Best Crypto Savings Accounts in the US

As more investors and developers help grow the crypto ecosystem, new products, facilities, and services are created. One of the more popular products is the high yield crypto savings account which allows investors to generate considerably high interests in their cryptocurrencies.

In this guide, we’ll help you find the best crypto savings account for you by going over some high-interest crypto savings platforms together with their key features and metrics.

Best Crypto Savings Accounts List 2025

Below are some of the best crypto savings accounts available for investors today.

- AQRU – Overall Best Crypto Savings Account Platform

- Crypto.com – Fast and Secure Crypto Savings Account Platform

- BlockFi– User-Friendly Crypto Savings Account with Compound Earnings

- Binance – Most Diverse Crypto Savings Account Platform

- Coinbase – Best Crypto Savings Account Platform for Beginners

Best Crypto Savings Accounts Reviewed

Just like how there are bank savings accounts, you can also get a savings account for crypto. Depending on your preferences, you might want high yield savings account crypto or maybe an FDIC insider crypto savings account. With this in mind, let’s take a closer look at some of the crypto savings account platforms available.

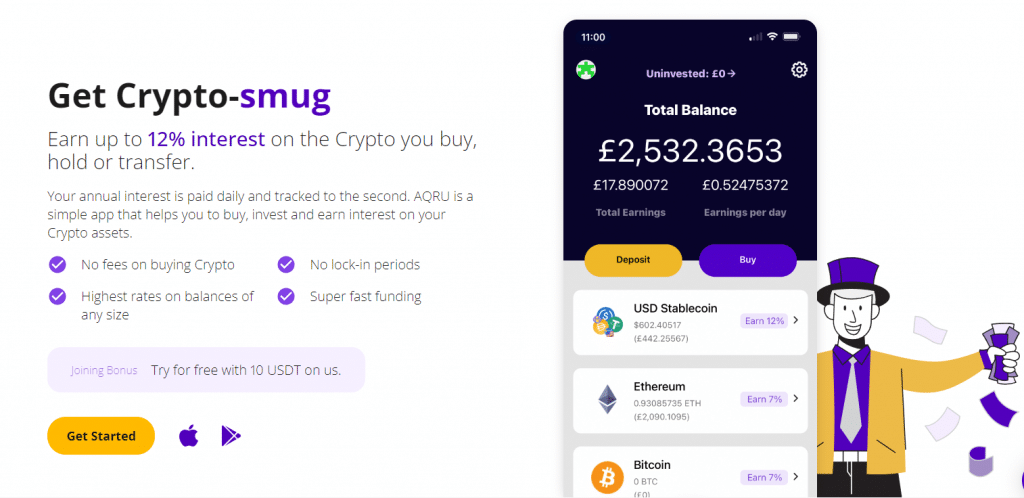

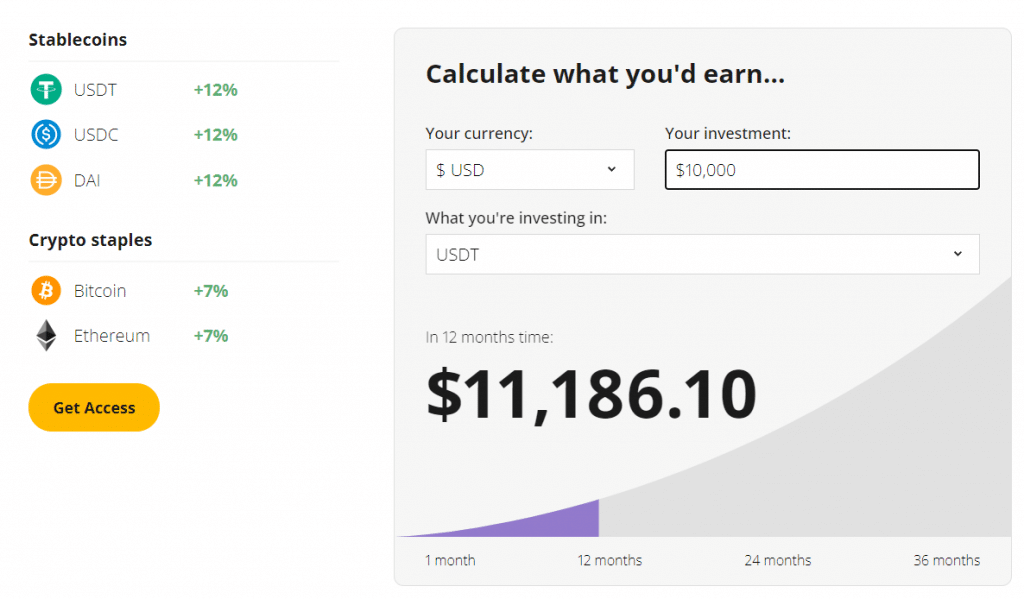

1. AQRU – Overall Best Crypto Savings Account Platform

If you’re looking for a great overall high-interest crypto savings account, we would recommend looking into AQRU. It’s one of the most recently launched crypto savings platforms having started just last December 2021. Aside from being one of the safest crypto savings accounts, AQRU offers a great anchor crypto savings account as well.

AQRU is owned by the London-based firm Accru Finance Ltd and is a private limited company registered in England and Wales. They use leading wallet infrastructure provider Fireblocks to keep your crypto savings account safe. There is also a $30 million policy in place in the event that assets are stolen according to their site.

How AQRU’s highest yield crypto savings account works is by lending out the crypto assets of their customers to institutional and retail borrowers. Some digital assets are also lent to decentralized exchanges (DEXs) to help provide for liquidity and other matters.

The minimum deposit for AQRU is $100 and there is currently no minimum for withdrawals as long as users can cover the $20 withdrawal fee. Users can deposit and invest in Bitcoin (BTC), Ether (ETH), or their stablecoins USDT, USDC, and DAI. AQRU plans on adding more coins given the crypto assets meet their strict requirements.

Pros:

Pros:

- No buying fees for crypto

- High rates for any balance size

- Zero lock-in periods

- Fast transaction speeds

- Joining bonus of 10 USDT

- Mobile app available

- No bank transfer and crypto transfer fees

Cons:

Cons:

- KYC and ID verification required

- Limited number of crypto available for earning

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

2. Crypto.com - Fast and Secure Crypto Savings Account Platform

One of the fastest-growing crypto savings account platforms out there is Crypto.com. Aside from being one of the best crypto exchange platforms available, Crypto.com is one of the highest APY savings account crypto platforms with over 10 million users worldwide.

Crypto.com’s high yield savings account crypto product is called Crypto Earn and markets up to 14.5 percent per annum on crypto and up to 14% per annum earnings for stablecoins. With support for over 40 different cryptocurrencies on Crypto Earn, investors can easily diversify their best crypto savings account. Popular coins such as Bitcoin, Ethereum, Tether, and Litecoin are all offered.

In order to have a Crypto.com high yield crypto savings account of up to 14.5 percent, investors will need to stake specified amounts of CRO, the Ethereum token that powers and validates transactions on the Crypto.com Chain. If you can stake $40,000 worth of CRO, you can earn the full per annum earnings from your high yield crypto savings account.

The Crypto.com high-interest crypto savings account allows for three holding term options:

- Flexible holding term

- 1-month fixed term

- 3-month fixed term

Furthermore, the Crypto com savings account has a minimum threshold per coin to earn yield. For example, to earn fixed and flexible holdings for USDT, the Crypto.com high yield crypto savings account must meet the 250 USDT thresholds.

Pros:

Pros:

- Supports over 40 cryptocurrencies for earning

- 14% annual returns on staking stablecoin on the platform

- Spend with the Crypto.com Visa Card and get up to 8% back

- NFT marketplace available

- Multiple DeFi integrations on the site

- Mobile app available

- Fees that are competitive, transparent, and offer discounts

Cons:

Cons:

- Lower returns per annum without staking CRO

- Difficult to navigate trading fee discounts

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

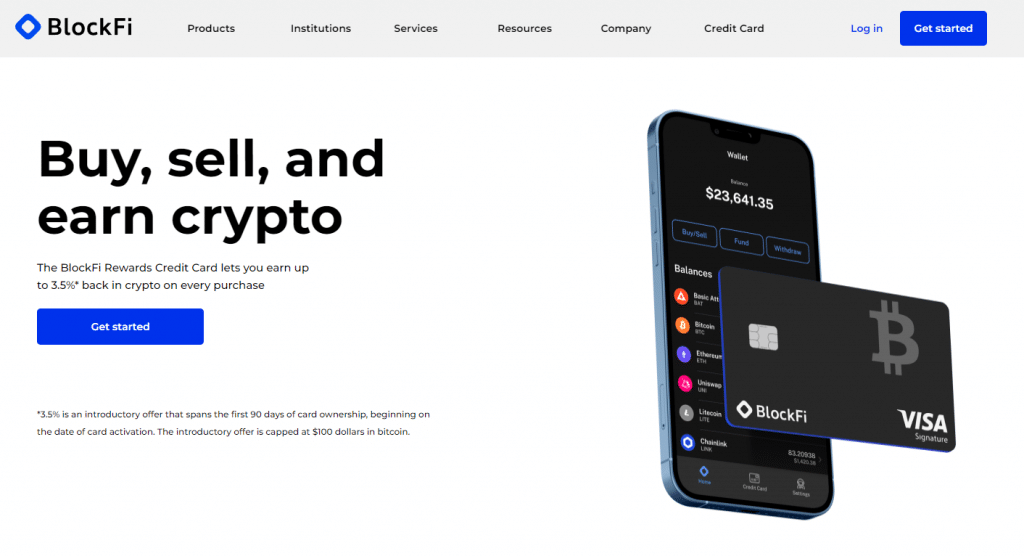

3. BlockFi - User-Friendly Crypto Savings Account with Compound Earnings

However, due to new regulatory restrictions, US-based BlockFi accounts won’t have access to the BlockFi active crypto savings account product known as the BlockFi Interest Account (BIA). Because BIA has not been registered under the Securities Act of 1933, the product remains unavailable for the US. Nonetheless, BlockFi users may still connect their BlockFi wallets to other high-interest crypto savings accounts and high yield savings account crypto platforms to earn.

Thankfully, BlockFi does not look to keep their high-interest crypto savings account clients on the ropes as they mention “actively engaging with US regulators at both the federal and state level as we work to fight for you and your right to have a suite of products and services to grow your crypto wealth - including earning interest on crypto-assets.”

As of now, BlockFi offers incredibly high yield crypto savings account rates with incredibly high limits. For example, users can expect an APY of 8 percent for USDT up to a cap of 20,000 USDT. The next tier for USDT is 20,000 to 10,000,000 USDT at an astonishing 7 percent APY.

Pros:

Pros:

- Allows for monthly compounding on earning positions

- Over 14 stablecoins and other cryptos are available for earning

- Higher upper limits for crypto interest tiers

- Mobile app available

Cons:

Cons:

- No 24/7 live support

- Available only for non-US clients

Digital currency is not legal tender, is not backed by the government, and crypto accounts held with BlockFi are not subject to FDIC or SIPC protections. Digital currency values are not static and fluctuate due to market changes.

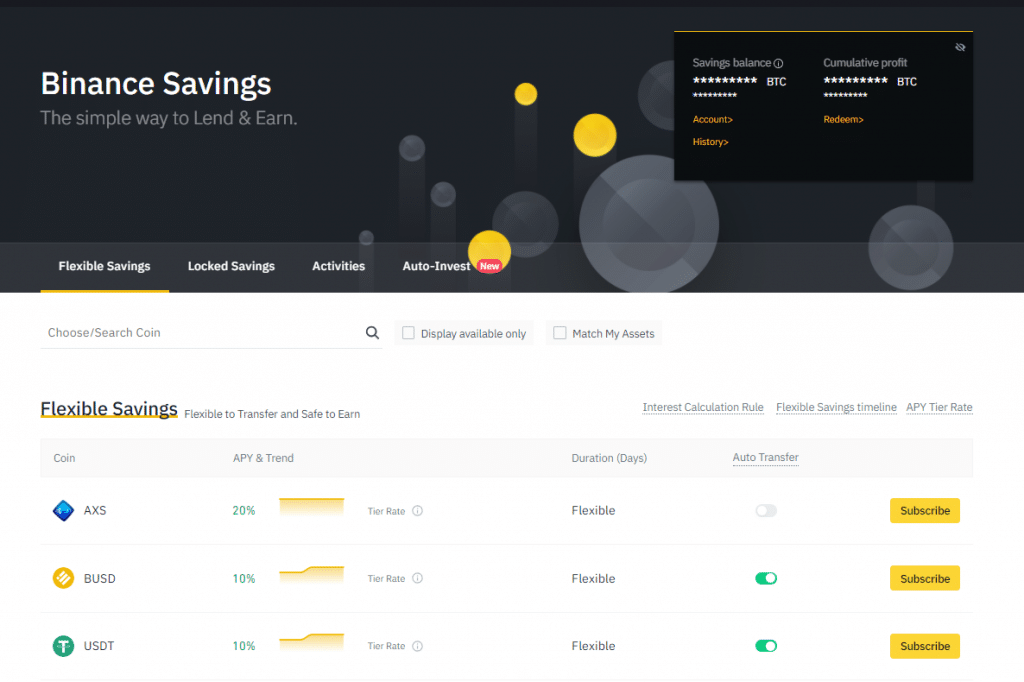

4. Binance -Most Diverse Crypto Savings Account Platform

Investors who want a lot of variety in the cryptocurrencies they want to earn interest in should take a look at Binance’s best high-interest savings account crypto product. Binance is perhaps the most popular cryptocurrency exchange with over 500 tradable crypto assets. You can exchange and convert different cryptos and fiats either through their peer-to-peer exchange or their central exchange.

Their best crypto savings account products are their Flexible Savings and Locked Savings features.

The Binance Flexible Savings is an active crypto savings account that lets you expose your held cryptocurrencies to interest while also giving you the option to withdraw them at any time. On the other hand, the Binance Locked Savings high yield savings account crypto product is a high-interest crypto savings account but only lets you withdraw after a certain period.

Use Binance’s active crypto savings account products to your advantage if you look to use the platform. For example, if you’re looking to trade cryptocurrencies often, you might want to use the Flexible Savings product so that some of the crypto assets in your account still earn passively. However, if you’re looking to hold your crypto longer, it might be best to use the Locked Savings product for cryptos like AXS and CAKE that offer an annualized interest rate of 25% for a seven-day locking period.

Pros:

Pros:

- Allows for daily compounding

- Over 140 stablecoins and cryptocurrencies available for the savings account

- Multiple savings products such as flexible and locked savings

- Crypto staking and DeFi services are available

- Mobile app available

Cons:

Cons:

- Requires account verification and KYC

- Average APY

Cryptocurrencies are highly volatile and speculative assets. Your capital is at risk.

5. Coinbase - Best Savings Account Platform for Beginners

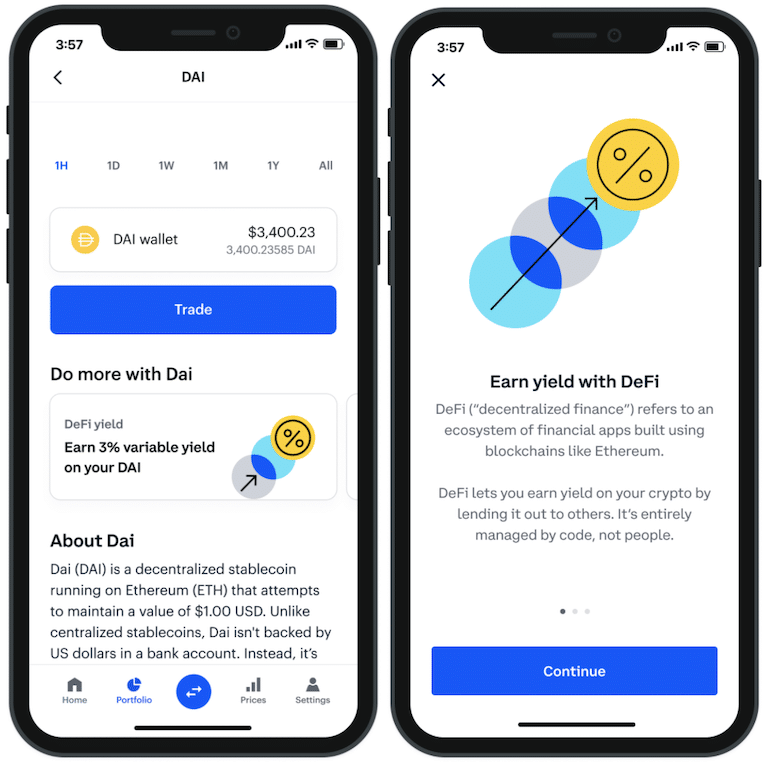

Last on our reviews for some of the best crypto savings accounts out there is the Coinbase platform. Coinbase is one of the most popular crypto exchanges and is the best beginner platform for those looking to trade and invest in cryptocurrencies. They have a very easy-to-use interface as well as accessible payment options that beginners will have an easy time using.

For their active crypto savings account, Coinbase lets users select which DeFi protocol to use to earn interest. This is done in their free crypto wallet app that’s available for iOS and Android. The supported coins available to earn interest are ETH, ATOM, ALGO, DAI, USDC, and XTZ.

Coinbase offers below-average returns compared to the other high yield crypto savings account products and high-interest crypto savings accounts featured. For example, earnings from the USDC stablecoin nets investors a 5 percent APR. Although Coinbase’s returns are low, many beginners might not mind this as earning can be done relatively quickly and in just a few clicks or taps.

Pros:

Pros:

- Beginner friendly platform

- Several popular coins available for yield

- User-friendly mobile app available

- Easy to deposit and access profile

Cons:

Cons:

- Limited number of yieldable crypto

- Below average returns

Your money is at risk.

Best Crypto Savings Accounts - Comparison

If you’re looking to use crypto as a savings account, then comparing different platforms to find the right one for you is necessary. Below is a comparison table of some of the best crypto savings platforms we’ve reviewed.

| Platform | Coins Available for Saving | Savings Rates |

| AQRU | USDT, DAI, USDC, ETH, BTC | Stablecoins: 12% per year

BTC & ETH: 7% per year |

| Crypto.com | 40+ (stablecoins and other cryptos) | Stablecoins: Up to 15% per year

Other Cryptos: Varies; up to 14.5% per year |

| BlockFi | 14+ (stablecoins and other cryptos) | Stablecoins: Varies; up to 9.25% per year

Other Cryptos: Varies; up to 10% per year |

| Binance | 140+ (stablecoins and other cryptos) | Stablecoins: Varies; up to 10% per year

Other Cryptos: Varies; up to 20% APY |

| Coinbase | ETH, ATOM, ALGO, DAI, USDC, XTZ | Varies depending on the provider and can change regularly – currently 5% per year for USDC deposits. |

What is a Crypto Savings Account?

If you’ve heard of cryptocurrencies, then you’re probably familiar with cryptocurrency trading and the various influencers, billionaires, and investors that have made a killing from exchange cryptocurrencies.

So what is a crypto savings account and why have they gotten a lot more attention recently than just crypto trading in general?

Much like how you would put your money in a bank savings account, a crypto savings account functions the same way. Bank savings accounts let you safely store your fiat currencies where the bank subsequently gains control of what you’ve stored. Banks use this money to lend to others or invest in many different things and in turn, give you an interest rate of about 0.5 percent APY or annual percentage yield.

Looking at crypto vs savings accounts, the differences become clear. The former offers higher returns as we’ve seen a crypto savings account 20 APY and higher depending on cryptocurrencies and locking periods.

A cryptocurrency savings account can achieve much higher returns compared to traditional bank savings accounts mostly because of the way cryptocurrencies are designed today. Basically, banks take more resources to run since it requires a system of employees on payroll, buildings, and land where bankers can work, and lots of equipment to do the lending, borrowing, and investing operations.

On the crypto-side, cryptocurrencies and crypto exchanges use what's known as smart contracts to validate transactions, collateralize lendings, and other important financial processes. Essentially, they cost much less to run than traditional platforms so they can give larger returns to investors who offer their crypto assets.

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

Which Platforms Have the Best Crypto Savings Interest Rates?

Now that we’ve answered the question: what is a crypto savings account, we can look more into some of the high-interest crypto savings account platforms and rates. When looking into different savings accounts for crypto, you should not only look at the specific rates but if the platform has tiered returns as well.

We recommend AQRU as the best crypto savings account platform since it gives reliable high returns at 12 percent APY for stablecoins and 7 percent APY for Bitcoin and Ethereum. Other platforms like Crypto.com and Binance might offer returns close to AQRU but are tiered, meaning once your account reaches a certain value, then the yield for the remaining value is decreased.

AQRU, given the crypto savings account, keeps the untiered 12 percent APY, which will really let investors get the full compounding effects. Furthermore, AQRU has no lock-in period just like Crypto.com’s flexible holding term or Binance’s Flexible Savings product.

What Cryptocurrencies Can You Earn Interest On?

Some of the best crypto to buy can be held on high-yield crypto savings account products and other active crypto savings accounts. These cryptocurrencies can be split into two categories: stablecoins and non-stablecoins. In this section, we’ll discuss both types individually.

Stablecoins

One of the problems that cryptocurrencies face today is price volatility. As more and more people used cryptocurrencies in their transactions, volatility became an issue since the value of one product or service can drastically change in a week or even a few days.

To solve this problem, cryptocurrencies that were pegged to the value of a fiat currency were created. These are known as stablecoins and are in relatively high demand thanks to how closely their value is to the underlying asset that it follows. High demand for stablecoins means higher interest rates from crypto accounts. USDT, USDC, and DAI are among the most popular stablecoins today.

Non-stablecoins

As the name suggests, all other cryptocurrencies that aren’t stablecoins fall into the non-stablecoin category. Popular coins such as Bitcoin and Ethereum as well as other altcoins fall under this category. Non-stablecoins can be found in high yield crypto savings accounts and lower yield ones. This is because returns are usually calculated based on the risk that non-stablecoin depositors take.

Usually, the riskier low-cap cryptocurrencies are those that offer higher returns while larger and more established non-stablecoins offer lower and more reliable returns.

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

How to Get Started with A Crypto Savings Account in the US

Owing to crypto’s growing popularity, most platforms have a seamless registration process that allows you to get started with crypto savings quickly.

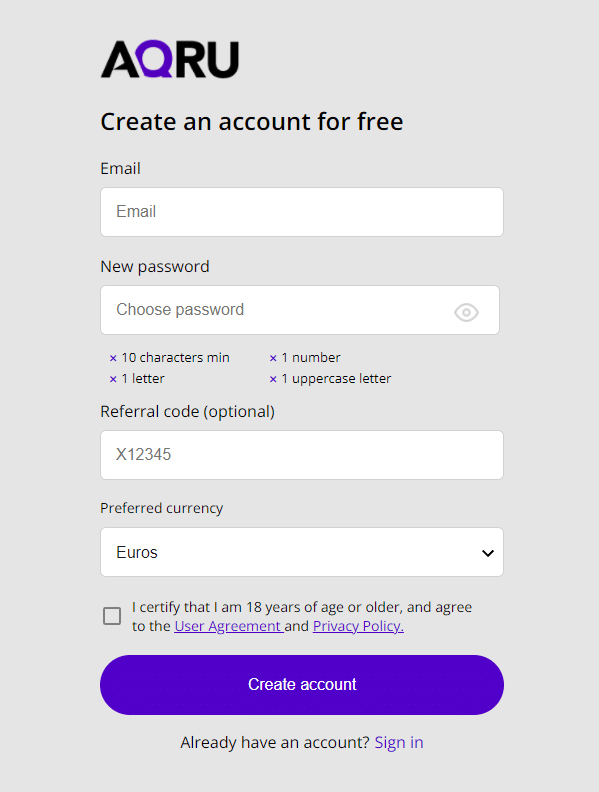

Below are some steps to help you get started with an AQRU crypto savings account which should take just minutes to open.

Step 1: Open an Account

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

First, head to the AQRU website and click on the Sign-Up button. You’ll fill in your email, password, optional referral code, and select your preferred currency. Afterward, you should complete your email verification which will allow you to access your AQRU account.

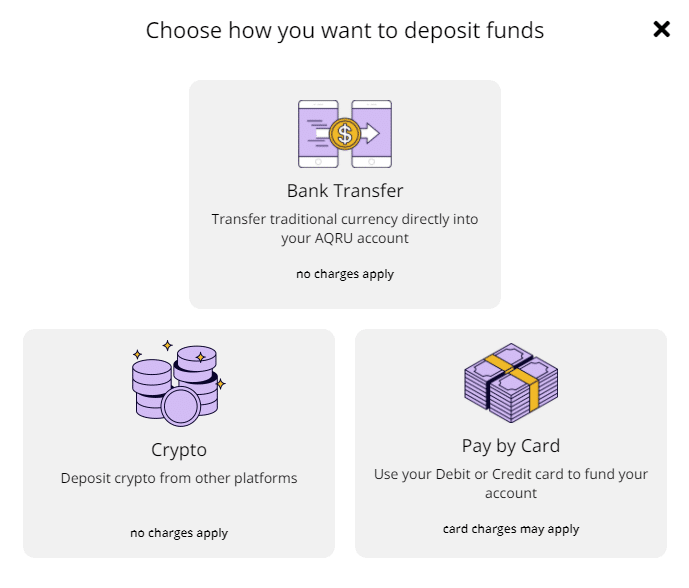

Step 2: Deposit Funds

Before you can deposit funds, you’ll first need to verify your account. This process will simply ask for citizenship details, your address, and also ask you to upload valid IDs. Once your account has been verified, you will be able to deposit funds via bank transfer, crypto from other platforms, or a bank card.

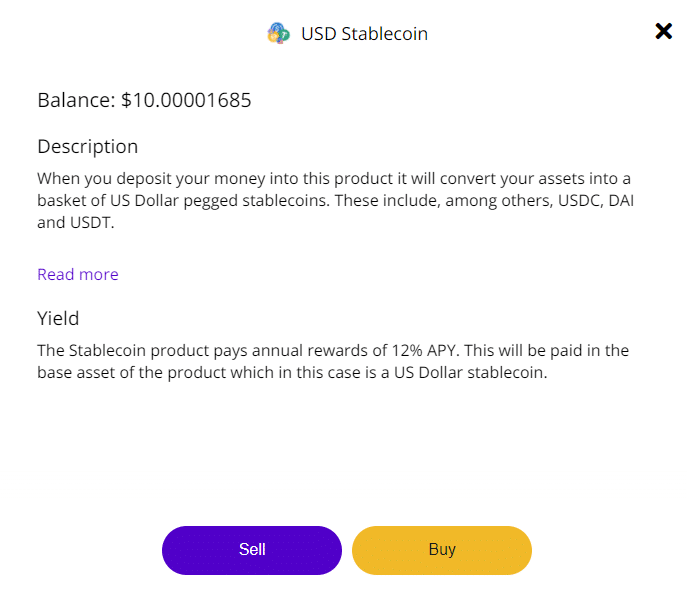

Step 3: Begin Earning Interest

Finally, click the ‘Buy’ button on your account dashboard and choose which crypto you want to buy to earn. Once you’ve selected how much you want to earn in your savings account, you can confirm the process to begin earning interest on your deposit! Withdraw any time while your account accrues daily.

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.

Are Crypto Savings Accounts Safe?

Before going out and pooling your money into a high yield crypto savings account, it’s important to understand exactly how safe these products are.

Because of the novelty of these products, many regulatory frameworks that offer account protection cannot apply to crypto savings accounts. Lack of regulations makes crypto savings accounts much riskier, so it’s important to understand this risk when purchasing these products.

Another aspect that can affect the value of your highest yield crypto savings account and all other crypto savings accounts is market volatility. Since many of the high-interest crypto savings accounts involve a lock-up period, investors won’t be able to liquidate their locked-up cryptocurrencies should the price of the crypto asset fall.

Conclusion

All in all, we've discussed in this guide the best crypto savings account for you and how many different aspects can affect your platform of choice. As the crypto sphere and markets grow in technology and investments, finding a high yield crypto savings account can definitely offer a new way of earning passive income.

If you’re looking to open a crypto savings account today, we recommend the AQRU platform. Start earning 12% APY on stablecoins and 7% APY on BTC and ETH with no hidden fees – all through AQRU’s handy mobile app!

AQRU - Best Crypto Savings Accounts Platform

Capital at risk. You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk. The price or value of cryptocurrencies can rapidly increase or decrease at any time.