8 Best Day Trading Platforms UK in February 2026

Day trading is a popular trading strategy that involves taking advantage of the minute-to-minute fluctuations in the financial markets. Implementing this trading strategy requires a robust trading platform that offers the tools that are needed to facilitate short-term trading.

Traders need a dedicated trading platform that offers access to a variety of markets, real-time research tools, and advanced technical analysis features.

In this guide, we’ll help you find a day trading platform in the UK for 2026 by comparing 8 options.

-

- 1. XTB – Day trading platform in the UK with over 2000 assets

- 2. AvaTrade – Reputable broker for forex day trading with 24/7 customer support

- 3. Pepperstone – Day trade over 1200 instruments on a regulated platform

- 4. FP Markets – CFD day trading broker with a wide range of instruments available

- 5. Trade Nation – User-friendly platform with regulated day trading signals

- 6. Admiral Markets – Day trading broker for MT4 and MT5

-

- 1. XTB – Day trading platform in the UK with over 2000 assets

- 2. AvaTrade – Reputable broker for forex day trading with 24/7 customer support

- 3. Pepperstone – Day trade over 1200 instruments on a regulated platform

- 4. FP Markets – CFD day trading broker with a wide range of instruments available

- 5. Trade Nation – User-friendly platform with regulated day trading signals

- 6. Admiral Markets – Day trading broker for MT4 and MT5

Best Platforms for Day Trading in the UK

There are dozens of day trading platforms to choose from in the UK, but it’s essential to get the right one for your trading style if you want to turn a profit. So, we reviewed five day trading platforms in the UK in 2026:

- XTB – Day trade over 2000 different assets with leverage of up to 30:1. Users can conduct advanced analysis on the xStation5 charting tool that is available on both desktop and mobile devices. XTB supports the trading of stocks and forex CFDs.

- AvaTrade – An FCA regulated platform that is available on mobile and desktop. AvaTrade users can trade forex, stocks, cryptocurrencies, CFDs and indices. The platform also offers 24/7 support via email, phone, and live chat. AvaTrade is compatible with MT4, MT5 and AvaGo trading platforms.

- Pepperstone – Trade over 1200 instruments across a variety of trading platforms, including MT4, MT5, and cTrader. Users can access 24/5 customer service and can trade on mobile or desktop. Pepperstone supports the trading of forex, cryptocurrencies, CFDs and commodities.

- FP Markets – UK trading platform with low fees and competitive exchange rates. Traders can access a wide range of financial markets and trade with low spreads.

- Trade Nation – Trade on a user-friendly platform that is available on mobile and desktop. Trade Nation offers 0 commissions and low-cost fixed spreads. Users can trade forex, indicies, commodities and bonds.

- Admiral Markets – Trade with up to £10,000 fund protection. Admiral’s offers CFDs, forex, ETFs, indicies, commodities, bonds and cryptocurrencies. The platform also supports fractional trading and is compatible with Meta Trader charting tools.

What is Day Trading?

Day Trading is a popular method of trading in the financial markets where traders buy and sell financial instruments within the same trading day. The main goal of day trading is to make quick profits by taking advantage of small price movements in stocks, currencies, options, or futures contracts. This form of trading requires skill, strategy, and constant monitoring of market trends.

One key aspect of day trading is leverage trading which allows traders to increase the size of their position, even when trading with a small amount of capital. With leverage, traders can potentially amplify their profits, but they also carry a higher risk of incurring significant losses. Therefore, it is crucial for day traders to have a solid understanding of risk management and to set strict stop-loss orders for managing potential losses.

Day trading requires traders to have a clear plan and strategy before entering any trade. They analyze charts, use technical indicators, and monitor market news to identify potential trading opportunities. Day traders often use short-term trading techniques such as scalping, where they make multiple trades within minutes or hours, or momentum trading, where they capitalize on the momentum of a stock’s price movement.

Investors who intend to day trade need to permanently keep in touch with current market news and events that may affect the pricing of the assets they are willing to trade. It is also important for investors to have a clearly defined strategy and a risk management plan.

Day trading can be rewarding, but it also involves a high level of risk – according to this study, 64% of trades lost money and only 36% realized profit in the last year. Investors have to confront a large scale of obstacles, including:

- market volatility

- liquidity

- competition

- fees and taxes.

What Are The Best Markets for Day Trading in the UK?

There are plenty of markets to choose from for day trading in the UK, including stocks, forex, commodities, indices, and cryptocurrencies. Investors have to acknowledge that some of the factors that influence a market’s suitability for day trading are liquidity, volatility, regulations, and trading hours.

Forex

The Forex market, also known as the foreign exchange market, is one of the most popular markets for day trading. With its high liquidity and constant fluctuations in currency values, it provides traders with ample opportunities to make profits on a daily basis. The Forex market operates 24 hours a day, 5 days a week. This means that traders have the flexibility to trade at any time that suits them, whether it’s early in the morning or late at night. Unlike other markets that have specific trading hours, the fact that Forex is always open ensures that day traders can take advantage of the market’s movements whenever they occur.

Stocks

Going further in our research, another suitable market for day trading is the stocks market. Stocks are one of the most popular and diverse markets for day trading, with thousands of companies listed on different markets around the world. It is the market in where investors are trading with companies shares. Stocks have high liquidity and volatility, especially during earnings seasons and market trends. Stocks can be traded at specific hours, it all depends on the stock exchange they are listed on, in the UK they are mainly listed on the London Stock Exchange (LSE).

Cryptocurrencies

Cryptocurrencies are a popular choice for day traders who also want to gain exposure to the DeFi space. Cryptocurrencies are considered to have high liquidity and volatility, especially when there are market cycles and events. Cryptocurrencies are open 24/7, which offers a lot of flexibility for day traders. Cryptocurrencies are less regulated than other markets, which offers more freedom but also more risk for day traders.

Day Trading Platforms in the UK February 2026 Reviewed

Day trading is a complex strategy that involves the use of advanced charting tools and indicators. Therefore choosing a suitable platform is paramount to seeing results. In the following section, we take a closer look at 7 reputable day trading platforms that you could consider in the UK.

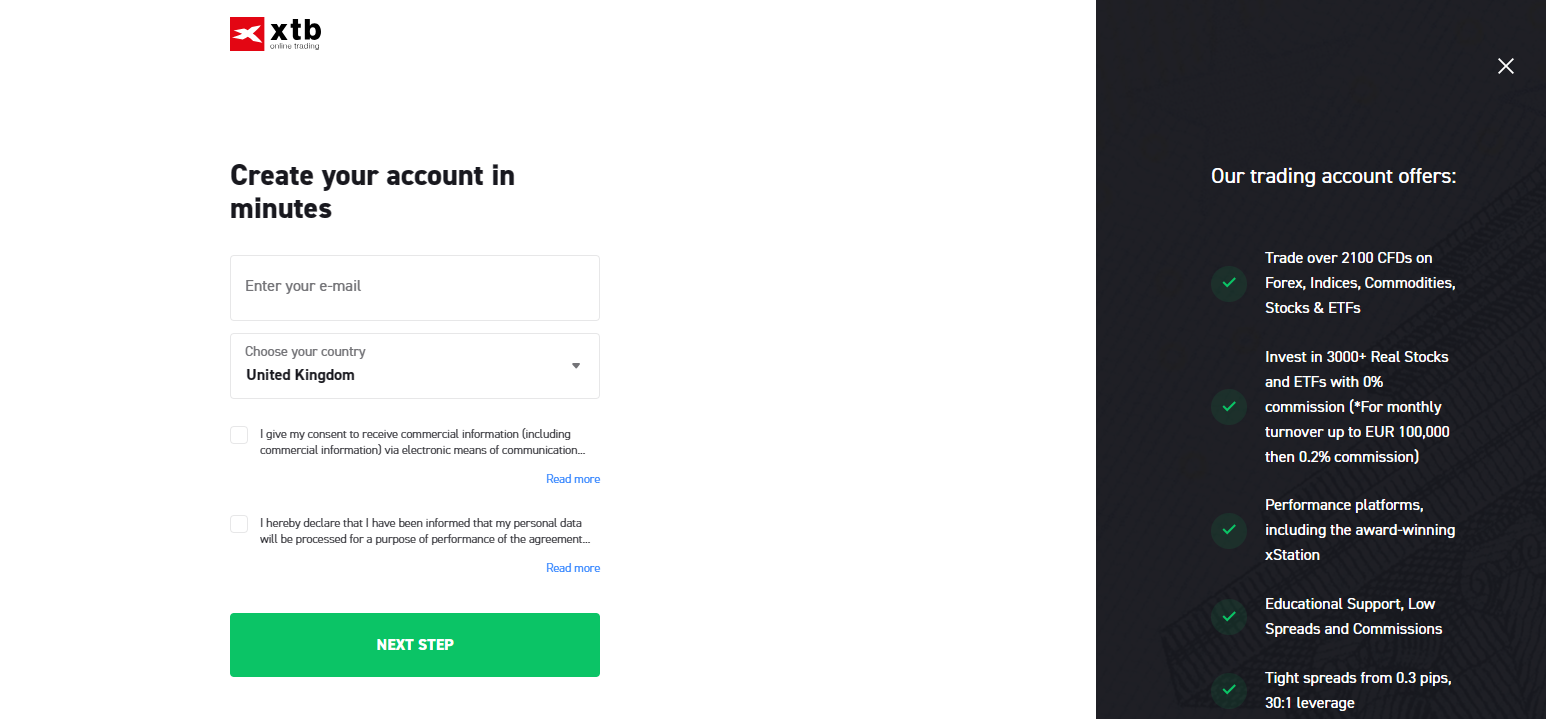

1. XTB – Day trading platform in the UK with over 2000 assets

To support a disverse trading strategy, UK day trading platforms should provide a range of assets to trade. For this reason, XTB takes the next spot on our day trading software in the UK list. Considering that the site has over 2000 different assets to choose from, there are always plenty of opportunities for traders to take advantage of.

If you are looking for a trading platform that can minimize your costs, whether it is the inherent costs of placing a trade or avoiding being burdened with additional costs such as wire fees, then XTB is what you are looking for. Furthermore, as a UK resident, it is possible to take advantage of XTB’s maximum leverage of up to 30:1.

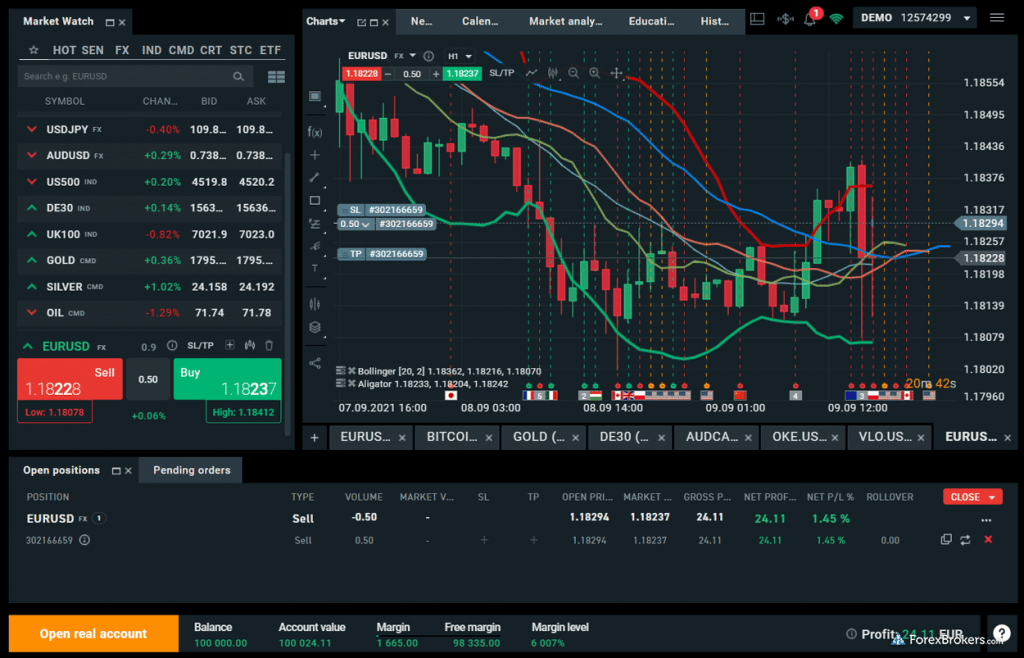

XTB’s proprietary trading software is called xStation 5, the company’s flagship product. It’s an extremely powerful piece of software with a well-designed interface. Besides supporting various instruments, the system provides fast order execution speed. The order book and the charts are available on the same tab as they follow the typical format of an order book.

Using the xStation platform offered by the broker, users can plot patterns on charts using various tools. This makes it possible for users to identify trends and plot patterns on charts. Regarding the technical indicators, XTB performs equally well compared to other trading platforms since it incorporates 39 indicators, including the most widely used indicators such as RSI.

Moreover, XStation offers a mobile platform called xStation Mobile. This platform has most of the same wonderful features as the desktop platform that is available to traders on their mobile devices.

With XTB, traders are able to choose from a wide range of payment methods. A wide variety of e-wallets, as well as bank transfers and credit and debit cards, are supported by the service.

Furthermore, there is no minimum deposit requirement on XTB which means that users can start with as little as £1. Aside from this, XTB does not have any fees associated with deposits, which means that it is a cost-effective broker.

75% of retail investor accounts lose money when trading CFDs with this provider.

2. AvaTrade – Reputable broker for forex day trading with 24/7 customer support

Launched in 2006, AvaTrade has grown into a significant global presence with offices in 11 countries. The company offers a variety of trading platforms accessible via the web, desktop and mobile devices.

AvaTrade is a trusted name worldwide, recognised for its diverse range of trading platforms for Forex and CFD traders, as well as its outstanding educational resources. AvaTrade’s mission is to enable people to invest and trade with confidence in an innovative and secure environment where they receive the highest quality, personalised service.

With total trading volume now exceeding $70 billion per month, AvaTrade stands out in the online trading landscape for its user-centric perspective coupled with strong financial stability. In addition, AvaTrade provides its users with multi-lingual, 24/7 customer support, a wide range of platforms and services, and a trading environment suitable for all levels, from beginner to advanced. The platform’s portfolio covers a full range of trading instruments, including stocks, commodities, cryptocurrencies and indices.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

3. Pepperstone – Day trade over 1200 instruments on a regulated platform

Pepperstone is known as a trusted broker with a global reputation, proved by positive reviews on Trustpilot. Besides this, Pepperstone stands out for its competitive gross spreads, fast trading and order execution, security through strict regulatory compliance and segregation of client funds.

Since their launch in 2010, they have facilitated access to global financial markets and experienced exponential growth. Today, more than 400,000 traders around the world use their platform. This significant expansion is indicative of the trust and popularity they enjoy with the global trading community.

Traders have access to an extensive range of over 1,200 instruments across all asset classes and can take advantage of three powerful platforms, all available free of charge: TradingView, MetaTrader 4 & 5 and cTrader. This provides flexibility and options to tailor the trading experience to each trader’s individual needs. Pepperstone also offers full account control through a secure and protected client area. Its 24/5 customer service is available around the clock, ensuring that clients can receive support and guidance at any time of the day or week.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

4. FP Markets – CFD day trading broker with a wide range of instruments available

FP Markets is a well-respected online forex and CFD broker known for its comprehensive trading solutions and customer-focused approach. Since its establishment in 2005, FP Markets has earned a reputation for offering a wide range of trading instruments, including forex, indices, commodities, and cryptocurrencies, catering to diverse trading preferences.

One of the standout features of FP Markets is its competitive pricing with tight spreads, enabling traders to maximize their profits. The broker supports various trading platforms, such as MetaTrader 4, MetaTrader 5, and IRESS, allowing traders to choose the platform that best matches their trading style and needs.

FP Markets places a strong emphasis on education and resources, providing traders with access to a wealth of educational materials, webinars, and market analysis. This commitment to trader education helps both beginners and experienced traders enhance their trading skills and make informed decisions.

The customer support at FP Markets is highly responsive and available 24/5, ensuring traders receive prompt assistance whenever needed. Additionally, the broker is regulated by top-tier authorities like ASIC and CySEC, providing traders with a sense of security and trust.

In summary, FP Markets is a reliable and versatile broker, offering a robust trading environment supported by competitive pricing, excellent educational resources, and top-notch customer service.

There is no guarantee that you will make any profits with this provider. Your money is at risk.

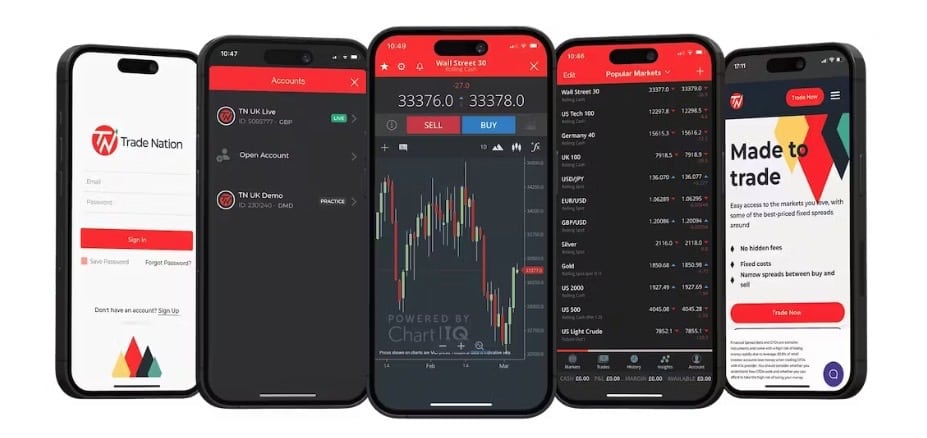

5. Trade Nation – User-friendly platform with regulated day trading signals

Established in 2014, Trade Nation has quickly built a solid reputation in the trading world. The company has rapidly built a name based on well-deserved recognition for its low-cost spreads. Trade Nation is deeply committed to promoting transparency and respect for clients and benefits from regulation by highly respected global financial governance bodies.

Trade Nation might be the right choice for both beginner and advanced traders who want to minimise trading costs and have access to advanced tools for developing trading strategies. The platform features an easy-to-use interface and a full range of tools, making it suitable for traders who want to become more informed and aware of market trends.

One of the distinct advantages of trading with Trade Nation is its fixed spreads, which are offered at the competitive price across a variety of markets. Unlike variable spreads, which can fluctuate rapidly, fixed spreads provide transparency and consistency in terms of trading costs. This allows traders to have clarity on their trading costs. Trade Nation also offers the advantage of zero commissions and eliminates any hidden fees, ensuring a transparent and efficient trading experience.

77% of retail investor accounts lose money when trading CFDs with this provider.

6. Admiral Markets – Day trading broker for MT4 and MT5

Admiral Markets is a state-of-the-art platform that first launched in 2001 and has continued to grow ever since, offering advanced trading solutions and an outstanding investment ecosystem. The company has now changed its name to Admirals, claiming that the rebrand marks the continued evolution of the platform.

One of the key points when it comes to security is that Admirals offers its clients access to robust and varied financial security policies. Client funds are always accessible and are held in segregated accounts with the most reputable and secure banks, separate from company capital. Admiral’s offers additional fund cover of up to €100,000 in order to provide additional protection for its clients.

Admirals offers users a wide range of trading and investment options, including an variety of financial instruments. These include stocks and ETFs, forex pairs, index CFDs, commodities, bonds and cryptocurrencies. With Admirals, users can also trade shares in fractions, allowing them to invest in top stocks at a more affordable cost.

They can also take advantage of smart and customised tools that ensure an exceptional trading experience. Users also have access to the renowned MetaTrader 5 and MetaTrader 4 platforms, which are used by traders and investors around the world to manage their portfolios.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Our Review Process: How We Tried, Tested and Reviewed UK Day Trading Platforms

The purpose of this article is to provide readers with an overview of day trading platforms that are available in the UK. To provide an accurate and transparent review, our team of experts spent time testing and meticulously reviewing different day trading options. We use a mixture of first-hand experience, online resources and user testimonials to gather the information required. We established suitable platforms by following the criteria below.

- Charting tools: Day traders use charting tools to conduct technical analysis, spot patterns and understand market conditions. Therefore, it is pivital that day trading platform provides users with these tools. We looked for platforms that support a variety of charting tools including MT4, MT5, cTrader, Trading View and others.

- Automated trading systems: Efficient day trading requires traders to be watching the market 24/7, which is difficult for traders who wish to day trade part time. Automated trading systems are a solution to this. Automated tools place trades on behalf of traders, according to pre-determined guidelines. Using a platform that offers these tools could be advantageous.

- Low trading fees: Day traders typically place multiple trades per day so it is helpful to use a platform that offers low trading fees. Instead, these platforms usually charge spreads, which are easier to handle as a day trader.

- Demo trading account: To test a new platform, it is helpful to have a demo account option. Day trading platforms that provide demo accounts are popular amongst traders who wish to test new strategies and tools.

- UK regulation: Regulated day trading platforms provide traders with a layer of protection. In the UK, the regulatory body is the Financial Conduct Authority (FCA). Some day trading platforms are regulated by bodies from other countries instead. Trading apps should be transparent about regulation and provide relevant certificates to support their regulated status.

- Leverage trading: Trading with leverage allows day traders to increase their stake, which can be one way to increase potential profits. However, trading with leverage could also increase the loss. Day traders use leverage to take advantage of small price fluctuations, without losing out on profits.

We used this criterion to establish suitable day trading platforms for UK traders. After carefully review the options available, we found 8 day trading platforms in the UK that could be worth considering.

Top Tips for Finding The Best Day Trading Platform in 2026

In this guide, we have taken a look at 7 potential day trading platforms that you could consider. However, you must conduct your own research and reviews before making any final decisions.

Even though the above brokers stood out at promising options to our editors, your experience with the platforms may be different. Therefore, it is helpful to know how you can go about researching different day trading brokers before finding the best one for you.

Speak with an advisor

First and foremost, it is a good idea to consult a financial advisor before embarking on day trading in the UK. An advisor will be able to assess your experience, goals and strategy and use their expertize to find a platform that meets your needs.

Financial advisors are registered professionals who understand what to look for in a trading platform.

Use a demo account

One you have found a selection of platforms to consider, you should use a demo trading account to practice using the software without putting any real funds at risk. Most reputable day trading platforms should provide a paper trading account that is free to use and offers access to the entire application. Before using a demo account, check that it is free to use and has no usage limits.

Diversify your trading

To thoroughly test a platform with a demo account, it is a good idea to diversify your trading strategy and explore multiple functions and features. This will give you a comprehensive understanding of how the platform works. Day traders regularly adjust their strategies to account for changing market conditions. You should try to emulate this in the demo trader so that you can be sure that the platform can facilitate day trading.

How To Manage Risk When Day Trading in the UK

Day trading is a trading method that involves buying and selling financial instruments like stocks, forex, commodities, indices, or cryptocurrencies on the same day. However, day trading also involves high levels of risk due to the volatile and unpredictable nature of the market. To manage risk, day traders in the UK should plan their trades, use stop-losses and limit orders, control leverage, educate themselves, and regularly review their performance.

Planning involves having a clear understanding of entry and exit points, profit and loss targets, and the risk-reward ratio. A trading plan should outline goals, strategies, and rules to avoid emotional and impulsive decisions that can lead to losses.

Using stop-losses and limit orders can help lock in profits and cut losses. Controlling leverage, which involves using borrowed funds to increase exposure to an asset, is crucial to avoid amplifying profits and reducing losses.

Educating oneself about markets, assets, and trading tools is essential for making informed decisions. Staying updated with the latest news and events can also help investors make informed decisions.

Reviewing one’s performance regularly and keeping a trading journal can help improve skills and avoid repeating mistakes. By following these strategies, day traders can effectively manage their risk and protect their capital in the UK market.

How to Get Started with a Day Trading Platform in the UK

It is important to follow the right steps when signing up for a day trading platform in the UK to avoid unnecessary fees or admin. Here is a guide on how to sign up for a day trading platform in the UK in 2026.

Step 1: Open an Account

The first step to trading is to register a new account at a regulated broker.

Create a new account using your email or by signing in with Google or Facebook. Most platforms will ask for further details either during the initial registration or once the account has been created.

Step 2: Verify Your Identity

Upload a copy of a government-issued ID like your driver’s license or passport and a proof of address like a recent utility bill or financial statement. Make sure that the photo is clear and that the ID is 100% visible.

Step 3: Deposit Funds

Next, deposit funds into your new account. If you choose to pay using a bank account, the minimum deposit required may be higher.

Step 4: Start Day Trading

From your account dashboard, search for the instrument you want to buy – stocks, ETFs, forex, indices, commodities, bonds, or cryptocurrencies.

Once you find the asset you want to trade, click ‘Trade’ to open an order form. Enter how much money you want to trade with – remember that this is priced in USD for US-based markets.

If you’re trading CFDs, also select how much leverage to apply to your trade. Then enter a stop loss level and take profit level to manage your trading risk.

When your trade is ready, click ‘Open Trade’ to execute your first day trade.

Final Thoughts

Finding the right online trading platform for day traders is critical to turning a profit from short-term trading. Active traders have to consider a lot of different features and keep an eye on their trading strategy when picking which platform to use. Signing up for a day trading account requires a few steps in the UK but is accessible to retail investors.

In this article, we have taken a look at 8 day trading platforms that are available to UK traders. Before making a decision, it is important to conduct thorough research of your own and use a demo trader to practice trading without putting funds at risk.

75% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

How much money do I need to start day trading?

The minimum amount you need to start day trading is just your broker’s minimum deposit. However, it’s an idea to set aside at least £500 to start day trading.

How do I day trade with a demo account?

Most day trading platforms offer a free demo account, although you may need to sign up in order to access it. Traders can day trade with the simulation without risking real money and reset the account as frequently as you wish.

What platform do most day traders use?

During our research, we found that the most popular day trading platforms in the UK are XTB, AvaTrade, Trade Nation, and Pepperstone. These brokers all offer advanced charting tools, fast execution speeds and tight spreads which are suitable conditions for day trading.

Can I day trade mutual funds?

You cannot day trade mutual funds. These funds typically settle transactions and update prices once per day, so there is no way to trade on price fluctuations throughout the day. However, you can day trade ETFs.

How do I day trade Bitcoin in the UK?

The UK recently banned CFD trading on Bitcoin and other cryptocurrencies.

Is day trading legal in the UK?

Yes day trading is legal in the UK. However, traders should stay up to date with regulations to make sure that they are compliant with current law.

References:

- https://www.avatrade.co.uk/about-avatrade#:~:text=In%20total%2C%20our%20clients%20complete,billion%20per%20month%2C%20and%20growing.

- https://uk.trustpilot.com/review/pepperstone.com

- https://www.ig.com/uk/trading-platforms/metatrader-4/what-is-mt4-how-to-use-it

- https://www.dnsassociates.co.uk/blog/taxes-on-day-trading-definition-and-profits-to-made

- https://www.daytradetheworld.com/trading-blog/day-trading-in-the-uk/

Alan Lewis Senior Editor

Alan Lewis Senior Editor

View all posts by Alan LewisAlan is Head of Content at TradingPlatforms.com and also contributes as a writer specializing in stocks and cryptocurrency trading. Alan earned an MA in English Literature from the University of Sussex in 2017. Since then, he has used his exceptional writing skills to create and edit content in the finance space for several reputable platforms.

Before working at TradingPlatforms, Alan worked as a content writer for IvoryResearch.com and Seven Star Digital. He is a skilled writer who is able to cover complex topics in a way that is easy to understand.

As well as creating content, Alan actively invests in the financial markets. This helps him to create insightful and actionable content and provides him with first-hand experience with many of the platforms that are covered by TradingPlatforms.com.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

To support a disverse trading strategy, UK day trading platforms should provide a range of assets to trade. For this reason,

To support a disverse trading strategy, UK day trading platforms should provide a range of assets to trade. For this reason,

FP Markets is a well-respected online forex and CFD broker known for its comprehensive trading solutions and customer-focused approach. Since its establishment in 2005, FP Markets has earned a reputation for offering a wide range of trading instruments, including forex, indices, commodities, and cryptocurrencies, catering to diverse trading preferences.

FP Markets is a well-respected online forex and CFD broker known for its comprehensive trading solutions and customer-focused approach. Since its establishment in 2005, FP Markets has earned a reputation for offering a wide range of trading instruments, including forex, indices, commodities, and cryptocurrencies, catering to diverse trading preferences.