5 Best cTrader Brokers & Platforms for February 2026

cTrader is fast becoming one of the world’s leading trading platforms for Forex trading, automated trading, and copy trading. However, with cTrader brokers popping up all over the world how do you separate the good from the bad?

Read on to learn more about some of the best cTrader brokers around and the unique features and benefits they provide to traders. We’ll also show you just how simple it is to get started with one of the cTrader brokers today!

-

-

Our List of Best cTrader Brokers in 2026

Below you can find a list of some of the top cTrader brokers around right now. Further down, you will also find a detailed cTrader review of one of the overall best brokers and why they make the top of the list.

- Pepperstone: Pepperstone is a well-established broker that is regulated by seven jurisdictions, making it a trustworthy option for US traders. Furthermore, client funds are held in top-tier banks to ensure safety. Traders can access cTrader as well as TradingView, MT4, and MT5. This provides users with a huge range of technical indicators, algo trading tools, APIs, and advanced charting features.

- IC Markets: IC Markets is the best cTrader broker for robo trading. The broker is also a popular option for high-frequency trading as it offers high speeds of under 40ms. Spreads start at 0.0 pips for some forex pairs and there are no volume restrictions. The platform offers 490 financial instruments including over 61 FX currency pairs, indices, and stocks.

- FX Pro: FX Pro is a UK-based online broker that can be used to trade forex. FxPro stands out by providing traders with a choice of four distinct platforms: FxPro MetaTrader 4, FxPro MetaTrader 5, FxPro cTrader, and FxPro Edge. This diverse selection allows users to opt for the platform that aligns best with their specific requirements, setting FxPro apart from competitors.

- Axiory: Axiory stands out as being a flexible broker option that supports cTrader. The platform has three account types: Nano, Standard and Max that cater to different trading styles. Axiory supports leverage of up to 700x for forex trading. It is also possible to trade CFDs in stocks, commodities, and indices. It is regulated by the International Financial Services Commission in Belize.

- Fondex: Fondex is a cTrader broker that supports crypto trading. This allows traders to use the cTrader platform to analyze and trade the crypto markets using a range of technical indicators. The platform is regulated by CySEC and provides 24/5 customer support through email or live chat. As well as cryptos, traders can access forex, ETFs, commodities, and indices.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

cTrader Brokers – Platform Benefits & Features

While cTrader is fast becoming one of the world’s most popular trading platforms, not every broker offers the platform. Of the cTrader brokers that do offer it, some offer far better additional features and service than the others. So, while the addition of the cTrader platform to your trading arsenal is likely to give you a great edge in the market, it needs to be done with one of the cTrader brokers!

The cTrader suite of trading platforms was designed by Spotware to offer a complete solution for brokers in which their clients can trade Forex, CFDs, or Spread Betting. The platform itself is feature-rich and designed with speed and safety in mind.

As such, the cTrader trading platform is increasingly becoming one of the world’s leading trading platforms and can be used on desktop, web, Android, and iOS operating systems. Traders can access a range of features including premium charting and manual trading operations and access to the cTrader Copy investment service, cTrader Automate algorithmic trading package, as well as cTrader FIX API for serious Forex traders.

Here are just a few of the unique features and benefits of the cTrader trading platform:

- Access cTrader Trade – a premium charting and manual trading platform offering advanced charting tools, advanced order types, level II pricing, and ultra-fast execution.

- View 54 different timeframes across a variety of chart types including Candlesticks, Bar, HLC, Line, Heikin Ashi, Dots, Renko, Range, and Tick charts.

- Use more than 70+ technical trading indicators built into the platform and access customised indicators via cTrader Automate.

- Access the cTrader Copy investment service. This allows traders to become a Strategy Provider and broadcast their strategies, among others scalping, for other traders to follow for free or for a fee.

- All-inclusive algorithmic trading solutions via cTrader Automate. Traders can use cTrader’s C# API to write code and create automated trading strategies and develop customised indicators.

- Build your own trading applications via cTrader Open API, a free and secure publicly accessible API for everyone. Developers can use the cTrader platform’s web, desktop, and mobile infrastructure to build upon.

- Access ultra-fast execution speeds with the cTrader FIX API which communicates directly with the cTrader server for low latency communication – completely free for traders using one of the right cTrader brokers.

- Trade from cTrader Desktop, cTrader Web, cTrader Android, and cTrader iOS.

- Access market sentiment, a live news feed, trade statistics, market depth, and advanced order protection among other features!

How to Choose the Best cTrader Brokers

There are a variety of factors to consider when choosing one of the cTrader brokers. The research can be time-consuming and a daunting task. Fortunately, the following list is some of the key factors you should look for when choosing your broker. While Pepperstone fits all of these criteria, it is good for you to know as well!

Regulation and Licenses

As more and more people enjoy the online trading boom, it also means there are many more shady, unregulated brokers popping up as well. Therefore, you need to be alert when choosing your cTrader broker and make sure they are authorised and regulated by a well-known financial regulator.

This peace of mind can ensure you focus on analysing and trading the market! After all, your broker will be holding your capital so make sure they are abiding by strict regulatory standards.

For example, Pepperstone is authorised and regulated by the FCA, CySEC, ASIC, BaFIN, DFSA, and others! More importantly, make sure your broker holds your funds in segregated accounts with tier 1 banking institutions and not with their own company funds, just as Pepperstone does.

Available Asset Classes

Having access to a range of global markets is essential. After all, the big institutional flows often follow themes across a broad range of asset classes. Sometimes it could be the currency market in play or the stock market or the commodity market.

You won’t find many cTrader brokers which offer stocks as their client base are usually serious Forex traders looking for low latency, ultra-fast execution speeds. However, a few cTrader brokers do offer other asset classes such as indices, commodities, and more.

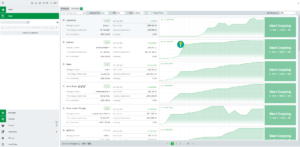

For example, Pepperstone offers more than 180+ financial instruments covering Forex, indices, commodities, and cryptocurrencies. You can view all of the asset classes available to trade directly from the cTrader platform as shown below.

Open a FREE account with Pepperstone today and trade with a highly regulated broker, offering commission-free trading and institutional grade spreads!

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Trading Fees

One of the most important factors when choosing one of the cTrader brokers to trade with is to make sure they offer competitive trading fees and are transparent about them. Regulated brokers will often detail their trading fees transparently on their website.

Trading fees can include a commission for buying and selling, spreads (the difference between the buy and sell price), and overnight swap fees. There may also be account administration fees and inactivity fees.

The screenshot above shows the minimum and average spread for the two account types offered by Pepperstone – the Razor account and Standard account.

The Razor account has a commission of £4.59 per round turn, per 100k traded which is very competitive, along with an average spread on EURUSD of just 0.09 pips.

The Standard account has zero commissions with an average spread on EURUSD of just 1.09 pips. However, Standard does not work with CTrader.

Trading Tools & Research

Having additional trading tools and high-quality market research can help you get an extra edge in the markets. Some cTrader brokers offer in-house market research from their own analysts, along with additional plugins to their trading platforms.

For example, Pepperstone offers live market analysis, as well as the MetaTrader 4 and MT5 trading platforms. They also offer a Smart Trader Tools package for MetaTrader and the AutoChartist plugin which provides real-time, actionable trading patterns.

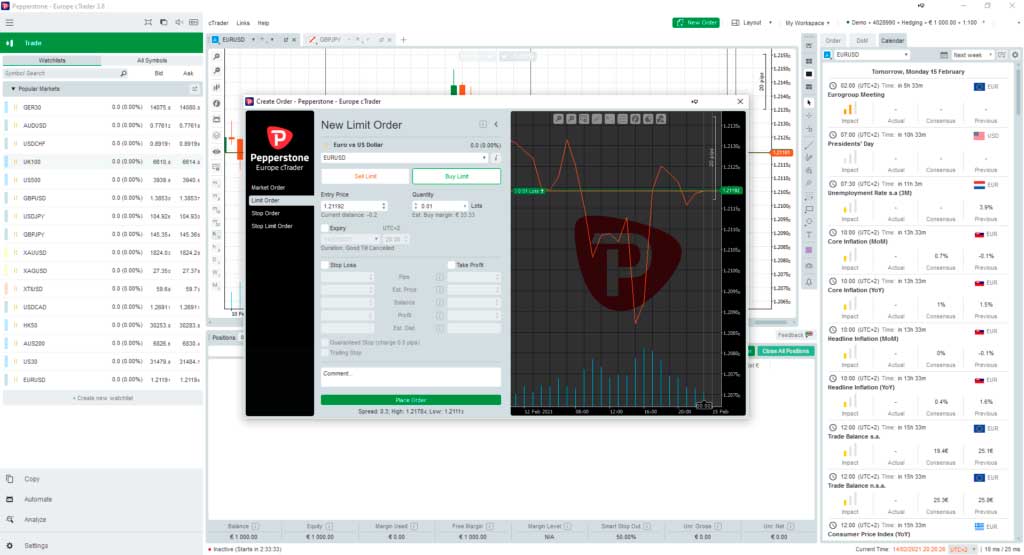

The Pepperstone cTrader package also includes access to a live economic calendar in the trading platform, as shown in the screenshot below on the right side of the platform.

cTrader also offers a trading community where users can find customised trading indicators to supercharge their trading platform. Having access to a range of trading platforms with one broker can be an ideal way to capitalise on all of the unique features on offer such as the additional features to your trading platforms.

You can open a FREE account with Pepperstone today and trade on more than 180+ global markets covering Forex, indices, stocks, commodities, and cryptocurrencies from a range of the world’s best trading platforms including cTrader, MetaTrader 4, and MetaTrader 5!

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Algorithmic & Copy Trading

More and more experienced traders are now joining in on the algorithmic and copy trading platform revolution. With cTrader, you can actually do both! For example, the cTrader Automate platform allows traders to develop automated trading robots using the C# API to write code. The platform also allows traders to test and optimise their strategies, as well as develop custom indicators.

The cTrader Copy platform, previously known as cMirror, helps traders to broadcast their trading signals to become a Strategy Provider. From here, other traders can follow their performance and copy their trading forex signals in their own accounts. The platform also provides detailed analytics for each strategy provider so inventors can make sound decisions before copying another trader.

In fact, Pepperstone makes it very simple to use the cTrader Copy feature. At the click of a button, you can access the performance of different strategy providers and start copying them, as shown below:

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Customer Service

When trading with one of the cTrader brokers, you must ensure they provide top-quality customer service. Having support that is easily accessible is essential if something goes down or you need to get in touch with them. Pepperstone offers customer service in multiple languages via live chat, telephone, and email 24 hours a day, 5 days a week!

Our In-Depth Reviews on Best Forex Brokers with cTrader Platform

While there are more and more cTrader brokers providing trading services to traders, there is one that stands out among the rest. Trading with the right cTrader broker is essential. While the platform may be feature-rich, can you trust your broker to provide you with the best service possible?

After all, your broker will be holding your trading capital for you, executing your trades for you, handling your deposits and withdrawals, and holding your details. Checking that you’re trading with one of the regulated cTrader brokers who offer outstanding customer service, high-quality execution services, and competitive fees is essential!

Of course, finding top-quality cTrader brokers you want to trade with can be a time-consuming and daunting task. Fortunately, we’ve made it easier for you with the in-depth review of one of the best overall cTrader brokers. Enjoy!

1. Pepperstone – Best Overall cTrader Broker

Of all the cTrader brokers, Pepperstone offers the highest safety for investors. This is because the broker is authorised and regulated by the FCA, CySEC, BaFIN, ASIC, CMA, DFSA, and the SCB.

Along with this high regulatory oversight, the broker also segregates client funds from their own and holds them with top tier 1 banking institutions. This is important as it provides a high level of safety of your funds, especially compared to other cTrader brokers based offshore. In fact, Pepperstone is based in Australia.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

The Pepperstone Standard Account provides beginners and intermediate forex traders with access to top trading platforms, competitive spreads, and excellent regulation through entities like FAC in the United Kingdom and ASIC in Australia. With a $0 minimum deposit, this account offers an accessible entry point for traders. Pepperstone stands out by not charging trading inactivity or account-keeping fees, making it particularly attractive for those on a budget. The account setup process is quick, taking just a few minutes for identity and address verification. Once verified, traders can deposit funds and begin trading without delay.

Pepperstone Razor Account is designed for more advanced traders who are looking for faster execution speeds, lower spreads, and a wider range of features. It is connected to some of the world’s largest liquidity providers to fill orders. This type of account is highly popular among scalpers and traders who want to run Expert Advisors. The Razor account gives you access to raw spreads from 0.0 pips, but with a commission applied. Unlike the Standard account, the Pepperstone Razor account uses cTrader, which is a commission-based platform. This account is available to residents of the UK, Europe, and Australia.

Along with low commissions and access to institutional grade spreads, traders can access more than 180+ financial CFD instruments covering different asset classes which include Forex, stocks, indices, commodities, and even cryptocurrencies. The broker prides itself on its ultra-fast execution speeds of less than ~30ms.

As one of the best overall cTrader brokers around, traders can access the full features and benefits of the trading platform as level II market depth, advanced order execution and functionality, access to cTrader Automate, and FIX API, all the inbuilt technical trading indicators, timeframes, chart types and more!

Pepperstone fees

Fee Amount Stock trading fee $0.02 per US stock Forex trading fee Spread, 1.59 pips for GBP/USD Crypto trading fee Spread, 50 pips for Bitcoin Inactivity fee Free Withdrawal fee Free Pros:

- Swift trade execution with average spreads starting from 0.0 pips.

- Absence of requotes or rejections in trading orders.

- Negative Balance Protection is in place to safeguard against losses exceeding account balance.

- Regulatory oversight from reputable authorities including the FCA and ASIC.

- Access to leading forex trading platforms such as cTrader, MetaTrader 5, and MetaTrader 4.

Cons:

- Losses may be amplified when trading with smaller pip values.

You can get started with one of the best overall cTrader brokers, Pepperstone, at the click of a button and start enjoying institutional grade spreads and ultra fast execution!

There is no guarantee that you will make money with this provider. Proceed at your own risk..

2. IC Markets – Best cTrader Broker for Robo-trading

IC Markets is built from the ground up for high-frequency trading, robo-trading, and ultra-fast day trading. This platform offers average execution speeds under 40ms and has a low-latency VPS (virtual private server) available for traders to take advantage of.

On top of that, IC Markets offers what it calls ‘raw spreads.’ These are ultra-low spreads that start as low as 0.0 pips. For the popular EUR/USD trading pair, traders pay an average of just 0.1 pips. There are no requotes and no restrictions on how much volume you have to trade to get these tight spreads.

IC Markets offers a selection of 490 tradable instruments, including 60 currency pairs, nearly 2 dozen indices, and over 200 stocks from the NYSE, NASDAQ, and ASX exchanges. The broker offers leverage up to 500:1 for forex CFD trading and 200:1 for index trading.

Notably, IC Markets offers cTrader as well as as being a MT4 broker and providing MetaTrader 5. That means that you can easily jump between these platforms depending on which one best suits your analysis. The cTrader integration is available for mobile apps and you can also run cTrader on IC Markets’ trading servers.

IC Markets utilizes a diverse set of liquidity providers, allowing them to provide remarkably low spreads, reaching as low as 0.0 pips on certain platforms. The average spread for EURUSD on a raw spread account can be as minimal as 0.02, while on a standard account, it may be around 0.62.

By directly connecting to the price source through MT4/5 under the raw pricing account, IC Markets can offer customers exceptionally tight spreads, with a nominal commission applied to transactions.

Leverage of up to 30:1 is accessible for trading in Forex, commodities, indices, and stocks.

IC Markets is regulated by CySEC, the Cyprus Securities and Exchange Commission. The broker offers 24/7 phone support in case you ever need assistance with your account.

IC Markets fees

Fee Amount Stock trading fee N/A Forex trading fee Variable spread, 0.1 pips for EUR/USD Crypto trading fee Variable spread Inactivity fee Free Withdrawal fee Free Pros:

- Extremely fast trade execution with VPS servers available

- Raw spreads starting at 0.0 pips and averaging 0.1 pips for EUR/USD

- Trade 490 forex pairs, stocks, commodities, and indices as CFDs

- Supports cTrader as well as MetaTrader 4 & 5

- 24/7 phone support

Cons:

- US traders cannot open an account

- No investor protection outside the EU

There is no guarantee that you will make money with this provider. Proceed at your own risk..

3. FXPro – Best cTrader Broker for Forex Trading

FXPro is a UK CFD broker with a 15-year-long history of serving traders. The platform offers trading in more than 260 markets through CFDs, including 70 major, minor, and exotic forex pairs. FXPro also supports commodities, index, and share trading through a cTrader integration.

In addition to offering the cTrader platform, FXPro brings a suite of its own custom tools to the table. The forex trading platform has economic and earnings calendars to help you stay a few days ahead of the market. It also has handy trade calculators that can help you determine how much cash you need for a position and what your swap rates will be.

The broker supports 8 different base currencies, which is a plus for global ctrader forex brokers market. You can make deposits using debit or credit cards, PayPal, Neteller, or Skrill, and you never have to worry about deposit or withdrawal fees with FXPro.

One of the best things about FXPro cTrader is that it comes with access to Trading Central. This gives you access to daily forex trade ideas based on technical analysis. For beginner traders, these ideas can be a great place to start. For advanced traders, they can offer inspiration or confirm your own analysis.

FXPro offers customer service by phone, email, and live chat. Support is 24/5 to match the hours of the global forex market. The brokerage is regulated by the UK FCA and CySEC, so it’s widely considered to be trustworthy.

FXPro fees

Fee Amount Stock trading fee Variable spread Forex trading fee Variable spread Crypto trading fee Swap charges scheme (long/short positions) Inactivity fee Free Withdrawal fee Free Pros:

- 70 forex CFDs to trade with leverage up to 500:1

- Includes economic and earnings calendars and a trade calculator

- Integrates with Trading Central to offer daily forex trade setups

- Low account fees and supports a wide range of payment methods

- 24/5 customer support and FCA regulation

Cons:

- A limited selection of stock CFDs

- FxPro’s pricing is not as competitive as industry leaders like IG and CMC Markets.

- While their proprietary platform, FxPro Edge, lays a foundation for a new web-based platform, it still falls short of competing with the best proprietary trading platforms.

- BnkPro app for banking and payments, offering a wide range of global stocks to trade, is segmented away from the FxPro client experience under the BnkPro brand.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. Axiory – Best cTrader Broker for Account Flexibility

Axiory is another top cTrader broker that stands out for the flexibility it offers for different types of traders. This broker has three different account types: Nano, Standard, and Max. The Nano account offers average EUR/USD spreads as low as 0.2 pips, but it comes with a fixed commission of minimum $6 per trade.

The Standard account has an average EUR/USD spread of 1.2 pips and the Max account has a spread of 1.8 pips. But both of these accounts are 100% commission-free for forex CFD trading, and the Max account offers leverage up to 777:1 – a degree of leverage that not many cTrader brokers can match.

All three accounts come with negative balance protection, and the minimum deposit is as low as $50 for the Max account. Axiory has more than 60 forex CFDs to trade, along with dozens of stock, commodity, and index CFDs. The broker has an average trade execution speed of 135ms, which is slower than some other cTrader brokers but still incredibly fast.

Axiory stands out for the quality of its educational resources, which are incredibly detailed. The platform has a trading academy that serves as a crash course in CFD trading for beginners, as well as webinars and a daily market news briefing. Axiory also offers a demo account, so you can try out the broker’s cTrader integration before committing real money to your trades.

This brokerage is regulated by the International Financial Services Commission in Belize. Although this isn’t a well-known regulator, Axiory requires all traders to verify their identity and the brokerage follows strict anti-money laundering rules. You can get in touch with the broker’s support team by phone or email 24/7.

Axiory fees

Fee Amount Stock trading fee $0.04 per CFD (min $6) for Nano and Standard accounts Forex trading fee Floating spreads from 0.00019 pips Crypto trading fee N/A Inactivity fee Free / Broker closes account after three months of dormancy Withdrawal fee Free Pros:

- Three account types with different spread and commission structures

- Trade 60 forex CFDs with leverage up to 777:1 with a Max account

- Minimum deposit as low as $50 to start trading

- A comprehensive library of educational resources for first-time traders

- 24/7 phone and email support for your account

Cons:

- Not overseen by a US or European financial regulator

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. Fondex – Best cTrader Broker for Cryptocurrency Trading

Fondex is a cTrader broker that offers CFDs for more than 80 forex pairs, over 900 stocks, ETFs, commodities, and indices. Even more notable, Fondex is one of the only cTrader brokers that offers cryptocurrency trading through CFDs. Currently, the platform offers a Bitcoin trading platform, Ethereum trading platforms, Litecoin, Ripple, and Dashcoin. (Crypto CFD trading is not allowed in the UK.)

The broker’s pricing structure is a good deal for traders, although it can be difficult to know exactly how much a trade will cost ahead of time. Fondex charges commissions starting from $1 for share, forex, and commodities trading but spreads start at 0.0 pips. This broker doesn’t charge any deposit or withdrawal fees on your account.

Fondex is incredibly transparent about its variable spreads and even goes so far as to offer a chart of historical spreads by time and asset. The broker prides itself on fast execution and there are no requotes when placing trades.

One thing that helps Fondex stand out is that it offers an incredibly wide range of order types. The broker supports not the only market, stop, and limit orders, but also trailing stop losses, once cancels the other orders, and good-til-day orders. Fondex also offers tools for manual, copy, and automated trading, all of which are available through its cTrader integration.

Fondex is regulated by CySEC and the Seychelles Financial Services Authority. The broker offers 24/5 customer support by email and live chat, but doesn’t have phone support at this time.

Fondex fees

Fee Amount Stock trading fee $0.01 per lot Forex trading fee Variable spreads Crypto trading fee Free Inactivity fee Free Withdrawal fee Free Pros:

- Trade over 900 stock CFDs, 80 forex pairs, and 5 cryptocurrencies

- Spreads start from 0.0 pips and commissions from $1

- A huge range of order types including one cancels the other and good-til-day orders

- Supports copy and automated trading through cTrader platform

- Regulated by CySEC and offers 24/5 customer support

Cons:

- No phone support available

WARNING:

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The CyprusCYSEC regulation (license number: 138/11) claimed by this broker is suspected to be clone. Please be aware of the risk!

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How to Get Started with cTrader Brokers

Now you know more about the features of trading with the powerful cTrader platform, as well as the benefits of trading with the best overall cTrader broker Pepperstone, let’s walk through how to open an account with them.

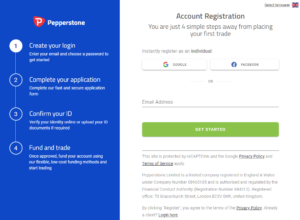

Step 1: Open an Account

You can open an account with Pepperstone quickly and easily. By clicking on the Start Trading button on the broker’s website you can start the four-step application process.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

The first step is to create your login with your email and password. After this, you will need to fill out an application form so your broker knows more about you and your history such as your employment and source of funds. This is standard regulatory practice for regulated brokers.

Step 2: Upload ID

All regulated brokers are required to verify your identity and address due to regulatory practices such as knowing your client and anti-money laundering measures. This is a simple process in which you need to provide two documents, usually including:

- A valid passport or driver’s licence.

- A utility bill or bank account statement (not older than 3 months).

With Pepperstone, verifying your account is a quick and simple process. Once completed you can start to deposit and withdraw funds and start trading.

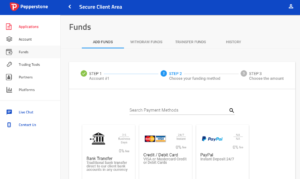

Step 3: Deposit Funds

Pepperstone offers a variety of different ways to deposit funds in your trading account. This includes via bank wire transfer, Visa debit card, Mastercard debit card, and PayPal. All deposits and withdrawals can be done from the Pepperstone secure client area, as shown below:

Step 4: Download cTrader!

From the Pepperstone secure client portal area, you can manage all of your live and demo trading accounts, while accessing all of their trading tools and platforms. For example, in the screenshot below you can view all of the platforms available when trading with Pepperstone.

Under the cTrader platform section, you can open cTrader Web, cTrader, cTrader mobile and cTrader Automate.

Step 5: Trade!

Trading from the cTrader platform is very simple. Once in the platform simply right-click on the chart or instrument and select New Order. This will open up a trading ticket in which you can access different order types (market, limit, stop, stop limit) and add expiries to the trader, adjust quantities, and more. You can also use the cTrader one-click trading feature as well!

Did you know you can open a FREE account with Pepperstone and access all of the features and benefits of trading with one of the best overall cTrader brokers today? This includes strong regulatory oversight, a range of different markets, platforms, and trading tools to use, and many other features that can supercharge your trading performance! See for yourself!

There is no guarantee that you will make money with this provider. Proceed at your own risk..

The Verdict

cTrader is fast becoming one of the world’s leading trading platforms. However, there is a wide range of good and not-so-good cTrader brokers to trade with. Make sure you are choosing one of the cTrader brokers that satisfy all of the factors listed above which includes strong regulation and safety of funds and competitive, yet transparent trading fees.

A simple way to get started is to choose the best overall cTrader broker Pepperstone! With multiple regulations all over the world, segregation of client funds from their own, commission-free trading, and access to institutional-grade spreads it’s a great place to start and use the cTrader platform. You can open an account in just four simple steps so you can see for yourself!

Pepperstone – Overall Best cTrader Broker

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Michael Graw Freelance Writer

View all posts by Michael GrawMichael Graw is a freelance journalist who covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech such as TechRadar and Top10.com. Michael has also written for StockApps, Buyshares and LearnBonds.

Before starting his career as a freelance writer, Michael studied at Cornell University where he obtained a BA in Microbiology. He then went on to recieve a Ph.D in Philosophy from Oregon State University. With 6 years of finance writing under his belt, Michael is an expert in his niche and has built up significant industry knowledge during his time as a writer. Michael writes informative content with the goal of supporting readers to make better financial judgements.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up