Swap Free Forex Brokers UK – Cheapest Platforms Revealed

Many FX traders today rely on Swap Free Forex Brokers whether it be because of their trading strategy, rules they must follow, or just to better manage their trading. Initially intended for Muslim traders, forex swap free accounts have been getting more and more popular among all traders in general.

With several swap free forex brokers out there, this article will help you find the right one for you with our swap free forex brokers lists, insights on swap in forex, and more.

Swap Free Forex Brokers UK List

With just a handful of brokers that offer swap free accounts in the UK, we’ve devised a list of platforms. Continuing down the article, you will get to better understand each swap free forex brokers’ advantages, features, and other relevant information.

Swap Free Forex Brokers UK Reviewed

1. AvaTrade

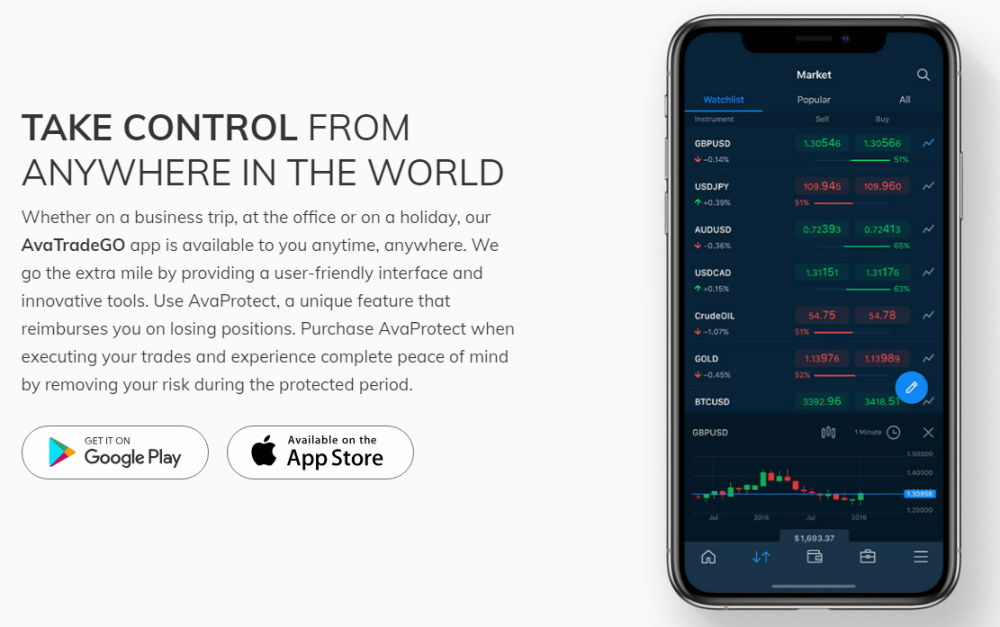

If you’re looking for a swap free forex broker that lets you buy and sell forex options then AvaTrade platform is an option for you. AvaTrade is a popular forex broker founded in 2006 and is internationally regulated. Users can trade forex, CFDs, and cryptocurrencies with zero commission, making AvaTrade another all-in-one platform as well.

With over 55 forex pairs from major, minor, and some exotic currency pairs, AvaTrade has plenty to show for itself. Given that it has zero commission fees, the platform becomes suitable for zero swap users who want to push the limits of no fees.

For the more advanced traders, AvaTrade has integrations with MetaTrader 4 (MT4) and MetaTrader 5 (MT5). With a simple interface and tools, AvaTrade’s mobile app supports social and copy trading.

Furthermore, the AvaTrade platform is excellent for traders who love learning new strategies and ways to trade. The broker has lots of educational content available in its web and mobile portals. There’s also a demo account available so that new users can use virtual equity to better understand the market movements.

To open an Islamic or swap free account with AvaTrade, a minimum deposit of 100 GBP is required. You’ll first need to deposit that amount in a regular account and request to convert the account into a swap-free account. Their customer service is available 24/5 and you can expect the conversion of your account within 2-3 business days.

The AvaTrade platform is regulated by both the FCA as well as the Australian Securities and Investments Commission (ASIC) among many more, meaning your capital is securely invested through AvaTrade. Despite being known for forex options trading, AvaTrade has many other features.

Avatrade fees:

| Fee | Amount |

| CFD trading fee | Variable spread |

| Forex trading fee | Spread. 0.9 pips for EUR/USD |

| Crypto trading fee | Commission. 0.25% (over-market) for Bitcoin/USD |

| Inactivity fee | $50 per quarter after three months of inactivity |

| Withdrawal fee | Free |

Sponsored ad. Your capital is at risk.

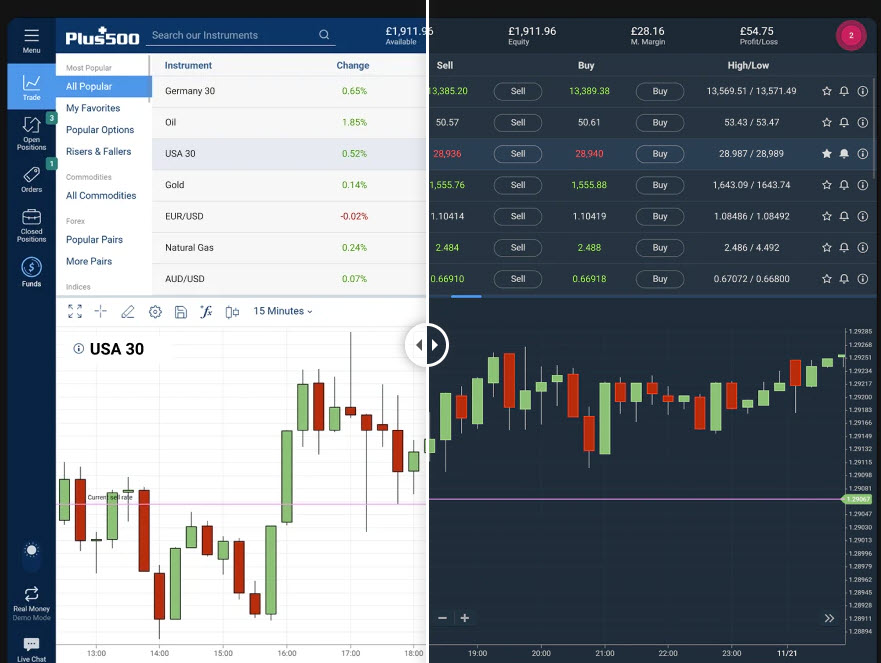

2. Plus500

Boasting access to over 2000 CFDs across a wide range of different asset classes, Plus500 is the largest CFD provider in the UK. With competitive spreads, low costs, and a proprietary web platform in WebTrader, the Israel-based company gets a spot on our swap free forex brokers lists.

Founded in 2008, the platform has grown to allow trading in multiple different financial industries. With Plus500 you trade a large variety of equities such as:

- Cryptocurrencies (availability depends on regulation)

- ETFs

- Forex

- Commodities

- Individual Shares

- Options

- Indices

As the leading CFD trading platform in the U.K., Plus500 allows for what is called guaranteed stop loss orders depending on market conditions. These protect users from market gaps but usually require larger spreads.

Plus500 is regulated by the FCA, one of the main regulatory agents in the U.K. Such credibility means that your capital is safe and secure.

If you want to create a swap-free account in Plus500, create a normal account first and contact their 24/7 customer support to help convert it into a swap-free account.

Plus500 fees

| Fee | Amount |

| Stock trading fee | Spread. 23.51 pips for Amazon. |

| Forex trading fee | Variable spreads |

| Crypto trading fee | Spread. 4.11% for Bitcoin. |

| Inactivity fee | £10 per month after three months |

| Withdrawal fee | Free |

Sponsored ad. Your capital is at risk.

Swap Free Forex Brokers UK Fees & Leverage Comparison

Below is a table comparison of some of the trading and other fees from our Swap Free Forex Brokers.

| GBP/USD Spread | EUR/USD Spread | Deposit/Withdrawal Fees | Inactivity Fees | |

| AvaTrade | 1.6 pips | 0.9 pips | None | $50 after 3 months of inactivity and a $100 administration fee after one year |

| Plus500 | 1.3 pips | 0.8 pips | None | $10 per month after 3 months of inactivity |

Below is a leverage comparison of the three Swap Free Forex Brokers for major and minor currency pairs.

| Major Currency Pair Leverage | Minor Currency Pair Leverage | |

| AvaTrade | 30:1 | 30:1 |

| Plus500 | 30:1 | 30:1 |

What Does Swap in Forex Mean?

A swap in forex is a transaction where two parties exchange a certain value of money but in different currencies. Because forex deals with two different currencies and both currencies have different interest rates, one party will earn or lose interest based on the discrepancy. Essentially, the parties loan each other money until they need to repay the amounts back at a specified date and exchange rate.

In simpler terms, the difference in interest rates between currencies means that there will be someone who will have to pay interest via swap and another who will be paid the interest via swap.

What is a Swap Free Forex Account?

Earlier in the article, we mentioned how forex swap free accounts were created to let Muslim traders partake in forex. Shariah law states that engaging in a contract that includes charging and receiving interest is strictly forbidden. Removing all swap in forex within a forex swap free account is the only way for Muslim traders to continue their practice.

As the name suggests, swap free forex accounts do not generate swaps. In forex, a swap is an interest that a broker charges when a trader decides to keep their position open overnight.

Additionally, swap free trading accounts do not generate swap interest which is the discrepancy between the interests of the currencies being exchanged as mentioned previously.

Swap free accounts are usually offered to Muslim traders to Islamic forex trading accounts, but some brokers also provide them to all traders.

Brokers earn from swap-free accounts by charging spreads or other fixed fees they may charge.

Tips For Trading With Swap Free Forex Accounts in the UK

It might be daunting to face the technicalities that come with swap-free accounts in forex. However, with a decent understanding of what swap in forex is and a few tips that we’ll show below, you’ll be able to better manage your forex swap free account.

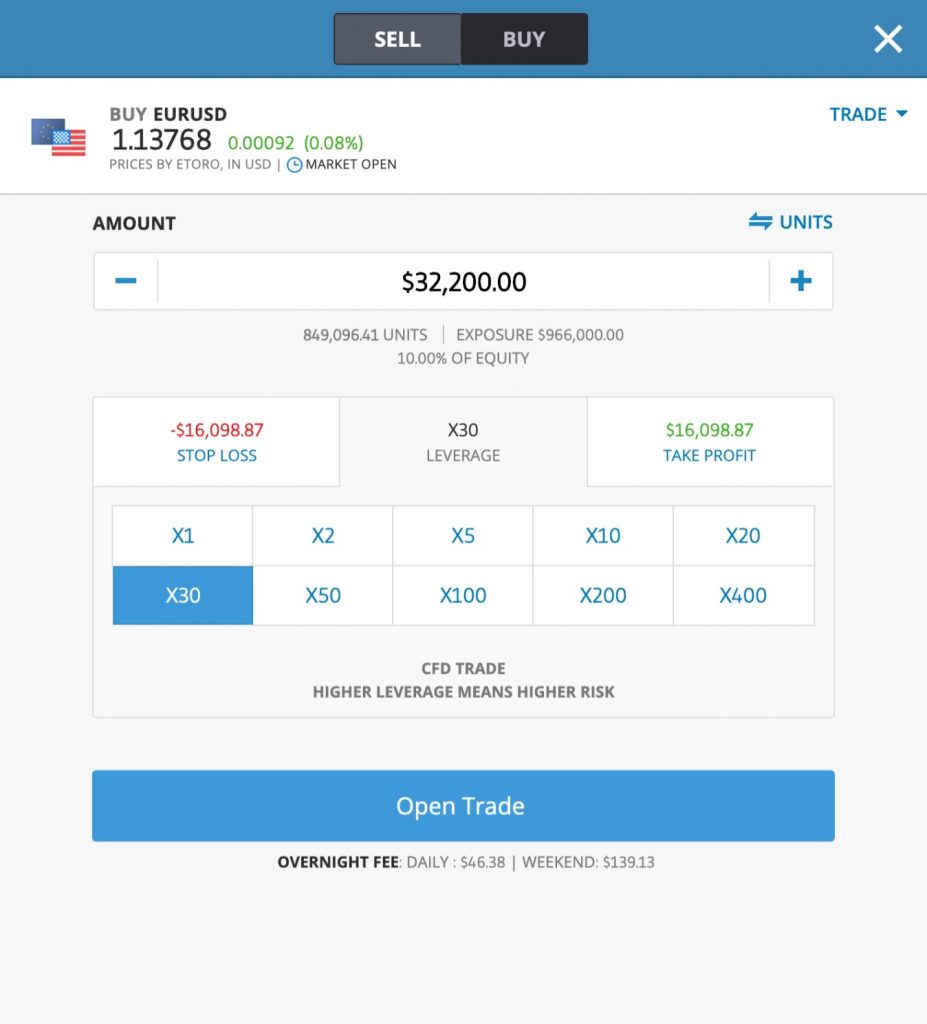

Leverage

Price changes in forex are usually very small, especially when it comes to major currency pairs like EUR/USD. Because of this, many traders use leverage when it comes to their forex trading. Leverage essentially is borrowing money from your broker in order to increase your trade position and earn more from small price changes.

One of the main reasons why traders opt for swap-free accounts is so that they don’t have to pay the overnight fee which is the interest for holding the broker’s money in an open position. As a swap-free forex trader, you’ll likely want to use leverage to take advantage of this.

Leverage isn’t completely for forex only, it can be used for other equities such as cryptocurrencies and stocks. There are plenty of leveraged trading platforms out there to choose from if you wish to trade other financial instruments.

Although leverage in forex means that your gains from small price changes are increased, this also means that your losses are just as significantly increased. Be careful especially when currency pairs become extremely volatile. Use a trading strategy that takes into account your swap-free account and understand your time frame for it.

Fixed Rates

Brokers will usually profit from swap free accounts mainly through the spread or the bid/ask price. However, some brokers might charge a fixed-rate fee instead of swaps. Make sure to check with your broker on what conditions they have regarding their swap free accounts.

Once you know how much your fixed rate is for when you make forex CFD trades, you can then account for it in your trading strategy. For example, if you plan on holding for a couple of days, you can add the costs of holding the position based on the number of days you plan on holding. Conversely, if your plan is more long term you may review the rates given the number of weeks.

Bottom line

Using a swap-free account has its advantages and disadvantages. Make sure that at the end of the day your trading strategy and style compliments the advantages of swap-free accounts. If this isn’t the case then you’ll need to rethink how you’ll want to trade using forex swap free accounts.

If you’re a beginner in forex, you may want to try trading with a virtual account for at least one month. You’ll get to understand how much leverage affects your position as well as any other costs that might affect your profits once you close certain positions.

For more adept forex traders who are looking to get into swap free accounts, make sure that you’ll benefit from having no swap costs. Again, check the broker that you wish to have your swap free account with and see if they have special costs and conditions associated with the account. The end goal for trading is to make a profit by managing costs, assessing risk, and making sure you set yourself up for the safest system for you.

It’s always important to keep in mind that all trading carries risk, whether it be through swap free trading in forex or even stable ETFs. Be prepared to invest only what you can afford to lose and practice responsible trading.

Conclusion

If your trading strategy calls for swap free trading in forex, make sure to get the one that suits you. Among swap free forex brokers in the UK is AvaTrade.