Bitcoin halving – What is BTC halving & how does it work?

Bitcoin halving, historically, is the signal for the start of a new bull cycle (Bull Run). The experts in the crypto market view this as a noteworthy event that occurs every 4 years.

For those of you who are new to the crypto world, we are writing this article today, with the aim of explaining the concept of Bitcoin Halving. We will also dive into how it works, and ultimately what the effects of this event in the cryptocurrency market are.

-

-

What is Bitcoin Halving?

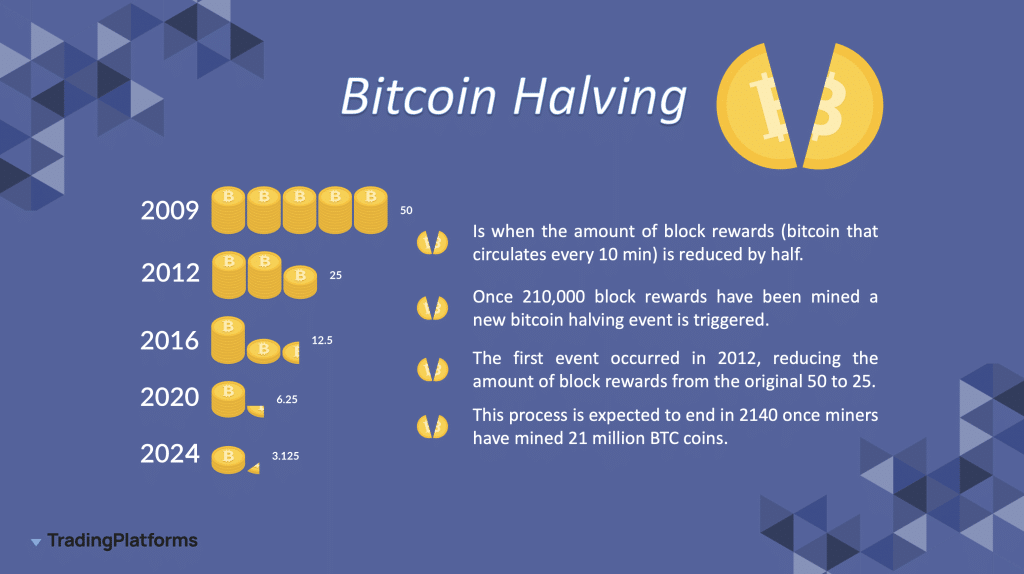

The Blockchain event where the rewards of Bitcoin coins are cut in half is known as BTC halving. The Bitcoin network goes through this process approximately every four years.

The goal is to slow down the amount of new Bitcoin creation and control the cryptocurrency’s supply.

The idea of BTC halving was first presented in the initial white paper that defined the architecture of the Bitcoin network and was released in October 2008 by Satoshi Nakamoto, the person who invented Bitcoin.

To regulate the quantity of bitcoins and maintain their value, the amount of new ones that enter circulation each year is generally cut in half.

BTC Halving takes place Every 4 Years

Every four years, a process known as “Bitcoin Halving” takes place in which the reward for mining new blocks on the blockchain is reduced by half. The Bitcoin protocol includes this procedure to guarantee that the creation of new bitcoins is regulated and ultimately constrained.

On the Bitcoin blockchain, 6.25 bitcoins are currently the reward for mining new blocks. This reward will be halved to 3.125 bitcoins every block when it happens.

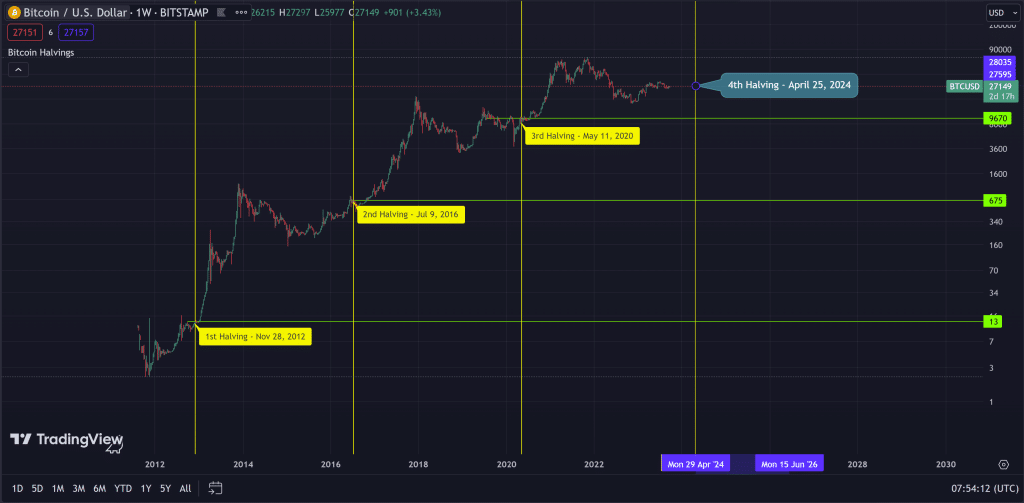

Throughout the network, halving has happened thrice: in 2012, 2016, and 2020. In 2024, the next halving is anticipated to take place.

By halving the number of bitcoins issued, it is possible to maintain both the supply and value of bitcoins growing at a known and controlled rate rather than being vulnerable to inflationary pressures like conventional fiat currencies are. Finally, it contributes to preserving Bitcoin’s value and stability over the long run.

Quick Facts about Bitcoin Halving:

- The goal of BTC halving is to slow down the amount of new Bitcoin creation and control the cryptocurrency’s supply.

- The idea of halving is presented in Bitcoin’s whitepaper. It was defined by the architect of Bitcoin, Satoshi Nakamoto in 2008.

- Through the process of Bitcoin Halving the mining reward for new blocks on the blockchain is reduced by half.

- BTC halving has happened three times: in 2012, 2016, and 2020. On April 25th, 2024, a new Bitcoin halving will occur.

- The final halving will take place in 2140, when there will be 21 million bitcoins in circulation.

The history of Bitcoin halving

Satoshi Nakamoto, the person who invented Bitcoin, had a thought in 2008.

What if you completely eliminated people from the financial system and produced fresh currency on a schedule that would last more than 100 years?

People could make extremely long-term plans with assurance because it would be predictable, monotonous, and boring. Moreover, without having to worry about unforeseen or rapid changes.

Bitcoin, however, needed to be rare like gold in order to be valuable. The maximum number of bitcoins was determined by Nakamoto at 21 million.

As a result, Bitcoin would have a lengthy, steady release rate because its quantity would be constrained.

The idea behind bitcoin mining was to reward users with brand-new bitcoin in exchange for their computational labor in approving brand-new blocks of transactions. The connection between Bitcoin mining & Bitcoin halving

The concept of Bitcoin Mining is strongly related to Bitcoin Halving

In order to understand how the two are related, it is definitely essential to garner an understanding of both.

Creating new Bitcoins and putting them into circulation is done through the process of Bitcoin mining.

Because it encourages users to enter accurate information into the shared ledger that records transactions and balances on an underlying blockchain network, mining is essential to the operation of Bitcoin.

Participants in this process known as mining compete for Bitcoin-based incentives. Also, the rewards vary every 4 years, because of the halving event, which cuts in half those rewards.

Years of BTC Halving Event BTC Mining Blocks Rewards 2008 – 2012 210,000 50 Bitcoins 2012 – 2016 420,000 25 Bitcoins 2016 – 2020 840,000 12,5 Bitcoins 2020 – 2024 1,680,000 6,25 Bitcoin 2024 – 2028 3,360,000 3,125 Bitcoin Bitcoin halving historically

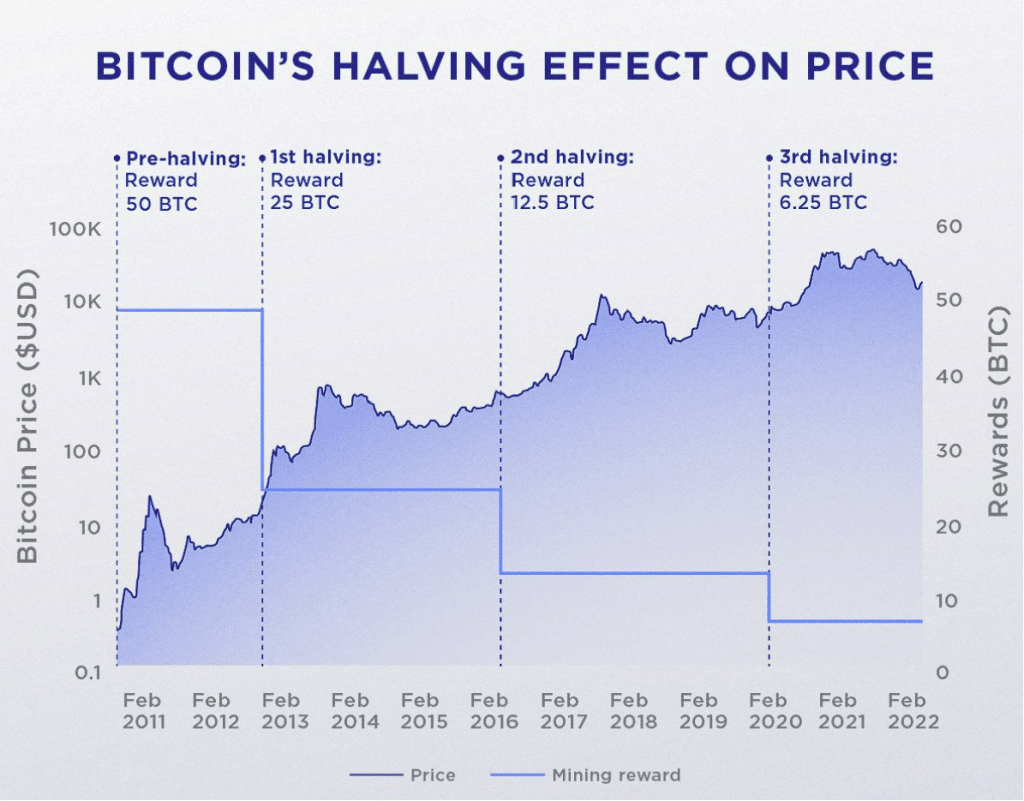

Late in 2012, when block number 210,000 awarded 50 BTC to the successful miner, the first BTC halving took place. However, block 210,000 and one, only gave its successful miner 25 BTC.

Midway through 2016, there was a second BTC halving event, with a new block reward. Therefore, the reward for blocks 420,000 and one, was 12,5 BTC.

And thus it will continue until all 21 million bitcoins have been mined at some point around the year 2140.

Why the alteration and Why not maintain the same reward?

The supply and demand provides the answers to the questions. There will soon be so many bitcoins in circulation that they will be worth very little if the coins are issued too quickly and there is no cap on the total amount that may be created.

Many experts address the reason for BTC halving distribution.

Inflation management is the major justification for this action. The fact that banks can generate unlimited amounts of traditional Fiat currencies controlled by central banks, is one of their primary flaws.

The rules of supply and demand also ensure that the value of the currency starts falling swiftly if it prints too much.

The goal of Bitcoin, on the other hand, is to mimic gold. There is a finite supply of gold in the entire globe. The remaining gold becomes more difficult to remove with each gram that is mined. Due to its scarcity, gold has remained valuable as a global medium of trade and a store of value for more than 5,000 years. Bitcoin is anticipated to follow suit.

Bitcoin Price after Bitcoin Halving

Now that you’ve gone through the majority of our guide on BTC Halving, you might be wondering how much higher the price of halving can increase to, after the next Bitcoin halving.

This is fairly difficult to forecast.

Some traders predict significant gains for Bitcoin – possibly six figures. Some others, contend that the market has long been aware of the predictable BTC halving schedule and has already factored this in.

Another unanswered concern for decades to come is whether miners will have sufficient motivation to continue their work as the payout for every 10 minutes keeps decreasing.

The exchange rate of Bitcoin against the US dollar did not significantly alter in 2016 a week after the Bitcoin halving event. When Bitcoin was trading at roughly $650 at the time of the event, it was about $675 a week later, not a very significant change.

Bitcoin was selling at roughly $300 a year before and $430 three months before the Bitcoin halving event itself, leading many to conclude that the predicted spike in price occurred between three months and a year before the actual Bitcoin halving event itself.

However, that was a different era. Predicting how the next bitcoin halving will affect exchange rates around the world is difficult. And this, given the media attention and subsequent increase in public awareness. Also, the explosion of initial coin offerings (ICOs) and new coins on the market. In addition, government regulations and restrictions on futures and derivatives offerings made institutional investments possible.

Years of BTC Halving Event Bitcoin Prices 2008 – 2012 From a few cents to $13 2012 – 2016 From $13 to $675 2016 – 2020 From $675 – $9,760 2020 – 2024 From $9,760 – 2024 – 2028 Unknown The importance of Bitcoin Halving

Those are the points to keep in mind. Bitcoin was created with value in mind. First of all, there will only ever be a limited amount of them. 21 million, and that Bitcoin’s economy is kept under control by reducing its supply through the process of halving BTC.

Also, keep in mind that the miners must be paid. In the end, they aren’t operating these pricey electricity-guzzler laptops for their health.

Therefore, Bitcoin miners will have to charge consumers ever-higher transaction fees unless the price of Bitcoin keeps rising because they will be able to collect fewer BTC in exchange for their labor. This can increase the cost of transmitting value through the system.

BTC halving Pros and Cons

As we already mentioned before, bitcoin halving and bitcoin halving are related to each other. Trying to spot the advantages and disadvantages of Bitcoin’s halve you need to have in mind the advantages and disadvantages of Bitcoin mining.

Let’s dive into this so we can have a better understanding of those two processes.

Pros:

- Once the BTC halving event occurs, Bitcoin prices rise

- Halving and Bitcoin mining are generating profits for miners

- BTC halving event, through the Bitcoin mining process, is maintaining security and decentralization

- Bitcoin halving and BTC mining have encouraged technological advancement in the hardware sector

- Halving and BTC mining are additional sources of income

Cons:

- Each halving event increases the volatility and market risk

- Halving through the Bitcoin mining process creates high energy consumption

- BTC halving requires a high cost of equipment and maintenance for Bitcoin miners

Conclusion

Bitcoin's price will eventually halve on a regular basis.

It's a fascinating look at the laws that govern this new economic system and one of the most cutting-edge Blockchain experiments is happening right now.

Halving is the reason why BTC will continue to rise and keep its value. Also, it’s the reason why many experts evaluate Bitcoin, the same as gold.

FAQs

What is Bitcoin Halving?

Bitcoin halving is a Blockchain event where the rewards of Bitcoin coins are cut in half.Every how many years does Bitcoin Halving take place?

The BTC halving event occurs every 4 years. The next event will occur in 2024.What is the effect of Bitcoin Halving on the Bitcoin price?

Historically speaking, in every Bitcoin Halving event, the Bitcoin price rises.Resources

- https://www.coinbase.com/learn/crypto-basics/what-is-a-bitcoin-halving

- https://coinmarketcap.com/events/bitcoin-halving/

- https://academy.binance.com/en/glossary/halving

- https://www.washingtonpost.com/business/2023/04/24/what-is-bitcoin-halving-and-does-it-push-up-the-cryptocurrency-s-price-q-a/2cd169a6-e27f-11ed-9696-8e874fd710b8_story.html

- https://www.bitcoin.com/get-started/what-is-bitcoin-mining/

- https://www.coinbase.com/learn/crypto-basics/what-is-mining

- https://www.blockchain-council.org/cryptocurrency/how-many-bitcoins-are-left/

- https://academy.binance.com/en/articles/what-is-crypto-mining-and-how-does-it-work

Ruby Layram Finance Editor

View all posts by Ruby LayramRuby is a Finance Editor who has 5 years of experience in the finance and cryptocurrency space. Ruby attended the University of Winchester where she received a BSc in Psychology. During her studies, Ruby developed an interest in financial psychology and began writing content around the topic on a freelance basis. Whilst she was studying for her degree, Ruby spent time learning about personal finance, investing and trading. She has written content for The Motley Fool UK, Bankless Times and Cryptonary where she also worked as an editor. Her interest in cryptocurrency came about after writing a piece for The Motley Fool about the rise of CBDCs. Since then, Ruby has actively invested in the crypto market with a focus on long-term investing. Ruby is also an experienced trader with good analytical skills. She has used a used a variety of platforms and tools to trade and has first-hand experience with many of the platforms that are featured on the Trading Platforms website.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up