Nejlepší obchodní platformy pro české investory v roce 2026

Použijte náš interaktivní vyhledávač pro vyhledání nejlepších českých akcií, Forexu, CFD, kryptoměn, sociálního nebo denního obchodování, které vyhovuje vašim potřebám.

- Představujeme pouze regulované makléře

- Odhalujeme skryté náklady, provize a spready

- Podívejte se na makléře, kteří mají dobré hodnocení zákaznické podpory

Plně regulováno

Odborně zkontrolováno

Bezpečné a důvěryhodné

Žádné skryté poplatky

Vhodné pro mobily

Trading platforms are an important bridge between you and the financial market. Whether you want to invest in stocks, commodities, cryptocurrencies or trade the forex market, you will always be looking for a free trading platform that meets your requirements.

At TradingPlatforms.com, we look for the best trading sites for you this year and next. These include trading platforms offering the best fees and commissions, the largest selection of assets, and of course, reliable regulation and oversight.

Trading platforms are also the starting point for every investor. It doesn’t matter whether you want to invest in cryptocurrencies, stocks or commodities. You will always need a trading platform for this. We have prepared a list for you of the best trading platforms that can be found on the market. Let’s take a look at them together.

Further in the article you will learn which trading platforms stand out from the crowd!

List for the best online trading platforms 2026

Below you will find a quick summary of the best trading platforms for 2026. You can find a full breakdown of each free trading platform later in the article!

[stocks_table id=”24″]

Reviews for the best trading platforms

You will come across hundreds of free trading platforms on the internet, so choosing the right solution is not an easy task.

For example, reputation and the range of investment assets need to be addressed, but fees and top-notch customer support are equally important. Then there is the range of trading features and tools, educational materials or indicators.

To get you started in the right direction, we’ve selected the best trading platforms of the year 2026 for you.

- eToro – Overall the best broker for buying bitcoins in the Czech Republic with FCA regulation

- XTB – Trusted CFD broker with a wide range of investment products

- Pepperstone – A popular CFD broker with three popular trading platforms

1. eToro – the overall best broker from the list for trading platforms, ideal for buying bitcoins in the Czech Republic with FCA regulation

When it comes to fees, we haven’t come across a more competitive Bitcoin broker than eToro. Before we get to the financing itself, let’s mention that eToro allows you to invest in Bitcoin from as little as $25.

This gives you the opportunity to invest small but regular amounts. If you want to diversify your cryptocurrency portfolio, you can invest in 15 other alternative currencies with eToro. These include ethereum , ripple or bitcoin cash . In addition to cryptocurrencies, you can also invest in more than 1,700 stocks and 150 ETFs ( Exchange Traded Funds). eToro also offers CFD trading on cryptocurrencies, but under new FCA rules, only 1:2 leverage is allowed.

eToro is also a suitable platform for complete crypto-newbies. It is very easy to use and does not require any prior investment knowledge. All you have to do is search for Bitcoin and enter the amount you want to invest. eToro also offers automated trading services, which are great for beginners. It also provides a professionally managed cryptocurrency CopyPortfolio.

You can also use the Copy Trading feature , which allows you to copy a professional Bitcoin investor. This way, you will automatically make the same trades as the experienced traders you have chosen. When opening an account, eToro requires a minimum deposit of $200. You can make this deposit with a Czech debit or credit card, e-wallet or bank transfer. Bitcoins can be easily purchased on eToro via their website or using the investment mobile app.

Advantages

Disadvantages

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

2. XTB - Trusted CFD broker with a wide range of investment products

XTB provides traders with access to CFDs on 2,000+ stocks , 22 commodities, 36 indices, 5 cryptocurrencies and 57 forex pairs. XTB also provides almost 7,800 cash stocks (without leverage) and over 350 ETFs such as iShares Core S&P 500 UCITS or iShares JP Morgan USD EM Bond. Cryptocurrency trading is also available on XTB only via CFDs.

XTB offers two account types - an extended standard account and a commission-based professional account. Fees are built into the spread and overall spreads at XTB are in line with the industry average (from 0.1 pip for forex trading and around 0.6% for most CFDs), but lag behind the best brokers in this category.

For active traders, XTB will refund a portion of the spread (from 5% to 30%) when you reach certain volume thresholds, starting from 20 lots per month up to 1,000 lots with a full 30% discount. XTB also offers traders the option to use margin of up to 5:1 when trading cryptocurrencies, 30:1 when trading forex, and 10:1 when trading stocks.

The XTB mobile app can compete with the best forex brokers. The xStation 5 app is cleanly designed with many features that mirror its web counterpart, such as news streaming, pre-defined watchlists, an economic calendar, top movers, and client sentiment data. Several integrated videos in the mobile app also provide webinar-style educational content, with several videos that are over an hour long.

Advantages

Disadvantages

Kryptoměny jsou vysoce volatilní a do značné míry neregulována aktiva.

3. Pepperstone - A popular CFD broker with three popular trading platforms

Pepperstone has become an increasingly popular and sought-after Australian broker in recent years

However, the broker mainly focuses on forex trading, while trading other offered financial instruments is possible through CFD contracts. In total, traders at this broker have a choice of more than 1,200 of the most sought-after and popular financial instruments. At the same time, the broker's offer also includes three very popular trading platforms, namely MT4, MT5 and cTrader. All three of these platforms are also available in Czech. An integral part of the offer is the demo account function, which will certainly be appreciated especially by novice traders, as well as the social trading function.

Advantages

Disadvantages

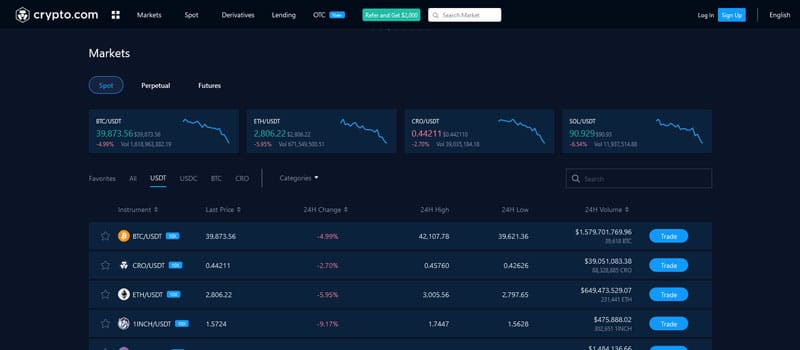

4. Crypto.com - Trade cryptocurrencies and NFTs in one place trading platform

Crypto.com was founded in 2016 and the platform also has its own cryptocurrency, which is cronos (CRO). Which allows its owner

As for money, the minimum amount that needs to be deposited into the account is arbitrary. The portal is available in many languages, but unfortunately Czech is not one of them yet.

Cryptocurrencies available on the Crypto.com portal include bitcoin (BTC), ethereum (ETH), litecoin (LTC), tether (USDT), cosmos, cardano, dogecoin (DOGE), polkadot, origin, EOS, stellar, XRP (ripple), TUSD and USDC. This is just a small list of cryptocurrencies that the platform offers for trading. The Crypto.com platform, as we have already generally imagined, is not only about cryptocurrencies, but also offers the opportunity to trade items in digital form, such as fine art, video or music.

Like many other platforms dedicated to cryptocurrency trading, Crypto.com also charges fees. For example, you will have to pay a 2.99% fee for card purchases (in some countries this fee reaches 3.99%). You can reduce your fees by trading with the native cryptocurrency cronos (CRO). It offers a 10% annual interest rate on regular use, cashback on card purchases, and a discount on fees when you buy it.

Advantages

Disadvantages

Kryptoměny jsou vysoce volatilní a do značné míry neregulována aktiva.

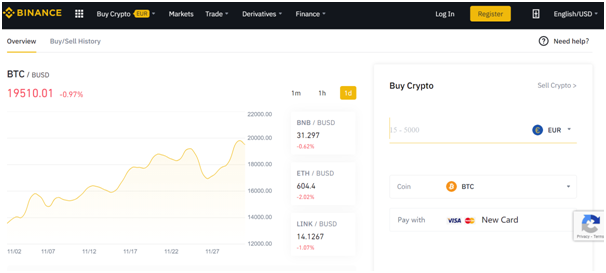

5. Binance – a popular Bitcoin exchange that supports Czech debit/credit cards and is among the best trading platforms

However, Binance also offers traditional brokerage services. This means that with Binance you can buy Bitcoin in the Czech Republic using your debit or credit card or bank account. All you need to do is open an account, upload your ID, and decide how much money you want to deposit into your trading account.

Once you complete your purchase, you can either keep your Bitcoins in your Binance account or withdraw them to a private wallet of your choice. Binance is known for its top-notch security features, and even has a dedicated User Asset Protection Fund (SAFU). This acts as a contingency reserve in case of a hacker attack. The funds from this fund would be used to compensate affected users.

The Binance trading platform offers very favorable fees. You pay a commission of only 0.1% for each trade you make. However, using a debit or credit card comes with a higher fee. This is usually a 2% transaction fee. However, Binance is currently offering a discount on this transaction fee, which is now 1%. The discount applies to all deposits made using Visa and MasterCard.

Advantages

Disadvantages

Kryptoměny jsou vysoce volatilní a do značné míry neregulována aktiva.

How to choose the best trading platforms

With such a wide range of options, choosing a trading platform can be a lengthy process.

It's no wonder, you're going to invest your hard-earned money, so you want to rely on it 100%.

The good news is that there are several key criteria to help you find the best trading platform for 2026.

The most important factors to watch out for:

Regulation

You may be tempted to choose a trading platform based on fee structure and markets, but the truth is that the absolute bottom line is the safety of your deposits.

You are ultimately transferring your real money to the chosen platform, which is why it is necessary to keep an eye on the regulatory authorities.

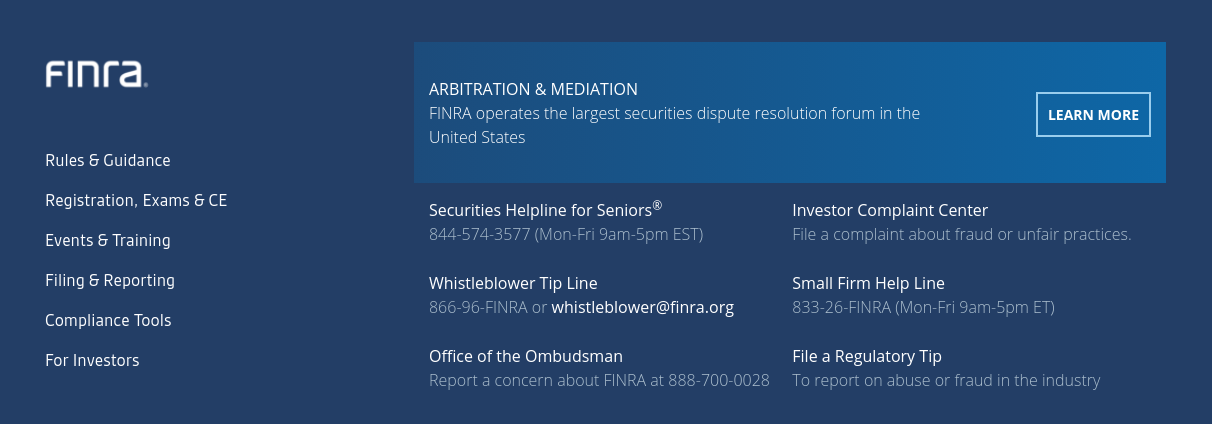

The best online trading platforms are usually overseen by organizations like FINRA or the SEC in the US, as well as the FCA and ASIC for the UK and Australia.

If you are wondering what benefits such oversight and strict regulation brings, here they are:

- Your funds are stored in segregated bank accounts. This means that the free trading platform cannot finance its activities (debt settlement) with your money.

- Regulated brokers must also comply with anti-money laundering regulations. Every trader must verify their identity, thus preventing potential crimes.

- The trading platform’s books are controlled by the relevant licensor, ensuring a fair and transparent environment for all.

A trading platform without regulation or operating in suspicious locations poses a risk to your finances.

Assets

Online trading is very popular with all types of investors. Some are attracted to pure stocks, while others are attracted to futures or options. When choosing a provider, you need to make sure that they offer the products you are interested in.

The best online trading platforms for beginners, which this article is about, offer these basic asset classes:

- Share

- ETFs, indices and mutual funds

- Bonds

- Forex and commodities

- Bitcoin and other cryptocurrencies

You can easily find the markets offered on the investment platform's website.

Fees

The best trading platforms offer truly competitive fees, without any question. Sometimes platforms have a very simple and transparent fee structure. However, there are also examples where the whole system is extremely confusing and complicated. It is then difficult to keep track of what you are paying for.

To help you better understand trading platform fees, we took a closer look at them:

Trade Commission

The most important fee to watch out for is trading commissions. These can come in two forms: fixed and variable. For example, with a fixed commission, you pay $15 when you buy a stock and another $15 when you sell it.

For example, variable commissions can be 1% on both purchases and sales. So if you buy shares worth $500, the commission will be $5. If you close this position at $600, the commission will be $6.

Spreads

If you are a long-term investor and want to hold shares for several years, you are not too concerned with the spread. On the contrary, for short-term traders of forex, commodities or cryptocurrencies, the spread is absolutely essential.

If you don't know the spread yet, it's the difference between the selling and buying price of an asset. In some cases, it's calculated as a percentage. However, in forex, you'll most often encounter a spread in "pips."

Transaction costs

The fees for deposits and/or withdrawals on an online platform might surprise you. Again, the terms and conditions vary from platform to platform. You can also find the difference in the way the fee is charged, sometimes it is a fixed amount and sometimes it is a percentage of the transaction.

Other fees

In addition to commissions, spreads, and transaction costs, you may encounter several other fees on the investment platform.

These include:

- Inactivity fee: Some trading platforms will start charging you a monthly fee after a period of inactivity. This is usually after 12 months, but it can be shorter. If you have any money sitting in your trading account, be sure to keep an eye on this fee.

- Margin fee: If you plan to trade on margin, check your broker's funding terms. This is usually a percentage that the broker charges you for each day the position is open.

- Account Fee: You can also find out if the trading platform charges ongoing fees – if so, they probably charge them monthly.

The fee structure may seem very complex at first glance, but understanding it is very important when choosing an investment platform.

Business tools and features

If you are all about buying and selling assets, you may not be interested in special features and add-ons. However, it is definitely not worth ignoring this area because you are missing out on useful trading tools.

These include:

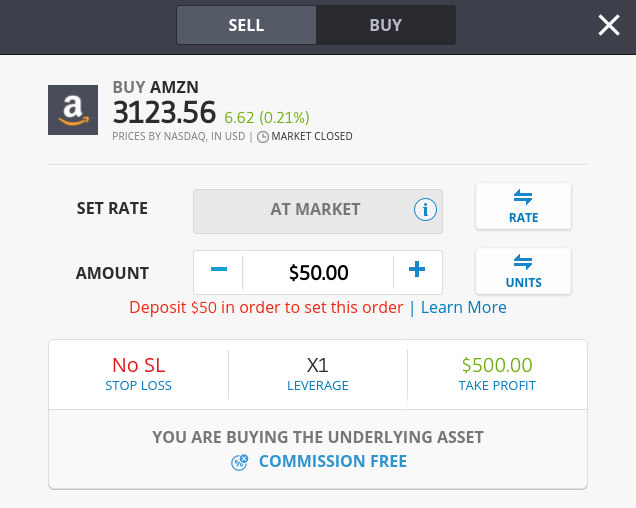

Fractional shares

The ability to buy fractional shares is important for retail clients on a budget. Admittedly, one share of Amazon for $3,000 or one share of Google for $1,700 can be a bit much. However, with fractional shares, you can only buy a “part” of that one share.

For example, on the top-rated trading platform eToro, you can invest in any of the 2,400 stocks on offer from just $50. So if you invest $50 in a stock that costs $500, you get a 10% stake. This makes investing much more affordable, and it also makes it easier to diversify your portfolio.

Command types

On every trading platform, you use “orders” to execute trades. These are what you tell your broker what your goal is. Every investment platform offers “buy” and “sell” orders, but in some cases you have a wider choice.

For example, the best trading platforms also have stop-loss and take profit orders. These are essential for risk management. You may also come across a trailing stop-loss order. You can find this on the eToro platform, for example, and it will keep you in a profitable position until it drops by a specified percentage.

Copying trades

If you want to trade actively but don't have enough experience, you might consider a copy trading platform. This simply allows you to copy 100% of traders' activities without any input from you.

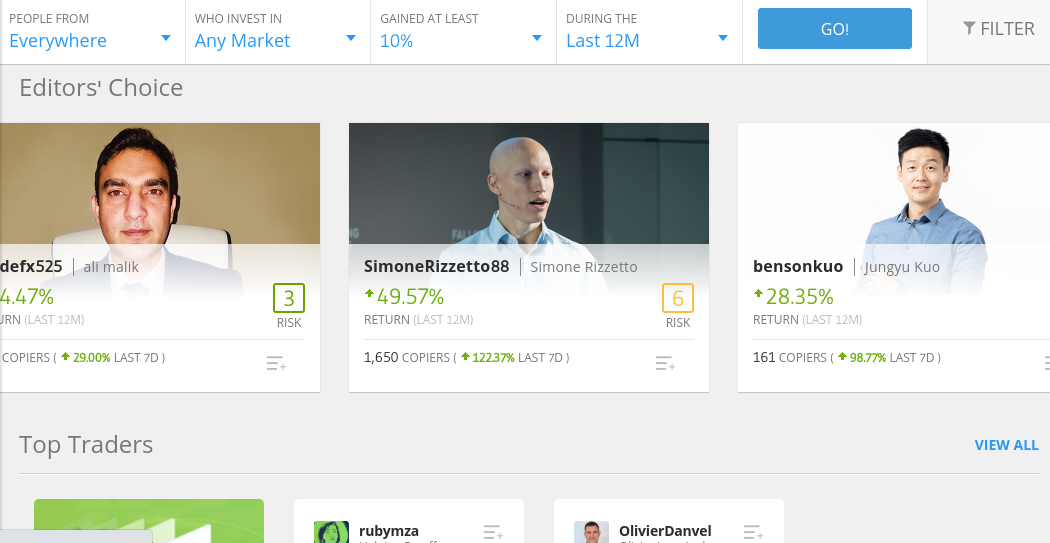

eToro, for example, is home to thousands of verified investors who have joined the copy trading program. Each trader has a profile where you can find key information such as historical performance, average monthly returns, risk rating, preferred assets, and average trade duration.

After selecting a trader, all you need to do is deposit at least 200 USD into your account. Each of their positions will be reflected in your trading account after confirmation. Of course, you can cancel copying trades at any time.

MT4/MT5

If you have been trading for a while, you will be familiar with the MetaTrader (MT) trading platforms. For those who don’t know, MT4 and MT5 are external trading platforms that sit between you and your broker. Many traders choose a broker that offers these platforms because they offer great features.

Example of the advantages of MT4 and MT5:

- Dozens of technical indicators

- Graph drawing and editing options

- Real-time rates

- Mirroring of trades

- Creation of automatic systems

- Works on mobile device

Not every investment platform offers MT4 and/or MT5, so you need to browse the offerings.

Notification

The financial markets are and will be very "live". Therefore, you want to have the best possible overview of current developments. Notifications are a great way to do this. The best trading platforms can be set to alert you when a price limit is broken - either via the app or by email.

For example, if you want to trade the GBP/USD pair when it hits 1.36, you can set a notification and you won’t miss a thing. The best trading platforms also offer the option to set notifications when a certain volatility level is reached. If one of your tracked assets experiences a sharp move, you’ll be notified immediately.

Education, research and analysis

We've found that the best online trading platforms on the market go the extra mile and offer in-depth education, teaching you the basics of buying and selling financial instruments without having to seek outside help.

The best trading platforms offer, among other things, the following educational tools:

- Tutorials and blog on key topics

- Webinars

- Podcasts

- E-books

- Mini-courses

In addition to education, the best online trading platforms also offer research and analytical tools. Research can include breaking news, breaking financial stories, in-depth analysis, and a closer look at market sentiment. As for analysis, the best providers offer advanced chart reading tools like technical indicators.

User experience

If you are going to trade for the very first time, you want to know clearly what to do. There are usually no problems with the web interface, but there are problems with the mobile apps.

This is an important thing for those interested in mobile trading, as they have to enter orders on a small screen. Therefore, you should familiarize yourself with the application interface. You want to know how to search for assets, key information, how to enter orders, close trades, find out the value of your portfolio, or how to deposit and withdraw money.

The good news is that the best trading apps usually offer versions for both Android and iOS. In other words, the app is built and optimized from the ground up specifically for your operating system. If the trading platform offers a demo account, you can try everything out without making any initial investment.

Payment options

Before purchasing assets, you always need to get money into your trading account somehow. Therefore, you should familiarize yourself with the available payment methods.

You can usually transfer money from your personal bank account without any problems. In some cases, the transfer will be immediate, while in others it will take 1-2 business days to process. Therefore, it is sometimes worth looking for a trading platform with a debit/credit card deposit option, which will process payments immediately in most cases.

Our top-rated trading platform, eToro, offers deposits not only with Visa and MasterCard, but also via Paypal, Netller and Skrill.

Customer support

Customer support varies greatly between investment platforms. Sometimes they only offer support via tickets or email. It is better to avoid these, as you may not get a response until several days later.

Instead, choose trading platforms with real-time support. Online chat is best, but phone support is also popular.

Also check the working hours. Most platforms do not offer support on weekends because the markets are closed. You will usually find working hours 24/5.

Best trading platforms to get started

So far, we've focused on selecting the best trading platforms currently on the market. We've also taken a closer look at the important factors for choosing a provider.

Finally, we will walk through the onboarding process of an investment platform. As an example, we have chosen the leading provider eToro, which offers trading on thousands of markets.

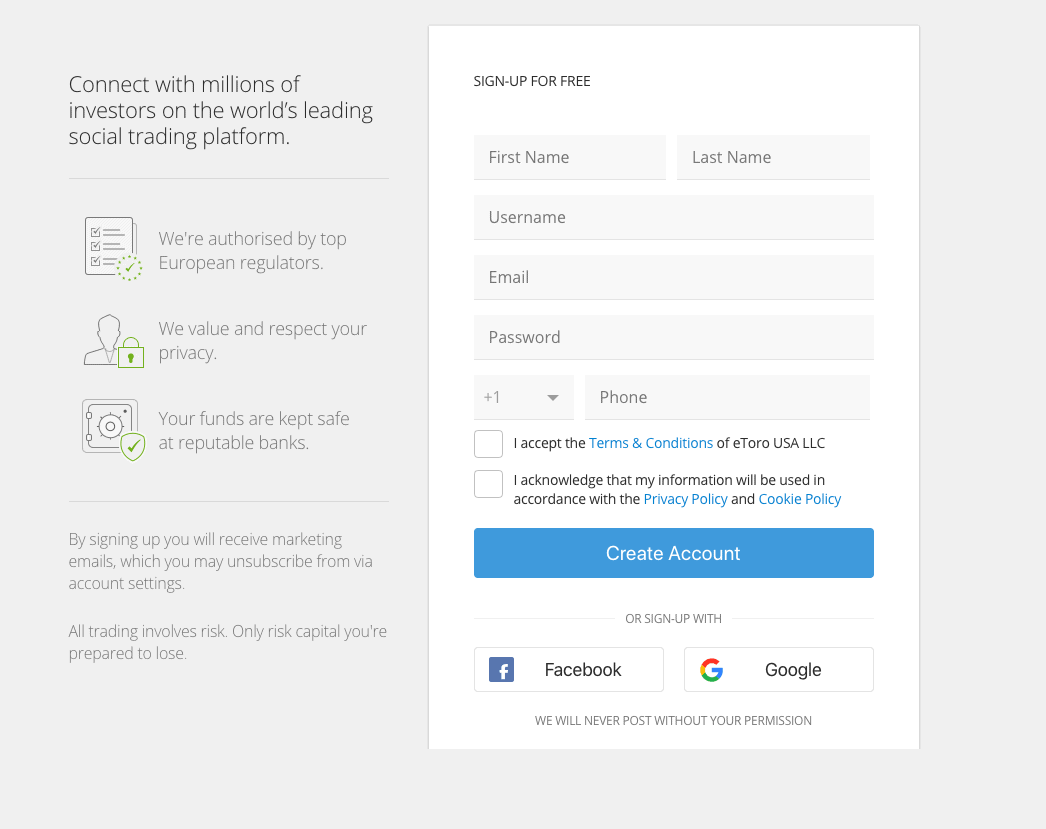

Step 1: create an account and upload documents on the trading platform website

Regardless of the trading platform, you always start by creating an account. On eToro, this step only takes a few minutes.

Go to the eToro website and click on the “So join” button. You will enter some information about yourself – name, nationality, address, date of birth. An email and phone number are also required for the trading platform.

Step 2: Verify your identity

eToro is regulated by the FCA, CySEC and ASIC and is also registered with FINRA. It is therefore legally required to verify your identity, without which you cannot withdraw your money. It is therefore best to complete the identity verification process right away, even if it is done in a timely manner.

You will upload legible copies of these two documents:

- Passport or driver's license

- Utility bill or bank statement (maximum 3 months old)

In most cases, verification will take place automatically, so you can get started right away .

Step 3: Make a deposit on the trading platform

Now it's time to deposit money into a new trading account.

You can choose from several payment options:

- Debit cards

- Credit cards

- Electronic wallet (Paypal, Skrill or Neteller)

- Bank transfer

eToro charges a 0.5% fee on all deposits in currencies other than USD. The minimum deposit is USD 200.

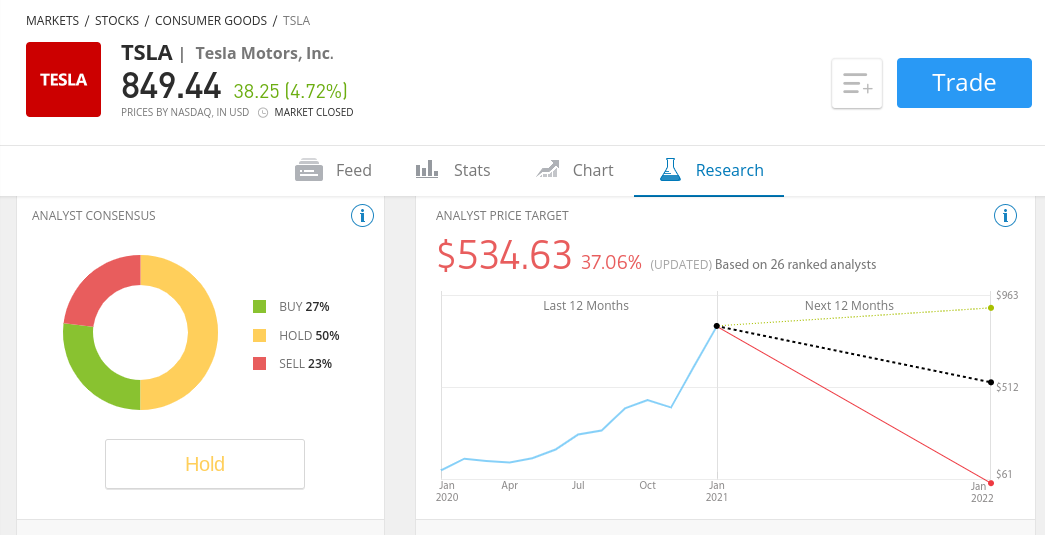

Step 4: Research the markets offered

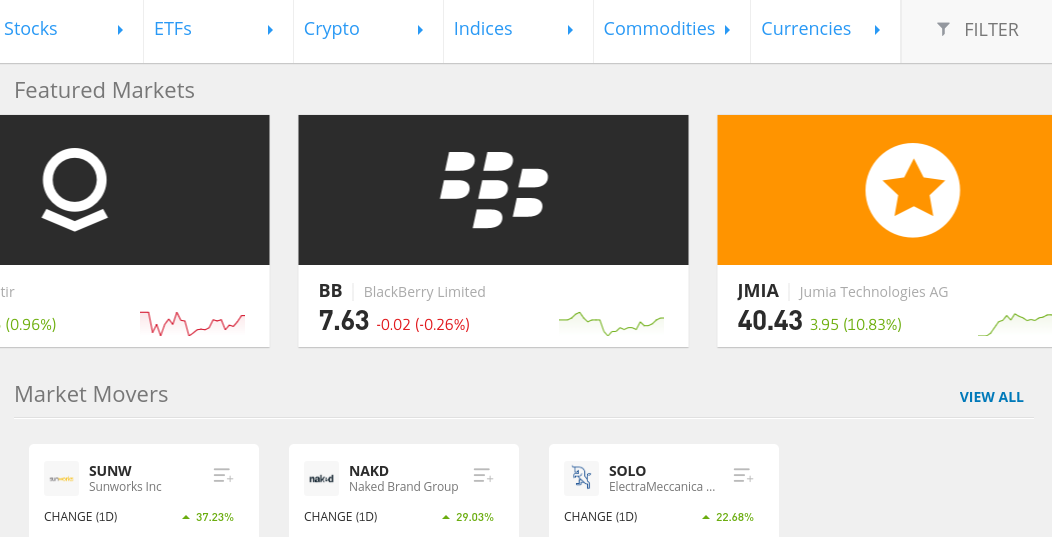

After making a deposit, it's time to explore the platform and find a suitable asset. If you know exactly what you're interested in, use the search.

If you just want to see what’s available, click on “Markets.” You’ll see tradable asset classes like stocks, cryptocurrencies, ETFs, forex, and commodities.

Step 5: Create a trade on the trading platform

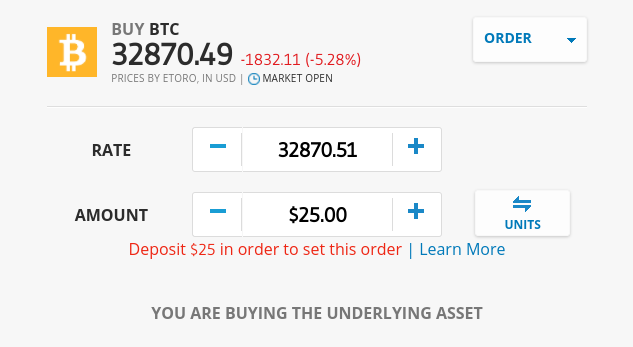

After selecting an asset, it is time to enter a trade order. In our example, we want to trade Bitcoin.

As you can see in the image, we entered $25 in the "Amount" field. If you want to set a stop-loss and/or take profit, you have the option.

Once you have your order ready, click the "Open Trade" button.

Summary - Trading Platforms

There are currently hundreds of trading platforms on the market, so choosing the right solution for your needs requires a significant investment of time.

For example, someone is primarily looking for low fees, while another is interested in specific markets and instruments.

We have concluded that eToro comes closest to being the ideal online trading platform.

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

FAQ – Frequently Asked Questions for Trading Platforms

Which trading platforms are the best? Can you make money trading?

How much do trading platforms charge?

Can trading platforms be a scam?

Where is the eToro trading platform available?

Can beginners use trading platforms?

Is it possible for trading platforms to be truly free?

What stocks do trading platforms offer?

What is the minimum deposit required by trading platforms?

Are withdrawals from the trading platform complicated?

Do trading platforms accept PayPal?