GO Markets Review UK- Is This A Good Broker To Use in 2025?

GO Markets offers beginners and experienced investors a quality trading platform and dedicated service through its award-winning online ECN brokerage. More than 1000 CFD instruments are available to clients across major global markets, including forex, indices, and commodities.

Our review of GO Markets 2025 explores the products and services provided by GO Markets, which will help potential investors to decide whether this CFD provider will suit their trading needs when they are looking to start or grow their portfolios.

GO Markets Review UK 2025– Overview

- GO Markets is a leading online broker among Australia’s best forex brokers that is regulated by the Australian Securities and Investments Commission (ASIC). The broker is also regulated by the Cyprus Securities and Exchange Commission (CySEC) and Financial Services Commission (FSC)

- GO Markets has received a number of reputable awards including several Investment Trends Awards in 2019, 2020 and 2021.

- Both new and experienced traders can benefit from GO Markets’ simple and competitive trading assets. Aside from shares, forex, commodities, indices and treasuries, it offers 1000+ CFD instruments.

- There are over 1000+ CFD instruments that can be traded at GO Markets, which covers a variety of markets such as forex, stocks, indices, and commodities. There are two main types of accounts available at GO Markets. GO Plus+ is a commission-based account with spreads starting at 0 pips, while the standard account is commission-free.

- In addition to Myfxbook and Trading Central, traders can access autochartist, MT4 and MT5 through the broker. Each of these trading platforms offers useful tools, which traders can use to execute profitable trades using fundamental and technical analysis.

Your money is at risk.

What is GO Markets?

GO Markets is an Australian CFD broker that integrates with MT4 to provide traders with everything that they need to navigate the market and make informed decisions.

As one of the first Australian brokers to support MT4, GO Markets is a popular choice for advanced traders who want to conduct fundamental and technical analysis. The MetaTrader 4/5 trading platforms are available on desktop, which does not require downloading an application.

There are over 1000 assets available for trading at GO Markets, including forex pairs and CFDs on individual stocks, metals, and indices. The possibility of trading commodities and treasuries is even available to users who want to diversify their portfolio.

In addition to the GO Plus+ trading account, the broker also offers the Standard trading account based on spreads. GO Markets also offers a free demo account to try out its services.

Even though GO Markets does not accept clients from Canada or the US, individuals can open a trading account with them from more than 175 countries worldwide. In some jurisdictions, you can use the leverage of up to 500:1

By supporting Myfxbook’s AutoTrade feature, GO Markets allows clients to access social and copy trading options. Furthermore, GO Markets offers MT4 and MT5 Genesis, Autochartist, a-Quant, Trading Central, and a Virtual Private Server (VPS) service for MT4 and MT5.

What assets does GO Markets offer?

Based on our GO Markets review, the website features 1000+ trading instruments traders can use to trade CFDs on Indices, Forex, commodities, treasuries and shares. Each trading instrument has its specifications and trading conditions. As a result of this broker’s tighter spreads, day traders are able to diversify their portfolios and generate profits by trading in competitive markets.

This broker offers several trading assets, which fall under the following main market segments.

- More than 50 minor, major, and exotic currency pairs are available, including AUD/USD, USD/CAD, USD/JPY, EUR/USD, USD/CHF, and GBP/USD.

- Regarding shares, users have access to more than 1000 shares, including 500 shares from NASDAQ and NYSE.

- A cash CFD and a futures CFD can both be traded in Index CFDs.

- Traders can trade precious metals CFDs in short or long positions according to their preference

- Bitcoin, Ethereum and dozens of other cryptos are available as CFD cryptocurrency options.

- As part of the commodities segment, traders can trade precious metals, crude oil, futures, and spot markets.

Leverage

UK traders can take advantage of the highest rate of 1:500 offered by the firm under their Mauritius (MU) entity. Each asset class has its own leverage limit, as follows:

- Forex: 1:500

- Indices: 1:100

- Commodities: 1:50

- 1:50

Your money is at risk.

Where is GO Markets based?

Since 2006, GO Markets has been authorized and regulated by the Australian Securities Investment Commission . In addition to its London location, it has one in Cyprus, Mauritius, Thailand, Australia and Malaysia. The broker has a distinctive green logo of a ribbon-shaped like an easily recognizable octagon.

GO Markets Awards

A special award was given to GO Markets by Investment Trends for the quality of its customer support during the trading week, which is available 24/5. In addition, a number of other awards have been won by this broker, including the award for Best Non-Commission Forex Account from Compare Forex Brokers, Best Educational Materials/Programs from Investment Trends, as well as Best Fintech Forex Broker Global and Most Trusted Forex Broker Europe in the Global Forex Awards.

GO Markets Fees

When choosing a broker, there are many different fees to consider. Each platform will charge different fees depending on how they operate and the type of assets that they offer. In general, the main fees to consider include:

- Commission – A trade’s entry and exit costs.

- Spread – The price difference between buying and selling

- Overnight swap fee – Overnight, leveraged positions have a cost associated with them.

- Conversion fees – A cost associated with converting your base currency into the currency of the asset you are trading if the currencies are different.

Go Markets does not include any withdrawal or deposit fees or any inactivity fees.

| Assets | Fee level | Fee terms |

| EUR/USD | Low | GO Plus+ account: 2.00GBP commission per lot per trade plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| GBP/USD | Low | GO Plus+ account: 2.00GBP commission per lot per trade plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | Low | 2 GBP commission per lot per trade plus spread cost. 0.35points is the average spread cost during peak trading hours. |

Non-trading Fees

It is important to note that GO Markets does not charge fees for deposits and withdrawals, nor does it charge fees for inactivity. It is a welcome development in an industry where almost every transaction has an extra fee. This means that you will not be charged for inactivity.

Your money is at risk.

GO Markets Regulation

The Australian Securities and Investments Commission (ASIC) has an exclusive regulatory jurisdiction over GO Markets since its founding in 2006 in Melbourne. Their Australian Financial Services Licence (AFSL) makes them one of the best Australian forex brokers.

- GO Markets Pty Ltd (gomarkets.com) holds AFSL 254963.

- GO Markets Ltd is GO Markets’ trading name in Europe. License number 322/17 is regulated by the Cyprus Securities Exchange Commission (CySEC). As such, they are regarded as a top UK forex broker. GO Markets Pty Ltd (MU) is a Global Business Company (Company No. 170969), authorized and regulated by the Financial Services Commission (FSC) of Mauritius as an Investment Dealer (Full Service Dealer, excluding Underwriting) (license No. GB 19024896)

Investor protections are enforced by CySEC and the Australian Securities Investment Commission (ASIC), including brokers holding client funds in segregated bank accounts to protect traders’ balances.

How To Open an Account with GO Markets

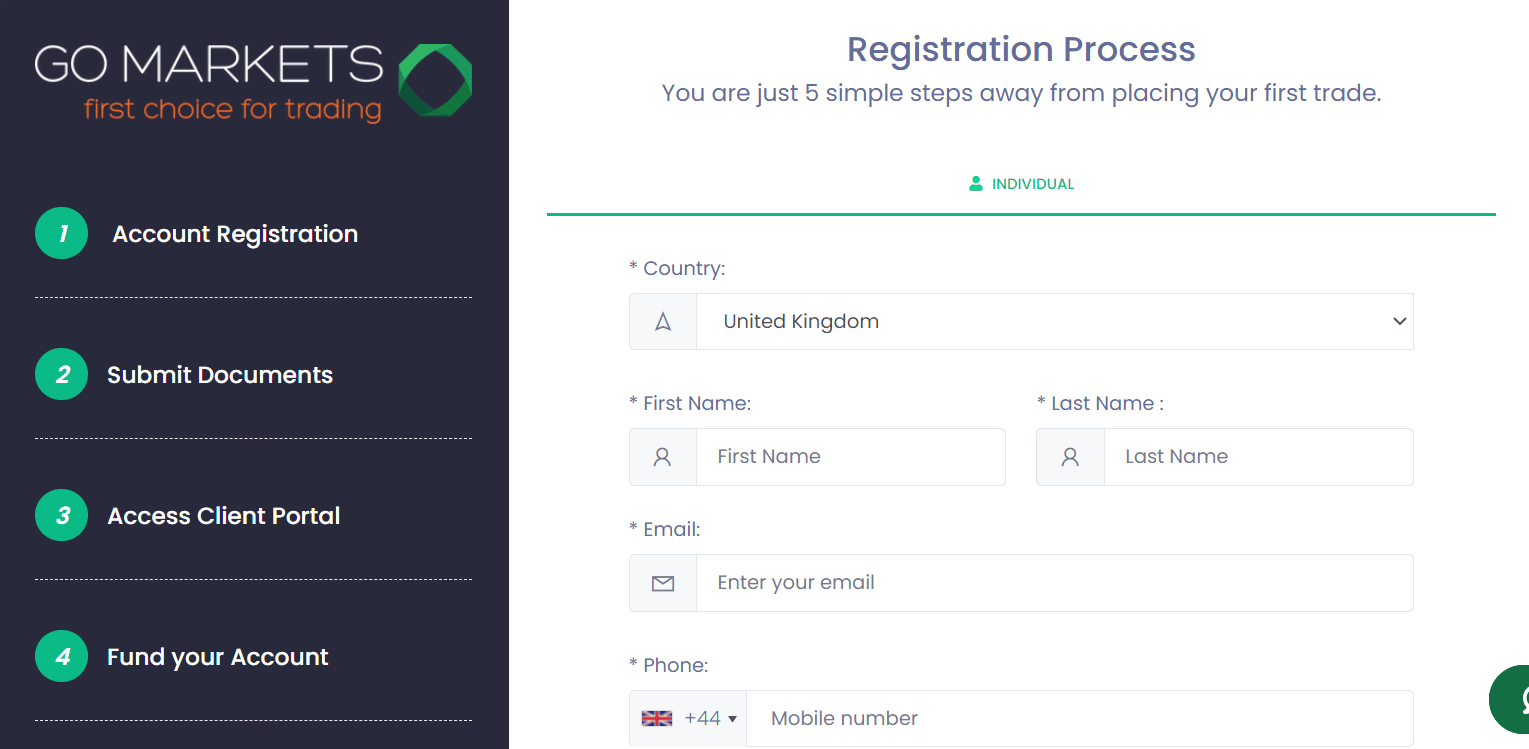

Opening an account with GO Markets is simple and easy to follow. The steps below show you how traders can start trading with this broker today:

Step 1: Create a CFD account

Navigating to the GO Markets’ website is the first step to registering and opening an account.

During this process, the trader must provide their full name, email address, contact number, etc.; once they complete this process, a verification link will be sent to their email address. Once the trader has verified the link, an account will be opened for them.

Step 2: Submit Verification Documents

Opening an account is a fast and fully digital process. Furthermore, the verification process takes only one business day to complete.

To verify your identity and residency, you will need to upload the following documents:

- Proof of identity: Passports, driving licenses, identity cards, or residence permits

- Proof of address: Tax returns, council tax bills, government-issued certificates of residence, utility bills not older than three months

Step 3: Deposit Funds

To start trading with GO Markets, you will need to deposit funds into your account. To do this, open the client portal area of the broker’s website.

Then, click on the deposit button, you can initiate the process of funding your account via your preferred deposit method. GO Markets accepts the following currencies: EUR, USD, GBP, AUD, AED, SGD, CHF, NZD and HKD.

Step 4: Practice With The Demo Account

GO Markets offers a demo account that allows you to practice trading over 1000 CFDs, with real-time spreads, a leverage of up to 1:500, and over 80 technical analysis tools, as well as 24/5 multilingual client support.

Users can receive up to $50,000 in virtual funds to practice on MT4 and MT5 on either their portable device or desktop computer. In addition, you can easily set up a paper trading account on the broker’s website by filling out an online form available on that site.

Step 5: Start Live Trading

Once you have practiced using the platform with a demo account, you can start live trading with GO Markets. It is very simple to switch between the demo and live trading account.

To start live trading, all you have to do is log in to the desired trading platform, either MT4 , MT5 or GO WebTrader, and navigate to the symbol charting section. Next, choose an asset from the list of symbols to display its price chart. Then, based on your strategy, you can apply technical analysis and open a long or short position based on the direction you think the asset will move.

Your money is at risk.

Pros and Cons of GO Markets

Pros:

- A licensed and regulated broker in Australia

- The minimum deposit to begin live trading is $200; commission-free trades are available

- There are more than 1000 instruments available for trading, and the spreads are tight

- Customer service is available 24x5

- Forex, commodities, stocks, indices, treasuries, metals, CFDs, and many other trading instruments are available

Cons:

Your money is at risk.

GO Markets- Key Features Reviewed

Demo Trading

Following registration and the opening of an account, users can begin demo trading with virtual funds. Demo accounts allow traders to familiarise themselves with the platform's features and functionalities while testing their various trading strategies.

The GO Markets demo trading account mimics live trading conditions and offers leverage of up to 1:500. Furthermore, the demo trading can be used alongside MT4 just like the live trading account so that users can perfect their analysis strategies.

Customer Support

There is multilingual customer support available 24 hours a day, Monday through Friday, on the GO Markets website. You can reach them via live chat, telephone, or email. In addition to the FAQ section, GO Markets offers a contact form or email address for traders with questions. Telephone support is also available through the website, which includes the phone number. In addition, traders can contact this broker through Instagram, Facebook, and LinkedIn, as they have a presence on social media.

MT4 And MT5 Platforms

GO Markets supports both MetaTrader 4 and MetaTrader 5 platforms. At the Global Market Financial Review's FX & Broker Awards, GO Markets was recognized as the Best Forex Platform Australia as the first Australian broker to use MetaTrader.

MetaTrader 4

MetaTrader 4 (MT4) has long been considered the industry standard in the Forex industry. Even though MT4 has reached its prime, it is still very popular due to its auto-trading capabilities and expert advisors (trading robots) that enable algorithmic trading. MT4 allows traders to:

- View real-time pricing & execution

- Positions can be opened and closed

- Get access to the full range of Expert Advisors (EAs)

- Orders for buying or selling can be placed

- Over 25 technical indicators are available to you

- Access the economic calendar

MetaTrader 5

MetaTrader 5 provides powerful trading tools, including Market Depth and a separate order and trade accounting system. Two order accounting systems are supported: the traditional netting system and the hedging option system. Various trading objectives can be met with various order execution modes: Instant, Request, Market, and Exchange. The platform, including market orders, support all types of trade orders, pending orders, stop orders, and trailing stops. In addition to providing access to over 80 technical indicators and analytical tools, this software allows you to open up to 100 charts in 21-time frames simultaneously.

GO Markets supports MT4/MT5 Genesis, an add-on to MetaTrader that offers advanced charting, expert advisors, and VPS options. In addition, upon installing this add-on, you will be able to access an extra set of trading tools that will enhance certain features of your platform that are already available.

One of the best features is an advanced order management system that enables traders to do other tasks while keeping the trades active on the screen. The terminal view can also be used to trade.

In general, although GO Markets only offers Metatrader platforms, which aren't as beginner-friendly as proprietary platforms offered by other brokers, MT4/5 are considered some of the industry's best third-party platforms.

Fast Execution Speeds

The company aims to be the first choice for new and experienced traders who are interested in trading CFDs. With dependable service, transparent pricing, fast execution, and platform stability, they provide the best trading experience to their clients.

With GO Markets, clients are assured of fast execution speed, quality trading platforms, and secure transactions.

Education Material

Regarding educational materials, GO Markets are good, but they aren't as good as some of their competitors.

In addition to downloadable handbooks, GO Markets offers a structured course, educational videos, and technical instruction videos to assist you in getting started with MetaTrader.

Handbooks: There are two free downloadable handbooks on GO Markets that cover Forex trading - one on the subject for beginners and another for more advanced traders. Amongst the topics covered in the beginner book are basic terminology, chart reading, and trader psychology. Registration is required for the advanced eBook, which covers technical analysis and trading strategies.

Videos: While some of the videos are available for public consumption, one must register for an account to view the entire video library. The videos are a useful resource to help new users navigate the platform.

Courses: It is absolutely free and open to the public to attend two-part Forex webinars, and all you need to do to take part is register your name and email address. In one of the courses, participants will learn about the Forex market and how to enter and exit trades. A second course looks at technical analysis, how to read charts, how to use technical indicators for understanding data, how to develop a successful trading plan, and how to manage advanced orders.

MT4/MT5 Tutorials: 18 technical videos for MT4 and MT5 are also included in this collection. These videos will help traders set up charts on the platform, lay them out, and place the first trade.

Trading Tools

In addition to MetaTrader Genesis, Myfxbook, Autochartist, Trading Central, a_Quant, a VPS, and hosting service, there are a wide range of trading tools available at GO Markets.

Autochartist

Undoubtedly, Autochartist is one of the most widely used charting tools on MT4 among the GO client base. Using Autochartist, you can eliminate the time-consuming and complex process of analyzing charts for patterns and automate the process of monitoring and scanning the markets on your behalf. Audio and visual alerts are sent when emerging, and completed patterns are identified. With a live trading account funded at 500 USD or more, traders can access this chart pattern recognition software.

Trading Central

With Trade Central, you'll receive actionable investment support, including 24-hour coverage of multiple assets, technical and fundamental analysis, and backtested trade strategies. In addition, you can receive market news via WebTV or email and build trading strategies within the platform. GO Markets' clients have access to Trading Central for free.

VPS

The use of VPS services can ensure that trades never get disrupted due to technological or connectivity issues, like load-shedding or internet service failure. This is a great benefit for algorithmic traders who need to connect to a server 24/7 to maximize their uptime. In addition, you can be able to optimize the features and capabilities of the MT4 & MT5 trading platforms by using a GO Markets VPS. The service fee will be 26 USD, but the fee will be waived if the client trades at least 10 lots per month.

MetaTrader Genesis

MetaTrader 4 & 5 Genesis enhances the power of the standard MetaTrader platform with a comprehensive suite of trading tools. In addition, MetaTrader Genesis offers the following benefits:

- Professional MetaTrader add-ons are available.

- An order management system that is sophisticated

- Getting trading alerts.

Myfxbook

The Myfxbook platform is used by 90,000 traders worldwide to copy trades across brokers. Traders can mimic other Forex traders' trades rather than following an algorithmic pattern similar to using EAs. Traders can use this system by connecting their GO Markets Standard Trading Accounts to Myfxbook. Users of Myfxbook can also access a wide range of statistics and analytics.

a-Quant

With a-Quant, you can aggregate millions of data points and apply machine learning algorithms for regime detection, sentiment analysis, clustering, cointegration, and developing Hidden Markov Models. Basically, a-Quant generates high-probability trading signals with certain risk/reward characteristics.

FX traders can use Daily Strategies as a signal service. This software generates large numbers of signals for high-frequency trading of major FX currency pairs. For example, for the 10 most popular FX currency pairs, a-Quant generates 9-12 signals per day on average. You can receive them directly in your inbox.

The trading tools offered by GO Markets will help traders make better trading decisions.

GO Markets Mobile Trading

You can use MetaTrader 4 and MetaTrader 5 on any mobile device. The platforms integrate with the broker similarly to desktop versions, so all trading activity is synchronized.

As a result of reduced time frames and fewer charting options, traders should be aware that there is some loss of functionality when compared to desktop trading platforms, but they can close and modify existing orders, calculate profit and loss, and trade on the charts.

Your money is at risk.

GO Markets Account Types

1000+ instruments are available to trade with GO Markets, which offers CFDs on forex, shares, indices, precious metals, treasuries and commodities.

Both beginners and experienced traders can choose between two simple account types at GO Markets.

An account with a lower minimum deposit and one allowing micro-lot trade is generally more suitable for a beginner trader. Spreads on these accounts are usually wider than those with higher minimum deposits, but not at GO Markets, where both accounts require a 200 USD deposit. The Standard Account has higher trading costs than the GO Plus+ Account, which has spreads that start at 0 pips (EUR/USD) for a commission of £4 round trip.

Experienced traders generally prefer a tighter spread and a higher minimum deposit. However, this trade-off does not occur at GO Markets since both accounts have a minimum deposit of $200, but the GO Plus+ account has lower trading costs.

The leverage on major currencies is 500:1, on share CFDs, it is 1:20; and on indices, it is 1:100. Client accounts, however, are set up with a 1:100 leverage rate by default.

In addition to being able to trade on both the MT4 and MT5 platforms, GO Markets also offers hedging, scalping, and copy trading to clients. Unfortunately, Islamic swap-free accounts are not available at GO Markets.

Standard Account

An $200 deposit is required to open a standard account, and traders can select either Mt4 or MT5 as their platform of choice. There is also a leverage of 500:1, and spreads start from 1.0 pips. In addition, there are no commissions charged by this broker, and the trader has the advantage of being able to execute their trades more quickly. Our review found that the standard account is the best option for new and experienced traders since the platform offers several educational tools to help them make informed decisions.

GO Plus+ Account

The minimum deposit for GO Plus+ accounts is $500, which is suited to high-volume traders. In addition, the spreads are low, starting at 0 pips. In terms of the standard account, there is a minimum trade size of 0.1 lots, and the trader has the option of using a leverage ratio of 500:1. All GO Plus+ and standard accounts come with a dedicated account manager.

Your money is at risk.

Is GO Markets Safe To Use In The UK?

Investors have access to all legal documents, including the company's privacy policy, which states that all personal data is highly protected against unauthorized access. Additionally, the broker is multi-regulated by some of the world's toughest financial watchdogs, further reinforcing its security.

What Is The Minimum Deposit for GO Markets?

GO Markets accepts deposits in AUD, USD, GBP, EUR, AED, SGD, CAD, CHF, HKD and PLN. However, if you deposit from another currency, your depositing company will charge a conversion fee, not GO Markets.

The client portal area makes depositing and withdrawing funds very easy. Credit/debit card deposits, Skrill, Neteller, and DotPay deposits are credited instantly, while bank transfers can take between one and three business days. There is a minimum deposit of $200 required.

Funding your account with GO Markets is easy with various fee-free methods. It is possible, however, that your bank or payment provider will charge you some fees.

| Method | Commission | Processing Time |

| Bank Wire | Zero | 1 – 3 business days |

| Credit/debit card | Zero | Instant |

| Neteller | Zero | Instant |

| Checkout.com | Zero | Instant |

| Fasapay and Skrill | Zero | Instant |

GO Markets Chelsea FC Partnership

In October 2020, GO Markets became Chelsea Football Club's official online trading partner as a global broker. In addition to offering multi-asset brokerage and liquidity to retail and institutional clients globally, GO Markets has established itself as one of the most trusted and respected online brokers. The company was formed in 2006 and specialises in providing online trading services in forex, shares, indices, and commodities.

GO Markets, like Chelsea FC, has been recognized for its high-quality execution, low costs, and premium customer service. The fact that GO Markets has received various awards from global award bodies is a testament to its excellence. In addition, GO Markets' branding features heavily at Stamford Bridge on matchdays, alongside branded digital content assets and in-depth player content features, raising awareness of GO Markets' products and mission to a global audience.

Go Markets Review UK 2025- Conclusion

GO Markets is one of the leading forex brokers in Australia and is a great option for UK traders also. Various tools are available, including Trading Central, Autochartist, Metatrader 4 and 5, and a demo account. Users can trade using a variety of platforms according to their convenience. Additionally, deposits and withdrawals can be made through various payment methods, and registration is easy. Although this broker offers a number of features, it is still advisable that traders research and analyse the broker before proceeding.

Your money is at risk.