A Guide To Forex Spread Betting in the UK 2026

If you’re based in the UK and looking to trade forex online – you might consider spread betting. In doing so, not only will you avoid paying any tax on your profits – but you can apply leverage of up to 1:30 on your positions.

If you’re new to Forex Spread Betting UK wise – this comprehensive guide covers everything you need to know.

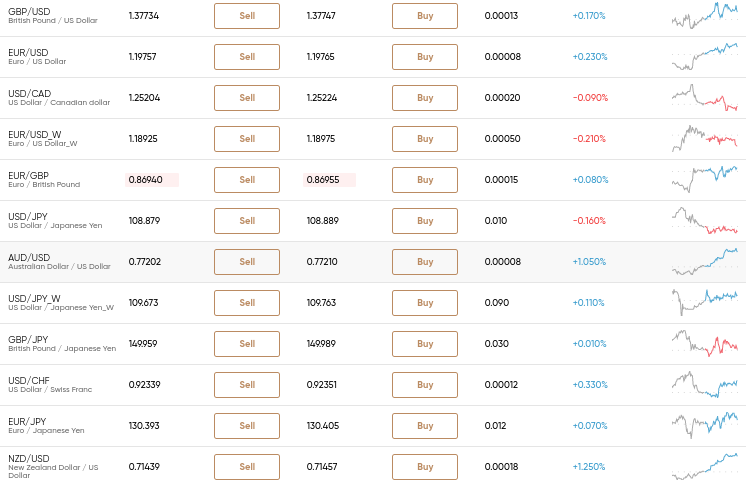

| [forex_table id=”81″ ] |

How to Start Forex Spread Betting UK

Before reading our guide in full – check out the basics of how to start forex spread betting UK from the comfort of your home.

- Step 1: You will first need to sign up with a forex spread betting UK platform that is regulated by the Financial Conduct Authority.

- Step 2: The minimum deposit to start spread betting at Pepperstone is just $200. You can fund your spread betting account instantly with a debit/credit card or e-wallet.

- Step 3: You can now search for the forex market that you wish to spread bet. For example, if you want to trade the British pound against the Canadian dollar – simply search for GBP/CAD.

- Step 4: Choose from a buy (long) or sell (short) order depending on whether you think the forex exchange rate will rise or fall.

- Step 5: Finally, enter your stake and confirm the spread betting position.

End to end, the above process should take you no more than 10 minutes to complete. Finally, the forex spread betting UK department at Pepperstone.

Forex Spread Betting Explained

Trillions of pounds worth of currencies change hands in the forex trading industry. This is why so many traders in the UK are turning to this lucrative investment scene.

However, spread betting forex UK does require some background knowledge of how things work – as you are putting your hard-earned capital into complex financial derivatives.

To ensure you enter the forex spread betting UK arena with your eyes wide open – make sure you read through the sections below.

What is Forex Spread Betting?

In its most basic form, spread betting forex is a form of online trading that allows you to speculate on the future value of currency pairs. For example, let’s suppose that you are trading the British pound against the Australian dollar. This pair – which is represented as GBP/AUD – is currently priced at 1.7830.

As a forex spread betting pro – your objective is to predict whether this exchange rate will rise or fall. If you speculate the market correctly – you will close the trade in profit. In this sense, spread betting is not too dissimilar to traditional forex trading. However, as we discuss in much more detail shortly – there are some clear differences.

For example, the forex spread betting UK markets move in ‘points’ as opposed to ‘pips’. Additionally, you also need to enter your stake in terms of pounds or pence per point movement.

For example:

- If you risk £3 per point on GBP/AUD and the pair moves from 1.7830 to 1.7840 – your profit or loss on this trade would be £30.

- This is because the pair moved by 10 points and you staked £3 on each point movement.

- Or, if EUR/USD moves from 1.1760 to 1.1790 and you staked 50p per point – this 30 point movement would result in a profit or loss of £15.

Although the overarching objective of forex, spread betting, and CFD trading are very similar (i.e predicting whether a pair will rise or fall in value) – there is a crucial difference when it comes to taxation. That is to say, in the UK – forex spread betting platforms allow you to avoid paying any capital gains or stamp duty tax. This is because spread betting is defined as ‘gambling’ by HMRC.

How Does Forex Spread Betting Work?

The section above provided you with the basics of how forex spread betting UK works. However, this financial trading arena is a tough cookie to crack – as most newbies end up losing money.

As such, we are now going to delve into the core characteristics of spread betting forex in much more detail.

Pairs and Ownership

First and foremost, it is important to remember that when you trade via a forex spread betting UK site – you do not own the underlying currencies. For example, if you’re trading USD/JPY – you are not buying or selling US dollars or Japanese yen.

On the contrary, you simply speculating on whether the forex pair in question will increase or decrease in value. As you do not own the underlying asset – this means that you won’t be liable for stamp duty tax. Straight away, this saves you 0.5% on all positions that you enter.

Stakes

When you trade currencies at a traditional forex broker – you will enter your total stake in pounds and pence. For example, you might decide to risk £200 on a GBP/USD buy order. Then, if the pair increases or decreases by 10% – you will either make or lose £20.

However, in the case of forex spread betting UK – you will stake an amount per point of movement. This essentially allows you to target uncapped financial returns. Of course, this is also the case with losses, too.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

In terms of minimum stakes, this will vary from broker to broker. With that said, some of the most popular forex spread betting UK platforms that we came across allow you to stake from just 10p per point. This ensures that spread betting is suitable for traders of all budget levels.

Points not Pips

As we mentioned earlier, traditional forex price movements are calculated in pips and in spread betting – this is in points. The fundamentals are, however, very similar.

For example:

- If you are using a traditional forex broker and EUR/GBP moves from 0.8610 to 0.8620 – that’s a price increase of 10 pips

- At a forex spread betting UK platform – this price movement would be represented as 10 points

However, when it comes to calculating profits and losses – there is a clear difference between spread betting and forex trading. This is because in spread betting – you are staking an amount per point movement.

Let’s look at a practical example of how this works when using a forex spread betting UK broker:

- You are trading USD/CHF – which is currently priced at 0.9670

- You think the exchange rate will decline – so you place a short position

- You stake £1.50 per point

- A couple of hours later – the exchange rate on USD/CHF drops to 0.9630

- That translates into a decline of 40 points

- On your stake of £1.50 per point – you make a profit of £60

Of course, had USD/CHF increased by 40 points – your short position would have resulted in a loss of £60. This is why you need to install a number of risk-management tools when forex spread betting UK – which we cover later.

Financial Markets Expire

Finally, it is important to note that spread betting forex UK markets will at some point in time expire. This is either on a daily or quarterly basis – depending on which market you prefer. If opting for the latter – this means that you can keep your forex position open for up to three months before it expires.

The former means that the market will expire on a same-day basis. Either way, if you still have a forex position open at the point of expiry – the spread betting broker will close it on your behalf. If you wish to remain in that particular marketplace – you will need to open a new position.

Spread Betting vs Forex Trading

We have loosely covered the difference between spread betting and forex trading in the sections above. However, in the name of clarity, check out the core similarities and differences below in bullet-point form.

- Pairs: Irrespective of whether you’re spread betting or forex trading – you will be speculating on the future value of currency pairs like EUR/GBP and USD/JPY.

- Price Movement: In forex trading, prices move in pips. In spread betting, this is stipulated in points.

- Stakes: When you enter a stake in forex trading – you specify the total amount you wish to risk (e.g. £100). In spread betting, you stake an amount per point.

- Ownership: You do not own the underlying asset when you engage in CFD forex trading or spread betting. Instead, you are looking to predict whether a currency pair will rise or fall.

- Trade Duration: In forex trading, you can keep your position open for as long as you wish. But, when using a spread betting site – markets come with an expiry date. This is usually on a daily or quarterly basis.

- Tax: Neither forex trading nor spread betting attract stamp duty tax. However, when trading forex in the traditional sense – all profits are liable for capital gains tax. In spread betting, there is no capital gains tax on any profits.

As you can see from the above, there are a lot of similarities between forex trading and spread betting. Perhaps the most pertinent difference is that the latter allows you to trade forex in a 100% tax-free environment.

Advantages of Forex Spread Betting

We would argue that if you are interested in trading currencies from the comfort of your home – spread betting is a popular way to trade in that way.

Below we unravel the main advantages of forex spread betting UK for your consideration.

Forex Spread Betting Tax

When you trade at a conventional forex or CFD trading platform – all profits that you make throughout the year will be liable for capital gains tax. The amount you pay will depend on a variety of factors – such as how much you make and what tax band you are on.

For example, if you are a higher tax rate payer – this stands at 20%. Fortunately, this can be avoided in its entirety by using a forex spread betting UK platform. In doing so, each and every pound of profit that you make is yours to keep. Crucially, this is because spread betting profits are viewed as gambling winnings in the UK – which are exempt from tax.

This is mainly because of the previously mentioned expiry date system using in spread betting. That is to say, because there is always an end date on spread betting markets (like in gambling) – this allows the sector to remain free of capital gains tax. Additionally, there is no stamp duty tax payable when using a forex spread betting UK site.

Trade on Margin

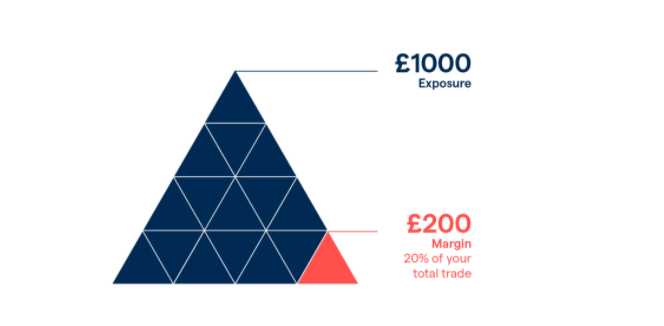

Many newbies are unaware that you can trade on margin when using a forex spread betting UK platform. This simply means that you can open a spread betting position that’s worth more than you have in your account. In fact, UK residents can enter a position with a margin of just 3.33% when trading major forex pairs. This includes the likes of GBP/USD, EUR/USD, and JPY/USD.

In practice, this means that for every £100 you stake – you only need to have an account balance of £3.33. To put it another way, an account balance of £500 would allow you to enter a forex spread betting position worth up to £15,000.

We should note that you need to understand the enhanced risks of spread betting on margin. The less margin you put upfront on the trade – the more chance you have of the trade being ‘liquidated’.

This means that the spread betting broker will close the position automatically if it goes down by the same level of margin you have on the trade. For example, if you are trading AUD/USD with a margin of 5% and the position drops in value by 5% – you will be liquidated.

Long or Short

Spread betting markets – whether that’s on forex, stocks, indices, or commodities – always allow you to choose from a long or short position. This means that you can enter positions irrespective of wider trading conditions and thus – profit from rising and falling markets.

For example, if the UK economy is strong – you might decide to go long or GBP/USD. Or, if interest rates in the US fall – you might decide to short AUD/USD. Either way, forex spread betting platforms UK give you lots of opportunities to make money on the back of political and economic developments.

Regulation

The forex spread betting UK markets are heavily regulated. In fact, for a spread betting platform to offer markets to UK residents, it must be authorized and licensed by the Financial Conduct Authority (FCA). This ensures that you are trading in fair and transparent conditions and that your capital is protected at all times.

For example, the Financial Conduct Authority expects all of its licensees to keep client funds in segregated bank accounts and verify the identity of all customers to prevent financial crime.

Furthermore, forex spread betting providers in the UK that we came across are also covered by the FSCS. This means that if the unlikely happened and the spread betting site wen bust – your capital would be covered by the FSCS up to the first £85,000.

Forex Spread Betting Strategies

If you are confident that forex spread betting UK is right for you and your financial goals – you need to ensure that you have a strategy in place before risking any money. As we cover in more detail later – platforms like Pepperstone offer a free spread betting demo account.

This allows you to test out your trading strategies in real-time without needing to risk any money. Then, when you are ready to start trading with real money – you can upgrade to a live account.

If you don’t have a forex spread betting strategy in mind – take some inspirations from the suggestions discussed below.

Keep Abreast of Economic News

If you don’t know how to read and analyze pricing charts or deploy technical indicators – start with fundamental research. This will require you regularly keep up to date with key economic and political news announcements. Crucially, this is because real-world news – whether positive or negative, will always impact the value of a currency.

For example:

- If the US government placed sanctions on Turkey – expect the value of the lira to decline.

- Similarly, if inflation levels in the UK are increasing at a faster rate than the markets had anticipated – expect the value of the pound sterling to decline.

These are just two examples of many. The main economic developments to look out for include interest rate decisions, GDP forecasts and results, inflation levels, and industrial output – like gold or raw materials. Additionally, you should also have an understanding of how geo-political events can impact the value of a currency.

For example:

- If the US signs a free trade deal with South Africa – there is every likelihood that the value of the rand will rise.

- Or, if tensions in the Middle East are on the rise – this could strength the US dollar, as the currency is often a safe haven for investors during times of economic instability.

Ultimately, once you have identified a potential trading opportunity on the back of an economic or political news development – it’s then just a case of heading over to your chosen forex spread betting UK broker to place the relevant market orders.

Swing Trading

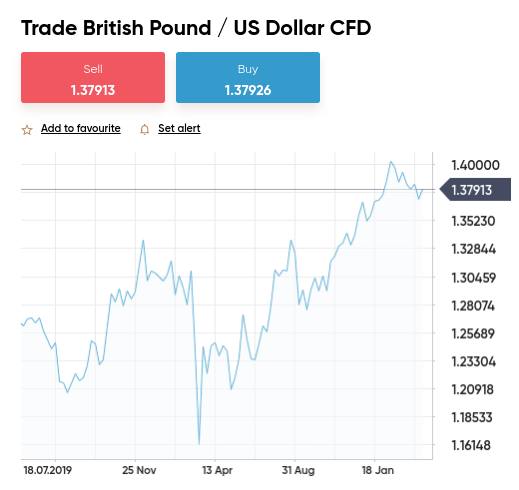

Swing trading is a flexible strategy that requires you to identify prolonged trends. The idea is to enter forex spread betting positions when you identify an ongoing pricing trend on a specific pair. For example, in the chart below – we can see that GBP/USD hit record lows of 1.16 in March 2020.

Since then, the markets have been extremely bullish on this currency pair – meaning that sentiment on pound sterling is strong. In fact, this upward trend has remained in place since March 2020 – since hitting highs of over 1.42. This is where a swing trading strategy comes into place.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

That is to say, rather than attempting to predict daily price movements – simply enter positions that follow the current market trend. In this respect, you would be required to enter a long position on GBP/USD at your chosen spread betting broker – meaning you will make a profit if the exchange rate continues to rise.

Support and Resistance Levels

If you have a bit of experience in forex trading and know your way around a pricing chart – then identifying support and resistance levels can be an effective way to profit from the spread betting scene.

For those unaware:

- A support level is a specific price level that historically – has encouraged traders to buy the currency pair. In turn, this prevents the price from dropping down below the support level and thus – drives the exchange rate higher.

- The resistance level is essentially the opposite of support levels. That is to say, this is the price point that traders are encouraged to sell – thus stopping the exchange rate from increasing any further.

Support and resistance levels are not an exact science – as there is every chance that the currency pair will break through these price points.

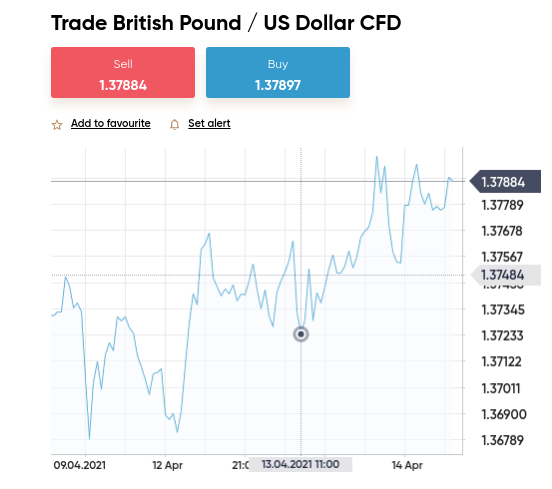

But, in many cases – these levels often prevent a currency pair from moving outside of an established range. For example, in the image above you will see the 1-hour timeframe on GBP/USD. In particular, you will notice that on two occasions over the past week – GBP/USD has met resistance just below the 1.38 level. That is to say, when the pair has approached this price – the trend has reversed southwards.

In terms of how you can capitalize on support and resistance levels that you have identified – you’ll need to place a series of orders at your chosen forex spread betting UK broker.

For example:

- Let’s say that your technical analysis leads to the identification of a resistance level on GBP/USD at 1.3820.

- The sensible option to take here is to place a short position just above this price – say at 1.3830

- If and when the price of GBP/USD hits 1.3820 – your short position will be executed by the spread betting broker

- Then, if this level is in fact a resistance point – you will profit when the price of GBP/USD begins to reverse

As per the above, you are also advised to deploy a stop-loss order when entering a spread betting position – irrespective of how confident you are. This ensures that your losses are limited in the event your precision does not come to fruition.

For example, you might decide to limit your potential losses to 20 points. This means that if you staked £2 per point – the most you can lose on the trade is £40. This is because your stop-loss order will be executed by the broker if GBP/USD hit a price 20 points above your short position of 1.3820 – at 1.3840.

How to Get Started with Forex Spread Betting – Tutorial

By this point in our guide on forex spread betting UK – you should have a firm grasp of how this trading scene works, have a strategy in place, and have chosen a suitable broker.

Now all that is left for you to do is enter your first spread betting position. If this is your first time spread betting online – follow the simple walkthrough below to trade at a commission-free provider.

Step 1: Join a UK Broker

As is the case with all online trading platforms – the first part of the process is to open a free brokerage account. This should take you less than five minutes. All you need to do is head over to the provider’s website and sign up.

Then, you will need to enter your personal information – including:

- Full Name

- Home Address

- Date of Birth

- Email Address

- Telephone Number

After confirming your email address – your forex spread betting account is ready to use.

Step 2: Upload ID

All registered users at an Financial Conduct Authority-regulated broker are required to go through a KYC (Know Your Customer) process. All this requires from you is a copy of your ID. A valid passport or driver’s license will suffice. In most cases, Capiotal.com can verify your submitted document instantly.

Step 3: Deposit Funds

If you wish, you can use a demo account to try spread betting for free. This will allow you to perfect your forex spread betting strategy without risking any money.

When you are ready to trade with real pounds and pence – the minimum deposit at many brokers is just £10 – 20. Instantly processed payment types include a debit/credit card (Visa/MasterCard) and a range of e-wallets.

Step 4: Find Forex Market

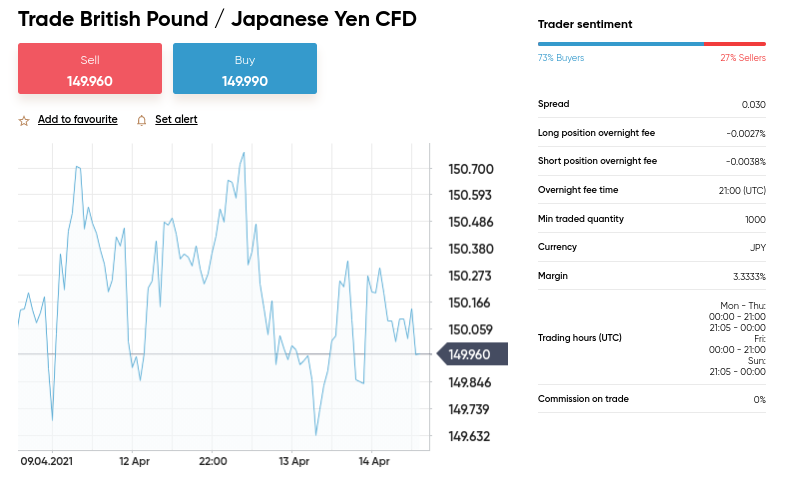

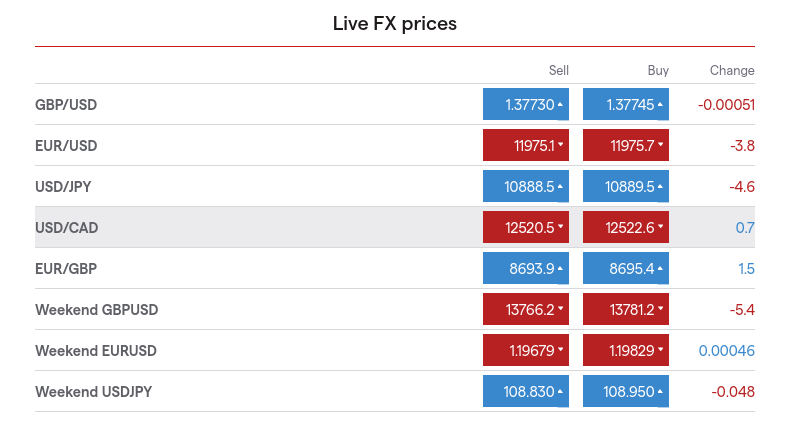

You can search for the pair that interests you or have a browse by hovering your mouse over the ‘Markets’ button and then click on ‘Forex.

Once you find the forex pair that you wish to spread bet – click it.

Step 5: Place Forex Spread Betting Trade

You will now see the main trading screen for the forex market you wish to trade.

- Now, you need to either click on the ‘Buy’ or ‘Sell’ button. This is whether you think the exchange rate of the currency pair will rise or fall.

- Then, you need to enter your stake. Don’t forget – this is the amount you wish to risk on each point movement – for example, £2 per point.

- You should also consider entering a stop-loss and take-profit value. This will ensure that your forex spread betting trade is executed in a risk-averse way.

Finally, confirm your order to enter your first spread betting position.

Spread Betting Forex Tips

If you’re looking to get your spread betting forex endeavors off on the right foot from the get-go, consider the following tips.

Tip 1: Avoid Margin

When you enter a spread betting forex position – avoid using margin when you first start out. Sure, the thought of only needing to put 5% of the position value down can be tempting – especially if you only have a small amount of capital. However, you stand the risk of having your spread betting forex position liquidated.

As we covered earlier, this means that you will have your trade closed by the broker automatically, and subsequently – you will lose your entire stake. Instead, consider trading within your means by avoiding margin.

Tip 2: Stick With Major Forex Pair

Major forex pairs always contain the US dollar and another strong currency like the pound sterling or the euro. In turn, major pairs benefit from the largest trading volumes and thus – highest levels of liquidity. As a result of this, you will find that major forex pairs are much less volatile than minors and exotics.

This is ideal if you are a forex spread betting newbie – as volatility can be intimidating. Plus, when you trade volatile markets, you will find that both your profits and losses move up and down in a much more parabolic manner. This in itself can result in irrational spread betting decisions being made – so stick with majors when you are first starting out.

Tip 3: Always Have an Entry and Exit Plan

Before you enter a forex spread betting position – always have an entry and exit plan in place. This means identifying the optimal price to enter the market based on your technical and fundamental research.

This also means assessing the right time to exit the market. The latter can be achieved by setting up a stop-loss and take-profit order. In following this simple strategy – you will be able to trade in a much more risk-averse manner and thus – protect your bankroll.

Spread Betting Forex – Conclusion

In summary, this guide has explained the ins and outs of forex spread betting UK and why this investment niche is ideal for active currency traders. Crucially, not only do spread betting forex providers like Pepperstone allow you to trade commission-free, but you won’t be required to pay any capital gains tax on your profits.

You can also spread bet forex pairs at this Financial Conduct Authority broker with leverage of 1:30 and the minimum deposit is just £20. Only invest what you can afford to lose and start by paper trading on a demo account.