FBS Broker Review – Pros & Cons

FBS is an online all-in-one trading platform that offers to invest in forex and CFD trading of stocks, indices, cryptocurrencies, and other equities.

In this FBS review, we cover and discuss everything you’ll need to know about the online platform. We’ll go through the key features, interface, important fees, commissions, regulations, and more.

What is FBS?

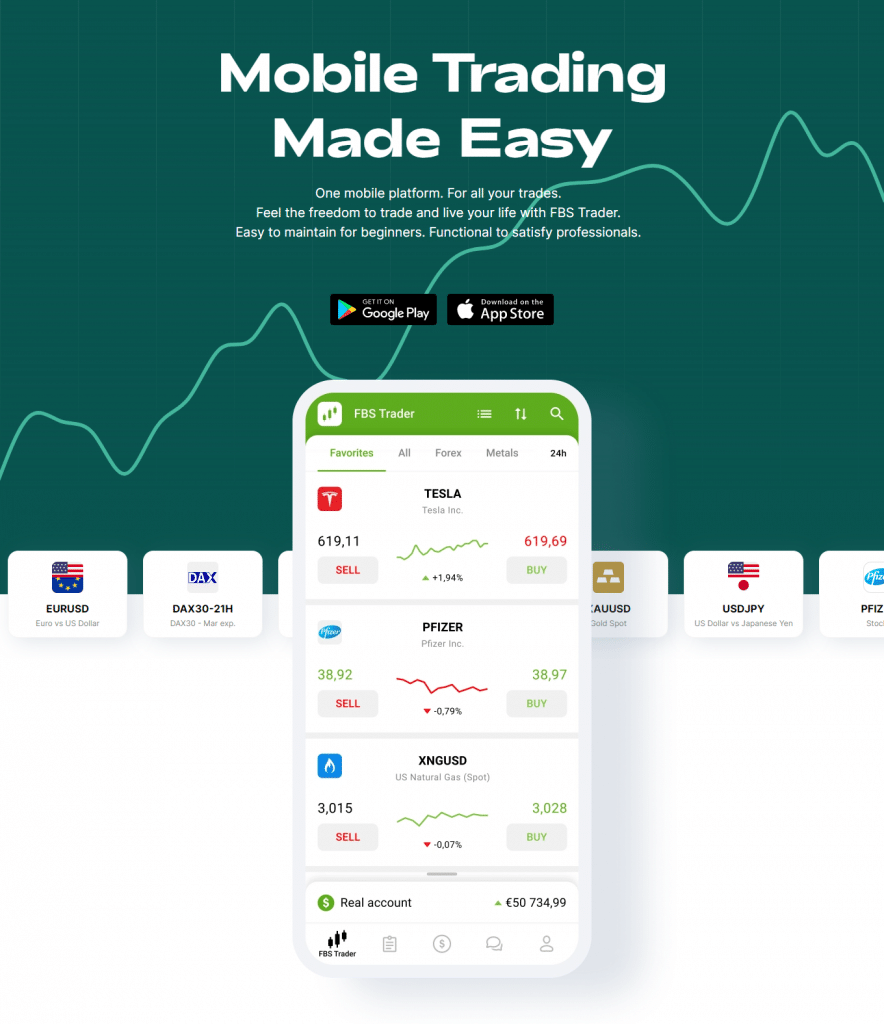

FBS boasts a base of 17 million traders coupled with 410 thousand partners who have chosen FBS as their preferred forex platform. With their motto of “easy to maintain for beginners – functional to satisfy professionals”, the broker has brought many opportunities for new and veteran traders alike.

Quite a few other organizations also had FBS reviews and have awarded the company multiple accolades as a broker in forex and CFD trading over the years. According to their site, they also total $500 million annual profit to their clients.

An important value that we found in this FBS forex review was regarding the platform’s views on diversity. FBS prides itself on its value for diversity. Specifically for Muslim traders, they offer swap-free accounts that do not go against Islamic law.

75.3% of retail accounts lose money when trading CFDs with this provider. Consider whether you can afford to take the high risk of losing your money.

FBS Pros & Cons

Pros

- Multiple account types for every trader and strategy

- Has an integration with MetaTrader 4 and MetaTrader 5 platforms

- Highly regulated trading platform internationally

- Organized training sessions, seminars, and special events

- Provides educational training materials and cutting-edge trading tech for the Forex market

- Access to a forex demo account

- Free participation in all their events and seminars

- 24/7 customer support

- Offers a wide range of payment methods like credit cards and debit cards, Apple Pay, and bank transfers with no deposit fees

- Payment methods adapt based on your country

- Offers highly competitive zero-spread accounts

- Can offer extremely low minimum deposits

- Mobile app available

Cons

- Limited stock and equities options compared to other brokers

- Offers only CFD and forex trading

- Slight learning curve for integrations in MT4 and MT5

75.3% of retail accounts lose money when trading CFDs with this provider. Consider whether you can afford to take the high risk of losing your money.

What Can You Invest in and Trade on FBS

There are several equities and markets to invest in and trade on FBS. In this FBS markets review, we’ll discuss the five main equities and markets that users can trade below.

Invest in Forex

Also known as the foreign exchange market or FX market, Forex is the world’s most traded market. About $5.1 trillion worth of value is exchanged per day and perhaps FBS is best known for its online platform for forex markets.

From the FBS forex review, multiple exchanges are available like EUR/USD, USD/JPY, GBP/USD, and AUD/USD among many others. All in all, the FBS platform features the standard 28 currency pairs and 16 exotic ones.

Trade Stocks

The stock market or stock exchange refers to a public market that offers buying, selling, and exchanging of stocks of publicly traded companies.

Based on the review broker FBS, the platform offers trading of 40 US, 30 UK, and 30 German company shares. Among them are the company stock of Apple, Google, Facebook, and Microsoft.

Invest in Indices

Indices are a measure of the price performance of a group of securities through a standardized metric. Index investing has become a low-cost way to achieve the returns of popular indices such as the S&P 500 Index or Dow Jones Industrial Average.

We found in our broker FBS review that users can trade futures of the NASDAQ and S&P 500 indices.

Trade Commodities CFDs

There are two main types of commodities in the commodities market – hard and soft commodities. Hard commodities are mineable and extractable raw materials like metals and gases. Soft commodities are usually farmed or livestock materials like grain and wool.

Based on the FBS broker review, the tradeable CFD commodities in the FBS platform are hard commodities. Among them are oil, natural gas, gold, and platinum.

Trade Cryptocurrencies

Normally in a social trading platform or exchange, you would need a crypto wallet when trading cryptocurrencies with Bitcoin. Cryptocurrencies are digital assets that are impossible to counterfeit and are based on a blockchain network.

The FBS platform offers trading of popular coins such as BTC, ETH, LTC, and XRP in differing currencies. As seen in the FBS broker review, these cryptocurrencies and other equities are accessible even in the mobile app.

If you are looking for more cryptocurrencies to trade, check out other day trading crypto exchanges to help you get more variety in your crypto trades.

FBS Fees & Commissions

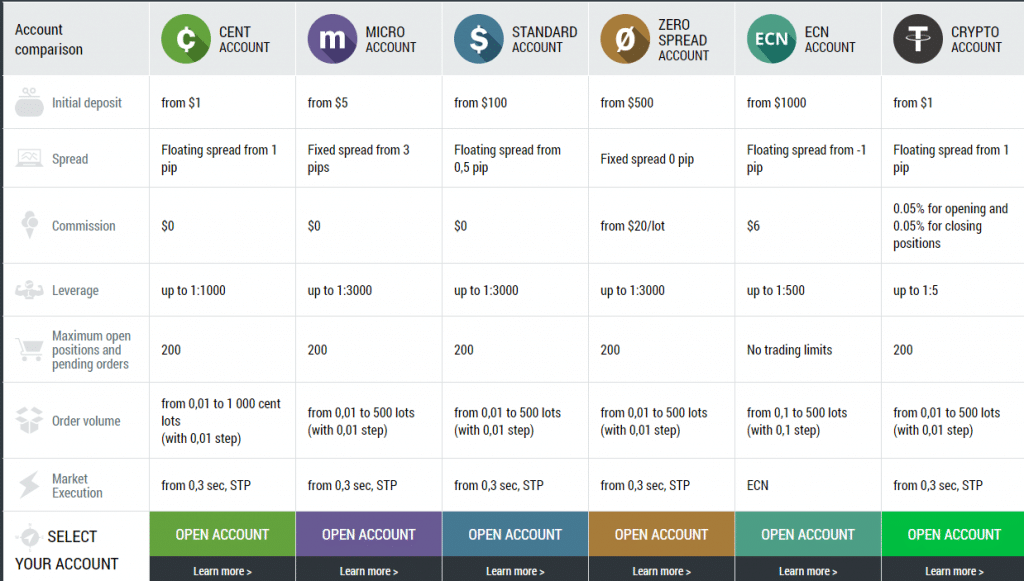

One of the most important things to take note of when it comes to fees in the platform is the FBS spread. Depending on the account type that you create, the FBS spread value can be low or high.

The table below shows the FBS spread per account type as well as the commission fees.

| Cent Account | Micro Account | Standard Account | Zero-spread Account | ECN Account | Crypto Account | |

| Spread | Floating spread from 1 pip | Fixed spread from 3 pips | Floating spread from 0,5 pip | Fixed spread 0 pip | Floating spread from -1 pip | Floating spread from 1 pip |

| Commission | $0 | $0 | $0 | From $20/lot | $6 | 0.05% for opening and 0.05% for closing positions |

| Inactivity Fee | $0 | $0 | $0 | $0 | $0 | $0 |

Other fees at FBS are the withdrawal which differs depending on the withdrawal method of your choice. Below is a table showing the differing fees per withdrawal method.

| Withdrawal Fee | Duration | |

| VISA | $1 | Max 2 days |

| NETELLER | 2%, min $1, max $30 | Max 48 hours |

| STICPAY | 2.5% +$0.3 | Max 48 hours |

| Skrill | 1% + $0.32 | Max 48 hours |

| Perfect Money | $0.5 | Max 48 hours |

FBS User Experience

The FBS trading platform provides a powerful and up-to-date experience when it comes to trading forex and CFDs. With the latest trading tools at your disposal, you can trade efficiently and plan your best trading strategies with the help of analytical patterns.

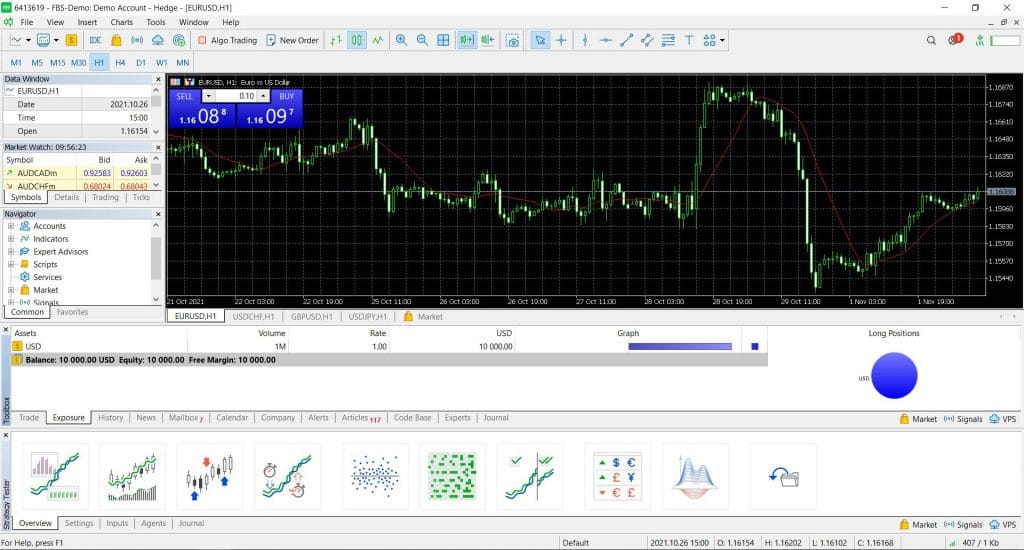

One of the key features of the FBS platform is its integration with the MetaTrader 4 (MT4) software. MT4 provides a trading experience that is seamless and easy to understand.

If you’re looking for a more versatile software, the FBS platform also has MetaTrader 5 (MT5) integration. It offers a wider choice of versatile tools, the option of trading stocks and commodities aside from forex, and additional timeframes.

Consider whether you can afford to take the high risk of losing your money.

If you’re still on the fence about using MT4 vs MT5, you may research further on the features of the platforms.

Depending on which trading platform you plan on integrating with your FBS platform, your experience may vary in terms of trading. However, the overall experience of using FBS with the versatility of different accounts remains the same.

We found in our FBS broker review that the differing and multiple options when it comes to account creating make the platform experience hard to rival. Since the platform has been well regulated and established across hundreds of countries, the experience is practically smooth.

Payment methods will adapt based on where you’re based. For example, if you live in the Philippines, FBS will offer bank transfer payment methods from the top banks of the country. This makes it extremely easy for Filipino users to create accounts.

The attention to detail in the trading and client diversity that FBS values so well only helps the platform in its experience for almost any user. It’s an all-in-one mobile application that can be likened to popular platforms like the eToro app keeps it up-to-date and mobile-friendly.

FBS Features, Charting, and Analysis

Depending on the account you open and which trading platform you plan on integrating with FBS, features may vary. In this part of the FBS review, we will explore the different features, charting, and analysis of the application.

Let’s start with how the features will be like for the recommended account of a beginner. In the broker FBS review, it is recommended that newbies start with a demo account where they are free to learn the price movements and how the app works.

Once the beginner is more familiar with the platform, they can start investing real money by getting a Cent account or a Micro account. The FBS spread for the former is a floating spread from 1 pip while the FBS spread for the latter is a fixed spread from 3 pips.

To execute trades, it’s recommended that beginners use the FBS trader application. In this platform, buying and selling forex is very simple and easy to understand. Furthermore, the price indicators that are being used are much simpler and clearer to see.

For the more advanced traders, the recommendation based on the FBS forex review is either the Standard, Zero-spread, or ECN account. These accounts typically require a higher initial deposit as more advanced or professional accounts need higher capital since most trade part-time or for a living.

All trading carries risk.

FBS Account Types

There are six account types based on our broker FBS review. A user can open many account types and can even deposit differing amounts per account type. Because there are different types of accounts that a user can access, it’s recommended that users first try the demo version of the account they want to try.

In the demo version of the account, all the tools and features are similar to the real account but no real capital is needed to execute trades. Basically, the demo account becomes a trial of sorts for users who want to venture out to try new account types.

Cent Account

The Cent account is a trading account on which the balance is displayed in cents, and transactions are carried out in cents as well. For example, if you deposit $10, you will have 1000 cents in your account.

We can tell from our FBS forex review that trading on the Cent account is low-risk, making it the go-to option for Forex newbies. Aside from this, using a Cent account can be a low-risk option for advanced traders who want to try out new trading strategies.

The Cent account allows people to trade smaller lot sizes and open an account with a lower initial deposit than any other account. From our broker FBS review, users can open a Cent account at FBS with a minimum deposit of just $1.

The Cent account supports the following trading instruments: 35 currency pairs, 4 metals, Indices, 33 stocks.

In the FBS platform, the Cent account is available on MT4. Try out a demo Cent account at FBS and learn firsthand about this account type.

Micro Account

For those who want to get into the specifics of their trades, the Micro account is the choice. As per the FBS forex review, the Micro account can help in the precise calculations of your trades. It does this by offering amazing trade measuring tools, such as Trader’s calculator.

To have a Micro account open at FBS, all that is required is a $5 initial deposit and a verified account.

The Micro account provides traders with our best bonuses – 100% Deposit Bonus, Level Up Bonus, and Cashback. From the FBS markets review, it has a fixed spread from 3 pips, leverage up to 1:3000, and is best for those who want to move up their strategies and keep improving.

The Micro account supports the following trading instruments: 35 currency pairs, 4 metals. In the FBS platform, the Micro account is available on MT4. You can try a demo version first if you’re still hesitant to use the real deal.

Standard Account

Traditional traders might want to seek out the standard account at FBS. The Standard account offers mega-competitive spreads with zero commissions.

At FBS, you are free to select your leverage (up to 1:3000). You can also benefit from special features like the Level Up Bonus. This gives users a free $100 and 100% Deposit Bonus that doubles the initial deposit.

The Standard account supports the following trading instruments:35 currency pairs, 4 metals, Indices, 33 stocks. In the FBS platform, you open the Standard account at MT4.

Zero-spread Account

The Zero Spread account is straightforward. It has no spread. This allows users to increase their profits and better forecast their profit. Just because the account has zero-spread doesn’t mean there aren’t any other costs involved. Take note of a commission of $20 per lot.

The Zero Spread account is the best for the high-speed traders out there. It offers traders 1:3000 leverage and 200 open positions and pending orders maximum. It also has 100% Deposit and Level Up Bonuses for those who create an account.

The Zero Spread account supports the following trading instruments: 35 currency pairs, 4 metals. In the FBS platform, the Zero Spread account is available on MT4.

ECN Account

For professional traders who want the best experience, the ECN (Electronic communication Network) account is the choice. The ECN account allows direct transactions between buyers and sellers, meaning no middlemen are involved.

To open the ECN account, you need to make an initial deposit of $1000. From our review broker FBS, the main benefits of the ECN account are the fastest market execution, low spreads (from -1 pip), best quotes with no delay, and a large number of liquidity providers. The spread on the ECN account is ultra-competitive, hence FBS requires a commission of $6.

The ECN account offers 25 currency pairs for trading. In the FBS platform, the ECN account is available on MT4.

Crypto Account

Are you willing to venture out of the forex market and try out cryptocurrencies? This account is perfect for those looking to invest in the latest digital asset.

The Crypto account supports more than 100 instruments: coins to coins, coins to fiat, coins to metals, etc.

FBs offers the following crypto terms: low spreads, fixed leverage 1:5, and easy deposits and withdrawals in fiat and crypto. Note that the Crypto account is available on MetaTrader 5 only.

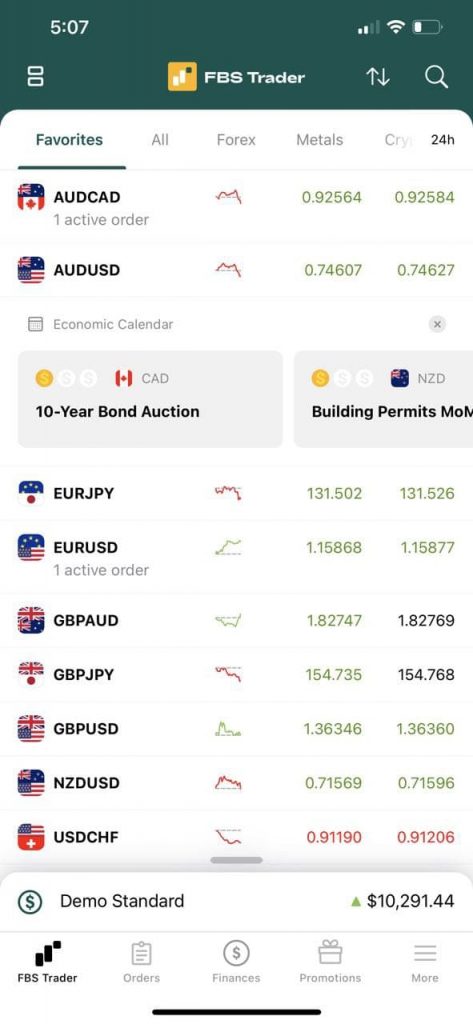

FBS Mobile App Review

In this part of our broker FBS review, we will be discussing the FBS mobile trader app. The application is available for download on both iOS and Android.

The sign up process should take just a few minutes, but in order to execute real trades, you’ll need to verify your account. The FBS mobile trader app is a great option for those looking to still continue trading on their mobile devices.

Through the mobile app, you can access the moving average technical indicator as well as the Bollinger bands. The app also allows for two different chart types: the standard candlestick and the tick-based chart. The app also features 1m, 5m, 15m, 30m, 1h, 4h, 1d, 1w, and 1m time frames for the charts.

Based on our broker FBS review, you can open multiple demo accounts at FBS and access each of them through the FBS mobile app. It’s important also to note that there is password and biometric authentication available in the application.

Consider whether you can afford to take the high risk of losing your money.

FBS Deposit and Withdrawal Methods

As seen in the FBS forex review, you can deposit funds into your account via credit card, debit card, Neteller, PerfectMoney, Skrill, Sticpay, and many more.

Depending on the account type, the minimum deposit can range from $1 to $1000. As shown previously in the commission and fees, there are withdrawal fees at FBS. Make sure to check out the table to see how much each withdrawal will cost based on your preferred withdrawal method. It usually takes a max of 48 hours for your account to reflect the transfer.

FBS Contact and Customer Service

The FBS customer support is available 24/5 and can be reached via phone, email, and live chat. To access their services quickly, you can reach out to them on social media platforms as well. Chat with them on Telegram, WhatsApp, and Facebook Messenger.

From our review broker FBS, the customer service will more or less respond within 24 hours. If you have any more concerns or would like to know more while waiting for a response, the FBS site has many FAQ articles and easy reads to get you acquainted with the site.

Is FBS Broker Safe?

It is important to ask about regulation when it comes to brokers, so is FBS regulated? The answer is a definite yes. FBS regulation has been well licensed as the broker has been around for over 12 years.

The FBS regulation allows the site to follow the licenses based on any user’s country that is available by the platform. To mention again, FBS is regulated by CySEC, IFSC, FSCA, and ASIC.

How to Start Trading with FBS

We have come to the portion of this FBS forex review where we will start showing how users can begin their FBS trading journey. Below is a short tutorial on how to start trading with FBS.

Step 1: Open a Trading Account

75.3% of retail accounts lose money when trading CFDs with this provider. Consider whether you can afford to take the high risk of losing your money.

First step, visit the FBS website and press the open account button at the top right portion of the screen. Next, either fill up the personal information in the form or you can choose to sign up via Google, Apple ID, or Facebook.

Step 2: Verify Your Identity

In this next step, you’ll need to upload a valid ID to prove your identity. Because FBS is a regulated broker, this step is important in order for you to use all the features such as depositing money and using the other types of accounts.

Step 3: Deposit Funds

Account verification should be complete in 24 hours or so, after which you can start to deposit funds. Check your account type to see the minimum deposit amount which ranges between $1 and $1000.

Step 4: Start Trading with FBS

With your account funded, you may now start trading via the FBS platform! Feel free to install MT4 or MT5 depending on your liking. You may also download the FBS trader app on your device to start trading. Simply go to the trading platform that you will integrate to FBS and find the CFD or forex you want to start trading.

75.3% of retail accounts lose money when trading CFDs with this provider. Consider whether you can afford to take the high risk of losing your money.

It’s just a matter of pressing the buy if you want to bet long on your position or pressing sell if you want to bet short. You also have the option of setting a take profit and stop loss which you can adjust depending on your trading strategy.

FBS Review – Conclusion

Whether you are new or are experienced in investing in forex and CFDs, FBS is a reliable and well-known broker that can easily suit your needs. All throughout this broker FBS review, we have covered all you need to know about this international online trading platform.

Ready to try out the FBS platform? Click the link below to begin and start trading forex, stocks, indices, and other equities – sign up here!

75.3% of retail accounts lose money when trading CFDs with this provider. Consider whether you can afford to take the high risk of losing your money.