Trade Bot – O Melhor Trade Bot de Forex e Criptomoedas em 2026

A trade bot is an automated financial advisor. These machines, programmed with computerized algorithms, can provide advice, manage money and invest on our behalf completely automatically, at any time.

Therefore, trade bots exist to manage investment portfolios with specific positions opened on the market by the client, through reliable platforms. In this sense, all the work is carried out by the robot. Automated management is an innovative element that is increasingly present in the financial world. Therefore, in this guide, we analyze trade bots , what they are, what they are for and how to make the most of their capabilities and which are the best options available on the market.

Trade Bot: The Best Trade Bot of 2026

The Trade Bots mentioned in the following section are some of the best currently available on the market. We have tried and tested each service.

What is an Automatic Trade Bot?

You may not be familiar with the concept of an automated trading bot . In short, it is an innovative type of investment, developed with cutting-edge technology.

Automated trading robots are tools that make our lives much easier. They can handle all investments on our behalf, operating 24 hours a day, 7 days a week. All market operations are precise, due to the advanced algorithms used by automated robots. They rely on software with specific instructions to open the most advantageous positions on the market in a completely automated way. This is possible thanks to algorithm-based trading, which includes codes and computer language capable of stipulating the best actions that the trade bot can implement in each potentially profitable investment scenario.

For example, a Forex trading bot can be programmed to buy and sell a certain amount of any currency or Forex currency pair at any time: when the value of currency X goes up, when the value of currency Y goes down, at any specific time during the day, every day. They are like Forex Brokers, but automated to perform all the trading operations for you.

The trade bot eliminates the psychological and emotional component associated with trading, as it executes all operations automatically, without your intervention. These machines can be programmed with specific strategies and can adapt to all types of investment profiles and objectives.

What types of Trade Bot are there?

Trade bots are distinguished by two key factors: first, by the types of assets they can trade. Second, by their own strategy, which is modified by the trader (e.g. buy and hold bots, signal-based bots, DCA bots, or arbitrage bots). Regarding the first classification, we will highlight two general types of reliable and popular trade bots in this guide :

Forex Robots

Forex trading robots are specialized in the MetaTrader 4 and MetaTrader 5 platforms, using pre-determined strategies and rules to decide their movements in the markets. Therefore, Forex robots automatically enter and exit positions in Forex currency pairs. Forex trading robots completely analyze the market in milliseconds and are extremely effective at finding opportunities that humans simply cannot identify. This ability, in an extremely volatile and fast-moving market like Forex, is essential to making money.

Forex robots can apply strategies based on chart patterns, technical analysis, support and resistance levels, or any other indicators. This pattern is programmed and the robot proceeds autonomously. Therefore, you can program a sell order when the GBP/USD currency pair reaches a certain resistance level, and the robot will always follow these specific instructions.

Trade Bot – Cryptocurrency Robots

Cryptocurrency trading bots specialize in trading digital currencies, similar to Forex trading bots, but their goal is to generate profits through the purchase of Bitcoin and other cryptocurrencies. Like Forex trading bots , they work extremely efficiently in highly volatile markets. In this case, cryptocurrency trading bots constantly monitor the cryptocurrency market and react according to patterns defined by the client. They can be configured according to the volume of tradable cryptocurrencies, orders, sales, price and market fluctuations.

The Most Efficient Trade Bot for Cryptocurrencies

We conducted thorough research and concluded that these four crypto bots are currently the best services on the market:

How Does a Trade Bot Work?

After knowing what trade bots are, you may start to wonder how do trade bots work ?

Trade bot software may include features such as:

- Opening investment positions

- Management of open positions

- Closing of investment positions

- Create signs for personal use

- Replicate operations periodically

- Operate automatically 24 hours a day

In manual or personal trading, you need to set your own rules as a trader, open positions in the market, monitor the development of your positions, and buy or sell assets according to your speculations. This means spending a lot of time in front of your computer or mobile device, as well as being able to make the right decisions at the right times.

To ease the burden, trading bots , especially those that you can automate, can make many of these decisions for you thanks to their advanced algorithms. For example, if you want to invest €100 in the EUR/USD currency pair every month, a trading bot can do this on your behalf. This allows you to spend your time on other investments or daily tasks, such as buying stocks or making money on Amazon.

What is the Best Trade Bot? The Best Trade Bots of 2026

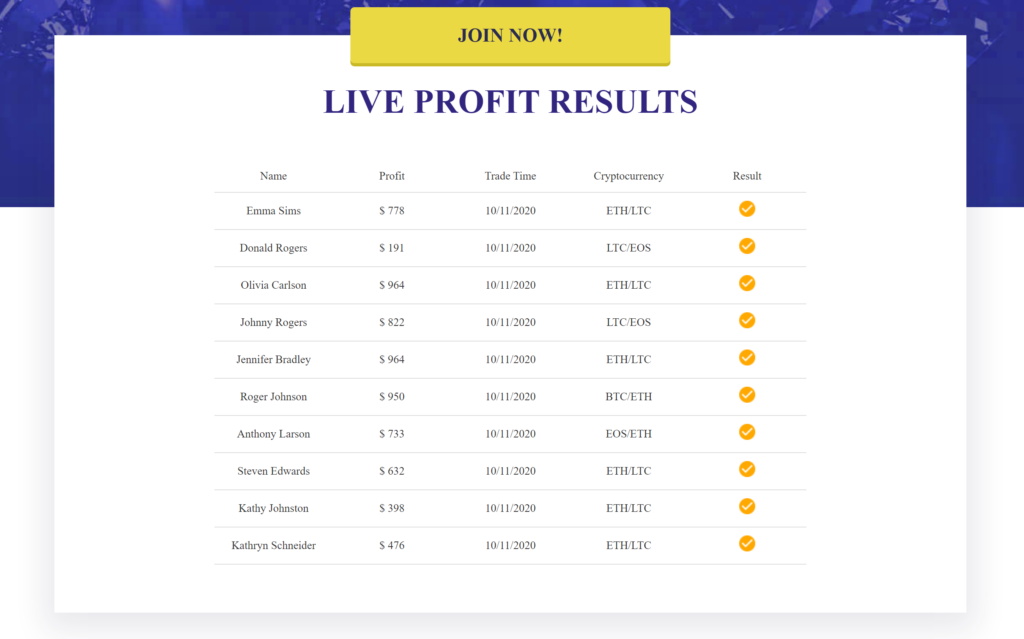

In this section, we will analyze and evaluate the best trade bots available on the market, based on several factors, such as their profitability, success rate, advantages, disadvantages, and availability.

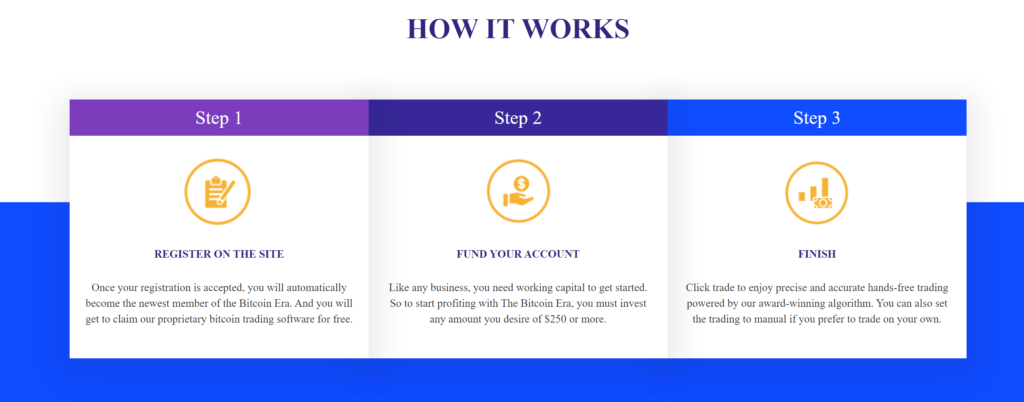

1. Bitcoin Era

The Bitcoin Era robot helps its clients make money daily with its advanced algorithms. Getting started is extremely easy, with a quick registration and verification process that allows you to start trading in less than 30 minutes.

Pros:

Cons:

2. Bitcoin UP

Pros:

Cons:

3. Bitcoin Profit

Pros:

Cons:

4. Bitcoin Revolution

The Bitcoin Revolution crypto trading bot is an automated trading software developed in 2017. It is free to use and you can start with just $250. Its creators have proven their commitment to providing traders with a safe and easy way to invest in the popular cryptocurrency Bitcoin.

Pros:

Cons:

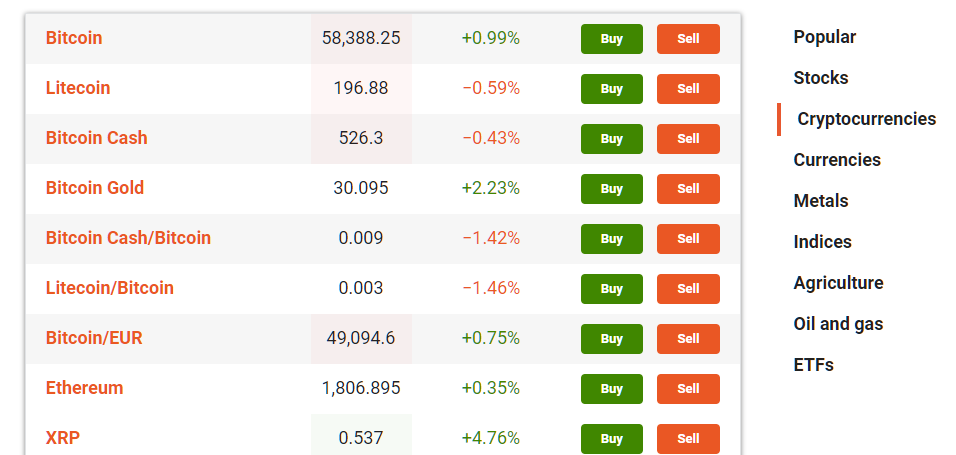

Best Brokers for Trading Cryptocurrencies and Forex

If you’re looking for a platform that allows you to trade manually, with automation options, we’ve highlighted the best options below. There are hundreds of different brokers out there today, but the following offer the best advantages in terms of security, financial assets, customer support, fees, and more.

1. Libertex – Trade on Their Award-Winning Platform

Libertex has its own software that you can use on mobile devices and computers, such as MT4 and MT5. This way, you can take advantage of its integrated trading robots and signals, capable of copying strategies and trades automatically.

The Libertex app allows you to trade and invest anywhere, anytime. It is extremely accessible and intuitive, both on mobile devices and on desktop. Its negative balance protection also provides security and peace of mind.

The platform is regulated by CySEC and FCA , which means you can trade without any security concerns. Libertex commissions are extremely low, starting at just 0.006%, and there are no spreads.

Pros:

Cons:

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

2. Crypto.com: 0% commission broker for trading

This is a top-notch trading platform that, despite specializing in cryptocurrencies, also allows its investors the freedom to invest in respected stocks and ETFs. In addition, you will have the possibility of investing in CFDs of these stocks. You will also have access to charts of the price assessment of ETFs and other stocks, for example. It is excellent for beginner investors!

Pros:

Cons:

There is no guarantee of financial profitability with this brokerage.

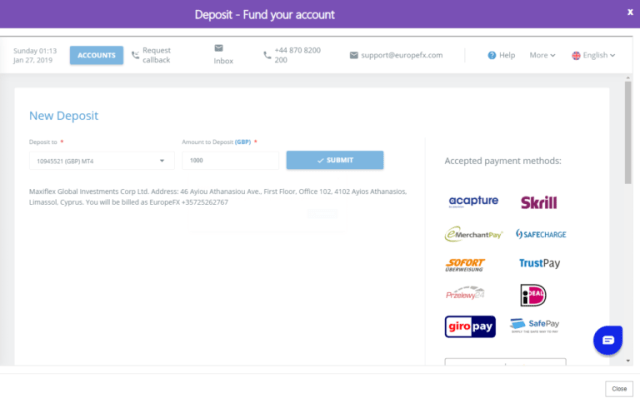

How to open an account with a trade bot?

To open an account with a trade bot, visit the Bitcoin Era website or any other service from the other brokers mentioned in this article. To create an account, there is a quick form on the home page. Fill in your personal details and click “Register Now”. You will need to provide your email, phone number and other personal details. You will receive a message congratulating you on your registration, with a button to click and start trading. You will have access to the Dashboard where you can invest. First, you will need to make an initial deposit. Please enter the amount. The minimum deposit allowed is €250 to start trading with your trade bot. There are several payment methods supported, including debit cards, credit cards, Plus, and other options. It is important to ensure that the affiliated broker you choose to use the robot is legitimate and regulated. All reliable brokers and platforms are currently regulated, increasing the security of your trading and investments. There are different regulatory bodies such as the FCA and CySEC, among many others. On the Sirix platform, you will have access to the full potential of this trading platform developed with advanced technology, where you can operate with your own trade bot, selecting your preferred instructions, based on pre-configured options or by customizing your rules. Your robot handles the rest of the trading operations. Simply select the amount you want to invest and set your Stop-Loss or Take-Profit limits , as well as the leverage level that best suits your personal strategy.

Step 1: Register with a trade bot

Step 2: Access the Dashboard and make your first deposit

Step 3: Check Your Platforms

Step 4: Access the Platform and Activate Automated Trading

How to Achieve Success with a Trade Bot

It is essential to select the best trading bot that will allow you to generate profits and achieve financial success. It will not be an easy choice as each trading bot claims to be more effective compared to its competitors. To that end, this section contains vital information to help you find the best trading bots .

Select the Currency and Market Correctly

No trading bot can operate with the same level of efficiency in all markets. To achieve the best results, select the appropriate currency pairs according to your risk tolerance and associated volatility. Similarly, it is important to adjust the leverage level in each market, which can vary. This is similar to the type of operations carried out by CFD brokers. The percentage of money invested obviously affects this distribution.

Profitability

The profitability ratio is a key factor. It is this percentage that allows you to know whether the trading bot is capable of generating profits. This factor is directly related to the profits and associated risks. A robot can be profitable, but if it requires risking all the money available in your account, it may not be ideal. This factor is calculated by the gross profit (sum of successful trades) divided by the gross losses (sum of losing trades). Ideally, you should get a result greater than 1. The higher this number, the better.

Risk-reward relationship

This ratio indicates the risk tolerance of the bot. For example, a trade bot set up with a Take Profit of 5 pips and a Stop Loss of 40 pips has a ratio of 8:1. This implies that it needs to have a success rate of 90% or higher to be profitable. Higher ratios, such as 12:1, imply that strategies are quite risky. This does not mean that they cannot generate profits: they can, and quite high profits. However, there is more risk involved if the bot fails to maintain the success rate on your trades, as the trade bot will also lose your money faster. Always consider this risk/reward ratio and adjust your Take Profit and Stop Loss margins accordingly.

Are Trade Bots Fraudulent?

Usually not. There have been trading robots active on the market since 2000, so some of these services have been around for as long as the MetaTrader 4 platform, where many of them operate.

Due to its popularity, there are currently a huge number of brokers, platforms, software and algorithms, and most of them claim to have the best trading bots . If you are interested in buying a trading bot or investing through this form of automated trading, you should look at its track record, how long it has been in the market, reviews from other users, and find out if it is a tested and verified system. Unfortunately, there are some scams online, but by doing your research before signing up, you can stay out of harm’s way and make the right decision.

Important : In general, when the “handout” is too large, it is likely to be a scam. In these cases, it is important to evaluate the use of the robot, its price, promises of profitability and other factors. Additionally, reviews from other users can also help you in this regard.

How to select a Trade Bot?

When selecting a trading robot or platform, your profile will determine which trading bot software is best suited to your needs. In the following sections, we present some vital factors to help you select the ideal service.

Opinions and Trajectory

A key aspect to consider when selecting a trading bot is whether the system has been independently reviewed or tested. The opinions of other traders are also extremely valuable, especially considering that automated trading always involves some risk. The track record of the best trading bots is marked by the profits they have made over the years.

Demo Account Availability

Testing the robot advisor before using it with real money is a great idea. You will be risking your savings, so it is best to familiarize yourself with the robot’s operation and performance. Although some demo accounts do not represent 100% of real financial world conditions, they are a valuable aid to test, experiment and get used to the robot. It is always advisable to use the trade bot demo account .

Your Investor Style and Profile

In this third factor, certain aspects, such as your ability to understand Forex technical indicators, are essential. For example, you may prefer a robot that you can calibrate or adjust yourself, rather than giving the automated system full responsibility for your trades. You may also be interested in understanding the type of signals that a profitable trading bot can provide you. Finally, you need to decide whether the robot takes care of your investments 100%, or only partially, leaving some room for you to control your trades manually.

If you decide that a trade bot can help you with your investments, consider the reality and all the factors of these virtual systems. Trade bots can be a valuable aid for any investor in cryptocurrencies or traditional currencies. Trading in these markets is fast and dynamic, tailored only for the most confident traders, but thanks to trade bots , many types of investors have access to the world of investments with the potential to make money. If you are determined to start your journey, we recommend that you use Bitcoin Era , one of the best robots capable of providing medium and long-term profits, with substantial series of profitable trades and investments in cryptocurrencies. However, if you prefer to maintain some control over your trading and investments, Libertex is a highly recommended option. You can choose from thousands of different instruments, including Forex and cryptocurrencies. To learn more and automate your trading, you can use the Copy Trading and Social Trading features. 85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.Conclusion: Which is the best trade bot?

Libertex – Copy Trading and Social Trading

FAQ: Frequently Asked Questions

What are the advantages of using a trade bot?

Do Trade Bots Really Work?

Are trade bots profitable?

What is the profitability rate of an efficient trade bot?