Best Forex Brokers and Trading Platforms in the UK 2026

For investors based in the UK and researching forex brokers, there are a number of forex brokers that are authorized and regulated by the FCA.

In order to find the right forex platform for their needs, prospective FX traders will need to look at factors like supported currency pairs, fees and commissions, trading tools, payments, and customer support. In this guide, we review several forex brokers that UK investors are accepted at.

-

- 1. XTB – Top UK forex broker with over 49 currency pairs and 5 stars on Trust Pilot

- 2. AvaTrade – Popular CFD forex broker with competitive fees

- 3. Admiral Markets – FX brokerage with extended hours and low forex spreads

- 4. Pepperstone – Award winning best MetaTrader 4 broker with over 60 FX currency pairs available

- 5. Trade Nation – Forex trading app that is compatible with MT4 for advanced trading tools

- 6. Alvexo – Online forex broker with user-friendly charting tools

- 7. FXCM – Forex trading app with a free demo account and copy trading features

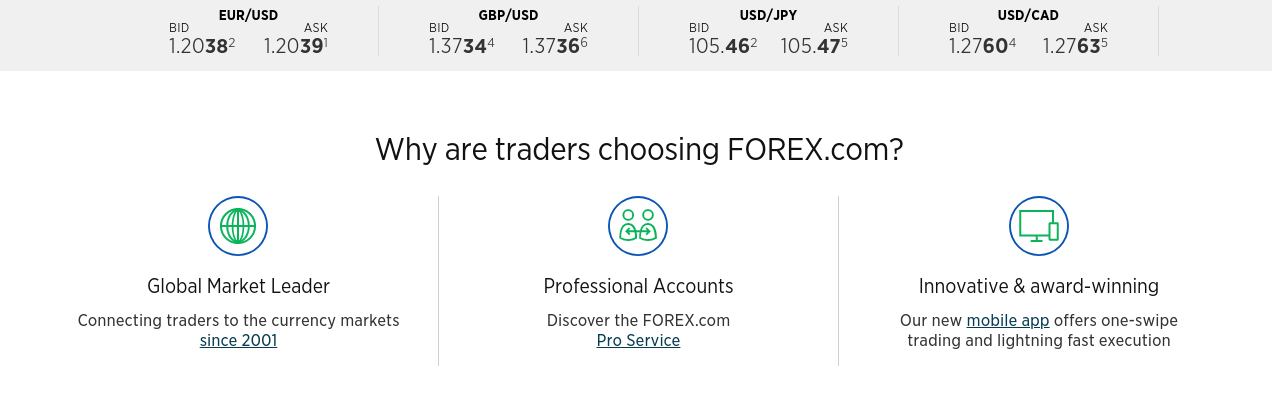

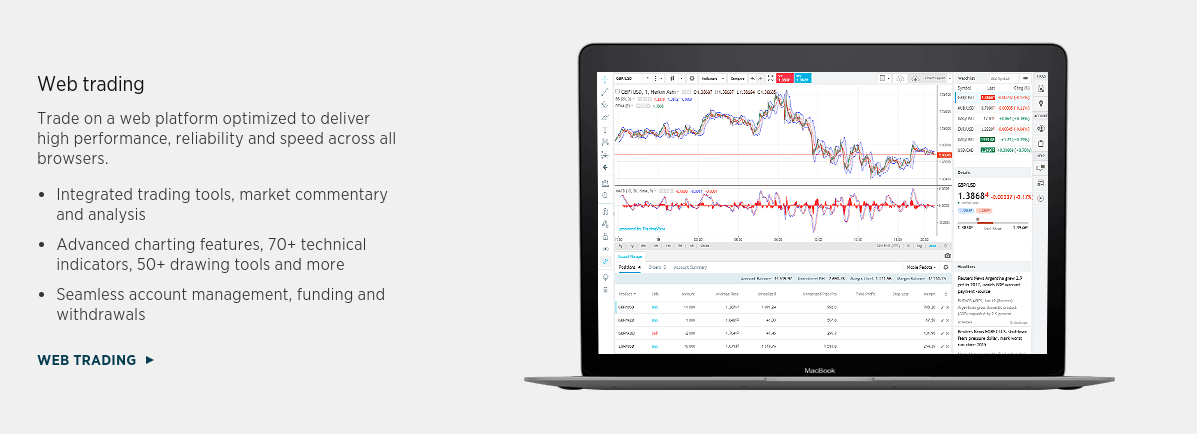

- 8. Forex.com – Market leading FX broker with automated trading features

-

- 1. XTB – Top UK forex broker with over 49 currency pairs and 5 stars on Trust Pilot

- 2. AvaTrade – Popular CFD forex broker with competitive fees

- 3. Admiral Markets – FX brokerage with extended hours and low forex spreads

- 4. Pepperstone – Award winning best MetaTrader 4 broker with over 60 FX currency pairs available

- 5. Trade Nation – Forex trading app that is compatible with MT4 for advanced trading tools

- 6. Alvexo – Online forex broker with user-friendly charting tools

- 7. FXCM – Forex trading app with a free demo account and copy trading features

- 8. Forex.com – Market leading FX broker with automated trading features

UK Forex Trading Platforms List for 2026

Below are various forex trading platforms suited to beginners. We review each forex brokerage in more detail further down on this page.

- XTB – XTB is a zero-commission platform that offers its clients access to over 5400+ instruments from CFDs for forex, commodities, indices, stocks and ETFs. This broker offers advanced trading and charting tools through the xStation 5 trading interface.

- AvaTrade – A trading platform that provides a multitude of financial instruments. AvaTrade offers a range of trading platforms from MetaTrader 4, AvaOptions, DupliTrade, AvaSocial and AvaTradeGO providing limitless trading experience.

- Admiral Markets – Classed as an investment ecosystem, Admiral Markets offers limitless investing in over 8,000 financial assets. The platform offers technically advanced financial analysis tools through the MetaTrader 4 and 5 interfaces, with endless customization through MetaTrader Supreme Edition and Stereo Trader.

- Pepperstone – Voted an award-winning MetaTrader 4 brokerage in 2023. Pepperstone offers a Razor Account type with zero pip spreads on 14 forex pairs and lower cost spreads on all other instruments than a standard account.

- Trade Nation – An FCA regulated broker and covered by FSCS which segregates user funds at London based Barclays Bank. The platform offers access to over 1000+ markets offering CFD trading and low cost spread bets.

- Alvexo – Founded in 2014 by a team of industry veterans, Alvexo is a regulated global investment brokerage offering a variety of payment methods, including PayPal, ApplePay and GPay. Alvexo offers CFDs for stocks, indices, currencies, commodities, and ETFs.

- FXCM – FXCM is a client-first, trader-driven brokerage. The platform provides access to spread betting, forex, and CFD trading services and has won multiple awards in the last three years.

- Forex.com – Forex.com was established in 2001 and is part of the StoneX Group. The platform offers CFDs for forex, indices, commodities, and shares. They have a notable news and analysis section that discusses popular trading topics, financial market alerts, and week ahead reports.

*not available for existing ECN clients, other fees may apply

What Is Forex Trading?

Forex trading (‘foreign exchange’ trading) involves buying and selling currencies through an online trading platform. It is a global market where individuals, institutions, and corporations trade currencies in order to make a profit or hedge against currency risks.

Unlike the stock market or other financial markets, forex can be traded around the clock as the market is open 24/7. This means that traders can trade currencies at any time, making it a flexible and accessible market for investors worldwide.

Forex trading involves buying one currency and selling another, in the hopes that the value of the currency being bought will increase relative to the currency being sold. Traders can make money in forex trading by taking advantage of price fluctuations in exchange rates.

To participate in forex trading, individuals can open an account with a reputable forex broker, who will provide them with a trading platform and access to the global currency market. Traders can then analyze the market, develop trading strategies, and execute forex trades online. It is important for retail traders to have a solid understanding of fundamental and technical analysis, as well as risk management techniques, in order to be successful in forex trading.

Forex CFDs and leverage trading

Forex traders usually trade CFD assets. CFDs are a type of instrument that can be traded without owning the underlying asset. They are used by day traders because CFDs offer tight spreads and fast execution speeds which means that they can be used as part of an active strategy. Trading forex CFDs also offers the benefit of leverage, which can be used to increase the size of a position without needing to deposit more funds. It’s also worth noting that while leverage increases your exposure to the forex market, it also maximizes potential losses.

Different Types of Forex Brokers

Forex brokers come in all shapes and sizes. They vary depending on what their FX quotations are based on. There are four main categories to choose from:

- No Dealing Desk: A broker that provides unfiltered access to the interbank of markets. These brokers act as a third party between the forex trader and interbank, allowing users to get the best price and execute trades immediately. NDD brokers are given liquidity by third-party platforms.

- Market Maker or Dealing Desk Broker: Market-makers use in-house experts to execute trades. The maker will provide a forex quote based on underlying market prices and then take the other side of the bid to provide liquidity.

- Electronic Communications Network (ECN): An electric trading platform whereby expert traders from commercial banks can enter bids. The main advantage of an ECN broker is that traders can maintain anonymity.

- STP (Straight Through Processing): STP brokers execute forex trades directly through a broker’s servers without the need for a dealing desk. Liquidity is provided by corporate banks. hedge funds and investors.

Forex Trading Useful Terminology

When searching for the best forex platform to use, it may be helpful to better understand some of the terminology that you may come across.

Trading account: This is the account that you will use to place trades. Forex trading accounts are typically managed by brokers. The accounts can only be accessed by the traders who created them or anyone of has the account login details.

Currency pairs: A currency pair is a type of asset that you trade in the forex market. The pair represents a price quote for two currencies- a base currency and a quote currency. When you place an order for a currency pair, the base currency is bought and the second currency is sold.

Leverage: Leverage is borrowed money that can be used to increase the size of a position on a trade. Leverage is shown as two numbers separated by a colon and represents the amount of money that you can borrow for every amount that you trade. For example, 1:100 means that you can borrow $100 for every $100 traded.

Pips: A pip is a unit of measurement between price points that is used to describe how much the price of a currency pair moves during a trade. The value of each pip depends on the size of your trade. For a trade position of 10,000 units, 1 pip would equal $1. So you would make or lose $1 for every 1 pip of price movement.

Spreads: A spread is the difference between the sell rate and buy rate of a currency pair. Narrow spreads are desirable as it is easier to profit from these pairs.

Best Forex Brokers in the UK Reviewed

The forex trading market witnesses trillions of pounds in daily activity. Consequently, numerous FCA-regulated trading platforms in the UK have emerged, offering traders the opportunity to find a provider aligned with their financial objectives.

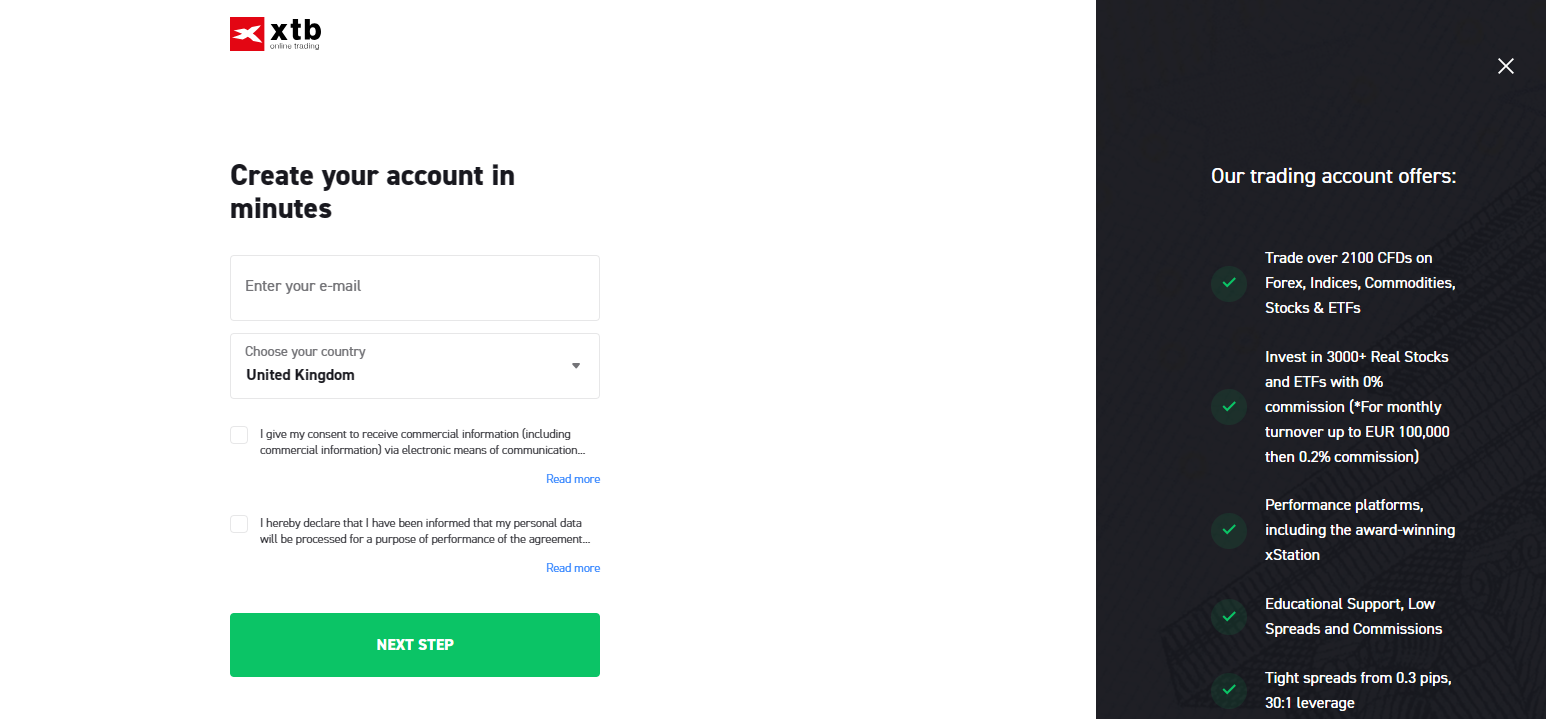

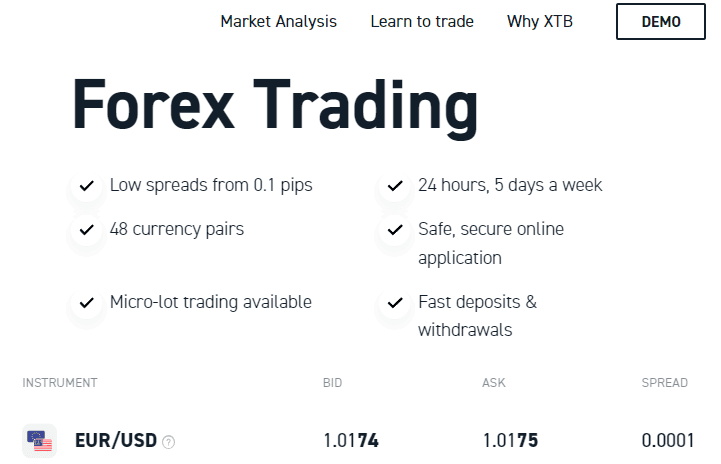

1. XTB – Top UK forex broker with over 49 currency pairs and 5 stars on Trust Pilot

As an online trading platform, XTB offers simplicity and cutting-edge tools and is ideal for beginners and experienced traders. As a result, the platform has attracted 60% 5-star reviews on Trust Pilot, which is impressive for a trading site.

Advanced traders may consider utilizing the 1:30 leverage available, enabling them to access 49 currency pairs encompassing major, minor, and exotic options.

Beyond this, XTB offers numerous benefits for traders. For instance, major pairs like GBP/USD can be traded with spreads as low as 0.1. Furthermore, XTB accommodates both large and small trades, catering to traders of all levels.

With XTB’s educational courses, new platform users can learn how to trade forex. In addition, they can keep up to date with all the latest news and developments in the foreign exchange markets and learn about the basics of trading.

Additionally, traders don’t need to deposit before they can start trading. There is also the option to trade microlots, which is substantially beneficial for them. There are also more than 2100 global markets that traders can trade in, including crypto, stocks, commodities, ETFs, and indices.

Both the xStation 5 and the xStation mobile platform are available to traders. Furthermore, multiple reviews and comparison sites have awarded XTB for their safety and implemented industry-leading security protocols.

75% of retail investor accounts lose money when trading CFDs with this provider.

2. AvaTrade – Popular CFD forex broker with competitive fees

AvaTrade is an FX and CFD broker that was founded in 2006 and is authorized by numerous financial regulators, including the Australian Securities and Investments Commission (ASIC)

and the Central Bank of Ireland (CBI). Users of Avatrade can trade forex, CFDs, and cryptocurrencies without paying a commission.

AvaTrade provides forex trading as well as a broad range of CFD derivatives, including stocks, bonds, ETFs, commodities, and indices. Traders may also trade seven different cryptocurrencies straight through the AvaTrade platform with no commissions and no bank fees.

Traders using AvaTrade will only encounter trading costs in the form of the bid-ask spread and the overnight financing fee if positions are held beyond standard trading hours.

For non-trading costs, there are no charges for deposits, withdrawals, or account maintenance. However, it’s important to note that AvaTrade imposes a $50 inactivity fee after three months of account inactivity. Additionally, following one year of inactivity, an annual administration fee of $100 will be debited from the trading account.

These include the Australian Securities and Investments Commission (ASIC), the South African Financial Sector Conduct Authority, Japan’s Financial Services Agency and the Financial Futures Association of Japan, the Abu Dhabi Global Markets Financial Regulatory Services Authority, CySEC, the Central Bank of Ireland, the B.V.I (British Virgin Islands) Financial Services Commission, and the Israel Securities and Exchange Commission. AvaTrade is also an Islamic forex broker.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

3. Admiral Markets – FX brokerage with extended hours and low forex spreads

Admiral Markets is a trading platform brokerage that offers its users access to over 8000 financial investment assets. Founded in 2001 it classifies itself as an investment ecosystem. The trading platform offers a range of financial investment instruments from CFDS for forex, stocks, indices, bonds, commodities and ETFs.

Customers are able to trade on-the-go using the proprietary Admirals mobile trading application, which is available for both Android and iOS. Alternatively for both PC and Mac, users can fully immerse themselves in an advanced trading experience with MetaTrader, a renowned tool for investors worldwide. Uniquely, Admiral Markets offers its client base access to MetaTrader Supreme Edition which is pre-loaded with state-of-the-art trading tools and technical analysis indicators.

For new customers, Admiral Markets offers various account types that offer different asset classes and have varied minimum deposit amounts. Users should evaluate which best suits them as there is a variety to choose from. When it comes to forex trading, Admiral Markets provides access to over 80 different CFDs on currency pairs available 24 hours a day, 5 days a week.

The trading platform offers low spreads on currency pairs, typically 0.6 pips for EUR/USD. The platform also offers an Islamic Forex Account, which allows users to trade without having interest fees credited or debited, however, this option is only available on the Trade.MT5 account type.

When trading with leverage, Admiral Markets offers up to 1:30 for retail cfd accounts. This broker also offers extended trading hours meaning that users are able to settle forex trades 24 hours a day, however, spreads may differ than main trading hours. There is also a wide range of educational materials available on the platform from articles, training programs, video tutorials and webinars.

For new users or clients who simply want to test out market strategies, Admiral Markets offers a demo account which is free to use. This allows traders to test out strategies, experiment with the various plug-ins and indicators, and optimise their preferred set-up for the trading interface. The demo account is risk-free and Admiral provides users with virtual money to trial trading under real-time market conditions.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

4. Pepperstone – Award winning best MetaTrader 4 broker with over 60 FX currency pairs available

Pepperstone was founded in 2010 by experienced retail traders and has grown to become one of the most popular MetaTrader brokerage platforms in the world. The company is regulated by a number of financial authorities globally and only holds user funds in tier 1 segregated banks.

The award winning broker offers clients access to over 1200 instruments from forex, commodities indices, commodities, shares and ETFs. Users can either trade CFD instruments, or participate in spread betting which is tax-free for their UK client base.

Pepperstone does not have a proprietary trading platform, however, has a range of trading interfaces for clients to use. The trading platforms are MetaTrader 4 and 5, cTrader and, Capitalise.ai which facilitates automated trading. It is worth noting that Pepperstone was voted the best MetaTrader 4 broker in the Good Money Guide Awards 2023. For clients who opt-in for the Razor account, Pepperstone integrates with TradingView allowing users to use the fully loaded features, and trade assets directly from the TradingView charts.

The platform offers highly competitive conditions with forex trading. This brokerage offers access to 60+ currency pairs and markets are open 2 minutes short of 24 hours. Pepperstone sources liquidity from multiple tier 1 banks which helps them to offer comparatively low spreads.

Through the high levels of liquidity users experience immediate fulfilment of trades, with no requotes or partial executions. Clients using the razor account benefit from 0.0 pip spreads on 14 pairs, while standard account have spreads of between 1.1 – 1.5 on major currency pairs. For forex and CFD traders looking for non-mainstream pairs, Pepperstone offers exotics from Chinese Yuan, Danish Krone, Hungarian Forint, Polish Zloty, Singapore Dollar, and Turkish Lira among others.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

5. Trade Nation – Forex trading app that is compatible with MT4 for advanced trading tools

Trade Nation is under the regulatory oversight of the Financial Conduct Authority (FCA) and stands out for its low-cost fixed spreads, making it one of the most cost-effective choices for forex trading in 2026.

Trade Nation provides access to a wide range of major currency pairs from across the globe, including some of the most commonly traded forex pairs. Traders have the flexibility to use either MT4 or TN Trader, which offers technical analysis tools and incorporates risk management features.

The platform offers a user-friendly interface which is suitable for beginner traders, and its mobile application ensures efficient trading on the go. For in-depth market analysis, traders can also utilize the desktop trading platform. Trade Nation supports traditional forex trading, as well as forex spread betting and CFD trading. This versatile approach caters to a diverse range of traders and accommodates various trading strategies

As well as forex, Trade Nation supports over 1000 financial instruments across different markets. Users can trade stock CFDs, indices, commodities and other popular markets through the platform. This makes it possible to diversify.

Trade Nation also provides highly-rated signal software that is regulated by the Financial Conduct Authority. The signals platform can be used to guide trading decisions and offer an extra layer of insight into the market.

There is no minimum deposit requirement for Trade Nation, and users can practice trading with the demo account for free before they deposit any funds. The customer support team is available 24/5 if you have any queries.

77% of retail investor accounts lose money when trading CFDs with this provider.

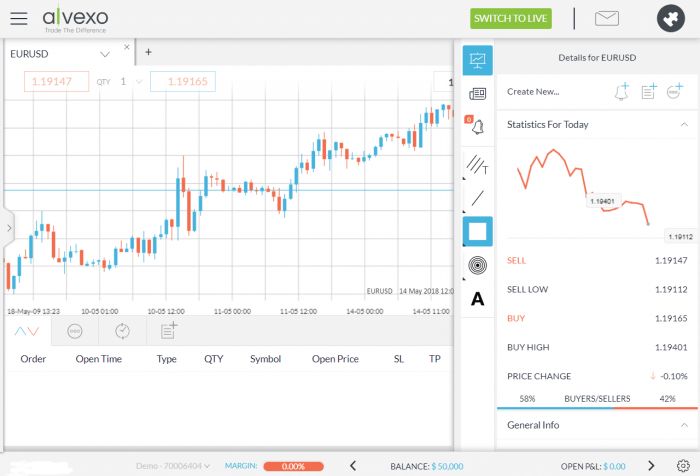

6. Alvexo – Online forex broker with user-friendly charting tools

There are more than 650,000 customers in over 20 countries who use Alvexo as a regulated online brokerage offering a whole range of investment opportunities, including CFD on Commodities, Stocks, Indices, and ETFs. “Trading real brokers for real traders,” this is how its website describes its main objectives.

With more than 450 assets, real-time quotes and an intuitive range of trading platforms and applications, Alvexo was founded in 2014 by market veterans. A number of tools are available for market analysis.

The fact that Alvexo offers educational resources, as well as customer service, is known among traders as well. Alvexo offers clients a wide range of economic news, trade courses, webinars, and even seminars, along with the daily market signals available through their platform.Alvexo fees:

Fee Amount Stock trading fee Variable Spreads Forex trading fee Variable spreads. 2.9% for EUR/USD on its Classic account Inactivity fee $10 per month after three months Withdrawal fee Free 76.22% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

7. FXCM – Forex trading app with a free demo account and copy trading features

FXCM is a forex trading account that was first launched in 1999. Authorized and regulated by the FCA, this forex provider is suitable for those seeking a reliable and low-cost way of accessing the currency scene.

That being noted, FXCM enjoys popularity not only among experienced traders but also among newcomers, thanks to its low initial deposit requirement of just $50. Furthermore, FXCM offers a risk-free environment for honing your forex trading skills through their demo account. When you feel prepared to transition to live trading, you have the convenience of making instant deposits using a debit card.

When it comes to supported markets, FXCM provides access to dozens of tradable forex pairs. This covers a good variety of majors, minors, and exotics. Users can also trade shares, commodities, and indices – all in the shape of CFD instruments. FXCM offers leverage on all of its supported markets.

Although retail clients are capped to 1:30, professional traders can get up to 1:400. When we explored the FXCM fee structure for our review, we found this UK forex broker does not charge any commissions. Spreads are also competitive, especially on major pairs. FXCM allows you to trade forex via its website or mobile app – which is available on Android and iOS.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

8. Forex.com – Market leading FX broker with automated trading features

Launched way back in 2001, Forex is a long-established trading platform. The platform is geared towards experienced FX traders who have access to over 80 forex pairs.

This covers a lot of bases in the currency trading scene – both in terms of majors/minors and exotics. When it comes to fees, Forex.com offers three account plans. If you’re on the Standard Account, you’ll benefit from zero commission forex trades and spreads from 1 pip.

However, seasoned pros trading larger volume, may want to consider either the Commission or STP Pro Accounts. The former gives you access to spreads of just 0.2 pips on EUR/USD. In turn, you’ll pay a commission of $5 per £100,000 traded.

Alternatively, the STP Pro account offers spreads of 0.1 pips on many pairs and commission starts at just $60 per $1 million traded. Irrespective of which account plan you sign up for, Forex.com is compatible with MT4. The platform also supports MT4 VPS hosting, which illustrates that it is a great option for automated forex EAs and high-frequency traders.

In terms of getting started, Forex.com requires a minimum deposit of £100 when using a debit card or PayPal. If opting for a bank wire, there is no minimum deposit. Finally, Forex.com is authorized by the FCA in the UK, and many other bodies around the world.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

Forex Trading Platform UK Fees Comparison

We’ll review how the UK’s forex brokers compare in terms of pricing so you can decide on the cheapest trading platform with the lowest fees. As many brokers have dynamic spreads, we’ve taken the spread for GBP/USD at the time of writing to give you an idea of how pricey each broker is.

Trading Platform Fees Spread or commission? GBP/USD Inactivity fee Overnight fees AvaTrade Spread 1.5 pips £50 after 3 months Yes FXCM Spread 1.4 pips £50 per year after one year Yes Forex.com Spread 2.1 pips £12 per month after 12 months. Yes How We Reviewed Top Forex Brokers in the UK

To provide readers with an informative overview of UK forex brokers, our team of expert writers spent time testing and reviewing a number of different platforms that are available in the UK. We used first-hand experience as well as user testimonials and websites to gather as much information as possible about each broker. We then established 11 suitable forex brokers for UK brokers, using the following criteria as guidance:

- Asset availability: We looked for platforms that support multiple FX currency pairs, including exotic pairs, to facilitate a diverse trading strategy. Some UK forex brokers also support other financial markets, including stocks and cryptos, which is ideal for traders who want to trade multiple markets on one platform.

- Charting tools: Forex trading requires advanced technical analysis To support this, trading platforms must offer a selection of charting tools and platforms. This could include MT4, MT5, TradingView, and others.

- Tight spreads: The spread is the difference between the buy and ask price when trading an FX pair. The tighter the spread, the more likely it will be to make a profit. Large spreads can catch traders out by keeping them at a loss, even when the trade has moved in their favor. We looked for platforms that offer tight spreads as well as low trading fees.

- Signals and APIs: The forex market is volatile, which can make manual analysis tricky. Signals and APIs pose a solution to this by using algorithms and AI technology to analyze the market on behalf of traders. Integrating signals into a forex trading strategy is one way to justify trading decisions.

- Low minimum trade requirements: Many forex traders wish to trade with smaller funds. This enables traders to place multiple trades per day. Platforms that require a large minimum trade may not be suitable for all forex trading strategies.

- Demo trading account: A demo trading account is a type of virtual trading account through which traders can practice trading without putting any real money at risk. Platforms that provide demo accounts allow new users to familiarize themselves with the features and tools before trading the live markets.

- Regulation: In general, it is wise to use forex brokers that are regulated by the FCA in the UK. Regulated brokers must follow strict security processes that are put in place to keep users safe.

Which Forex Broker has a Range of Currency Pairs?

For day traders and other short-term forex trading strategies, you might want to research the range of supported currency pairs. This is because day trading, scalping, and spread betting, all try to capitalize on short-term price movements within a single trading day.

With this in mind, let’s take a closer look at just how many forex pairs forex brokers in the UK offer.

Forex Broker Currency Pairs AvaTrade 59+ currency pairs Libertex 45+ currency pairs FXCM 40+ FX pairs Forex.com 91+ currency pairs Forex Brokers for New Traders

If you’re just stepping into the world of online investing, forex trading can be quite a challenge at first. With so much to learn and so many variables that have a direct impact on trading outcomes, you need to pick the right forex broker that’ll assist you every step of the way in terms of customer support.

After reviewing several forex brokers in the UK, we found that XTB is suitable for less-experienced traders. For a platform review covering fees and commissions, tradable assets, and payment methods, read our full XTB review.

XTB facilitates low-commission forex trading. This means that when you trade currency pairs, you’ll only have to pay the low spread, starting with just one pip. This is also a swap free forex broker. Opening an account is free, and there are no markups, ticketing fees, or stamp duty tax.

Approaching the forex markets without any knowledge of the space is like trying to navigate a ship through a storm without a helm. Traders will therefore appreciate the free demo account that XTB provides. Practice your trading strategies and broaden your knowledge of online investing with the XTB demo account. These practice accounts, or paper trading accounts, allow you to trade in a simulated, risk-free environment that mimics real market conditions.

75% of retail investor accounts lose money when trading CFDs with this provider.

Forex Brokers for Professionals

Experienced forex traders are less reliant on automated trading features and demo accounts. For an advanced investor, technical indicators and fully customizable charts are more valuable than a copy trading tool, but which forex broker offers the right tools and features for advanced users?

This is where MetaTrader 4 comes in. MT4 has been operating since 2005 and is among the industry-leading forex brokers in the UK. As well as forex, MetaTrader 4 can be used to participate in other markets, such as commodities and indices, through CFDs and spread betting.

MT4 is widely accepted for two main reasons. Firstly, it’s highly customizable to your trading goals and preferences. Secondly, it offers automated trading via algorithms to close and open positions based on pre-set criteria.

MetaTrader 4 features:

- Fully customizable and flexible trading platform

- Access trading signals from trusted third-party providers

- Expert advisors for algorithmic trading

- Global accessibility via PC, web, android, iOS

A forex broker for professionals is AvaTrade. This CFD and forex broker was launched in 2006 and is heavily regulated by financial authorities, including ASIC and the Central Bank of Ireland.

To gain access to the MT4 trading platform, simply open a live trading account with AvaTrade and choose MetaTrader 4 as your preferred trading platform. The minimum deposit is £100 to gain exposure to the markets. Then download MT4 and log in using your AvaTrade credentials.

MT4 has several features that allow you to conduct advanced price analyses on all supported instruments. These include a range of timeframes, interactive charts, and built-in technical indicators. The AvaTrade MT4 platform allows you to pinpoint the optimal prices to enter and exit your positions.

AvaTrade does not charge trading commissions, meaning the only trading fees you will encounter are the bid-ask spreads, and the overnight financing fee if you keep positions open after standard market hours transpire. For a more detailed look at the ins and outs of AvaTrade see our dedicated AvaTrade review.

75% of retail investor accounts lose money when trading CFDs with this provider.

How to Get Started with a Forex Trading Account

The steps below cover how to create a forex broker account and start trading forex.

Step 1: Open an Account and Upload ID

Visit a regulated UK forex broker and open an account. This will require you to enter some personal details, such as your name and email address.

You will also be asked to upload a copy of your

- Valid passport or driver’s license

- Utility bill or bank account statement (issued within the last 3 months)

Once you upload the above documents, you’ll be able to make a withdrawal at any given time. Your deposit limits will also be removed.

Step 2: Deposit Funds

Add funds to your account, via:

- Debit card

- E-wallet (Paypal, Skrill, or Neteller)

- Bank transfer

Step 3: Search for Forex Trading Pair

You can now search for the forex pair that you wish to trade. The way to do this is to enter the specific pair into the search box at the top of the page. Then, you need to click on the ‘Trade’ button.

Step 4: Place a Trade

You now need to select from a buy or sell order. Select the former if you think the exchange rate will increase and the latter if you think the opposite. Enter your stake into the ‘Amount’ box and select your desired leverage ratio, if applicable. Finally, click on the ‘Open Trade’ button to start trading forex.

Conclusion

According to the Gov.uk, the UK is the largest forex trading center in the world, accounting for 43.1% of the global market share. With so many forex brokers in the UK to choose from, it can be challenging to know which one to go with. For precisely this reason, our experts created this guide on Forex Brokers.

We analyzed the most important aspects of trading platforms, choosing the best options for our readers. The main thing is that your chosen provider is one regulated by the FCA, supports your chosen pairs, and offers low fees and tight spreads. It takes just 10 minutes to open an account at one of the various forex brokers in the UK that we reviewed.

75% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

Is forex trading legal in the UK?

Yes, although forex trading in the UK is heavily regulated, it is perfectly legal to buy and sell currency pairs online. Just make sure that your chosen forex platform is regulated by the FCA.

What is the a suitable forex trading platform UK for beginners?

XTB is often the go-to forex trading platform for beginners. The platform is particularly simple and getting started takes minutes. Furthermore, it offers a demo account which can be used to practice trading in a risk-free manner.

What is a popular forex pair to trade in the UK?

Irrespective of your skill set, the main pair to trade in terms of spreads, volume, and liquidity is EUR/USD. USD/GBP is also worth considering if you are looking for the aforementioned characteristics.

How can I check if a forex broker is regulated?

Regulated brokers will display their FCA license or make a reference to it on their homepage. Alternatively, you could simply visit FCA main page and enter the name of the forex broker you’re interested in. If it holds a license with the FCA, it will appear in the search results along with the license number.

Is forex trading safe in the UK?

Well-established forex brokers in the UK are safe, as they will be regulated by the FCA. This ensures that you can buy and sell forex pairs in a safe and secure manner.

References:

- https://www.fca.org.uk/news/warnings/exclusive-forex-trading

- https://pepperstone.com/en-gb/why-pepperstone/awards/

- https://www.gov.uk/government/statistics/uk-overseas-trade-in-goods-statistics-august-2021

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

As an online trading platform,

As an online trading platform,

FXCM is a forex trading account that was first launched in 1999. Authorized and regulated by the FCA, this forex provider is suitable for those seeking a reliable and low-cost way of accessing the currency scene.

FXCM is a forex trading account that was first launched in 1999. Authorized and regulated by the FCA, this forex provider is suitable for those seeking a reliable and low-cost way of accessing the currency scene.