How To Buy Amazon Shares UK – Best Places To Buy

In the UK, Amazon is one of the most attractive long-term investment opportunities due to its remarkable growth since its founding in 1997, which is when it emerged as a major global retailer. Additionally, Amazon shares did not experience significant losses during the COVID-19 crisis. On the contrary, Amazon shares were able to benefit from the volatility of the stock market for some time.

During this article, we will show you how to buy Amazon shares in the UK and give you a quick guide to some of the most trusted brokers to invest in for UK traders.

How Much Are Amazon Shares Worth?

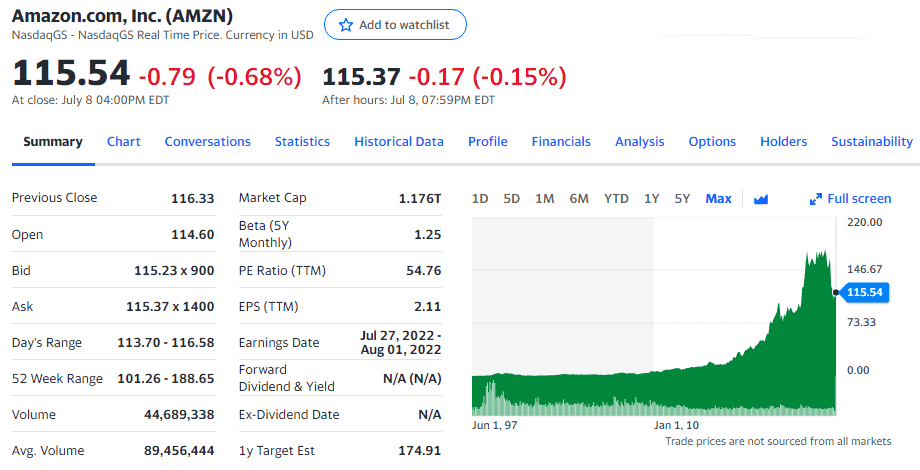

The price of every stock fluctuates throughout the day, and that is no exception for the price of Amazon’s stock. Currently, the Amazon stock price per share is $115.54 as of July 9th, 2022.

Sponsored ad. Your capital is at risk.

To put things in perspective, let us look at the trajectory that explains Amazon’s exponential performance over the past few decades in a concise way.

Having shared Jeff Bezos’ vision when Amazon first went public in 1997, you would now be enjoying unprecedented gains. In those days, you could buy shares for just $18 each. Unfortunately, Amazon has initiated many stock splits, so we must adjust this future accordingly. Therefore, the initial Amazon share price in the UK was just $1.73.

For example, if you had invested £1,000 in Amazon in 1997, your investment would now be worth over £1.6 million. However, Amazon shares haven’t always been smooth sailing.

In contrast, the stock was heavily affected by the early 2000s Dot Com bubble. It took over a decade for Amazon shares to return to pre-bubble levels. The market has, however, been on an upward trajectory ever since. In recent years, Amazon has undoubtedly benefited from the Coronavirus pandemic.

In 2020, most of its divisions and subsidiaries performed well, but its retail platform exceeded expectations. As a result, Amazon’s shares started the year at $1,900 each – an increase of 75% in a year. Overall, Amazon now has a market value of multi-trillion dollars.

In the years following the pandemic, Amazon has grown rapidly, diversifying into a range of high-growth markets. As part of Amazon’s ongoing strategy, the company’s Amazon Web Services (AWS) division holds the largest market share within the flourishing cloud computing sector.

Two reasons explain Amazon stock’s rise in early July. First, JEDI (Joint Enterprise Defense Infrastructure), a $10 billion contract awarded to Microsoft for cloud computing, was canceled shortly afterward. Amazon’s stocks surged to record highs after it was announced that it might win the JEDI contract.

Toward the end of June, Comcast Corp. signed a deal enabling its Peacock app to be accessed on Amazon devices. It is interesting to note that the Comcast-Amazon partnership has garnered a lot of investor interest with 42 million active users, especially considering the demand for live streaming services.

Yahoo Finance estimates that this market will be worth $947 billion by 2026 – more than double its value in 2021. This highlights Amazon’s immense growth potential, boosted by its e-commerce and streaming businesses.

Amazon Share Dividends

However, it may be a surprise that Amazon has yet to pay a single penny in dividends. The same applies to other stocks, such as Facebook, Netflix, and Google. Since most high-growth businesses reinvest their profits to grow, it is not uncommon for them not to pay dividends.

As a result, any gains from Amazon’s stock will be realized through increased share prices. About $60 billion has been spent by Amazon on properties, employees, and other projects over the past three years.

How To Buy Amazon Shares Overview

Step 1: Choose A Broker

Open a trading account with a regulated broker. You will be required to provide certain personal information, including your name, address, birth date, etc.

Step 2: Fund Your Account

For KYC purposes, upload two documents to verify your account and remove withdrawal restrictions: A passport or driver’s license, a recent utility bill, or a bank statement.

Step 3: Search For Amazon Stock

You’re ready to buy Amazon shares now that you’ve funded your brokerage account. Once you’re on your broker’s dashboard, you can search for ‘AMZN’ in the search bar and click the result.

Step 4: Buy Amazon Shares

By clicking on Amazon, you will be taken to a trading window where you can click the ‘Trade’ button. After completing the investment process, you will be asked to enter your total stake. A trade can be placed if the amount exceeds the broker’s minimum investment threshold.

Best Places To Buy Amazon Shares UK- Reviewed

1. Alvexo – Stock Trading Platform With Outstanding Educational & Research Features

With a focus on providing traders with a friendly trading experience while offering a place to enhance their knowledge and skills, traders of all experience levels can execute trades instantly by taking advantage of the company’s leading trading technology.

Besides offering many of the same services as stockbrokers, Alvexo also offers many web-based and mobile trading platforms and MT4 support for forex trading. Due to Alvexo’s focus on CFDs, each asset’s spread includes the platform’s commissions. Depending on the type of account used, there can be as few as 2.9 pip spreads on the classic account. In particular, there is only a spread charge; there are no additional transaction fees.

With Alvexo, traders can trade while gaining knowledge simultaneously. Many educational resources are available, including trading signals, news, webinars, eBooks, economic calendars, and Financial Web TV. Additionally, because Alvexo is regulated by CySEC and licensed to work in the EU, traders can benefit from its reputation for security.

Pros:

Pros:

- It offers a wide range of deposit and withdrawal methods

- Contains a wide variety of tools to create a user-friendly experience

- Protection against negative balances

Cons:

Cons:

- There is a higher initial investment on this platform than on others

- Investing in bonds and stocks is not possible with a basic account

69.80% of retail investor accounts lose money when trading CFDs with this provider.

2. Fortrade - UK's Stock Platform With Competitive Spreads

Through user-friendly technology, Fortrade focuses on providing a simple trading environment suitable for experienced traders and beginners. Experts at the company have designed and developed a series of fully-scalable trading platforms that allow clients to keep an eye on global financial markets and derivatives at the time and place of their choice.

Furthermore, Fortrade aims to be the most affordable player in the market, with opening deposits starting at $200, tight and competitive spreads, and leverage ratios as high as 1200.

With the FCA regulating the firm, traders can trade in a safe and secure environment.

Pros:

Pros:

- Multilingual support and website

- Islamic accounts are supported

- There are many educational tools available

- Market news and insights in-depth

Cons:

Cons:

- It may take up to 15 business days for debit/credit card withdrawals

Your capital is at risk.

How To Buy Amazon Shares UK- Conclusion

By definition, investing consists of the allocation of funds to a stock or company with the expectation that it will provide additional rewards as a result. The investment in stocks over the long term has the potential to generate very high returns for investors. This is because it is one of the most effective methods of increasing capital in the financial world.

It is no secret that Amazon has achieved phenomenal success in the market. Moreover, it continues to prove to be a profitable business to invest in as it grows exponentially. As far as market analysts and financial research firms are concerned, Amazon's successful and impressive market performance is expected to last for some time.

Due to its FCA regulation, Alvexo provides investors with extensive protection and makes it easy for you to invest in Amazon stock quickly in a safe and user-friendly environment. So get started and click the button below to open an account with Alvexo in less than five minutes.

Sponsored ad. Your capital is at risk.