Cómo comprar Uniswap: Análisis UNI de 2026

The world of cryptocurrencies continues to grow and evolve, and with so many new developments, more and more people are interested in buying Uniswap (UNI). Buying Uniswap is becoming more and more common among users. Among so many innovations in an increasingly expanding and globalized world of cryptocurrencies, what we know as decentralized finance is also on the rise. One of the biggest interests of users who are already part of DeFi networks is buying Uniswap.

Uniswap, more than just a cryptocurrency with its UNI token, is actually a network and a decentralized DEX exchange that’s becoming increasingly talked about. In this article, you’ll learn everything you need to know about how to buy Uniswap and what this network really is, including all the details about its benefits and contributions to the cryptocurrency ecosystem.

[knock]

How to buy Uniswap (UNI) in five steps

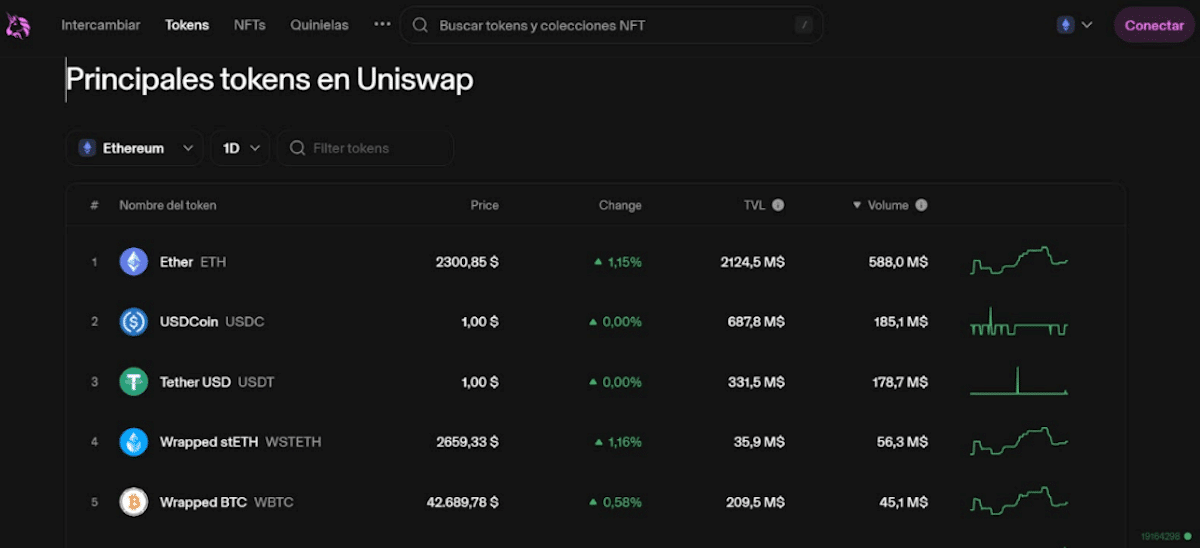

Las inversiones en criptomonedas pueden no ser apropiadas para los inversores minoristas y se puede perder la totalidad del capital invertido. Es importante leer y comprender los riesgos de esta inversión, que se explican en detalle en este enlace. Uniswap UNI is a highly significant decentralized platform in the year 2026, which uses a protocol based on the Ethereum network . It is community-governed, and some of the available features include concentrated liquidity and range orders, among others. More than just an exchange, it has become an efficient and fast trading tool through swaps . It was created by Hayden Adams in 2018 with the goal of simplifying automated trading , which has revolutionized the crypto market. The launch price of $UNI in 2020 was $3.4 USD. However, after a bull run to $44 USD in 2021, its price in 2022 did not exceed $12 USD . By 2023, the price of $UNI stabilized, bouncing around between $4 USD and $6 USD until the end of the year. Purchasing on Uniswap is much more intuitive than traditional transactions. With its own native token, $UNI , the platform has achieved a market capitalization of over $3.6 billion, allowing it to offer rewards and benefits to holders through liquidity pools . The entire Uniswap UNI ecosystem is based on swapping tokens compatible with the Ethereum, Polygon, Optimism , and other networks. It’s also important to note that it also allows for the trading of NFTs. This allows for efficient capitalization of these non-fungible tokens , available on the Marketplace. Uniswap’s evolution has allowed us to witness its various versions. Through this exchange, you can buy Uniswap and other cryptocurrencies and earn through fees , generate revenue from liquidity pools, or participate in the development of dApps . Uniswap works like any other decentralized broker , as it operates on a protocol, in this case, Ethereum. This means that in order to exchange for other cryptocurrencies, they must be compatible with this network . However, this exchange has managed to forge links with other networks such as Optimism and Polygon . To get an idea of the characteristics that define how $UNI works and why it’s one of the best cryptocurrencies to invest in , we’ll share some key aspects: Below, we share a table summarizing the most relevant aspects of Uniswap : $UNI is an ERC-20 token provided by Uniswap , which allows the platform to access sustained liquidity. The currency is subject to fluctuations and is compatible with the Ethereum network. It has currently been linked to other networks such as Arbitrum, BNB, Gnosis, and Polygon, among many others. Regarding the price of Uniswap UNI , we can say that although it is moving away from its historical highs, it shows a clear recovery compared to 2023. As of today, $UNI is trading at $6.15 USD, with an increase of 1.56% in the last 24 hours, according to data from CoinMarketCap. Purchasing Uniswap not only offers the opportunity to trade the token on the decentralized market, but also allows you to acquire NFTs . Additionally, it’s possible to earn a percentage of the return through the liquidity pools enabled on this platform. So, if you’re still not sure how to buy Uniswap , here are some projections : If you want to buy UNI , there are currently many online platforms where you can purchase cryptocurrencies . In the specific case of Uniswap, we recommend those that offer a variety of payment methods and no fees for purchasing the UNI token. Let’s take a look at a list of the best commission-free brokers where you can buy the UNI token: It’s very likely that at some point you’ll need to know how to use PayPal or credit cards on an exchange. It’s actually one of the most reliable digital wallets that allows you to pay online in EUR and USD . This online payment service will allow you to buy Uniswap from the official platform or through verified brokers . In this quick guide, we’ll share some recommendations on how to buy Uniswap using different payment methods. The first step you should consider before investing in Uniswap UNI with PayPal is to activate an account . To do this, you need to access the official website and complete the registration form . Once you complete this step, you can pay on exchanges like AvaTrade using the email address assigned to your PayPal account. PayPal fees in Spain are typically 2.90%, so you’ll need to keep this in mind when making your first deposit. Credit card use is common in Europe , and thanks to the global presence of Visa and Mastercard, processing is quite secure. If you want to link a credit card to the exchange, you must share the card number, cardholder name, expiration date, and security code. Very few brokers charge fees for credit or debit card deposits. After making your first deposit, you can invest in Uniswap UNI , and the tokens you purchase will be stored in your wallet . If you’re still unsure about how to buy Uniswap , this section will likely help clear up some of your questions. Knowing which online trading platforms allow you to buy Uniswap , with fair terms and secure policies , gives you greater confidence when making your first investment in the $UNI token . These are some of the exchanges reviewed by our team , whose features provide better performance when trading cryptocurrencies. One of the best options for purchasing Uniswap is AvaTrade , a Spanish-language broker that has been operating since 2006. Although it has significant relevance in the crypto market, you can also trade other instruments such as CFDs and Forex , expanding your opportunities to capitalize on different assets. With AvaTrade, you can enjoy the confidence of trading with low risk , as it’s an exchange regulated by Ireland and Australia. This allows you to invest real money in some of the most stable cryptocurrencies on the market , such as BTC and ETH. Its analytical tools , easy-to-use trading interface, and fast processing make AvaTrade a popular choice among Spanish users. It’s also worth noting that it accepts minimum deposits starting at $100 USD . Spreads for cryptocurrencies start at 0.15% , offering a fairly competitive environment for those seeking high profitability through crypto trading.

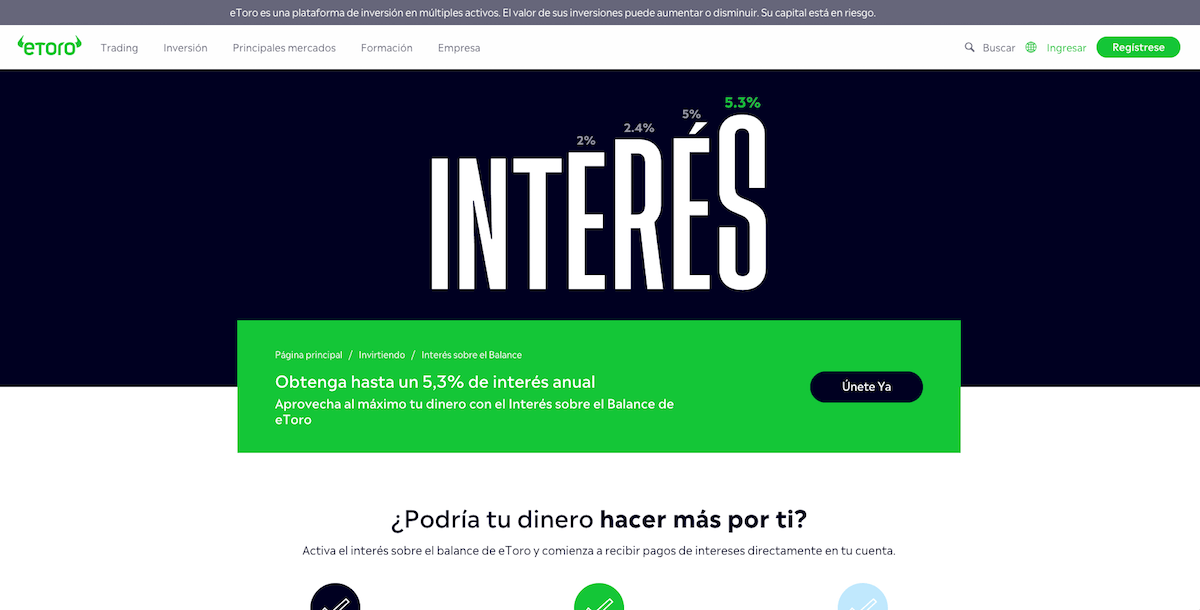

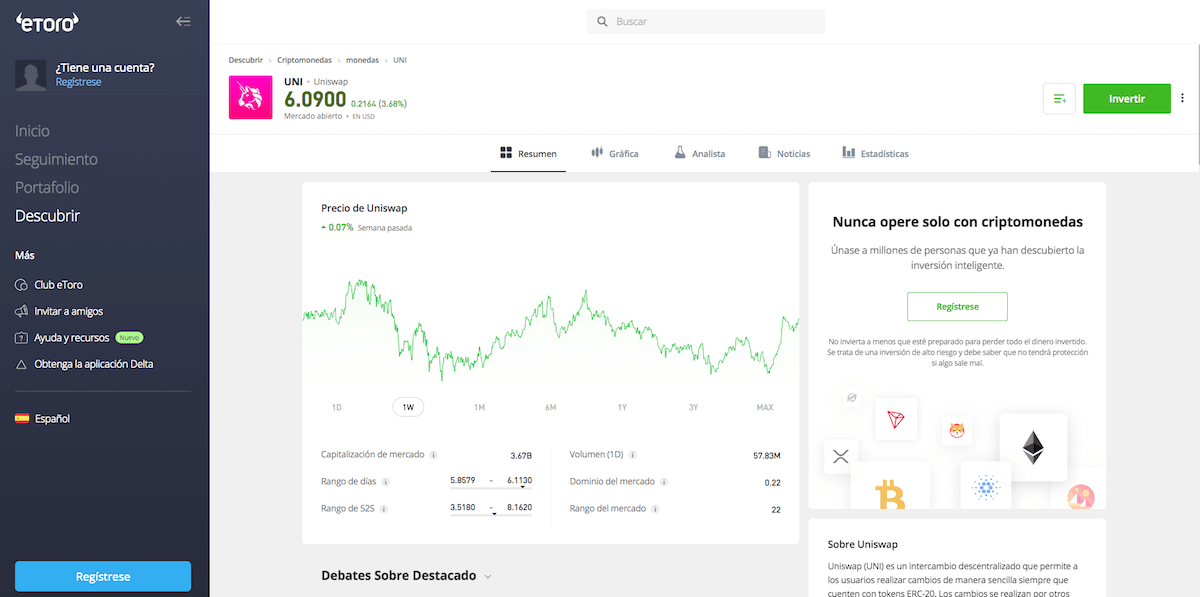

Los CFD son instrumentos complejos y conllevan un alto riesgo de posible pérdida rápida del capital debido a su apalancamiento. El 76% de las cuentas de los inversores minoristas pierden capital cuando operan CFD con este proveedor. Among the reliable platforms for purchasing Uniswap , eToro ranks high. It is a highly reputable broker in Spain , offering more than 80 cryptocurrencies to trade. Investing in Uniswap UNI from this platform is safe, as they comply with strict security protocols required by the UK financial authority. While spreads can sometimes be somewhat high, they are generally around 1% . Its mobile compatibility allows you to trade through its native iOS and Android app, allowing you to make Uniswap purchases from anywhere. It typically charges $5 USD for withdrawals , which can be one of the least appealing aspects of trading with eToro. You can fund your account with instruments such as credit cards. This way, you can focus on your investment strategy with very few obstacles , using the eToro wallet. The broker has been operating since 2007, which encourages the confidence of investing through this exchange.

Las inversiones en criptomonedas pueden no ser apropiadas para los inversores minoristas y se puede perder la totalidad del capital invertido. Es importante leer y comprender los riesgos de esta inversión, que se explican en detalle en este enlace. While there are many platforms where you can't buy Uniswap , such as XTB , this broker does allow trading with other stablecoins . In fact, it's a popular option for Spanish users to purchase cryptocurrencies with low spreads and good rates . The ability to deposit as little as $1 USD guarantees significant flexibility when investing. In addition to being regulated in the United Kingdom, this platform has strict security policies to protect your funds, reducing the risk of account vulnerability. XTB has over 20 years of experience in the financial sector . This gives it a wealth of experience, which can be seen in its trading software and analytical tools. It also has a native app that you can install on iOS and Android devices .

El 78% de las cuentas de inversores minoristas pierden dinero en la negociación de CFDs con este proveedor. Since its founding in 2017, OKX has positioned itself among the ideal exchanges for investing in emerging cryptocurrencies . The first thing you need to know is that it's regulated by the Seychelles authorities. This, in addition to guaranteeing absolute transparency in the way you operate, offers support for your finances . Of the modern exchanges, OKX is one of the most recommended, as you can buy Uniswap UNI with flexible terms. Compared to other platforms, it offers competitive fees and a focus on optimizing the trading experience for new users. Among the qualities that favor purchasing Uniswap from this exchange is the fact that it has a trading bot . Furthermore, its various real-time tracking tools will make it easier for you to buy Uniswap from a website designed to streamline your crypto exchanges as much as possible.

Below, we'll present a simple tutorial that will help you learn how to buy Uniswap. In just a few minutes, you'll have everything you need to start trading on your favorite platform. The first thing, before getting into the details of Uniswap, is to select the right platform that suits your needs. We've already seen the options our experts recommend for buying Uniswap (UNI). Choose the one that best suits your needs.

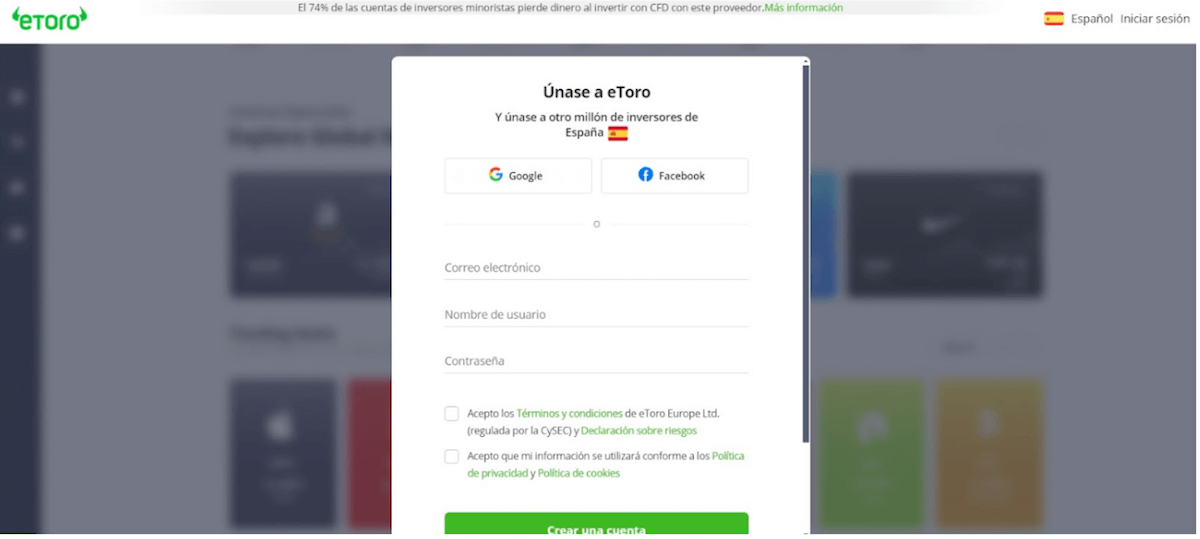

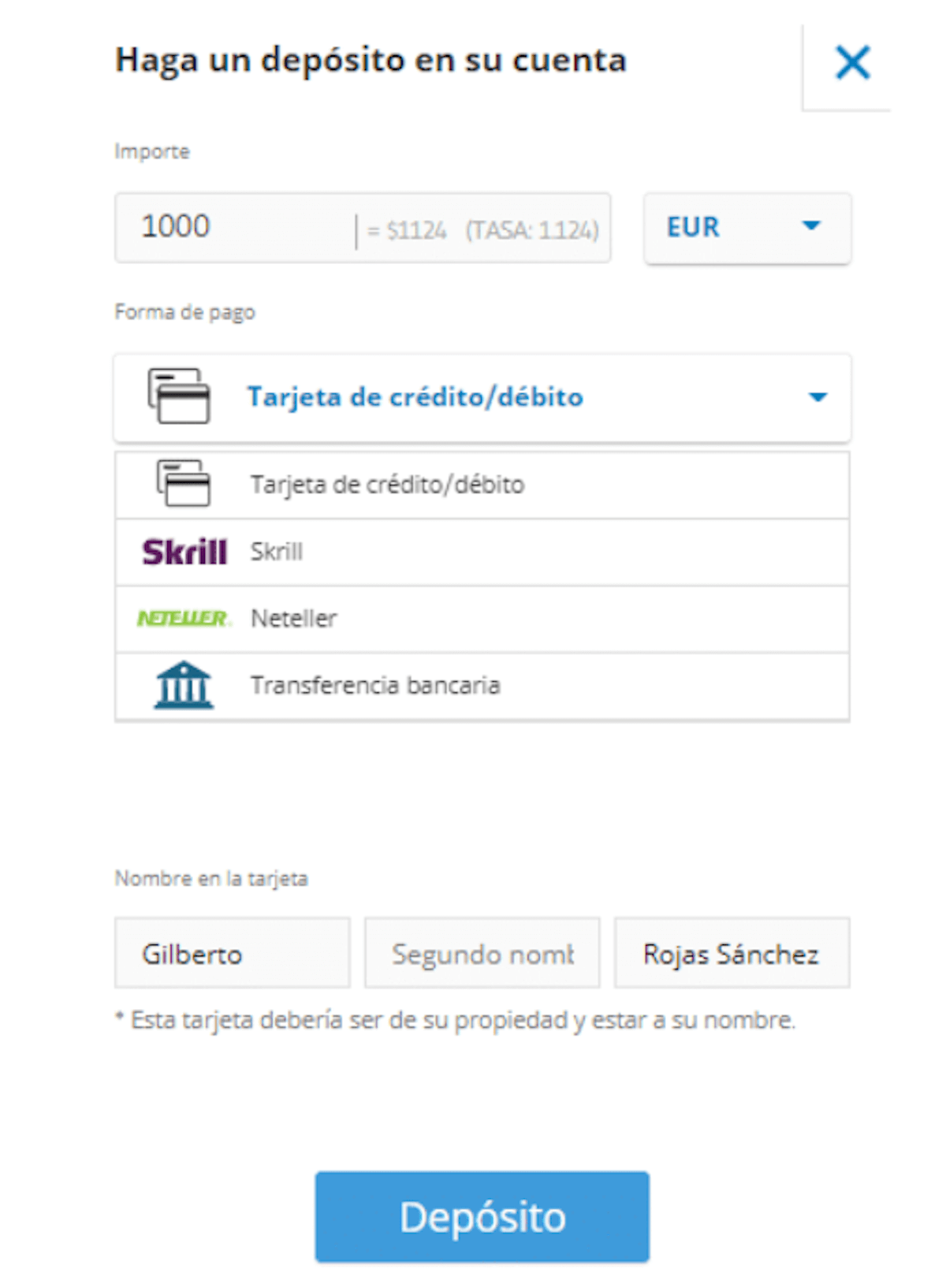

Las inversiones en criptomonedas pueden no ser apropiadas para los inversores minoristas y se puede perder la totalidad del capital invertido. Es importante leer y comprender los riesgos de esta inversión, que se explican en detalle en este enlace. Once you've chosen a broker, in this case eToro, all you have to do is register and create an account . To do this, you'll typically need to fill out a form that will ask for the following information: email address, phone number, username, and password. Once you've verified your account, you can make a deposit to start trading on eToro. You have several payment methods available on this platform: Skrill, bank card, wire transfer, etc. Here you can buy UNI directly . To do so, simply enter the name in the eToro search engine and then make your investment.

Las inversiones en criptomonedas pueden no ser apropiadas para los inversores minoristas y se puede perder la totalidad del capital invertido. Es importante leer y comprender los riesgos de esta inversión, que se explican en detalle en este enlace. The close of 2023 for the Uniswap UNI token represented the possibility of a bull run during the first month of 2024. The activity recorded around the Uniswap token was quite interesting, which stimulated Uniswap buying at levels not seen all year. In fact, at its peak, trading volume reached over $237 million . This led many to question whether it was a good idea to buy Uniswap at the time. Now that the first month of the year is over, things remain stable, and a consistent picture can be seen regarding $UNI . At the close of January, $UNI traded at around $6 USD. Although the trend has remained bearish for several days, there have been no massive liquidations. This shows that confidence in Uniswap remains at an adequate level , which could lead to an increase in its value in the coming months. There's little chance of the $UNI price dropping below $5 USD , as it has encountered strong resistance there. Forecasts for the current year indicate that this token's value could be between $10 USD and $15 USD . It even has the potential to break above this range and represent a pleasant surprise for investors. The truth is that today there are a huge number of users who own Uniswap. As you know, the UNI token distribution was carried out among thousands of users around the world. There are also celebrities who perhaps didn't receive the UNI token as part of that distribution, and that's why they support and invest in Uniswap . Below is a list of celebrities who in some way support the Uniswap project. The renowned bassist of the world-famous and iconic rock band KISS has publicly stated that he is willing to receive the value of said property in cryptocurrency. It's quite unusual for someone like Gene Simmons to decide to accept cryptocurrencies as a payment method for his property. It's also surprising that he mentions Uniswap as one of the few options that stands out as acceptable for the business. We say this because Gene Simmons isn't open to accepting all types of altcoins. The fact that Uniswap appears on Gene Simmons' list of options speaks volumes about this project and the appreciation for the protocol it offers. We're not going to talk specifically about the UNI token here, but rather about something that highlights the diversity that Uniswap offers. Currently, many digital artists have also marketed their NFTs through the Uniswap network, generating large sums of money. Seen from this perspective, Uniswap offers a lot in different areas, and this is proof that liquidity pools and AMMs aren't all that important. Uniswap also lends itself to creating a protocol where different projects can be developed and, as has been the case with some NFTs, become part of charitable projects. Whales are large cryptocurrency holders who begin accumulating tokens with a specific goal in mind. One of the tokens currently being accumulated by these well-known whales is Uniswap's UNI. Token accumulation by whales and large wallets always influences altcoin prices. This is currently happening with Uniswap, which is supporting it and accumulating tokens to positively influence its price. Since the Uniswap project launched, there has been a spike on the Polygon chain. At that time, 99.3% of Uniswap users voted in favor of bringing this V3 project to Polygon . Finally, to conclude with the different types of users who can support the Uniswap project, it's worth mentioning that there are also the so-called HODlers. These are users with extremely high purchasing power who decide to invest in a very large amount of a single token solely to implement the holding's strategy. In this way, they hold the crypto-asset, speculate on its price, wait for its value to increase dramatically in the market, and finally sell it. A holder could invest an estimated $23 per token, and perhaps in a few months, if the value rebounds, they could make profits of up to 100% in a matter of weeks. While the numbers are unknown, there is no doubt that Vitalik knows the great potential of Uniswap's native currency.

What is Uniswap?

How does Uniswap work?

Broker

Uniswap

Creator

Hayden Adams

Year of release

2018

Markets

Cryptos, NFTs

Compatible networks

Ethereum, Polygon, Optimism, Arbitrum, BNB, Gnosis, Avalanche, Fantom, Aurora, Base, Klaynt, zkSync.

Native token

$UNI

What is $UNI? The Uniswap token

How to Buy Uniswap (UNI): Best Brokers Compared

Platforms

Advantages

Commissions

AvaTrade

eToro

XTB

OKX

How to buy Uniswap with PayPal or credit/debit card?

🦄How to buy Uniswap UNI with PayPal

🦄How to buy Uniswap UNI with a credit/debit card

Best platforms to buy Uniswap analyzed

1. AvaTrade – The best alternative platform to buy $UNI

AvaTrade Pros:

Cons of AvaTrade:

2.eToro - A reliable exchange to invest in Uniswap tokens

eToro Pros:

Cons of eToro:

3.XTB - Our UNI traders' preferred broker

Pros of XTB:

Cons of XTB:

4.OKX - A reliable and modern platform for trading $UNI

Pros of OKX:

Cons of OKX:

How to buy Uniswap step by step in 2026?

Step 1: Choose a broker

Step 2: Register on the platform of your choice

Step 3: Deposit funds

Step 4: Buy UNI

Is it a good idea to buy Uniswap in 2026?

Who owns or has bought Uniswap (UNI) today?

Gene Simmons

NFT Artists

Cryptocurrency Whales

HODLers

Vitalik Buterin

What does Uniswap bring to the world of cryptocurrencies?

It's important to know that after the arrival of Uniswap UNI , many users were able to understand the usefulness of this protocol . Buying Uniswap doesn't just mean investing in a token , but rather becoming part of a strong, thriving decentralized community .

- It facilitates the exchange of ERC-20 tokens , since through Swaps, it does not require validations for transactions.

- Additionally, the way to buy Uniswap has been greatly improved , thanks to a scheme that has been adopted by other exchanges . This vision, by Hayden Adams , has allowed the entire crypto environment to evolve rapidly.

- The incorporation of automation is one of the benefits that have brought greater efficiency to trading.

- Fluidity is one of the most important factors when purchasing Uniswap . The volume of transactions that must be validated per second is crucial for a market to function.

- The Uniswap platform offers a fast and transparent alternative that allows for increased trading volume and a much more enjoyable and intuitive exchange experience for users.

- The importance given to users and the community maintains the spirit of autonomy for holders . This is precisely the message cryptocurrencies were created to convey: giving control to the user .

- $UNI perfectly defines the utility of crypto finance . Furthermore, by operating on the Ethereum network, low transaction fees guarantee higher returns for investors.

Conclusion

As you've seen, there are several alternatives for buying Uniswap. However, after reviewing all the details related to what's truly best for you, we believe the best platform is eToro.

Uniswap (UNI), more than just a token, is a protocol and, at the same time, a cryptocurrency exchange network. Investing or purchasing Uniswap is a very good idea despite the UNI token's current declining value.

Analysts themselves recommend buying it because the Uniswap price is expected to reach its all-time high again, and perhaps even surpass it by 2026.

Las inversiones en criptomonedas pueden no ser apropiadas para los inversores minoristas y se puede perder la totalidad del capital invertido. Es importante leer y comprender los riesgos de esta inversión, que se explican en detalle en este enlace.

Uniswap (UNI) FAQ

What is Uniswap?

Does Uniswap have anything to do with Ethereum?

Is it risky to invest in Uniswap?

Uniswap is an exchange that has strict privacy and access controls. The protection of funds is absolute, so the only risk related to the use of Uniswap is linked to the volatility of the crypto market.

What is a CEX broker?

What is a DEX broker?

This type of exchange allows users to operate in a decentralized environment, in which decisions are executed by a community.

Is it possible to stake with Uniswap (UNI)?[ /Q6] References: