Best Penny Stock Trading Platform 2025

Penny stocks typically refer to small companies that are up and coming. In the US, this is any stock that is trading at $5 or less. Other regions have different definitions, albeit, most penny stocks come with a much higher risk/reward ratio than traditional blue-chip shares.

In this guide, we review the popular online brokers for penny stocks. We also discuss the many metrics that you may choose when trading this asset class.

Popular Penny Stock Trading Platform 2025 List

The popular penny stock trading platform of 2025 can be found below. Scroll down for a full review of each broker to ensure you find a platform that meets your needs!

- Libertex

- Robinhood

- Interactive Brokers

- Fidelity

- TradeStation

Popular Penny Stock Trading Platforms Reviewed

In the sections below, we review some of the popular penny stock trading platforms in 2022.

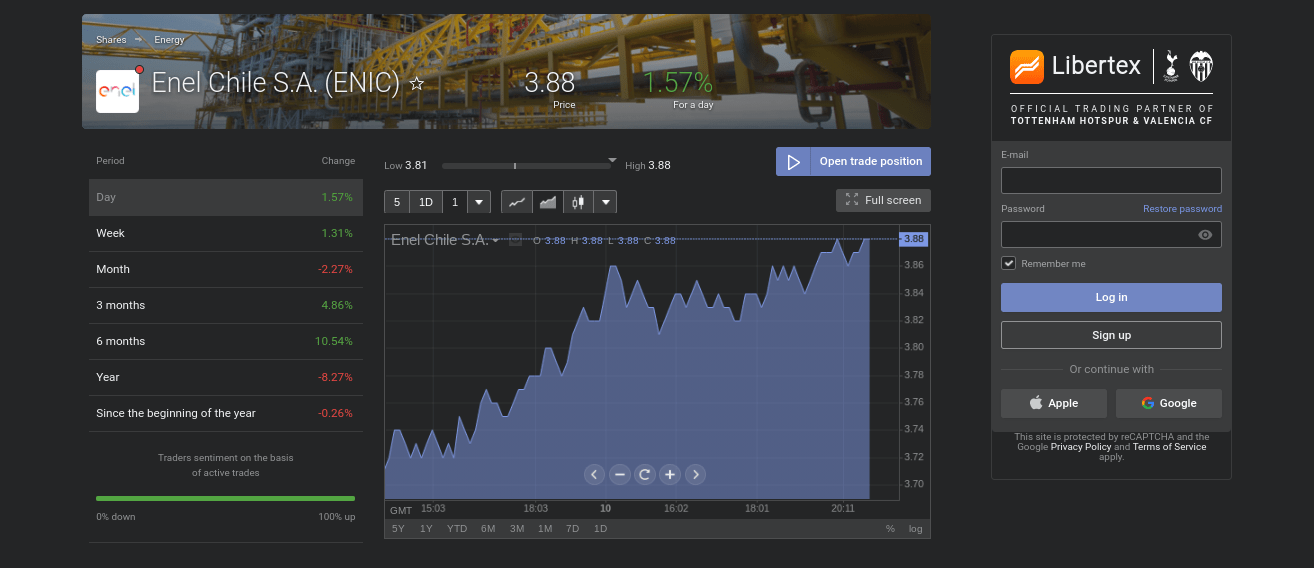

1. Libertex

Libetex is a CFD trading platform – this means that you won’t own the underlying penny stock – as you are merely speculating on its future price.

With that said, Libertex allows you to trade penny stock CFDs on a long or short basis. In other words, not only can you speculate on the price of the penny stocks going up – but down, too. This offers much more flexibility in comparison to a traditional stock brokerage site.

Moreover, Libertex also allows you to trade penny stocks with leverage. Your limits will be determined by your location – but this typically stands at 1:10 for non-UK and European clients. These regions are capped at 1:5. Either way, applying leverage on your penny stock trades at Libertex gives you much more in the way of purchasing power. However, this makes users more prone to higher losses and profits as well. Therefore, this feature is suited for investors with a high risk tolerance.

Libertex also charges tight spreads. When it comes to commissions, most stocks at Libertex can be trading fee-free.

Some stocks and other assets on the platform come with a small commission that rarely surpasses 0.2%. Libertex also allows you to trade via MT4. As you likely know, this platform comes with advanced orders and technical indicators.

Alternatively, you can also use the Libertex web-based platform or mobile app. Libertex requires a minimum deposit of just $100 (and $10 on all subsequent deposits). This covers debit/credit cards, bank wires, and e-wallets.

Libertex fees

| Fee | Amount |

| CFD trading fee | Free |

| Forex trading fee | Commission. 0.008% for GBP/USD. |

| Crypto trading fee | Commission. 1.23% for Bitcoin. |

| Inactivity fee | $5 a month after 180 days |

| Withdrawal fee | Free |

Sponsored Ad. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

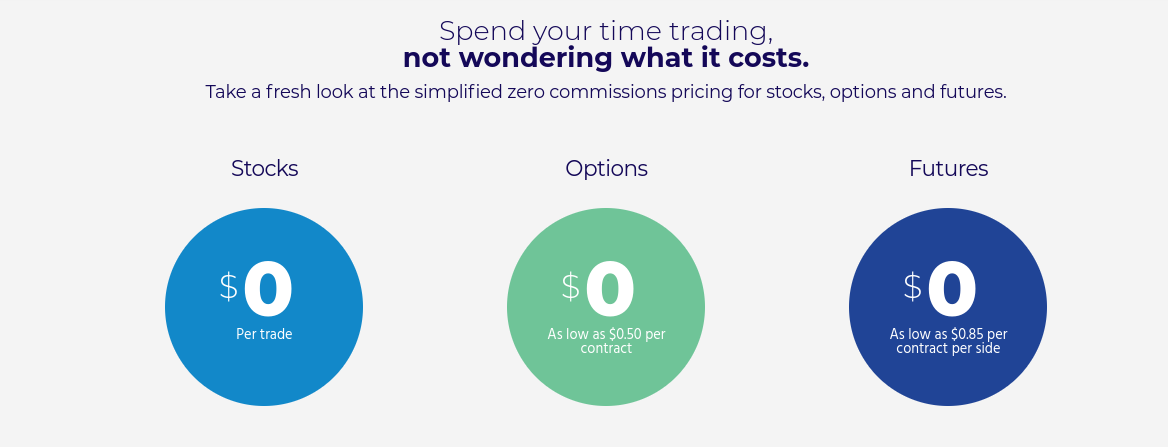

3. Robinhood

Robinhood is a popular trading platform where there is no minimum deposit or trade size when you trade stocks. In terms of what’s supported, Robinhood is home to over 5,000 stocks.

Apart from a few hundred international shares, these are all US-listed. Now, we should note that Robinhood isn’t a specialist penny stock broker. On the contrary, the platform offers stocks and shares of all shapes and sizes. But, the platform offers a really useful filter tool that allows you to find the popular penny stocks currently in the market.

All you need to do is head over to the stock trading section, choose the sector that interests you (e.g. energy and water, food and drink, consumer goods), and then specify a maximum share price of $5. After all, a share price of less than $5 meets the SEC definition of a penny stock.

Once you have found a penny stock that interests you – there is no minimum investment amount. As such, you can diversify across dozens or even hundreds of penny stocks to mitigate your risk. We should also note that Robinhood does not charge any trading commissions – so it’s only the spread that you need to look out for.

If remaining on the Standard account, there is no monthly fee or surcharges, either. You might choose to upgrade to the Gold account, as this gets you access to leverage and more advanced data feeds. This will set you back just $5 per month. Either way, deposits come in the shape of a US bank wire or ACH. Whether or not you benefit from an instant deposit will depend on your account type.

Robinhood fees

| Fee | Amount |

| Penny stocks trading fee | Free |

| Forex trading fee | N/A |

| Crypto trading fee | Free |

| Inactivity fee | No inactivity fee |

| Withdrawal fee | No withdrawal fee |

Sponsored Ad. Your capital is at risk.

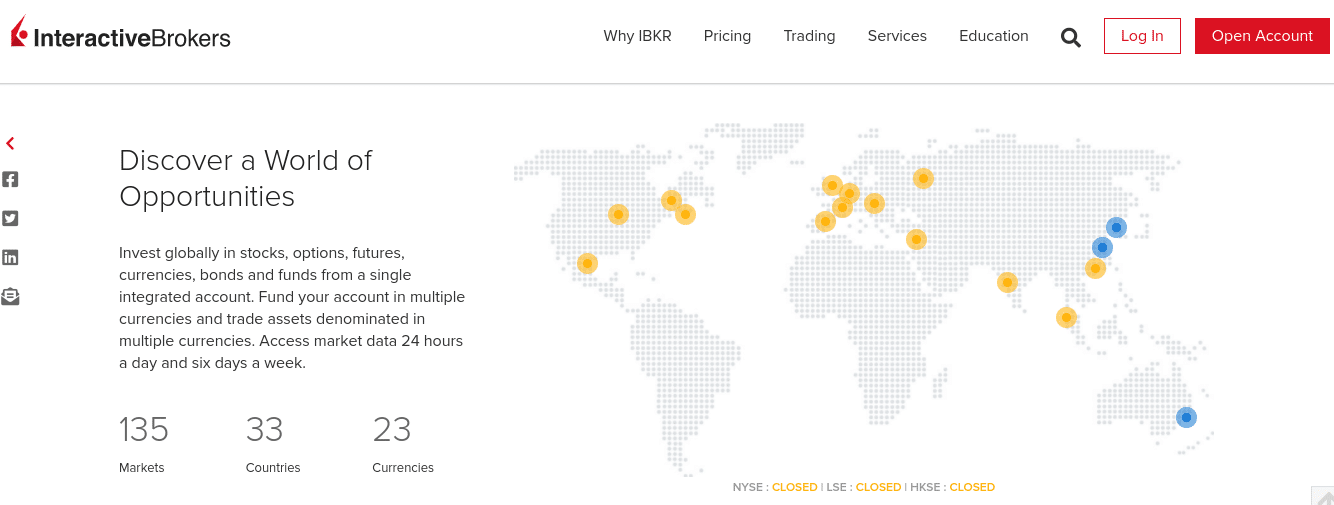

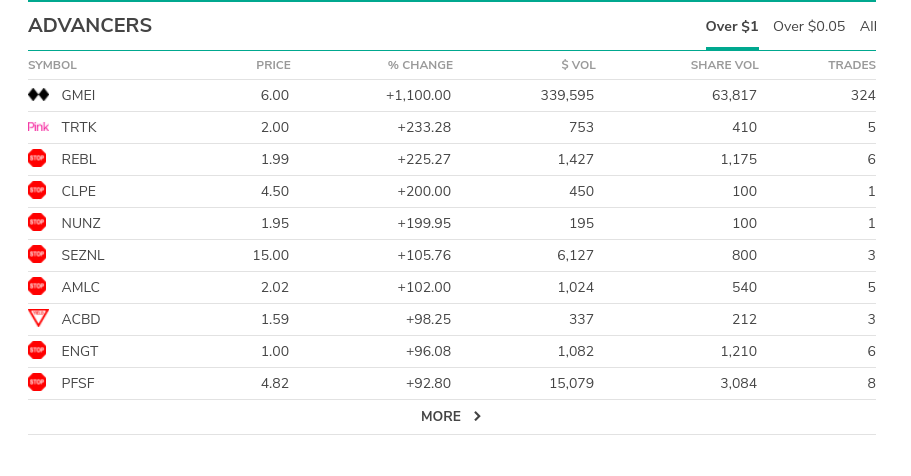

4. Interactive Brokers

Interactive Brokers is a popular platform that gives users access to OTC (Over-the-Counter) markets. After all, penny stocks typically trade on the OTC Pink Sheets -or ArcaEdge.

Once you go through the initial sign-up process and verify your identity – Interactive Brokers allows you to buy and sell thousands of penny stocks from a variety of US-based OTC markets. When it comes to pricing, US-listed stocks on the NYSE and NASDAQ can be traded commission-free.

However, this isn’t the case when trading penny stocks on the OTC. Instead, you’ll need to pay a commission – which will vary depending on your account type and trading volume. Outside of the US-listed penny stock scene, Interactive Brokers gives you access to 135 markets in 33 different countries.

Here, you will find thousands of penny stocks that are priced at less than $5 per share. On top of stocks, Interactive Brokers also offers funds, ETFs, options, futures, and even forex. What we really like about it this broker is that there is no minimum deposit. Debit/credit cards are not supported though – so you’ll need to perform a bank transfer.

Interactive Brokers fees

| Fee | Amount |

| Penny stocks trading fee | $0.0035 per share |

| Forex trading fee | Commission + spread. Commission is 0.08 to 0.20 basis points. 0.1 pip GBP/USD |

| Crypto trading fee | Commission. $15.01 per Bitcoin futures contract |

| Inactivity fee | $20 per month |

| Withdrawal fee | Free |

Sponsored Ad. Your capital is at risk.

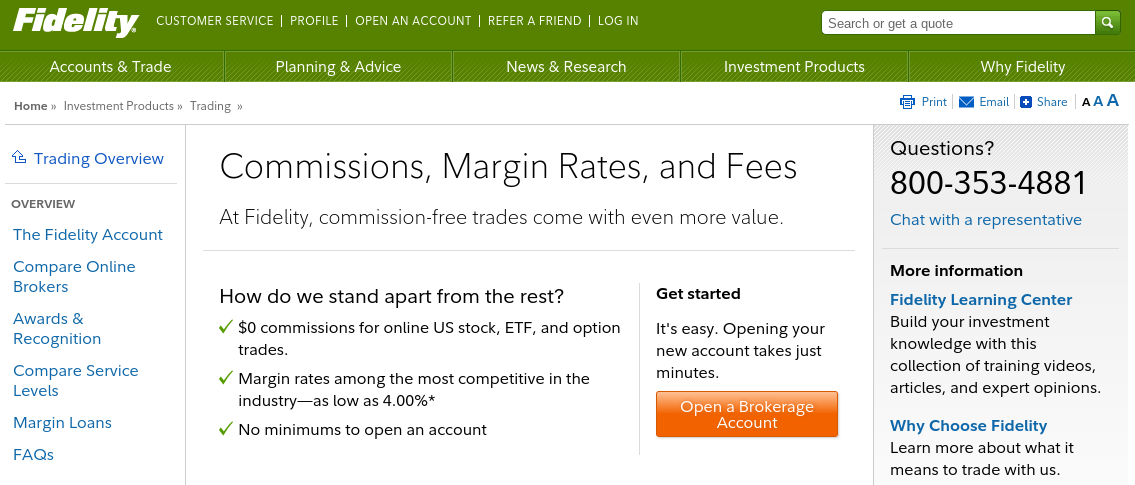

5. Fidelity

Fidelity is a highly established online broker that is popular with active traders of all shapes and sizes. On top of blue-chip shares, index funds, ETFs, options trading, futures, and bonds – Fidelity offers a fully-fledged penny stocks trading platform.

Interestingly, although the SEC defines penny stocks as an equity worth less than $5 per share, Fidelity considers this at sub-$3. Nevertheless, you will have access to penny stocks via the main OTC markets as well as via small-cap listings. You will, however, need to go through a ‘risk understanding’ process before Fidelity gives you access to these markets.

This simply means that you accept the added risk that comes with buying and selling penny stocks. Perhaps the stand-out feature with Fidelity is that it doesn’t charge any commission to access the OTC markets. This is unusual, as brokers typically charge a premium for this. Like most of its competitors, Fidelity also offers a $0 commission rate on NYSE and NASDAQ-listed stocks.

We should note that Fidelity isn’t only suitable for US investors – as this brokerage site accepts account applications from several countries. This includes the UK and multiple EU nations. In terms of getting started, Fidelity doesn’t have an account minimum policy in place. You will, however, need to go through a rather cumbersome KYC process before you can start on a trading account.

Fidelity fees

| Fee | Amount |

| Penny stocks trading fee | Free |

| Forex trading fee | N/A |

| Crypto trading fee | N/A |

| Inactivity fee | Free |

| Withdrawal fee | Free |

Sponsored Ad. Your capital is at risk.

6. TradeStation

If you are looking to trade penny stocks on your phone – you’ll want to choose a brokerage site that offers a popular mobile app. TradeStation allows you to trade penny stocks through its intuitive mobile platform – which is available on iOS and Android.

The app allows you to place buy and sell orders on your chosen penny stocks, check the value of your portfolio, and even perform research and technical analysis.

It also comes with an alert function which allows you to set a custom alert on a specific penny stock and thus – you’ll receive a notification when this is triggered. When it comes to supported penny shares, TradeStation gives you access to the OTC stocks arena. Furthermore, it doesn’t charge any trading commissions.

However, if you end up purchasing more than 10,000 penny stocks via a single trade – anything above this figure will be charged at $0.005 per share. In terms of accessing OTC pricing data, this is charged at $5 per month.

TradeStation fees

| Fee | Amount |

| Penny stocks trading fee | Free only for the first 10,000 shares |

| Forex trading fee | N/A |

| Crypto trading fee | 0.15% |

| Inactivity fee | $50 per year |

| Withdrawal fee | Free |

Sponsored Ad. Your capital Is at risk.

Penny Stock Trading Guide

It’s important for users to know the basics of penny stocks before making any investment decisions. Here’s what you need to know:

What is Penny Stock Trading?

As we briefly mentioned earlier – there isn’t a universally accepted definition for penny stocks. For example, the SEC (U.S. Securities and Exchange Commission) defines a penny stock as any traded equity with a share price of less than $5. Such a broader spectrum means that even though a company is classed as a penny stock by the SEC – it can still possess the characteristics of a more stable equity.

- For example, at the time of writing, the likes of Opko Health has a stock price of $4.31 – meaning the SEC defines it as a penny stock.

- However, the medical testing company is not only listed on the NASDAQ – but it has a market capitalization of almost $3 million.

- In other regions – such as the UK, the definition of a penny stock is any traded equity with less than £1.

- In many ways, this is even broader than the definition given by the SEC.

- After all, UK shares are priced in pennies as opposed to pounds. As such, some of the largest and most established UK companies are defined as penny stock.

With that said, there are many subjective factors that typically define a penny stock – such as trading on the OTC markets, being overly volatile, and lacking liquidity. We cover this in more detail later on.

How Does Penny Stock Trading Work?

The main premise of penny stock trading works much like other investment scenes. That is today, you will be looking for an app to purchase penny stocks and then sell them at a later date more than you initially paid. If you are able to do this, you will make a profit.

With that said, experienced traders will look to buy and sell penny stocks on a short-term basis. This is with the view of making small but frequent gains throughout the trading day.

Penny Stock Trading Risks

Users may want to know some of the risks before purchasing penny stocks. We have listed a few of these down below.

OTC Markets

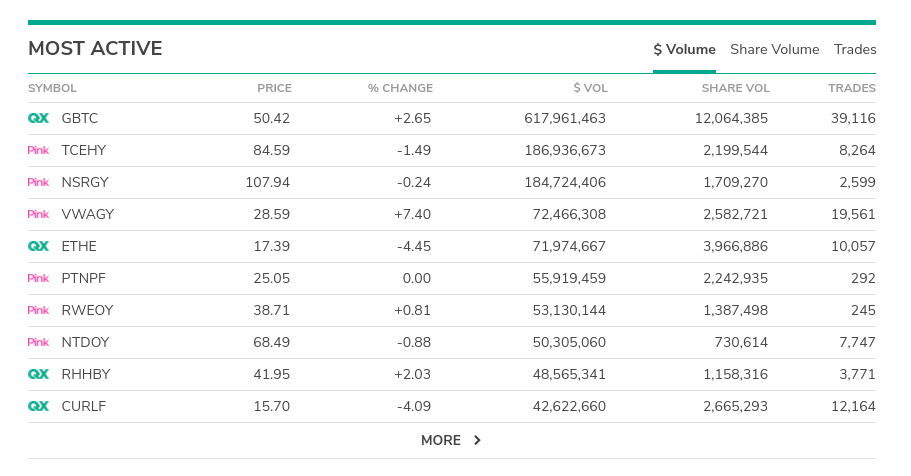

As we briefly noted earlier, most penny stocks trade on the OTC markets. Much of this is dominated by the Pink Sheets market, although other platforms exist, too. The key problem here is that the OTC markets are very difficult to access as a retail client.

This is because the OTC market sees investors buy and sell penny stocks on a direct basis. As such, prices are agreed upon between the two parties.

This is completely different from buying shares on a public exchange like the NASDAQ or NYSE – as stock prices are based on market forces.

Volatility

Penny stocks are somewhat similar to digital currencies like Bitcoin, insofar that they are highly speculative and volatile.

Users should look to invest in these stocks after deciding their risk tolerance and analysing whether it is worth trading in penny stocks.

Pump and Dumps

Pump and dump schemes are notorious in the penny stock trading scene. For those unaware, this refers to a group of speculators that will collude with one another with the view of artificially pumping the value of the penny stock northwards. This is easily achieved in the penny stock space – as many companies have a very small market capitalization.

The idea behind this is to collectively purchase a selected penny stock to drive the price up – to encourage unsuspecting investors to all enter the market. This will result in the penny stock rising in value at an even faster rate.

Then, when the speculators are happy with their returns – they will collectively sell their penny stocks and cash in their gains. This is known as the ‘dump’ – as results in the penny stock crashing back down to where it began. This means that unsuspecting investors will be looking at significant losses.

Liquidity

Another major risk of investing in penny stocks is that most companies struggle to attract liquidity. For example, at the time of the writing, although the Pink Sheets market has over 11,000 securities listed, the total value of all these companies is just $3.5 billion. This means that there are very few buyers and sellers active in the respective market.

As a result, you will find that the ‘spread’ on penny stocks is often sky-high. This means that ther gap between the buy and sell price is wide – meaning that you are indirectly paying a large fee to enter or exit the market.

Lack of Information

Finally, when trading penny stocks that are listed on the OTC markets, you won’t be accustomed to the same information as you get with regular shares.

For example:

- Companies listed on public stock exchanges like the NYSE or NASDAQ must regularly update shareholders with quarterly financial reports.

- Any information that can impact the stock will need to be made public by the company – to ensure all investors are on a level playing field.

- Plus, there are thousands of financial commentators that analyze this information – allowing you to keep tabs of how a company is performing in real-time.

However, these regulatory requirements simply do not exist in the world of OTC penny stocks. Instead, these companies are not obliged to release information to the public – meaning that you have no idea about the fundamentals of the firm’s balance sheet.

How to Start Penny Stock Trading

Now that you know everything you need to know about penny stocks, you can analyse the information and make a decision on whether or not you wish to invest in the industry.

Should you choose to do so, you may want to pick a suitable brokerage that will cater to your investing needs. In the sections below, we will show you how to begin trading with the chosen broker of your choice.

Step 1: Open Your Trading Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Verify Your Identity

Most popular brokers are regulated – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest in Penny Stocks

Once your account has been funded, proceed to search for any penny stocks you wish to purchase by searching on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

In this guide, we have looked to analyse the basics of penny stocks along with the popular brokers that allow users to invest in these stock varieties. However, users should conduct their own research and decide whether they want to invest in this sector depending on their risk-taking abilities, diversification strategies and more.