7 Best Spread Betting Brokers & Platforms in the UK February 2026

If you’re based in the UK and looking to trade in a tax-efficient way, it might be worth considering a spread-betting platform.

In doing so, you’ll still be able to trade assets like stocks, forex, gold, and oil, but you won’t pay any tax on your spread betting profits. This is because spread betting falls under the umbrella of gambling in the UK, which, since 2010, has been tax-free.

In this guide, we review UK spread betting brokers for 2026. We also explain how spread betting works and how to get started with an account today through a simple step-by-step walkthrough.

-

- 1. Pepperstone – Compatible with MT4, MT5 and cTrader for advanced spread betting strategies

- 2. AvaTrade – Top spread betting platform with tight spreads and 24/7 customer support

- 3. Trade Nation – CFD and forex spread betting platform that is compatible with MT4

- 4. Admiral Markets – A reputable UK spread betting account with over 12,000 instruments to trade

- 5. IG – Access over 17,000 spread betting markets and trade with leverage of up to 1:30

- 6. ETX Capital – One of the UK’s leading spread betting brokers with access to over 5000 markets

- 7. Markets.com – Reputable spread betting broker with excellent educational resources

-

- 1. Pepperstone – Compatible with MT4, MT5 and cTrader for advanced spread betting strategies

- 2. AvaTrade – Top spread betting platform with tight spreads and 24/7 customer support

- 3. Trade Nation – CFD and forex spread betting platform that is compatible with MT4

- 4. Admiral Markets – A reputable UK spread betting account with over 12,000 instruments to trade

- 5. IG – Access over 17,000 spread betting markets and trade with leverage of up to 1:30

- 6. ETX Capital – One of the UK’s leading spread betting brokers with access to over 5000 markets

- 7. Markets.com – Reputable spread betting broker with excellent educational resources

Spread Betting Platforms in the UK Compared

Here’s an overview of the spread betting platforms currently available to UK traders. Read our review of each provider by scrolling down.

- Pepperstone: UK-based spread betting platform suitable for advanced traders. It offers CFDs, forex, and spread betting. Pepperstone is compatible with third-party platforms like MT4, MT5, TradingView, and cTrader, offering advanced trading tools and a wide range of financial instruments.

- AvaTrade: A spread betting broker for stocks, forex, cryptocurrencies, commodities, and more. Their mobile-friendly platform caters to traders of all levels, providing a wide range of tradable instruments, educational resources, and low minimum deposit options.

- Trade Nation: A well-regulated platform specializing in CFD and forex spread betting. With transparent fixed spreads and access to MT4, it offers a hassle-free trading experience with no minimum account fees, inactivity fees, or deposit or withdrawal charges.

- Admiral Markets: Admirals is an international financial group with over 12,000 tradable instruments for CFD spread betting. They prioritize fund security and provide extensive trading options, making portfolio management efficient.

- IG: IG, a well-established online brokerage, provides access to over 17,000 financial spread betting markets, emphasizing forex, indices, shares, and commodities. They offer leverage capped at 1:30 for UK retail clients, but higher limits with professional accounts and crucial Negative Balance Protection.

- ETX Capital: ETX Capital operates commission-free and offers competitive spreads, such as 0.6 points for EUR/USD and 0.8 points for AUD/USD. It’s particularly cost-effective for share and index spread betting.

- Markets.com: Markets.com offers a straightforward spread betting facility covering various markets with leverage. Traders can practice with a free demo account and access educational resources.

What Is Spread Betting?

Spread betting is a form of trading in which a bet is placed in the direction of the price movement of a particular financial instrument, such as a stock, currency pair, or commodity. The bet is placed on the difference between the buying and selling price of the asset, also known as the spread.

Spread betting allows traders to speculate on the future price movements of an asset without actually owning the underlying asset. Instead, traders bet on the direction the price will move and the amount they want to bet per point of movement.

If the trader’s prediction is correct, they earn a profit based on the amount of the bet and the number of points the asset has moved in their predicted direction. However, if the price moves against the trader’s prediction, they can incur losses.

Spread betting is popular in the UK because it is exempt from capital gains tax and stamp duty, making it a tax-efficient way to trade. However, it is also a high-risk form of trading, and traders can lose more than their initial stake if the market moves against them. It is important to understand the risks and seek professional advice before engaging in spread betting.

Is Spread Betting Taxed In The UK?

In the UK, spread betting is not subject to capital gains tax or stamp duty, making it a popular form of trading. However, it’s worth noting that tax laws can change, and it’s always wise to consult with a tax professional to ensure compliance with current regulations.

It is also worth noting that spread betting is considered to be a form of gambling, which means that it could one day be taxed in the UK. If you start spread betting with a popular broker, it is a good idea to stay up-to-date with the latest government tax information.

Spread Betting Brokers in the UK Reviewed

While all UK spread betting brokers allow you to trade in a tax-free environment, there are many other metrics that you need to consider when choosing a provider.

For example, you need to explore what assets the UK trading platform supports, the minimum trade size, commissions, payments, and customer support.

To help you make an informed choice, below we discuss the spread betting brokers UK investors are accepted at right now.

1. Pepperstone – Compatible with MT4, MT5 and cTrader for advanced spread betting strategies

If you are seeking a trading platform in the UK suited for advanced spread betting, consider Pepperstone. This UK-based provider operates in the CFD, forex, and spread betting sectors.

Pepperstone is well-suited for experienced traders, offering access to advanced charting tools such as MT4, MT5, TradingView, and cTrader. These platforms are provided by third parties and can be integrated with Pepperstone trading accounts.

These platforms are equipped with a range of advanced trading features, customizable charts, and technical indicators. Pepperstone supports a wide array of trading opportunities, including shares, indices, forex, hard metals, US Treasury securities, and energy assets

When it comes to spreading betting fees at Pepperstone, this will depend on which account type is used. If opting for the ‘Standard’ account, traders will not pay any commissions on spread bets. Instead, everything is built into the spread. If opting for the ‘Raw’ account, then traders will benefit from 0 spreads on many markets.

However, a commission of £2.25 is payable per slide. If you like the sound of Pepperstone for your financial spread betting needs, the platform allows users to deposit funds with a debit or credit card, bank transfer, or PayPal. The platform is authorized and licensed by the FCA and is now home to almost 300,000 clients globally.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

2. AvaTrade – Top spread betting platform with tight spreads and 24/7 customer support

AvaTrade is an Irish-based brokerage company that specializes in providing trading services in various financial markets. These markets include currencies, commodities, stock indices, shares, securities, options, cryptocurrencies, and bonds. All of these assets can be traded on the exchange through their trading platforms and mobile app.

AvaTrade offers a wide range of trading platforms suitable for both manual and automated trading. This gives traders the flexibility to make the right choices and feel comfortable in their trading environment. If traders are just starting out, they can explore the Trading for Beginners section for useful articles on Forex and CFDs.

AvaTrade offers a wide range of tradable instruments with industry-standard spreads. These are available on a variety of trading platforms, are suitable for both manual and automated trading, and can be accessed from a variety of devices. Traders can spread bet on forex currency pairs, stocks, commodities, cryptocurrencies and stock indices.

For new traders, AvaTrade offers the ability to open accounts with as little as 100 units of the base currency, making trading more affordable, and the broker also provides dedicated educational and research resources to help new traders quickly become familiar with the financial market.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

3. Trade Nation – CFD and forex spread betting platform that is compatible with MT4

Trade Nation is a well-regulated broker specializing in CFD and Forex trading. It is known for its transparent fixed-spread commission structure, which makes it an attractive option for traders who want to control their trading costs while having access to a wide range of essential tools for developing an efficient trading strategy.

Trade Nation offers the popular MetaTrader 4 platform as well as its own proprietary trading platform. Its core promise is total transparency in options trading. That’s why it provides a market information sheet with details about each instrument, associated spreads, and trading hours to ensure that traders have all the information they need to make informed decisions.

Trade Nation has no minimum account fees, no inactivity fees, and no deposit or withdrawal fees. The account-opening process is completely digital and hassle-free. The company is also renowned for its high-quality customer service, ensuring that traders receive support and guidance throughout their trading experience. In the UK, Trade Nation, which operates under the trading name Finsa Europe Ltd., offers £85,000 in deposit protection through the Financial Services Compensation Scheme (FSCS).

77% of retail investor accounts lose money when trading CFDs with this provider.

4. Admiral Markets – A reputable UK spread betting account with over 12,000 instruments to trade

In more than 20 years, Admiral Markets – a brokerage firm, has grown into an international financial group providing access to over-the-counter markets in more than 130 countries. Following a rebrand in 2021, the company’s name was changed to Admirals. With this change, the updated platform received new integrated risk management solutions.

As a broker specializing in Forex and CFD currency trading, Admirals offers a highly diversified range of trading products and assets. With nearly 4000 CFDs and 8400 tradable symbols to choose from, traders have the possibility of finding exactly what they’re looking for. This is particularly beneficial for traders who prefer to keep all their positions in one brokerage account, making portfolio management simpler and more efficient.

For any investor, the security of their funds is the most important aspect when choosing a trading platform or broker. A key feature of this broker is that it pays the utmost attention to the security of its clients. This means that users can deposit with Admirals with confidence, knowing that their funds are completely safe in the unlikely event that problems arise.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

5. IG – Access over 17,000 spread betting markets and trade with leverage of up to 1:30

IG is an established online brokerage firm that covers several divisions in the investment scene. This includes traditional shares and funds, CFDs, forex, and spread betting. In total, IG gives users access to over 17,000 spread betting markets – which is huge.

This covers a variety of asset arenas, with a strong focus on forex, indices, shares, and commodities. Each and every spread betting market offers a long and short position, as well as leverage. Once again, this is capped at 1:30 for UK retail clients.

Much higher limits are available with a professional IG trading account. This stands at over 1:222 when spread betting forex, indices, and commodities. Either way, it is not possible to lose more than the trading balance permits when entering a leverage position at IG, as the platform has that all-important Negative Balance Protection in place.

In terms of fees, IG allows traders to use its spread betting platform in a commission-free manner. However, users should keep an eye on the spread, which is largely very competitive at IG. For example, spread bets on indices and shares can be traded at just 0.1 points, commodities at 0.3 points, and forex at 0.6 points.

IG is available as a desktop trading platform that can be accessed through the website. The broker also offers a mobile app that is compatible with iOS and Android phones. The minimum deposit at this UK trading platform is £250. IG supports debit cards and UK bank transfers.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

6. ETX Capital – One of the UK’s leading spread betting brokers with access to over 5000 markets

Founded way back in 1965, this London-based trading platform has a positive reputation. The provider offers an abundance of markets that span over 5,000 financial instruments. This means that traders can spread bets on popular assets like shares, forex, indices, hard metals, and energies.

ETX Capital is a reputable spread betting platform in the UK if you want to stake small amounts. This is because major markets can be traded at just 10 pips per point. As such, ETX Capital is one option for traders who want to give spread betting a go without risking too much money.

In terms of trading costs, ETX Capital is another spread betting account that operates a commission-free policy. Once again, this means that traders need to focus on the spread. This is largely competitive at ETX Capital, as traders can trade EUR/USD and AUD/USD for just 0.6 and 0.8 points, respectively. For traders who are planning to spread bet shares or indices, this is also competitive.

For example, UK, US, and European shares carry a spread of just 0.1%. If you’re interested in FTSE 100 spread betting – this is even more competitive at 0.05%. Traders can open an account and deposit funds with a debit card or e-wallet. The minimum deposit is just £100 at this UK FCA broker.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

7. Markets.com – Reputable spread betting broker with excellent educational resources

Markets.com is an online trading platform that offers a stripped-back way to trade online via a jargon-free platform that can be accessed via a web browser.

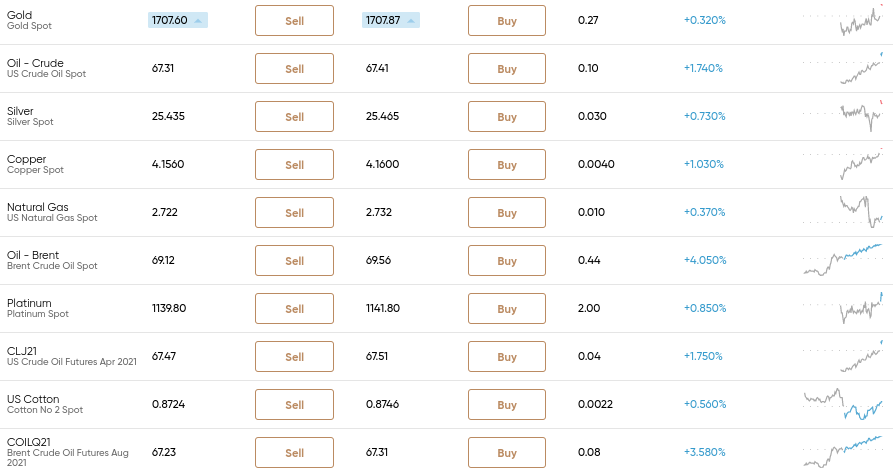

On top of conventional CFDs, Markets.com offers a comprehensive spread betting facility. At the time of writing, this covers 67 currency pairs, 28 commodities, 40 indices, 60 ETFs, and over 2,000 shares. All of these markets can be traded with leverage, as per UK limits.

Markets.com allows traders to start off with a free demo account facility. This means that traders can practice financial spread betting endeavors without risking any money. There is also an ‘Introduction to Trade’ department on the platform, which offers a range of guides and explainers.

When it comes to fees, this will depend on which spread betting market users wish to access. For example, it is possible to spread bet forex, commodities, and indices commission-free, so it’s just the spread that needs to be paid. Markets.com offers 0.90 pips on EUR/USD, $0.50 on gold, and just $0.05 on spot crude oil.

For users who are interested in stocks, they will also need to factor in a commission. This stands at $10 per slide. This means that irrespective of how much is being staked, traders will pay $10 to enter the stock trade and $10 to close it, plus the spread.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

How We Rated UK Spread Betting Brokers

To provide a helpful and insightful guide, our team of expert writers spent time testing several different spread betting broker options that are available to UK clients. The options were narrowed down to those deemed most suitable based on the following criteria:

- Demo account availability: Spread betting is an advanced trading strategy that requires skill and experience. One way to practice spread betting without putting any money at risk is to use a demo trading account. Our writers used these accounts to investigate all of the functions provided by each site.

- Advanced charting tools: Spread bettors use technical analysis to spot potential trades. Platforms must offer advanced charting tools to facilitate this analysis. Many of the platforms that we reviewed are compatible with third-party charting tools such as MT4, MT5, and Trading View.

- Spreads and fees: Most traders look for trading platforms that offer tight spreads and low fees. Spreads are calculated in pips, which reflect the distance between the bid and ask prices of an asset.

- Educational resources: Educational resources can be helpful when learning a new trading strategy. Our team of experts reviewed resources such as articles, courses, and webinars that are offered by some spread betting brokers in the UK.

- Customer support: Investors who require assistance with their trading accounts can benefit from 24-hour customer service. Platforms should include a number of support alternatives, including live chat, phone assistance, email, and a FAQ section to answer frequently asked questions.

- Regulation: The Financial Conduct Authority (FCA) regulates financial spread betting brokers in the United Kingdom. The FCA supervises financial institutions in the United Kingdom to ensure that platforms follow proper security and safety protocols.

What Are The Risks of Spread Betting?

Spread betting is an appealing strategy because it offers the potential to make quick profits. However, spread betting comes with a high level of risk and is most suitable for experienced traders.

Substantial losses

One of the main risks of spread betting is the potential for substantial losses. Since spread bets are leveraged products, it means that traders can gain exposure to a much larger position than their initial deposit. While this can amplify profits, it also means that losses can be magnified, and traders may end up losing more than they initially invested.

Traders are warned to place spread bets that are within their means. This involves only using leverage that you can afford to pay back if your trade is not successful.

High volatility

Another risk associated with spread betting is market volatility. Financial markets can be highly unpredictable, and prices can fluctuate rapidly. This volatility can lead to sudden and unexpected losses or gains, making it essential for traders to carefully manage their positions and implement risk management strategies.

The nature of spread betting makes it inherently volatile. The concept of spread betting is based on predicting the price movement of an asset within a specific timeframe, which can be challenging and often subject to sudden changes. Market sentiment, investor behavior, and unforeseen events can quickly impact prices and result in sharp movements, creating both opportunities and risks for spread bettors.

How to minimize the risks of spread betting

Spread betting can be an exciting and potentially lucrative method of financial trading. However, like any investment, there are risks involved. It’s essential to have a clear plan and take precautions to minimize these risks.

First and foremost, it’s crucial to educate yourself about spread betting and understand how it works. Take the time to research trading strategies, analyze market trends, and learn from experienced traders. By building your knowledge and skills, you’ll be better equipped to make informed decisions and minimize potential losses.

Another important step is setting a budget and sticking to it. Determine how much capital you’re willing to risk and avoid exceeding this limit. It’s also advisable to limit the size of your bets to a small percentage of your overall capital. This approach can help you avoid large losses and preserve your funds for future opportunities.

Furthermore, it’s essential to be disciplined and manage your emotions when spread betting. Fear and greed can lead to impulsive and irrational decisions, which often result in losses. Create a trading plan that includes entry and exit points, stop-loss orders, and take-profit levels. Stick to this plan, even if your emotions are urging you to deviate from it.

Lastly, consider using risk management tools offered by spread betting brokers. These can include guaranteed stop-loss orders, which protect against significant losses if the market moves against your trade. Additionally, carefully monitor your positions and regularly review your trading strategy to identify any necessary adjustments.

What To Look for in a Spread Betting Broker

There are hundreds of spread betting providers available to UK traders. Therefore, it is important to know what to look for when conducting research of your own. Below is an overview of the key features that you will find when reviewing and testing spread betting accounts in 2026.

Markets

In order to support diverse trading, spread betting brokers often offer multiple markets that can be traded. Here is an overview of some of the markets that are available through spread betting platforms.

- Shares: Markets covering stocks listed in the UK and abroad

- Hard Metals: Gold, silver, and platinum

- Energies: Crude oil and natural gas

- Forex: Variety of major, minor, and exotic currency pairs

- Indices: FTSE 100, Dow Jones 30, Nasdaq 100, S&P 500, and more

Visit the platform’s website to view the full list of markets that are available.

Fees

There are fees involved with spread betting in the UK. Fees include spreads, commissions, account management fees, overnight fees, withdrawal fees, and deposit fees. Trading platforms should state the exact fees that are charged on their websites.

Here is an overview of some of the fees that are involved with spread betting.

Commission

One spread betting account in the UK that we came across, Ava Trade, allows traders to trade in a commission-free manner across all supported markets. This is also the case with Pepperstone, ETX Capital, and City Index. However, certain platforms in this space will charge a commission for entering and exiting a trade.

For example, Markets.com charges a commission of $10 per slide on all stock trading markets. This can be very costly for traders who are planning to trade small amounts. Other spread-betting platforms will charge a variable commission. For example, a user might pay 0.1% per slide, so a £1,000 stake would amount to a commission of £1.

Spreads

Unless you are opening a specialist ‘Raw’ account with the likes of Pepperstone, you will always need to consider the spread. In fact, this is how commission-free brokers like Pepperstone make money.

In a nutshell, the spread is the difference between the buy and sell price on a chosen market. Apart from forex, which is assessed in ‘pips’, spread betting brokers operate in ‘points’. The larger the gap between the buy and sell prices, the more it will cost to trade.

Overnight Financing

Spread betting brokers are not geared towards long-term investors. Instead, they allow traders to speculate on the future price of an asset in the short run. Crucially, this is because spread betting markets attract overnight financing fees.

This means that for every day that a trader keeps their spread betting position open, they will pay a small fee. This is like an interest rate charged by the platform, which is multiplied by the size of the stake.

Trading Tools and Features

We found that the UK spread betting brokers will offer a variety of trading tools and features that might be of interest.

These include:

Leverage

Unlike traditional stock trading platforms, spread betting companies allow you to trade with leverage. As we briefly covered earlier, this allows you to boost the size of your position. The limits available to you are capped by the FCA.

For example:

- Pepperstone allows you to trade with leverage of 1:30 on major forex markets.

- If, for instance, you traded with GBP/USD with a stake of £10 per point, this would boost your position to £300 per point

- As such, if you made gains of 20 points on this trade, your profit would go from £200 up to £6,000

Make sure your chosen spread betting account offers Negative Balance Protection. This will ensure that you never lose more than you have available in your trading account.

Risk Management

Financial spread betting is a lot riskier than conventional stock investing, so it’s crucial that you choose a platform that offers risk management tools. For example, many of the platforms that we have discussed on this page offer stop-loss orders.

As the name implies, this will automatically close your spread-betting trade when it goes against you by a certain amount. For example, if you stake £5 per point and wish to limit your losses to £50, then you can set up a stop-loss order at 10 points. This, in addition to Negative Balance Protection, will ensure that you never lose more than you can afford.

Third-Party Platforms

If you’re an experienced trader, then you might want to choose a spread betting broker that offers support for third-party platforms. Think along the lines of MT4, MT5, and cTrader. In doing so, you will have access to an abundance of advanced trading features, such as customizable charts, drawing tools, and technical indicators.

These third-party platforms also support automated robots. This means that the robot will place spread betting trades on your behalf 24/7.

Education

Pepperstone offers a huge range of educational tools to help you become a better trader. For example, the provider offers fully-fledged spread betting guides, which cover risk management and potential spread betting strategies to consider. The ‘InvestMate’ app also offers mini-courses on all-things trading.

User Experience

Spread betting brokers should provide a user-friendly experience that enables traders to efficiently navigate the trading tools and features. This could include providing users with a mobile app, providing a clear dashboard and platform structure, facilitating various trading strategies, and offering a platform walkthrough to demonstrate how the platform can be used.

Demo Account

Demo trading facilities offer traders a way to familiarize themselves with the intricate instruments provided by spread betting brokers. With these facilities, you can place spread betting positions without the need to deposit or risk any actual money; instead, you’ll be trading with demo funds. In many cases, the demo account replicates real trading conditions, including pricing, liquidity, and volume.

Before starting with a spread betting demo account, it’s essential to check a couple of key factors. Firstly, ensure that the broker doesn’t require a deposit for access. Additionally, determine the amount of demo trading funds you’ll receive. Crucially, determine if there’s a time limit on the usage of the demo account.

Payment Methods

The spread betting brokers that we have reviewed provide a variety of payment methods to suit different traders.

Spread betting platforms in the UK will usually support debit cards. Many now accept e-wallets too, which is also safe and instant. If you want to deposit through a traditional bank account transfer, this might take a couple of days to process.

You should also explore what fees are applicable to your chosen payment method. Pepperstone is well-known in this respect, as it doesn’t charge anything on deposits or withdrawals. This won’t always be the case, though, with the likes of ETX Capital charging £10 on withdrawals of less than £100.

Customer Service

Whether you are looking for an explanation of a specific spread betting market or you want an update on a withdrawal request, it’s important to stick with spread betting brokers that offer 24/7 customer support.

For example, Pepperstone offers a 24/7 live chat facility as well as a dedicated telephone support line. In fact, this spread betting broker also offers support via WhatsApp, Facebook, Viper, and Telegram.

How to Get Started with a UK Spread Betting Platform

The following guidelines outline the process of signing up to a spread betting platform in the UK.

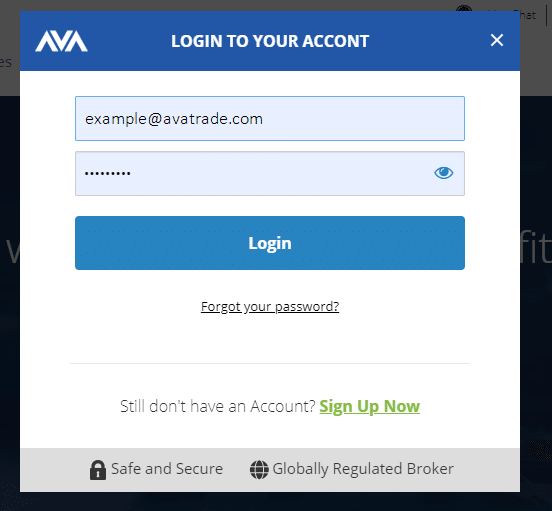

Step 1: Open a Spread Betting Account

The first step is to register for an account. Traders will need to fill out a sign-up form that initially asks for your email address and chosen password. After that, you will need to enter a range of personal information, such as your name, home address, date of birth, national insurance number, and and and telephone number.

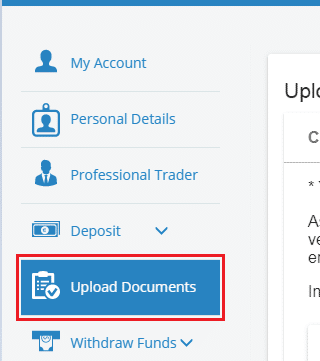

Step 2: Upload ID Documents

A broker authorized and regulated by the FCA will need to verify your identity. All you need to do here is upload a copy of your passport or driver’s license, along a proof of address (bank account statement, utility bill, etc.)

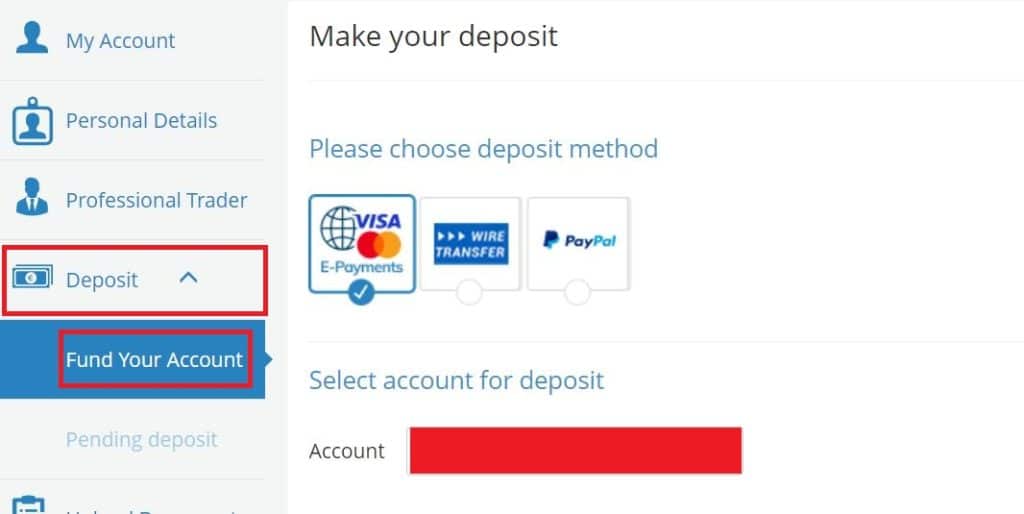

Step 3: Deposit Funds

Once you have uploaded your documents, you will then be asked to make a deposit.

In order to benefit from this low minimum, you need to opt for a debit or credit card or e-wallet deposit. If, however, you prefer to transfer funds from your UK bank account, the minimum shoots up to £250.

Step 4: Find Spread Betting Market

Now that you have a funded trading account, it’s time to search for the spread betting market that interests you. You can do this by hovering your mouse over the ‘Markets’ button at the top of the page and then selecting your preferred asset (stocks, forex, etc.).

Or, you can simply use the search function to go straight to the respective market. As you can see from the example above, we are searching for ‘gold’. Then, to go to the respective trading page, we click on the market once it pops up.

Step 5: Place Spread Betting Order

You will now be presented with a charting area that displays two key buttons: ‘buy’ and ‘sell’. This enables traders to take place spread bets. Then, you will need to enter your stake. Be careful here, as spread betting brokers operate in ‘points’. For example, if you stake £1 per point, your profit or loss will rise and fall by £1 for each point the asset rises or falls by.

You should also consider setting up a stop-loss order, which will ensure you cap your losses to a certain amount should the trade not go in your favor. Finally, confirm your buy-or-sell order.

Conclusion

The provisional 2022–2023 year-to-date (April–March) total for GBD receipts is £1,015 million – the best proof of the popularity of this activity. UK spread betting brokers offer an alternative to conventional trading platforms. In other words, by using CFD trading platforms and forex trading platforms traders will need to pay tax on their spread betting profits. But by trading via a spread betting facility instead, traders can keep 100% of their trading gains.

The important thing is that you choose the appropriate spread betting broker in the UK for your needs. To do this, focus on metrics like supported spread betting markets, commissions and spreads, minimum trade per point, and, of course, FCA regulation. Spread betting comes with a high level of risk and most retail investors lose money. It is important to conduct thorough market research and spend time practicing with a demo account before putting any money at risk.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

FAQs

What is spread betting UK?

Not to be confused by traditional gambling markets, spread betting platforms allow traders to trade financial instruments like gold, forex, stocks, and oil. Traders aim to make a profit by correctly predicting whether the financial instrument will rise or fall in value. What sets spread betting apart is that traders are not required to pay any capital gains tax on their profits.Is Spread betting taxable in the UK?

No, spread betting is not taxable in the UK. On the contrary, HMRC views spread betting in the same light as gambling. As such, you won't need to pay any capital gains tax on your gains.Is spread betting legal in UK and Ireland?

Yes, spread betting is legal in the UK and Ireland. However, the industry is heavily regulated - meaning that your chosen spread betting broker must be authorized and licensed by the FCA. Additionally, as of January 2021, you can no longer spread bet cryptocurrencies.What is better CFD or spread betting?

CFDs and spread betting are very similar, insofar that you can trade a financial asset without owning it. Both trading segments give you the option of going long or short, and you can apply leverage on all financial markets, within FCA limits. However, the key difference is that while CFD trading is taxable in the UK, spread betting isn't. Plus, spread betting profits and losses are calculated in points, while CFDs utilize pips and percentages.Is spread betting gambling?

Whether or not spread betting is gambling is somewhat subjective. After all, the process involves risking money to make money. Crucially, although spread betting profits are viewed as gambling winnings and thus - tax-free, the industry is regulated by the FCA and not the Gambling Commission. This will illustrate that spread betting, on a broader scale, is more aligned with trading than gambling.What is a popular spread betting platform in the UK?

After reviewing dozens of providers, we found that Pepperstone is a popular spread betting broker UK traders can join. This is because the platform offers thousands of spread betting instruments, allows you to trade commission-free, and requires a minimum deposit of just £200.What is the margin in spread betting?

When 'trading with margin' at a spread betting platform, this means that you are utilizing leverage. In simple terms, you are trading with more than you have in your spread betting account. In the UK, retail clients can get leverage of up to 1:30, meaning the margin requirement is just 3.33%.References:

- https://www.ig.com/uk/spread-betting/what-is-spread-betting-how-does-it-work

- https://www.independentinvestor.com/spread-betting/how-spread-betting-is-taxed/

- https://www.valutrades.com/en/blog/negative-balance-protection-why-it-pays-to-trade-with-valutrades

- https://www.handbook.fca.org.uk/handbook/glossary/G1118.html

- https://www.cityindex.com/en-uk/trading-academy/courses/trading-with-leverage/overnight-funding-explained/

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Visit eToroYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up