Level 2 Trading Platform – Beginner’s Guide 2026

Level 2 trading platforms refer to the platforms that allow traders to view the order books for any particular security so that they can see what the pending orders are, what prices they’re at, and what orders have just been fulfilled.

In this guide, we review the different Level 2 trading platforms available to investors in the UK. We also go through the advantages, disadvantages, and the different asset classes available for trading on Level 2 trading platforms.

Level 2 Trading Platforms UK List 2026

While there are several different Level 2 trading platforms that you can use in the UK, very few truly combine access to Level 2 order books with a wide range of assets, low fees, and high leverage, making for a smooth trading experience. The top Level 2 brokers that you can use are VanatgeFX, and Pepperstone, each of which has been reviewed below.

1. VantageFX

VantageFX is a Level 2 broker in the UK for 2026 that offers a variety of different account types. It has a high leverage account that provides you with higher leverage than other similar platforms, and a cost-effective trading solution that helps you minimise the fees that you pay to trade on the platform. It is the ideal platform for high-volume traders that are looking for fast execution speeds combined with competitive spreads and a fully transparent trading environment that provides access to different liquidity providers.

VantageFX is a Level 2 broker in the UK for 2026 that offers a variety of different account types. It has a high leverage account that provides you with higher leverage than other similar platforms, and a cost-effective trading solution that helps you minimise the fees that you pay to trade on the platform. It is the ideal platform for high-volume traders that are looking for fast execution speeds combined with competitive spreads and a fully transparent trading environment that provides access to different liquidity providers.

There are three primary account types that VantageFX provides, all of which offer access to the Level 2 Order Book. The first is the Standard STP account, which is an ideal trading solution for beginners who do not wish to pay commissions. The second option, the Raw ECN account, is very popular among seasoned traders who wish to get an account that provides high leverage with only a low deposit requirement. The third option is the Pro ECN account that was designed for professional traders that wish to get the fastest execution with low commissions and zero spreads, designed to be used for automated trading strategies.

VantageFX offers access to over 300 markets and forex pairs. It also provides leverage of up to 500x, which is among the highest in the industry. Furthermore, you can also trade on VantageFX via MT4 and MT5, allowing for advanced technical analysis and charing techniques to be deployed.

VantageFX fees:

| Fee | Amount |

| Stock trading fee | Variable spread |

| Forex trading fee | Spread, 1.4 pips for GBP/USD |

| Crypto trading fee | N/A |

| Inactivity fee | Free |

| Withdrawal fee | Free |

Sponsored ad. Your capital is at risk.

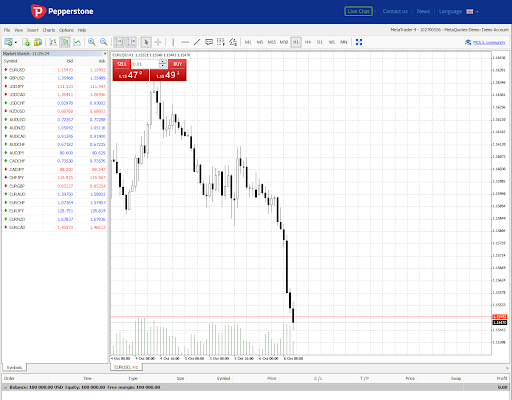

2. Pepperstone

Pepperstone is another very popular Level 2 broker that has over 500,000 users worldwide. It is a no-dealing desk broker and offers both ECN and STP accounts by providing access to some of the top liquidity providers in the industry, such as banks.

It provides access to over 800 instruments and CFD forex pairs through a range of advanced trading platforms. When you choose to set up an account with Pepperstone, you have the option to choose which platform you wish to trade through, based on your level of experience and trading requirements. This includes the MT4 and MT5 platforms alongside other niche platforms and trading tools such as cTrader, MyFXBook, MirrorTrader, and RoboX.

They offer two types of accounts, the Razor and the Standard accounts. The Razor, as the name suggests, is an ideal trading account for those looking to scalp trade, whereas the Standard is much more suitable for all other trading requirements. All in all, Pepperstone is definitely known for having one of the lowest spreads and fees in the market, being as low as 0.1 pips sometimes for major currency pairs like the EUR/USD.

Pepperstone fees

| Fee | Amount |

| Stock trading fee | $0.02 per US stock |

| Forex trading fee | Spread, 1.59 pips for GBP/USD |

| Crypto trading fee | Spread, 50 pips for Bitcoin |

| Inactivity fee | Free |

| Withdrawal fee | Free |

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Why Choose a Level 2 Trading Platform?

There are several reasons for you to choose a Level 2 platform over a platform that does not provide access to the Level 2 order books. For starters, traders that trade primarily on market sentiments need to know what the market is thinking, and one way to do this is through the use of the Level 2 order book. By looking at the volume as well as the prices of all pending and completed orders, you can ascertain what the market is thinking, and then use this knowledge to place trades accordingly. Therefore, the Level 2 trading book is very useful for day traders who do not keep their trades open for long periods of time and therefore rely on the market sentiments and the resultant price movements in order to profit.

In addition to this, trading through a Level 2 order book ensures that there is a wider range of buyers and sellers. By bypassing the market maker and instead of dealing with other market participants directly, you can save money that you would otherwise have paid the broker in the form of spreads. Since commissions are fixed on every trade, and the increasing competition among brokers means that commissions are quite low on trades, you end up spending less while trading through a Level 2 broker if you are a regular trader than you would have if you traded through a broker that charges spread. Therefore, you save money while also gaining access to a larger liquidity pool and being free from the conflict of interest that plagues market makers. Not to mention, a majority of Level 2 trading platforms and brokers that charge commissions usually have rebates in case you exceed a particular trading volume in a month, so active brokers can actually get a major part of the fees that they pay back as a rebate from the platform itself.

Another advantage is that Level 2 order books allow you to compare the live prints with the order books. The live prints refer to orders that were just executed by market makers or through the liquidity pools. If there is a large block of shares that is slowly making its way into the live prints, albeit at a lower and lower price for each trade, then you know that this is someone trying to sell off a major chunk of their share in a particular instrument, and you can take advantage of this. The same is also true for the opposite scenario if you look at a major bid order that is not getting filled despite a higher rate than the live price. This indicates that there is a large buyer who will buy the instrument at a higher rate than what it is currently trading at, indicating an opportunity for you to sell off your shares in order to book profits or buy more shares to ride the wave alongside the major market player.

Sponsored ad. Your capital is at risk.

Which Assets Are Available in a Level 2 Trading Platform?

There are several assets that you can trade through a Level 2 trading platform, and the selection of assets is not that different from the assets traded through a normal trading platform. A list of these assets, alongside how access to a Level 2 order book is useful in each of their cases, has been provided below in detail.

Stocks

Usually, Level 2 brokers allow their traders to trade on US, UK, European, as well as other global stocks for which there is a significant enough market and the scope of a liquidity pool is available.

One of the commonly traded asset classes through a Level 2 broker, stock trading has several advantages when done correctly through the use of a Level 2 Order book. For starters, it enables you to understand what people think about a particular company’s share. In addition to this, you can also look at large orders that are being placed, identify who is placing them, and then use this information to take on your own positions. For example, this can enable you to spot panic buyers or sellers, as well as people who are taking on large positions in anticipation of a large announcement that will move the shares in either direction. With this knowledge, you can then decide whether you wish to take on the opposite position or simply take on the same position and join their wave.

Commodities

Level 2 trading platforms also allow their traders to trade on major commodities. This could include precious metals such as gold and silver, but also other commodities such as oil, natural gas, and aluminum. Trading on commodities also usually involves the use of leverage, which platforms allow. While the exact degree of leverage you will get access to depends on the platform you use and the level of experience you have, commodity trading usually allows you to take on large positions while only risking a small amount of your own capital.

Commodity prices are also usually affected by a lot of factors, including demand/supply issues, macroeconomic factors, as well as company-specific factors. Therefore, it might not always be straightforward for you to look at all the underlying factors that are responsible for the movement in the prices of a commodity. In this situation, a Level 2 order book comes in handy since it allows you to observe the movement in the prices of the commodity and take positions accordingly, without having to worry about the underlying reasons for this momentum.

Indices

Indices are also very commonly traded on Level 2 trading platforms. An index is a collection of stocks that usually have something in common. For example, popular indices in US markets like the S&P 500 is a collection of the 500 most valuable companies that trade on the US markets. Similarly, the NASDAQ30 is the collection of the 30 most valuable stocks that trade specifically on the NASDAQ exchange. Indices can also be made on the basis of the industry that companies are in, their geographical location, as well as the market capitalisation of these companies. Investing in indices is a way of eliminating the risk that comes from only investing in one company, and instead diversify your risk into multiple companies.

Bonds

Bonds and other fixed-income instruments have always been of interest to investors in times of market volatility because they offer a fixed source of income and a guaranteed rate of return. This is why bonds are traded around the world, either as a hedge or as a primary investment tool. They are suitable for different risk appetites and offer the possibility of riskless returns, which is suitable for investors who might not want to take on a lot of risks. There are three types of bonds:

- Treasury bonds issued by the Treasury of countries, which usually carries the lowest risk and the lowest coupon rates.

- Muni bonds, issued by local governments in cities, towns, and states for usage in various infrastructure and public projects, which have a higher degree of risk and therefore pay higher coupon rates.

- Corporate bonds, issued by companies in order to raise finances, which have different risks based on the credit score of the company.

Currencies

The forex market is the largest trading market in the world, with billions of dollars in capital being traded in and out of the markets on any given day. Currency markets are predominantly reliant on interest rates, and interest rate announcements in any country are watched very closely since they have a relationship with a country’s currency. For example, if the UK raises interest rates, then people will want to store their cash in the UK for higher interests. Therefore, there will be an increase in the demand for GBP, thereby pushing up the price as supply contracts.

In addition to this, there are other strategies too that are used to trade currencies, which are usually automated or momentum-based strategies that try to profit off of short-term price movements in currencies.

68% of retail investor accounts lose money when trading CFDs with this provider.

Risks of Dealing With a Level 2 Trading Platform

There are quite a few risks associated with trading through a Level 2 platform. These have been discussed below in detail:

- The first and biggest risk is that the overload of data that you get from a Level 2 order book might make it difficult for you to come to a clear conclusion. Often, beginner traders either start focussing on the wrong patterns or identify trends where none exist, leading to poor decision-making and losses. This is not a fault of the platform per se, but it does underline the fact that a lot of knowledge, experience, and discipline are important and necessary when trading through a Level 2 trading platform.

- The strategy might not be very suitable or relevant if you are a fundamental trader. Therefore, the exact point where you enter a stock or the stock market sentiment at the time of entry is irrelevant since your time horizon is long enough for it to not matter.

- Unless you are an active regular trader, you will normally pay higher fees through commissions on a Level 2 broker than you would’ve paid via spreads on a normal broker that does not provide Level 2 access. This will cut into your profits and further affect the profitability of your trading strategies.

Are Level 2 Trading Platforms Regulated in the UK?

Yes, Level 2 trading is regulated in the UK just like the trade of any other form of trading. The Financial Conduct Authority (FCA) is responsible for regulating the different brokers and platforms that provide access to Level 2 trading. The FCA ensures that all Level 2 trading is carried out in a legal and regulated manner so that the interests of all the parties are protected.

The Verdict

In conclusion, if you’re looking to get started with a Level-2 trading platform, one option for you is to do so via VantageFX It is a reliable and safe trading platforms for investors and traders of all experience levels, and it also contains among the largest variety of asset classes to trade on. Their trading platform and its functionalities are unparalleled in the industry, and it also has low spreads and fees on the trading of stocks and forex pairs. All in all, VantageFX is definitely a strong option to consider for your trading needs.