Coinbase vs Gemini – Which Crypto Exchange is Best?

If you’re looking for a new cryptocurrency exchange to buy, sell, and trade digital coins – you might be considering the likes of Coinbase and Gemini. But which, if any, provider is right for you?

In this guide, we compare Coinbase vs Gemini to see which exchange is worth your consideration.

Coinbase vs Gemini Comparison

Coinbase – crypto

Visit SiteYour money is at risk. The exchange holds an e-money license from the FCA....

What are Coinbase and Gemini?

Put simply, Coinbase and Gemini are both cryptocurrency exchanges and brokers. This means that the two platforms allow you to buy and sell digital coins like Bitcoin, Ethereum, Ripple, and more from the comfort of your home.

In turn, Coinbase and Gemini charge an assortment of fees and commissions. Coinbase itself was founded back in 2012, making it one of the most established exchanges in this space. The Gemini exchange was launched a few years later in 2015.

Both providers are renowned for their institutional-grade security services, especially when it comes to wallet safety. Furthermore, both Coinbase and Gemini are US-based and thus – heavily regulated.

With that said, Gemini has taken its regulatory standing to the next level – as it is licensed by the New York State Department of Financial Services. In terms of clientele, Coinbase is more suited to the average Joe Trader. That is to say, Coinbase is often the go-to platform for newbies that are looking to buy cryptocurrency for the first time.

This huge popularity with beginners has not only resulted in Coinbase attracted over 35 million customers, but it is now listed on the NASDAQ as a public company. Gemini, on the other hand, is more suited to institutional investors.

Coinbase Pros & Cons

Pros:

- Trade 64 popular cryptocurrencies

- Accepts credit cards, debit cards, and PayPal

- Excellent security protocols in place

- Simple instant buy or more advanced Coinbase Pro interfaces

- Earn rewards for learning more about crypto

- Tools for businesses and developers

- Integrated cryptocurrency wallet

- Regulated in the US and publicly traded on the NASDAQ

Cons:

- No margin trading or crypto futures

- High trading fees

- Huge debit card transaction fees

- Limited customer support

Your capital is at risk

Gemini Pros & Cons

Pros:

- Regulated by the New York State Department of Financial Services

- Institutional-grade security features

- Buy crypto instantly

- Crypto savings accounts allow you to earn interest

- Exchange services with 40+ supported coins

- Highly suited to large-scale crypto investors

Cons:

- Much lower trading commissions available elsewhere

- High debit card purchase fees

- Not suitable for newbies

Your capital is at risk

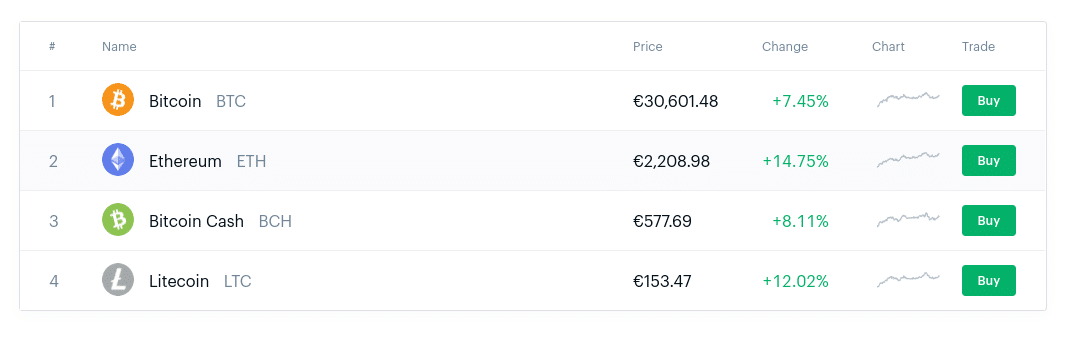

Supported Coins

So now that we have covered the pros and cons, in this section of our Coinbase vs Gemini comparison we are going to explore what digital currencies the two platforms support.

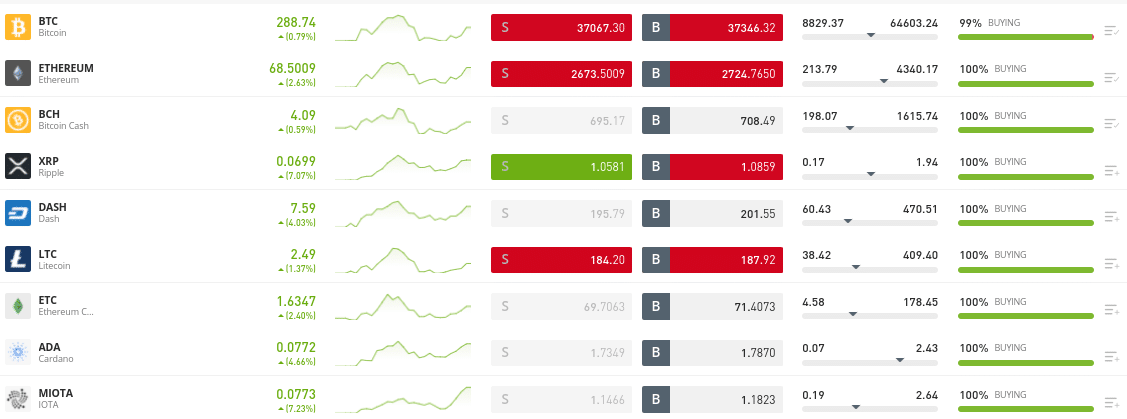

Starting with Coinbase, the platform gives you access to 64 cryptocurrencies. This covers the core basics - such as Bitcoin, Ethereum, Litecoin, Ripple, EOS, and Bitcoin Cash. You can, however, also invest in a number of ERC-20 tokens.

Unlike a lot of other cryptocurrency trading platforms in this industry, Coinbase is very selective in the digital coins it adds to its site. After all, for many years the broker supported just four digital assets until management decided to broaden the platform's scope.

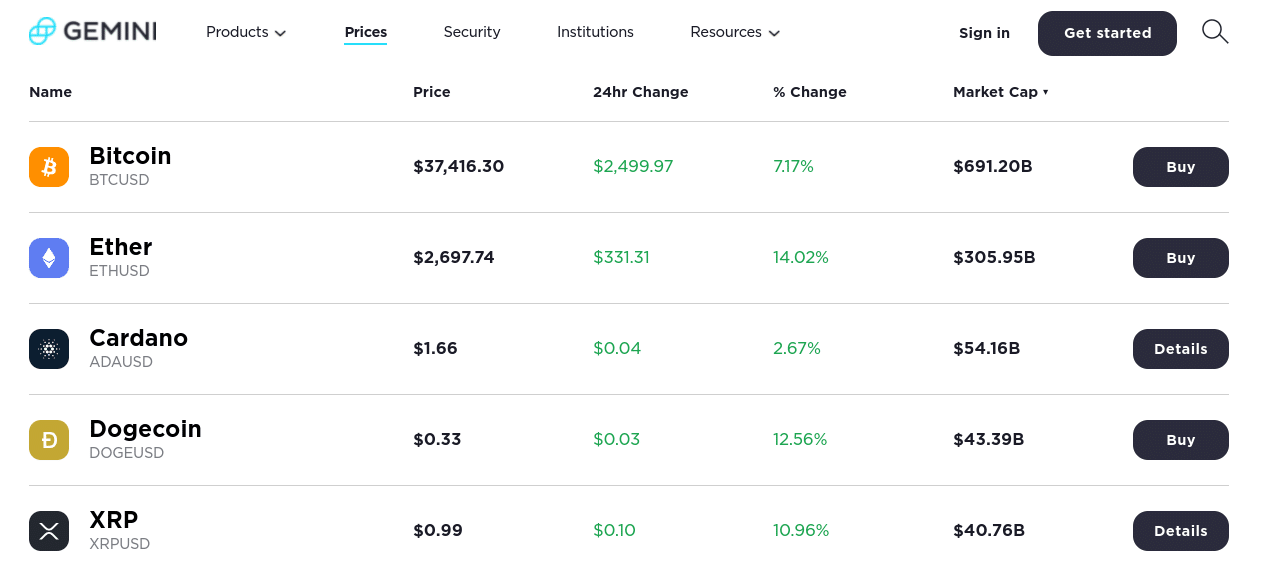

Over at Gemini, the exchange allows you to buy, sell, and trade more than 40+ digital currencies. Much like Coinbase, this covers the most popular cryptocurrencies in terms of market capitalization, alongside a smaller selection of medium-cap projects.

Coinbase vs Gemini Fees

Before we break down the fee structure in more detail, we should note that our Coinbase vs Gemini comparison found that both platforms are somewhat expensive. Not only in terms of trading commissions, but the fees charged on fiat deposits.

Trading Fees

Starting with Coinbase, the platform will charge you 1.49% in standard trading commission. This means that you will pay 1.49% to purchase your chosen digital coin and another 1.49% when you cash out.

- For example, if you were to buy Dogecoin at a stake of $600 - you'd pay a commission of $8.94.

- If you chased out your Bitcoin investment when it was worth $1,200 - your 1.49% commission would then amount to $17.88.

As you can imagine, if you were to purchase or sell a significant amount of cryptocurrency from Coinbase, you'd pay a very hefty fee.

Over at Gemini, it appeared at first glance that the platform was much cheaper in the commission department. This is because the provider charges just 0.5% as a convenience fee when you buy or sell digital currencies.

However, in addition to this, Gemini will also charge you 1.49% as a standard commission - which mirrors that of Coinbase. As such, the total commission payable on trades amounts to 1.99% per slide.

- For example, if you were to buy Ethereum at a stake of $600 - you'd pay a commission of $11.94.

- If you chased out your Ethereum investment when it was worth $1,200 - your 1.99% commission would then amount to $23.88.

As we cover in more detail later in this Coinbase vs Gemini comparison - there are much cheaper options available in the cryptocurrency day trading scene. For example, eToro allows you to purchase digital currencies on a spread-only basis - which is the gap between the bid and ask price.

Non-trading Fees

When it comes to non-trading fees, our Coinbase vs Gemini review team found that things get even more expensive. At the forefront of this is the fee charged on debit card deposits.

Coinbase, for example, will charge you a deposit fee of 3.99% of the transaction amount. This is huge, especially when you consider that there are cryptocurrency platforms out charging less than 1%. In some cases, nothing at all.

This 3.99% fee is a direct purchase charge - meaning that you won't pay the previously discussed 1.49% standard commission to enter the market. You will, however, need to pay 1.49% when you get around to cashing out.

- For example, let's suppose that you want to buy $2,000 worth of Bitcoin Cash with your debit card

- Coinbase will charge you 3.99% on the direct purchase, so that's a fee of $79.80

- Let's then suppose that your Bitcoin Cash investment has grown to $3,000

- You decide to cash out, so will need to pay a commission of 1.49% - so that's another $44.70

Over at Gemini, you will pay a debit card fee of 3.49% to purchase cryptocurrency. While this is slightly lower than Coinbase, this is still very expensive.

To illustrate this point with an example, popular brokerage site eToro allows you to deposit funds with a debit/credit card or an e-wallet like Paypal without paying any fees if you're based in the US. Everyone else pays a small fee of just 0.5%.

With this in mind, our Coinbase vs Gemini comparison found that you will save a considerable amount of money in both trading and non-trading by looking elsewhere.

Nevertheless, here's an overview of the main fees charged by both Coinbase and Gemini - which are accurate at the time of writing.

| Standard Commission | Instant Buy Fee | Deposit Fees | Withdrawal Fees | |

| Coinbase | 1.49% | 3.99% when using a debit card | Typically no fees on bank transfer deposits | Up to 2% on debit card withdrawals |

| Gemini | 0.50% + 1.49% | 3.49% when using a debit card | Typically no fees on bank transfer deposits |

No fee on wire transfer withdrawals |

Buying Limits

Coinbase does not clearly state what buying limits it has in place. This is because your limits will depend on various factors - such as where you are based, what payment method you are using, and how long you have been registered at the platform.

over at Gemini, the daily buying limit when using a debit card is $1,000 - which is on the low side. ACH bank transfers are much higher at $5,000 per day or $30,000 per month. If you are able to deposit funds via wire transfer, Gemini notes that there are no deposit limits. This is the case for both individual and institutional clients.

Coinbase Wallet vs Gemini Wallet

Coinbase certainly stands out when it comes to storage facilities. This is because you can quite easily leave your digital coins in your Coinbase web wallet without needing to worry about the safety of your funds. Crucially, the platform has a significant number of safeguards in place to ensure your account is not comprised.

This includes:

- The vast majority of client funds held in cold storage

- Two-factor authentication (2FA)

- IP address whitelisting

- Device whitelisting

- Vault feature that always locks withdrawal requests for 48 hours

If you want more control over your digital funds, Coinbase also offers a stand-alone mobile wallet. This can be downloaded to your iOS or Android device and comes alongside a number of security features.

It could be argued that the Gemini wallet is even more secure than its Coinbase counterpart. For example, Gemini has custodial insurance in place on its digital fund holdings, which is a major safety net. This means that in the event of an external hack, there is every chance that you might be covered financially.

Additionally, and much like Coinbase, Gemini keeps the vast bulk of client funds in cold storage. The Gemini wallet also doubles up as a mobile app - which is available on iOS and Android devices.

Mobile App

Any cryptocurrency exchange worth its weight in gold will offer a comprehensive mobile app that comes packed with useful features. Our Coinbase vs Gemini comparison found that both platforms meet this requirement.

The Coinbase app, for example, allows you to buy and sell digital currencies at the click of a button. The app will be linked to your main Coinbase account, which makes the process even more seamless. And of course, much like the main Coinbase website, the app is really simple to use.

The Gemini app also allows you to perform many of the same features as found on the main desktop website. This includes the ability to buy, sell, and exchange cryptocurrencies without needing to leave the app. The mobile application is highly rated on both Google Play and the App Store - which stands at 4.5/5 and 4.8/5, respectively.

User Experience

If you are simply looking to buy and sell cryptocurrency, our Coinbase vs Gemini review found that the process at both platforms is relatively straightforward. Coinbase, in particular, is highly suited for those with little to no experience in digital currencies. Gemini also offers a basic platform that makes it simple to purchase your chosen crypto asset.

Both platforms simply require you to choose the respective cryptocurrency, enter the amount you wish to purchase and confirm the order. The digital coins will then appear in your web wallet - which are available for withdrawal.

We should note that both Coinbase and Gemini also offer a more advanced trading platform that is aimed at experienced investors. The former comes in the shape of Coinbase Pro - which gets you access to more digital currency pairs, trading tools, and order types.

The Gemini ActiveTrader is similar to Coinbase Pro in this respect, as it offers seasoned traders more tools and features. This is especially the case when it comes to chart analysis and block trading.

Trading Tools and Features

In this section of our Coinbase vs Gemini comparison, we are going to unravel the main tools and features that you will find on each platform.

Let's start with Coinbase.

Coinbase Core Features

The most notable features offered by Coinbase are as follows:

- Coinbase Card: Coinbase is the latest cryptocurrency exchange that offers its own debit card. This allows you to spend your cryptocurrency holdings in the real world. The debit card is backed by Visa, so you use it online, in-store, or at ATMs.

- USDC: Coinbase, in partnership with Circle, offers its very own cryptocurrency - the USDC Coin. This operates as a stablecoin that is pegged to the USD on a 1:1 basis.

- Recurring Buys: For those interested in investing in cryptocurrencies over a long period of time, Coinbase offers recurring buys. This allows you to purchase a digital currency at set intervals automatically. For example, you might choose to buy $50 worth of Bitcoin every week or $200 worth of Ethereum at the end of each month.

- Education: As a platform that is aimed at cryptocurrency newbies, it makes sense that Coinbase is home to a top-rated educational department. This consists of a range of helpful guides and explainers that can take your understanding of the crypto arena to the next level.

Gemini Core Features

The most notable features offered by Gemini are as follows:

- Gemini Earn: This feature allows you to earn a fixed amount of interest on your idle cryptocurrency holdings. The amount of interest on offer will depend on the digital currency in question. For example, the highest rate available is 7.40% APY - which is payable on the Gemini Dollar, Dai, and Filecoin. Interest rates on Bitcoin are much lower at 2.05%.

- Gemini Dollar: Much like Coinbase, Gemini also offers its very own stablecoin that is pegged to the US dollar. The Gemini Dollar is backed by actual USD reserves that are held in an FDIC-insured bank account.

- Gemini Pay: This allows you to purchase goods and services in-store with your mobile phone. You simply need to select the digital asset you wish to use the fund the transaction and then the merchant will scan the respective barcode. Gemini Pay is currently available in over 30,000 US stores.

Coinbase vs Gemini Payments

Our Coinbase vs Gemini review found that both providers offer fiat currency facilities. This includes debit cards, meaning that you can buy your chosen cryptocurrency instantly. Perhaps the main drawback with using a debit card at either Coinbase or Gemini are the fees involved.

As we covered earlier, Coinbase charges 3.99% on direct debit card purchases while at Gemini - this will cost you 3.49%. Bank transfers are also an option. In the US, you can choose from a bank wire or ACH. Other supported regions are offered local bank transfers - such as Faster Payments in the UK.

In most cases, the fees on bank transfer deposits are super low or completely fee-free. You will, however, need to wait for Coinbase or Gemini to process your bank deposit, with timeframes depending on where you live.

Minimum Deposit

Neither Coinbase nor Gemini have a minimum deposit policy in place - which is great for those looking to invest on a budget. You do, however, need to be careful when it comes to fees if you are planning to deposit little small amounts into Coinbase. This is because the platform charges a flat fee when your deposit is below a certain amount.

For example, deposits of between $10 and $25 attract a fee of $1.49, while transactions between $25 and $50 cost $1.99. These flat fees might not sound like a lot, but they are when you work this out on a percentage basis. Over at Gemini, there is no premium for depositing small amounts.

Coinbase vs Gemini Regulation & Licensing

Our Coinbase vs Gemini comparison found that both platforms have an excellent reputation in the cryptocurrency exchange industry. After all, both providers are located in the US - so they must meet and comply with all relevant regulations and guidelines.

For example, For example, Coinbase is regulated by the SEC and as noted earlier - is now a publicly traded company on the NASDAQ. Gemini is registered as a trust company and is regulated by the New York State Department of Financial Services.

Both platforms also offer FDIC-insured accounts on US dollar deposits. You do need to be a US-based customer to benefit from this. All in all, while both providers are super expensive when it comes to fees, our Coinbase vs Gemini comparison found that regulation and safety is top-notch.

Contact and Customer Service

Both Coinbase and Gemini offer limited customer support. For example, neither offer live support via telephone or live chat - which is a major drawback. Gemini requires you to send an email to [email protected].

Response times can and will vary depending on how busy the support team is. Coinbase requires you to get in touch via an online support ticket system, which again, can result in lengthy response times.

Coinbase vs Gemini vs eToro

Although you might be looking to choose between Coinbase and Gemini for your cryptocurrency needs, it is important to remember that these are just two exchanges out of hundreds of other providers. After reviewing dozens of platforms in this industry, we found that eToro offers a much better service in most areas.

For those unaware, eToro is an online broker that is now used by over 20 million clients around the world. It is heavily regulated - with licenses issued by the FCA, ASIC, and CySEC. The broker is also registered and approved by the SEC and FINRA.

On top of stocks, forex, ETFs, precious metals, energies, and indices - eToro offers a great selection of cryptocurrencies that you can buy and sell at the click of a button. This includes everything from Bitcoin, EOS, and Cardano to Ripple, Litecoin, and Dash. You can also buy DeFi coins such as Uniswap and Aave.

The first major benefit of choosing eToro over Coinbase or Gemini is that you will save a considerable amount in fees. For example, if you're based in the US, you can deposit funds with a debit/credit card, e-wallet, or bank account without paying any transaction fees. If you're based elsewhere, the fee is just 0.5%.

As we have noted throughout this Coinbase vs Gemini comparison, you will pay 3.99% to use a debit card at the former and 3.49% with the latter. When it comes to standard trading commissions, eToro operates a spread-only pricing model.

| Trading Fee | Deposit Fees | Withdrawal Fees | |

| Coinbase | 1.49% per slide | 3.99% on debit cards | Up to 2% on debit card withdrawals |

| Gemini | 0.50% + 1.49% per slide | 3.49% on debit cards |

Free on bank wire withdrawals |

| eToro | Spread-only (varies by coin) | Free for US traders, 0.5% for non-US traders | $5 per withdrawal |

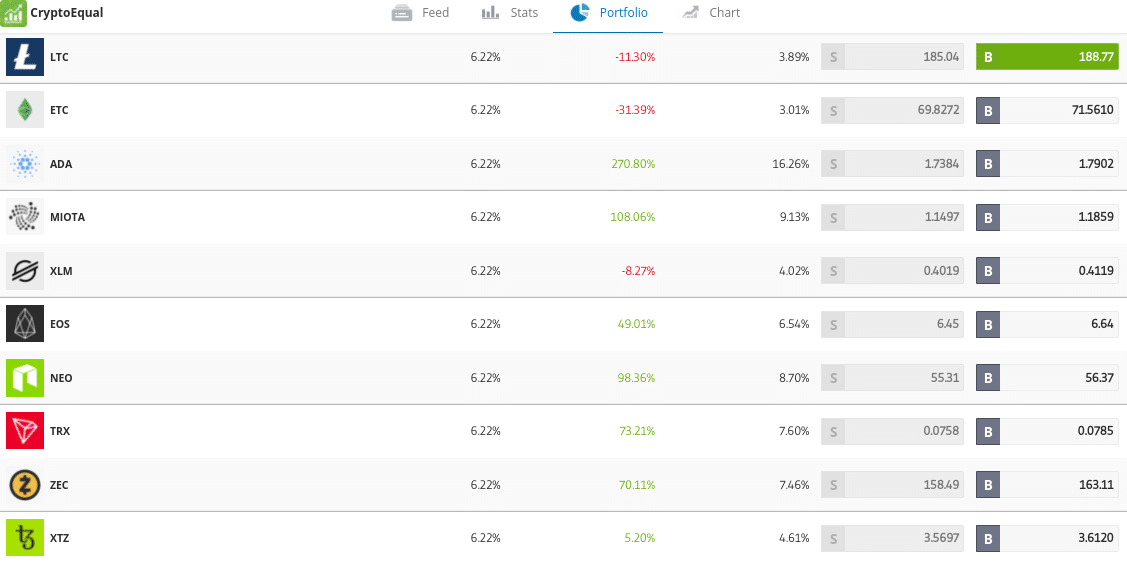

This will vary depending on the digital coin you are buying, but we found that across the board, this works out much cheaper than both Coinbase and Gemini. We also found that eToro offers a lot more in the way of tools and features. For example, there is a CryptoPortoflio service that allows you to invest in a diversified basket of digital coins.

Through a single trade, you'll be gaining exposure to 16 different cryptocurrencies - with each coin weighted based on market capitalization. Ultimately, this allows you to invest in the wider digital currency industry without needing to pick individual coins.

You then have the eToro Copy Trading tool, which is another passive investment product. This allows you to select an active eToro trader that has a proven track record on the platform. You can then elect to copy their ongoing positions like-for-like at an amount proportionate to what you invest ($500 minimum).

67% of retail investor accounts lose money when trading CFDs with this provider.

Past performance does not guarantee future results.

The Verdict

This Coinbase vs Gemini comparison has covered each and every metric that needs to be considered before choosing an exchange for your cryptocurrency needs. We found that both platforms have a great reputation, are regulated heavily in the US, and offer a reasonable number of supported digital currencies.

With that said, upon reviewing dozens of other providers, we found that eToro stands out from the crowd. Unlike Coinbase and Gemini, eToro allows you to deposit funds and subsequently trade cryptocurrencies in a low-cost environment.

You can easily fund your account with a debit/credit card and even Paypal and Neteller, and the process of opening an account takes minutes. We also like the cryptocurrency-based Copy Trading and CopyPortfolio tools on offer, which allows you to invest in a passive manner.

eToro - Overall Best Broker to Trade Cryptocurrencies

67% of retail investor accounts lose money when trading CFDs with this provider.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.