ACY Securities Review 2025 – Pros & Cons Revealed

In this ACY Securities review 2025 we’ll cover everything you need to know from fees, commissions, tradable assets, payment options, regulations, and more.

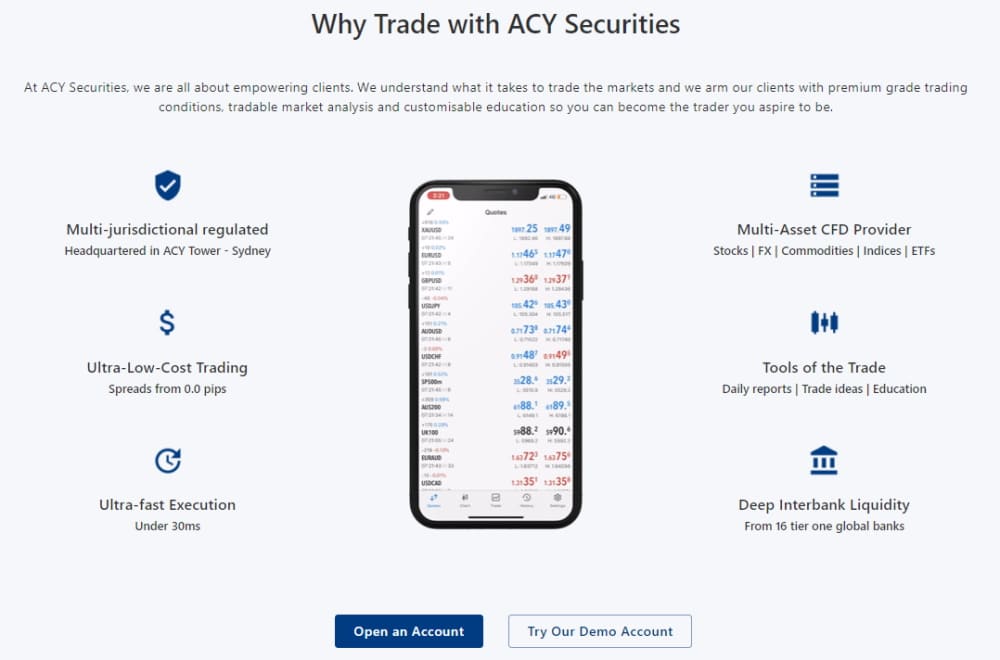

ACY Securities is a leading multi-asset online trading platform that’s based in Australia. With a strong track record of serving traders since 2013, this top-rated forex and CFD broker offers a range of financial trading products along with market-leading spreads that start from 0.0 pips. But is ACY Securities right for you?

What is ACY Securities?

Launched in 2013 ACY Securities is a widely popular CFD and forex broker offering a range of tradable products and markets with low fees and competitive spreads starting from 0.0 pips. In September 2018, ACY Securities recently acquired the leading Australian forex trading platform Synergy Financial Markets. This move represents ACY Securities’ commitment to expand its global presence and secure its position as a trusted broker in the trading industry.

This multi-award-winning and regulated broker is a multi-licensed regulated financial derivatives provider that holds licenses in Australia and Vanuatu. ACY Securities supports MetaTrader 4 and MetaTrader 5, which means you can choose to trade on your desktop or mobile device. Furthermore, this top-rated forex broker also offers super-fast order execution, liquidity from 16 international banks, and no Dealing Desk system.

Your Capital is at risk.

There are also heaps of educational resources and materials to choose from including webinars, trading courses, and much more. All these leading features and tools help to make ACY Securities one of the best trading platforms to buy and sell tradable assets right now.

ACY Securities Pros & Cons

What we like

- Access to MT4 and MT5, & a demo account

- Take a position on over 1,600 products

- Competitive low spreads starting at just 0.0 pips

- Customer support available 24 hours a day, 5 days a week

- Wide range of payment methods to choose from including credit/debit cards and e-wallets

What we don’t like

- Only offers CFDs

Your capital is at risk.

What Can You Invest in and Trade on ACY Securities?

With over 1,600 different trading instruments across the MetaTrader 4 and MetaTrader 5 platforms, you can access a variety of markets such as Forex, Precious Metals, Indices, Commodities, Cryptocurrencies, ETFs and Share CFDs.

Share CFDs

ACY Securities provides access to more than 1,600 of the market’s leading companies that are listed on major exchanges including the NYSE, NASDAQ, and ASX. Using the ACY Securities MT5 trading platform you can trade with leverage of up to 5:1, which is among the highest among its competitors. This popular CFD broker allows you to hedge your positions, diversify your portfolio, and speculate on trending stocks like Apple, Google, Netflix, Facebook, BlackRock, and Alibaba Group just to name a few.

Your capital is at risk.

ETF CFDs

Exchange-Traded Funds are financial instruments that track the performance of companies that make up indexes like the S&P 500. Trading ETF CFDs give you the chance to open long or short positions and amplify the size of the trade using leverage.

Trading ETF CFDs continues to gain popularity amongst beginner traders as it’s often cheaper than investing in individual stocks in the traditional sense. At ACY you can trade over 60 ETF CFDs on the trusted MetaTrader 5 platform with as little as $50. Investors trade ETFs to build a diversified portfolio, gain exposure to unique markets and trading opportunities. At ACY you can choose from a variety of exchange-traded funds including stock index ETFs, commodity ETFs, and Sector and industry ETFs.

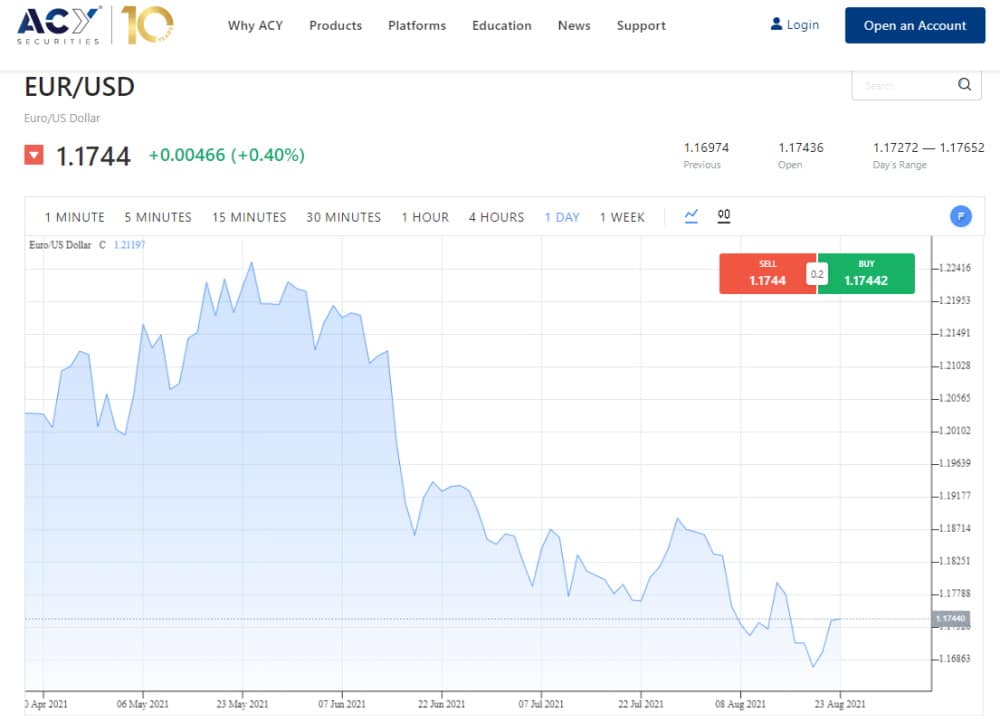

Forex

The forex market is the world’s largest financial market, with average daily trading volumes exceeding the $6.5 trillion mark. ACY allows you to access more than 60 of the most popular currency pairs with deep liquidity, ultra-fast execution speeds, and negative balance protection.

Your capital is at risk.

Here are some of the top benefits of trading forex with ACY Securities:

- 24-hour market availability means you can participate in market movements anytime to capitalize on uptrends and downtrends based on your trading strategy.

- Low-cost fees – the Standard account comes with 0% commissions and market-leading spreads, averaging approximately 0.8 pips.

- Access a huge range of more than 40 currencies, including majors, crosses, and exotic forex pairs. These include majors, crosses, and commodity currencies such as EUR/USD, EUR/GBP, and NZD/USD.

- The forex market is a global market that is influenced by macroeconomic, political, and regulatory policies and trends. Using the ACY MT4 and MT5 trading platforms you can buy and sell all the major currency pairs across the world.

Commodity CFDs

Commodity CFD trading is a popular way to gain exposure to one of the most actively traded and liquid markets across the board, without taking ownership of the underlying asset. When it comes to CFD trading you will be able to speculate on the future price movements of the underlying assets with leverage of up to 10:1. At ACY you can trade with competitive spreads from just $0.015 on WTI oil.

Some of the commodities on offer at ACY Securities include WTI and Brent Crude Oil, Copper, Aluminium, Silver, Gold, and much more.

Index CFDs

Trading Index CFDs are ideal for investors looking to gain exposure to the leading global indices, including the SP500, Dow Jones, and the AUS200 and many more. Index trading continues to be a popular market for beginner and advanced investors. At ACY, you can access over ten index CFDs that cover major exchanges such as the US, and Europe on a commission-free basis. You can trade major indices with leverage of up to 20:1.

Cryptocurrency trading

At ACY Securities, you can buy and sell the top five cryptocurrency CFDs based on market capitalization and dominance. These include Bitcoin, Ripple, Ethereum, Litecoin, and Bitcoin Cash. ACY makes it easy for you to trade your view on the volatile crypto market. Cryptocurrency trading has been gaining traction ever since Bitcoin first paved the way for decentralized currencies back in 2009. Cryptocurrency CFDs allow you to speculate on whether the price of the underlying digital asset will rise or drop, with leverage of 2:1.

Your capital is at risk.

ACY Securities Review – Fees & Commissions

The trading fees and commissions charged by ACY Securities vary depending on the account type you choose. For example, traders take advantage of commission-free forex trading on the Standard account, $6 per lot on the ProZero account, and $5 per lot on the Bespoke account.

Shares and ETFs can be traded with zero commission, while fees for forex, cryptocurrency, indices, and commodities vary depending on the account type you choose. For example, the typical spread for the EUR/USD pair is 1 pip for the Standard account, 0.1 pips for the ProZero account, and 0.1 for the Bespoke account. There are also no commissions charged on indices and cryptocurrency trading with either of the three available account types.

For a more comprehensive look at ACY’s trading fees take a look at the following table:

| Fee type | Charge |

| Forex Commission | 0% for Standard account, $6 per lot for ProZero, and $5 for Bespoke |

| Indices Commission | 0% Commission |

| Cryptocurrency Commission | 0% Commission |

| Leverage | Up to 30:1 depending on the asset class |

| Account base currencies | USD, AUD, EUR, GBP, NZD, CAD, JPY |

| Deposit fees | Free |

| Inactivity fees | None |

| Withdrawal fees | Free withdrawals to Australian-based banks, otherwise there is a $25 service charge for international transfers. |

| Account fees | No |

| Minimum deposit | $50 |

ACY Securities Review – User Experience

During our research, we found that ACY provides a user-friendly and well-designed trading platform. From the moment you land on the website, navigating your way around the different features is a seamless experience. There are three account types to choose from based on your individual needs and trading goals.

Furthermore, with a wide range of products and markets to choose from, you can build a diversified portfolio with low costs from the comfort of your own home. Additionally, ACY supports MT4 and MT5 which are widely popular trading platforms with tons of technical indicators and other convenient features to help you make the most of your trading endeavours.

With a first-time minimum deposit of just $50, you can open a Standard account and participate in the forex markets with 0% commission right now. You can also download the MT4 or MT5 trading app directly to your Apple or Android smartphone and start investing anytime and anywhere.

Finding the answers to your questions is easy, with 24/5 customer support and a dedicated FAQs page. Beginner traders will appreciate the educational resources and materials, ranging from seminars and webinars to a full eBook. The account opening process is fully digital and streamlined, taking a matter of minutes to complete.

When it comes to buying and selling tradable assets, the MT4 and MT5 trading terminals make this process simple and easy. To sell or buy Market Order simply hover over and right-click on the underlying asset you’re interested in. Then click on ‘New Order’, specify the stake amount, place a stop loss and take profit order and click on Sell or Buy depending on your speculations.

ACY Securities Review Features, Charting, and Analysis

Since ACY allows you to connect your live trading account with MetaTrader 4 and MetaTrader 5 you can access all the real-time price charts that MetaQuotes has to offer.

One of the main differences between MT4 vs MT5 is that the fifth-generation trading platform (MT5) offers more analytical features. Real-time price charts offer a broader functionality.

Charting

Charts in MT5 and MT4 are fully customizable, thus allowing traders to tailor their charts to meet their trading objectives and needs. The MetaTrader trading terminal provides three chart types: a broken line, Japanese Candlesticks, and a sequence of bars. You can also assign separate colors to all items within a chart to create a unique workspace tailored to long-term and short-term trading. You can also choose from a variety of timeframes ranging from one minute to monthly.

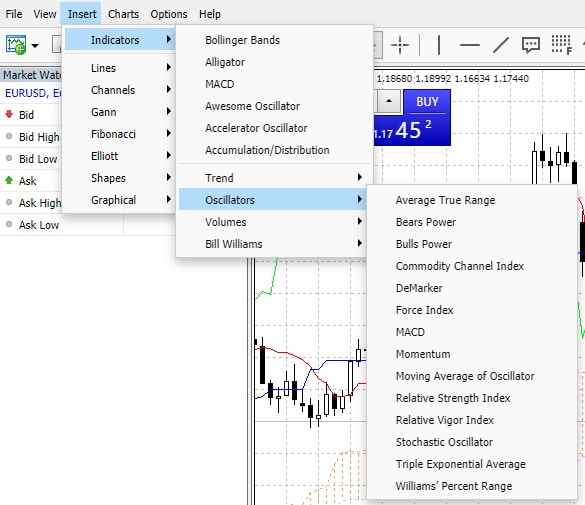

Technical Indicators

You can access around 38 technical indicators that are conveniently grouped in the navigational toolbar at the top of the trading terminal. The supported technical indicators are:

- Trend indicators – Such as Bollinger Bands, and Parabolic SAR

- Oscillators – such as MACD and Stochastic Oscillator

- Volumes – such as the Money Flow Index

- Bill Williams – such as Alligator and Fractals

For experienced investors looking for more advanced indicators, you can download third-party technical indicators from the MQL5 Code Base and buy more in the MQL5 Market with the click of a button.

Analytical Tools

There is also a wide range of analytical tools in the MetaTrader 5 terminal including Elliott, Fibonacci, and Gann tools, graphical objects (including objects for interactivity with MQL5 programs), shapes, channels, lines, and much more.

News and Market Analysis at ACY

ACY also provides access to the latest news and market analysis from leading experts, as well as Trade Ideas to give you an accurate insight into what the current market sentiment is.

Industry-leading Account Management Portal – ACY.Cloud

Developed by ACY Securities from the ground up, ACY.Cloud is arguably one of the best client portals in the industry right now. With a user-friendly intuitive interface, and a full range of functionalities you can manage your trading account anywhere, anytime. This means you can deposit and withdraw funds, access analytical data, and engage with educational materials with the click of a button.

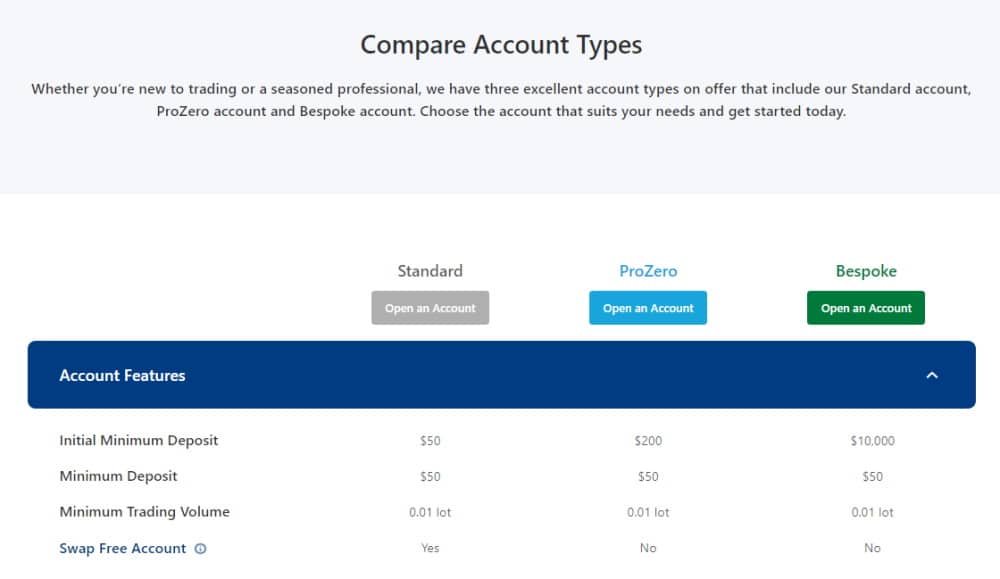

ACY Securities CFD Account Types

Your capital is at risk.

It doesn’t matter if you’re a beginner or an experienced pro trader, ACY has three account types that include:

- A Standard account

- ProZero account

- Bespoke account

ACY Standard Account

The infrastructure that powers the Standard account are the Equinix trading servers based in New York, which are located close to ACY’s liquidity providers’ pricing engine servers. The deep liquidity comes from 16 international banks. This makes for fast matching and the best pricing regardless of the time you enter the markets.

ACY ProZero account

The ProZero trading account allows you to buy and sell assets with market-leading spreads, including forex pairs from 0.0 pips. This brokerage account type facilitates zero-spread trading with fixed commissions to help reduce the overall trading costs. For active and high-volume traders, the $3 lot per side allows you to make maximum potential gains with minimum trading costs.

ACY Bespoke account

The Bespoke account is ideal for professional traders looking for a trading account that offers fast execution speeds and competitive spreads. This account offers spreads as low as 0.0 pips and low commissions that start from just $2.50 per side. The Bespoke account gives users access to ACY’s global fibre-optic network with servers based in New York and Hong Kong.

ACY Account Types Comparison Table

| Account Features | Standard | ProZero | Bespoke |

| Initial Minimum Deposit | $50 | $200 | $10,000 |

| Minimum Deposit | $50 | $50 | $50 |

| Minimum Trading Volume | 0.01 lot | 0.01 lot | 0.01 lot |

| Swap Fee Account | Yes | No | No |

| Forex Commission | None | $6 | $5 |

| Indices Commission | None | None | None |

| Cryptocurrency Commission | None | None | None |

| Deposit fee | $0 | $0 | $0 |

ACY Mobile App Review

When you open a trading account with ACY Securities you can participate in the global markets via the MetaTrader 4 and MetaTrader 5 mobile trading apps. These are compatible with both iOS and Android mobile devices, and can be downloaded from either the Google Play Store or the App Store.

With the wide range of trading functionalities including different timeframes, built-in technical indicators, real-time market data and useful order types. MT4 and MT5 are among the best trading apps available right now.

What are the advantages of using the ACY Securities MT5 and MT4 mobile trading apps?

- Set up real-time price alerts and push notifications to stay in the loop wherever you are in the world.

- Monitor and analyse real-time market volatility on the move.

- Buy and sell forex and CFDs from your mobile device.

- Customize charts and compare up to four different assets on the same terminal.

- Manage your trading account even when you’re commuting or travelling.

ACY Securities Payment Methods

ACY supports a range of payment options from bank wire transfers, Mastercard and Visa debit/credit cards, to e-wallets including PayPal, Neteller, Skrill, FasaPay, China Union Pay, Trustly, and dragonpay just to name a few.

While debit/credit card and e-wallet deposits are processed instantly, bank transfers typically take a few business days for the funds to be credited to your account.

Additionally, there are no deposit fees for funding your account using a wire transfer. However, non-Australian banks can charge you to make international transfers.

When it comes to withdrawal charges:

- International Transfers receive a $25 service charge per withdrawal

- Withdrawals using Skrill incur a 3% merchant fee per withdrawal

- There is no charge for withdrawals using an Australian-based bank transfer up to three times per calendar month.

Switch to ACY Securities this month to receive one of two bonus offers

Offer 1 – 60% Welcome Bonus

When you open a trading account with ACY and deposit up to $500 you’ll get a 60% welcome bonus that’s paid directly into your ACY brokerage account. But it doesn’t end there, for every lot you buy and sell, you could potentially earn anything up to $0.50 via the ACY Level Up Reward Program.

Offer 2 – Deposit $50,000 and Receive a Signed Tim Cahill Jersey

When you deposit $50K into your ACY Securities trading account and trade the minimum volume, you receive a limited-edition signed and framed Tim Cahill jersey.

ACY Contact and Customer Service

The ACY customer service team is on hand to support all of your trading needs 24 hours a day, 5 days a week. You can contact customer support via phone, email or live chat. There’s also a handy FAQ page with a plethora of answers to the most common queries.

Is ACY Securities Safe?

ACY Securities is fully regulated and authorized by the Australian Securities and Investments Commission and the Vanuatu Financial Services Commission.

How does ACY protect its clients’ funds? All client funds are held in segregated trust accounts at the Commonwealth Bank. These client funds are kept apart from all ACY company funds, meaning that if the CFD broker were to go bust no client funds would be used to compensate creditors.

As well as negative balance protection, ACY AU and ACY LTD cover their respective clients with Professional Indemnity Insurance.

Does ACY implement anti-money laundering measures?

ACY complies with strict KYC (Know Your Customer) regulations which means that all new clients must provide proof of identity and address when opening a live brokerage account. Furthermore, all deposits and withdrawals are required to be made from and paid to the same person as the trading account owner. Third-party payments are prohibited.

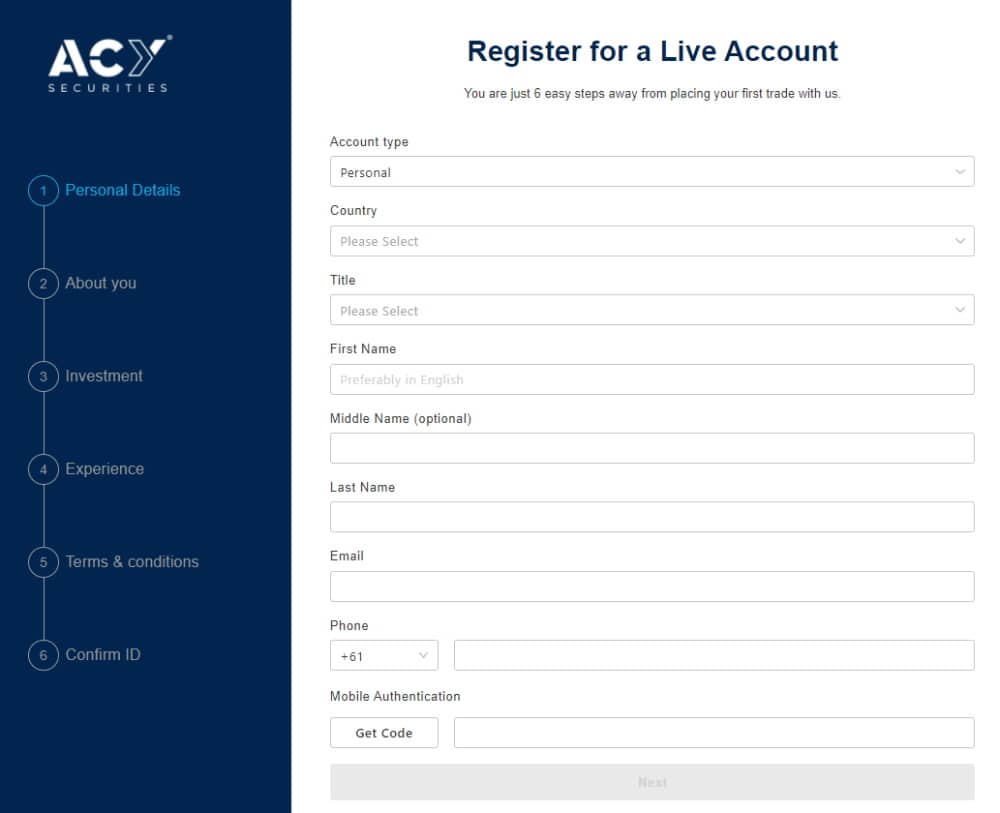

How to Start Trading with ACY Securities

The onboarding process at ACY is fully digital and user-friendly. You can start trading with ACY in a few simple steps.

Step 1: Open an Account

Opening a live ACY trading account takes just four minutes online. To get the ball rolling, navigate your way to the ACY Securities official website and click on the button marked ‘Open an Account’ at the top of the screen. You will then need to provide your details such as your name, email address, and mobile phone number.

Your capital is at risk.

Step 2: Verify your Account by Uploading ID Documents and Proof of Address

As part of the standard KYC process, you will need to upload proof of identity and address. These can be in the form of a valid passport and a recent utility bill.

Step 3: Deposit Funds into your Trading Account

With no deposit fees to worry about, you can deposit funds into your account using a variety of payment methods such as debit/credit cards, bank transfers, and e-wallets.

To deposit funds log in to your client portal with your account credential and click on Cash Management and then Deposit.

Step 4: Trade over 1,600+ CFDs on MetaTrader 5 with Low-Cost Trading fees

You can now start trading via the ACY MT4 or MT5 trading platform as well as mobile trading apps. Simply select the tradable asset you want to buy or sell, place your order type, specify the amount of leverage you want to use, and confirm your position.

ACY Securities Review – The Verdict

If you’re eager to participate in the global financial markets but aren’t sure where to start, ACY Securities is a great option. From market-leading spreads and 0% commission to MT4 and MT5, ACY has everything you need in one convenient trading platform.

So, if you want to buy and sell forex and CFDs with the click of a button, just follow the link below and open a live trading account with ACY Securities today!

ACY Securities – Best Forex and CFD Broker with Competitive Spreads From 0.0 Pips

Your capital is at risk.