Libertex España- Revisión y opiniones de la plataforma de trading 2026

Are you interested in CFD derivatives trading and want to know the Libertex review? Are you interested in speculating on the underlying prices of assets such as currencies, commodities, cryptocurrencies, ETFs, and more? If so, Libertex is a name you should memorize. This Libertex review, with its pros and cons, aims to address the broker’s highlights.

Among other aspects, we’ll conduct a comprehensive analysis of Libertex reviews, evaluating the opinions of users and experts. Nothing beats the testimony of clients and people familiar with these platforms to help you find out if this broker is the best fit for your needs.

By the end of this article, we’ll have covered all of Libertex’s essential features, from its fees and commissions to the payment methods it supports and the trading platforms it uses. Our Libertex review aims to be useful, educational, and informative, in line with the goals that TradingPlatforms pursues.

85% of retail investor accounts lose money when trading CFDs with this provider.

What is Libertex?

Libertex serves clients from over 100 countries, ranging from casual traders to active and experienced investors, and provides access to over 250 different financial instruments. Unlike most of its competitors, Libertex keeps its product offering as simple and streamlined as possible.

After all, this CFD broker focuses primarily on assets with the highest trading volume. This includes a wide range of stocks, cryptocurrencies, indices, ETFs, and more.

Working with leverage allows you to gain much greater exposure to the financial market you’re trading in compared to the total amount you deposited to open the position.

Libertex allows retail clients in Spain to invest with leverage of up to 1:30. This means that an account balance of €1,000 can give you access to €30,000 in trading capital. Professional traders, meanwhile, have access to a maximum leverage of up to 1:500.

IMPORTANT: Always keep in mind that leveraged CFD derivatives maximize both potential profits and losses.

Regarding the available investment platforms , Libertex offers two options. First, we have Libertex’s proprietary web platform, ideal for beginner traders looking for an easy-to-use online trading tool without any complex or advanced technical features.

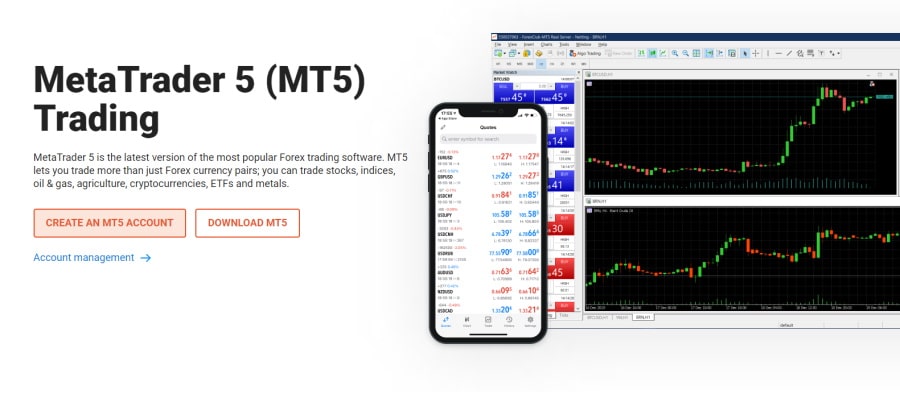

On the other hand, advanced investors with extensive trading experience can take advantage of technical indicators, fully customizable charts, drawing tools, and automated robo-advisory services through the popular MetaTrader platform.

85% of retail investor accounts lose money when trading CFDs with this provider.

Libertex Review: Pros and Cons of the Broker

Libertex reviews include, among other things, a summary of the broker’s advantages and disadvantages . To fully complete our analysis of Libertex reviews, we’ll separate the pros and cons into the following columns:

What we like

What we don’t like

85% of retail investor accounts lose money when trading CFDs with this provider.

What can you trade on Libertex?

First of all, you should keep in mind that trading with Libertex opinions is nothing like traditional investments, as you don’t actually own the underlying asset. However, with CFD derivatives trading, you speculate on the underlying price of an asset, such as currencies, stocks, ETFs, options, and others.

As we’ve already mentioned, a contract for difference, commonly known as a CFD, is a type of financial derivative that allows you to trade on market price movements without owning the underlying instrument.

CFD trading has several added advantages, such as the ability to go long or short. This means that if you predict the price of the underlying asset will rise, you buy, and if you think the price will fall, you sell.

Secondly, leveraged CFD trading allows you to gain full market exposure for a small initial deposit, which, in financial terms, is called margin. Simply put, to gain full market exposure, you only need to deposit a portion of the cost of the position as margin.

Trading Forex with CFDs

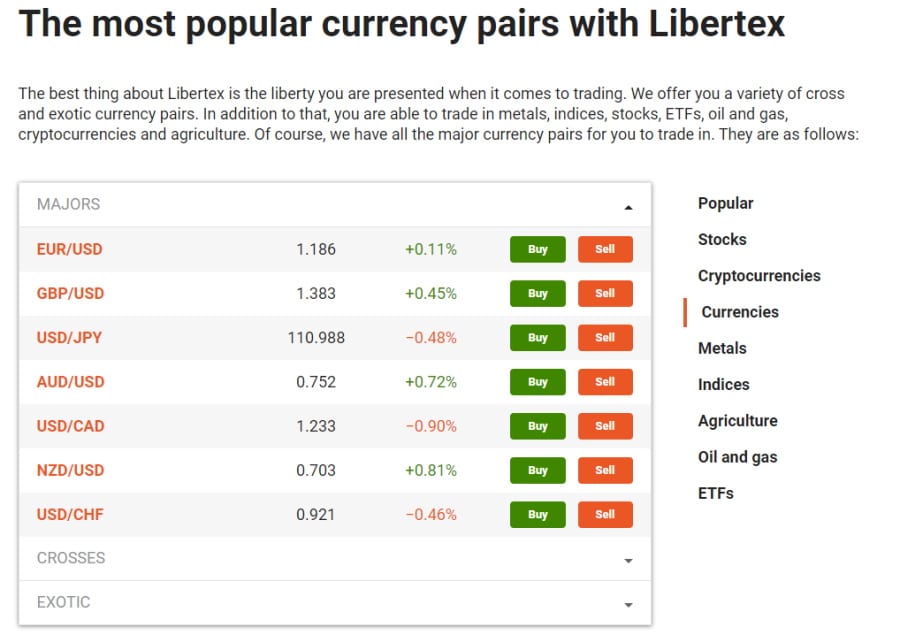

Libertex is a popular choice among forex traders, especially because this CFD trading platform supports a wide selection of major, minor, and exotic currency pairs, such as:

- EUR/USD

- EUR/AUD

- GBP/JPY

- USD/CAD

- NZD/USD

- USD/CHF

- USD/JPY

- USD/ZAR

The minimum trading volume per trade for all currency pairs is €20, and you can trade with leverage of up to 1:30 and 1:20, depending on the currency pair you choose.

Additionally, you can connect your Libertex live trading platform account to MetaTrader 4 or MetaTrader 5. MT5 is a multi-asset trading platform that provides in-depth market functionality and is powered by MetaQuotes. To learn more about the pros and cons of MT4 vs. MT5 , we invite you to read our comparative review.

Crypto CFD Trading

First, since January 6, 2021, the FCA has passed new legislation that means cryptocurrency instruments are not available to retail traders in Spain.

Professional traders have access to a wide range of cryptocurrencies, from Bitcoin to crypto-to-crypto pairs. This means you can buy Dogecoin (DOGE/USD) and other digital assets with 0% commission.

Another advantage of cryptocurrency trading is that you don’t acquire ownership of the underlying digital asset. This means you speculate on the market price and don’t have to worry about storing cryptocurrency in a wallet.

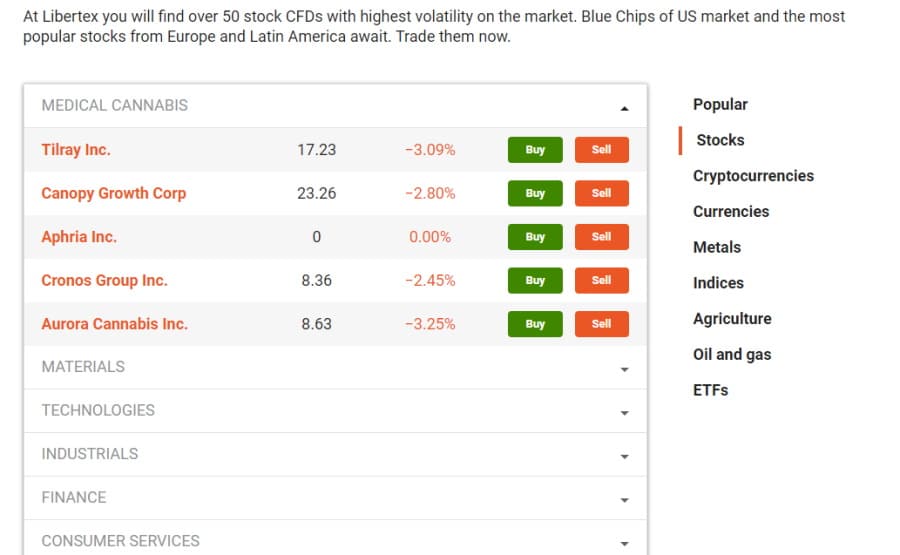

Trading CFDs on stocks

With a Libertex trading account, you’ll find over 50 stock CFDs with the highest volatility and liquidity on the market. These include blue-chip stocks from US stock exchanges and key stocks from companies listed on European and Latin American markets.

As we’ve already mentioned, when you trade stock CFDs, you don’t buy actual shares. Instead, you gain speculative exposure to the underlying stock market, as you try to predict whether the stock price will rise or fall.

For example, on Libertex reviews, you can trade Apple (APPL) stock with leverage of up to 1:5 and a commission of -0.207%. You can also receive 0.2200 dividends per share. This means that if you have a long position, the capital will be credited to your account, and conversely, if you have a short position, the money will be debited.

Además, puedes navegar por toda la oferta de CFDs de acciones o puedes seleccionar acciones en función de su correspondiente sector e industria. Estos incluyen:

- CANNABIS MEDICINAL

- MATERIALES

- TECNOLOGÍAS

- INDUSTRIALES

- FINANZAS

- SERVICIOS AL CONSUMIDOR

- LUJO

- TELECOMUNICACIONES

- BIENES DE CONSUMO

- ENERGÍA

- SANIDAD

- INDUSTRIAS DEL AUTOMÓVIL

Comercio de materias primas en CFDs

Libertex también admite el comercio de materias primas, lo que significa que puedes exponerte a tres ramas clave del comercio de commodities: metales, agricultura y petróleo y gas. Veamos una lista completa de los tipos de CFD sobre materias primas a los que puedes acceder en esta plataforma de negociación de CFD y divisas.

- Metales – Cobre, Paladio, Platino, Plata, Oro.

- Petróleo y gas – Petróleo Brent, Petróleo Brent Cash, Petróleo Dulce Ligero, Petróleo para calefacción, Gas Natural Henry Hub, Petróleo WTI.

- Agricultura – Cacao, café, maíz, soja, azúcar y trigo.

En lo que respecta a las comisiones de negociación, éstas varían en función del activo subyacente, pero generalmente se sitúan entre el 0,0 % y el 0,516 %.

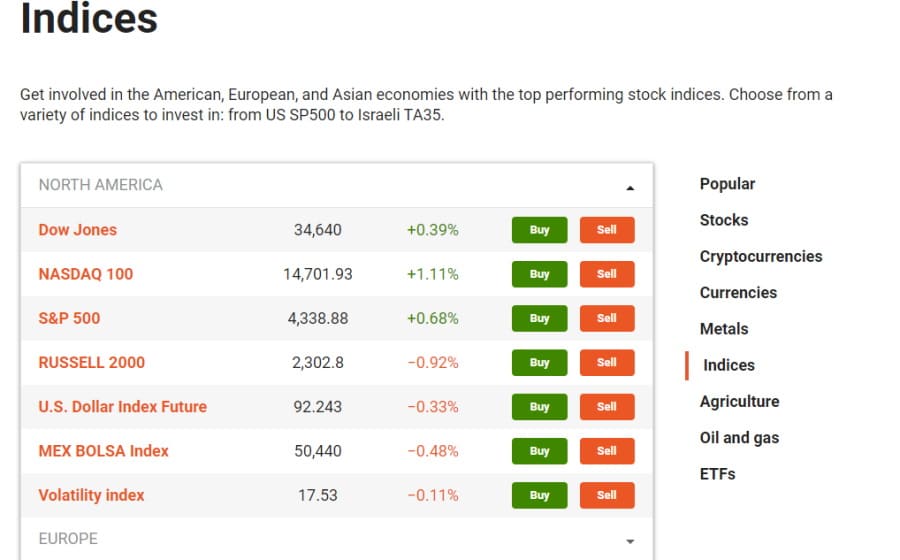

Comercio de índices bursátiles en CFDs

Los índices funcionan como una medida de los movimientos de precios de una cesta de acciones de una bolsa de valores, como la Bolsa de Madrid. Por ejemplo, el índice FTSE 100 es una medida de la evolución de los precios de las 100 principales empresas que componen la LSE. La negociación de índices ofrece a los inversores una exposición total a la economía o al sector de un país, con una sola operación.

Como con todos los CFD, puedes especular con la subida o la bajada del precio del índice sin poseer el activo subyacente. Los índices son populares entre los operadores, ya que son un mercado muy líquido para comprar y vender. Los mercados de índices bursátiles suelen tener un horario de negociación más largo en comparación con otros mercados, lo que significa que puedes estar más expuesto a oportunidades de negociación únicas cuando surjan.

Con esto en mente, Libertex opiniones cubre los mercados europeos, estadounidenses y asiáticos con los índices bursátiles más populares. Puedes elegir entre una amplia gama de índices como:

- S&P 500: mide el rendimiento de las 500 empresas estadounidenses de mayor capitalización

- NASDAQ 100: sigue el valor de las 100 mayores empresas estadounidenses no financieras

- DAX – mide la evolución de los precios de los 30 principales valores que cotizan en la Bolsa de Frankfurt

- Índice Hang Seng: controla la evolución de los precios de las principales empresas que cotizan en la Bolsa de Hong Kong

- Nikkei 225: sigue el valor de las 225 principales empresas de la Bolsa de Tokio

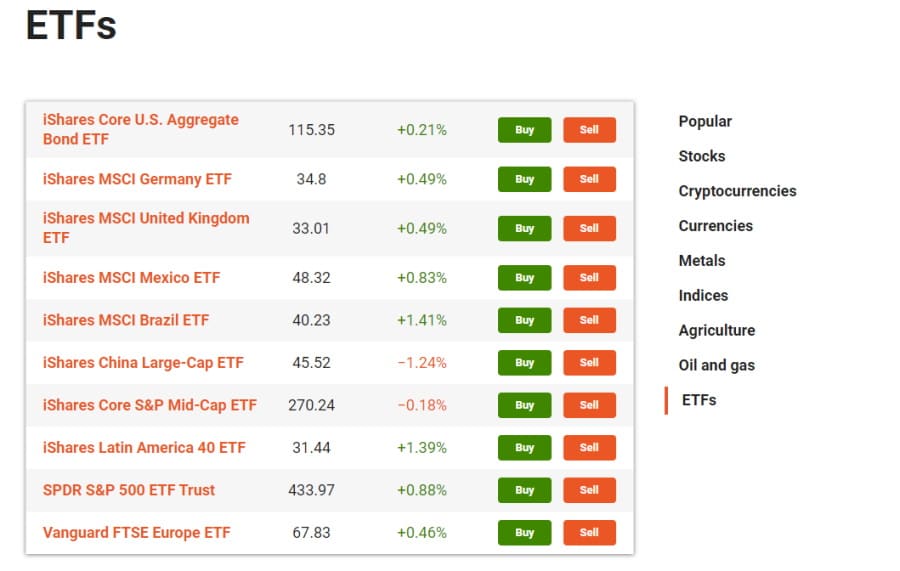

CFDs de ETFs

Trading ETFs with derivatives is an effective way to gain exposure to short-term price movements within specific markets and industries. When you trade an ETF through CFDs and spreads, you can take advantage of leverage, which Libertex reviews cap at 1:5, to gain full exposure to the ETF, while only having to deposit a portion of the total trade value to open a position.

This deposit is called margin, and while it reduces the amount needed to open a position, it also maximizes potential losses. This is because CFD profits and losses are calculated on the total trade size, not the initial deposit.

In Libertex reviews you can access the following ETFs with commissions as low as -0.08%:

- iShares Core US Aggregate Bond ETF

- iShares MSCI Germany ETF

- iShares MSCI United Kingdom ETF

- iShares MSCI Mexico ETF

- iShares MSCI Brazil ETF

- iShares China Large-Cap

- iShares Core S&P Mid-Cap ETF

- iShares Latin America 40 ETF

- SPDR S&P 500 ETF Trust

- Vanguard FTSE Europe ETF

CFD Options

Simply put, options trading is divided into two key types: puts and calls. In CFD trading, the buyer of a call option anticipates or speculates that the price of the underlying asset will rise, while the buyer of a put option predicts that the price will fall.

Buying and selling options CFDs typically provides greater exposure than other trading instruments. As a result, traders and investors can open larger positions at a lower cost. For example, with leverage of up to 1:10, for every €1,000 you deposit, you can trade options CFDs worth up to €10,000.

That said, Libertex offers the following options CFDs with leverage up to 1:5 and a 0.0% commission:

- Bitcoin

- Brent Oil

- DAX

- S&P 500

- Gold (XAU/USD)

85% of retail investor accounts lose money when trading CFDs with this provider.

Libertex Fees and Commissions

We continue our analysis of Libertex reviews by discussing the various commissions and fees we’ll find on the platform.

CFD trading with zero spreads

The most striking thing about Libertex reviews about commissions is that you don’t have to pay the spread. This is unique among CFD brokers, as spreads are usually charged when commissions start at 0%. In other words, the spread is the difference between the buy and sell price of an asset.

This means that if the spread is 0.5%, you’ll need to make a minimum profit of 0.5% to break even. This zero-spread offer is good news for your potential trading profits.

Commission charges

As a result of zero spreads when trading CFDs on Libertex, the free trading platform charges a commission when you trade on the platform. The commission ranges from 0% to 1.623% depending on the underlying asset. All commissions can be found on the CFD specifications page or in the trading terminal when you click on an asset.

For example, when it comes to forex trading, if you wanted to trade the EUR/USD currency pair, you would have to pay a commission of 0.011% and could use leverage of up to 1:20.

Most CFD and forex trading platforms offer commission-free trading, but this comes with spreads. Libertex, on the other hand, facilitates zero-spread trading, while some instruments, such as options CFDs, can be traded commission-free and with a zero spread .

Non-commercial rates

The overnight financing fee , also known as the swap fee, is a charge incurred for keeping your position open beyond standard trading hours. CFD derivatives are leveraged financial instruments that attract interest. For example, the swap buy fee and swap sell fee for leaving trades open overnight for Apple stock CFDs are 0.0302% and 0.0254%.

If the Client Account is inactive for 180 calendar days (i.e., no trades, open positions, withdrawals, or deposits), the Company reserves the right to charge a monthly account maintenance fee of €10. (Applicable only to clients with a total account balance of less than €5,000.)

85% of retail investor accounts lose money when trading CFDs with this provider.

Libertex User Experience

Within the analysis of Libertex reviews , we must evaluate the user experience. Libertex reviews agree that if you are a beginner trader with little or no trading experience, this is a good broker to choose. You can trade CFD derivatives through Libertex’s web and mobile trading platforms, or you can use the MetaTrader 4 and MetaTrader 5 platforms .

For example, the account opening process is streamlined, making funding your account very easy. From the Libertex web trading platform, you can browse financial instruments based on the following criteria:

- Popularity

- Hot

- Indexes

- Options

- Above, the ascent

- Falling Superior

- Maximum volatility (1 day)

- Tendency to rebellion 30d

- Downward trend 30d

- Basic products

- Oil and gas

- Metals

- Actions

- Coins

- ETFs

You can also create a favorites list. You can also manually search for the tradable asset you want using the search bar at the top of the trading terminal.

With its user-friendly and intuitive interface, Libertex makes online trading much simpler, as all you have to do is click on your preferred asset, specify the trade amount and leverage, place an order type such as Stop Loss or Take Profit, and click buy or sell to execute the trade.

Overall, Libertex offers a user-friendly trading platform and website for both beginners and more advanced investors.

85% of retail investor accounts lose money when trading CFDs with this provider.

Libertex Features, Charts, and Analysis

Graphic

As we’ve already mentioned, Libertex gives you access to its own trading platform, as well as MetaTrader 4 and MetaTrader 5.

Advanced traders and experienced investors will be very familiar with the MetaTrader suite and the plethora of trading tools and instruments available. MetaTrader is a third-party trading platform created by MetaQuotes Software Corp. that can be linked to your Libertex trading account. Both MT4 and MT5 offer fully customizable trading terminals, as well as automated Forex robot services. MT4 and MT5 are compatible with iOS and Apple devices, and you can download the trading software to your computer.

Charts, features, and analytics on the Libertex web trading platform

The Libertex investment platform is easy to use, and you can start trading your favorite assets with just one click.

As for the charts, you can fully customize each chart by selecting bars, candles, hollow candles, line, area, and Heiken Ashi charts. You can set the time interval between 1 second and 1 month.

When it comes to technical indicators, there are over 40 to use, and they fall into three categories:

- Trend: such as Aroon, Choppiness Index, Ichimoku Cloud, MACD, Mass Index, Moving Average, Exponential Moving Average, Weighted Moving Average, Parabolic SAR, Price Oscillator, Triple EMA, Williams Alligator, ZigZag, Arnaud Legoux Moving Average, Coppock Curve, Directional Movement Index, Double Exponential Moving Average, Engulfing, Hull MA, Least Squares Moving Average, and more.

- Oscillators: such as the Awesome Oscillator, Balance of Power, Stochastic RSI, Williams %R, True Strength Indicator, and many more.

- Volatility : Includes Bollinger Bands, Bollinger Band Width, Donchian Channels, Keltner Channels, Relative Volatility Index, and Chande Kroll Stop.

You can also compare different assets on the same chart by clicking the compare button at the top of the screen and entering the asset you want to compare. You can also use various drawing tools to customize the charts to suit your trading needs and objectives.

Libertex charts are ideal for beginner traders, as each chart features trader sentiment in the top right corner and an Open Trade Position button so you can execute trades without having to switch tabs or close the chart window.

Libertex traders can also identify unique trading opportunities through trading signals from the top-rated third-party provider, Trading Central.

85% of retail investor accounts lose money when trading CFDs with this provider.

Libertex Account Types

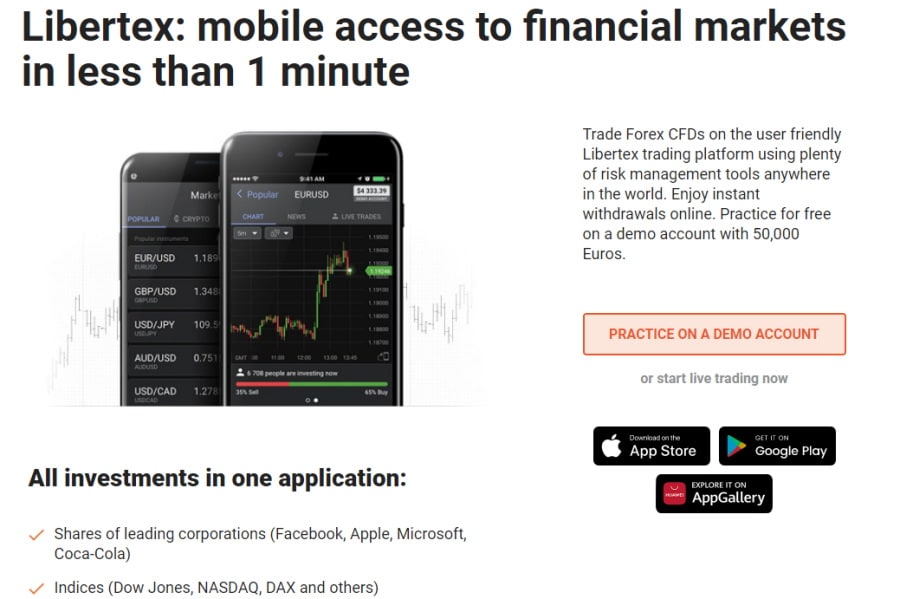

Libertex offers a live trading account and a demo account with a virtual account balance of 50,000 euros.

Demo accounts are perfect for new traders to practice online trading and familiarize themselves with the trading platform in a risk-free simulated environment that mimics live market conditions.

You can switch from a real account to a demo account by simply tapping the demo or real account buttons in the top right corner of the trading platform.

Libertex mobile app reviews

As is typical among today’s trading platforms, Libertex has a comprehensive mobile trading app that is compatible with Apple and Android mobile devices. This means you can buy and sell CFD derivatives with zero spreads and locate the best trading opportunities from your smartphone or tablet.

You can also download the MT4 or MT5 mobile trading app and log in with your Libertex account details.

The mobile trading platform mirrors the same functionality you find on web-based trading platforms, in that you can trade financial instruments, manage your portfolio, and access charts and forex signals from your mobile device.

Alerts and notifications in the Libertex app reviews

Another useful and convenient feature is that you can set price alerts and notifications through the MT4 and MT5 mobile trading apps. This means you’ll never miss a single trading opportunity. Stock and forex trading strategies can be more flexible, while reacting to these key events can be much faster, as the MetaTrader platforms offer the ability to use investment alerts.

You can set alerts to notify you of key trading events, so you don’t miss out on opportune moments. Price alerts eliminate the need to spend countless hours monitoring price movements, as the trading platform will notify you in real time via email or a notification on your mobile device. You might also be interested in eToro reviews .

85% of retail investor accounts lose money when trading CFDs with this provider.

Libertex Payments reviews

Libertex supports a wide range of payment methods, including credit cards, debit cards, PayPal, SEPA/International bank transfers, Skrill, Neteller, and others. There are no deposit fees, and your funds are credited to your account instantly, except for bank transfers, which take 3-5 days.

When it comes to withdrawals, options include PayPal and Skrill, which carry no withdrawal fees, while credit/debit card, SEPA bank transfer, and Neteller withdrawals carry a small withdrawal fee.

Here’s a complete list of available options, along with their respective fees and processing times:

| Deposit payment method | Fee | Process time |

| PayPal | None | Instantly |

| Credit/Debit Card | None | Instantly |

| Sofort | None | Instantly |

| ideal | None | Instantly |

| SEPA/International Bank Wire | None | 3-5 days |

| giropay | None | Instantly |

| Skrill | None | Instantly |

| Trust in | None | Instantly |

| Multibanco | None | Instantly |

| Przelewy24 | None | Instantly |

| Fast transfer | None | Instantly |

| teleentry | None | Instantly |

| Neteller | None | Instantly |

Withdrawal methods

| Withdrawal method | Fee | Processing time |

| PayPal | No | Instant |

| Credit/debit card | €1 | 1-5 days |

| SEPA/International Bank Wire | 0.5% min €2, max €10 | 3-5 days |

| Skrill | No | In 24 hours |

| Neteller | 1% | In 24 hours |

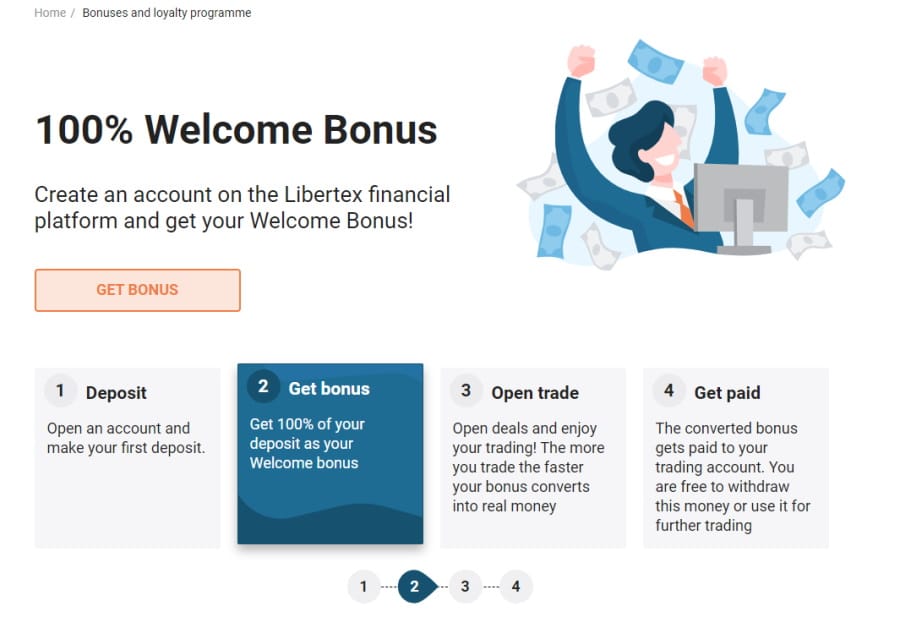

Libertex 100% Welcome Bonus

By opening a Libertex account and depositing a minimum of 100 euros, you can receive a welcome bonus of up to 10,000 euros.

To qualify for the welcome bonus, you must complete the registration process and fund your account with an initial deposit of at least €100. According to Libertex, the welcome bonus rules state that you can recover 10% of all trading commissions paid as a bonus, which is converted into real capital. The broker then pays the converted bonus directly into your trading account in 2% installments. You are then required to execute sufficient trading volume to convert the entire bonus within 90 days.

85% of retail investor accounts lose money when trading CFDs with this provider.

Libertex Contact and Customer Service

You can contact Libertex customer service via live chat, email, phone, WhatsApp, and Facebook Messenger.

Additionally, you can find a helpful FAQ page, news, blog, education, CFD specification, and economic calendar under the Trading Information tab at the top of the libertex.com website.

When you click on the trading education page, you can learn the basics of online investing with a 3-hour trading course created by the award-winning Libertex Investment Academy.

Is Libertex safe?

The brokerage firm does not accept clients from or operate in any of the following countries, including Spain, the United States, Japan, Brazil, and the rest of the EU.

Libertex is a trading platform operated by Indication Investments Ltd., a Cypriot investment company regulated by CySEC (Cyprus Securities and Exchange Commission) with CIF license number 164/12.

On the other hand, Libertex Pty. is a South African financial services provider and is regulated and supervised by the Financial Sector Conduct Act (FSC) under FSP number 47381.

Setting up two-factor authentication on your live trading account is essential to protecting your funds on the Libertex trading platform. Libertex supports two 2FA options: text message and Google Authenticator.

Regarding the protection of client funds, CySEC regulations require brokers to keep all client funds in segregated bank accounts. Additionally, you are covered up to €20,000 by the investor protection plan in the event of Libertex entering into bankruptcy.

85% of retail investor accounts lose money when trading CFDs with this provider.

How to start trading with Libertex

To start using Libertex reviews, just follow these steps.

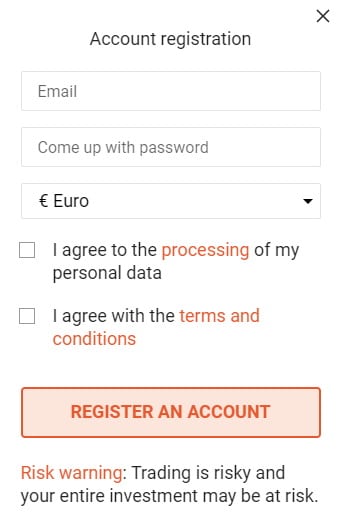

Step 1: Open a trading account

Go to the main website and click Register at the top of the screen. To register for a live trading account, you’ll need to enter your email address and password through the mobile app’s registration dialog, or through the web platform or website itself. You can also use your Facebook credentials to create a trading account .

Step 2: Deposit funds

After your initial deposit, you’ll be asked to upload documents for verification purposes, such as proof of identity and residency. Newly registered accounts typically take 3 business days to process.

Step 3: Demo Account

You can use the demo account before starting to trade with real money. It’s a useful way to get started in the world of trading and get used to using the platform properly. We recommend using the Libertex demo account!

Step 3: Start negotiating

To start trading, you can choose between the Libertex web trading platform or mobile trading app, as well as MT4 or MT5.

From the Libertex web platform, simply search for your preferred financial instrument and click on the buy or sell button. A trading window will open where you can specify the trade amount, the multiplier, and place take profit and stop loss orders with the click of a button.

Libertex Review – The Verdict

In short, if you’re new to online trading, Libertex is an ideal choice for anyone interested in CFD trading, with zero spreads and commissions as low as 0% on certain assets.

Overall, the Libertex platform is easy to use, and you can work your way up to a live trading account through the €50,000 demo account. So, to begin your online trading journey with a top-rated broker, simply click the link below and open a Libertex account today.

Libertex – The best CFD and Forex trading platform with zero spreads and low commissions

85% of retail investor accounts lose money when trading CFDs with this provider.

Frequently Asked Questions

What is Libertex?

Can I trade with leverage at Libertex?

Does Libertex support access to MetaTrader 4 and MetaTrader 5?

What is the account minimum at Libertex?

How much does it cost to trade with Libertex?