Best Low Spread Forex Brokers – Pros & Cons

Professional forex traders always look for low spread forex brokers to maximize each trade they make.

In this low spread forex article, we’ll take a look at all the best forex brokers with low spread and their key features as well as things you should know about low spread forex brokers scalping.

Best Low Spread Forex Brokers List

Below is a list of our four best forex brokers with low spread. As you read on in this low spread forex brokers article, you’ll see which forex broker has the lower spreads and how to start trading forex!

- eToro – Overall Best Forex Trading App 2026

- Libertex – Popular Forex Trading App That Offers Tight Spreads

- AvaTrade – Multiple Forex Trading Apps and Competitive Fees

Best Low Spread Forex Brokers Reviewed

Let’s get started with short broker reviews on the best forex brokers with low spread. Below we will share the key features, spreads, trading costs, and pros & cons of the four low spread forex brokers.

1. eToro – Overall Best Forex Trading App

Our recommended platform among the low spread forex brokers is Etoro. The social trading app is one of the most popular to date, with key features such as copy trading, demo account trading, an ultra-intuitive platform, and excellent customer support.

In terms of spreads, they start from just 1.0 pips, a high-value spread for what eToro has to offer. The broker has over 45 forex CFDs featuring major and minor pairs including a few exotic pairs to boot.

What’s more, is that eToro is an all-in-one trading platform that features a plethora of other equities too. Trade over 2,000 stocks and ETFs from around the world. There are also over 15 cryptocurrencies (including Bitcoin) and dozens of commodities to trade from too.

eToro is also known for having absolutely zero commission. Yes, there are certain fees when it comes to withdrawing, and there is a 1.90% spread for cryptocurrencies, but this is a good deal by many standards. The platform is just so simple and easy to use. Since eToro is the frontrunner in social trading, they were able to develop a very simple and intuitive platform for users to easily get into. Because they also offer a lot of different equities, it’s appealing for users to use just one platform for all their different trades.

If you’re a beginner and just getting into forex, eToro is a great choice because of the various opportunities to learn how to trade that is offered. If you’re looking to learn hands-on without risking any capital, you can use a demo account with virtual equity. If you want to start trading with capital but unsure how to handle trades, you can copy a trader.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro also boasts a strong customer service – live chat, 24/5 customer support, and an inquiries system means they can respond to any concerns or questions you may have regarding their platform. Higher-tiered users are also fortunate enough to have an account manager or an account agent with who they can email and schedule calls regarding their accounts.

eToro fees

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Spread, 2.1 pips for GBP/USD |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros

- 100% commission-free trading

- Trade stocks, indices, ETFs, cryptocurrencies, forex, and more

- Multiple payment methods with debit/credit card, e-wallet, or bank transfer

- Social trading and copy trading features

- Excellent mobile app

- Accepts PayPal

- Regulated by the FCA, ASIC, and CySEC

Cons

- Not suitable for advanced traders looking for deeper technical analysis

- Lacking smaller cryptos and stocks

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Libertex – Popular Forex Trading App That Offers Tight Spreads

Taking a more unique approach to forex trading fees, Libertex charges fixed commissions instead of variable spreads. With over two decades of financial markets and online trading experience, the international broker is great for casual and seasoned traders alike.

With over 250 tradable assets and 40 international awards, it’s easy to trust the viability of Libertex for forex.

When it comes to the actual trading, Libertex has its own proprietary trading platform online. However, those looking to use other platforms like MetaTrader 4 or MetaTrader 5 will be pleased to hear that the online broker offers integrations for these too. Use the different technical indicators and trading tools at your disposal on the Libertex platform to try out the best forex strategies for you.

With just a $10 minimum deposit coupled with no deposit/withdrawal fees, Libertex makes it easy to transfer your funds and credits. Leverage options for major currency pairs cap out at 30:1, with minor currency pairs capping at 20:1. Use CFD trading and leverage to your advantage.

Still not completely confident with trading? Feel free to practice on the Libertex demo account before you start live trading. Don’t worry, the demo account is completely free to use!

Libertex fees

| Fee | Amount |

| Stock trading fee | Commission. 0.034% for Amazon. |

| Forex trading fee | Commission. 0.008% for GBP/USD. |

| Crypto trading fee | Commission. 1.23% for Bitcoin. |

| Inactivity fee | $5 a month after 180 days |

| Withdrawal fee | Free |

Pros

- Fixed commissions instead of variable spreads

- MetaTrader 4 and 5 integration

- Zero deposit fees

- Wide range of payment methods

- User-friendly mobile trading app

- Demo account with virtual equity of $50,000

- Well-designed web platform for beginners

Cons

- Purely CFD derivatives trading

- Limited customer support available

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

4. AvaTrade – Multiple Forex Trading Apps and Competitive Fees

Established in 2006 AvaTrade is a popular forex broker regulated by recognized financial authorities. It is considered an all-in-one platform as AvaTrade users can trade forex, CFDs, and cryptocurrencies with zero commission.

When it comes to the variety of equities, AvaTrade offers forex plus a wide range of CFD trading stocks, bonds, ETFs, commodities, and indices. To add, seven different cryptocurrencies are directly tradeable through the AvaTrade platform without any commission, bank fees, or deposit fees.

For forex trading, AvaTrade has integration with MetaTrader 4 as well as MetaTrader 5. There is also a proprietary mobile application available for download on Android and iOS.

Additionally, AvaTrade has plenty of digital resources and tools that beginner traders will highly appreciate. A free virtual trading account with $100,000 of virtual equity to practice any trading strategy in a risk-free environment plus other educational materials at the site are offered. With access to 250 financial instruments including 24/7 crypto trading, there’s plenty to look at on AvaTrade.

The online broker operates entities on an international scale and as such is authorized and regulated by multiple top-tier financial authorities. Among them are the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority in South Africa, and CySEC.

Avatrade fees:

| Fee | Amount |

| CFD trading fee | Variable spread |

| Forex trading fee | Spread. 0.9 pips for EUR/USD |

| Crypto trading fee | Commission. 0.25% (over-market) for Bitcoin/USD |

| Inactivity fee | $50 per quarter after three months of inactivity |

| Withdrawal fee | Free |

Pros

- No deposit or withdrawal fees

- Wide range of payment methods like credit/debit cards, wire transfer, and e-payments

- Only $100 minimum deposit

- Using a credit card instantly credits funds to the account

- Integration with MT4, MT5, AvaTradeGo, Automated Trading, and AvaSocial

- Multiple educational materials and resources are available

- Free demo account

- Fully regulated by authorities such as FSCA, Australia’s ASIC, Japan’s FSA.

Cons

- Higher-than-average inactivity fees

- Lack of traditional investments like stock trading

- Fractional share trading not supported

71% of retail investor accounts lose money when trading CFDs with this provider.

Low Spread Forex Brokers Fees & Leverage Comparison

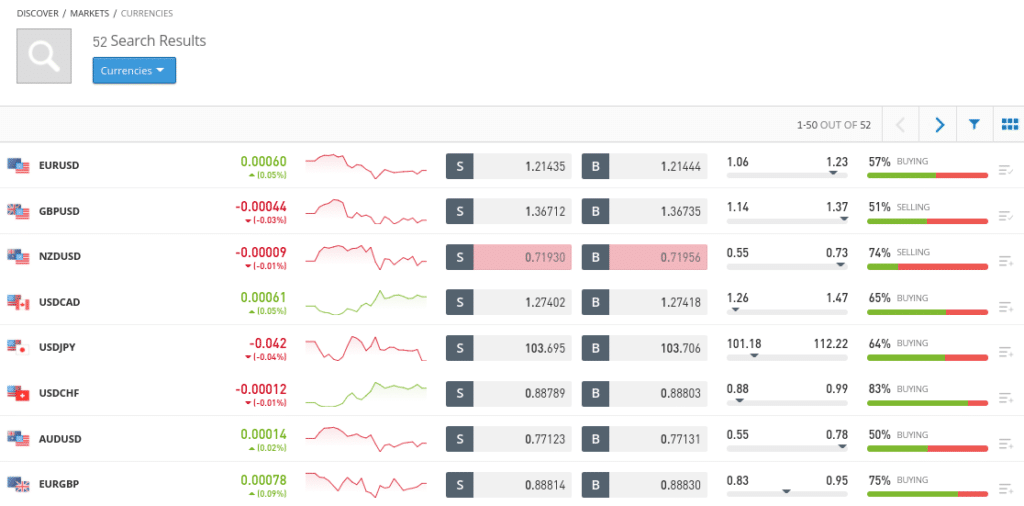

Below is a table comparison of the EUR/USD and GBP/USD spreads among the low spread forex brokers as well as their other fees.

| EUR/USD | GBP/USD | Deposit/Withdrawal Fees | Inactivity Fees | |

| eToro | 1.0 pips | 1.4 pips | $5 per withdrawal | $10 per month after 12 months |

| Libertex | 0.8 pips (0.008% commission) | 1.3 pips | None | $5 after 6 months |

| AvaTrade | 0.9 pips | 1.6 pips | None | $50 after 3 months of inactivity and a $100 administration fee after one year |

Below is a leverage comparison of EUR/USD among the four low spread forex brokers for major and minor currency pairs.

| Major Currency Pair Leverage | Minor Currency Pair Leverage | |

| eToro | 30:1 | 30:1 |

| Libertex | 30:1 | 20:1 |

| AvaTrade | 30:1 | 30:1 |

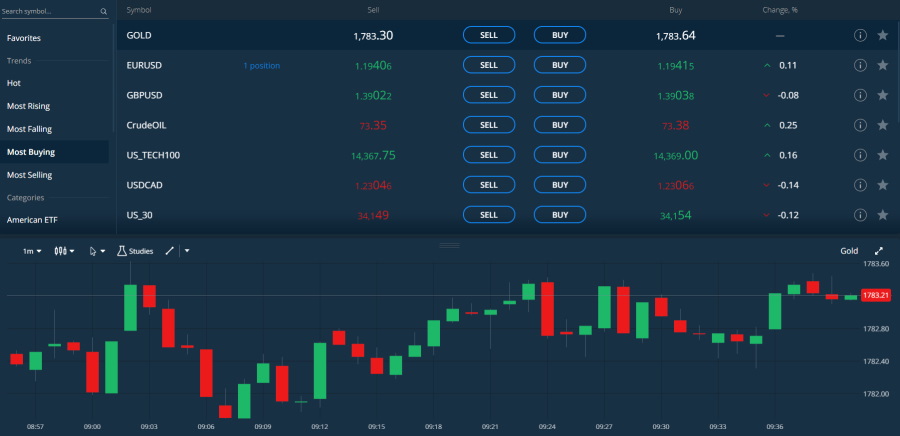

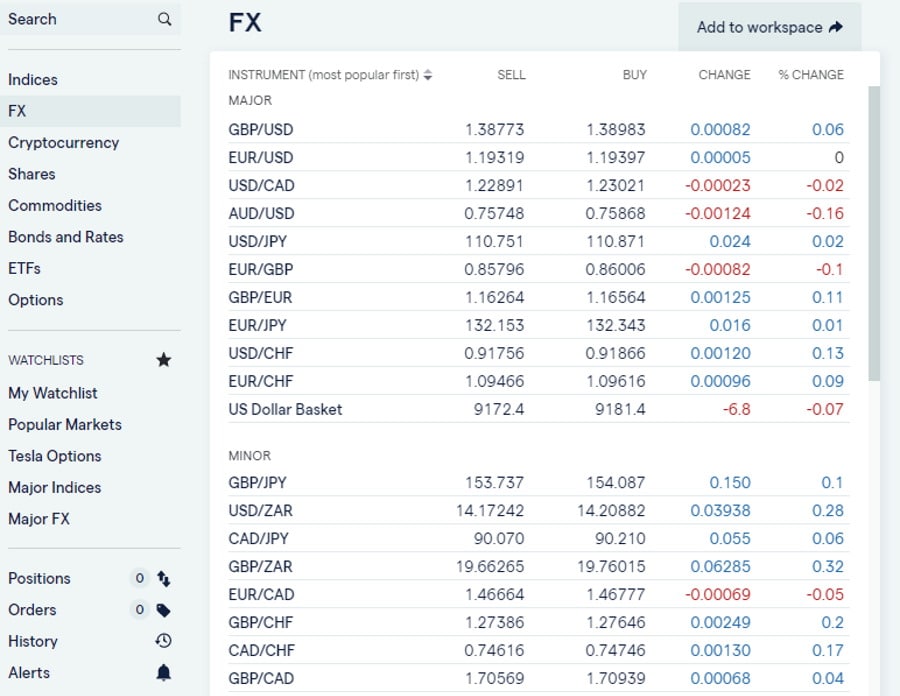

What Are Forex Spreads?

Forex brokers usually do not charge commissions. Rather, they make money through spreads (also known as pips) between buy and sell prices. The spread in a forex trade is the difference between the bid (buy) and ask (sell) price of a currency pair.

Typically, when you buy a currency, you’ll pay slightly more than the seller receives for selling that currency. That difference is the spread, and it goes to your broker as a fee for mediating the trade.

What Is Considered A Low Spread In Forex?

So what is a good spread in forex? The short answer is, it depends.

When you’re talking about low spread forex, the value needs to be taken into context. Depending on the currency that you’re trading, a low spread in forex can vary significantly.

Major currency pairs, the ones that are traded the most per day, have the lowest spreads. This is because there is more trading volume and they are more liquid. More niche or minor currency pairs tend to have higher spreads because they are less liquid with lower trading volumes.

One of the most popular currency pairs, EUR/USD, is often the baseline comparison to brokers’ spreads. The EUR/USD pair benchmark average spread is around 1.0 pips. Brokers that charge lower than that are typically considered low spread forex brokers.

It’s important to note that even major pairs can greatly vary in price. For example, the lowest spread forex broker for EUR/USD might not have the lowest spread for USD/JPY. This is important if you’re looking to trade only a particular currency pair or pairs among the lowest spread forex brokers.

Tips For Trading With Low Spread

One of the most important things to consider in currency trading is the spread. So what is low spread in forex? As mentioned previously, major currencies usually have a spread of 1 pip. Currency pairs lower than this can be forex pairs with the lowest spreads.

However, when we start to compare the average spread to the average daily movement of a pair, several issues come up. First, there will be some pairs that will be better to trade than others. Second, short-term trading will have higher spreads for retail traders. Third, a currency pair with a larger spread does not necessarily mean the pair is not gonna be a good trader. Conversely, the same is the case for a smaller spread. Foreign exchange pairs with the lowest spreads might not be the best trade.

Form a Baseline

A baseline rate is needed in order to find the best spreads and eventually the best forex trades. For this, the daily average of the currency pairs’ spread is calculated. This will allow for a comparison among spreads versus the maximum pip potential for day trading.

Because the average spread is supplied as the baseline, the value can be used at any point in the day to see how large or small you can see the spread to be. Furthermore, you can even use the same test to identify the ranges among longer-term spreads.

By creating a deadline, you will better be able to find which forex broker has the lower spreads and what is low spread in forex.

Choose the Best Currency Pairs

The spread can be significant especially when it is expressed this way (as a percentage of the daily average move). This will have a large impact on day trading strategies. You’ll get the most value by finding the forex pairs with the lowest spreads. Look at the currency pair spreads to get the best forex broker lowest spread.

Day traders who only look at a particular currency pair trade pairs with the lowest spread as a percentage of maximum pip potential. Over time, traders will be able to identify that some forex pairs are better to trade long-term than others.

Bottom Line

It is important for any trader to know that spread is a significant portion of the daily average range in many forex pairs. They’ll need to factor in likely entry and exit prices where the spread becomes much more significant.

Short-term traders can monitor daily average movements to verify if trading during low volatility times presents enough profit potential to realistically make active trading (with a spread) worthwhile.

At the end of the day, it’s all about risk management and finding the best risk-to-reward strategy that is best suited for you. Traders need to understand if volatility will change the risk when it comes to their trade and whether it becomes too big of a risk in their short-term and long-term price goals.

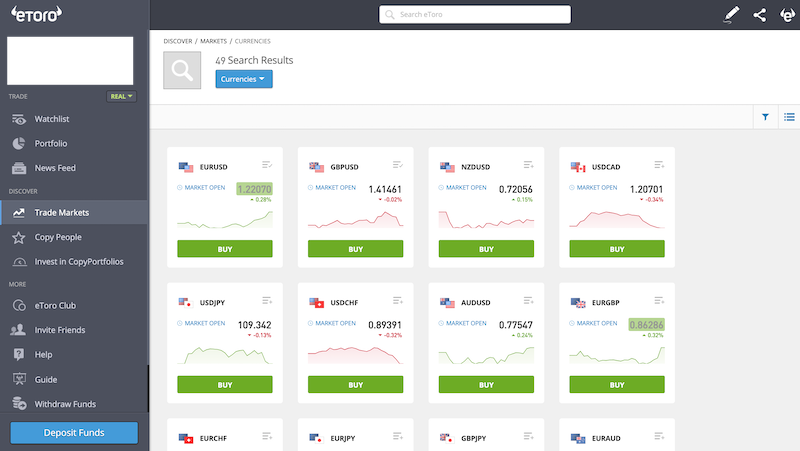

How To Get Started With A Low Spread Forex Broker – eToro

Among the best forex brokers with low spread is eToro, the all-in-one popular trading platform. Below, we’ll show you a short tutorial on how to start trading with eToro!

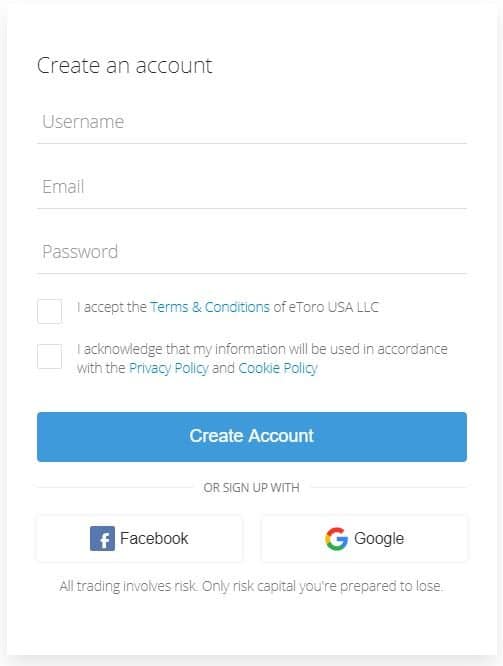

Step 1: Open a Trading Account

67% of retail investor accounts lose money when trading CFDs with this provider. Your capital is at risk.

Get on the eToro website and create an account. Fill up the personal details on the form or you can choose to connect your Facebook or Google account to sign up.

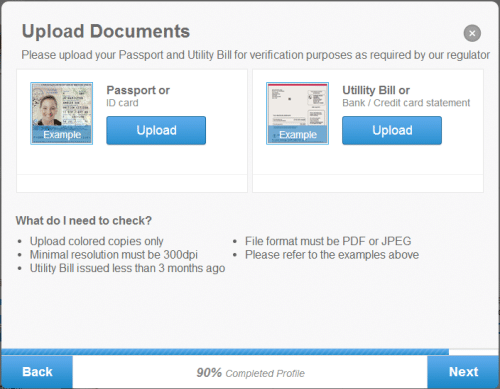

Step 2: Verify Your Identity

Being a regulated trading platform, eToro requires all its users to verify their identity to make sure that they are trading in the country they live in and their users are legit. Upload a copy of your driver’s license or passport to verify your identity. Wait a few days for the system to fully verify your account.

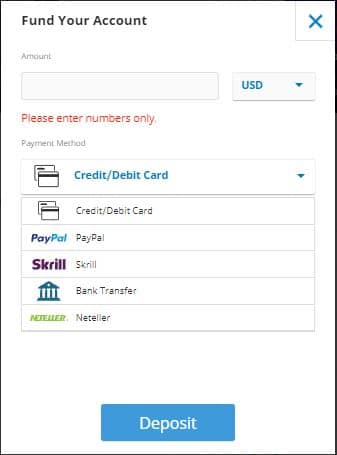

Step 3: Deposit Funds

A minimum initial deposit of $200 or £160 is required to start live trading in eToro. Don’t worry, there are multiple payment methods available such as debit or credit card, bank transfer, PayPal, and e-payments. More or fewer payment methods will be available depending on where you live.

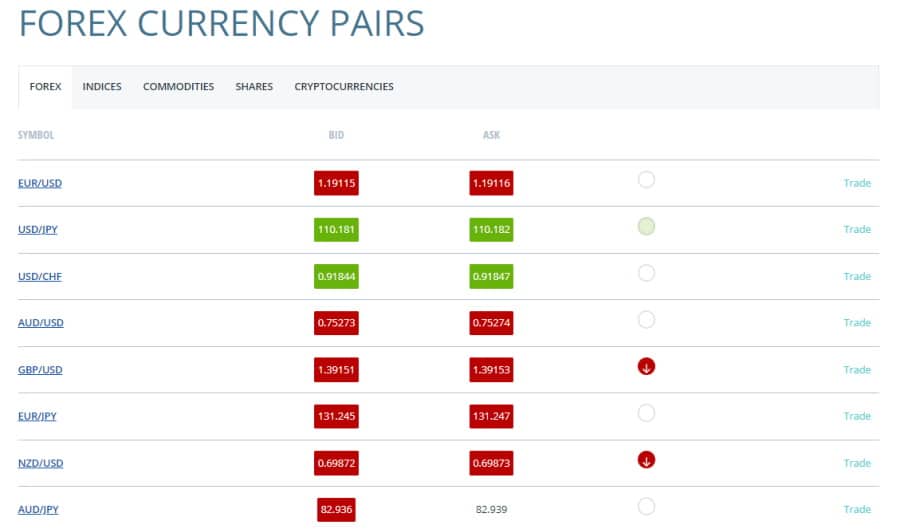

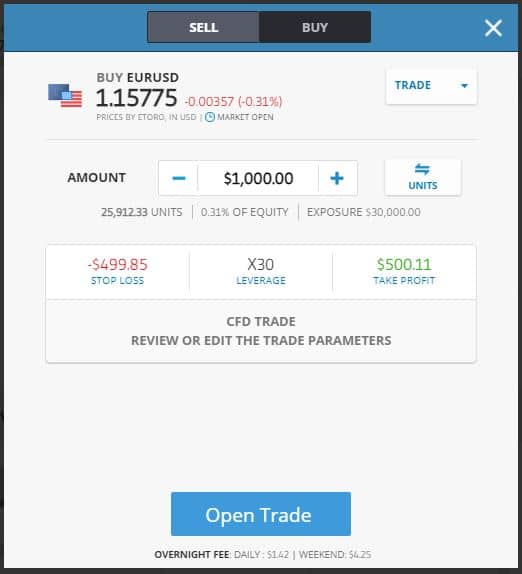

Step 4: Start Trading with Low Spread

67% of retail investor accounts lose money when trading CFDs with this provider. Your capital is at risk.

For the final step, you’ll be trading forex! Search for the currency pair that you would like to trade. For example, search ‘EURUSD’ to find the EUR/USD currency pair. Then, press the ‘TRADE’ button. Choose the amount of leverage you would like to use as well as how much you are willing to trade.

Depending on your trading strategy, you can also edit your stop loss and take profit values. The stop loss and take profit options are automatically placed once you open a trade but are editable. You can’t lower your stop loss at a certain point without paying extra because you are trading CFDs, but make sure to always keep up to date with the price as to not get margin called.

Conclusion

With a daily trading volume amounting to over $6.6 trillion, forex is the largest exchange of hands in the world. So for those who wish to take part in the forex market make sure to maximize profits with the best forex brokers with low spreads.

Ready to start trading with the best forex brokers with low spread? Click the link below to sign up for an eToro account today!

eToro – Overall Best Low Spread Forex Broker

67% of retail investor accounts lose money when trading CFDs with this provider. Your capital is at risk.