10 Best Automated Trading Platforms in the UK February 2026

Automated trading platforms are used by traders who want to trade passively, with the assistance of AI technology. These platforms allow traders to buy and sell assets, without needing to spend hours on research and analysis. Automated trading platforms also take away the emotional element of trading which could improve trading decisions.

In this guide, we review the best automated trading platforms in the UK and walk you through the process of getting started with one.

-

- 1. XTB – Best automated trading platform with advanced charting tools

- 2. AvaTrade – UK algorithmic trading platform with a user-friendly interface

- 3. Admiral Markets – Expert Advisor strategies and technical analysis pattern recognition tools

- 4. MT5 – via Pepperstone – UK automated trading platform for CFDs, trade with MT5, tax-free spread-betting available

- 5. Learn2Trade – Signals automated trading platform for UK traders, developed by industry experts, from £40 per month

- 6. Dash 2 Trade – Crypto automated trading robot developed by industry experts, blockchain-based trading platform

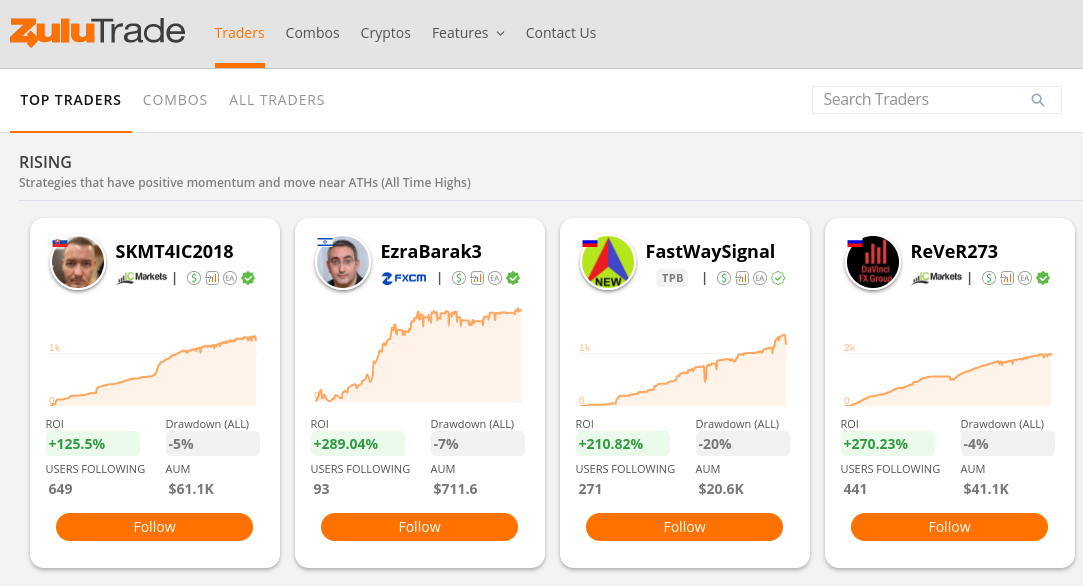

- 7. ZuluTrade – via AvaTrade – Copy trading platform for UK traders, mimic the trades of experts, low commissions and spreads

- 8. Ninjatrader – via FXCM – UK automated trading platform with a variety of strategies to choose from; free demo account available

- 9. ProRealTime – via IG – Algorithmic trading platform UK for forex and CFD trading, regulated by the FCA

-

- 1. XTB – Best automated trading platform with advanced charting tools

- 2. AvaTrade – UK algorithmic trading platform with a user-friendly interface

- 3. Admiral Markets – Expert Advisor strategies and technical analysis pattern recognition tools

- 4. MT5 – via Pepperstone – UK automated trading platform for CFDs, trade with MT5, tax-free spread-betting available

- 5. Learn2Trade – Signals automated trading platform for UK traders, developed by industry experts, from £40 per month

- 6. Dash 2 Trade – Crypto automated trading robot developed by industry experts, blockchain-based trading platform

- 7. ZuluTrade – via AvaTrade – Copy trading platform for UK traders, mimic the trades of experts, low commissions and spreads

- 8. Ninjatrader – via FXCM – UK automated trading platform with a variety of strategies to choose from; free demo account available

- 9. ProRealTime – via IG – Algorithmic trading platform UK for forex and CFD trading, regulated by the FCA

Best Automated Trading Software for UK Traders in February 2026

In researching automated trading platforms in the UK for 2026 – we found that the following providers are often mentioned:

- XTB: XTB provides access to over 2100 trading instruments, including stocks, commodities, and currencies. It also provides educational resources, tutorials, and a demo account for traders to test the platform. No minimum deposit is required to use XTB.

- AvaTrade: AvaTrade is a UK automated trading platform known for its user-friendly interface. It offers automated strategies through AvaOptions and MetaTrader 4, supporting expert advisors (EAs) for strategy automation. Traders can backtest their strategies and access educational resources to enhance their trading efficiency.

- Admiral Markets: Admiral Markets is a reputable broker that offers traders access to over 8000 financial instruments across forex, indices, stocks, commodities, bonds and ETFs. The platform offers advanced technical analysis indicators and analyst opinions through MetaTrader Supreme Edition interface. Users are able to access the Forex Featured Ideas and Technical Insight sections to gain Expert Advisor chart analytics across all assets, and technical analysis pattern recognition for forex currency pairs.

- MT5 – via Pepperstone: Pepperstone offers algorithmic trading through MT5, suitable for UK traders seeking CFDs beyond forex. Traders can copy expert traders’ positions for a fee, and a minimum deposit of £100 is required. The platform is regulated by the FCA.

- Learn2Trade: Learn2Trade specializes in trading signals for UK traders, offering guidance on buying and selling assets, primarily in forex and cryptocurrencies. Subscription plans include a free option and a premium plan at £40 per month, with real-time signal delivery through Telegram.

- Dash 2 Trade: Dash 2 Trade is a UK crypto automated trading system launched in 2022. It offers advanced analysis tools, market insights, and copy trading features. Traders can automate their strategies or use signals and engage with other traders for skill improvement.

- ZuluTrade – via AvaTrade: ZuluTrade is a popular copy trading platform where UK traders can interact with a community to discuss ideas. AvaTrade supports ZuluTrade and offers access to various assets. A minimum deposit of $300 is required, and ZuluTrade charges a performance fee.

- Ninjatrader – via FXCM: Ninjatrader provides over 120 strategies for automated trading, available through FXCM. Users can select strategies and implement them via FXCM’s CFD offerings. A demo account with £50,000 in virtual funds is available for testing.

- ProRealTime – via IG: IG is the only UK spread betting platform supporting ProRealTime strategies. Traders can automate their spread betting systems, covering over 17,000 markets. IG charges a commission on stocks and requires a minimum deposit of £250.

What is Automated Trading in the UK?

So now that we have discussed the main providers in this space – we need to explain how automated trading actually works in the UK investment space. Put simply, automated trading removes the need for traders to pick and choose which investments to make. Instead – either through a human trader or a piece of automated software – all trading positions will be executed on their behalf.

Automated trading platforms provide tools and features that can be used to passively trade. Sometimes this involves setting parameters based on risk appetite and market conditions. Alternatively, some platforms come with predetermined parameters that can be switched on and off according to the trader’s needs.

Some auto trading platforms use algorithmic software to analyze the markets and place trades. Other platforms use human traders (or account managers) to facilitate the process and place trades according to signals.

UK Automated Trading Software Systems & Strategies

There are many different ways that traders can conduct algorithmic trading in the UK. As we covered in our reviews of the automated trading platforms UK traders can use – this covers everything from Copy Trading, signals, and software robots that traders can install into MT4 or MT5. A report by The Insight Partners explained that the overall social/copytrading industry is likely to grow at a compounded rate of 7.8% annually. At the end of 2021, the market size was at $2.2 billion and it is forecasted to grow to $3.77 billion by 2028.

It’s important that users have a firm understanding of which system is right for their individual financial goals. As such, below we elaborate on the many different types of automated trading strategy that traders can access in the UK.

Automated Copy Trading

The Copy Trading feature available through AvaTrade is a widely recognized option in the market. This reputation is bolstered by the fact that the broker is regulated by the Financial Conduct Authority, ensuring traders are engaging with a legitimate provider.

Additionally, AvaTrade does not charge any fees for its Copy Trading feature, and users gain access to a multitude of verified investors. As previously mentioned, AvaTrade maintains a rigorous vetting process to assess the qualifications of your chosen trader.

For example, users can assess:

- The profit and loss for each month since the trader joined AvaTrade

- The average trade duration – which gives users an idea of whether they are a short-term trader or long-term investor

- Which markets the trader likes to target – such as stocks or forex

- The maximum drawdown – which gives us an idea of how much risk the trader takes

- A risk rating that is assigned by AvaTrade

- The assets currently held in the trader’s portfolio

- How many people are copying the trader and how much capital has been invested

- And much more

Users have access to a significant amount of data when it comes to selecting a trader to copy.

Here’s an example of how copy trading works:

- You invest £1,000 into an investor that specializes in stock trading

- The investor risks 5% of their portfolio by purchasing HSBC stocks

- In turn, user invests £50 into this trade (5% of £1,000)

- A few weeks later, the investor sells their HSBC stocks at a profit of 15%

- Trader automatically does the same, resulting in a profit of £7.50 (15% of £50 stake)

This example illustrates that a trader was able to make a 15% profit without needing to lift a finger. Of course, there is no guarantee of making money by copying a trader at AvaTrade – which is why it makes sense to diversify. To do this, users can elect to copy as many traders as desired – as long as the $500 minimum is met.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

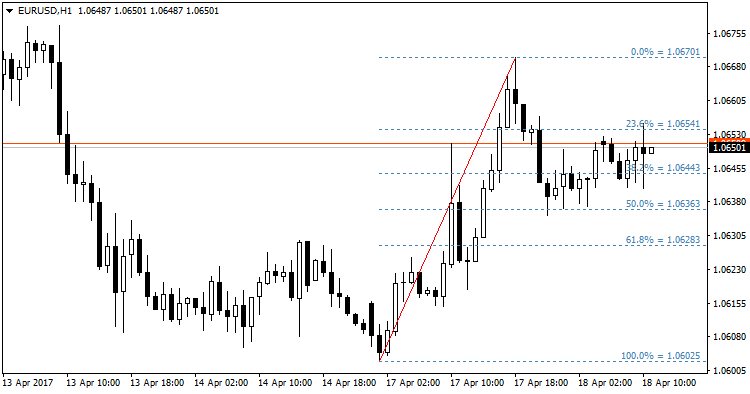

Semi-Automated Trading Signals

The next option that traders have when selecting an automated trading platform in the UK is a signals service. This results in a semi-automated strategy – as traders will be required to place the suggested orders manually. One signal platform that we came across is Learn2Trade – which mainly focuses on forex trading and cryptocurrencies.

The way it works is the team of in-house analysts at Learn2Trade will manually scan the financial markets by deploying technical indicators. When the team finds a potential trading opportunity, it will send out a signal to the 16,000+ members that have joined the Learn2Trade Telegram channel.

The signal might look like the following:

- Pair: AUD/USD

- Order: Buy

- Limit Price: 0.75990

- Stop-Loss: 0.75700

- Take-Profit: 0.76100

As per the above, a Learn2Trade signal will provide information around which asset the suggestion relates to and whether traders should go long or short. Traders are also told the price in which they should deploy a limit, stop-loss, and take-profit order.

Crucially, this is a semi-algorithmic trading strategy as the research is done by the software – but traders are still required to place the respective position. This gives users a bit more control as they are under no obligation to act on the trading signal.

Automated Trading Robots and EAs

Trading robots – also referred to as EAs, use pre-programmed software. The software file has a set of conditions built into it – which determines whether or not the robot should enter a trade. These pre-defined conditions will also dictate the entry and exit price that the robot takes.

- In order to trade in this manner, traders first need to obtain a robot from a third-party provider.

- There are thousands of options available online – some of which promise unfounded financial returns. This is why it is important to test the robot out before risking any money.

- It is possible to do this when using an online broker that is compatible with MT4 or MT5 and offers a demo trading facility.

- All a user needs to do is register with a chosen broker, log in to MT4/5, and then install the robot file. Then, run the robot for as long as desired in the demo mode.

- This will allow evaluation of how the algorithmic trading robot performs over the course of several days or weeks.

The main advantage of opting for an automated robot over a Copy Trading tool is that it can scan the markets 24/7. It doesn’t suffer from fatigue or emotions – making robots suited to the volatile nature of online trading.

With that said, the main drawback with an automated robot is that it relies exclusively on technical analysis and historical pricing trends. In other words, it doesn’t have the capacity to trade off fundamental news – like a rise in interest rates or political unrest.

We suggest reading through all of our automated trading system reviews before selecting a provider – which you’ll find below.

Automated Trading Platforms in the UK Reviewed

There are many ways that traders can automate their online day trading endeavours. Strategies include Copy Trading, EAs, and robots via MT4/5, and even fully-fledged Multi-Account Manager (MAM) accounts.

Traders need to consider the risks involved when choosing the right automated trading platform in the UK – as not all providers in this space are credible.

In the sections below, we review automated trading platforms in the UK for 2026 – covering a broad spectrum of providers that should appeal to a variety of investment strategies.

Our research process – How we rated UK automated trading platforms

In order to provide a comprehensive overview of UK automated trading platforms, our team of writers spent time carefully researching the various options that are available. We looked at aspects such as fees, demo account availability, asset variety and regulation to find platforms that are suitable for UK traders. Read through the following criteria to learn more about how we ranked the automated trading platforms.

Automated trading tools: There are various different methods that can be used to conduct algoruthmic trading in the UK. This includes automated trading signals, copy trading, algorithmic trading platforms and AI-based trading tools. When reviewing each platform, we looked at the different types of methods that are supported by each platform.

Demo trading account: Automated trading strategies are complicated to implement. Demo trading accounts can be used by traders to test out new strategies without putting any money at risk. By providing a demo account, automated trading platforms allow their users to familiarize themselves with the tools and features that are available.

Advanced charting tools: Technical analysis is a vital component of automated trading. To conduct technical analysis, traders must be able to access advanced charting tools. This could include MT4, MT5, TradingView and a number of other platforms.

Financial instruments: Some trading platforms offer a variety of financial instruments that can be traded using the same interface. Popular assets include stocks, commodities, cryptocurrencies, indices and forex.

Trading fees: Automated trading systems often place multiple trades per day. Therefore, it is important that platforms offer low spreads and commissions. A spread is the difference between and the bid and ask price of an asset. A commission is a percentage that is charged per trade.

Customer service: Good customer service options allow users to trade knowing that they can get support if they need it. Trading platforms typically offer customer service via phone, email, live chat and sometimes an in-depth FAQ section.

1. XTB – Best automated trading platform with advanced charting tools

XTB Broker is a well-known trading platform in Europe, offering access to stocks, commodities, and currency trading across a range of assets. The platform has a history of over 15 years in the market and boasts a global membership of over 400,000 individuals.

XTB provides access to a wide selection of over 2100 trading instruments, making it an attractive option for those looking to diversify their investment portfolios and expand their market exposure. In addition, XTB maintains competitive spreads and associated costs. For traders who hold positions beyond market hours, there are overnight fees applicable.

Members of XTB can access a range of educational tools if they are brand-new to trading. There are also numerous tutorials and a whole trading academy included. As well as this, Users can also access in-depth market analysis to guide their trading on XTB.

Moreover , XTB offers a demo account which is a way to try out the platform without putting any money at risk. XTB offers two different trading platforms: XStation 5 and XStation Mobile. The second option is ideal for trading on the go.

The XStation platform offers fast execution speeds and an industry-recognized user interface. XTB does not impose a minimum deposit requirement, allowing traders to commence trading with their desired initial investment.

75% of retail investor accounts lose money when trading CFDs with this provider.

2. AvaTrade – UK algorithmic trading platform with a user-friendly interface

AvaTrade provides an option for algorithmic trading through its AvaOptions platform, which is designed to help traders execute forex trades using automated trading strategies. The platform is user-friendly and equipped with a range of built-in trading tools and indicators that allow traders to develop and test their own automated trading strategies.

In addition, AvaOptions offers a simple interface that makes it possible for traders to execute their trading strategies and monitor their positions. AvaTrade also supports automated trading through the MetaTrader 4 platform, which enables traders to use expert advisors (EAs) to automate their trading strategies. EAs are programs that can be customized to automatically execute trades based on specific rules and conditions, making trading more efficient and less time-consuming.

Another important aspect of AvaTrade’s automated trading options is the ability to backtest trading strategies. Backtesting involves testing a trading strategy against historical market data to evaluate its effectiveness before deploying it in a live trading environment. AvaOptions allows traders to backtest their trading strategies using real market data, which can help them identify any potential flaws or areas for improvement in their strategies.

Furthermore, AvaTrade offers a wide range of educational resources, including webinars, video tutorials, and trading guides, to help traders learn how to develop and test their own automated trading strategies. With AvaTrade’s automated trading options, traders can access powerful tools that can help them increase their efficiency and improve their trading outcomes.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

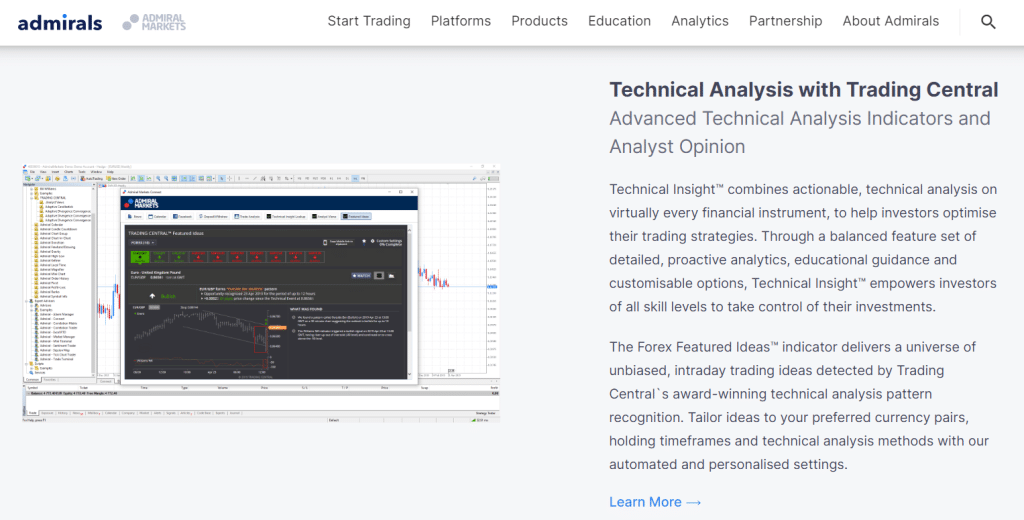

3. Admiral Markets – Expert Advisor strategies and technical analysis pattern recognition tools

Admiral Markets is a comprehensive brokerage platform that offers access to over 8000 financial instruments across various markets. The platform is one of few that integrates with several trading platform interfaces including its own proprietary trading app, MetaTrader 4 & 5, StereoTrader and uniquely MetaTrader Supreme Edition.

Users are able to access automated strategies and Expert Advisor chart analytics by using the MetaTrader Supreme Edition integration. Admiral Markets provides two different forms of automating the trading experience through their Trading Central Indicators.

One method is via the Forex Featured Ideas tool which provides unbiased trading ideas utilising technical analysis pattern recognition. Traders are able to tailor ideas to their desired currency pairs, holding time frames and technical analysis methods using both automated and personalised settings. The Forex Featured Ideas section also provides traders updates when a technical event occurs and offers commentary surrounding the signal and what it can reflect on the price action.

The second tool is Admiral Markets Technical Insight function which helps trader to optimise trading strategies through actionable technical analysis with the assistance of Expert Advisors. This feature provides proactive analytics, educational guidance and customisable options to highlight Technical Events across all financial instruments on the platform. As a result, a Technical Summary Score is allocated to the asset being analysed, which uses a proprietary weight-of-evidence approach. Using the score, traders can identify the directional outlook across both short and long term time frames and evaluate either bullish, bearish or neutral circumstances. Technical Insight is a patented pattern recognition library of over 50 charting patterns, technical indicators and oscillators.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

4. MT5 – via Pepperstone – UK automated trading platform for CFDs, trade with MT5, tax-free spread-betting available

It is possible to access algorithmic trading through Pepperstone via MT5. As the name suggests, MT5 is owned and operated by the same provider as Metatrader 4. MT5 is the latest edition and is particularly favoured by technical traders seeking access to a wider range of assets beyond forex. This is because MT5 supports CFDs across various categories, including stocks, indices, hard metals, energies, and more.

Many argue that MT5 is more advanced than MT4. It comes with a rich array of pre-loaded technical indicators, charting tools, and an unlimited number of pricing screens. Moreover, MT5 is among the automated trading platforms available to UK traders, offering mirror trading functionality. This operates similarly to the previously mentioned AvaTrade Copy Trading tool, wherein users can replicate the buy and sell positions of chosen traders.

However, the process differs here, as it involves MT5. This entails downloading the free MT5 platform to your desktop device and also requires an account with an MT5 broker. For instance, Pepperstone is one such option, a regulated platform offering a wide range of markets. On the Raw Account, trading with zero spreads is possible, while the Standard Account comes with spreads but no commission charges.

Regarding MT5’s mirror trading service, it grants access to a multitude of potential traders. A trader that suits preferences can be selected by considering metrics related to their past performance, preferred asset class, and average trade duration. The primary difference is that, MT5 imposes a subscription fee to copy a trader. Although fixed, the fee varies depending on the trader chosen for emulation.

Traders can start using MT5 through Pepperstone for auto trading by signing up to the online broker. The minimum deposit at Pepperstone is a reasonable £100. But, if traders wish to test their selected mirror trader first, they can do so through the Pepperstone demo account feature, easily linked to MT5 with a simple click. Furthermore, the security of your capital is assured with Pepperstone, as the platform is regulated by the FCA.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

5. Learn2Trade – Signals automated trading platform for UK traders, developed by industry experts, from £40 per month

Learn2Trade has gained significant attention on Reddit trading subs. This provider specializes in trading signals, according to its website advertising.

Signals refer to trading suggestions – meaning that users will be told which assets to buy and sell and when but these trades won’t be placed passively. In the case of Learn2Trade, the platform largely focuses on forex and cryptocurrency signals. With that said, the platform occasionally offers signals that cover the stock markets, as well as commodities and indices.

Either way, when traders receive a signal from Learn2Trade – they will be given the exact orders that need to be placed. This includes the asset, whether they should place a buy or sell order, and what entry price to execute the position. Most importantly, Learn2Trade will also provide the required stop-loss and take-profit price – which is crucial for risk-management purposes. As Learn2Trade is a signal provider and not a brokerage firm – traders will need to place these orders with an online trading site.

In terms of pricing, Learn2Trade offers two plans. If users wish to test the platform first, the free plan provides three signals per week. Alternatively, for traders who seek to leverage the expertise of the Learn2Trade team, the premium plan offers 3-5 signals per day.

This subscription is priced at just £40 per month, with the flexibility to cancel at any time. For even more cost-effective options, discounted rates are available with our 3-month, 6-month, or lifetime plans. Regardless of your selected plan, signals are delivered in real-time through the Learn2Trade Telegram channel.

Additionally, Learn2Trade successfully launched a comprehensive MAM account service. This service allows traders to invest directly with a Learn2Trade analyst who will execute trades on their behalf.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

6. Dash 2 Trade – Crypto automated trading robot developed by industry experts, blockchain-based trading platform

Dash 2 Trade is an automated trading platform in the UK for crypto trading. The platform was launched in 2022 and is backed by the team that developed the Learn2Trade platform.

Dash 2 Trade harnesses the power of advanced web3 technology to provide users with a fully innovative system that includes everything you need to make informed decisions and place profitable crypto trades. This means that subscribers can use the platform for every step of the process.

Key features of Dash 2 Trade include:

- Advanced analysis tools

- Market-leading educational resources

- Daily market insight

- Expert analysis

- Social trading

- Accurate signals

- Token listing alerts

- Token ratings

- Copy trading features

Dash 2 Trade will also provide regular trading competitions through which users can win D2T tokens. This provides users with a extra way to profit from their trading. D2T is the native token of the ecosystem that will be used to pay for platform subscriptions. The basic subscription starts at 400 D2T.

D2T is a deflationary ERC20 asset that will increase in value as demand rises. As a result, it is wise to subscribe to the platform early before the cost of the subscription rises. One way to keep updated about platform developments is to join the Dash 2 Trade discord channel which can be found on the website.

Crypto traders have the option to automate their trading using Dash 2 Trade’s copy trading and signal services. This enables the replication of expert strategies and trades, which can be fully customized to align with your trading objectives. You can opt to fully automate your trading or use the signals to make informed decisions about which trades to replicate.

To support automated trading, the Dash 2 Trade platform offers a comprehensive suite of tools and resources for market analysis. Conducting your own research is imperative when employing automated strategies, especially when capital is at risk.

Furthermore, subscribers will have the opportunity to engage with other crypto traders and industry experts to enhance their strategy development. This allows users to seek insights into expert strategies and replicate them if desired.

The primary goal of the Dash 2 Trade platform is to deliver substantial value to crypto traders, facilitating skill improvement.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

7. ZuluTrade – via AvaTrade – Copy trading platform for UK traders, mimic the trades of experts, low commissions and spreads

ZuluTrade is a popular automated trading platform that is suitable for all types of traders in the UK. The provider offers Copy Trading tools alongside a social community that allows traders to discuss investment ideas and strategies with other users. This functions in a similar way to Linkedin or Facebook – as everyone has a public profile.

For example, a user might decide to post a question regarding a potential upswing swing on gold with the view of seeing what the ZuluTrade community thinks. Users can ‘Like’ or comment on the post – just like a traditional social media site. Then to get the most out of ZuluTrade’s copy and social trading features, link it up with a regulated trading site.

This is because ZuluTrade itself does not operate as a brokerage firm. We identified one platform that supports ZuluTrade, which is AvaTrade. AvaTrade is regulated in more than six jurisdictions and offers a comprehensive CFD platform, enabling trading across various markets, including stocks, forex, ETFs, futures, options, and commodities. AvaTrade operates on a commission-free model, so your primary consideration is the spread.

Regarding the investment process, you’ll need to establish a connection between your AvaTrade and ZuluTrade accounts. Once connected, you can explore a pool of over 10,000 verified traders to find one that aligns with your financial objectives and risk tolerance. ZuluTrade’s filtering system is a valuable tool, allowing you to search for traders based on fundamental criteria. For instance, you can seek a forex trader who has achieved at least a 10% return over the past 12 months. After selecting an investor to replicate, you’ll need to meet a minimum deposit requirement of £500.

Although AvaTrade doesn’t charge any commissions – ZuluTrade has a pricing structure in place on its Copy Trading tool. In fact, the platform is really expensive – as you will need to pay a 20% performance fee when certain profit conditions have been met. .

There is no guarantee that you will make any profits with this provider. Your money is at risk.

8. Ninjatrader – via FXCM – UK automated trading platform with a variety of strategies to choose from; free demo account available

Another option worth considering when searching for an automated trading platform that welcomes UK investors is Ninjatrader. This third-party platform offers connectivity to several brokers, including FXCM. At its core, Ninjatrader allows traders to install, backtest, and implement pre-loaded trading strategies.

Ninjatrader offers over 120 strategies through its marketplace, providing a broad selection of trading strategies and systems. It’s advisable to conduct thorough research on each product before making a decision.

To provide an overview of available options, consider the Charging Bull ATS strategy. This strategy continuously scans forex and futures markets around the clock, extracting data based on trends, volumes, and momentum. It subsequently formulates entry and exit points for execution through stop-loss and take-profit orders. Additionally, there’s the Bollinger Market Maker trading strategy.

As the name implies, the Bollinger Market Maker strategy focuses on Bollinger Bands, a technical indicator that analyses the relationship between price and volatility. It’s important to note that these strategies are developed by third-party providers, which may involve a fee for purchasing the respective system. After acquiring a Ninjatrader strategy, it can then be implemented via FXCM.

This trading platform provides access to CFDs, including gold, oil, stocks, indices, and more. FXCM does not charge trading commissions, and in general, the spreads are competitively priced. Of significant note, FXCM offers a demo trading account pre-loaded with £50,000 in virtual funds. This allows users to test their Ninjatrader strategy without risking their actual trading capital.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

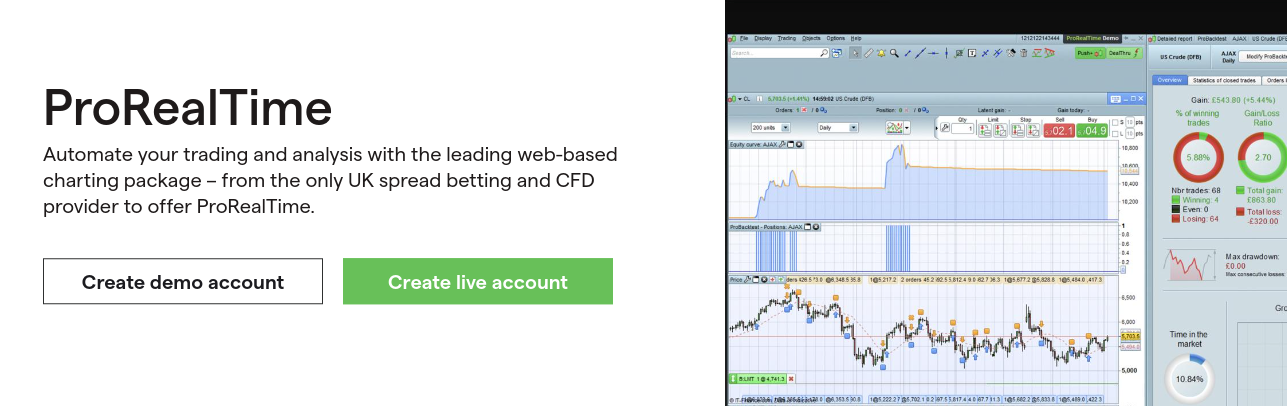

9. ProRealTime – via IG – Algorithmic trading platform UK for forex and CFD trading, regulated by the FCA

Whether you’re investing in stocks or trading forex and CFDs, it’s important to note that profits may be subject to capital gains tax. However, there’s one notable exception in the UK trading landscape, and that’s spread betting.

Spread betting operates similarly to other trading sectors, involving speculation on the future value of an asset. The key distinction is that spread betting allows for leverage, short-selling, and profit and loss calculations based on ‘points.

Nevertheless, even for experienced spread betting traders that wish to fully automate the process – consider the ProRealTime feature offered by UK broker IG. This is because IG is the only spread betting platform in the UK that supports ProRealTime strategies.

In terms of how this works – there is typically a 7-step process. This includes coming up with a trading idea, selecting a market, implementing risk-management systems, and transforming this into an automated system. Then, it’s a case of testing the spread betting system out, setting up desired parameters, and finally – deploying it via IG.

Traders can amend the spread betting system at any given time by backtesting it via ProRealTime. In terms of the specifics, IG’s spread betting platform covers over 17,000 markets. This includes thousands of stocks across dozens of UK and international exchanges, forex, commodities, and more.

All spread betting instruments can be traded commission-free apart from stocks, which average 0.10% per slide. The minimum deposit at IG is £250 – which users can fund via debit/credit card or UK bank account. The platform is, of course, regulated by the FCA giving traders confidence of safety when using this broker.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

What Are the Risks of Using Automated Systems for Trading in the UK?

Auto trading platforms can be used to guide decision making and trade throughout the day, even when traders aren’t able to manually execute orders. For this reason, automated trading platforms are often recommended to UK traders. However, automated trading does come with risks.

Although, automated trading tools are backed by advanced AI technology, the tools can never be 100% accurate. Here are some of the risks involved with using automated trading systems in the UK.

There is a fine line between automated trading and gambling

One of the biggest risks of using an automated trading account is that traders will switch from trading to gambling without realizing so. This is because automated trading platforms and signals can be very addictive and take away the need to conduct any deep analysis or research.

When the manual research element of trading is taken away, there is a potential that traders could start betting on the market instead of making informed decisions.

Gambling is very risky because decisions are not backed by any research. Gambling can also be addictive which can make it difficult for traders to stop, even when they run out of disposable funds.

To avoid gambling with an automated trading account:

- Put on a limit of the number of trades made each day.

- Always conduct manual research and analysis alongside the auto trading tool.

- Only use disposable funds to place trades.

- Remove emotion and trade objectively.

Automated tools are not 100% accurate

Another risk of using automated systems is that they are not 100% accurate. The financial markets are volatile and some price movements cannot be predicted, even by advanced algorithms.

There is always a chance that a prediction could be wrong which means that some trades placed by automated platforms will be unsuccessful. This becomes very risky when traders do not know when to opt out of the automated trading system.

Traders should continuously monitor automated trading systems and stop the trading tool when the market changes. Removing funds from the trading platform when the system stops working is one way to avoid a complete loss.

It can take some time for algorithmic trading systems to correct themselves when market conditions change. During this time, outdated trading strategies may not be effective and traders who keep the system running could lose their funds.

By monitoring the algorithmic trading software throughout the day and withdrawing funds when trades stop working, it is possible to avoid losing everything.

Some automated trading platforms are not regulated in the UK

UK traders should be aware that some automated trading platforms are not regulated. This means that the platforms do not adhere to Financial Conduct Authority guidelines or standards, which could mean that they aren’t as secure as regulated alternatives.

Traders in the UK should try to use regulated automated trading platforms, such as AvaTrade, to ensure safety and compliance measures. Platforms that are regulated provide a layer of protection for traders, ensuring that trading services are transparent and fair.

What Is a Well-Known Automated Crypto Trading Platform UK?

The crypto market is known for its volatility which makes it difficult to analyse and predict. As a result, automated crypto trading platforms are popular amongst traders. One UK platform that supports automated crypto trading platform in 2026 is Dash2Trade – a new trading platform that offers everything that traders need to navigate the crypto market.

Dash2Trade is an option to consider because it was built specifically for crypto traders and has a simple fee structure. Unlike some automated crypto trading tools, Dash2Trade is prioritizes transparency and quality. The platform encourages users to learn about the crypto market whilst using the various features to make informed trading decisions. Users can choose which trading tools and features they use, and also personalise the trading strategy to suit individual needs. Dash2Trade also offers crypto trading signals and social trading features which can be used to automate the trading process.

There are a number of scam automated crypto trading tools available online that charge a high subscription fee and produce very poor results. On the other hand, Dash 2 Trade is secured by blockchain technology and charges a basic subscription fee of 400 D2T tokens (around $4) per month. This makes the platform very affordable and maximizes the potential profit margin.

How to Start Automated Trading in the UK

In this section of our guide, we will provide an overview of how to use algorithmic trading software.

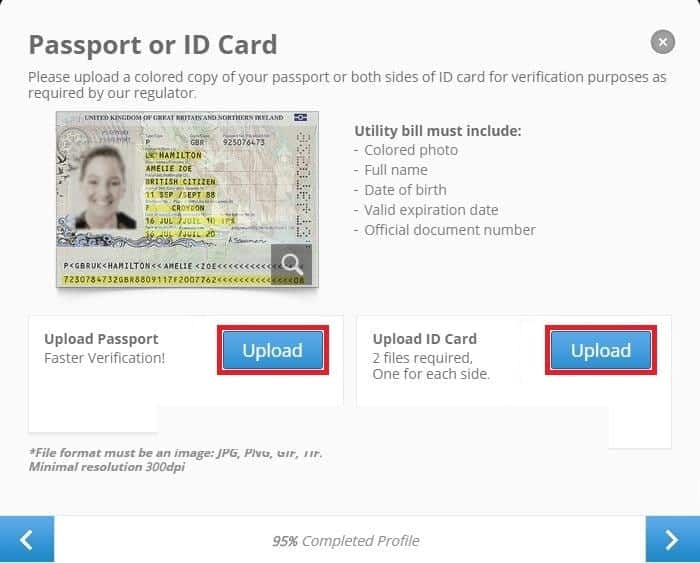

Step 1: Open an Account and Upload ID

Open an account with a regulated broker for auto trading. Traders must enter their personal information and contact details.

It is also a requirement to upload a copy of a valid form of photo ID. Some platforms allow traders to skip the verification part until they make a withdrawal request – as long as they are not depositing more than $2,250 (about £1,600).

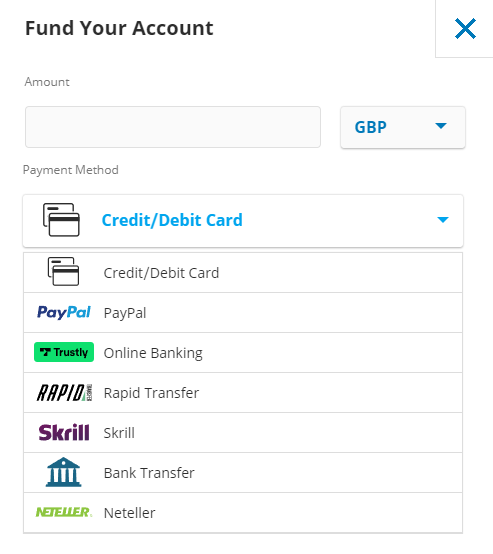

Step 2: Deposit Funds

The next step is to make a deposit. Don’t forget, each Copy Trader that is selected to a mirror will require a minimum investment of $500 (about £350).

Algorithmix trading platforms allow users to deposit funds with a debit/credit card, e-wallet, or bank transfer.

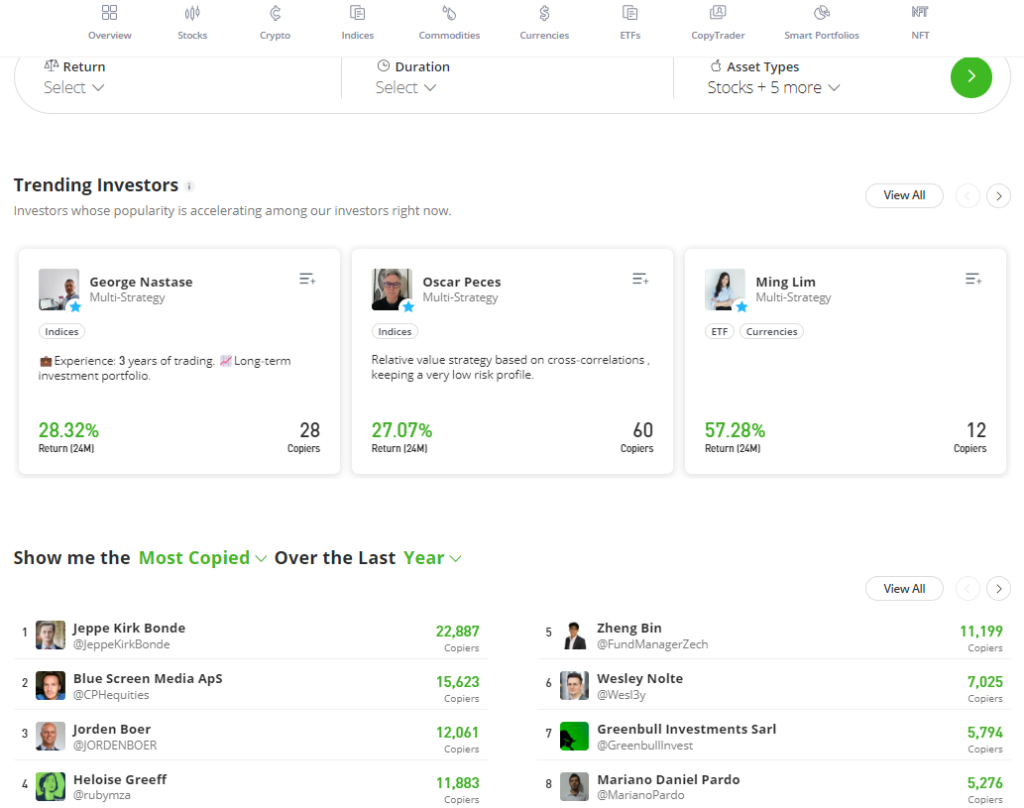

Step 3: Choose an Automated Copy Trader

Next, traders must find an experienced trader to copy based upon their individual goals and requirements. It is possible to spend time researching different traders before settling on one. It is also possible to follow multiple traders at one time.

Users are able to utilise the filter system to narrow down options and consolidate traders based upon individual goals. For instance, users can specify the trader’s expertise in a particular asset class, their minimum annual return, and their risk rating. After clicking on the ‘Apply’ button, a review will be presented showing the statistics of any traders that are of interest.

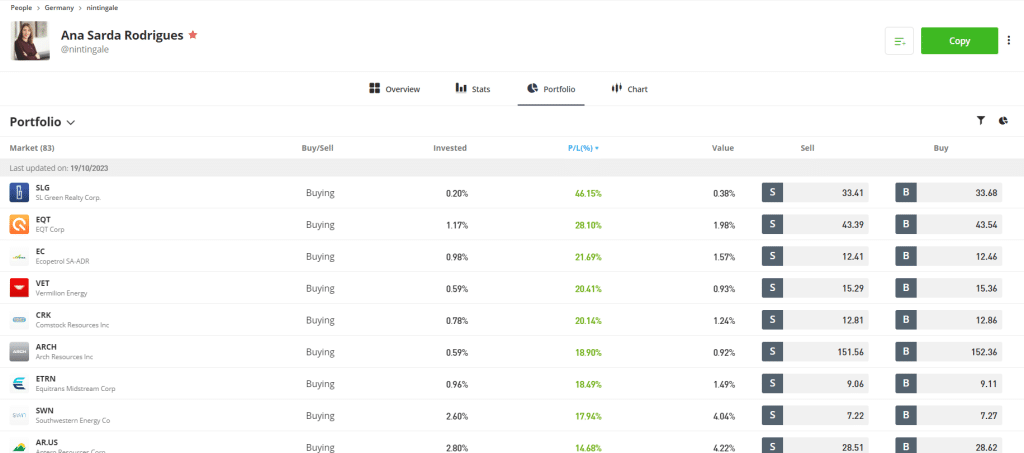

Step 4: Find a Copy Trader

Once a decision has been made on the desired trader to be copied, users then need to complete their investment process. First, the ‘Copy’ button must be clicked – which can be found on the top-right hand side of the trader’s profile page.

Then, an order box will appear. There are two key pieces of information that need to be provided here:

- Amount: This is the amount to be invested in the trader. This needs to be entered in US dollars and at a minimum of $500. In our example, we are investing $1,000 into the trader ‘Nintingale’.

- Copy Open Trades: If the ‘Copy Open Trades’ button is not ticked – then it will only copy the individual’s current portfolio. As such, if a user wants to copy all ongoing buy and sell positions – the box must be ticked.

In order to complete the copy investment – users must simply click on the ‘Copy’ button.

Step 5: Monitor the Investment

Within a couple of seconds – the copy trade will be executed by the copytrading platform. In order to keep tabs on how a selected investor is doing – click on the ‘Portfolio’ button.

Users will then get a full breakdown of how the copied investment is doing in real-time. Users can add or remove traders to copy in the portfolio at any time. In order to exit a Copy Trading position – users must click on the ‘Cog’ icon followed by ‘Stop Copying’.

Conclusion

We have discussed everything there is to know about automated trading in the UK investment scene. Not only have we discussed the many different types of algorithmic trading available – but many of the platforms currently in this marketplace. There are many providers to choose from.

One FCA regulated broker also had a popular Copy Trading tool – allowing users to automate buy and sell orders by following an experienced investor like-for-like. There are no commissions or platform fees to use this automated trading tool and the minimum investment is just $500 – or about £350.

FAQs

What is a popular automated trading software program?

If you’re looking for an automated trading software to install into MT4 or MT5 – there are thousands of options in the market. It can be difficult to separate the wheat from the chaff – as many providers claim unprecedented financial returns.

How does automated trading work?

This depends on which automated trading strategy you opt for. For example, automated Copy Trading entails mirroring the trades of an experienced investor. You then have automated robots that you can install into third-party platforms like MT4 and MT5. These are fully-automated and trading decisions are based on pre-programmed code.

Do automated trading systems work?

There is no simple answer to this question as it all depends on the respective automated trading system that you are using. Sure, some systems have a track record of making consistent gains. But, many automated systems eventually end up losing money. This is why you need to do lots of homework before taking the plunge.

Is automated trading regulated in the UK?

While online forex brokers and trading platforms are regulated by the FCA in the UK, this isn’t the case with automated systems. This is because providers are not supplying you with trading facilities. With that said, AvaTrade – which offers automated Copy Trading – is authorized and regulated by the FCA.

What is the many popular auto trading app UK wise?

FCA-regulated broker AvaTrade offers an auto trading app, AvaSocial, UK traders can use. The app – which is available on iOS and Android, allows you to copy a successful trader like-for-like without paying any commissions or fees.

What are automated trading algorithms?

Put simply, automated trading algorithms have the ability to buy and sell financial assets in a fully autonomous manner. The algorithm trading strategy is built into a software file – which can then be uploaded to MT4, MT5, cTrader, or another popular third-party platform. The software will only place orders when a pre-programmed condition is triggered.

What is the best AI trading platform in the UK?

One AI trading platform in the UK is Dash2Trade which uses AI tools to analyze the crypto market and produce trading signals. Learn2Trade is also an AI platform trading traditional stocks and shares in the UK.

How much money do you need for algorithmic trading?

To start algorithmic trading in the UK, you need to have disposable funds that can be lost without affecting your financial stability. To start automated trading with AvaTrade, you need at least $100 in disposable funds.

References:

- https://www.ig.com/en/trading-platforms/algorithmic-trading/what-is-automated-trading

- https://en.wikipedia.org/wiki/Automated_trading_system

- https://www.investopedia.com/articles/trading/11/automated-trading-systems.asp

- https://www.investopedia.com/articles/technical/112601.asp

- https://admiralmarkets.com/education/risk-management

- https://www.gov.uk/capital-gains-tax

- https://www.theinsightpartners.com/reports/social-trading-platform-market

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

XTB Broker

XTB Broker

Although AvaTrade doesn’t charge any commissions – ZuluTrade has a pricing structure in place on its Copy Trading tool. In fact, the platform is really expensive – as you will need to pay a 20% performance fee when certain profit conditions have been met. .

Although AvaTrade doesn’t charge any commissions – ZuluTrade has a pricing structure in place on its Copy Trading tool. In fact, the platform is really expensive – as you will need to pay a 20% performance fee when certain profit conditions have been met. .