Bond Trading Platform UK – Beginner’s Guide

Bonds and other fixed-income instruments have always been particularly attractive for investors in times of market volatility because they offer a fixed source of income and a guaranteed rate of return. This is why bonds are widely traded instruments around the world, either as a hedge or as a primary investment tool.

In this guide, we review the various bond trading platforms and go over practices.

Bond Trading Platforms UK List 2025

While there are different bond trading platforms available in the market, some of the notable bond trading platforms that you might consider have been reviewed below.

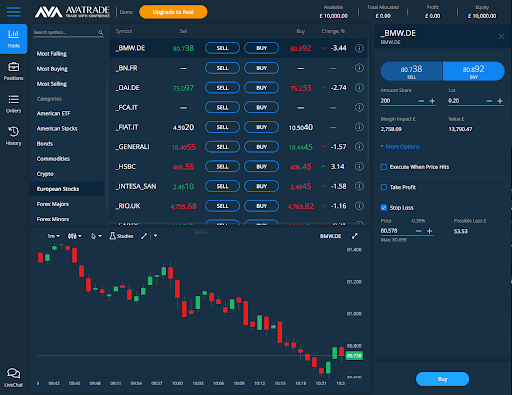

1. AvaTrade

However, perhaps the biggest USP of Avatrade is that it offers extremely high leverages for trades. For example, on many currency pairs, it offers a leverage of 400x, making it extremely popular for experienced traders who are comfortable with the risk. It offers the opportunity to trade bond CFDs and a wide variety of bond ETFs, however, this offering is limited as compared to its competitors.

Sponsored ad. Your capital is at risk.

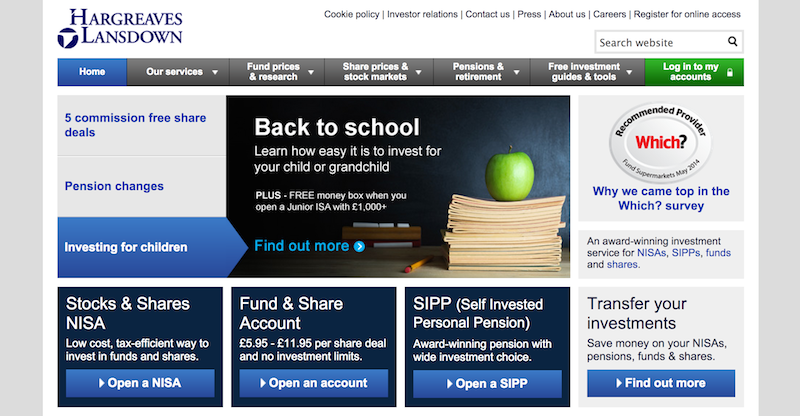

3. Hargreaves Lansdown

They also charge competitive commissions on bond trading. Some of their offerings are available online, while the others are limited to their telephone trading service, which usually costs higher than the standard online trading portal. Not only does Hargreaves Lansdown support MT4 and MT5 trading platforms, but it is also offers the opportunity to trade bond CFDs and a wide variety of bond ETFs, however, this offering is limited as compared to its competitors.

Sponsored ad. Your capital is at risk.

Bond Trading Platform Fees Comparison

| Platform | US Treasury Bonds | UK Gilts | Bond ETFs | Commissions |

| AvaTrade | Yes | No | Yes | Zero commissions |

| Hargreaves Lansdown | Yes | Yes | Yes | 11.95 GBP per lot |

Bonds to Invest

If you are looking to invest in bonds, it is important for you to know the different kinds of bonds that you can invest in. Primarily, there are three types of bonds that you could choose to invest in, and these have been discussed below in detail.

Treasury Bonds

A common form of bonds that investors choose to purchase are treasury bonds. They are preferred for a variety of reasons. The first is that if you choose to buy treasury bonds from a major country such as the US (called t-bills) or the UK (called gilts), then there is a very negligible chance of default. For example, the US has never defaulted on its bond obligations ever. Therefore, investing in treasury bonds is considered to be a risk-free investment. Another advantage is that you will have a fixed source of income in the form of coupon payments. You can buy treasury bonds for any period of time ranging from 1 year to 30 years, and the interest rate at which these bonds pay coupon payments changes every day.

There is another type of treasury bond that investors sometimes prefer to invest in. These are called TIPS, or Treasury Inflation-Protected Securities, and these are designed to be a hedge against inflation. In this case, the principal payment of the bond is pegged to an inflationary measure, and therefore the payments you receive are directly in sync with the inflation. This allows you to escape the effects of inflation on the bonds that you purchase. For example, if you buy a TIPS bond pegged to the CPI with a face value of $100 and a coupon rate of 3%, and the CPI increases by 2% during the year, then your coupon payment of 3% will be calculated on the inflation-adjusted face value, which is 102. You will therefore be repaid $102 with an interest payment of $3.06.

Municipal Bonds

Municipal bonds, also called muni bonds, are predominantly only used in the US, though they are sometimes used as a way of raising money in other countries too. Muni bonds are issued by states, cities, and other local government entities to finance public projects or offer public savings. This could include infrastructure projects or any form of development that is expected to be useful and beneficial to the public living in that area. For example, a city might decide to issue muni bonds in case they wish to build a new bridge or redo a neighborhood park.

Corporate Bonds

The last type of corporate bonds, which also happen to be a diverse and popular form of bonds that investors can choose to invest in, are called corporate bonds. When a company wishes to raise financing, it can either do so through selling equity or taking on debt. If they choose the latter, then their options are to either take a bank loan or sell bonds. Since bank loans are generally more expensive than issuing bonds, companies might choose to issue debt in order to raise money. There are different types of bonds that a company can issue, and this has a direct impact on how safe these bonds are and how much coupon rate they carry.

For example, if a company chooses to issue bonds that are secured against its assets, then the bond is considered to be secure and the chance of default is quite low. Therefore, the coupon rate that this bond carries quill be quite low. On the other hand, unsecured debt carries more risk and therefore has to have a higher coupon payment to be attractive to investors.

How Can I Trade Bonds?

The steps that you should follow in order to begin trading bonds have been discussed below in detail.

Step 1: Select a platform

The very first step that you need to take is to select a platform that allows you to trade bonds. While there are several such trading platforms, it is important for the platform you choose to be suitable for your trading requirements. The different criteria that you should look at include the fee structure of the platform, the non-trading fees such as the withdrawal and deposit fees, the range of products that they allow you to purchase, as well as the general usability of the platform.

Some platforms, while providing low fees and a wide product variety, are designed in a way that makes them difficult to navigate. Therefore, you will end up spending several months just getting used to the platform and its navigation. If this is the case, it is important that the platform offer a demo account where you can practise trading strategies and understand how the platform has been made, to avoid mistakes with real money. In addition to this, it is preferable for the platform that you use to have a mobile app as well, so you can monitor and manage your positions on the move.

Step 2: Identify the type of bonds

The next step, once you have identified the platform that you will be trading bonds with, is to identify what type of bonds you wish to trade. Each of the bonds has a different form of investor that prefers them. For example, government bonds are generally more liquid than muni bonds, and thus you can sell them on the secondary market. Corporate bonds sold by major corporations are also quite liquid and can be sold off readily. However, they carry a higher inherent risk than Treasury bonds, because a company is more likely to default than a government.

Another way in which the different types of bonds differ is the factors that affect their yields in the secondary market. For example, Treasury Bonds are affected by macroeconomic events such as high inflation, low GDP growth, or a high rate of unemployment. They are also affected by monetary and tax policies. On the other hand, corporate bonds are only affected by these factors to a small extent. The main factors that dictate their yield include industry and company events, such as a wider potential for default in the industry, or any event that might make it harder for the company to turn enough profits for paying off their interest obligations in a year.

Step 3: Identify assets based on your risk profile

The next step, once you have identified the type of bonds that you will be trading, is to select a group of bonds that you will be trading based on your risk profile. For example, if you will be trading Treasury Bonds, you should identify the countries whose Treasury Bonds you will be trading on. For corporate bonds, you should select a list of companies whose bonds you are comfortable trading or holding.

This is important for 2 reasons. One, it ensures that all your trades are within the same risk profile. There are two main rating agencies that you should look at while investing in bonds: Moody’s and Standards & Poor. they release ratings for each bond issue, that can let you know how safe a bond is. The higher the grating, the lower the chance that the issuer will default on their obligations, and therefore, the lower the coupon that is paid on the bond. While these ratings are not foolproof, they are a useful indication of how risky a bond is. Therefore, selecting bonds that have higher than a particular rating is a way of ensuring that you minimise your risk and only trade within your risk profile.

Step 4: Begin trading

Once you have all this sorted out, all that is left for you is to prepare a strategy that you will use to trade, and then begin trading through the platform that you have selected. A variety of potential strategies that you could use for trading bonds have been detailed below in this guide.

Risks of Trading Bonds

There are several risks associated with trading bonds. Some of these are avoidable and others are not, however, as a bond trader you should be aware of them since they will help you either mitigate them or prepare for them. These risks have been detailed below.

- They generally provide much lower returns than other asset classes such as stocks or currencies.

- There is always a risk, no matter how small, that the issuer of the bond might default.

- There is a very low level of transparency in the bond market, therefore there is no telling if the brokers that you trade through are charging higher prices than usual.

- Bond yields are usually inversely related to the interest rates in an economy. Therefore, if the interest rates rise, then the bond yields will fall. This is especially a risk in the current macroeconomic climate.

Bond Trading Strategy

In order to trade bonds profitably, it is important for you to have a strategy that you can use. While there are several different strategies available that have been proven to be profitable, common ones have been discussed below.

Fundamental Trading

One prominent strategy that traders or investors employ for trading bonds is the passive bond trading strategy based on a fundamental approach. Under this strategy, bonds that are rated higher than a particular level are bought in a fixed proportion. These bonds are bought in a way that they are well-diversified in terms of their geographical location, the industry in which the company is, and the general factors underlying the movements in their prices. The idea here, broadly speaking, is to create a diversified bond portfolio to reduce the idiosyncratic risk while also adhering to a certain risk profile and ensuring that the portfolio is not too risky.

Once the portfolio has been created, it then has to be rebalanced and modified after a specific period of time so as to ensure that the proportions in which the bonds had been purchased are still constant. This will avoid the portfolio being weighed too heavily in one direction or the other, which would increase the riskiness of the portfolio. Apart from this, since the portfolio is comprised of bonds with a minimal amount of risk, there is a fixed guaranteed cash flow that comes with these bond portfolios, and this can then be used for a variety of other investments.

Trading Interest Rates

Another very popular trading strategy that is used by bond traders is that of trading on interest rates. As mentioned earlier, interest rates have an inverse relationship with bond yields. This is because when interest rates in an economy rise, people sell off their existing bonds so that they can buy new bonds which have higher coupon rates associated with them. Therefore, bond yields fall as no one wishes to buy these bonds anymore.

Therefore, a bond strategy is to trade on interest rate announcements. This can be done in 2 ways. A risk-averse investor would normally wait until after the announcement has been made by the monetary policy committee to initiate a trade, whereas an investor who is comfortable with higher risks would opt for trading on the news before the announcement has been made using forecast tools. Therefore, exploiting the inverse relationship between interest rates and bond yields is a very profitable bond trading strategy.

Is Bond Trading Regulated in the UK?

Yes, bond trading is regulated in the UK just like the trade of any other financial instrument. The Financial Conduct Authority (FCA) is responsible for regulating the different brokers that provide access to bond trading. In addition to this, the trading of UK Treasury Bonds (also known as gilts) is regulated by the Bank of England. Together, these two agencies ensure that all bond trading is carried out in a legal and regulated manner so that the interests of both the traders and the government are protected.

Conclusion

In conclusion, if you’re looking to get started with a bond trading platform, one option for you is to do so via AvaTrade. It is a reliable and safe trading platform for investors and traders of all experience levels, and it also contains among the largest variety of bonds that you can trade on, alongside several other asset classes. Their trading platform and its functionalities are nearly unparalleled in the industry, and it also has low spreads and fees on the trading of stocks and forex pairs. All in all, AvaTrade is definitely a strong option to consider for your bond trading needs.