick and free account creation, low fees (no deposit, withdrawal, or inactivity fees), and 9 base currencies.

It is worth noting that in the Good Money Guide Awards 2023, Pepperstone was voted the best MetaTrader 4 broker. Pepperstone offers a Razor Account, which has zero pip spreads on 14 forex pairs and lower spreads on all other instruments than a standard account that has spreads ranging from 1.1 to 1.5 on major currency pairs. Pepperstone provides non-mainstream currency pairs such as Chinese Yuan, Danish Krone, Hungarian Forint, Polish Zloty, Singapore Dollar, and Turkish Lira.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

High Leverage Forex Brokers UK Fees & Leverage Comparison

The table below provides insights into the leverage that most platforms provide for retail and professional traders, and what their fees are like.

Broker Professional Leverage Retail Leverage Fees VantageFX 500x 500x Commission-free FinmaxFX 200x 200x Commission-free Plus500 300x 30x Commission-free AvaTrade 400x 400x Commission-free Forex.com 50x 50x Commission-free FXTM 1000x 1000x Commission-free Getting Started with a High Leverage Broker

In the following section, we will walk you through the steps that are involved with using a high leverage forex trading platform in 2026.

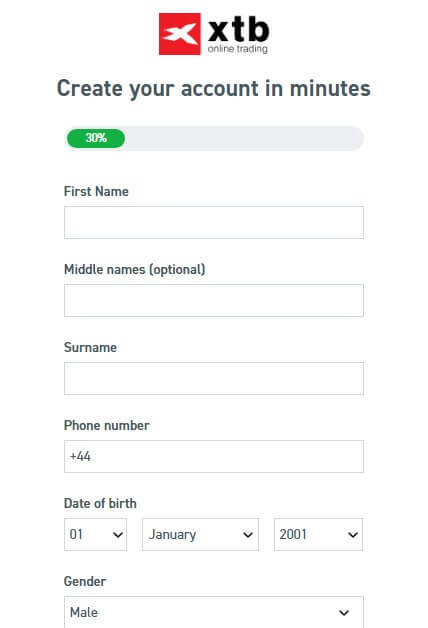

Step 1: Open an account

The first step is to open an account with the high leverage broker that you would like to use. For this example, we will use XTB.

You can create an account for free by providing your personal information. All high-leverage forex brokers in the UK will require personal information to comply with KYC policy. Therefore, you will need to have a form of ID to hand when creating a broker account.

Step 2: Explore the high leverage forex broker

After registering, XTB will verify your details which can take up to 48 hours. Whilst this is happening, you will be able to access the brokerage account and explore the different features that it offers.

This is a good time to use XTB's educational resources to improve your trading knowledge. The broker offers a good selection of forex trading articles that provide an in-depth look at best practices and different strategies.

You will receive an email notification once your details have been verified.

Step 3: Practice trading with a demo account

Before you start live trading, use the demo account to practice different high leverage trading strategies. The demo account can be used to trade with leverage up to 30:1 and provides $100,000 in virtual funds. Users can also access 24/7 support, over 2100 CFDs and 3000+ real stocks to trade.

Use the demo account until you feel confident. Most traders will use the demo account every time they adopt a new strategy or to make adjustments to their existing strategy. You can access the XTB demo trader at any time.

Step 4: Deposit funds

Before switching to live trading, you will need to fund your XTB account. In the UK the platform accepts deposits via bank transfer and debit card. Never invest more money than you can afford to lose.

Step 5: Search for currency pairs

Use the search tab to search for FX pairs that you would like to trade. For each pair, the dashboard will display a price chart and real-time market data. Use this information to make informed decisions about potential trading opportunities.

It is possible to add forex pairs to a watch list so that you can conduct analysis and keep track of pairs that you may consider.

Step 6: Conduct technical analysis

XTB provides numerous tools for technical analysis including the xStation 5 and xStation Mobile charting tools. Traders can use these platforms to conduct technical analysis and spot trading opportunities. Spend time familiarizing yourself with the market and conducting in-depth analysis before placing any high-leverage forex trades

Step 7: Place an order

After conducting analysis, you can place a high-leverage trade by searching for the pair that you would like to trade, navigating to the order box and filling in the required details.

You can set the leverage in the form as well as stop-loss and take-profit targets. XTB allows traders to place both buy (go long) and sell (go short) orders. To finalize the trade, click either 'Buy' or 'Sell'. The trade will then appear under open positions in your account.

75% of retail investor accounts lose money when trading CFDs with this provider.

Can I adjust my leverage level once I've opened a position?

XTB allows its clients to adjust their leverage level on existing positions. This can be particularly useful if you want to reduce your exposure to risk or if you want to take advantage of market movements and increase your potential profits.

To adjust your leverage level, simply log in to your XTB trading account and navigate to the 'Open Positions' tab. From there, you will be able to view all your current positions and make adjustments to your leverage level. It is important to note that changing your leverage level will have an impact on your margin requirement.

Top Tips For Trading Forex with High Leverage

We conducted research into high leverage trading best practices. Whilst these tips can help to minimize trading risk, they will not eliminate it completely.

- Understand and use risk-management tools. Most brokers have their own tools to manage and mitigate risk, so it is important for you to be aware of them and how they can help you.

- Use a risk-reward ratio while setting a stop-loss to ensure that the reward you get is proportional to the risk that you are taking.

- Only use high leverage while trading short-term positions. If you are opening a position that you wish to hold in the long-term, do not use high leverage as the time frame, and hence the probability, in which the trade can go against you is longer.

- Practice with a demo account. You can use a demo trading account to test out new platforms and strategies without putting any real capital at risk. It is a good idea to use demo account until the percentage of profitable trades becomes higher than the percentage of unsuccessful trades.

- Don't trade with more than you can afford to lose. Even though leverage trading allows you to trade with only a small amount of capital, you will be responsible for paying any losses that occur. Therefore, you should only trade with leverage if you can pay back money that is lost.

Conclusion

Trading with leverage is a high-risk trading that is used by traders who want to trade with more capital than they have in their accounts. Due to the risky nature of this trading strategy, it is important for you to do your research on choosing the right broker before you get started. There are several brokers that are suitable, which have all been reviewed above, including one regulated by the FCA in Britain. It is important that before you take the plunge into trading, you thoroughly analyse each broker to see if it meets your needs and preferences.

Choose a broker that allows you to trade a variety of highly leveraged forex pairs. You can choose from one of the options we've outlined in this guide or do your own research. However, please note that it is important to choose a broker that accepts UK traders.

75% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What are the advantages of high leverage trading?

Most brokers only function as the intermediaries between the trader and the market. Since FX pairs do not fluctuate a lot on any given day, brokers are able to provide high leverage while also still managing their own risks and exposure.How do forex brokers UK provide leverage?

Most brokers only function as the intermediaries between the trader and the market. Since FX pairs do not fluctuate a lot on any given day, brokers are able to provide high leverage while also still managing their own risks and exposure.Do UK forex brokers charge a fee for leverage?

Yes, most brokers charge a fee for providing leverage. This is called the overnight fee or the swap rate and is the rate of interest for them providing you with additional capital. Some brokers also have margin fees.Which UK broker has the highest leverage?

The highest leverage among forex brokers is with FXTM, which provides as much as 1000x leverage.Can I trade cryptocurrencies with leverage in the UK?

Yes, some brokers, such as AvaTrade, provide leverage on cryptocurrencies too, however, the leverage provided is much smaller when compared to FX pairs.References:

https://www.investopedia.com/articles/forex/11/why-trade-forex.asp"

"https://www.metatrader4.com/en" target="_blank" rel="noopener nofollow"

"https://corporatefinanceinstitute.com/resources/derivatives/contract-for-difference-cfd/"

"https://www.wealthwithin.com.au/learning-centre/leveraged-trading/leverage-trading-the-pros-and-cons"

"https://www.sciencedirect.com/topics/economics-econometrics-and-finance/foreign-exchange-market"

"https://www.youtube.com/watch?v=Y6xyQRDbJvU"Nishit Kumar Finance Writer and Analyst

View all posts by Nishit KumarNishit is a NGL Trader Analyst at Akari Trading. He has also worked as an analyst for Morgan Stanley and Onyx Commodities.

Before starting his career in finance, Nishit studied at the University of Warick where he was an active member of the Hedge Fund society. Due to his qualifications and experience, Nishit is considered an industry expert and enjoys writing content that could help traders to make informed decisions.

As well as writing, Nishit worked as Associate Editor for The Economic Transcript until 2021. He has also written for Newsweek and has good knowledge of current events that could affect the financial markets.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up