Hargreaves Lansdown Platform Review UK

If you’re looking for a reliable UK broker that will enable you to trade on the equity markets in a reliable and safe manner, then Hargreaves Lansdown is definitely a platform you should consider. As one of the largest UK-based stock trading platforms, Hargreaves Lansdown stands out from its competition based on the sheer quality of its trading platform and the services that it offers. In this guide, we review the Hargreaves Lansdown trading platform. We also go through the key features, the interface, the important fees, commissions, regulations, and everything else you need to know about the platform before you begin trading on it.

-

-

What is Hargreaves Lansdown?

Hargreaves Lansdown is one of the premier UK-based share trading platforms. It was founded in 1981 and is regulated by the Financial Conduct Authority (FCA) in the UK, making it a reliable platform that is preferred by UK-based experienced traders. It is also a listed company and is a constituent of the FTSE 100, an index that comprises some of the biggest companies listed in the UK markets. Hargreaves Lansdown is considered to be a safe investing and trading platform primarily because of its long-standing track record, and the fact that it has consistently provided top-notch service to its clients over the years.

Among other things, Hargreaves Lansdown is also a fund platform, and it manages over 130 billion GBP for 1.5 million clients. It provides a wide range of services to its clients. For example, they offer a variety of ready-made investment portfolios to their clients, wherein the client can just simply choose a portfolio and invest in them. There are a variety of such portfolios available, and they cater to different types of investors. These portfolios are distributed across asset classes like the forex and the stock markets, and they are distributed over the capitalisation of the securities. For example, investors who are unwilling to take on higher risk can choose to invest in large-cap stocks, whereas more risk-tolerant investors can invest in a portfolio that contains both large-cap and small-cap stocks.

Hargreaves Lansdown also offers their own cash management service to help you deal with the idle cash you have leftover in the form of savings after you meet your expenses. At the same time, they also offer a variety of other services such as the ISA, Junior ISA, as well as Vantage SIPP accounts. Each of these accounts is suitable for a certain type of investor or trader.

Perhaps the biggest USP of Hargreaves Lansdown is that they offer both trading as well as investment services, which sets them apart from several other similar platforms. They have a trading platform equipped with a variety of tools, and at the same time, their asset and cash management teams are constantly working to provide you with an increased variety of investment options, both pre-tailored and customised to your needs. On this note, they also have PWM (Private Wealth Management) services, and for a small fee, you could book a consultation with one of their financial experts. This will give you an opportunity to learn and understand how you can structure your portfolio to boost your chances of achieving your long-term financial plans. The personal nature of their customer service efforts, in coalition with their team of experts, have made Hargreaves Lansdown the platform of choice for British nationals looking to invest/trade for over 30 years.

Sponsored ad. Your capital is at risk.

What Can You Invest in and Trade on Hargreaves Lansdown Trading Platform?

There are several products that you can trade through Hargreaves Lansdown, ranging from the forex market to the equities markets. Each of these markets, the Hargreaves Lansdown offering, and how competitive trading on Hargreaves Lansdown is compared to other platforms, have been discussed below in detail.

Invest in Forex

Also known as the foreign exchange market or the FX market, the forex currency market is a popular market for beginners to start with. This is because new traders are already familiar with the different currencies and exchange rates, hence they find it easier to parlay this knowledge into the trading world. About $5.1 trillion worth of value is exchanged per day, and Hargreaves Lansdown is particularly well known for its forex markets.

They offer over 40 different currency pairs that you can trade on through Hargreaves Lansdown, including major, minor, and exotic currency pairs. You can trade these currency pairs either through their online platform or via their phone option. They have very low spreads, which means that they are quite competitive in terms of the pricing structures that they offer their clients. Hargreaves Lansdown also allows you to trade several major currency pairs such as GBP/USD, EUR/USD, and USD/JPY at extremely low spreads and commissions.

Trade Shares

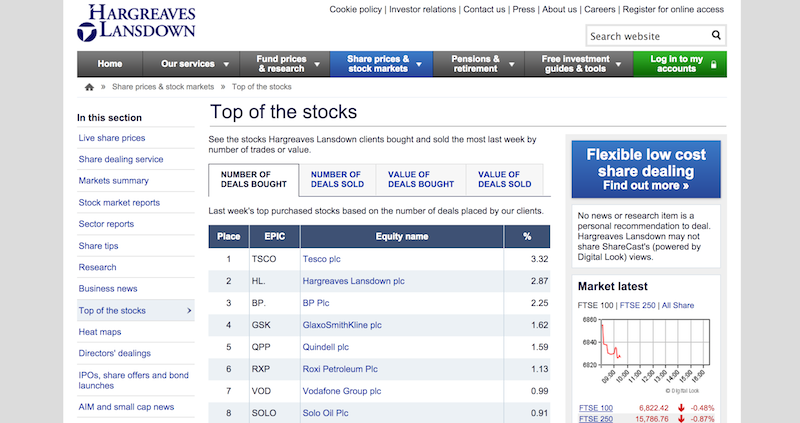

Hargreaves Lansdown also allows you to invest and trade in shares across a variety of markets. You can not only trade all the shares that are listed on the FTSE 100 and on the London Stock Exchange, but the platform also provides you with access to the US markets. This allows you to trade on some of the largest varieties of stocks, thereby giving you access to more markets and options than their competitors. Their fees are also quite low when compared to the rest of the industry, especially given the product variety that they are offering.

Trading shares through the Hargreaves Lansdown trading platform by using technical analysis strategies is also simple because the platform has a variety of charting tools and analysis methods that will make your process easier. The educational guides that that Hargreaves Lansdown offers will teach you how to improve your analysis through the use of these tools.

At the same time, you can also invest in stocks instead of trading them through Hargreaves Lansdown. In this case, you will have to set up an Investment Account, which offers a lot of low-cost flexible options depending on the amount of capital you are looking to invest and the investments you wish to manage.

Invest in Indices

Lastly, Hargreaves Lansdown also allows you to trade on and invest in indices. This includes standard indices from the various exchanges that Hargreaves Lansdown provides you access to but also includes a variety of custom-curated investment funds and indices that you can have access to. You can also invest in funds that are provided by asset managers around the world. The search feature on the Hargreaves Lansdown platform is particularly useful in this regard since it allows you to filter through funds by the sector they primarily function in, the unit type, the type of fund (actively or passively managed), and the provider of funds.

They also have a selection of Master Portfolios that you could choose to invest in. They are designed by Hargreaves Lansdown experts and are supposed to be used as a starting point for the investor. Whereas Hargreaves Lansdown provides the basic template for investing to the investor via a Master Portfolio, it is the responsibility of the investor to identify which of the investments provided match their risk profile and are suited to help them accomplish their investment goals. You can choose from among five styles when trying to select a Master Portfolio, which are:

- Adventurous

- Medium Risk

- Conservative

- Investing for Children

- Investing for Income

Another specific option that Hargreaves Lansdown provides that sets them apart from their competition is that they allow you to invest in 6 ready-made portfolios that invest in a broad range of assets from a number of countries, thereby enabling you to diversify risk. These portfolios have been curated by the Investments team at Hargreaves Lansdown, and they are rebalanced every 6 months. There is no additional cost that you have to incur while investing in these portfolios, however, they do have a minimum investment of 1000 GBP associated with them.

Hargreaves Lansdown Trading Platform Fees & Commissions

Hargreaves Lansdown has very low fees if you choose to trade bonds and funds through their platform. However, their fees for trading stocks and ETFs are not much lower than the rest of their competitors.

Usually, there are 2 main types of fees that a platform charges: trading fees and non-trading fees. Trading fees refer to commissions and spreads, which are only incurred every time you make a trade. On the other hand, non-trading fees are fees that are not linked to how much you trade. For example, inactivity fees, withdrawal or deposit fees, and similar fees like these are classified under non-trading fees.

Hargreaves Lansdown primarily offers you access to stock markets in 3 countries: the UK, the US, and Germany. For trading stocks in each of the 3 countries, they do not charge a spread, however, they do charge a commission that is volume-based. The commission that they charge is approximately 0.8%, however, this depends on the volume that you have traded in the previous month. They have certain predefined thresholds, and your commission in the next month will be lower if your trading volume exceeds that threshold. The commission that you will have to pay per trade depending on your trading volume for the previous month has been explained below in a tabular format.

Trades in the previous month Commission per trade 0-9 trades 11.95 GBP 10-19 trades 8.95 GBP 20+ trades 5.95 GBP At the same time, if you are looking to buy and sell funds instead of stocks, then the fees are much lower. Hargreaves Lansdown does not charge any spreads or commissions on the purchase and sale of funds, so you can trade on them frequently. However, if you are looking to invest in these funds, then you will have to pay an annual holding fee, depending on the amount of capital that you have invested in these funds for the first 250,000 GBP that you choose to invest in these funds and hold for over a year, the fee that you will have to pay is 0.45% of your investment. If your investment is higher than 250,000 GBP, then the fees that you will be paying will usually be quite lower than this. The fees are pro-rated across the year and are charged on a monthly basis from your account.

If you are looking to trade using the Portfolio+ options, using one or more of the 6 curated portfolios that are developed by the fund managers at Hargreaves Lansdown, then you will have to pay 2 charges: the first is an ongoing annual charge for mutual funds, and the second is an annual management fee. The annual management fee varies over time depending on how the portfolio has performed, both in absolute terms and compared to the benchmark indexes. The management fee is usually somewhere between 1.25 and 2% of the value of your portfolio invested in these funds.

As far as the non-trading fees are concerned, Hargreaves Lansdown does not charge any account management fees on their Standard Accounts. This allows it to stand out from its competitors, many of whom charge an annual fee just to allow investors to use the platform. Hargreaves Lansdown also does not charge any inactivity fees, as opposed to other similar platforms that can charge as much as 15 GBP a month if your account remains inactive after a period of more than 6 months.

Hargreaves Lansdown Trading Platform User Experience

The Hargreaves Lansdown platform user experience has been positive, with traders and investors reporting that they found the interface to be simple to navigate. The platform is available as both a mobile app and a web platform. However, the one that many traders primarily use is the web platform.

Their platform has been self-developed, and it is available only in English. The platform has been designed and tested in a way that provides maximum convenience for traders. Similar tools and products have been grouped together to make it easier to search for products, their search filters are useful and relevant, and will easily enable you to search for the instruments you need. One of the only drawbacks of the navigation in the platform is that it cannot be customised.

The login and security on the platform are also seamless, and it allows you to use a one-step login process. They give you a secure number once you complete the registration, and you have to enter your password as well as three randomly selected digits from the secure number every time you need to sign in. The platform allows you to place 4 types of orders: a market order, a limit order, a stop-loss order, and a stop trailing order. You can also use a variety of order time limits when placing an order, providing you with a cache of useful tools that might be relevant to your strategies.

A major limitation of the platform is that while it allows you to set alerts and notifications for price movements, dividend payouts, and regulatory news, you can only do this for Uk stocks. This functionality is not available for non-UK stocks, making it difficult for those who trade on the US markets.

Overall, however, the platform is known to be simple to use, as compared to other platforms that require you to spend a long time just learning how to navigate it. The menus and the search options are incredibly useful and intuitive, which make for a comfortable trading experience.

Hargreaves Lansdown Trading Platform Features, Charting, and Analysis

The Hargreaves Lansdown platform provides you with access to a variety of features to assist you with trading. For example, you can set price alerts on UK stocks for price movements, dividend payouts, and regulatory announcements. By doing so, you can keep yourself updated with the various developments in the market. At the same time, they also have a variety of other options that you can use in order to make your trading experience better.

As for their charting and analysis tools, these tools are very extensive. They offer a lot of analysis tools and charting methods that you can customise for your own requirements. This makes them suitable for a lot of different strategies. However, there are a few tools that the platform does not offer, which makes it unsuitable for some very specific scalping strategies.

They also have an option wherein you can create and adapt new trading tools within certain limitations to assist with your technical analysis. With their news feed option in addition to their top-notch charting tools, the Hargreaves Lansdown platform offers the perfect combination of technical and fundamental analysis to assist you with making decisions.

Another proprietary feature of the Hargreaves Lansdown platform is that you get to see analyst ratings on different stocks and indices. These analyst ratings are given by analysts at Hargreaves Lansdownbased on the research and knowledge of the industry and can be an incredibly useful tool for you to understand how analysts perceive the financial health and prospects of a particular security to be.

Hargreaves Lansdown Trading Platform Account Types

Hargreaves Lansdown allows you to set up several different account types based on your requirements and investment potential. The tabular representation of each account type that they offer, along with a basic description of these accounts, has been given below:

Account Type Short Description Fund and Share Account Basic investment account Stocks and Shares ISA ISA account that allows you to invest tax-free up to the yearly limit as permitted by the government guidelines. Lifetime ISA Quite similar to a normal ISA account but the government also contributed to your Lifetime ISA account, and it is governed by different regulations. SIPP Tax-efficient pension investment account Cash ISA ISA account to save up to 20000 GBP every year, tax-free Junior Investment Account ISA account to invest on the behalf of a child on a tax-free basis CFD and Spread Betting Account The account is provided by IG for forex, CFD, and cryptocurrency trading Hargreaves Lansdown Trading Platform Mobile App Review

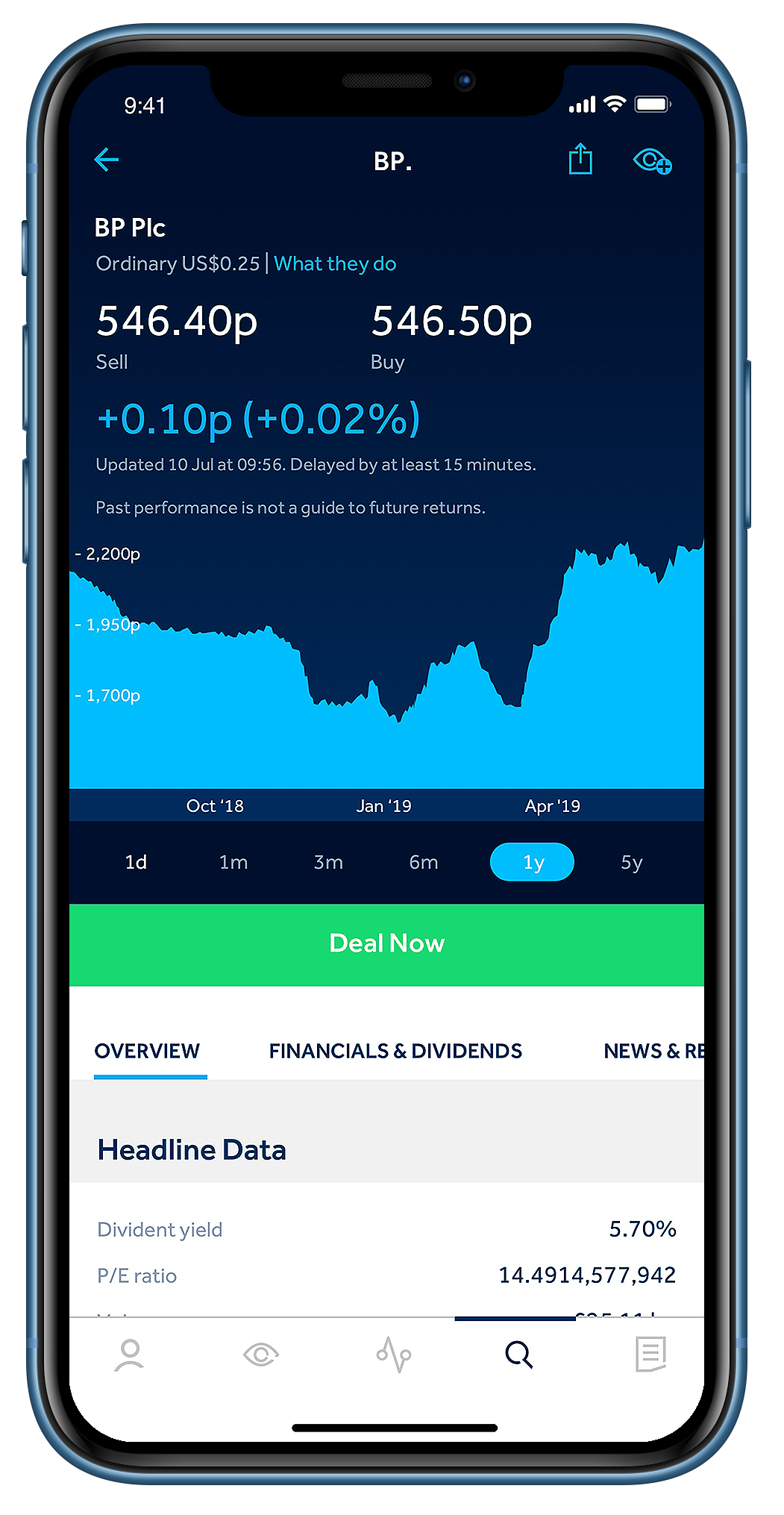

The mobile trading platform of Hargreaves Lansdown also has positive reviews, the same as their web platform. It is very well-designed and simple to use, and it has also been created in a manner that makes navigating it very intuitive. However, unlike the web platform, the mobile app does not allow you to set alerts and notifications for major market-moving events, thereby limiting its use as an on-the-go tool for trading stocks and forex pairs.

A convenient thing about their mobile platform is that they also allow you to sign in using biometric authentication, which makes the sign-in process much faster. The search bar has an additional feature that the web platform doesn’t: when you search for a stock, you can also see the news related to this particular stock, and thus keep yourself updated with the major events that might affect stock prices. The different order types and time limits that you can use are similar to the web platform.

Hargreaves Lansdown Trading Platform Deposit and Withdrawal Methods

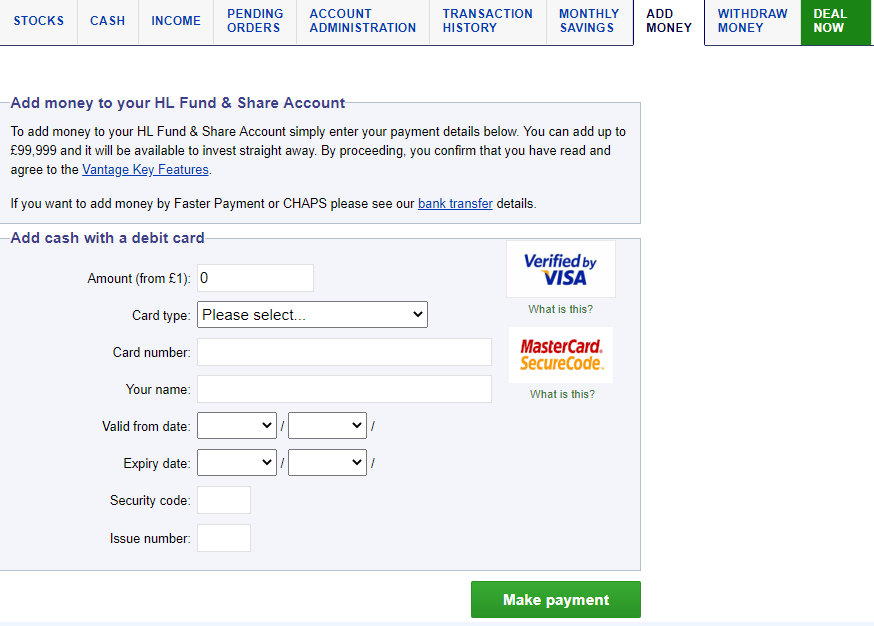

Hargreaves Lansdown allows you to deposit funds into your account by the use of a credit/debit card as well as a bank transfer. They do not support the use of electronic wallets. They also do not charge any deposit fees, however, you can only deposit funds in GBP. If you choose to deposit funds in another currency, you will be subject to the current market exchange rate.

As for withdrawals, you can only withdraw funds to your bank account via bank transfer. Hargreaves Lansdown does not support withdrawals via credit/debit cards or via electronic wallets. Similar to deposit fees, they do not charge any withdrawal fees either.

Hargreaves Lansdown Trading Platform Contact and Customer Service

The Hargreaves Lansdown customer service is widely known as being efficient. You can access their customer service team through either an email or a call. The customer service team is available 24/5, and usually resolves queries instantly or within a few business days. The team is very familiar with commonly faced issues, and can assist you with a swift and efficient resolution of your concerns.

The only limitation with their customer service and contact team is that the platform does not allow you the option of live chat with a member of the team. Hence, you have to either call them or send them an email, which could be a little inconvenient for people who prefer using the live chat option to get their problems resolved.

Is Hargreaves Lansdown Trading Platform Safe?

The Hargreaves Lansdown platform is safe, and you can be sure about this for one simple reason: they have been providing services to their clients for over 30 years. They are a listed company on the London Stock Exchange, and they are among the largest financial advisory firms and UK trading platforms, which is why they are also a part of the FTSE 100. They are known for their platform’s ease of use, below-average fees, and reliable service. Over the course of their years of service, they have had very few complaints, and they constantly update their platform and portfolios to take care of any small and big issues that might arise while trading. They are also primarily catered to UK traders and they have their headquarters in the UK, therefore they are a safe and reliable platform.

Is Hargreaves Lansdown Trading Platform Regulated in the UK?

Yes, the Hargreaves Lansdown trading platform is regulated in the Uk by the highest regulatory authority in the country, which is the Financial Conduct Authority (FCA). The regulator ensures that Hargreaves Lansdown is providing services in a manner that protects the interests of the traders and that the capital invested with Hargreaves Lansdown is invested in a safe and secure manner.

At the same time, the regulator also places some restrictions on what customers and clients the platform can take on, and this is why new users usually have to submit proof of their identity and complete the Know Your Customer (KYC) process before they are allowed to trade on the platform. Regulatory scrutiny and compliance are also important for the platform since it provides users with access to ISA accounts, which are closely monitored by the government.

How to Start Trading with Hargreaves Lansdown Trading Platform

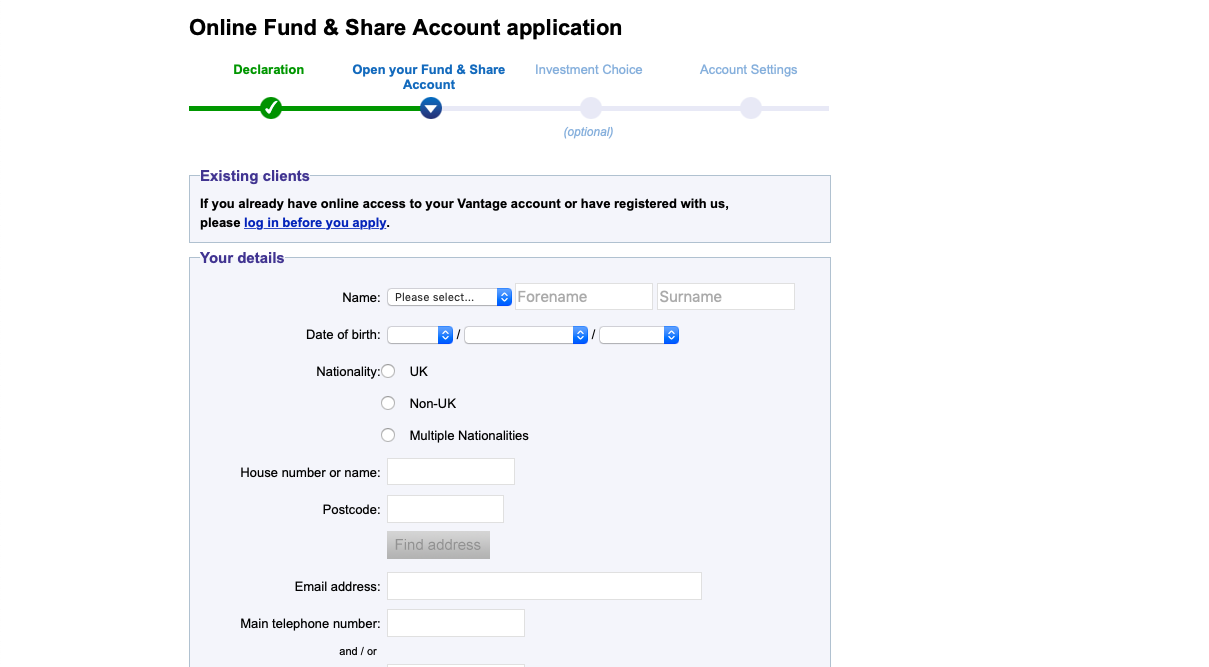

The process to begin trading with Hargreaves Lansdown is simple and straightforward, and only comprises 4 steps. These steps have been discussed below in detail.

Step 1: Open a Trading Account

The first step is to head over to the Hargreaves Lansdown website and register yourself for a trading account. All you need to do is to set up your login credentials and enter your contact details. This includes your email ID and your phone number too.

Once you complete filling in this form, you will be given a unique security code that you should note down. Whenever you log in to your account using the web portal, you will be asked to enter 3 specific digits of your unique security code in order to sign in.

Sponsored ad. Your capital is at risk.

Step 2: Verify Your Identity

The next step for you is to verify your identity on the platform before you are allowed to trade. Since Hargreaves Lansdown is regulated by the FCA, they need their new users to complete the Know Your Customer (KYC) process. This involves submitting proof of identity to the platform.

For UK residents, you can do this very easily online by submitting either a copy of your passport, driving license, firearms license, tax credit, pension, or other educational grants. It should be a document that lists out your name, address, and establishes that you are a resident of either the UK or whichever country you have mentioned in your registration form.

Step 3: Deposit Funds

The next step for you to do once your account has been verified is to deposit funds into your account. The minimum deposit requirements for Hargreaves Lansdown are just 1 GBP. The platform also does not charge any deposit fees.

In order to deposit funds into your account, you can do so via either debit/credit card or bank transfer. However, the card or bank account that you use has to be in your name and should have adequate funds. If you choose to add funds through a debit/credit card, then the funds will show in your account instantaneously. However, if you choose to use a bank transfer, then it will take up to 2 business days.

Step 4: Start Trading with Hargreaves Lansdown Trading Platform

Once your account has been created, verified, and funded, then the next step is for you to begin trading. Simply log in to your account and search for the instrument that you wish to trade. Then,m enter the size of the order, the type of order that you wish to place, the order time limit if any, the stop-loss and take profit percentages, and click on either buy or sell. The order will be executed almost instantaneously.

Hargreaves Lansdown Trading Platform Review – Conclusion

In conclusion, Hargreaves Lansdown is a reliable platform that is used by traders in the UK. it offers the ability for you to be able to trade stocks and forex pairs. They have an simple platform with a variety of trading and analysis tools, and they charge very minimal fees. However, they have above-average fees for stocks and ETFs. they also offer a variety of investing and fund options, some of which have been curated by their own team. All in all, the platform is suitable for traders in the UK looking to trade or invest their funds.

FAQs

Where is Hargreaves Lansdown headquartered?

Hargreaves Lansdown is headquartered in the city of Bristol, located in the United Kingdom.Who founded Hargreaves Lansdown?

Hargreaves Lansdown was founded by Peter Hargreaves and Stephen Lansdown in 1981 as a trading platform and a financial advisor.Can I invest in shares in the Hargreaves Lansdown Trading Platform

Yes, you can invest in shares by opening a Standard Shares and Funds account through Hargreaves Lansdown, or you can choose an alternative type of account that better suits your needs.Is Hargreaves Lansdown Trading Platform regulated in the UK?

Yes, the platform is regulated by the Financial Conduct Authority (FCA) in the UK.Can I open an account with Hargreaves Lansdown overseas?

Yes, you can open an account with Hargreaves Lansdown regardless of the location where you are staying. However, if you are investing from outside the UK, some fund options will not be available to you.Nishit Kumar Finance Writer and Analyst

View all posts by Nishit KumarNishit is a NGL Trader Analyst at Akari Trading. He has also worked as an analyst for Morgan Stanley and Onyx Commodities.

Before starting his career in finance, Nishit studied at the University of Warick where he was an active member of the Hedge Fund society. Due to his qualifications and experience, Nishit is considered an industry expert and enjoys writing content that could help traders to make informed decisions.

As well as writing, Nishit worked as Associate Editor for The Economic Transcript until 2021. He has also written for Newsweek and has good knowledge of current events that could affect the financial markets.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

By continuing to use this website you agree to our terms and conditions and privacy policy.Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Registered Company number: 103525

© tradingplatforms.com All Rights Reserved 2023

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up