Nejlepší investiční aplikace pro rok 2026 – Srovnání funkcí a poplatků + návod

If you want to trade on the stock market, investment apps are an indispensable part of it . Not only do they allow you to buy and sell stocks from anywhere in the world, you can also check the status of your portfolio at any time. This ensures that you never miss an investment opportunity or the opportunity to exit a losing trade. But how do you choose the best app in 2026? Let’s take a look at a comparison of the best investment apps and also discuss the key factors that you need to know thoroughly before choosing an app.

4 best investment apps for the year 2026

If you’re looking for a detailed overview of the best investment apps, keep reading.

If you’re just interested in a quick overview, check out the list below.

- eT oro – Overall best investment app

- XTB – User-friendly mobile trading application

- Pepperstone – Popular forex and CFD broker with low spreads

- Libertex – Enhance your mobile investing experience

- Avatrade – Award Winning AvaTradeGo Investment App

[stocks_table id=”24″]

Fast trading through eToro investment apps – Review winner

Get started with the eToro investment app by following these 4 easy steps highlighted below.

[/blade]

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

Best investment app for the year 2026

There are now hundreds of investment apps available, so choosing the best one for your trading goals is not always easy.

Fortunately, we're here to help you, whether you're looking for the best mobile investing app for your Android or iOS smartphone.

To narrow our list of selected providers down to five, we focused on the following criteria when selecting investment app reviews:

- The application must be regulated by a first class regulator such as the FCA, ASIC or SEC

- Fees and commissions must be competitive

- You should be able to deposit and withdraw cash using everyday payment methods - such as debit/credit cards

- The app should offer you access to a bunch of stocks from different exchanges

- The user interface should allow you to buy and sell shares without any hassle

With these aspects in mind, we have outlined the best investment apps of the year 2026 in descending order below.

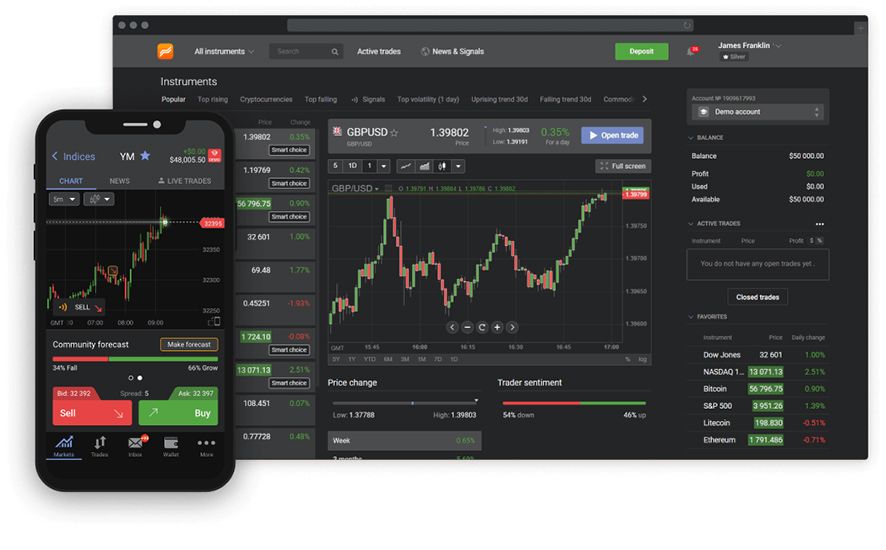

1. eToro - Overall Best Investment App

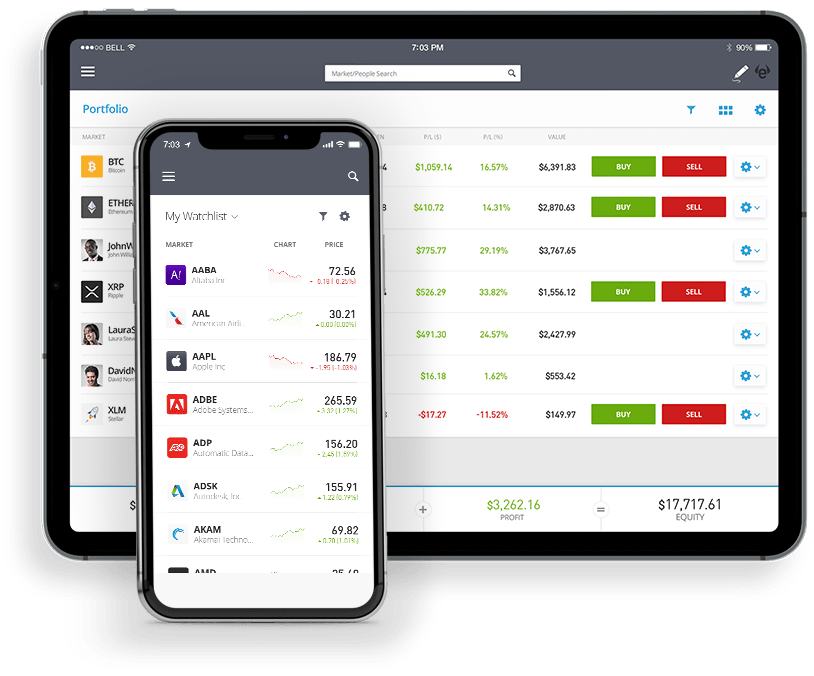

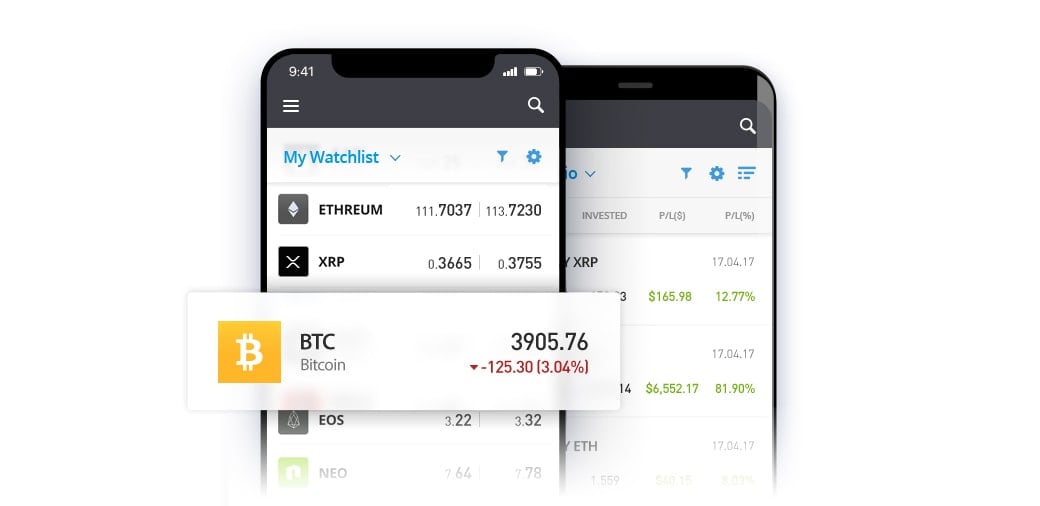

The platform offers investors both a web-based and a mobile investment app. The app is free to download for Android and iOS devices. If your phone does not support one of these operating systems, you can access eToro through your mobile browser.

That's why it's our first choice for the best mutual fund app on the market. As such, the eToro investment app is one of the most competitive in the global stock market.

When it comes to investing, eToro supports 17 international markets. That's over 1,700+ stocks in total. You'll be able to invest in companies listed in the US, UK, and Canada, as well as Hong Kong, Australia, Germany, and beyond. First and foremost, the eToro investment app is popular with beginners. That's because it takes just a few minutes to set up an account, and the app's interface makes buying the stocks you want very easy. Depositing money into your eToro account is also very easy.

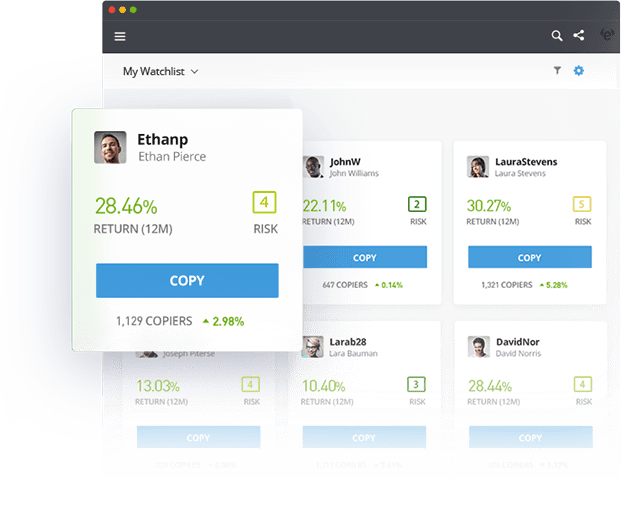

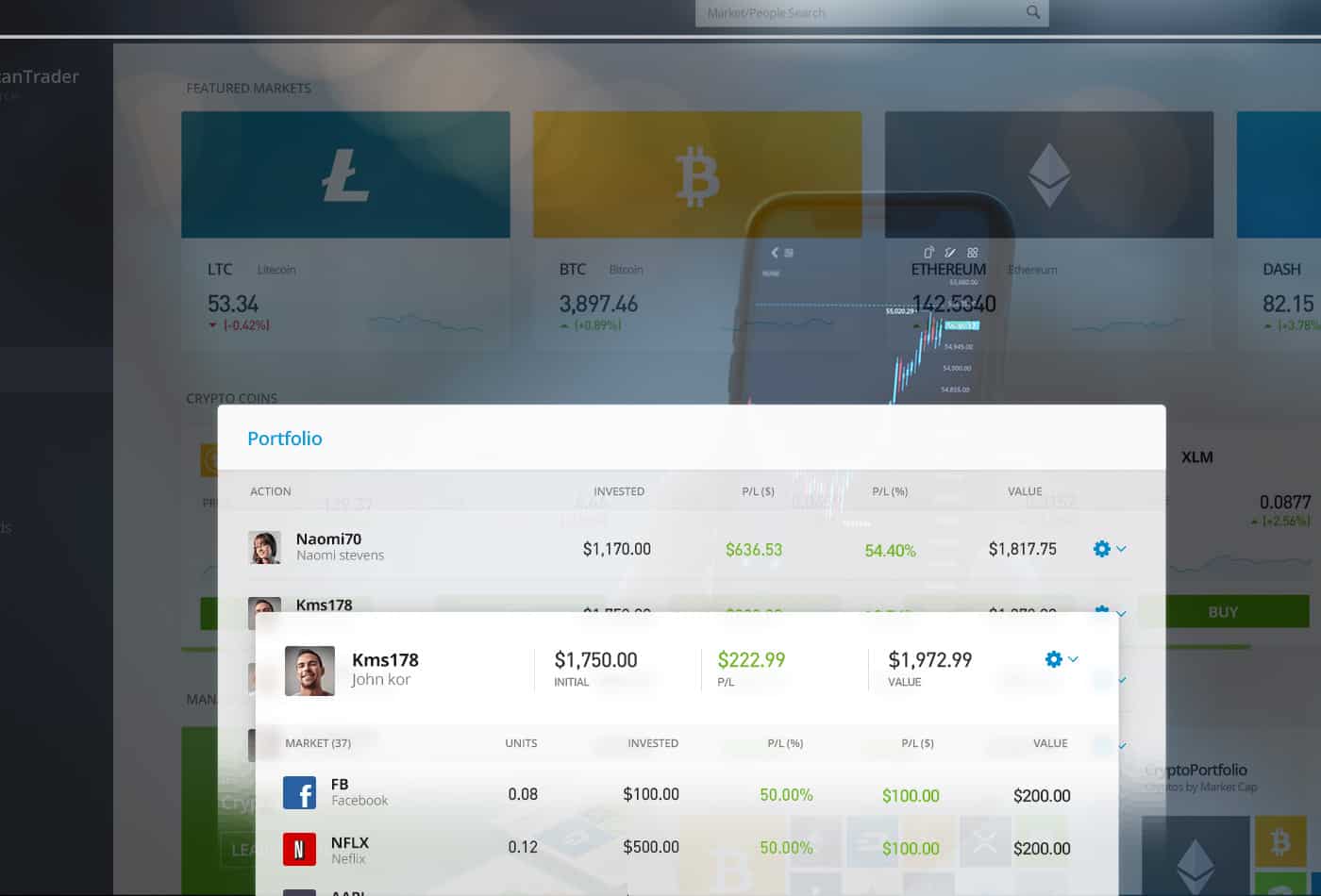

For example, you can instantly deposit money using a debit/credit card or e-wallet. If you deposit in a currency other than USD, you will pay a small 0.5% transfer fee. You will also need to deposit a minimum of $200, but the app allows you to invest from as little as $50 per share. We should also mention the feature in the app - Copy Trading , which allows you to copy the trades of an experienced stock trader. For example, if an investor has 10% of their portfolio in IBM shares, your portfolio will do the same.

This is especially important if you want to gain experience with the global stock markets but have no idea how they work. The best part is that there are no additional fees for using the Copy Trading feature and you can invest from as little as $200.

In terms of security, eToro is highly regulated. This includes licenses from three tier one authorities - FCA (UK), ASIC (Australia), and CySEC (Cyprus). Finally, eToro is available in most US states for the purpose of investing in stocks - but you will not be allowed to bet on the negative. Still not convinced that the eToro investment app is for you? Read our eToro review to learn more about what this investment app has to offer.

Advantages

Disadvantages

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

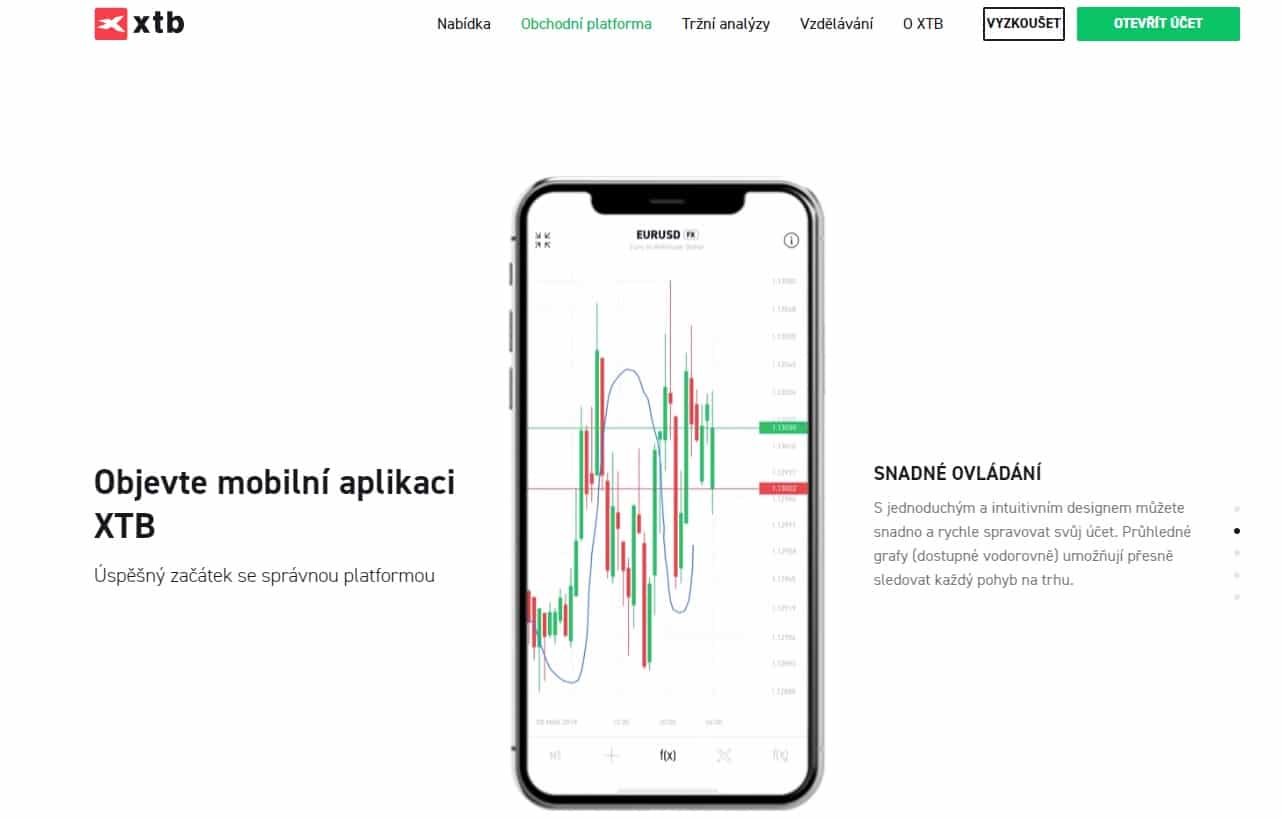

2. XTB - User-friendly mobile trading app

XTB offers its users over 5,900 financial instruments that can be traded on two

The xStation 5 trading platform itself has a user-friendly interface, making it very easy for traders and investors to use and understand. In addition, this platform can be used to trade from any device, including mobile devices. Another great benefit is the XTB mobile trading application , thanks to which traders and investors will no longer miss a trade, as they will always have their trades and investments in sight.

As mentioned above, XTB offers a truly wide selection of over 5,900 financial instruments. Traders and investors can choose from 70+ forex pairs, 20+ indices , 50+ most traded cryptocurrencies , 300+ global ETFs , dozens of commodities, led by gold and oil , and over 3,000 stocks from all possible sectors and global markets, including emerging markets.

Advantages

Disadvantages

3. Pepperstone - Popular forex and CFD broker with low spreads

Pepperstone is an Australian broker that is still relatively unknown in Europe, but it offers traders  a highly competitive and fully-featured trading platform that focuses mainly on forex trading . However, lovers of other financial instruments will also find something to their liking, as its offer also includes stocks , cryptocurrencies , indices and commodities, but via CFD contracts.

a highly competitive and fully-featured trading platform that focuses mainly on forex trading . However, lovers of other financial instruments will also find something to their liking, as its offer also includes stocks , cryptocurrencies , indices and commodities, but via CFD contracts.

The broker is headquartered in Australia, where it was also founded in 2010. However, it is currently starting to become much more involved in other parts of the world, such as Europe or Asia. The broker cites absolute security and transparency as its main advantage, which is guaranteed by full regulation by several of the most important and recognized regulatory authorities, such as the FCA or ASIC. In the Czech Republic, the broker is also regulated by the Czech National Bank.

With this broker, traders will also find a number of top-notch trading platforms, such as MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader. Each of these platforms is also tailored to support the different trading needs of individual traders, from manual to algo-trading. Compared to the competition, Pepperstone stands out mainly for its innovative feature sets, which will certainly be appreciated by both novice and experienced traders. An integral part of a successful broker is its customer support, which in the case of Pepperstone is at an excellent level. Traders can therefore contact support 24/7 with any problem.

Advantages

Disadvantages

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

4. Libertex - Enhance your investing experience

The Libertex platform won four different awards in 2020, the first for Best Broker, the second for Best Platform, and the third for Best FX Platform.

Together with 3 million other users, you can invest in CFDs from many different markets. Libertex has a sophisticated mobile investment application for web and smartphone, which can be used by both beginners and advanced traders. It also offers various educational tools to help you make better and more informed investments.

Zero spreads are what sets Libertex apart from the competition. Moreover, the investment fees are so small that they won’t detract from your turnover. You can also start with just $100, and only $10 after your first deposit. Another interesting thing is that Libertex is a Tottenham fan. Thanks to this, you can take advantage of various campaigns in which you can get bonuses, win cars and many other special offers that you won’t find anywhere else.

Advantages

Disadvantages

73,77 % účtů drobných investorů ztrácí peníze při obchodování CFD s tímto poskytovatelem.

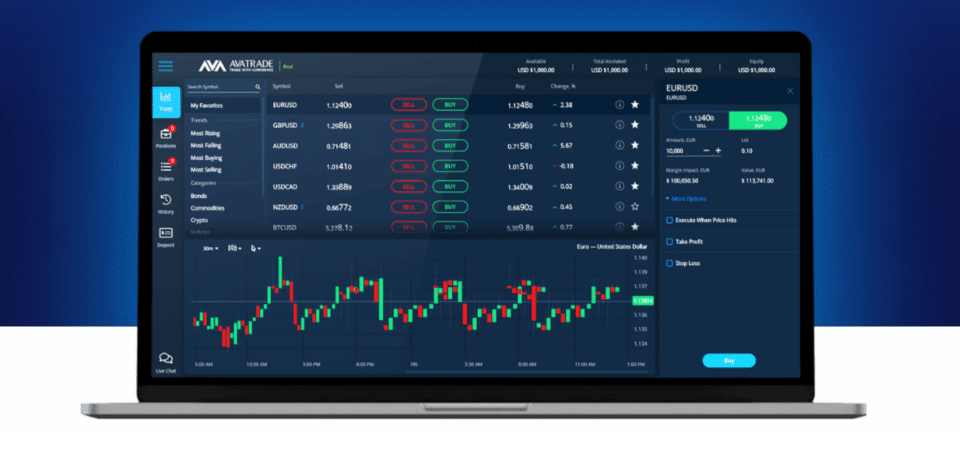

5. AvaTrade - Popular AvaTradeGo Investment App

AvaTrade offers you the opportunity to invest with many advantages. You have over 1250+ different investment instruments to choose from, including stocks , indices, cryptocurrencies , forex and more. The platform is regulated in 6 different jurisdictions, making it one of the most regulated brokers in the market.

Its mobile investment app AvaTradeGo is highly rated - for example, it has been awarded five out of five stars by Trustpilot. You can invest and take control of your investments from anywhere in the world. It offers many features such as live social trends.

The AvaTrade platform is a good companion and it doesn’t matter if you are a beginner or an advanced trader. They give you the opportunity to learn from their strategy ebooks and informative video tutorials. Deposits and withdrawals are free of charge and the minimum deposit is only $100. If you haven’t used your account for three months, you will have to pay an inactivity fee, which is $50 and $100 after a year.

Advantages

Disadvantages

71 % účtů drobných investorů přichází o peníze při obchodování s CFD s tímto poskytovatelem.

How to choose the best investment apps

Although we have selected the best apps above, it is important to remember that there are dozens of other investment apps to choose from. Therefore, there may be a situation where you decide to use an app that we have not discussed on this page. You should also do a little research on our selected providers before you jump in.

Anyway, below we will show you some of the most important factors that you should consider when choosing the best investment app for you.

Regulation

There are several mobile apps that allow you to buy and sell stocks even though they are not legally licensed to do so. Therefore, it goes without saying that you should make sure that the investment app you choose is licensed by a first-tier authority before you decide to part with your money.

Some of the most respected and strict regulatory bodies in the scene include:

- SEC (US)

- FINRA (US)

- CySEC (Cyprus)

- FCA (UK)

- ASIC (Australia)

- MAS (Singapore)

The above-mentioned regulatory authorities guarantee that free investment apps keep client funds in segregated bank accounts and protect personal data. They also require investment apps to identify all account owners through a government-issued ID, apparently preventing the risks of investing for those with new client accounts. All of the best investment apps mentioned on this page are licensed by at least one first-tier authority.

Investment assets

Although your chosen investment app may be licensed, it may be weaker in terms of assets. Therefore, you need to research which stocks the app will allow you to invest in. This can vary greatly depending on the broker.

For example , eToro gives you access to thousands of stocks across a multitude of international exchanges. Additionally, there may come a time when you want to invest in assets other than just stocks . These could be mutual funds, ETFs , or investment companies. Most of the online investment apps mentioned on this page also give you access to CFD trading options.

Fees

The fees associated with buying and selling stocks are a fraction of what they used to be these days. After all, four of the five investment apps we selected allow you to buy stocks without paying a single penny in commission.

However, other fees to watch out for when choosing an investment app are:

- Spreads: This is the difference between the buy and sell price of an asset. The larger the spread, the more you will indirectly pay in fees. This is because you need to make profits at least equal to the spread to stay without losses.

- Maintenance Fees: Even some of the best stock investing apps charge maintenance fees. This refers to recurring fees you have to pay to use the app - typically paid monthly.

- Transfer Fees: These fees are charged every time you deposit or withdraw cash. Some investment apps allow you to make transactions for free, while others do not. Therefore, make sure to check the rules before opening an account.

- Currency Conversion: Some investment apps charge a currency conversion fee when you try to access international markets. Others, like eToro, only charge a fee when you deposit in a currency other than the US dollar.

- Inactivity Fees: Some investment apps charge an inactivity fee if your account remains inactive for a specific period of time. You won't have to pay this fee if you hold any stocks in your account, even if you haven't used the account for months.

As you read above, there are a lot of fees you should be aware of when searching for the best investment app, which is why the research process can take a long time.

Platform and usability

Once you’ve spent enough time assessing fees, you should start focusing on the app itself. By that, we mean whether or not the investment app is user-friendly.

This is especially true if you are investing for the first time, as you don’t want to be overwhelmed by advanced features and tools. It is especially useful if the investment app offers a live demo account. After all, you will have the opportunity to test the app without having to risk your own capital.

Business tools and features

Just because an investment app is user-friendly doesn't mean it shouldn't have useful features.

For example, eToro offers copy trading , which allows you to copy the investments of an experienced trader. Additionally, the eToro investment app allows you to buy fractional shares.

If you are a more experienced investor, you will probably be looking for more sophisticated tools.

Education, research and analysis

If you're a complete novice and want a slow but steady approach to investing, you'll be best served by an app that offers internal educational materials. This can include investment guides and explanations, as well as educational videos.

Some of the best investment apps, like eToro, go a step further and offer regular webinars. For example, AvaTrade will provide you with educational video tutorials. When it comes to analysis, it’s a huge plus if your chosen investment app offers essential research tools. Specifically, if you have access to up-to-date news, earnings releases, and market insights – this will help you avoid having to use search research providers.

Mobile investment application

It is definitely necessary to check whether the investment app you choose is compatible with your device or not. As we have already discussed, most brokers design their apps for both iOS and Android devices.

If you have an operating system that is not compatible with the app, you will still be able to invest through your standard mobile web browser. Of course, it won't be as smooth as using an app that was designed specifically for your system.

Payments

You will be using an investment app to buy and sell stocks with real money, so it is important to consider how you plan to deposit and withdraw cash from the app.

Some of the most commonly used payment methods are:

- Debit cards

- Credit cards

- E-wallets

- Google Pay

- Apple Pay

- Bank transfer

All of the above payment methods allow you to deposit cash instantly - except for bank transfer. However, you need to make sure that the investment app you choose offers your preferred payment method before you register.

Customer care

There's nothing worse than opening an account with an investment app, only to find out later that the customer service is subpar. There are a few factors to consider. For example, you'll need to find out what kind of customer service is offered - such as live chat, phone support, or email.

Additionally, you will need to find out what hours customer service is available. In most cases, the best investment apps offer 24/5 support, mirroring traditional stock and mutual fund platforms.

How to start an investment application

Now that we've clarified what to look for when choosing an investment app provider, we'll walk you through the process of getting started.

The instructions below are based on our top-rated investment app, eToro - and include the quick steps needed to register, deposit, and then invest in stocks.

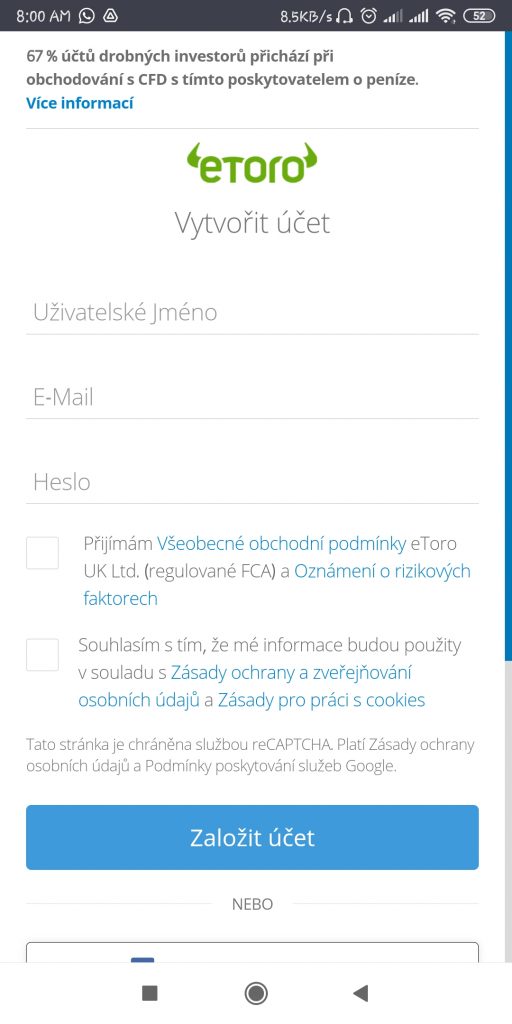

We will start by visiting the eToro website and downloading the mobile investment app. After selecting your operating system (Android or iOS), eToro will redirect you to the Google Play / Apple Store. Once the app is installed on your phone, click the “Create Account” blue button. eToro will then ask you for some personal information, such as eToro requires you to verify your identity before you can withdraw cash, so it’s best to do this as soon as possible. They will ask you to send a copy of your ID and proof of residence. You can take a photo of these documents with your phone and send them directly to the app. Now you will need to make a deposit. You can choose between debit/credit cards, e-wallets, or bank transfer. The minimum deposit starts at $200, and non-US payments include a 0.5% currency conversion fee. Except for bank transfer, all deposit options are instantly credited to your eToro account, meaning you can start investing in stocks right away. Once you have cash in your investment app, you will need to find a company you wish to invest in. Alternatively, you can browse the eToro stock library until you find a stock that you like. In our example, we want to invest in Apple, so we put the company name in the search engine and click on the results. The last part of the process is to enter the amount you wish to invest. As we mentioned earlier, eToro supports fractional ownership, so you can invest as much as you want as long as it is at least $50. To complete your investment on the eToro stock app, click the “Open Trade” button.Step 1: Download and install the eToro app

Step 2: Create a trading account

Step 3: Deposit cash

Step 4: Trade or buy shares

Conclusion

As we discussed during our tutorial, investment apps should be a minimum requirement for all stock traders. This is because with the press of a button, you can see the value of your portfolio and enter buy/sell positions. You will also be able to conduct market research and make deposits and withdrawals.

In conclusion, we hope that our guide to available investment apps has been informative and helpful in your search for an app that meets your needs!

eToro - Overall Best Investment App

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

eToro – Nejlepší pro začátečníky i experty

FAQ

What is the best investment app for beginners?

Which investment apps allow PayPal?

How do I make sure an investment app is safe?

What is the minimum number of shares I can buy through an investment app?

Is there an investment app for Windows?