Best Crypto Debit Cards in 2025 – Spend Bitcoin Instantly in the UK

In this guide we will review some of the best crypto debit cards that are available in the UK. Cryptocurrency has gained immense popularity in the global investment and financial payments world, and a growing amount of companies and finance institutions are becoming involved in digital assets. This paired with the technological improvements in web3 and integration of digital payments has paved the way for cryptocurrency to be used as a means of spending.

For retail investors looking to spend some of their digital gold, crypto debit cards are a frictionless payment mechanism. A crypto money card allows users to spend cryptocurrency, with funds being deducted directly from ones crypto portfolio. Many platforms began developing their crypto cards to give customers a method to spend their cryptocurrency. The world’s leading payment processors Visa and Mastercard have partnered with several crypto exchanges and custodians to provide card payment services which we will cover below.

Best Crypto Debit Cards in 2025

In this review of the best crypto debit cards we have selected 4 crypto money card providers. We will discuss each of them in depth covering the primary advantages, features and benefits, to assist readers to find a crypto debit card that is most suitable to individual needs.

- Crypto.com – Best Crypto Debit Card with Multiple Perks & Discounts

- Coinbase – Best Crypto Card for Visa Spending Worldwide

- Revolut – Best Debit Card for Travel Spending & Online Shopping Cashback

- Gemini – Best Credit Card to Earn Cashback in 50+ Cryptocurrencies

Our Expert Review Process – How we identified the best crypto debit cards

In order to identify the best crypto debit card to spending popular cryptocurrencies instantly we looked at several key factors as outlined below. It is crucial for our expert panellists to conduct several hours of research and user trials on each platform to test out its features and functionality first-hand.

Crypto.com – Supports 80+ Cryptocurrencies, Shopping Discounts & Perks

Score: 9.5/10

Fees: Must Stake CRO

Rewards: Up to 5% cashback in CRO

Supported Cryptocurrencies: 80 different tokens

Mobile app UI/UX: 9/10 | Sleek design & smooth user journey

Customer Support: via email, in-app or dm on X

Extra Perks: Spotify, Netflix, Amazon Prime subscriptions

As one of the world's largest cryptocurrency exchanges, Crypto.com was founded in 2016 by Bobby Bao in Singapore and today is one of the fastest and most secure cryptocurrency exchanges in the UK. Crypto.com card holders are able to spend over 80+ cryptocurrencies and 20+ fiat currencies anywhere where Visa payments are accepted.

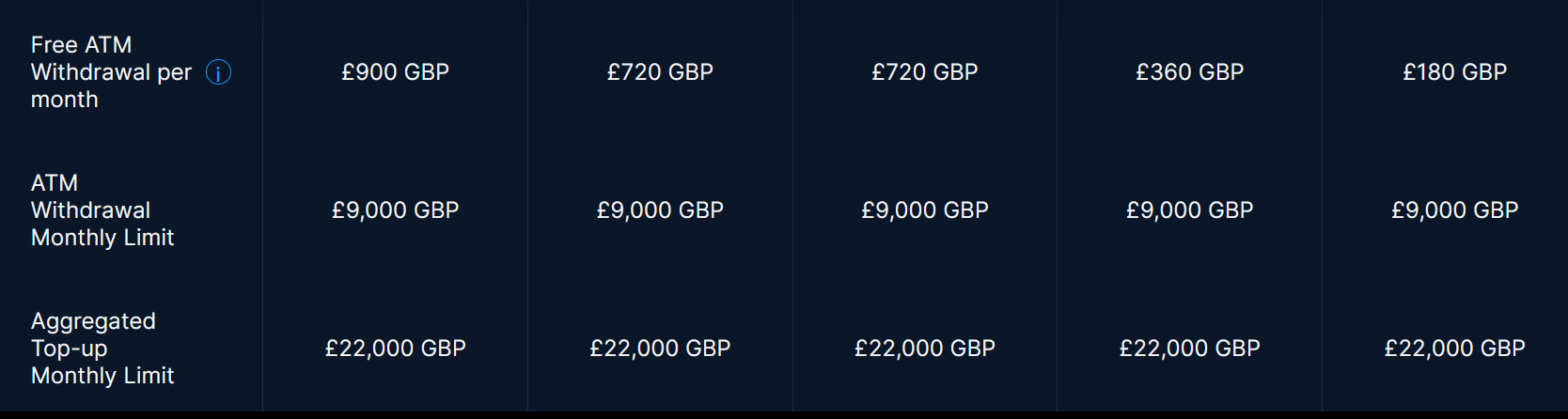

It is noteworthy that Crypto.com offers five different types of crypto money cards, determined by the amount of CRO (Crypto.com token) you own and stake. Moreover, it offers cashback ranging from 0% to 5%, depending on the amount spent and of what type of crypto money card you have. Crypto.com card can be topped-up using different methods such as Fiat Wallet, Crypto Wallet, or credit/debit card from within the Crypto.com mobile app.

The cards have a tiered system and to qualify for the card perks and benefits you must stake CRO for 180 days in varied amounts:

- £0 for Midnight Blue - No added perks, £180 0% ATM fee,

- £300 for Ruby Steel - 1% cashback, £360 0% ATM fee, 6 month Spotify membership

- £3,000 for Royal Indigo & Jade Green - 2% cashback, £720 0% ATM fee, 6 month Spotify & Netflix, Airport Lounge

- £30,000 for Frosted Rose Gold & Icy White - 3% cashback, £720 0% ATM fee, free subscriptions, travel discounts & perks

- £300,000 for Obsidian - 5% cashback, £900 0% ATM fee, free subscriptions, travel discounts & perks

Click here to view more information about the Crypto.com Visa Card types and packages available.

You have monthly withdrawals at ATMs up to the limit indicated by your card, which ranges from £180 for Midnight Blue to £900 for Obsidian. If you spend more than this amount, you will be charged a 2% fee. In addition, the monthly free currency exchange transactions range from £1,800 for Midnight Blue to £14,000 for Frosted Rose Gold & Icy White, but if you have the Obsidian card, this would be unlimited. If the amount exceeds that limit, a 0.5% fee will be charged.

Crypto.com offers numerous benefits to customers, including free access to applications such as Netflix, Spotify, and Amazon Prime, discounts on Expedia, Airbnb, and access to airport private lounges. Higher tier card owners can also earn bonus points for extra perks, receive higher CRO lock up rewards, added 2% APR on Crypto Earn and Crypto.com private member status.

Crypto.com has obtained many security certifications, including those issued by CCSS, SGS, Burea Veritas, NIST, and a stress-tested by Kudelski Security.

Coinbase - Visa Crypto Card Supported by 40M+ Merchants

Score: 9/10

Fees: No annual fee

Rewards: Up to 4% cashback

Supported Cryptocurrencies: Only 8 tokens

Mobile app UI/UX: 10/10 | All-in-one web3 suite

Customer Support: Virtual Assistant & Support Ticket

Extra Perks: None

Coinbase is one of the only cryptocurrency exchange platforms that is publicly listed on the NASDAQ. The company provides custody to over $100 billion worth of institutional money and trading volumes exceed $50 billion per quarter. It is one of the long-standing digital asset platforms being founded in 2012.

Coinbase account holders can use the Coinbase card to spend 8 different cryptocurrencies worldwide in all Visa locations. When initiating purchases the card will automatically convert the preferred crypto into fiat to make the payment. However, there is a 2.49% fee associated with crypto liquidations. Coinbase is also known to have some of the highest spreads which means users may receive less value than the uncapped spot price.

Cashback is quite a standard offering and you can get 1% for spending Bitcoin, Ethereum and meme coin DOGE. What is great about the Coinbase Card is that users can earn up to 4% back when spending other cryptos like Steller XLM. Coinbase allows users to link a bank account and you can deposit GBP instantly with zero fees using the Faster Payments Scheme.

Our expert review panel found that Coinbase Card had a lack of added perks and extra benefits. We expected that Coinbase would have a range of benefits and discounts considering that they are one of the oldest crypto card service providers.

Coinbase has extra added security that user can manage from within the app. These include two-factor authentication, card freezing, track spending, pin change and more.

Revolut - Best Debit Card for Travel Spending & Online Shopping Cashback

Score: 9/10

Fees: Free basic plan, £14.99/m Metal, £55/m Ultra

Rewards: Up to 10+% cashback, reduced crypto fees on paid plans

Supported Cryptocurrencies: 120+ cryptos & 36 fiat

Mobile app UI/UX: 9/10 | Top-tier personal financial management

Customer Support: via email or live chat support

Extra Perks: Device & everyday insurance, online shopping discounts

Revolut is a digital bank founded in 2015 which quickly grew to become a leading global challenger bank, currently having over 35+ million users worldwide and supports 150+ countries and regions. Revolut was able to land the authorization to provide cryptocurrency services in the EEA region and launched their crypto trading feature in 2017. Since then Revolut has shown itself to be one of the easiest platforms to use for instantly being able to deposit fiat from a normal bank account and swap into 120+ different cryptos all within a few clicks.

Revolut can be used in the same way as a Visa debit card and you can make payments globally on the Visa payment network. The only slight inconvenience with spending crypto is that users will need to manually swap crypto to the desired fiat currency from within the app. For Revolut users who do not have a premium subscription plan, the fee is the higher out of £1.49 or 1.49% per transaction. However, in comparison to Coinbase, this fee is much better considering Coinbase charges a 2.49% crypto liquidation fee.

Revolut offers an attractive range of benefits such as online shopping cashback and travel discounts when spending. Our expert research panel found there to be the most comprehensive range of cashback options with Revolut partnering with hundreds of global merchants. Retailers include global online store brands such as Amazon, ASOS and Wish to leading fashion brands such as North Face, Ralph Lauren and Nike. Shopping in-store also qualifies and Revolut offers cashback for shopping at Footlocker or the UK's largest fashion brand clothing outlet, Bicester Village.

If you are looking to spend crypto profits on travel, excursion activities or wining and dining then Revolut offers a great range of travel, food & beverage offers. These range from discount bookings, limited time special offers and worldwide airport lounge access deals. Users can get up to 10% cashback on hotel stays and up to 65% off on international travel resorts in over 30 destinations.. We found that there is quite a vast range to choose from, so if you're considering to make any bookings, its always a good idea to check Revolut for some extra savings. However, it must be noted that cashback is capped at €300 per month.

Although, Revolut is not a typical crypto card by nature, we found to to be one of the most unrestrictive debit cards for personal spending, eating out, luxury and travel. Ultimately, this makes Revolut stand out to use as a secondary card which is perfect for managing individual shopping expenditures. The mobile app has great UI and UX features, and viewership of information is easily digestible.

Revolut offers three different payment card types for a layer of extra security when shopping online. Users have the option to use the physical card (which can also be connected to ApplePay & GPay), the virtual card, and the disposable online shopping card. The disposable shopping card changes the card number, sort code and CVV every time so users do not have to share their real pegged account details with every retailer.

Gemini - Best Credit Card to Earn Cashback in 50+ Cryptocurrencies

Score: 7.5/10

Fees: No annual fee

Rewards: Up to 3% cashback | Over 5% merchant rewards

Supported Cryptocurrencies: 50+ cryptos

Mobile app UI/UX: 8/10 great security, limited functionality

Customer Support: 24/7 Customer Support

Extra Perks: None

Gemini is a digital currency exchange created by the Winklevoss brothers in 2015 in New York and supports more than 50 cryptocurrencies. As one of the world's most secure exchanges, it is committed to bringing choice, independence, and opportunity to individuals around the globe.

Our expert analysts found that the Gemini Credit Card is slightly different from other typical crypto cards in that it is a credit card. Users simply will spend using a credit card, and then must fulfil the credit balance. This means that they are not actually spending their own cryptocurrency, but spending fiat currency which is borrowed money. The downside of this is that fees for missed payments are very high variable APR of 18% to 30%, and penalties for missed payments are 35.24%.

When spending using the Gemini Credit Card users are able to earn cashback rewards depending on the category of purchase. You can earn three types of cashback, 3% on dining, 2% on groceries, and 1% on all other purchases. What is unique about the Gemini Credit Card is that you can choose the cryptocurrency in which you wish to receive your rewards and change the choice anytime. Users can choose rewards in Bitcoin, Ethereum or one of the other 50+ cryptocurrencies supported.

One major advantage of this card is that there are no annual fees, foreign transaction fees, or exchange fees to acquire your rewards. Also, when applying for a card, users can choose between three physical versions: black, silver, or rose. Gemini has taken a security-first approach as they have removed the card details from the front of the card, giving customers peace of mind by protecting users' account details.

Like every competitor, the account can be managed via the Gemini mobile or web application. One thing we noticed is the lack of extra perks available, however, Gemini does has limited-time exclusive offers with selected merchants including DoorDash, HelloFresh, Lyft, and ShopRunner.

Gemini has incorporated world class security in their operations extending the Mastercard zero liability protection on unauthorized transactions to customers. Users also have the security of Mastercard ID theft protection and can also instantly lock their card manually from within the app.

Comparing the Best Crypto Money Cards

We have summarized the most important features of the crypto cards offered by the main exchanges that offer crypto debit cards, explaining the various features, terms and reward offerings. Below you can find a quick summary table to compare each card offering as outlined above.

| Provider | Supported Coins | Fees | Rewards | Availability |

| Crypto.com | 80+ | Must stake CRO | Up to 5% cashback | Anywhere that Visa cards are accepted |

| Coinbase | 8 | No monthly fees | Up to 4% cashback | Anywhere that Visa cards are accepted |

| Revolut | 120+ | No monthly fees | Up to 10+% cashback | Anywhere that Visa cards are accepted |

| Gemini | 50+ | No monthly fees | Up to 3% cashback | Anywhere that Mastercard cards are accepted |

How do Crypto Cards Work?

Crypto cards can be referred to as e-money cards or crypto debit cards as you can only spend the funds in your balance without exceeding it, and they do not offer credit facilities. The exception here is the Gemini Credit Card which actually let's you spend a credit balance and be rewarded with crypto cashback.

The debit card versions of crypto cards operate similarly to bank debit cards. They share many of the same characteristics, such as a physical card (Visa or Mastercard), a card number, expiration date, a CVV/CVC code. The crypto spending card is linked to a recognized exchange platform, where you can view your account balance and make transfers or operations using your account. Using the physical card users can withdraw money from an ATM, use it to make payments where accepted or make online purchases.

When using this card to pay for goods or services or to transfer money, you might ask yourself, will I be transferring cryptocurrencies? The answer is no since crypto cards work so that people receive fiat money into their accounts, not cryptocurrency. Your account converts your linked cryptocurrencies into the local currency used for the transaction and subsequently uses that cash to make a payment.

As an example, if you have £300 of Bitcoin equivalent in your crypto debit card and you pay £100 in a store with the card, the system will deduct £100 from your Bitcoin, so you now have £200 in your card, the same method would be used when withdrawing money from an ATM that allows it.

As well as facilitating these transactions, each card can provide additional benefits and incentives as the Crypto.com card offers. Users can receive a range of benefits such as cashback, extra staking rewards, free subscription memberships, and competitive exchange rates. Users can also manage all transactions from a highly secure and comprehensive mobile application while also benefit from fee-free deposits, making it more attractive to use the crypto money card for spending.

Your money is at risk.

Benefits of Crypto Money Cards

If you wish to obtain a crypto money card, we will provide you with a list of the major general advantages that we could determine from our analysis of the key brokers in this guide so that you can decide if they are right for you.

-

Rewards and Incentives

As crypto platforms compete for customers, they offer rewards to encourage them to use their services, such as cashback, discounts, staking, very low commissions when withdrawing physical money, and extremely low exchange rates.

-

Payments for goods and services

In the case of cryptocurrencies, there is always the issue of converting them into fiat currency since there are not many establishments where you can spend your crypto funds. However, with crypto money cards you can buy things using your crypto as the exchange platform will convert it for you and process the payment through Visa or Mastercard.

-

Can Be Used Anywhere

Crypto money cards can be used worldwide as they are integrated on the Visa or Mastercard payment network. In addition, due to the novelty of this type of payment, some platforms offer very low exchange rates, or zero foreign transaction to entice you to use their cards.

-

Portability and Accessibility

It is possible to carry this card in your wallet and use it wherever you want, and it is very easy to keep track of your transactions and balances using web based or mobile applications for iOS and Android. Some platforms also offer digital/virtual cards that can be used on any mobile device and can also be linked to individuals ApplePay & GPay.

Your money is at risk.

How to Choose the Right Crypto Card for You

Once you have all the information presented to you, you should evaluate all the positive aspects of these platforms to decide which crypto card is the most convenient to meet your needs.

The following points are important factors to consider and will help you decide which is the best crypto money card in the marketplace for you.

-

Fees

The main types of fees that need to be considered are annual fees, foreign transaction fees, exchange fees for purchasing rewards, and ATM withdrawal fees.

By analysing with consideration of the amount of money you wish to move on your card, you will identify the best option for your funding level. Some platforms do not charge these fees or keep them at very low and competitive rates. Most cards have free withdrawal limits, meaning any ATM withdrawals after a certain amount will be charged, typically up to 3.5%.

Your money is at risk.

-

Supported Crypto Types

Since the amount of money on the crypto debit card depends on how many cryptos an individual owns. It is an important consideration to choose a platform that offers a wide variety of cryptocurrencies.

For example, with the Crypto.com Card, you have access to pay with 80+ cryptocurrencies, among them Bitcoin, Ethereum, XRP, and Litecoin along with smaller market cap coins. This will allow users to store a diversified range of cryptos and choose which to spend froma t what time.

-

Eligibility

Similar to the process of traditional banks evaluating users before issuing a debit card, the same process occurs with crypto cards. Each platform has a series of requirements before granting you the physical card.

Although, certain platforms require you to be part of a waiting list before you are provided with a card. While on other platforms, you must be a member of a club, have a lot of capital to qualify, or stake a significant amount of tokens before receiving the card.

-

Rewards

A fundamental factor is the rewards offered by these cards. We have observed that most of them offer cashback, discounts, and rewards points. Crypto.com offers the highest cashback with up to 5%, but the Obsidian card is a bit complex to acquire due to the amount of capital required. For merchant cashback rewards, Revolut offers over 10% with some retailers, however, you will have to convert your own crypto in the app and spend fiat, which incurs a 1.49% crypto swap fee.

How to Qualify for and Use a Crypto Card

Now that you have reviewed all the benefits of crypto money cards including the different features and rewards offered by each platform, you may still be wondering how to register and qualify for a crypto money card. Read on to find out the steps required to obtain one.

Step 1: Open an Account

The first step is to register with Crypto.com by downloading the mobile app and registering with your details.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. "

Step 2: Create a card

Once you have registered for an account, navigate to the ‘card’ tab in the app. From here, you can select which crypto card you would like to create.

The Midnight Blue card is the most accessible option and can be created by any Crypto.com user. To create any other cards, you will have to lock up CRO tokens. Click here to view more information about the Crypto.com Visa Card types and packages available.

Step 3: Top up card

You can use the Crypto.com app to transfer funds to your crypto card. The monthly top up limit for all cards is £22,000 GBP.

Step 4: Receive Crypto.com Card

After setting up your card, it will be sent to your home address via post. The card should arrive within 5 working days.

Step 5: Use Crypto.com Card

Once you have received your card, you will be able to use it to make purchases and withdrawals at ATMs.

If opting for higher tier cards, you will also be able to make the most of benefits such as airport lounge access, free Netflix, Amazon Prime, Spotify and much more.

Your money is at risk.

Best Crypto Money Card – Our Final Verdict

Due to the popularity of cryptocurrencies, crypto money cards have become a deciding factor when considering which reputable broker to use and conduct trading operations. Here, we have reviewed all the information relating to the best crypto debit card providers in the UK and coverage of the benefits they provide, key terms, reward/benefit offerings and any other aspects such as fees, spending limit and other terms.

Our research concludes that the overall best crypto debit card is the Crypto.com card, however, to obtain most of the extra perks you will need to stake a significant amount of CRO. However, there are a number of advantages such as automatic staking rewards, extremely low exchange rates, bank transfers, and no annual or withdrawal fees. The higher tier Crypto.com cards also comes with a range of leisure perks such as airport lounge access, free entertainment subscriptions and travel booking discounts.

For users who do not have that capital requirement, a good option for a limitless spending card is Revolut. They offer very attractive cashback terms at thousands of merchant partners and also support multiple global fiat currencies making it perfect for spending abroad. The only downside with Revolut is users need to manually exchange crypto every time, however, the fee is reasonable at just 1.49%.

All-in-all, it is ultimately down to individuals needs and preferences, and this review of the best crypto debit cards should asssit you to choose the right crypto money card for you.

Your money is at risk.