Investiční a obchodní aplikace pro rok 2026 – Srovnání

The best online brokers now offer dedicated mobile apps for stock trading (trading apps). The best trading apps, which are usually compatible with both iOS and Android devices, allow you to buy and sell financial instruments with just the click of a mouse.

However, you need to do proper research before choosing a trading app that suits your needs.

To help you get a little more savvy, we’ll use this guide to compare the best business apps to choose from in 2026.

Best Business Apps for the Year 2026

Want to download the best stock trading app today? If so, below are the top-rated stock trading apps we think you should consider. Scroll down to learn more about each provider.

- eToro – Overall Best Stock Trading App of 2026

- XTB – Very popular CFD broker with its own mobile app

- Pepperstone – A sought-after and licensed CFD and forex broker with low spreads

- Libertex – CFD application for stock trading with zero spreads

- AvaTrade – Best Forex Trading App by Global Forex Awards

[stocks_table id=”24″]

Quick Start with Trading App Test Winner – eToro

Getting started with the eToro trading app is easy. Follow these 4 simple steps and start trading today!

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

Business Apps – Rating and Choosing the Best

There are now hundreds of stock trading apps active on the mobile investing scene, which is great because you are sure to find a provider that will help you meet your financial goals.

However, you need to focus on a number of factors when looking for the best stock trading app – such as those surrounding tradable markets, commissions, usability, and regulation.

The good news is that we’ve done the work and reviewed the best business apps currently available on the market.

1. eToro – Overall Best Free Trading App of the Year 2026

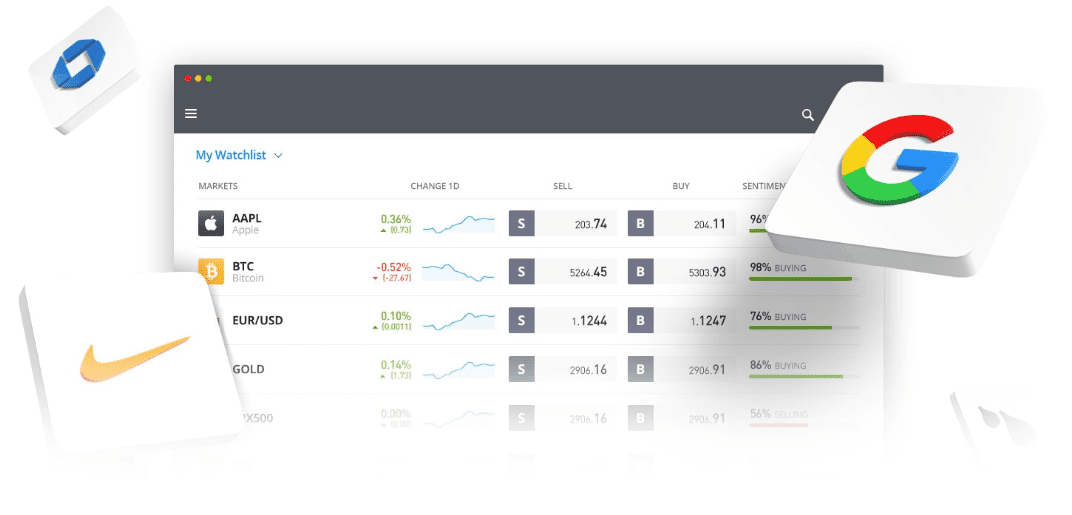

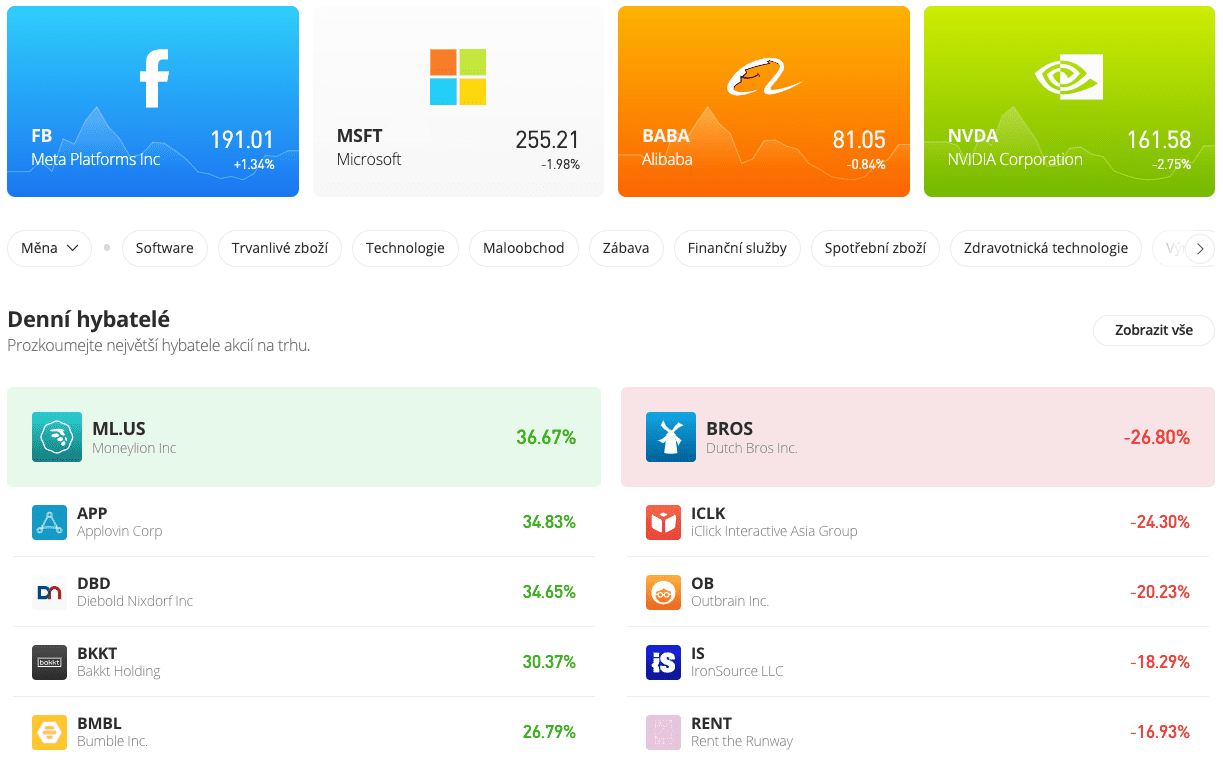

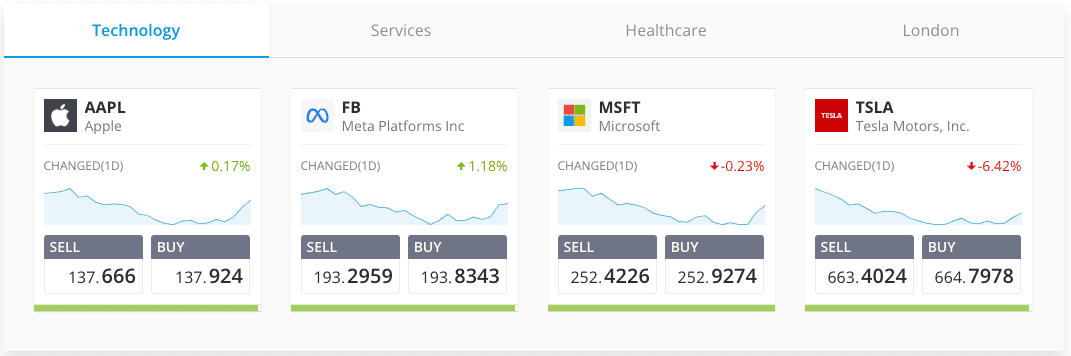

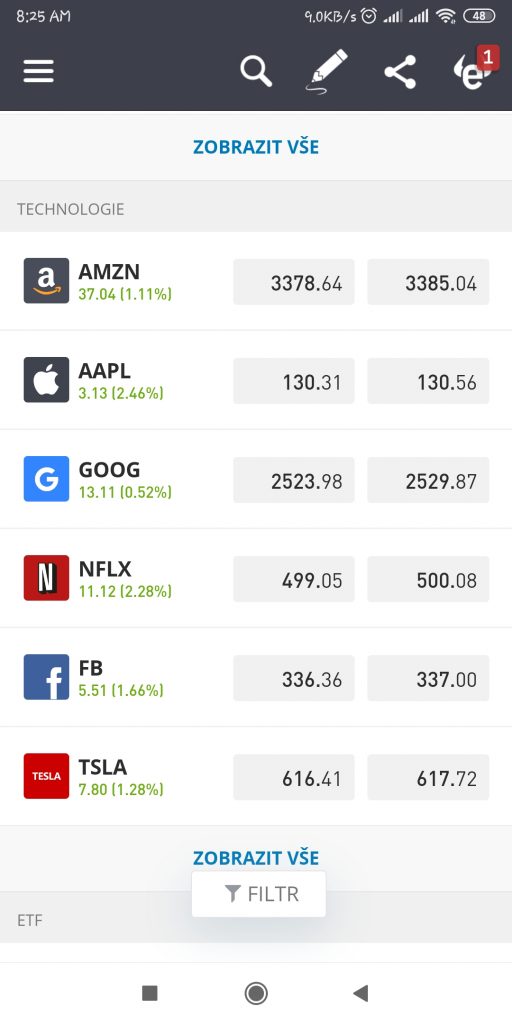

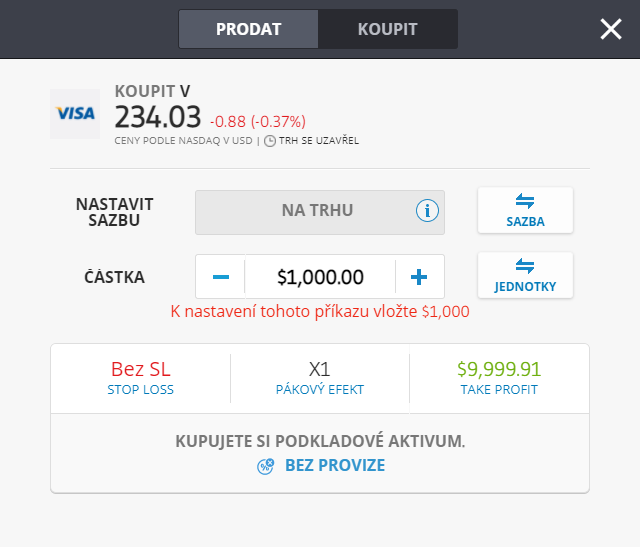

Once you’ve completed the 10-minute registration process, you’ll gain access to thousands of tradable markets. These include over 2,400 stocks from 17 international markets, over 250 ETFs, 16 cryptocurrencies, and a host of CFD instruments. The latter include everything from gold, silver, and oil to natural gas, wheat, and copper. You can also trade forex on this top-rated investment app , with support for over 55 pairs.

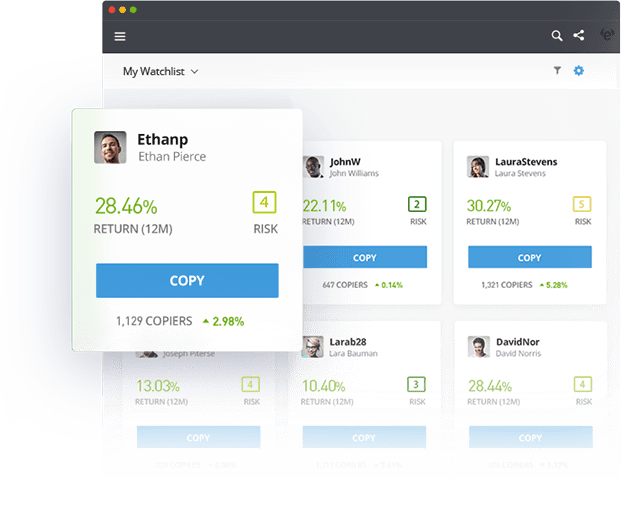

In terms of basic features, the eToro stock trading app allows you to do what is known as socially passive investing. For example, the Copy Trading tool allows you to choose from thousands of verified investors and then copy all of their ongoing positions. The stock trading app also allows you to invest in diversified portfolios that are managed by the eToro team.

We also like this social trading app provider because it offers a full demo account that is pre-loaded with $100,000 worth of fictitious funds.

Many mobile trading and investing apps that you can find on Google Play or the Apple Store are not as heavily regulated as eToro. eToro’s regulation includes a license from the FCA, ASIC, and CySEC. The app provider is also registered with FINRA in the US. If you like the eToro stock trading app, you only need to meet a minimum deposit of $200. You can add funds to your account directly from the app – supported payment methods include debit/credit cards and e-wallets like PayPal.

eToro Festival

| Charge | Amount |

| Stock trading fee | 1$ |

| Forex trading fee | Spread 2.1 pips on GBP/USD |

| Cryptocurrency trading fee | Spread 0.75% for Bitcoin |

| Inactivity fee | $10 per month after one year |

| Withdrawal fee | $5 |

Advantages

Disadvantages

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

2. XTB - Very popular CFD broker with its own mobile app

XTB is one of the largest CFD brokers in the world, which is gaining great popularity among the general public.

The selection at XTB is really wide, so it can be said that everyone can choose here. Traders and investors can also choose from more than 70 forex currency pairs, more than 50 cryptocurrencies , 20 indices , 300 ETFs or even commodities, dominated by oil and gold .

With this broker, potential users can choose from two account types. One of them is a standard account, with which trading is commission-free and spreads start at 0.8 pips. The second account type is a swap-free account, which is also commission-free, but the spreads are slightly higher in this case. With this account, traders have the opportunity to maintain their trading positions overnight, without paying swap fees. It is also worth noting that XTB does not require its users to make any minimum deposit or two-step user verification. This is also another of the many things that makes this broker much more accessible to the general public.

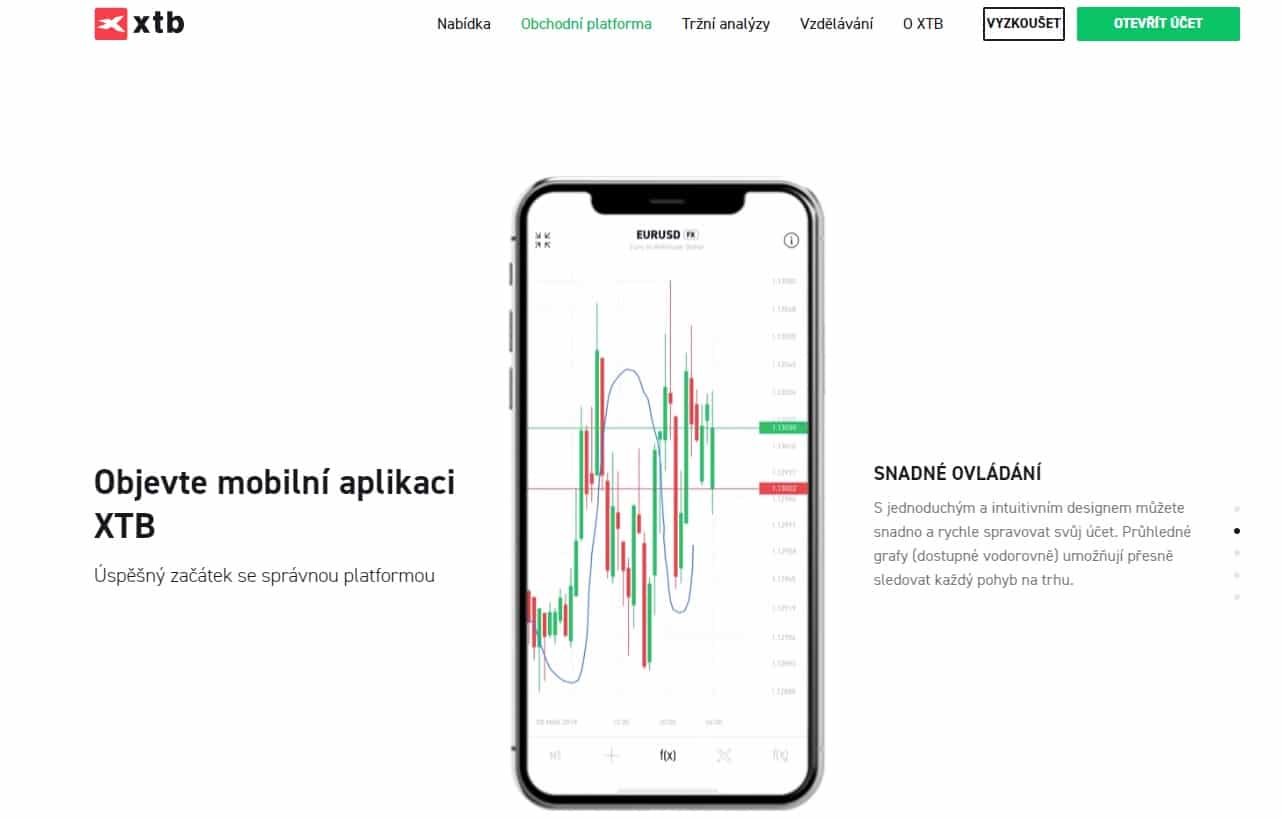

A big plus of XTB is the trading platform xStation 5 itself. It is a trading platform that is available both via web browsers and applications for iOS and Android, and it can also be downloaded for Windows and Mac. Moreover, all of these options always offer the same functions and tools. Of course, there is also a demo account function , which gives traders and investors the opportunity to try out the trading platform before they start trading with their real funds. At XTB, the demo account is free and only for one month.

But the list doesn't end there. XTB also thinks about those traders and investors who don't have the opportunity to sit at a PC all the time and still want to have access to the world's financial markets at their fingertips, whenever they need it. This broker makes this possible through its new XTB mobile application, where traders and investors will also be able to choose from more than 5,900 CFD markets from around the world.

XTB fees

| Charge | Amount |

| Stock trading fee | Free |

| Forex trading fee | Spread from 0.8 pip |

| Cryptocurrency trading fee | Spread of 0.22% |

| Inactivity fee | 10 EUR per month after one year |

| Withdrawal fee | Free |

Advantages

- User-friendly trading platform

- Buying physical shares with 0% fees

- Over 3,000 stocks and 300 ETFs

- No commissions

- Demo account

- Great mobile business app

Disadvantages

- Demo account for 1 month only

- It is not possible to use your own AOS

3. Pepperstone - A sought-after and licensed CFD and forex broker with low spreads

Pepperstone is a little-known Australian broker in the Czech Republic, which  offers its users a highly competitive and fully equipped trading portal, which focuses mainly on forex trading . Of course, an integral part of the broker's offer also includes other financial instruments such as stocks , indices, commodities or cryptocurrencies , but they can only be traded via CFD contracts. Pepperstone is headquartered in Australia, where it was also founded in 2010. At first, it only operated in Australia, but where it managed to build a very good reputation as a safe, transparent and regulated broker in a relatively short time. After this success, it has now started to direct its efforts and goals to Europe and Asia, where it would like to rank among the top brokers over time.

offers its users a highly competitive and fully equipped trading portal, which focuses mainly on forex trading . Of course, an integral part of the broker's offer also includes other financial instruments such as stocks , indices, commodities or cryptocurrencies , but they can only be traded via CFD contracts. Pepperstone is headquartered in Australia, where it was also founded in 2010. At first, it only operated in Australia, but where it managed to build a very good reputation as a safe, transparent and regulated broker in a relatively short time. After this success, it has now started to direct its efforts and goals to Europe and Asia, where it would like to rank among the top brokers over time.

Traders at Pepperstone will find a wide selection of financial instruments, services, tools, platforms and products that can ultimately help them trade profitably and easily on the financial markets. In order to make the broker as attractive and accessible as possible to the general public, there is no minimum deposit, it only recommends depositing at least 200 USD. Beginner traders in particular will certainly appreciate the opportunity to use a demo account, thanks to which they have the chance to get a good feel for the platform and its tools and learn how to handle them before they start trading with their real money. Another feature that they can use is the social trading function . If any problem arises, the trader can contact customer support, which is available to them 24/7. Unfortunately, despite being very fast and helpful, customer support does not speak Czech. Traders will therefore have to communicate their problem in a foreign language. However, the list of offers at Pepperstone does not end there. Those traders who like to educate themselves can also use the countless materials and videos found in the Education section for their studies.

Pepperstone Fees

| Charge | Amount |

| Stock trading fee | There are no commissions for the standard account, but higher spreads |

| Forex trading fee | There are no commissions for the standard account, but higher spreads |

| Cryptocurrency trading fee | There are no commissions for the standard account, but higher spreads |

| Inactivity fee | Free |

| Withdrawal fee | Free |

Advantages

- Safe and regulated broker

- More than 1,200 financial instruments

- Low spreads

- Negative balance protection

- Integration with MT4, MT5 and cTrader platforms

Disadvantages

- Trading only through CFD contracts

- A business account cannot be maintained in Czech currency.

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

4. Libertex – Low-cost CFD trading app with zero spreads

However, this brings several advantages when using the Libertex stock trading app. For example, Libertex allows you to buy and sell financial instruments without paying spreads. Commissions on each trade are extremely low, with the main assets costing less than 0.1%.

Libertex also offers leverage of up to 1:600 for professional clients and less if you are a retail trader. In terms of what you can trade, this top-rated stock trading app supports everything from forex , cryptocurrencies and commodities to stocks and indices .

If you are looking for a place for more sophisticated trading, Libertex is also compatible with MT4. All you need to do is download the trading platform app with MT4 and then log in using your Libertex login details. Getting started with Libertex is really easy as it only takes a few minutes to open an account.

You can then use the Libertex demo account or deposit a minimum of $100 if you want to trade with real money. Supported payment types include debit/credit cards, bank transfers and e-wallets. Libertex has an excellent reputation for security. The company first launched its proportional online trading platform in 1997 and is approved and regulated by CySEC.

Libertex Fees

| Charge | Amount |

| Stock trading fee | Commission 0.034% at Amazon |

| Forex trading fee | Commission 0.008% for GBP/USD |

| Cryptocurrency trading fee | Commission 1.23% for Bitcoin |

| Inactivity fee | $5 per month after 180 days |

| Withdrawal fee | Free |

Advantages

- CFD trading with zero spreads

- Very competitive commissions – starting from 0%

- Good educational materials

- Long-established broker

- Compatible with MT4

- Large selection of markets

Disadvantages

- CFDs only

73,77 % účtů drobných investorů ztrácí peníze při obchodování CFD s tímto poskytovatelem.

5. AvaTrade – Best Forex Trading App by Global Forex Awards

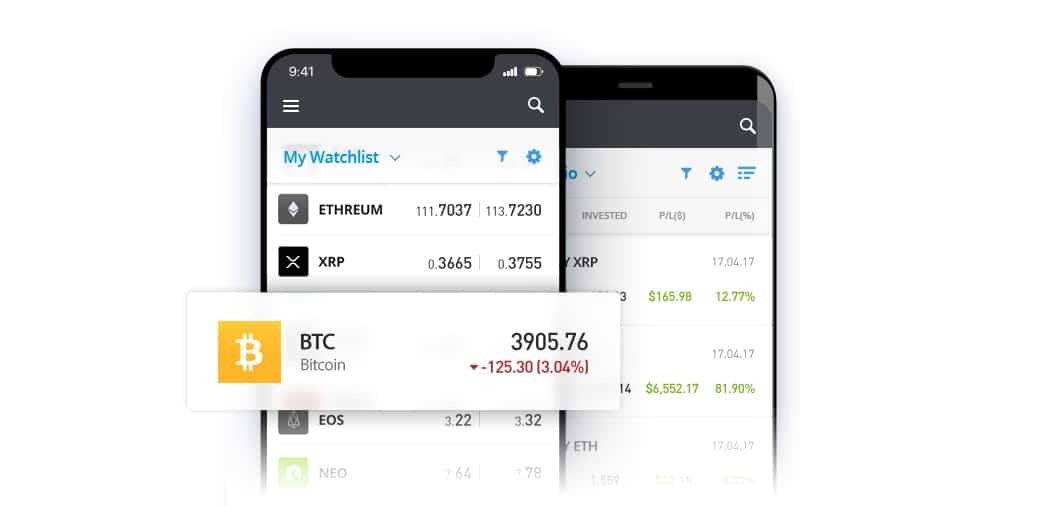

AvaTrade has an app called AvaTradeGO, where you can choose and trade over 1,000 instruments, including the best forex pairs, stocks, cryptocurrencies, commodities, and many more.

The AvaTrade app is designed for traders who want a smooth trading experience. You will be able to navigate through all the different instruments and menus through a sophisticated dashboard. They also offer a variety of different management tools and other useful features. One of them helps you monitor social trends so you can follow the market developments in real time.

Another feature is AvaProtect. With it, you can recover money lost on trades up to one million dollars. It allows you to protect a particular trade from losses for a certain period of time.

With 24/7 customer support in multiple languages, you’re sure to get help if you need it. They offer several payment methods, including debit and credit cards, bank transfers, and e-wallets.

AvaTrade Fees

| Charge | Amount |

| Stock trading fee | From 5% |

| Forex trading fee | Spread 0.9 pip in EUR/USD |

| Cryptocurrency trading fee | From 0.25% to the market |

| Inactivity fee | $50 per quarter after 3 months of inactivity + $100 after 1 year of inactivity |

| Withdrawal fee | Free |

Advantages

- Award-winning application

- Unique technology

- Trading protection against loss

- Regulated by ASIC, FSCA, BVI, FSC and FSA

- Free deposit and withdrawal

- More than 1,000 financial instruments

Disadvantages :

- High inactivity fees

71 % účtů drobných investorů přichází o peníze při obchodování s CFD s tímto poskytovatelem.

How to choose the best business app

We've reviewed the 10 best mobile stock trading apps to consider in 2026 and beyond. And because no two stock trading apps are the same, each provider will appeal to a specific type of investor.

For example, while some apps are great for long-term investments, others are better suited for short-term CFD trading.

With that in mind, below we will discuss some of the most important factors to consider when looking for the best stock trading app.

Regulation

No matter which stock trading app you are interested in, you need to make sure that it is approved and regulated by a reputable financial authority. The regulator in question may not be based in your home country, as the stock trading apps discussed on this page often have a global presence.

- For example, eToro, our top-rated stock trading app for 2026, is regulated by three tier-one authorities.

- This includes the FCA (UK), ASIC (Australia) and CySEC (Cyprus), meaning you have regulatory oversight on three fronts.

- For those of you based in the US, the eToro stock trading app is registered with FINRA.

By choosing a regulated stock trading app, you can feel safe knowing that your funds are secure. You can also be sure that the trading app provider offers transparent fees and fair trading conditions for all clients.

Active

When choosing a trading app provider, there is often a huge difference in the types of assets you can trade or invest in. First, you need to consider whether you plan to invest in traditional assets like stocks and mutual funds, or whether you consider yourself a short-term intraday trader.

In the latter case, you will probably want to use a CFD trading platform app. This way, you will be able to trade assets using your phone without having to own them. Not only will this result in low trading fees and spreads, but you will potentially have access to thousands of assets. This can include forex , metals, energies, bonds, interest rates, stocks, indices and more.

On the other hand, if you want to create a long-term investment plan, be sure to check if the stock trading app offers traditional ownership. This means that by investing in stocks, ETFs , or mutual funds, you will be entitled to your share of the dividend payout. This is also the case with bonds, even though you will receive fixed-yield coupon payments.

Our top-rated stock trading app, eToro, actually covers both long-term and short-term strategies. This is because it offers thousands of traditional stocks and ETFs, as well as CFD instruments.

Fees

Once you've checked to see if your chosen stock trading app supports your preferred financial market and strategy, it's time to investigate how much you'll be charged in fees.

The type and amount of fees you pay can vary greatly from app to app, so we've broken down the main fees to look out for below.

Trading fees

Trading fees are associated with long-term traditional assets like stocks, ETFs, and mutual funds. The best stock trading apps typically charge a flat trading fee—like $10 per trade.

This means that no matter how many shares you buy, you will always pay $10. When you redeem the shares, you would pay $10 again. While the flat fee may sound appealing at first glance, this will not be the case if you plan to trade frequently or want to invest small amounts.

For example, if you bought $40 worth of stock with a $10 trading fee, that means you are paying a 25% commission just for entering the market.

Commission

If you use CFD trading apps on the stock exchange, you will likely pay a variable commission. This means that you are charged fees based on how much you bet.

- For example, if a stock trading app charges a commission of 0.2% for a gold CFD and you bet $500, you will pay $1 to enter the market.

- If you were to then sell your $900 gold CFD position, you would pay a commission of $1.80.

The best stock trading apps we reviewed on this page – such as eToro and Plus500 – charge no commissions at all for buying and selling CFD instruments.

Overnight funding fees (Swap)

Regardless of whether your chosen stock trading app charges a commission or not, when entering the CFD markets you will always need to factor in an overnight funding fee. As the name suggests, this is a fee charged by the stock trading app for each night you keep your position open.

- For example, suppose the overnight funding fee starts at 23:00 GMT.

- If you opened a position on Tuesday at 10:00 GMT, you will be charged the first overnight funding fee at 23:00 GMT on the same day.

- If you then left the position open the next day, the overnight funding fee would be triggered again at 23:00 GMT.

This is because CFDs are leveraged financial products – meaning you are only required to put up a small percentage of the value of the asset. This in turn means you are essentially borrowing capital from the stock trading app provider, resulting in a daily interest charge.

Spready

Spreads are charged by all stock trading apps except Libertex. The spread is the difference between the bid and ask price of an asset and is how the stock trading app provider makes money.

The bigger the difference between the two prices, the more you are indirectly paying. The best stock trading app providers discussed on this page offer very competitive spreads – especially in highly liquid markets.

However, it can be difficult to find out what spreads you are actually paying if the trading app doesn't provide this information. If this is the case, you will need to calculate it yourself to make sure you are not overpaying for access to your chosen market.

Business tools and features

Once you've evaluated the fees charged by your chosen stock trading app provider, it's worth spending some time researching what tools and features you'll have access to.

With many stock trading apps now offering zero commissions and competitive spreads on the market, providers will try to stand out from the crowd by offering some notable features that can enhance your trading experience.

Some of the best features to look out for are as follows:

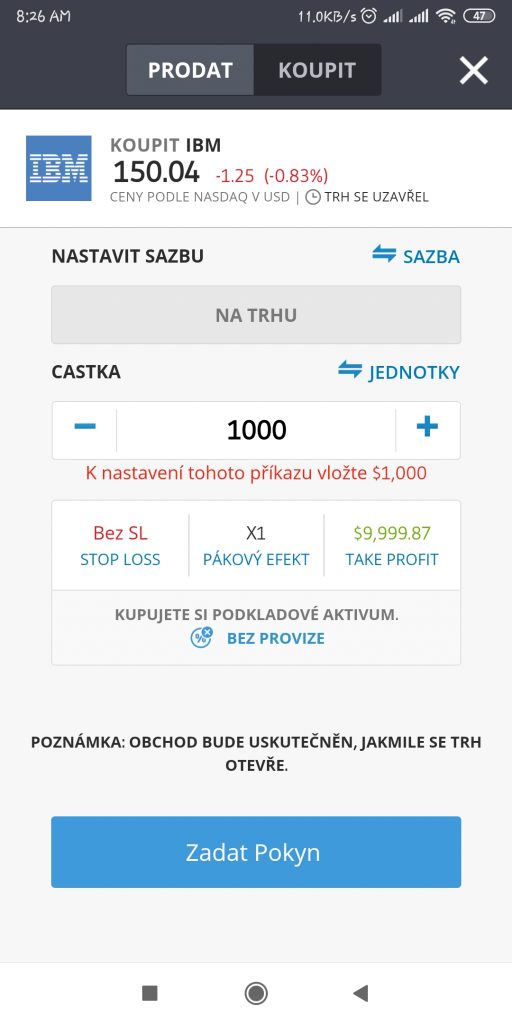

Leverage and margin trading

If you plan to trade via your phone but don't have access to a significant amount of capital, you may want to consider an app that offers leverage.

As we briefly mentioned earlier, leverage allows you to trade with more money than you have in your account. The top-rated stock trading apps that offer CFD markets usually provide leverage.

The specific amount you can earn will vary depending on the app provider, your location, and the relevant asset class.

However, for your information:

- Clients in the Czech Republic and Europe have a maximum leverage limit of 1:30, which means you can trade with 30 times the amount you have in your account.

- US clients, although they do not have access to CFDs, can trade forex with leverage up to 1:50.

- Residents of other countries – such as those in Asia and the Middle East – can often trade with leverage of up to 1:300.

The best stock trading apps will often also offer margin options for investing in stocks. This works similarly to leverage, even if you're not trading CFDs or forex.

Partial shares

Most retail investors won't want to spend more than $3,000 on a single share of Amazon . The good news is that you don't have to, as the best stock trading apps support fractional ownership.

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

This means you can invest much smaller amounts, resulting in you owning a fraction of a share. eToro allows fractional ownership from as little as $25 for cryptocurrencies and $50 for stocks.

Copy Trading – To support traders

The best stock trading app providers of the year 2026 offer automated trading tools. For example, eToro allows you to copy other traders in copy trading . For example, you might decide to copy a successful stock trader with a flawless track record on the platform. If the trader risks 10% of their balance on Square shares, you would do the same. This ultimately allows you to invest and trade without having to do anything.

The eToro Copy Trading tool is also ideal for those who have no knowledge or understanding of how to research financial instruments. Best of all, this tool comes with no additional fees, so you will be able to invest 100% commission-free.

Education, research and analysis

Stock trading app providers know that many investors are new to the market, so the best apps come equipped with a range of educational tools.

These include:

- Trading manuals

- Webinars

- Market statistics

- Podcasts

- Trading Tips

- Social trading tools

- Tutorials in the form of videos

- Mini-Ducks

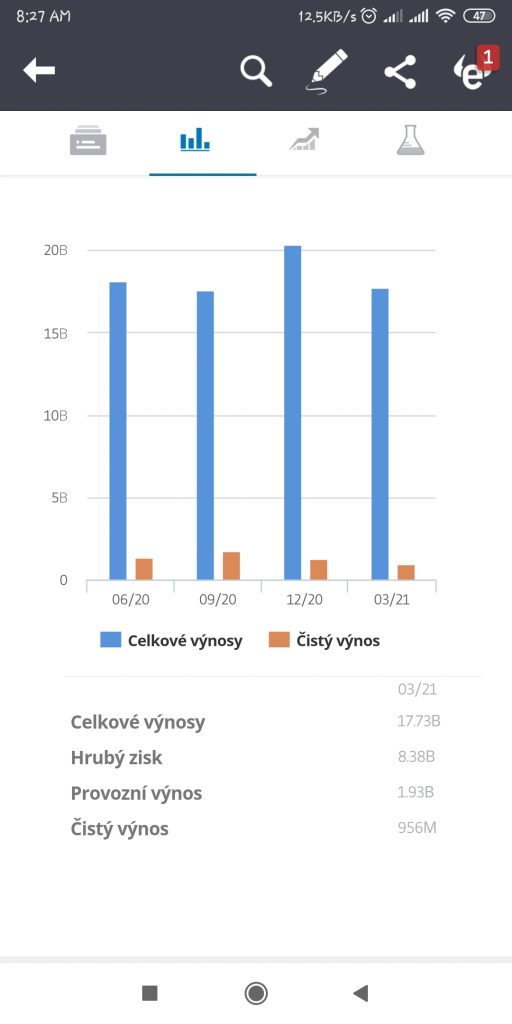

If you already have some knowledge of how the trading scene works, you’ll need access to research and analysis tools. The best stock trading app providers we’ve reviewed on this page offer everything from technical indicators and charting tools to financial reports and real-time data feeds.

User experience

The user experience that trading apps provide can vary greatly, so you need to make sure that the app is easy to use and that your investing efforts aren’t hindered by a smaller screen.

This is especially true if you are trying to engage in short-term trading as opposed to long-term investing. By that we mean buying and selling assets as an intraday or swing trader. After all, you will need to enter and exit the market with the click of a button, so you don’t want to choose an app that is clunky and difficult to use.

Similarly, you will be performing technical analysis and examining price trends if you are a short-term trader, so a top-notch user experience is essential.

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

Even if you only plan to add a few stocks or mutual funds to your portfolio, a stock trading app should still make the process seamless. For example, a trading app should offer a clean and clear search facility, and placing an order should be a breeze.

Payment methods

Once you have gone through the process of opening an account with your chosen stock trading app, you will be asked to make a deposit. The best stock trading app providers will allow you to do this instantly and most importantly, through the app.

For example, the eToro stock trading app allows you to instantly deposit funds via debit/credit card, PayPal, Neteller, Skrill, and more.

Other app providers, such as International Brokers, only support traditional bank transfers, meaning you will need to log into your online or mobile banking account and transfer the money manually.

Customer service

If there comes a time when you need help with your account, you'll likely be able to easily contact a member of the support team.

The best stock trading app providers offer their own live chat – this means you can speak to a support agent in real time. You should also check what hours of the day the support team is open.

Most stock trading app providers offer customer service Monday through Friday during standard business hours, but eToro goes a step further by offering 24/7 support.

Business Applications - How to Get Started

If you’re planning to use stock trading apps for the first time, we’ll show you how to get started now.

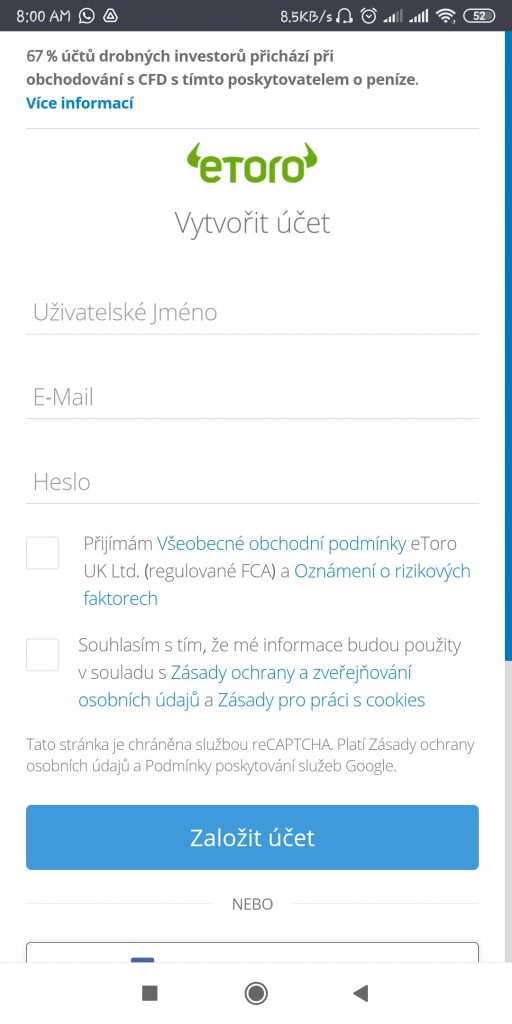

Even if you want to get started with an eToro demo trading account, you will still need to open an account. This process only takes a few minutes and requires some personal information from you.

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty. After you go to the eToro website and click the “Join Now” button, you will need to provide the following: Once you register with eToro, the platform will then redirect you to the official download page based on your operating system. The app is available on both iOS and Android devices. Once the eToro stock trading app is downloaded and installed, open it. You can now log in to your eToro account using the app. You will need to use the username and password you created when you registered. Once you log into the app, you can trade for free using an eToro demo account. If you want to invest or trade with real money, you can deposit funds directly through the app. Funds will be credited immediately when using the following payment methods: The minimum deposit is $50 for US citizens and $200 for all other nationalities. Once you make a deposit using one of the above payment methods, you can start trading immediately. To find the asset you want, use the search tool at the top of the app screen. You can also browse the asset library by clicking on the relevant financial instrument – for example, a crypto or an ETF. Then it’s just a matter of placing your order. All you have to do is click the “Trade” button next to the asset and enter your deposit in US dollars. To place your order, click the “Open Trade” button.Step 1: Visit the eToro website and open an account

Step 2: Download the eToro stock trading app

Step 3: Log in

Step 4: Deposit funds

Step 5: Invest or trade

Conclusion

Overall, choosing the best-rated stock trading app can be challenging as there are many factors to consider. For example, not only does the app need to have a great reputation and offer competitive fees, but it also needs to support your chosen financial market.

And of course, you also need to look at what features and tools are offered and whether or not the app provides a good user experience. Taking all these important points into account, we found that the best stock trading app provider for 2026 is eToro.

The app is easy to use and takes just 10 minutes to get started. Plus, we really like the Copy Trading feature, which lets you trade actively but in a completely passive way.

eToro – The best stock trading app

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

eToro – Nejlepší pro začátečníky i experty

FAQ

What is the best stock trading app for beginners?

Are there any free stock trading apps?

Which mobile trading apps are the best for stock trading?

Are these stock trading apps safe?

How much do the best stock trading apps charge?

How do you find the best online stock trading apps for investing?

What is the best online trading app for leverage?