Melhores app de investimento 2025

In this guide, we explore the best investment apps for 2025. We also discuss some of the key factors you need to explore before choosing a provider, such as fees, commissions, tradable shares, regulations, and payments.

Start investing with the Libertex investment app in 4 simple steps

Get started with the Libertex app by following the 4 easy steps outlined below.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

The main investment apps in Portugal

You can keep reading for an in-depth look at the best investing apps, but if you’re just looking for a quick summary, check out the list below.

- Libertex – Boost your mobile investing experience

- Crypto.com – App with trading platform and 0% commission

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

The best investment apps of 2025

There are now hundreds of free investment apps to choose from, so choosing the best one for you isn’t always easy. Luckily, we’re here to help, whether you’re looking for the best investment apps for iPhone or the best investment apps for Android.

To narrow down our list of selected providers to just four , we focused on the following requirements when conducting our investment app reviews:

- The app must be regulated by a tier one body such as the FCA , ASIC or SEC

- Fees and commissions must be competitive

- You must be able to deposit and withdraw funds with an everyday payment method – such as debit/credit cards

- The app should give access to stock stacks from multiple markets

- The user experience should allow you to buy and sell stocks in a seamless way

With that in mind, we present below the best investment apps for 2025.

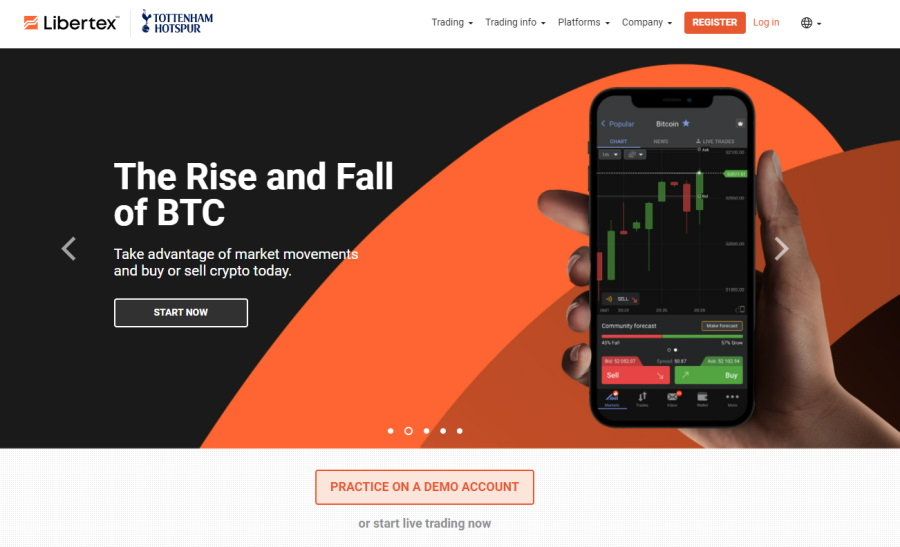

1 – Libertex – Boost your mobile investment experience – Investment App

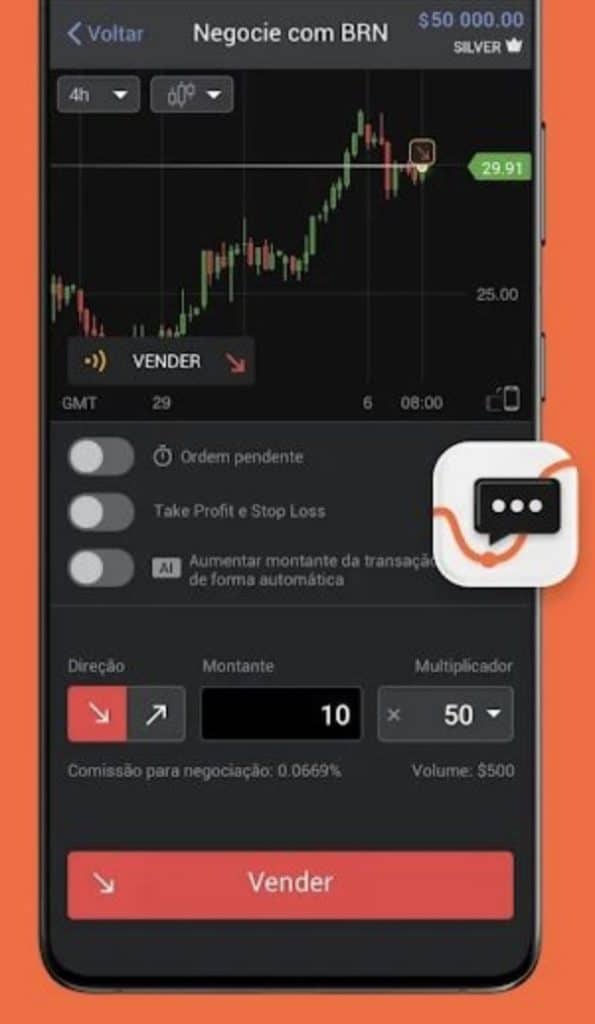

You can invest in CFDs from many different markets, along with over 3 million other users. Libertex has a powerful investment app that both experienced and beginner traders can use. They also offer different tools to help you make better investments.

Zero spread on assets sets them apart from competitors. Furthermore, the investment fees are extremely low, meaning that your return is not eaten up by it. You can also start with €100 and only €10 after your first deposit.

Another interesting thing is that Libertex is a big Tottenham fan. Because of this, you can take advantage of different campaigns where you can receive bonuses, win cars and many other special offers that you won’t get anywhere else.

Pros:

Cons:

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

2. Crypto.com: 0% commission broker with investment app

This is a high-end investment platform that, despite specializing in cryptocurrencies, also allows its investors the freedom to invest in respected stocks and ETFs. In addition, you will have the possibility of investing in CFDs of these stocks. At Tesla, you will also have access to charts of the price assessment of the ETF and other stocks, for example. It is excellent for beginner investors!

Pros:

Cons:

73.05% of retail investors lose money when trading CFDs on this website

How to Choose the Best Trading Investment App in Europe - App Exchange

While we’ve discussed our top picks in the sections above, it’s important to remember that you have hundreds of top stock investing apps to choose from. As such, there may come a time when you decide to use an investing app that isn’t discussed on this page. Likewise, you may want to do some additional research on our selected providers before taking the plunge.

Either way, below we’ve listed some of the most important factors you need to look out for when choosing the best investment app for you .

Regulation

As such, it goes without saying that you should ensure that your chosen investment app is licensed by a tier-one body before parting with your money. Some of the most respected and stringent licensing bodies in the investment landscape include:

- SEC (USA)

- FINRA (USA)

- CySEC (Cyprus)

- FCA (UK)

- ASIC (Australia)

- MAS (Singapore)

The above regulatory bodies ensure that free investment apps keep client funds in segregated bank accounts and protect personal data. They also require investment apps to identify all account users through a government-issued ID and clearly state the risks of investing to those in retail client accounts. All of the top investment apps listed on this page are licensed by at least one top-tier body.

Investment Assets - Investing in Stocks

While your chosen investment app may be licensed, it may fall short in the asset department. As such, you need to explore which stocks the app allows you to invest in. This can vary greatly depending on the broker in question.

For example, Libertex or Crypto.com give you access to thousands of stocks across a number of international exchanges. Additionally, there may come a time when you want to invest in assets other than just stocks. This could include mutual funds, ETFs or investment funds. Most of the online investment apps we’ve listed on this page also offer access to CFD trading facilities.

Fees

The fees associated with buying and selling stocks are now just a fraction of what they used to be. After all, four of our five selected investing apps let you buy stocks without paying a single penny in commission.

However, other fees to look out for when choosing an investment app are:

- Spreads: This is the difference between the buy and sell price of an asset. The higher the spread, the more you indirectly pay in fees. This is because you need to have earnings equal to at least the spread just to break even.

- Maintenance Fees: Even some of the best stock investing apps charge maintenance fees. This is a recurring fee that you have to pay just to use the app — and it’s usually charged every month.

- Transaction fees: These are the fees charged every time you deposit and withdraw funds. Some investment apps allow you to make transactions for free, while others don’t. So, check this before opening an account.

- Currency conversion: Some investment apps charge a currency conversion fee when you try to access international markets. Others - like Libertex - will charge you this when you deposit in a currency other than US dollars.

- Inactivity fees: Some investing apps charge an inactivity fee when your account remains active for a specified period of time. You won’t have to pay if you have stocks in your account, even if you haven’t used them for months.

As you can see above, there are a lot of fees that you need to be aware of in your search for the best investment apps, which is why the research process can be time-consuming.

Platform and usability

Once you’ve spent the necessary time evaluating the fees, your focus needs to shift to the app itself. That is, you need to explore whether the investment app is user-friendly or not.

This is especially the case if you’re investing for the first time, as you don’t want to be overwhelmed by advanced features and tools. If the investment app offers a live demo account, this is particularly useful. After all, you’ll have the opportunity to test the app without having to risk your own funds.

Trading Tools and Resources

Just because an investment app is easy to use doesn’t mean it shouldn’t come packed with useful features. For example, Libertex offers Copy Trading – which allows you to mirror the investments of an experienced stock trader. Additionally, the Libertex investment app allows you to buy fractional shares.

While other platforms like Quantum AI is a trading tool in itself, and gives you advice on what to buy and sell.

If you are a more advanced investor, you will probably look for more sophisticated tools.

Education, Research and Analysis

If you’re a complete beginner who’s looking for a slow and steady approach and to have apps for investing, you’ll want to choose an app that offers in-house educational materials. This can include investing guides and explainers and helpful videos as well.

Some of the best investment apps – such as Libertex – will go a step further by offering regular webinars. AvaTrade even offers educational video tutorials.

When it comes to analysis, it’s a big plus if your chosen investment app offers fundamental research tools. Specifically, if you have access to real-time news, earnings reports, and market insights – this will avoid the need to use a third-party research provider.

Device Compatibility

Of course, it goes without saying that you need to check whether or not the investment app you choose is compatible with your device. As we’ve seen, most brokers will develop their apps for both iOS and Android devices.

If you have an operating system that is incompatible with the app, you can invest through your default mobile web browser. The process, however, will not be as smooth as a dedicated app that was designed specifically for your operating system.

Payments

You’ll be using an app to invest in the stock market and to buy and sell stocks with real money. As such, you’ll need to consider how you intend to get funds into and out of the app.

Some of the most commonly accepted payment methods are:

- Debit cards

- Credit cards

- E-wallets

- Google Pay

- Apple Pay

- Bank transfer

All of the above payment methods allow you to deposit funds instantly – in addition to bank transfers. That said, your chosen investment app may not offer your preferred payment method, so you’ll need to check this before signing up.

Customer service

There’s nothing worse than opening an account with an investment app, only to find that the customer support is subpar. There are several factors you need to check in this regard. For example, you’ll need to explore what support methods are available – such as live chat, phone support, or email.

Additionally, you also need to check the customer support team’s operating hours. In most cases, the best investment apps offer 24/5 support to mirror traditional stocks and share space.

How to get started with an investment app

Now that you know what to look for when choosing an investment app provider, let’s walk you through the process of getting started. The guidelines below are based on our top-rated Libertex investment app – and include the steps required to register, deposit and subsequently invest in stocks.

To get the ball rolling, visit the Libertex website and download the app. Once you select your respective operating system (Android or iOS), Libertex will redirect you to the Google Play/Apple Store. Once the app is installed on your phone, click on the ‘Create Account’ button. Libertex will ask you to enter some personal information such as: Libertex must verify your identity before you can make a withdrawal, although it’s best to get it out of the way now. To do so, you’ll need to upload a copy of your government-issued ID and proof of address. You can take a photo of the documents with your phone’s camera and upload them directly to the app. Now you’ll need to make a deposit. You can choose between debit/credit card, e-wallet or bank transfer. Minimum deposits start at €200 and payments outside of the European Union attract a 0.5% currency conversion fee. Apart from a bank transfer, all deposit methods are credited to your Libertex account instantly, meaning you can invest in shares straight away. Once your investment app is funded, you will need to research the company you want to invest in. Alternatively, you can browse the Libertex stock library to find a stock that appeals to you. In our example, we want to invest in Apple, so we enter the company name in the search box and click on the result that appears. The final part of the process is to input the amount you wish to invest. As we noted earlier, Libertex supports fractional ownership, so you can invest as much as you want, as long as you reach a minimum of €50. To complete your investment in the Libertex stock app, click on the ‘Open trade’ button.Step 1: Download and install the Libertex app

Step 2: Open a stock market investment account

Step 3: Deposit Funds

Step 4: Trade or Buy Stocks – App to Invest in Companies

As we’ve discussed throughout our guide, investing apps should be a minimum requirement for all stock market traders. This is because, with the click of a button, you can check the value of your portfolio and enter buy/sell positions. You can also conduct market research and execute deposits and withdrawals. All of this can be achieved no matter where you are – as long as you have an internet connection. With so many free investment apps on the market, we hope our guide has helped clear the fog in your search for an app that suits your needs. In our opinion, Libertex is one of the best stock apps in 2025. If you are looking for commission-free trading and a super user-friendly platform, you can start using Libertex right now by clicking the link below!

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.The Verdict – What is the best investment app ?

Libertex – Best trading app and best financial applications overall with 0% commission

FAQ: Frequently Asked Questions

What is the best stock trading app for beginners?

Which investment apps support PayPal?

How can I be sure an investment app is safe?

What is the minimum amount of shares I can buy through the app?

Is there an investment app for Windows?