Low Spread Forex Brokers UK – Cheapest Platforms Revealed

Spreads are an additional charge implemented by forex brokers to charge users for trading. Spreads often catch traders out by making seemingly low-cost trades more expensive. This can make it tricky to trade forex on a tight budget in the UK. The solution is to use low-spread forex brokers that limit the spreads that are charged per trade.

In this guide, we review some low-spread forex brokers that you can use in the UK during 2026.

-

- 1. XTB – One of the best zero spread accounts for advanced forex trading strategies

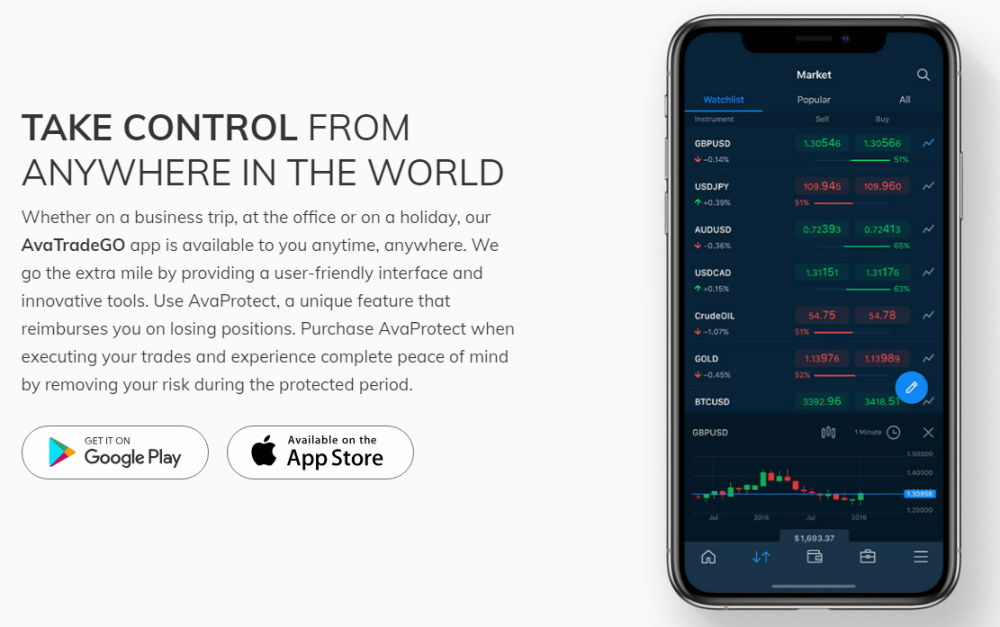

- 2. AvaTrade – Low spread forex broker with a variety of charting tools

- 3. Admiral Markets – Investment Ecosystem with Numerous Awards in the UK

- 4. Pepperstone – Voted Best MetaTrader 4 Broker in 2023

- 5. Trade Nation – Competitive Spreads and Fully Regulated in Numerous Jurisdictions

-

- 1. XTB – One of the best zero spread accounts for advanced forex trading strategies

- 2. AvaTrade – Low spread forex broker with a variety of charting tools

- 3. Admiral Markets – Investment Ecosystem with Numerous Awards in the UK

- 4. Pepperstone – Voted Best MetaTrader 4 Broker in 2023

- 5. Trade Nation – Competitive Spreads and Fully Regulated in Numerous Jurisdictions

Best Low Spread Forex Brokers in the UK 2026

There are several brokers out there that allow you to trade on forex currency pairs with low spreads. Here is an overview of the options available to UK traders.

- XTB – Multiple award-winning forex brokerage that offers trades access to 48 currency pairs and uses the xStation 5 trading interface. XTB provides more than 2100 trading instruments in total. This makes it a tempting choice for anyone wishing to diversify their portfolio.

- AvaTrade – UK regulated brokerage platform that offers numerous trading interfaces for a limitless trading experience. The platform provides access to over 50 currency pairs, including major, minor, and exotic pairs, allowing traders to diversify their portfolio.

- Admiral Markets – Admiral Markets classes itself as an investment ecosystem and is an award-winning regulated broker in the UK. Offers its client base the chance to trade on desktop or remotely on-the-go using their mobile trading application which is available for both iOS and Android users.

- Pepperstone – Voted the TradingView Broker of the Year 2022 and Best MetaTrader 4 Brokerage 2023. It allows clients to trade assets using a variety of trading platforms including the world-renowned MetaTrader 4 and 5 interfaces.

- Trade Nation – A brokerage platform offering a range of assets regulated by financial bodies worldwide, including the UK Financial Conduct Authority since 2014.

75% of retail investor accounts lose money when trading CFDs with this provider.

What Are Forex Spreads?

A forex spread is one of the many ways in which a forex brokerage platform makes its profits. Whenever you place an order on the market, there is a difference between the price at which you are willing to buy a particular forex currency pair and the price at which the seller is willing to sell their currency pair. The difference between these two prices is called the spread, and it is how exchanges make their money.

However, low spread brokers these days are market makers. Therefore, they do not directly fulfill your order at the exchange. On the other hand, they observe the current price of whatever currency pair you are looking to trade, and then they give you their own buy and sell price based on the current market price. If you, for example, place a buy order on the USD/EUR pair, then your broker will take on the other side of the transaction and sell you USD/EUR pairs.

They will then set off this position in the market or by combining a buy position from you and a sell position from someone else. What this means is that market maker brokers do not actually fulfill your order directly at the exchange, but they take on the other side of the transaction themselves. The fee that they charge for doing this is called the spread and is visible as the difference between the buy and the sell prices of the pair.

This is why, if you decide to buy and sell something instantly, you will actually end up booking a loss, because the selling price for a currency pair on a market-making platform is always lower than the buy price at any given point in time. This is called the spread. This is the way commission-free platforms such as XTB make their money.

What Is Considered A Low Spread In Forex?

The spread refers to the difference between the buying and selling price of a currency pair. It is essentially the cost that traders have to pay to execute a trade. In forex trading, a low spread is considered to be anything between 0 and 3 pips. Spreads bigger than this are considered to be high. A low spread is generally considered favorable for traders as it means they are able to enter and exit positions at a lower cost.

Lowest Spread Forex Brokers UK Reviewed

Now that you have seen the list of some low spread forex brokers in the industry, below is the detailed review of the brokers on the list.

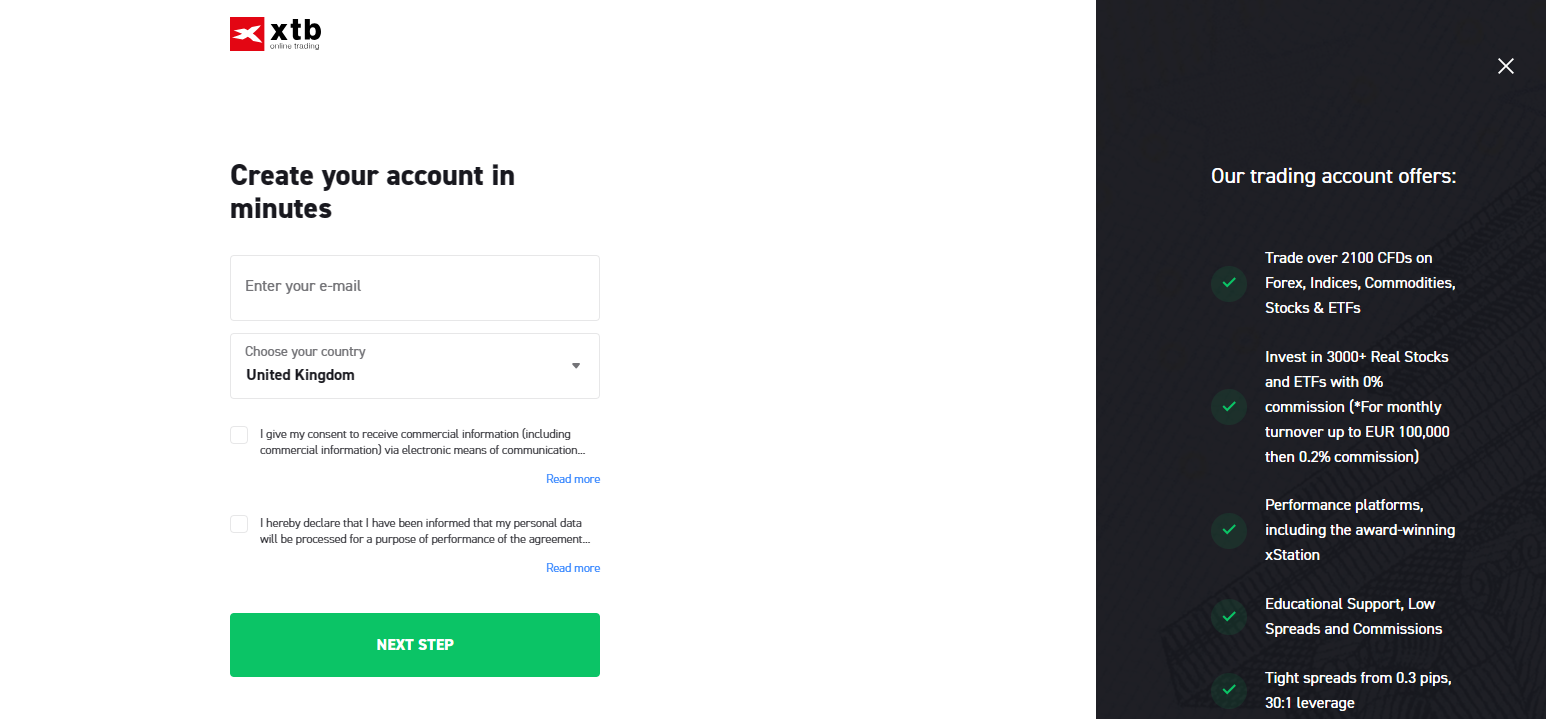

1. XTB – One of the best zero spread accounts for advanced forex trading strategies

A popular trading platform for stocks, currencies, and commodities that accepts a variety of assets is called XTB Broker in Europe. The platform has been accessible for more than 15 years and has more than 400,000 subscribers globally.

XTB provides more than 2100 trading instruments in total. This makes it a tempting choice for anyone wishing to diversify their portfolio and increase their market exposure. Additionally, XTB promises reasonable spreads and charges. Those who maintain positions after the market closes are subject to overnight costs according to the website.

Members of XTB can access a range of educational tools to improve their skills. There are also numerous tutorials and a whole trading academy included. Additionally, Users have access to in-depth market analysis to help them make informed trading decisions on XTB.

Additionally, XTB provides a demo account to test out the platform without risking any money. XStation 5 and XStation Mobile are the two trading systems that XTB provides. The second choice is the best for mobile trading.

XTB is suitable for scalping because the platform offers fast execution speeds. You can start trading with as little as you like because XTB has no minimum deposit requirements.

75% of retail investor accounts lose money when trading CFDs with this provider.

2. AvaTrade – Low spread forex broker with a variety of charting tools

AvaTrade is a widely used platform that facilitates seamless forex trading in the UK. AvaTrade provides access to over 50 currency pairs, including major, minor, and exotic pairs, allowing traders to diversify their portfolios and potentially increase their returns.

The platform offers competitive spreads and flexible leverage options, which means that traders can manage their trading costs and increase their trading power.

In addition, AvaTrade provides a range of trading tools and resources to help traders make informed decisions about their trades, including real-time market news and analysis, as well as advanced charting tools. The platform also supports automated trading through its AvaOptions and MetaTrader 4 platforms, which can help traders execute their trading strategies more efficiently and accurately.

Another important feature of forex trading on AvaTrade is the availability of risk management tools. Forex trading can be volatile, and AvaTrade offers a range of tools to help traders manage their risk and protect their investments. These tools include stop-loss orders, which allow traders to limit their potential losses by setting a predetermined exit point for a trade, and take-profit orders, which enable traders to lock in profits by setting a predetermined exit point for a trade.

Additionally, AvaTrade offers negative balance protection, which means that traders cannot lose more than their account balance. This can provide peace of mind for traders, especially during times of high market volatility. AvaTrade’s commitment to risk management and investor protection has earned it a reputation as a trustworthy and reliable forex broker.

Finally, AvaTrade offers excellent customer support and assistance, including 24/7 live chat and phone support, as well as email support and a comprehensive FAQ section. Overall, forex trading with AvaTrade offers traders a comprehensive platform to execute their trades.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

3. Admiral Markets – Investment Ecosystem with Numerous Awards in the UK

Admiral Markets is a low spread broker founded in 2001. It classifies itself as an investment ecosystem and provides users access to over 8000 financial instruments including CFDs for forex, stocks, indices, bonds, commodities and ETFs.

Admiral Markets offers its client base the chance to trade on desktop or remotely on-the-go using their mobile trading application which is available for both iOS and Android users. For users wishing to trade on desktop users have access to MetaTrader the advance trading platform used by traders worldwide. For more masterful charting and analytics, Admirals provides users access to MetaTrader Supreme Edition and Stereo Trader, which are both pre-loaded with state-of-the-art trading tools and technical analysis indicators.

Admiral Markets offers various different account types which offer access to different asset classes and have different minimum deposit requirements. With regards to trading forex currencies, provides its users access to over 80 different currency pairs.

The trading platform has competitive spreads, typically for EUR/USD it is 0.6 pips. Admiral Markets also offers an Islamic Forex Account, which enables trading forex without having interest fees applied to credit or debits. The Islamic Forex Account is only available to use if signing up to the Trade.MT5 account type.

Admiral Markets also offers its clients educational materials. These include webinars, tutorials and articles to help investors navigate the world of trading. The platform also offers a Forex 101 course which is a three step programme, containing 9 online video lessons, which helps beginners learn the ins and outs of forex trading.

The trading platform also offers a wide variety of trading and analytics tools allowing users to trade using the MetaTrader 4 and MetaTrader 5 trading interfaces. Users can also get access to the MetaTrader Supreme Edition which comes packed with pre-set trading strategy indicators. Users also have access to StereoTrader, which is a MetaTrader trading panel for a more immersive trading experience.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

4. Pepperstone – Voted Best MetaTrader 4 Broker in 2023

Pepperstone is a multi asset brokerage firm founded in 2010 by a group of experience traders committed to improving online trading experiences. Since its establishment Pepperstone has grown to become on of the world’s largest brokerage firms facilitating multi billions of trades per day.

This brokerage is regulated across multiple jurisdictions including Australia, Cyprus, Germany and the UK, among others. It offers clients access to over 1200+ financial instruments across forex, commodities, indices, stocks and ETFs.

Pepperstone allows clients to trade assets using a variety of trading platforms including the world renowned MetaTrader 4 and 5 interfaces. Users can also use cTrader, and all platforms are available to use on desktop or mobile for iOS and Android. One unique integration that Pepperstone provides is integration directly with TradingView whereby Pepperstone clients are able to directly connect and trade via their TradingView accounts.

Traders also have access to Capitalise.ai which is Pepperstone’s proprietary automation trading tool. Using Captialise.ai allows code-free automation trading while also presenting users with tools to back test simulated trading strategies, get smart notifications to monitor market movements, explore various live strategies, and customize advanced trading features.

Pepperstone offers clients 3 different account types, Razor, Standard and Spread Betting with the primary difference being the spread and commission on forex trading. The Razor account type has lower spreads for forex typical averages are 0 – 0.2 pips for EUR/USD and other major currency pairs.

Although, with the Razor account there is commission of 2.25 GBP per lot per side. With the Standard and Spread Betting account types no commissions are charged for forex trades, however, spreads are significantly higher with averages spreads for EUR/USD being 1.0 – 1.2 pips for Standard Account, and 0.6 – 1.0 pips for Spread Betting accounts.

Regarding forex trading, Pepperstone offers clients access to over 60+ currency pairs, with deep liquidity and competitive spreads. The platform hosts majors, minors, crosses and exotics. A unique asset market type covered by Pepperstone is Currency Indices referred to as Currency Index CFDs.

These are key tools to assist traders by measuring the value of a currency against a basket of other currencies. This allows traders to understand the strength of a given currency in comparison with other global currencies for a better measure of sentiment, and to find new trading opportunities.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

5. Trade Nation – Competitive Spreads and Fully Regulated in Numerous Jurisdictions

Trade Nation is known to be one of the cheapest CFD forex brokers that offers fixed spreads from just 0.6 pips. The platform also charges no deposit or withdrawal fees or inactivity fees. Furthermore, there is no minimum deposit requirement to use the demo account to practice trading.

Traders can practice with Trade Nation without depositing any funds or putting any money at risk. This is ideal for less-experienced users who may want to improve their skills before trading live markets.

Trade Nation offers access to forex CFDs, stock CFDs, spread-betting, indices and commodities. It is possible to trade over 1000 financial instruments from around the globe. Traders can choose to use either MT4 or Trade Nation’s own TN Trader charting platform to trade. Both tools offer a variety of indicators that can be used to conduct analysis and make informed decisions.

Trade Nation has a clear interface which makes the platform ideal for all types of traders. What’s more, users can access the platform on the go through the mobile application.

Fee Amount Stock trading fee Fixed spreads from 0.6 pips Forex trading fee Fixed spreads from 0.6 pips Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free 77% of retail investor accounts lose money when trading CFDs with this provider.

How We Chose The Best Low Spread Forex Brokers

When selecting trading platforms, our team of experts look at a number of important criteria. These criteria are essential in choosing the right platform for investors.

- Firstly, we look for brokers that are available in the UK and offer low spreads.

- Secondly, we look for brokers that offer the major and minor currency pairs in the market and a wide range of other digital asset classes such as: stocks, indices, ETFs, cryptocurrencies and commodities.

- We also know how important the issue of fees is, which is why in our article we have selected platforms that are convenient and do not require you to deposit a certain amount or pay extra for withdrawals. Some of them are even free, the fee only applies to premium accounts. These accounts are usually recommended for more advanced investors.

- Educational resources and analysis tools are also important. Our chosen platforms offer the opportunity to learn, test and analyse the market through these tools. Many even offer a free demo account so you can familiarise yourself with the platform and the trades.

Tips For Trading With a Zero Spread Account in the UK

If you are looking to trade with a low spread broker, then there are several things that you should keep in mind. Some of these things have been listed below in detail:

- Ensure that you are aware of whether the spread is variable or fixed. In case it is a variable spread, ensure that you find out when the spreads are at their lowest and only trade during these times.

- Make sure that you are aware of any other hidden charges that the broker might levy. This might include overnight fees, inactivity fees, and deposit/withdrawal fees. Such small fees can actually add up and eat into your profits, thereby affecting the effectiveness of your trading strategies.

- Make sure that you’re not trading with higher leverage than what you are comfortable with. The main thing that you need to remember is that the higher the leverage that you use, the lower your risk of margin and the higher your losses will be if the trade turns against you. Therefore, you should only use leverage if you’re comfortable with that degree of risk.

- Combine both technical and fundamental analysis. For you to be a successful trader, it is important to be proficient in either technical or fundamental analysis. However, whichever strategy you choose in order to trade, it is important for you to be aware of the other side as well. For example, if you primarily trade on technical analysis, you should still know about major events and macroeconomic announcements that might affect currency prices. Knowing both sides of the trading world is important for you to maximise your chances of success in the forex markets.

How to Start Trading With the Lowest Spread Forex Broker

Step 1: Register to the forex broker

Go to the XTB website and create a personal account. You will be asked to provide your personal details and to comply with the identity verification procedure in accordance with the regulations in force.

Step 2: Identity Authentication

In order to verify your identity, XTB will ask you to provide a document with your personal details. You can include a copy of your identity card, passport or driving licence.

Step 3: Upload Funds to Your Account

Once your account verification has been successfully completed, you are free to add funds to your XTB account. You can choose from a variety of methods, including credit/debit cards, bank transfers or online payment services such as PayPal.

Step 4: Explore the platform

Once you’ve funded your account, you can start exploring the platform to better understand how it works and familiarise yourself before you start trading. You can also explore assets and track market data in real time.

Step 5: Choose a currency

Select the specific asset you wish to trade. offers a wide range of assets including stocks, cryptocurrencies, indices, commodities and more.

Step 6: Start trading

To initiate a trade, select the “Trade” button and determine the amount you wish to invest, the optional stop-loss and take-profit thresholds and the level of leverage, if any.

Step 8: Validate the trade

Before confirming the transaction, we recommend that you carefully review the details of the transaction, including the potential profit/loss and associated risk.

75% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

Trading forex using a low spread broker gives you access to among the biggest capital markets in the world. Having low spreads enables you to trade while paying minimal fees which could be advantageous for some traders. While there are several low spread forex brokers in the UK, and different brokers are suitable for different needs, not all platforms will provide the tools needed to make informed trading decisions.

In this guide, we have taken a look at several low spread forex brokers that are suitable for UK traders. Each platform offers educational tools and resources as well as charting tools, customer support and mobile capabilities. Conduct your own research before making a decision as to which broker to use.

FAQs

Which is the lowest spread forex broker?

According to our research, the lowest spread forex broker is XTB which offers spreads from 0 pips on pro trading accounts. On the standard account, the minimum spread is just 0.9 pips.

Which forex currency has the lowest spread?

EUR/USD is the lowest spread forex pair followed by USD/JPY and GBP/USD.

Is a low spread good in forex?

Low spreads indicate that volatility is low and liquidity is high which are both good signs for forex traders. Low volatility reduces the risk of entering a trade and makes it easier to conduct analysis. High liquidity means that it is possible to buy contracts without affecting the market.

References:

“https://www.forex.in.rs/forex-trading-statistics/?utm_content=cmp-true”

“https://www.wallstreetmojo.com/all-courses/”

“https://corporatefinanceinstitute.com/resources/wealth-management/financial-instrument/”

“https://www.youtube.com/watch?v=FyCbKDUhBJM”Nishit Kumar Finance Writer and Analyst

View all posts by Nishit KumarNishit is a NGL Trader Analyst at Akari Trading. He has also worked as an analyst for Morgan Stanley and Onyx Commodities.

Before starting his career in finance, Nishit studied at the University of Warick where he was an active member of the Hedge Fund society. Due to his qualifications and experience, Nishit is considered an industry expert and enjoys writing content that could help traders to make informed decisions.

As well as writing, Nishit worked as Associate Editor for The Economic Transcript until 2021. He has also written for Newsweek and has good knowledge of current events that could affect the financial markets.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

A popular trading platform for stocks, currencies, and commodities that accepts a variety of assets is called XTB Broker in Europe. The platform has been accessible for more than 15 years and has more than 400,000 subscribers globally.

A popular trading platform for stocks, currencies, and commodities that accepts a variety of assets is called XTB Broker in Europe. The platform has been accessible for more than 15 years and has more than 400,000 subscribers globally.