10 Best Stock Trading Platforms in the UK for February 2026

If you’re looking to buy and sell shares online – you’ll first need to find a stock trading platform.

Put simply, there are dozens of FCA-regulated providers that allow stock trading in the UK which means that traders need to conduct research into what each platform offers before deciding which one to use. This could include looking fees and commission, tradable stocks, payments, and customer support.

In this guide, we review 6 potential stock trading platforms in the UK investors are accepted at in 2026. We also show you how to buy shares UK with a simple step-by-step walkthrough

-

- 1. XTB – Best online stock trading platform for advanced strategies and tools

- 2. AvaTrade – Online trading platform for stock CFDs

- 3. Trade Nation – Free trading platform that offers regulated stock trading signals

- 4. Admiral Markets – One of the cheapest trading platforms in the UK that is compatible with MT4

- 5. Pepperstone – Stocks and forex trading platform with tight spreads

- 6. Alvexo – UK online stock trading app with over 450 assets available

- 7. IG – Commission-free UK stock trading platform

- 8. Hargreaves Lansdown – Established UK stock trading brokerage account

-

- 1. XTB – Best online stock trading platform for advanced strategies and tools

- 2. AvaTrade – Online trading platform for stock CFDs

- 3. Trade Nation – Free trading platform that offers regulated stock trading signals

- 4. Admiral Markets – One of the cheapest trading platforms in the UK that is compatible with MT4

- 5. Pepperstone – Stocks and forex trading platform with tight spreads

- 6. Alvexo – UK online stock trading app with over 450 assets available

- 7. IG – Commission-free UK stock trading platform

- 8. Hargreaves Lansdown – Established UK stock trading brokerage account

List of 10+ Online Brokers for Stock Trading That Are Available in The UK

In our search for a stock tracking platform for UK traders we found that the following providers are popular. You can scroll down for a review of each trading platform below.

- XTB: XTB is regulated by the FCA and supports trading in stocks, forex, commodities, ETFs, and more. It features the user-friendly xStation 5 platform, comprehensive educational resources, and multilingual customer support. XTB prioritizes safety with SSL connections and separate client accounts.

- AvaTrade: AvaTrade is a CFD stock trading platform in the UK, regulated by various authorities, including ASIC and the Central Bank of Ireland. It offers diverse assets, including stocks, forex, bonds, indices, and cryptocurrencies, with zero commission on certain trades. AvaTrade provides a mobile and desktop platform, 24/7 customer support, and robust chart analysis tools.

- Trade Nation: Trade Nation is a reputable CFD and forex broker known for low fees and no inactivity or withdrawal charges. Its user-friendly platform offers diverse trading options, but it primarily focuses on spread betting, forex, and CFDs. However, it does not offer access to real stocks or options.

- Admiral Markets: Admiral Markets is a forex and CFD broker. It offers competitive fees, negative balance protection, and the popular MetaTrader 4 platform. Admirals stands out for its low forex CFD fees and provides access to various markets, including indices, commodities, and cryptocurrencies.

- Pepperstone: Pepperstone is a forex and CFD that supports the MetaTrader charting tool. The platform offers low fees, efficient account operations, and strong customer support. It offers a variety of assets but primarily focuses on forex and CFDs. Pepperstone provides a fast account opening process, user-friendly platforms, and a robust search function.

- Alvexo: Alvexo is a regulated broker offering CFDs on over 450 assets. With a focus on education and market analysis, it provides various tools and resources for traders. Alvexo charges variable spreads and offers a range of educational materials, making it suitable for traders of different experience levels.

- IG: IG is a commission-free UK stock trading platform offering access to thousands of stocks and shares ISAs. While it charges a flat commission for stock trades, frequent traders can benefit from reduced fees. IG also provides CFD and spread betting options, suitable for different trading preferences.

- Hargreaves Lansdown: Hargreaves Lansdown is a well-established UK stock trading platform known for its IPO access and research tools. It offers a low minimum deposit of £1 and provides market insights and fundamental research for free. Hargreaves Lansdown is also regulated by the FCA.

*not available for existing ECN clients, other fees may apply

What Is a Stock Trading Platform?

A stock trading platform is an online software or application that allows individuals to buy and sell stocks in the stock market. It serves as a virtual marketplace, where investors can place orders, conduct analysis and view real-time market insight. These platforms provide access to various financial instruments, including stocks, bonds, exchange-traded funds (ETFs), and more.

One of the key features of a stock trading platform is its user-friendly interface. Most platforms offer intuitive dashboards and customizable layouts, making it easy for users to navigate and monitor their portfolios. Additionally, these platforms provide real-time market data, allowing investors to analyze trends and make informed decisions.

Another important aspect of an online broker is its security measures. Most UK brokers are regulated and must comply with anti-money laundering policies to protect investors. The protection that is offered by online trading accounts is one reason that many investors choose to use a broker rather than buy stocks directly from companies.

Lastly, a stock trading platform often offers additional resources to enhance the investing experience. These may include educational materials, financial news updates, and research tools. Some platforms even provide access to professional investment advisors who can offer personalized guidance and recommendations.

What Stock Broker is Best For Beginners in the UK?

In this guide, we will take a look at some of the best online brokers to consider in the UK. However, it is helpful to understand what type of platform is best if you’re a beginner. With various types of stock brokers in the market, it can be confusing to determine which one is best suited for beginners. However, there are a few factors to consider that can help narrow down the choices.

For beginners, it is recommended to opt for a full-service or traditional stock broker. These brokers provide comprehensive investment guidance and offer a range of services, including portfolio management, research reports, and personalized advice. This can be extremely valuable for beginners who lack experience and knowledge in investing. While full-service brokers may charge higher commissions, the benefits of their expertise and support can help beginners navigate the complexities of the stock market.

For beginners who are looking to trade stocks with lower fees and a more active strategy, CFD trading platforms could be a good option to consider. Many CFD brokers in the UK offer zero commissions for some stocks and low spreads. These accounts often have lower minimums because CFD platforms support fractional trading which means that you can trade part of a stock instead of buying the entire asset.

To provide a comprehensive overview of the best stock brokers and online trading platforms in the UK, our team spent time reviewing various types of accounts. read through the mini-reviews below to decide which platform is best suited to your needs.

Best Online Trading Platforms For Stocks in the UK Reviewed

With so many stock trading platforms to choose from in the UK, knowing which provider to open an account with can be a time-consuming task. After all, not only do you need to ensure that your desired stock markets are supported, but you also need to look at how much the broker charges in day trading fees.

To ensure you find a UK trading platform to suit your needs- below we review a selection of UK providers.

How we reviewed UK stock trading platforms in the UK

The purpose of this guide is to help you to better understand the stock trading platforms that are available to UK traders so that you can choose which platform is suitable for you. To create helpful, informative content, our writers spent time reviewing and researching a number of different stock trading options. We narrowed this down to a list of 11 platforms that were deemed suitable according to the following criteria:

- Low stock trading fees: Low fees are an important factor to consider when choosing a stock trading platform in the UK. Trading fees can eat into profits if they are too high and make it difficult to trade on a budget. We looked for platforms that offer low commissions and spreads.

- Demo account: A demo trading account is a virtual account that allows traders to test out new strategies and platforms without using any real funds. Also known as paper trading accounts, these accounts mimic real-life trading conditions so that users can test strategies, tools and features realistically.

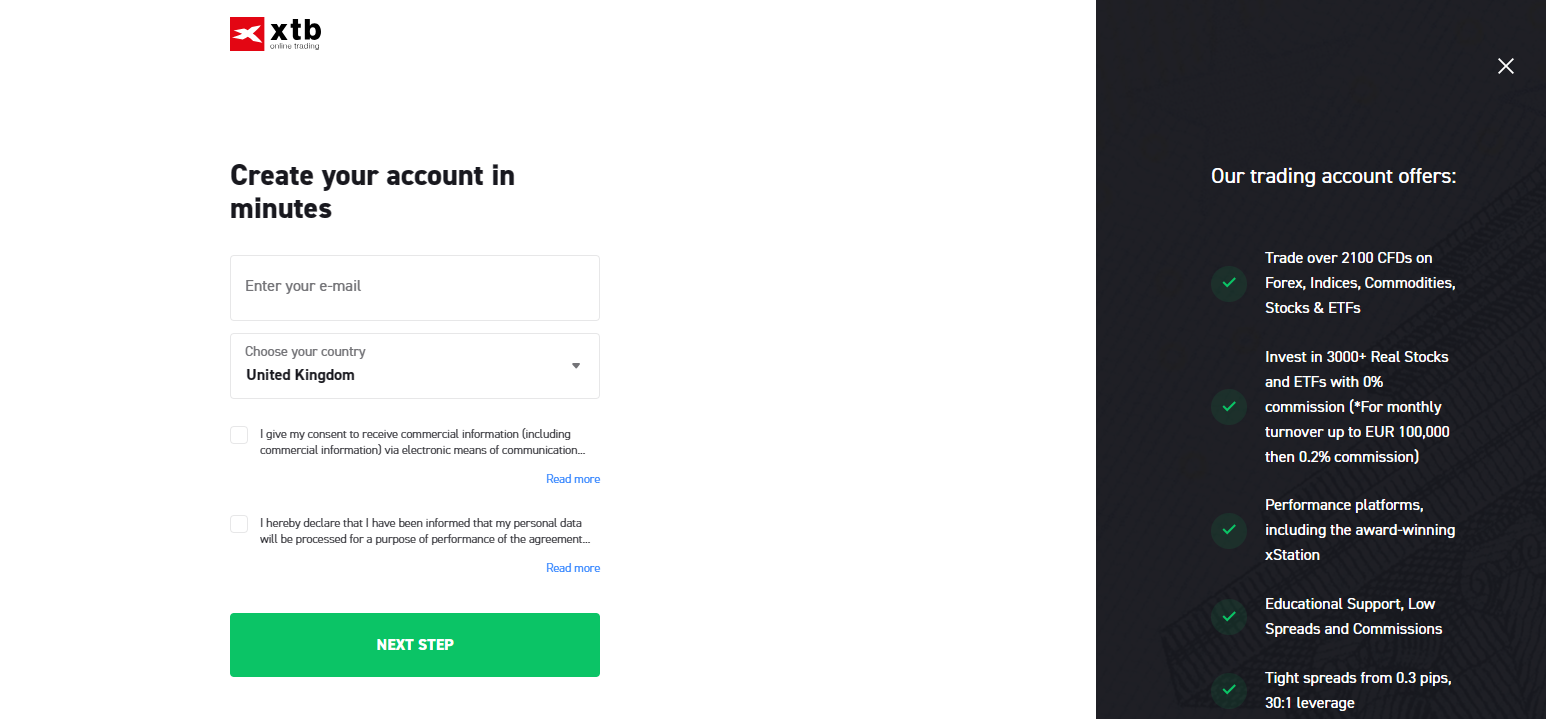

1. XTB – Best online stock trading platform for advanced strategies and tools

With a user base of 495,000 customers globally, XTB has become a prominent player in the online trading sector. XTB offers traders a plethora of tools for trading, making it a versatile choice for traders of all levels. The platform supports the trading of stock CFDs, ETFs, forex, crypto, indices and commodities.

The proprietary platform, XStation 5, exemplifies this approach, featuring customizable technical charts, numerous drawing tools, and technical indicators. XTB also places a strong emphasis on education and market analysis. They offer a wealth of educational resources, including articles, eBooks, webinars, and live events with market experts. Their integrated heat map and real-time trade history insights provide a comprehensive view of the market.

Customer support is another area where XTB does well. They offer multilingual support through email, local phone lines, and live chat. Additionally, clients have dedicated account managers to address account-related issues promptly.

XTB use secure SSL connections on their website, and client funds are kept in separate accounts to ensure safety. XTB is regulated by prominent authorities like the FCA, KNF, CySEC, and IFSC, providing an extra layer of protection for traders.

75% of retail investor accounts lose money when trading CFDs with this provider.

2. AvaTrade – Online trading platform for stock CFDs

AvaTrade, established in 2006, is a well-known brokerage firm that specializes in offering forex and CFD trading services. Regulated by several prominent financial authorities, including ASIC and the Central Bank of Ireland, AvaTrade provides a secure trading environment for its users.

The platform offers a variety of assets to trade including stocks, forex, CFDs, bonds, indices and cryptocurrencies. Each market can be traded with 0 commissions. However, spreads may apply. Notably, traders can access seven different cryptocurrencies with zero commissions and no additional bank fees.

AvaTrade is available to UK stock traders on both mobile and desktop. The proprietary web-based platform, AvaTradeGo, is suitable for all types of traders and has a clear interface.

Traders using AvaTrade can take advantage of over 80 technical indicators for chart analysis, and the platform provides trading ideas through a third-party service called Trading Central. Additionally, AvaTrade offers an Economic Calendar for tracking macroeconomic events that can impact the financial markets.

Regarding fees and commissions, AvaTrade stands out as it charges zero commission fees for forex, CFD, and cryptocurrency trades. Instead, traders are subject to bid-ask spreads and overnight financing fees if they hold positions beyond standard trading hours. The typical spreads can vary based on market conditions and events.

AvaTrade provides a range of deposit and withdrawal options, and customer support is available 24/7 through live chat, phone, and email. There’s also an FAQ section, a chatbot named AvaGuide, and dedicated account managers for accounts with a deposit of at least $1,000.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

3. Trade Nation – Free trading platform that offers regulated stock trading signals

Trade Nation is a reputable CFD and forex broker with a strong presence in multiple countries, including the UK, Australia, Bahamas, South Africa, and Seychelles. One of its standout features is its low fees, particularly for stock and index CFDs. Notably, Trade Nation does not charge any inactivity or withdrawal fees, making it an attractive option for traders.

The account opening process at Trade Nation is fully digital and comes with the advantage of not requiring a minimum deposit. Accounts are verified promptly, typically within one business day, ensuring a fast and hassle-free start to trading.

For deposit and withdrawal, Trade Nation offers free options through bank transfers, credit cards, and electronic wallets. However, the selection of account base currencies is somewhat limited, covering only a few options.

Trade Nation provides its own web trading platform, Made to Trade, which is user-friendly and equipped with a robust search function and guaranteed stops. While it offers a positive trading experience, it lacks a two-step login for added security.

The mobile trading platform from Trade Nation, also called Made to Trade, is user-friendly with effective search functions. However, it does not provide a two-step login and lacks price alerts, which may be important for some traders.

On the desktop, Trade Nation relies on the MetaTrader platform, known for its high customizability and clear fee reporting. Despite these advantages, it shares the same drawback as the other platforms in lacking a two-step login.

In terms of available markets and products, Trade Nation primarily offers spread betting, forex, and CFD trading. It does not provide access to popular asset classes such as real stocks, bonds, mutual funds, and options.

77% of retail investor accounts lose money when trading CFDs with this provider.

4. Admiral Markets – One of the cheapest trading platforms in the UK that is compatible with MT4

Admirals, also known as Admiral Markets, is a globally recognized forex and CFD broker that boasts regulation by multiple authorities, including the esteemed FCA and ASIC. Notably, Admirals offers a competitive edge with its low forex CFD fees, making it an attractive choice for traders seeking cost-effective options. The account opening process is quick and entirely digital, with a reasonable minimum deposit requirement of $100.

When it comes to deposit and withdrawal, Admirals impresses by not charging any fees for these transactions. Traders have a variety of options, including credit/debit cards, bank transfers, and e-wallets, though the availability of certain e-wallet options may vary for some clients.

Admirals employs the MetaTrader web trading platform, which is highly customizable and provides a clear fee report. However, it lacks modern design elements, two-step login security, and price alerts.

The mobile trading app from Admirals is well-designed, user-friendly, and includes a robust search function and secure login. It does not, however, support price alerts and some account types.

For desktop trading, Admirals offers the MetaTrader 4 platform, similar to its web counterpart but with the added benefit of price alerts. Unfortunately, it still lacks a two-step login and has room for design improvement.

Admirals stands out with regulation by several financial authorities, including the FCA, ASIC, and CySEC. It also provides negative balance protection, although it does not hold a banking license.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

5. Pepperstone – Stocks and forex trading platform with tight spreads

Pepperstone is a well-known name in the forex industry, and it offers a compelling option for traders comfortable with MetaTrader platforms. One of its standout features is the fast and fully digital account opening process, which doesn’t require a minimum deposit for the Standard account. The broker also excels in customer service, providing quick and relevant responses to inquiries.

Pepperstone’s fee structure is competitive, especially when it comes to forex trading, and it doesn’t impose inactivity or account fees. Additionally, deposit and withdrawal procedures are seamless and mostly free, although there is a high withdrawal fee for bank withdrawals outside the EU and Australia.

However, Pepperstone’s product offering is primarily limited to forex and a range of CFDs, which may not meet the needs of traders seeking a broader range of assets. The MetaTrader platform it uses is functional but has a basic design and user experience, which may not appeal to everyone. Furthermore, the absence of two-step login and price alerts can be seen as drawbacks.

In summary, Pepperstone is an attractive choice for forex and CFD trading, with low fees, efficient account operations, and strong customer support. Traders who value a wide variety of asset classes or advanced trading platform features may need to consider alternative brokers.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

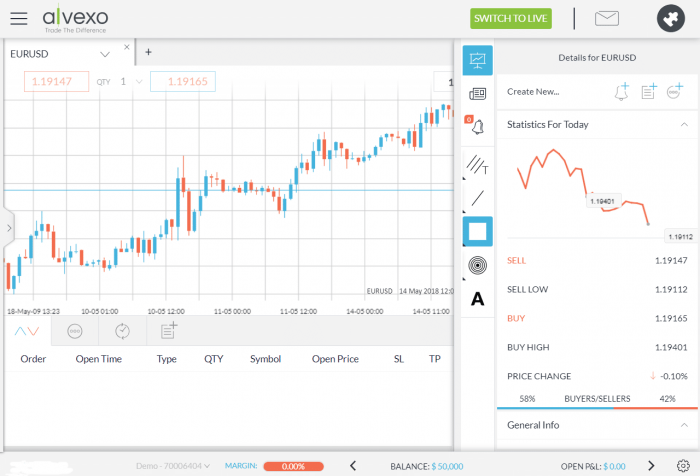

6. Alvexo – UK online stock trading app with over 450 assets available

With over 650,000 customers worldwide, Alvexo is a regulated online broker offering a wide range of products including CFD on Commodities, Indices, Stocks, and ETFs. “Trading real brokers for real traders” is how the company describes itself.

In 2014, market veterans founded Alvexo, providing real-time quotes on over 450 assets and a range of intuitive trading platforms. Several tools are available for market analysis for less-experienced and advanced traders.

It’s a known fact among traders that Alvexo offers educational resources and customer service. The Alvexo trading platform offers clients a wide range of economic news, a trading academy, webinars, and seminars in addition to daily market signals.

Alvexo fees:Fee Amount Stock trading fee Variable Spreads Forex trading fee Variable spreads. 2.9% for EUR/USD on its Classic account Inactivity fee $10 per month after three months Withdrawal fee Free *not available for existing ECN clients, other fees may apply

76.22% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

7. IG – Commission-free UK stock trading platform

One way to invest in stocks in the UK is through a stocks and shares ISA. These investment accounts are offered by some brokers in the UK. One of the UK trading platforms that supports ISAs is IG. The brokerage – which was launched more than four decades ago, offers a huge selection of stocks.

This includes thousands of UK stocks from both the London Stock Exchange and AIM, as well as dozens of international markets. If you are planning to add your stock investments to your ISA, then IG charges a flat commission of £8 per trade.

If, however, you place 3 or more trades in a 30-day period, the commission goes down to just £3. Take note, IG will charge you a quarterly custodial fee of £24 should you fail to trade at least three times over a 3-month period. As such, this does make IG somewhat expensive – especially when you factor in its share dealing account fees.

On the other hand, if you are a regular trader – you could receive free US stock trades if you place at least three orders per month. Additionally, IG also offers a CFD stock trading facility. This isn’t suitable for ISAs and you will pay a variable commission. This stands at 0.10% on UK stocks. Non-UK stocks are charged at different rates depending on the market.

If making tax-efficient trades is important to you, then you might consider the IG spread betting facility. This allows you to trade in a similar way to stock CFDs – but you won’t pay any tax on your capital gains. In terms of payments, IG requires a minimum deposit of £250 and it supports debit cards and bank account transfers.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

8. Hargreaves Lansdown – Established UK stock trading brokerage account

Not only does Hargreaves Lansdown have a positive reputation, but it is a notible online stock broker UK if you’re interested in IPOs. All you need to do is register your interest on the Hargreaves Lansdown website, and you’ll be noticed when a new IPO has been announced.

Then, it’s just a case of deciding how much you wish to invest in the IPO, and Hargreaves Lansdown will take care of the rest. Additionally, this online broker is also one of the well-known platforms for research and analysis. You’ll find detailed market insights, stock price analysis, and fundamental research tools – all of which can be accessed free.

You don’t, however, need to open an account with Hargreaves to read its research materials. Nevertheless, if you do decide to proceed with this broker, the minimum deposit is just £1 – which you fund with your UK debit card. The platform offers thousands of shares and is regulated by the FCA. Your capital is also protected by the FSCS.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

Our Ranking Criteria for UK Stock Brokers

We have covered the online trading platforms currently active in the UK investment scene. However, it’s also a good idea to perform a bit of extra research yourself to ensure the platform is right for your trading needs. The way to do this is to focus on a number of core factors – such as regulation, tradable stocks, commissions, user experience, and payment methods.

Below is an overview of features to look out for when researching UK trading platforms.

UK Stock Trading Regulation

Before you sign up with a UK stock trading platform – it’s crucial that you check the provider’s regulatory standing. In most cases, online trading platforms in the UK will be regulated by the FCA. This means that you can avoid the worry of choosing a shady broker – as the FCA is one of the most stringent regulators in this space.

For example, all FCA-regulated UK trading platforms must:

- Comply with all UK laws surrounding securities trading and investments

- Install a KYC (Know Your Customer) program – meaning all active traders need to have their identity verified

- Keep client money in segregated tier-one bank accounts – ensuring the platform doesn’t use your capital for its own day-to-day expenses

- Adhere to regular audits

In addition to choosing an FCA-regulated provider, reputable UK trading platforms will also be covered by the Financial Services Compensation Scheme (FSCS). This means that in the unlikely even the platform runs into financial problems – your capital is protected up to the first £85,000 – should they go bankrupt.

At the other end of the spectrum, choosing a stock trading platform that isn’t licensed by the FCA – or is regulated by an offshore body, means that your capital is at risk.

Tradable Stocks

Some traders in the UK prefer to stock with UK-listed stocks. This would mean that you are trading equities listed on the FTSE 100, FTSE 250, or even the AIM (Alternative Investment Market).

However, there might come a time where you also wish to add some international stocks to your portfolio – especially those listed in the US.

For example:

- The NASDAQ and NYSE exchanges contain some of the largest and most recognized companies in the world. Think along the lines of IBM, Disney, Tesla, Facebook, Amazon, Visa, and Microsoft.

- Additionally, if you want to trade stocks listed in the emerging markets, the reliable stock brokers UK give you access to high-growth exchanges in Singapore, Brazil, Indonesia, Thailand, and Russia.

- You should also look to see whether the stock trading platform gives you access to IPOs. This will allow you to invest in or trade companies that have just gone public.

Fees

It goes without saying that you should always check what fees and commissions you will be liable for when trading stocks online. This can come in various forms, so below we explain what fees to keep an eye on in your search for stock brokers in the UK.

Share Dealing Fees

When you buy stocks online through a traditional brokerage, you will pay a share dealing fee. This is a flat fee that is charged when you buy a stock and again when you cash out.

This means that irrespective of how much you are investing – the fee will always remain the same. This will actually suit large-scale traders more than those investing small amounts.

For example:

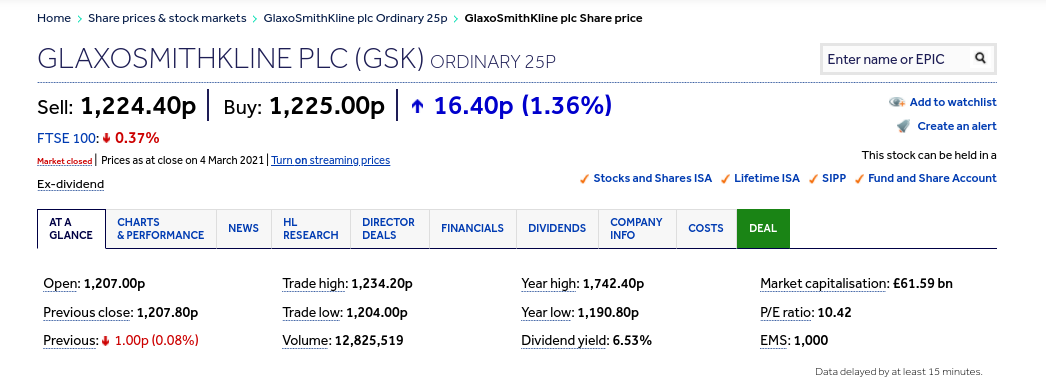

- Popular stock trading platform Hargreaves Lansdown charges a share dealing fee of £11.95

- Let’s suppose you buy £150 worth of BP stocks

- In paying £11.95 on this trade, your commission actually amounts to just under 8%

- In other words, you need to value of BP stocks to rise by at least 8% just to break-even

Fortunately, low-cost UK trading platforms like XTB do not charge any share dealing fees. This means that in the above example – you could have invested £150 into BP shares and saved £11.95.

Stock Trading Commission

While share dealing fees are aligned with traditional share investments, variable commissions are charged when you engage in actual trading. By this, we mean buying and selling stocks throughout the trading day – as opposed to investing over several years.

- For example, let’s say your chosen platform charges a commission of 0.1% to trade UK stocks

- We’ll then say you placed a buy order on HSBC stocks at a value of £100

- In doing so, you would pay a commission of £0.10

- Then, we’ll say you close your HSBC stock trade when it is valued at £150

- Again paying a small commission of 0.1% – this time your fee amounts to £0.15

A variable commission is much more viable for small stock trading stakes, as your fee is relative to the amount you stake. However, keep an eye on platforms that have a ‘minimum’ commission in place – as many do.

Stock Spreads

Once you have assessed whether you will be paying a share dealing fee or variable commission – don’t forget to check what spreads you will be charged. This is typically overlooked by newbie traders, so allow us to explain further.

In a nutshell, all stock trading apps in the UK, make money through the spread. This is how they are able to offer commission-free trading. The spread is simply the difference between the ‘bid’ and ‘ask’ price of a stock. If the gap between these two prices is too big, then you are indirectly paying more to trade.

To give you an idea:

- XTB offers an average variable spread of 0.70% on major stocks

- This means that when you open your stock trade – the value of your position will immediately stand at negative 0.70%

- In other words, you need the value of your stock to increase by 0.70% to get back to the break-even point

- Any gains above 0.70% is pure profit

Now, the key problem is that many stock trading platforms in the UK fail to state what the spread is on a particular market. As such, to ensure you are not getting a bad deal – quickly calculate this yourself.

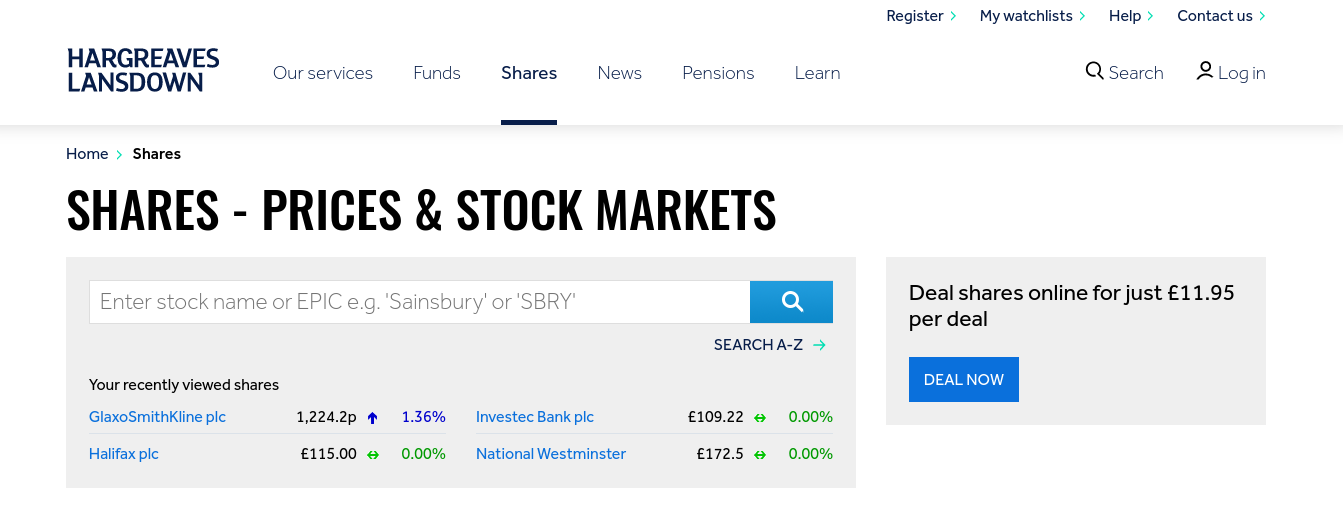

For example, in the image above – you can see that Hargreaves Lansdown is offering a bid (buy) and ask (sell) price on GlaxoSmithKline shares of 1,224.40p and 1,225.00p respectively. This works out at a spread of just 0.049% – which is competitive.

Unfortunately, you’ll then get hit with an £11.95 share dealing fee – which completely wipes out the competitiveness of the spread.

Overnight Financing

Another stock trading fee that is overlooked by newbies is that of overnight financing. This is a daily fee charged when you keep a leveraged CFD stock position open overnight. Each stock trading platform will have a set time when this kicks in – such as 6 pm.

This means that for each day you keep a CFD trade open past 6 pm, you will pay a small fee. This is why CFD trading platforms – although appropriate for low fees, leverage, and short-selling – are suited for short-term strategies.

Trading Tools & Features

If you’re the type of individual that is simply looking for a platform to buy and sell stocks – then you might not be too concerned about trading tools. However, this might be somewhat short-sighted, as we came across a plethora of notable features that can take your stock trading endeavors to the next level.

This includes the following:

Short-Selling

The thing about stock trading – as opposed to buying shares, is that you get to determine whether you think the equity will rise or fall in value. In order to do this, you need to choose a stock trading platform that offers CFDs (contracts-for-differences). This is simply a financial instrument that tracks the real-time price of the stock – meaning that you don’t actually own it.

All of the UK trading platforms reviewed on this page offer CFDs – so you can choose from a ‘buy order’ if you think the share price will increase or a ‘sell order’ if you think it will decrease.

Leverage

An additional benefit of choosing a stock trading platform that offers share CFDs is that you can apply leverage. This allows you to ‘multiply’ the size of your stake. In the UK, retail investor clients can apply leverage of up to 1:5 when trading stocks.

For example, if you had an account balance of £200 and applied leverage of 1:5 on a Royal Mail stock CFD – this means that you can enter a stock trade worth £1,000. Once again, all of the shares trading platforms in the UK that we have reviewed today offer leverage.

Fractional Shares

The best online stock brokers in the UK that we came across , allows you to buy ‘fractional shares’. This means that you can buy a small fraction of one stock – rather than needing to spend more than your budget allows. The minimum investment will vary from platform to platform – but at XTB there is no minimum deposit.

For example:

- Let’s say that you wish to invest in Google (Alphabet) stocks

- At current prices, one Google share is worth $2,003 – or about £1,400

- You decide to stick with the minimum – so invest £35 into Google

- This means that you own approximately 2.5% of a single Google stock

Crucially, your profits and losses will still work out the same when engaging in fractional ownership. For example, if Google stocks increase in value by 50%, your £35 investment would now be worth £52.50. As such, the specific number of shares that you own is irrelevant, as gains are based on the amount you invest.

Stock News

I’s important to choose a stock trading platform that offers relevant, up-to-date financial news. This will allow you to make informed decisions about which stock trades to place.

- For example, if Vodafone announces that it has just won a government contract on 5g technology – this will all-but-certainly result in an increased stock price.

- As such, you would want to be made aware of this, and any other important news, as soon as the story breaks.

On the other hand, if you’re chosen stock trading platform doesn’t offer real-time news – this isn’t overly problematic. This is because you can obtain this information from a third-party website for free.

Demo Account

All of the stock broker UK providers discussed on this page offer a demo account – barring Hargreaves Lansdown. Put simply, this allows you to trade stocks with your chosen broker without depositing or risking any money.

Instead, the stock trading platform will give you an allocation of ‘paper funds’. This allows you to buy, sell, and trade stocks in live market conditions – in a 100% risk-free way.

Demo accounts are not only suitable for first-time traders – but seasoned pros that wish to test out new systems and strategies.

Payment Methods

When you open an account with a stock trading platform, you will then be asked to make a deposit. After all, in order to make financial gains from your stock trading endeavors, you need to risk your own money. As such, check to see what payment methods your chosen platform supports.

All of the stock trading apps reviewed on this page allow you to make a deposit with a debit/credit card or UK bank transfer.

Customer Service

Finally, it’s crucial the pick a stock trading platform that puts the customer experience at the heart of everything. This means offering a support system around the clock – preferably via a Live Chat facility.

Some of the platforms discussed today – such as Hargreaves Lansdown, also offer a telephone service. Be careful with this though, as if you place a telephone trade at Hargreaves, you need to pay a surcharge for this.

How To Start Stock Trading in the UK

If you’re ready to start buying and selling shares online – we are now going to walk you through the stock trading process like-for-like. For our tutorial, we are showing you the required steps to join a commission-free stock trading platform and step by step-by-step guide how to buy shares UK.

Step 1: Open a Trading Account

You will first need to open an account at a regulated platform. You can do this online or via your mobile phone by heading over to a provider’s website.

Follow the on-screen instructions by providing your:

- Personal information

- Contact details

- National insurance number

- Creating a username and password

- Verifying your email address and mobile number

Step 2: Confirm Identity

You will now be asked to provide a copy of your passport or driver’s license as part of the KYC process. Additionally, a copy of a recently-issued utility bill or bank account statement.

Note: You can upload the above documents later, but you will need to do this before you can request a withdrawal.

Step 3: Deposit Funds

You will need to deposit some funds into your stock trading account before you can start trading stocks.

Choose from one of the following supported payment types:

- Visa

- MasterCard

- Maestro

- Paypal

- Skrill

- Neteller

- Bank Transfer

Step 4: Search for a Stock

Now that you have a fully-funded account, click on the ‘Trade markets’ button, followed by ‘Stocks’. This will give you a full breakdown of which stocks you can trade. You can use the filter buttons to narrow your search down by the exchange (e.g. NYSE) or sector (e.g. consumer goods).

If you already know which stock you wish to trade – you can instead search for it. When the respective stock loads up, click it.

Step 5: Place a Stock Trade

If you want to apply leverage (maximum 1:5 on stocks), you can select your multiple.

To place your commission-free stock trade, click on the ‘Open Trade’ button.

Conclusion

All in all, finding the right stock trading platform UK for your needs can take a lot of time. As we have covered extensively, there are many important factors to consider before taking the plunge.

This includes everything from regulation, and supported markets to fees, spreads, and payment methods. You also need to check whether the provider offers tools like Copy Trading, leverage, short-selling, and financial news.

When choosing a stock trading platform in the UK many opt for one that’s FCA regulated and FSCS protected, with a range of stocks across different UK and international markets.

75% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

Which stock trading site is for beginners in the UK?

If you're a novice investor looking for an online share trading platform, XTB wins hands down. The platform allows you to trade from just 0.01 lots, and comes packed with educational tools and guides.What is an online share trading platform with low fees?

If you're searching for a share broker in the UK in terms of fees, XTB allows you to buy and sell 3000+ stocks on a commission-free basis. Additionally, the provider waivers the 0.5% stamp duty tax that you pay on UK stocks.How do I trade on the stock market UK?

Trading UK stocks online has never been easier. All you need to do is open an online brokerage account, make a deposit, and then choose which stocks you want to trade. Just make sure that your chosen broker is regulated by the FCA.Is stock trading legal in UK?

Yes, the UK stock trading scene has never been more popular - especially with retail clients. As such, you can legally buy, sell, and trade stocks from the comfort of your home.How much money do you need to trade stocks UK?

Many UK share brokers now offer fractional stocks - meaning that you can trade with really small amounts. At XTB, for example, the minimum stock trade is just 0.01 lots.How do you trade UK stocks with leverage?

If you want to trade UK stocks with leverage, you need to choose a platform that offers share CFDs. UK share brokers will offer leverage of up to 1:5 on stocks - meaning you can trade with five times the size of your account balance.What is the a free stock trading platform in the UK?

If you want to trade stocks for free, you need to choose a commission-free share broker. XTB is one such example - as the platform doesn't charge any share dealing fees.References:

- Copy Trading: Assessing the regulatory landscape and licensing requirements

- Financial Services Compensation Scheme

- Financial Conduct Authority

- Is There a Catch to Free Stock Trading?

- Overnight Trading: What it is, How it works, Benefits and Examples

- Volatility Definition

- Apple Market Cap 2010-2023 | AAPL

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up